S corp health insurance on w 2 information

Home » Trend » S corp health insurance on w 2 informationYour S corp health insurance on w 2 images are available in this site. S corp health insurance on w 2 are a topic that is being searched for and liked by netizens today. You can Find and Download the S corp health insurance on w 2 files here. Download all royalty-free photos and vectors.

If you’re looking for s corp health insurance on w 2 images information related to the s corp health insurance on w 2 topic, you have pay a visit to the ideal site. Our site frequently gives you hints for seeing the maximum quality video and picture content, please kindly surf and locate more enlightening video content and graphics that fit your interests.

S Corp Health Insurance On W 2. If you’re using the desktop version, you’ll need to first create the payroll item and enter a liability adjustment to properly record the premium. This rule also applies to the health insurance paid on behalf of your parents, spouse, children or grandchildren who are working for your s corporation, even if they are not shareholders of the corporation. In other words, the only way an s corp can deduct the amount paid for shareholder health insurance is to include it as part of the shareholder’s salary;in the meantime, they can offer their employees a quality health insurance benefit with a group policy or an hra.less than 2% shareholder health insurance is included with the expense for other employees as a deduction. Deduct employee insurance premiums on your business tax return s.

Medical insurance premiums as wages. You must pay income tax on the health insurance premium payments made by your s corporation. If you’re using the desktop version, you’ll need to first create the payroll item and enter a liability adjustment to properly record the premium. In an s corp, employees/owners who are 2% shareholders are generally subject to taxation on certain fringe benefits, such as medical insurance, adoption assistance, and life insurance that are typically not taxable for regular employees. For a health plan to be considered as established by the business, the s corporation must either pay the premiums covering the shareholder in the current tax year or reimburse the costs of premiums paid by the shareholder. Prior to your final payroll of the year, please share the total cost of your health and/or accident insurance premiums and hsa amounts with asap to report visit url category:

The internal revenue service has defined a 2% shareholder as a person who owns (on any day during the tax year) more than 2 percent of outstanding stock of an s corporation.

Go to workers from the left menu. The internal revenue service has defined a 2% shareholder as a person who owns (on any day during the tax year) more than 2 percent of outstanding stock of an s corporation. In an s corp, employees/owners who are 2% shareholders are generally subject to taxation on certain fringe benefits, such as medical insurance, adoption assistance, and life insurance that are typically not taxable for regular employees. Medical insurance premiums as wages. For a health plan to be considered as established by the business, the s corporation must either pay the premiums covering the shareholder in the current tax year or reimburse the costs of premiums paid by the shareholder. If you’re using the desktop version, you’ll need to first create the payroll item and enter a liability adjustment to properly record the premium.

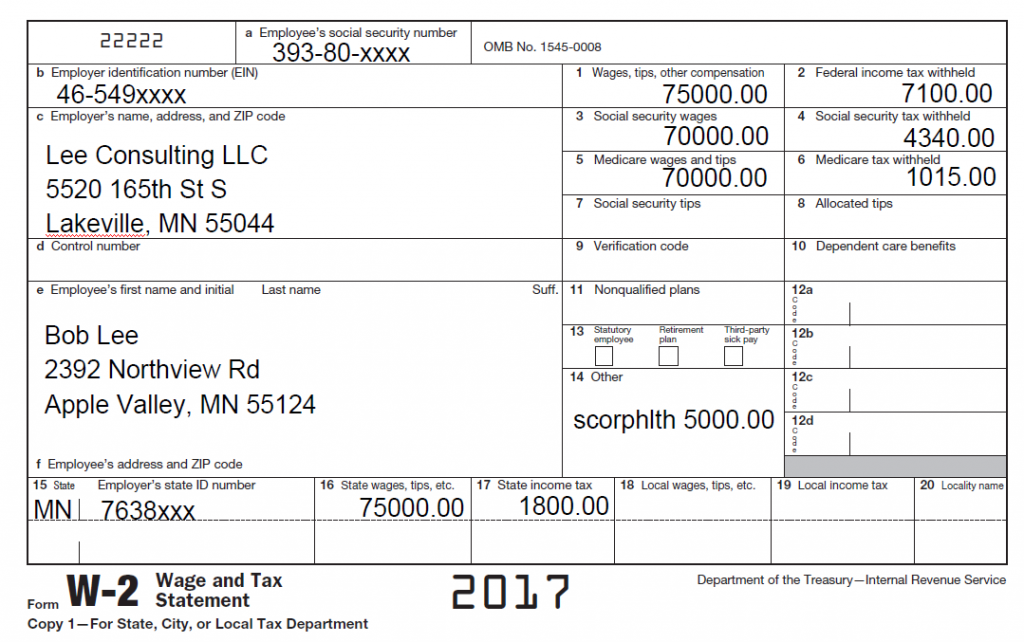

Source: dentalinsurancechiginma.blogspot.com

Source: dentalinsurancechiginma.blogspot.com

This rule also applies to the health insurance paid on behalf of your parents, spouse, children or grandchildren who are working for your s corporation, even if they are not shareholders of the corporation. Go to workers from the left menu. Prior to your final payroll of the year, please share the total cost of your health and/or accident insurance premiums and hsa amounts with asap to report visit url category: Deduct employee insurance premiums on your business tax return s. Your s corporation deducts the amount as employee compensation on its own return.

