S corp health insurance Idea

Home » Trend » S corp health insurance IdeaYour S corp health insurance images are available in this site. S corp health insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the S corp health insurance files here. Download all free photos and vectors.

If you’re searching for s corp health insurance pictures information connected with to the s corp health insurance topic, you have visit the ideal site. Our website frequently provides you with suggestions for viewing the highest quality video and picture content, please kindly search and locate more enlightening video content and graphics that fit your interests.

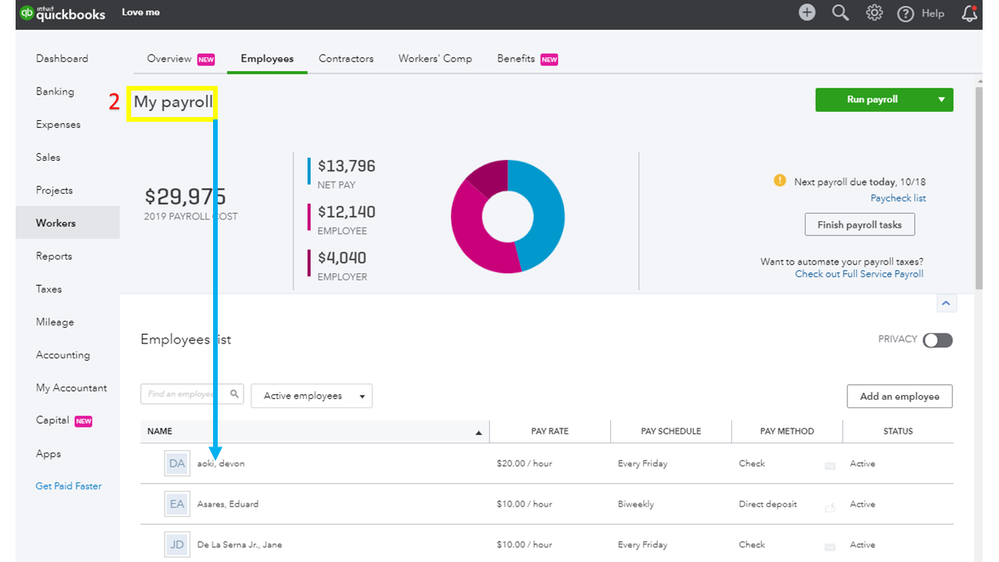

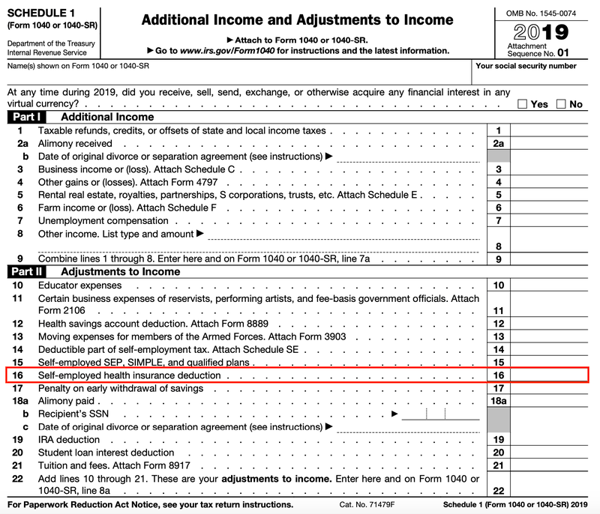

S Corp Health Insurance. But, the premium amounts are taxable for your employees. Health insurance premiums paid by an s corp for more than 2% shareholders must be treated as wages to that owner. S corporations are able to provide health insurance benefits to their employees as a perk. While an s corp has pass through taxation, like many other forms of tax elections, in respect to health insurance premiums, the law gets more complex.

