Rpa in insurance information

Home » Trend » Rpa in insurance informationYour Rpa in insurance images are ready. Rpa in insurance are a topic that is being searched for and liked by netizens today. You can Get the Rpa in insurance files here. Find and Download all royalty-free photos.

If you’re looking for rpa in insurance pictures information related to the rpa in insurance keyword, you have come to the ideal site. Our site always gives you hints for downloading the highest quality video and picture content, please kindly search and locate more informative video content and graphics that fit your interests.

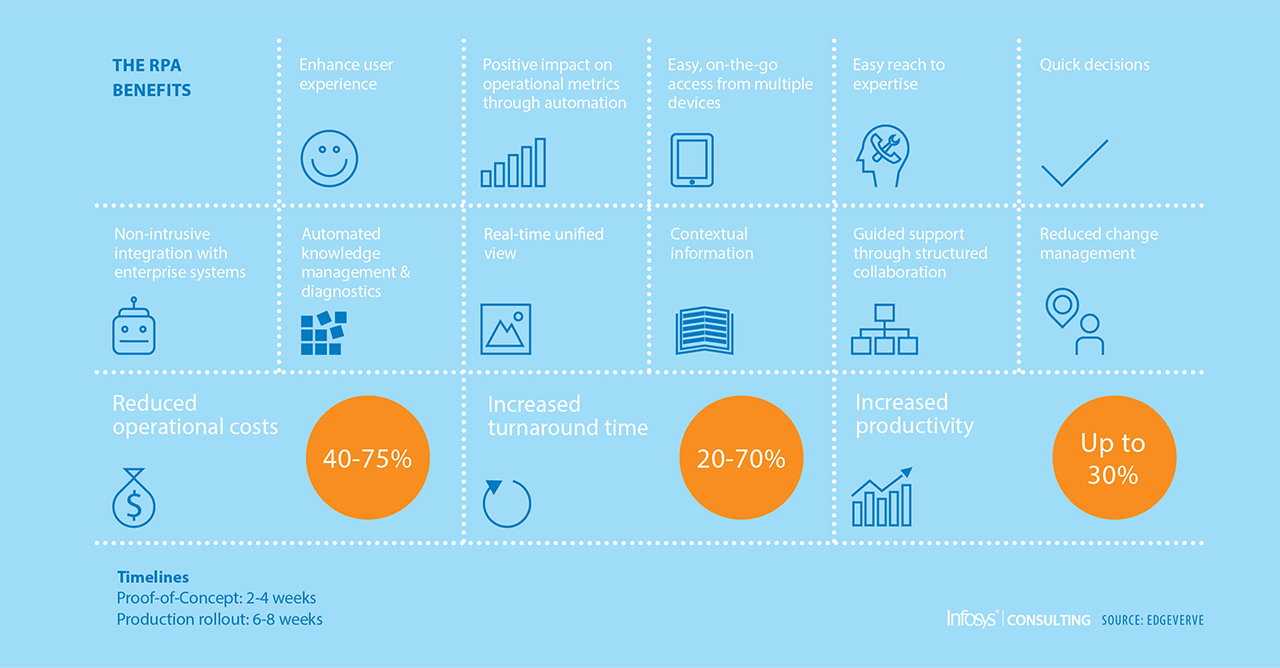

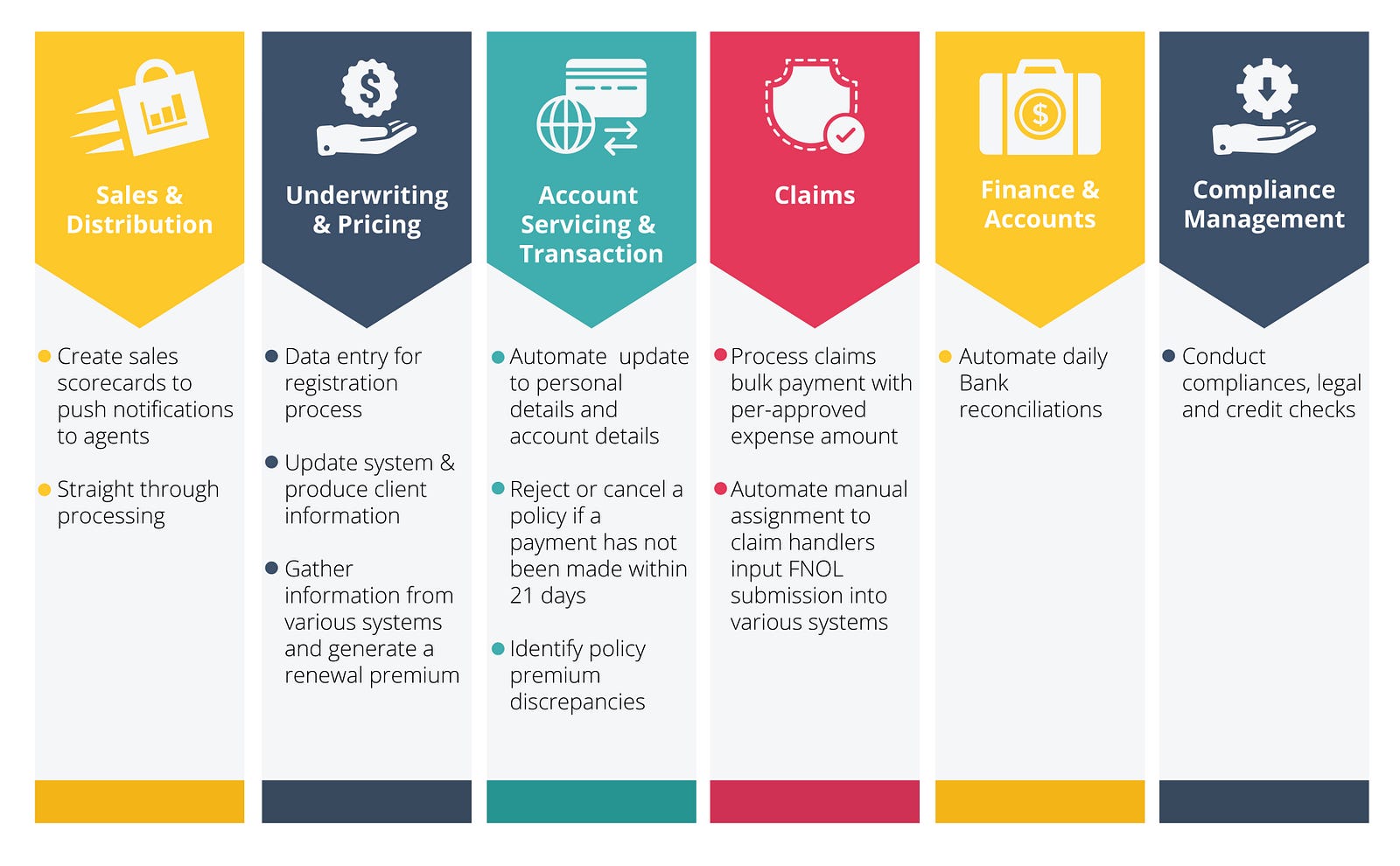

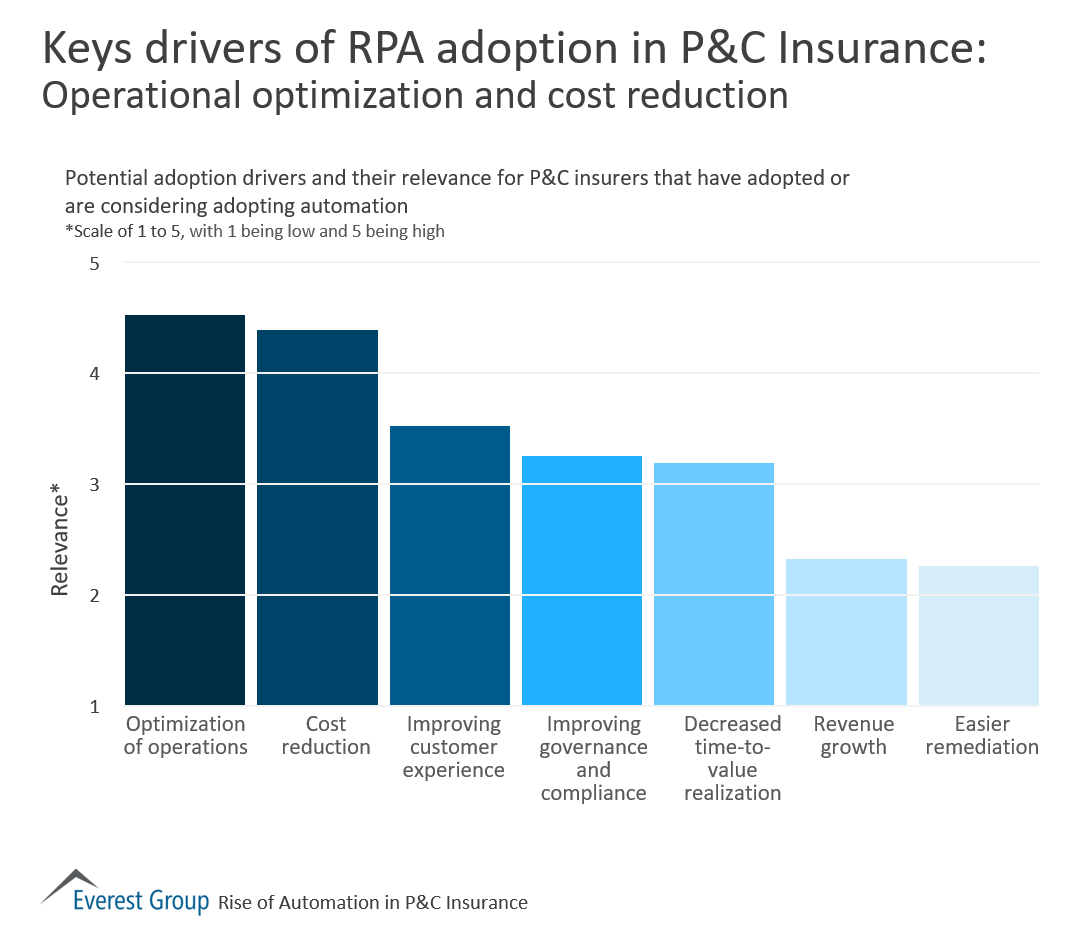

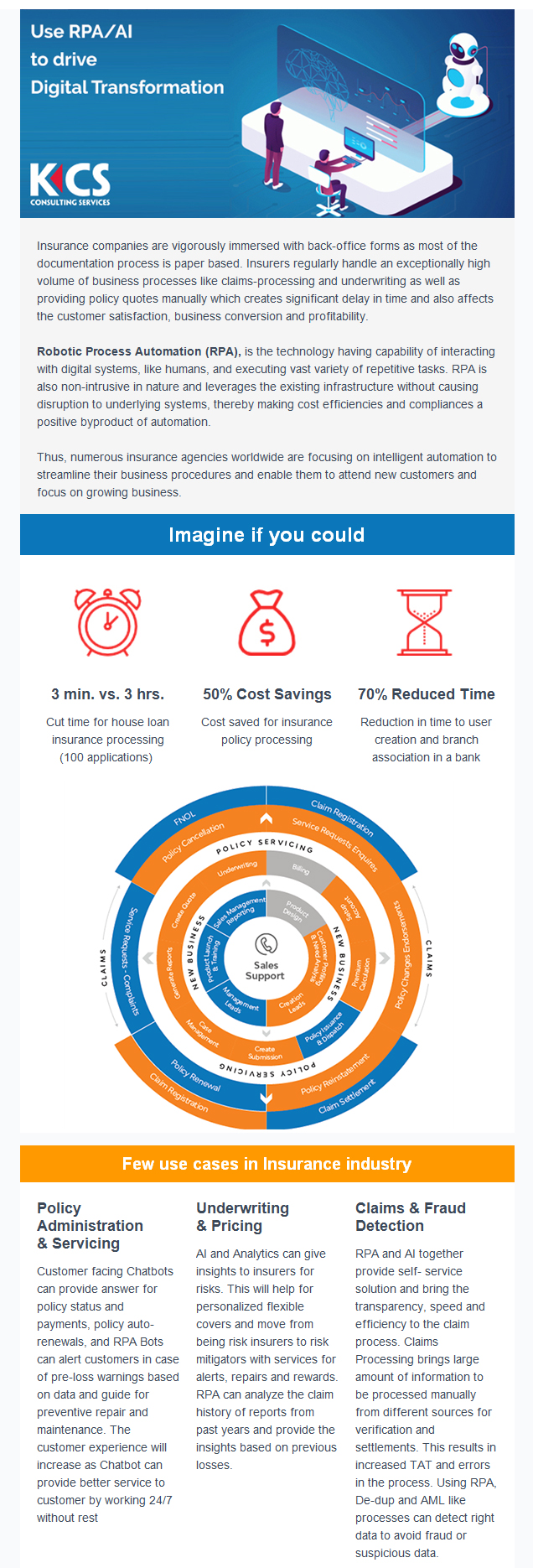

Rpa In Insurance. Benefits of using rpa in the insurance sector. Insurance rpa easily connects core insurance processes with the newer capabilities you need to reduce response times, decrease operations costs, and ultimately focus your employees on higher value work. Rpa in insurance allows all key