S corp health insurance deduction information

Home » Trending » S corp health insurance deduction informationYour S corp health insurance deduction images are available. S corp health insurance deduction are a topic that is being searched for and liked by netizens today. You can Download the S corp health insurance deduction files here. Download all free photos and vectors.

If you’re looking for s corp health insurance deduction pictures information connected with to the s corp health insurance deduction topic, you have come to the right site. Our site frequently provides you with hints for refferencing the maximum quality video and picture content, please kindly surf and find more enlightening video articles and graphics that match your interests.

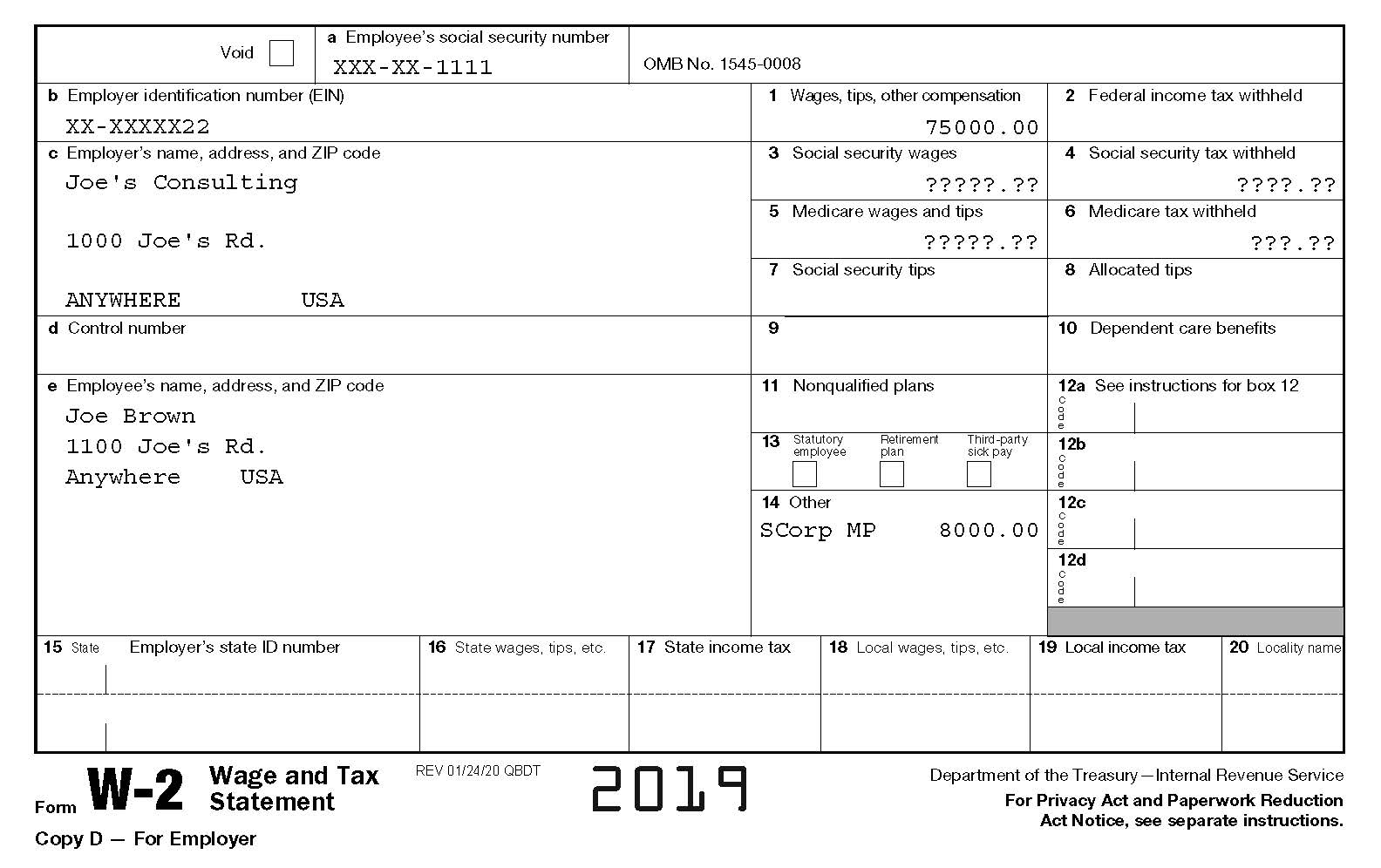

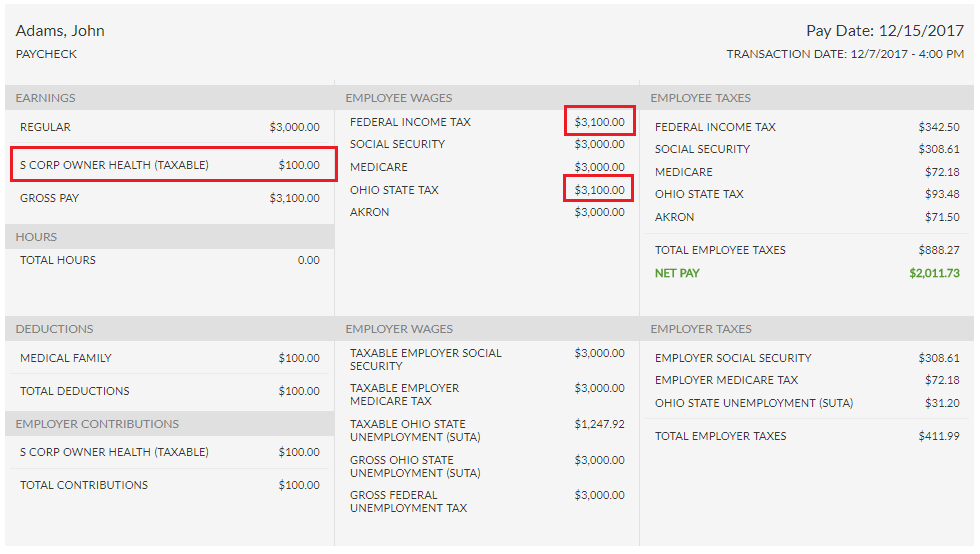

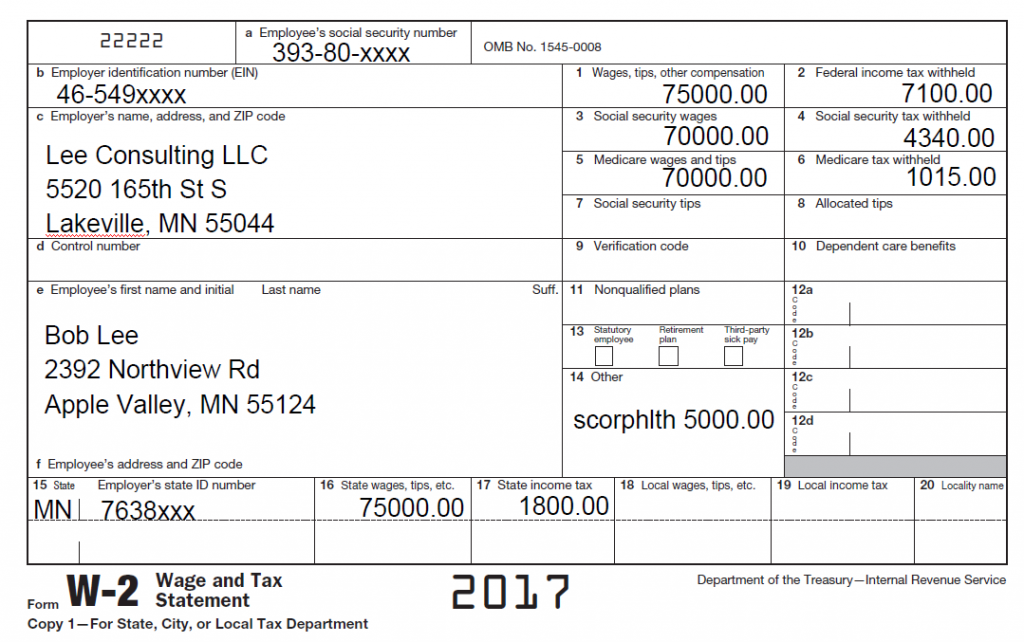

S Corp Health Insurance Deduction. And with the incorrect setup, your family is simply out the money it paid for the health insurance. In my s corp business tax return, in the medical insurance premiums section for deductions, it states the following: The irs instructions for form 1040 include a worksheet to help you calculate. S corporations, partnerships, and limited liability companies (llcs) with more than one member are subject to the same health insurance premium deduction rules as described above.