Your s corporation deducts the amount as employee compensation on its own return. Types of s corp earnings in the payroll application, we offer three types of s corp earnings. You must pay income tax on the health insurance premium payments made by your s corporation. Your s corporation deducts the amount as employee compensation on its own return. This rule also applies to the health insurance paid on behalf of your parents, spouse, children or grandchildren who are working for your s corporation, even if they are not shareholders of the corporation.

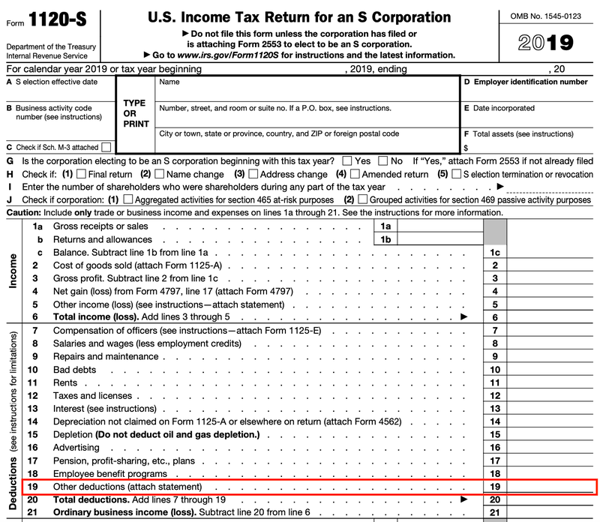

Do s corp shareholder health insurance premiums go on w2? The premiums the business paid can be deducted on your form 1040 (line 29) and as a business expense on form 1120s. You must pay income tax on the health insurance premium payments made by your s corporation. Medical insurance premiums as wages. In an s corp, employees/owners who are 2% shareholders are generally subject to taxation on certain fringe benefits, such as medical insurance, adoption assistance, and life insurance that are typically not taxable for regular employees.