Buy LIC�s Best Life Insurance,Call Now 9350647008 Life From pinterest.com

Buy LIC�s Best Life Insurance,Call Now 9350647008 Life From pinterest.com

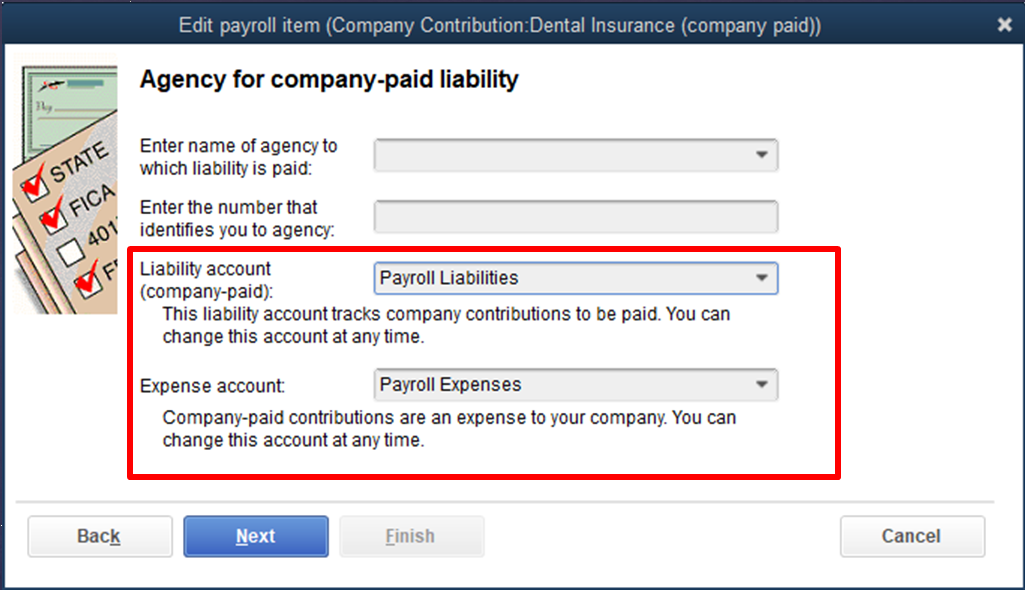

The s corporation can then deduct the cost of their premiums from their taxes as a business expense. But, the premium amounts are taxable for your employees. One drawback to the s corporation is that employee/owners cannot deduct the cost of health insurance from taxes.s corporation owners who participate in management are considered employees, which.s corps have complicated issues with health insurance premiums paid for their.the irs requirements are constantly changing, so it is always good practice to. S corporations are able to provide health insurance benefits to their employees as a perk. If the company provides health insurance to employees who own more than 2% of stock in the s corp, the premiums are tax deductible for your company. To do this, the s corporation first establishes a health insurance plan for you in one of two ways:

While an s corp has pass through taxation, like many other forms of tax elections, in respect to health insurance premiums, the law gets more complex.

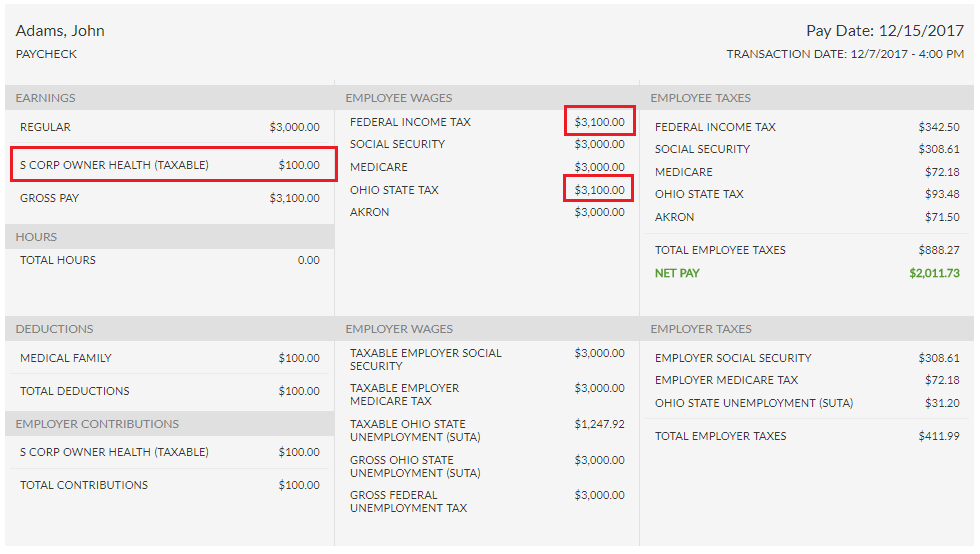

We’ll have to perform a payroll correction to negate the paycheck. However, when it comes to deducting the cost of health insurance for you and your family, an s corporation is not always so great. If the company provides health insurance to employees who own more than 2% of stock in the s corp, the premiums are tax deductible for your company. Ordinarily, when you form a corporation to own and operate your business, you�ll work as its employee. This means the company offers group health insurance to employees and deducts the cost as a business expense, paying no taxes on the insurance premiums. The s corporation makes the premium payments for the accident and health insurance policy covering you (and your spouse or dependents, if applicable).

Source: youtube.com

Source: youtube.com

An s corp can offer group health insurance to employees and deduct the costs as a business expense. If the company provides health insurance to employees who own more than 2% of stock in the s corp, the premiums are tax deductible for your company. Health insurance premiums paid by an s corp for more than 2% shareholders must be treated as wages to that owner. In other words, the only way an s corp can deduct the amount paid for shareholder health insurance is to include it as part as part of the shareholder’s salary; When you pay your premiums with personal money, make sure that your business reimburses you.