players within each process or each silo to accomplish a plethora of operations easily without involving vast navigation across systems. Because of the flexibility and improvements that rpa can deliver, its adoption by insurance companies is only expected to become more global and inevitable.

RPA in the insurance industry lessons learned & best From youtube.com

RPA in the insurance industry lessons learned & best From youtube.com

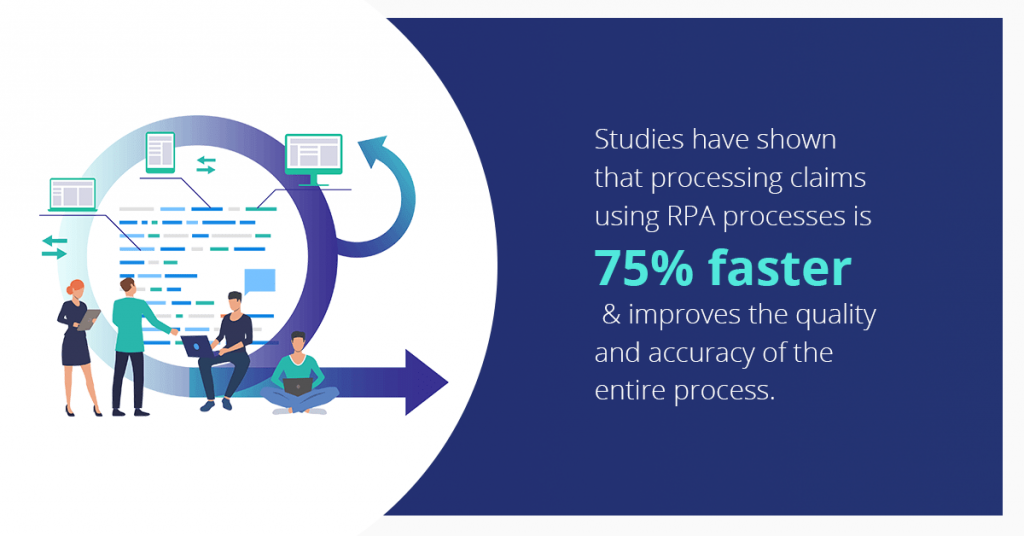

19% of the time where human expertise is currently required. Impact on employment in insurance. Using artificial intelligence (ai) and enabling technologies with intellectual capabilities advance robotic process automation (rpa) to support businesses and meet client demands. Similarly, rpa could be used to move data from historical claims records in an insurance carrier’s system into analytics applications so long as the insurance carrier reprograms the rpa software whenever they introduce a new way. Benefits of using rpa in the insurance sector. The following are the top rpa use cases in insurance:

Uipath estimates that current rpa technology can save insurers:

Your rpa programmer does not need to know how insurance works, but they should have experience working in automating business operations. Rpa facilitates coverage verification, triage and assignment of claims, settlement notifications and payment. Discover how rpa easily connects core insurance processes with capabilities to reduce response time, decrease operation cost, and focus employees on high value work. Rpa is implemented in various industries and it include insurance industry too. Using automation to do these tasks saves time and generates highly accurate data which unlocks more insights. Rpa can help insurers achieve increased profits, permanent company growth, better compliance, and improved customer service, all at a lower cost than ever possible before.

Source: thelabconsulting.com

Source: thelabconsulting.com

Claims registration & processing & fraud detection. Insurance companies are only starting to launch pilot automation programs, with both rpa (robotic process automation) and intelligent automation, and the impact of these technologies on the sector is expected to be enormous. The following are the top rpa use cases in insurance: Insurance rpa easily connects core insurance processes with the newer capabilities you need to reduce response times, decrease operations costs, and ultimately focus your employees on higher value work. In the insurance industry or any other field, rpa can also work effectively, contributing to solving optimization problems for business processes.

Source: thelabconsulting.com

Source: thelabconsulting.com

Rpa facilitates coverage verification, triage and assignment of claims, settlement notifications and payment. Impact on employment in insurance. Similarly, rpa could be used to move data from historical claims records in an insurance carrier’s system into analytics applications so long as the insurance carrier reprograms the rpa software whenever they introduce a new way. Using artificial intelligence (ai) and enabling technologies with intellectual capabilities advance robotic process automation (rpa) to support businesses and meet client demands. Uipath estimates that current rpa technology can save insurers:

Source: pinterest.com

Source: pinterest.com

It can interact with core legacy systems to create a scalable, secure, and reliable digital workforce that expedites claims handling processes, increases fraud detection and improves overall customer satisfaction. It can interact with core legacy systems to create a scalable, secure, and reliable digital workforce that expedites claims handling processes, increases fraud detection and improves overall customer satisfaction. In the insurance industry or any other field, rpa can also work effectively, contributing to solving optimization problems for business processes. As compliance is an ongoing process, testing, implementation and monitoring are critica. Discover how rpa easily connects core insurance processes with capabilities to reduce response time, decrease operation cost, and focus employees on high value work.

Source: altoros.com

Source: altoros.com

Rpa in insurance featured content. Insurance rpa easily connects core insurance processes with the newer capabilities you need to reduce response times, decrease operations costs, and ultimately focus your employees on higher value work. Similarly, rpa could be used to move data from historical claims records in an insurance carrier’s system into analytics applications so long as the insurance carrier reprograms the rpa software whenever they introduce a new way. 23% of stakeholder interaction time. Rpa can help insurers achieve increased profits, permanent company growth, better compliance, and improved customer service, all at a lower cost than ever possible before.

Source: medium.com

Source: medium.com

At the heart of the insurance industry is the mission to provide customers prompt, empathetic support in times of crisis. Delivery center transition nets large insurer high roi, strategic partner. Besides automating processes, rpa benefits insurance companies by improving compliance, making claims management easier, and improving overall productivity. Rpa and insurance form a unique combination which has the potential to deter most of the obstacles that insurance companies encounter. Your rpa programmer should be someone who has an understanding of what the insurance industry is all about.

Source: flobotics.io

Source: flobotics.io

Here are some of the benefits of using rpa bots for your insurance company: If these people have worked in insurance, you can produce even better programs. Rpa in insurance featured content. It essentially automates transactional and administrative parts of activities such as accounting, settlements, risk capture, credit control, tax, and regulatory compliances. As compliance is an ongoing process, testing, implementation and monitoring are critica.