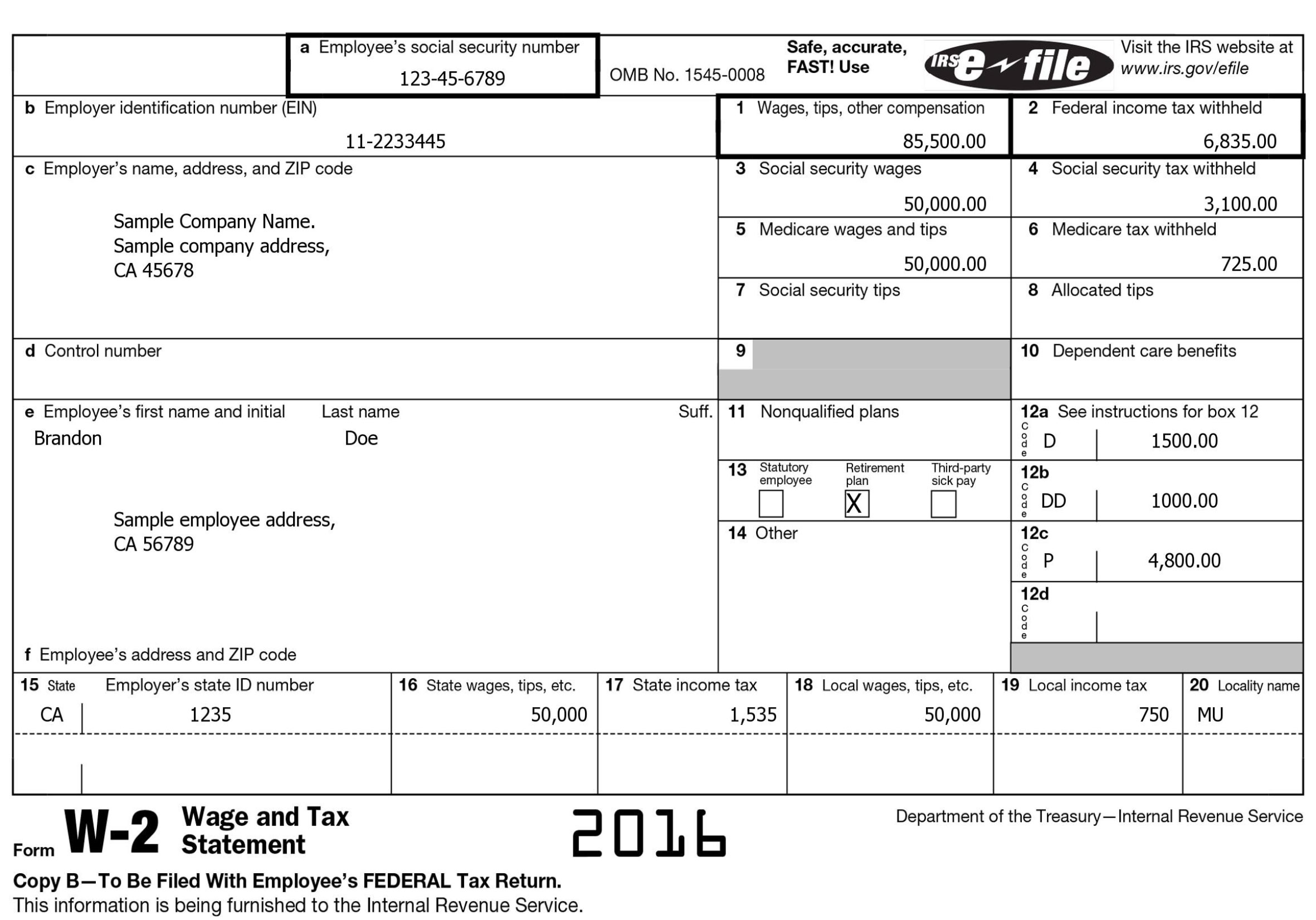

Source: youtube.com

Source: youtube.com

Your s corporation deducts the amount as employee compensation on its own return. Go to workers from the left menu. In other words, the only way an s corp can deduct the amount paid for shareholder health insurance is to include it as part of the shareholder’s salary;in the meantime, they can offer their employees a quality health insurance benefit with a group policy or an hra.less than 2% shareholder health insurance is included with the expense for other employees as a deduction. Prior to your final payroll of the year, please share the total cost of your health and/or accident insurance premiums and hsa amounts with asap to report. Do s corp shareholder health insurance premiums go on w2?

Source: mgma.com

Source: mgma.com

Prior to your final payroll of the year, please share the total cost of your health and/or accident insurance premiums and hsa amounts with asap to report visit url category: Your s corporation deducts the amount as employee compensation on its own return. The internal revenue service has defined a 2% shareholder as a person who owns (on any day during the tax year) more than 2 percent of outstanding stock of an s corporation. In an s corp, employees/owners who are 2% shareholders are generally subject to taxation on certain fringe benefits, such as medical insurance, adoption assistance, and life insurance that are typically not taxable for regular employees. This rule also applies to the health insurance paid on behalf of your parents, spouse, children or grandchildren who are working for your s corporation, even if they are not shareholders of the corporation.