Source: tax-queen.com

Source: tax-queen.com

We’ll have to perform a payroll correction to negate the paycheck. One drawback to the s corporation is that employee/owners cannot deduct the cost of health insurance from taxes. If you own more than 2% of your. The employee will not be taxed for the benefit and the company can deduct the contributions on its tax return. Client is a 50/50 unrelated shareholder s corp with 1 other full time employee.

Your s corp must pay your health insurance costs to get the personal tax deduction. Your s corp must pay your health insurance costs to get the personal tax deduction. Let me point you in the right direction to remove the county tax on the paycheck. Thanks for visiting the community, wesbuda. Neither you nor your employees will be taxed for it—it’s as simple as that!

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

But, the premium amounts are taxable for your employees. Health insurance employee benefit for a s corporation the affordable care act has given rise to even more issues. Health insurance premiums paid by an s corp for more than 2% shareholders must be treated as wages to that owner. While an s corp has pass through taxation, like many other forms of tax elections, in respect to health insurance premiums, the law gets more complex. S corp shareholder health insurance premiums can be deducted for those shareholders who own more than 2 percent of the s corp.

Source: revisi.net

Source: revisi.net

You need to call the insurance company and open a corporate plan under the s corporation. This includes anyone who has owned at least 2 percent of the company�s stock on at. Shareholder a has health insurance through a separate 100% owned s corp. Client is a 50/50 unrelated shareholder s corp with 1 other full time employee. S corps have complicated issues with health insurance.

Source: fool.com

Source: fool.com

If you form a regular c corporation, your corporation. Client is a 50/50 unrelated shareholder s corp with 1 other full time employee. The employee will not be taxed for the benefit and the company can deduct the contributions on its tax return. How an s corporation deducts health insurance premiums. Prior to your final payroll of the year, please share the total cost of your health and/or accident insurance premiums and hsa amounts with asap to report on.

Source: kenyachambermines.com

Source: kenyachambermines.com

The employee will not be taxed for the benefit and the company can deduct the contributions on its tax return. While an s corp has pass through taxation, like many other forms of tax elections, in respect to health insurance premiums, the law gets more complex. The s corporation makes the premium payments for the accident and health insurance policy covering you (and your spouse or dependents, if applicable). Health insurance premiums paid by an s corp for more than 2% shareholders must be treated as wages to that owner. Let me point you in the right direction to remove the county tax on the paycheck.

I’ll also answer some common questions my clients have in regards to health insurance for their s corporations. The employee will not be taxed for the benefit and the company can deduct the contributions on its tax return. Thanks for visiting the community, wesbuda. S corporations are able to provide health insurance benefits to their employees as a perk. To do this, the s corporation first establishes a health insurance plan for you in one of two ways:

Source: marathonhr.com

Source: marathonhr.com

One drawback to the s corporation is that employee/owners cannot deduct the cost of health insurance from taxes. An s corp can offer group health insurance to employees and deduct the costs as a business expense. We’ll have to perform a payroll correction to negate the paycheck. When you pay your premiums with personal money, make sure that your business reimburses you. Health insurance premiums paid by an s corp for more than 2% shareholders must be treated as wages to that owner.

Source: pinterest.com

Source: pinterest.com

This means the company offers group health insurance to employees and deducts the cost as a business expense, paying no taxes on the insurance premiums. The irs rules for employee fringe benefits dictate that an s corp is treated as a partnership and that any shareholder of at least 2 percent qualifies as a partner. This means the company offers group health insurance to employees and deducts the cost as a business expense, paying no taxes on the insurance premiums. When you pay your premiums with personal money, make sure that your business reimburses you. S corp shareholder health insurance premiums can be deducted for those shareholders who own more than 2 percent of the s corp.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

The owner’s health insurance can no longer be called an insurance expense or employee. An s corporation deducts the premiums it pays for accident and health insurance to cover a 2% shareholder/employee (and his spouse and dependents) as compensation paid to the shareholder/employee. Health insurance premiums paid by an s corp for more than 2% shareholders must be treated as wages to that owner. The owner’s health insurance can no longer be called an insurance expense or employee. One drawback to the s corporation is that employee/owners cannot deduct the cost of health insurance from taxes.

Source: revisi.net

Source: revisi.net

If the company provides health insurance to employees who own more than 2% of stock in the s corp, the premiums are tax deductible for your company. Let me point you in the right direction to remove the county tax on the paycheck. The employee will not be taxed for the benefit and the company can deduct the contributions on its tax return. Health insurance employee benefit for a s corporation. Neither you nor your employees will be taxed for it—it’s as simple as that!