Source: blog.athenagt.com

Source: blog.athenagt.com

Besides automating processes, rpa benefits insurance companies by improving compliance, making claims management easier, and improving overall productivity. Robotic process automation (rpa) in insurance is an important technology to increase customer satisfaction and operational efficiency as well as ensure compliance. From personal and commercial insurance line underwriting and onboarding, to policy holder services and claims processing, many insurance companies are realizing the benefits of standardized workflows streamlined. Discover how rpa easily connects core insurance processes with capabilities to reduce response time, decrease operation cost, and focus employees on high value work. Uipath estimates that current rpa technology can save insurers:

Source: comtecinfo.com

Source: comtecinfo.com

Impact on employment in insurance. How will automation affect insurance? Here’s how rpa can subdue all the obstacles: Rpa, when used in risk and compliance fields of insurance leads to companies being proactive instead of reactive. At the heart of the insurance industry is the mission to provide customers prompt, empathetic support in times of crisis.

Source: claysys.com

Source: claysys.com

Robotic process automation (rpa) in insurance is an important technology to increase customer satisfaction and operational efficiency as well as ensure compliance. 34% of employee time in the data processing. Robotic process automation (rpa) has emerged as a magic wand for insurance companies. Robotic process automation (rpa) is changing the way insurance companies operate faster than any other technology today. Rpa in insurance featured content.