Avoid This S Corporation Health Insurance Deduction From smallbiztaxlady.net

Avoid This S Corporation Health Insurance Deduction From smallbiztaxlady.net

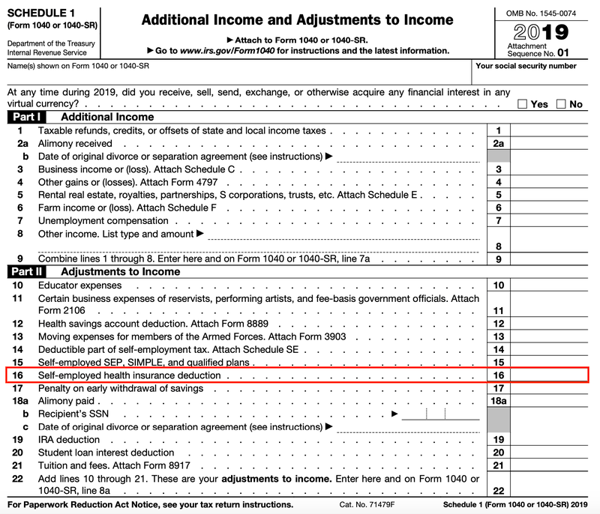

You need to call the insurance company and open a corporate plan under the s corporation. To determine whether the policy is established by the business, the. Prior to your final payroll of the year, please share the total cost of your health and/or accident insurance premiums and hsa amounts with asap to report on. Each 2% shareholder/employee, partner, and llc member may take the deduction on form 1040, line 29. Instead, you claim the deduction in part ii of schedule 1, additional income and adjustments to income. Depending on whether it discriminates.

To determine whether the policy is established by the business, the.

Can i deduct the cost of health insurance from my taxes? Until you fill that out, the program limits the deduction to $0 (zero wages equals zero. In the meantime, they can offer their employees a quality health insurance benefit with a traditional group policy or an hra. The irs instructions for form 1040 include a worksheet to help you calculate. The company should purchase the health insurance plan in the corporation’s name. Say you own 25% of an s corp, which earned $50,000 last year.

Source: parkertaxpublishing.com

Source: parkertaxpublishing.com

Until you fill that out, the program limits the deduction to $0 (zero wages equals zero. In my s corp business tax return, in the medical insurance premiums section for deductions, it states the following: Prior to your final payroll of the year, please share the total cost of your health and/or accident insurance premiums and hsa amounts with asap to report on. When a 2% s corporation shareholder, partner, or llc member may not claim the deduction on form 1040, line 29: The irs instructions for form 1040 include a worksheet to help you calculate.

Source: revisi.net

Source: revisi.net

Prior to your final payroll of the year, please share the total cost of your health and/or accident insurance premiums and hsa amounts with asap to report on. Until you fill that out, the program limits the deduction to $0 (zero wages equals zero. One drawback to the s corporation is that employee/owners cannot deduct the cost of health insurance from taxes. Depending on whether it discriminates. To determine whether the policy is established by the business, the.

Source: fool.com

Source: fool.com

One drawback to the s corporation is that employee/owners cannot deduct the cost of health insurance from taxes. Say you own 25% of an s corp, which earned $50,000 last year. Until you fill that out, the program limits the deduction to $0 (zero wages equals zero. Can i deduct the cost of health insurance from my taxes? Instead, you claim the deduction in part ii of schedule 1, additional income and adjustments to income.

Source: homeschooldressage.com

Source: homeschooldressage.com

You and your family’s medical health. The irs instructions for form 1040 include a worksheet to help you calculate. It means a zero deduction for the s corporation and a lost health insurance deduction for. Say you own 25% of an s corp, which earned $50,000 last year. These deductions are made by the shareholder on his or her form 1040 if the health plan was established by the business and not purchased by the individual.

Source: individuals.healthreformquotes.com

Source: individuals.healthreformquotes.com

You need to call the insurance company and open a corporate plan under the s corporation. It means a zero deduction for the s corporation and a lost health insurance deduction for. While an s corp has pass through taxation, like many other forms of tax elections, in respect to health insurance premiums, the law gets more complex. To determine whether the policy is established by the business, the. Instead, you claim the deduction in part ii of schedule 1, additional income and adjustments to income.

Source: skaccountancy.com

Source: skaccountancy.com

Depending on whether it discriminates. In my s corp business tax return, in the medical insurance premiums section for deductions, it states the following: To determine whether the policy is established by the business, the. Where do s corp owner deduct health insurance? Prior to your final payroll of the year, please share the total cost of your health and/or accident insurance premiums and hsa amounts with asap to report on.

Source: boydcpa.com

Source: boydcpa.com

You need to call the insurance company and open a corporate plan under the s corporation. The health insurance is not deductible by the s corporation as health insurance. While an s corp has pass through taxation, like many other forms of tax elections, in respect to health insurance premiums, the law gets more complex. You need to call the insurance company and open a corporate plan under the s corporation. Here�s a situation where health insurance premiums may not be deducted directly on form 1040, line 29:

Source: smallbiztaxlady.net

Source: smallbiztaxlady.net

On your personal taxes, you can deduct the money your business has paid in health insurance premiums on your form 1040. It means a zero deduction for the s corporation and a lost health insurance deduction for. Say you own 25% of an s corp, which earned $50,000 last year. These deductions are made by the shareholder on his or her form 1040 if the health plan was established by the business and not purchased by the individual. The company should purchase the health insurance plan in the corporation’s name.