An s corp can offer group health insurance to employees and deduct the costs as a business expense. Thanks for visiting the community, wesbuda. The owner’s health insurance can no longer be called an insurance expense or employee. The employee will not be taxed for the benefit and the company can deduct the contributions on its tax return. Shareholder a has health insurance through a separate 100% owned s corp.

Source: revisi.net

Source: revisi.net

However, when it comes to deducting the cost of health insurance for you and your family, an s corporation is not always so great. How an s corporation deducts health insurance premiums. We’ll have to perform a payroll correction to negate the paycheck. However, when it comes to deducting the cost of health insurance for you and your family, an s corporation is not always so great. If you own more than 2% of your.

Source: patriotsoftware.com

Source: patriotsoftware.com

This means the company offers group health insurance to employees and deducts the cost as a business expense, paying no taxes on the insurance premiums. If the company provides health insurance to employees who own more than 2% of stock in the s corp, the premiums are tax deductible for your company. The irs rules for employee fringe benefits dictate that an s corp is treated as a partnership and that any shareholder of at least 2 percent qualifies as a partner. How an s corporation deducts health insurance premiums. Client is a 50/50 unrelated shareholder s corp with 1 other full time employee.

However, when it comes to deducting the cost of health insurance for you and your family, an s corporation is not always so great. However, when it comes to deducting the cost of health insurance for you and your family, an s corporation is not always so great. The s corporation makes the premium payments for the accident and health insurance policy covering you (and your spouse or dependents, if applicable). This means the company offers group health insurance to employees and deducts the cost as a business expense, paying no taxes on the insurance premiums. The owner’s health insurance can no longer be called an insurance expense or employee.

Source: youtube.com

Source: youtube.com

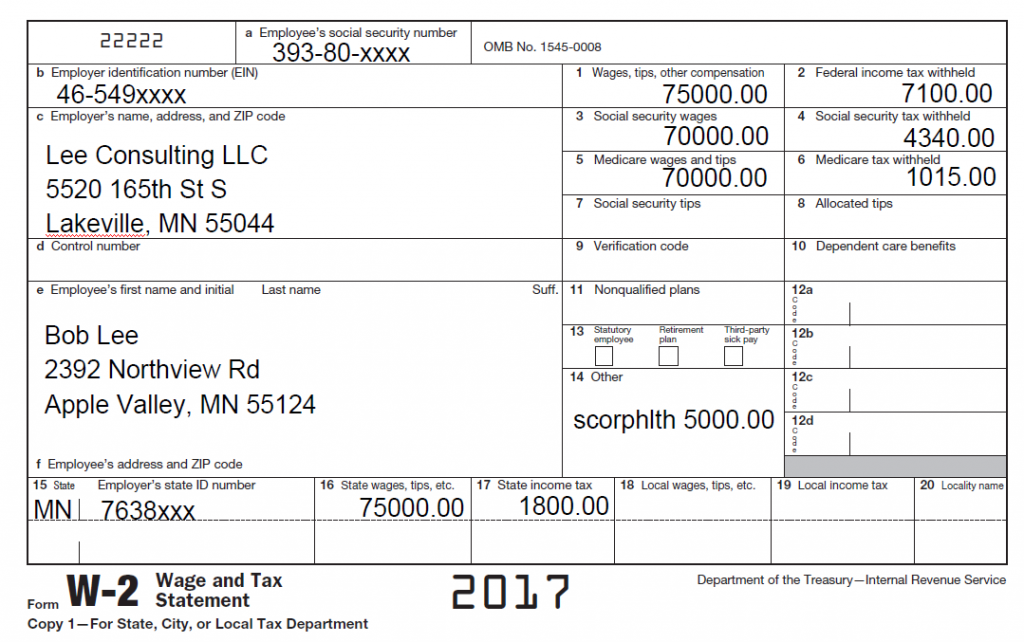

While an s corp has pass through taxation, like many other forms of tax elections, in respect to health insurance premiums, the law gets more complex. An s corporation deducts the premiums it pays for accident and health insurance to cover a 2% shareholder/employee (and his spouse and dependents) as compensation paid to the shareholder/employee. Neither you nor your employees will be taxed for it—it’s as simple as that! You need to include the amount of health insurance premium in that employee’s payroll documentation and taxable wages. If you own more than 2% of your.

Source: fool.com

Source: fool.com

However, when it comes to deducting the cost of health insurance for you and your family, an s corporation is not always so great. S corporations are able to provide health insurance benefits to their employees as a perk. If the company provides health insurance to employees who own more than 2% of stock in the s corp, the premiums are tax deductible for your company. How an s corporation deducts health insurance premiums. If you own more than 2% of your.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title s corp health insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information