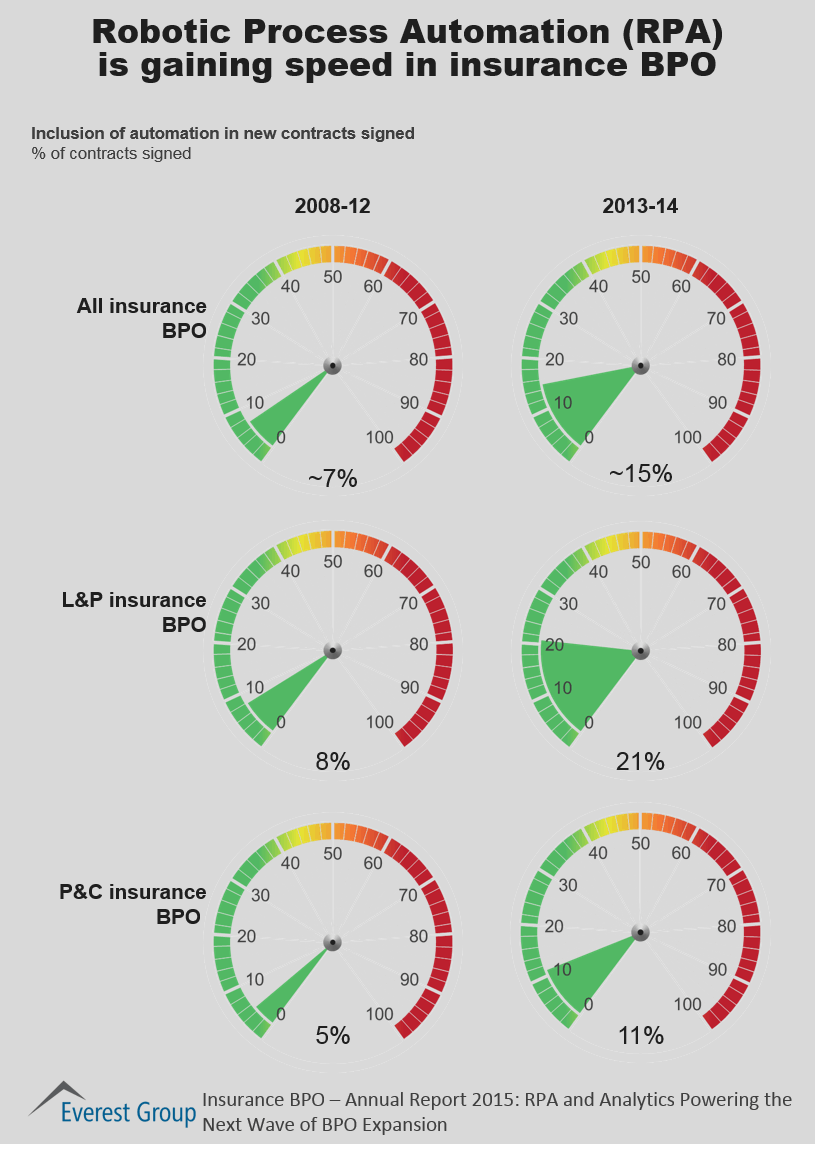

Source: everestgrp.com

Source: everestgrp.com

Claims registration & processing & fraud detection. Rpa facilitates coverage verification, triage and assignment of claims, settlement notifications and payment. Puresoftware’s rpa services and solutions for the insurance industry enable the insurance. Rpa, when used in risk and compliance fields of insurance leads to companies being proactive instead of reactive. Your rpa programmer does not need to know how insurance works, but they should have experience working in automating business operations.

Source: kanooconsulting.com

Source: kanooconsulting.com

As compliance is an ongoing process, testing, implementation and monitoring are critica. Rpa facilitates coverage verification, triage and assignment of claims, settlement notifications and payment. Insurance rpa easily connects core insurance processes with the newer capabilities you need to reduce response times, decrease operations costs, and ultimately focus your employees on higher value work. Insurance automation using rpa can be extensively used in the niche for working with the legacy systems, automating the redundant tasks and also gather external data. Rpa in insurance featured content.

Source: prweb.com

It can interact with core legacy systems to create a scalable, secure, and reliable digital workforce that expedites claims handling processes, increases fraud detection and improves overall customer satisfaction. Impact on employment in insurance. If these people have worked in insurance, you can produce even better programs. Delivery center transition nets large insurer high roi, strategic partner. Your rpa programmer does not need to know how insurance works, but they should have experience working in automating business operations.

Source: wns.com

Source: wns.com

23% of stakeholder interaction time. Delivery center transition nets large insurer high roi, strategic partner. 19% of the time where human expertise is currently required. Using automation to do these tasks saves time and generates highly accurate data which unlocks more insights. Robotic process automation (rpa) is changing the way insurance companies operate faster than any other technology today.

Source: netscribes.com

Source: netscribes.com

Similarly, rpa could be used to move data from historical claims records in an insurance carrier’s system into analytics applications so long as the insurance carrier reprograms the rpa software whenever they introduce a new way. Robotic process automation (rpa) has emerged as a magic wand for insurance companies. Robotic process automation (rpa) is changing the way insurance companies operate faster than any other technology today. Claims registration & processing & fraud detection. Puresoftware’s rpa services and solutions for the insurance industry enable the insurance.

Source: everestgrp.com

Source: everestgrp.com

Rpa and insurance form a unique combination which has the potential to deter most of the obstacles that insurance companies encounter. 23% of stakeholder interaction time. Here’s how rpa can subdue all the obstacles: Discover how rpa easily connects core insurance processes with capabilities to reduce response time, decrease operation cost, and focus employees on high value work. The following are the top rpa use cases in insurance:

Source: youtube.com

Source: youtube.com

It can interact with core legacy systems to create a scalable, secure, and reliable digital workforce that expedites claims handling processes, increases fraud detection and improves overall customer satisfaction. It essentially automates transactional and administrative parts of activities such as accounting, settlements, risk capture, credit control, tax, and regulatory compliances. 23% of stakeholder interaction time. You can apply rpa to a variety of industries. 19% of the time where human expertise is currently required.

Source: automationanywhere.com

Source: automationanywhere.com

Impact on employment in insurance. Here’s how rpa can subdue all the obstacles: Robotic process automation (rpa) in insurance is an important technology to increase customer satisfaction and operational efficiency as well as ensure compliance. Insurance companies are only starting to launch pilot automation programs, with both rpa (robotic process automation) and intelligent automation, and the impact of these technologies on the sector is expected to be enormous. The following are the top rpa use cases in insurance:

23% of stakeholder interaction time. Rpa in insurance featured content. At the heart of the insurance industry is the mission to provide customers prompt, empathetic support in times of crisis. Uipath estimates that current rpa technology can save insurers: In the insurance industry or any other field, rpa can also work effectively, contributing to solving optimization problems for business processes.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title rpa in insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information