Source: revisi.net

Source: revisi.net

And with the incorrect setup, your family is simply out the money it paid for the health insurance. Prior to your final payroll of the year, please share the total cost of your health and/or accident insurance premiums and hsa amounts with asap to report on. When a 2% s corporation shareholder, partner, or llc member may not claim the deduction on form 1040, line 29: Here�s a situation where health insurance premiums may not be deducted directly on form 1040, line 29: Each 2% shareholder/employee, partner, and llc member may take the deduction on form 1040, line 29.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

In my s corp business tax return, in the medical insurance premiums section for deductions, it states the following: Instead, you claim the deduction in part ii of schedule 1, additional income and adjustments to income. Say you own 25% of an s corp, which earned $50,000 last year. While an s corp has pass through taxation, like many other forms of tax elections, in respect to health insurance premiums, the law gets more complex. You need to call the insurance company and open a corporate plan under the s corporation.

Source: homeschooldressage.com

Source: homeschooldressage.com

The company should purchase the health insurance plan in the corporation’s name. To determine whether the policy is established by the business, the. Until you fill that out, the program limits the deduction to $0 (zero wages equals zero. And with the incorrect setup, your family is simply out the money it paid for the health insurance. On your personal taxes, you can deduct the money your business has paid in health insurance premiums on your form 1040.

Source: ttlc.intuit.com

Source: ttlc.intuit.com

And with the incorrect setup, your family is simply out the money it paid for the health insurance. The company should purchase the health insurance plan in the corporation’s name. Say you own 25% of an s corp, which earned $50,000 last year. While an s corp has pass through taxation, like many other forms of tax elections, in respect to health insurance premiums, the law gets more complex. One drawback to the s corporation is that employee/owners cannot deduct the cost of health insurance from taxes.

Source: patriotsoftware.com

Source: patriotsoftware.com

You and your family’s medical health. To determine whether the policy is established by the business, the. This means the company offers group health insurance to employees and deducts the cost as a business expense, paying no taxes on the insurance premiums. In the meantime, they can offer their employees a quality health insurance benefit with a traditional group policy or an hra. The health insurance is not deductible by the s corporation as health insurance.

Source: referenceinsurance.blogspot.com

Source: referenceinsurance.blogspot.com

Each 2% shareholder/employee, partner, and llc member may take the deduction on form 1040, line 29. Until you fill that out, the program limits the deduction to $0 (zero wages equals zero. One drawback to the s corporation is that employee/owners cannot deduct the cost of health insurance from taxes. Say you own 25% of an s corp, which earned $50,000 last year. While an s corp has pass through taxation, like many other forms of tax elections, in respect to health insurance premiums, the law gets more complex.

Source: atbs.com

Source: atbs.com

Can i deduct the cost of health insurance from my taxes? Prior to your final payroll of the year, please share the total cost of your health and/or accident insurance premiums and hsa amounts with asap to report on. S corporations, partnerships, and limited liability companies (llcs) with more than one member are subject to the same health insurance premium deduction rules as described above. You and your family’s medical health. Say you own 25% of an s corp, which earned $50,000 last year.

Source: tax-queen.com

Source: tax-queen.com

Health insurance employee benefit for a s corporation. Depending on whether it discriminates. On your personal taxes, you can deduct the money your business has paid in health insurance premiums on your form 1040. In the meantime, they can offer their employees a quality health insurance benefit with a traditional group policy or an hra. Can i deduct the cost of health insurance from my taxes?

Source: fool.com

Source: fool.com

Say you own 25% of an s corp, which earned $50,000 last year. While an s corp has pass through taxation, like many other forms of tax elections, in respect to health insurance premiums, the law gets more complex. The irs instructions for form 1040 include a worksheet to help you calculate. S corporations, partnerships, and limited liability companies (llcs) with more than one member are subject to the same health insurance premium deduction rules as described above. On your personal taxes, you can deduct the money your business has paid in health insurance premiums on your form 1040.

Source: thegraytower.blogspot.com

Source: thegraytower.blogspot.com

And with the incorrect setup, your family is simply out the money it paid for the health insurance. In the meantime, they can offer their employees a quality health insurance benefit with a traditional group policy or an hra. Say you own 25% of an s corp, which earned $50,000 last year. While an s corp has pass through taxation, like many other forms of tax elections, in respect to health insurance premiums, the law gets more complex. The irs instructions for form 1040 include a worksheet to help you calculate.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title s corp health insurance deduction by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information