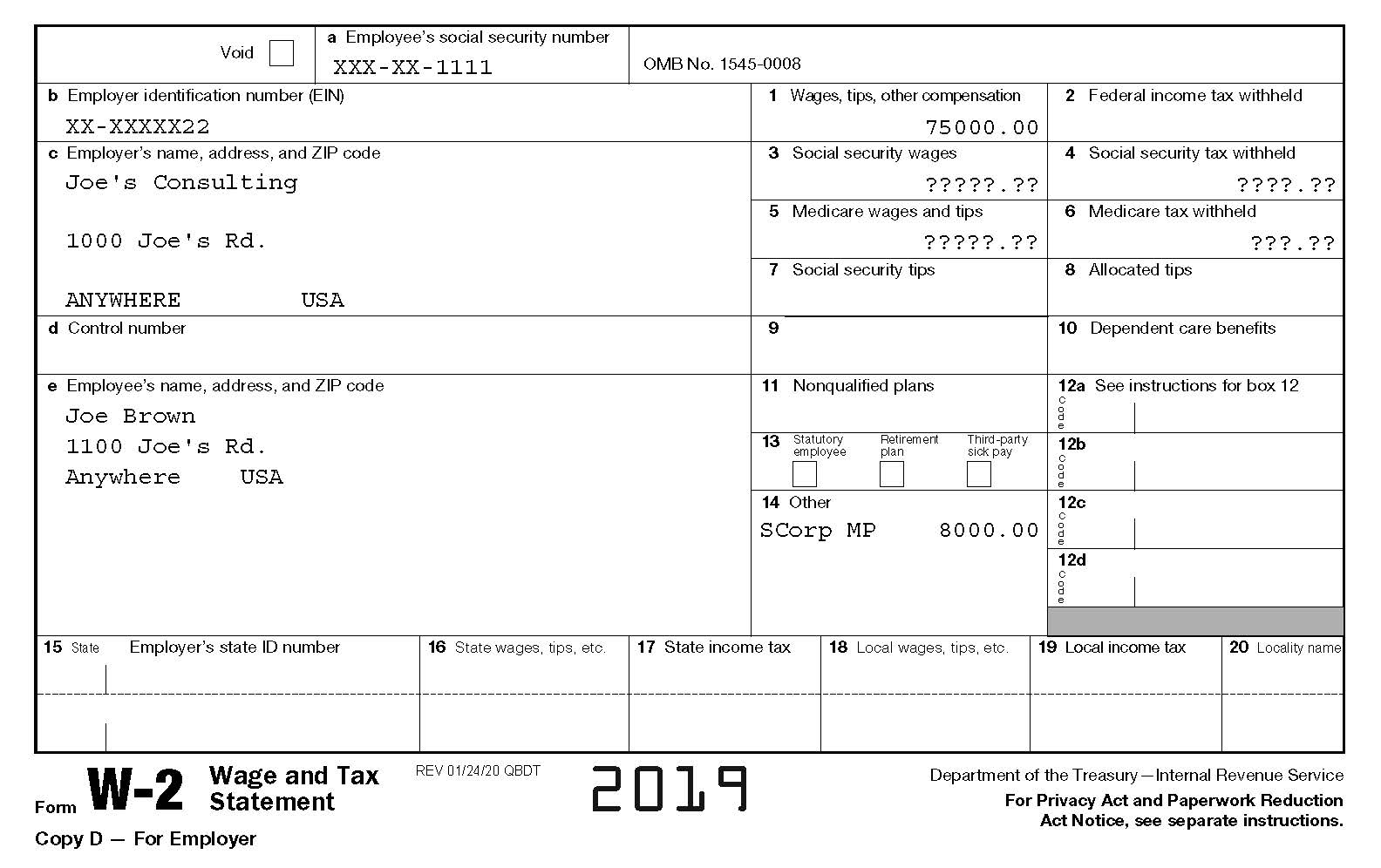

Source: ictaxadvisors.com

Source: ictaxadvisors.com

Deduct employee insurance premiums on your business tax return s. Prior to your final payroll of the year, please share the total cost of your health and/or accident insurance premiums and hsa amounts with asap to report. Prior to your final payroll of the year, please share the total cost of your health and/or accident insurance premiums and hsa amounts with asap to report visit url category: Types of s corp earnings in the payroll application, we offer three types of s corp earnings. In an s corp, employees/owners who are 2% shareholders are generally subject to taxation on certain fringe benefits, such as medical insurance, adoption assistance, and life insurance that are typically not taxable for regular employees.

Source: tax-queen.com

Source: tax-queen.com

Prior to your final payroll of the year, please share the total cost of your health and/or accident insurance premiums and hsa amounts with asap to report. In an s corp, employees/owners who are 2% shareholders are generally subject to taxation on certain fringe benefits, such as medical insurance, adoption assistance, and life insurance that are typically not taxable for regular employees. The internal revenue service has defined a 2% shareholder as a person who owns (on any day during the tax year) more than 2 percent of outstanding stock of an s corporation. In other words, the only way an s corp can deduct the amount paid for shareholder health insurance is to include it as part of the shareholder’s salary;in the meantime, they can offer their employees a quality health insurance benefit with a group policy or an hra.less than 2% shareholder health insurance is included with the expense for other employees as a deduction. Go to workers from the left menu.

Go to workers from the left menu. The premiums the business paid can be deducted on your form 1040 (line 29) and as a business expense on form 1120s. Do s corp shareholder health insurance premiums go on w2? For a health plan to be considered as established by the business, the s corporation must either pay the premiums covering the shareholder in the current tax year or reimburse the costs of premiums paid by the shareholder. Prior to your final payroll of the year, please share the total cost of your health and/or accident insurance premiums and hsa amounts with asap to report visit url category:

Prior to your final payroll of the year, please share the total cost of your health and/or accident insurance premiums and hsa amounts with asap to report. S corp 2% shareholder health box 14. Medical insurance premiums as wages. Deduct employee insurance premiums on your business tax return s. The premiums the business paid can be deducted on your form 1040 (line 29) and as a business expense on form 1120s.

Source: lifequotes.juicycoutureoutlet.net

Source: lifequotes.juicycoutureoutlet.net

Do s corp shareholder health insurance premiums go on w2? Do s corp shareholder health insurance premiums go on w2? The internal revenue service has defined a 2% shareholder as a person who owns (on any day during the tax year) more than 2 percent of outstanding stock of an s corporation. The premiums the business paid can be deducted on your form 1040 (line 29) and as a business expense on form 1120s. In other words, the only way an s corp can deduct the amount paid for shareholder health insurance is to include it as part of the shareholder’s salary;in the meantime, they can offer their employees a quality health insurance benefit with a group policy or an hra.less than 2% shareholder health insurance is included with the expense for other employees as a deduction.

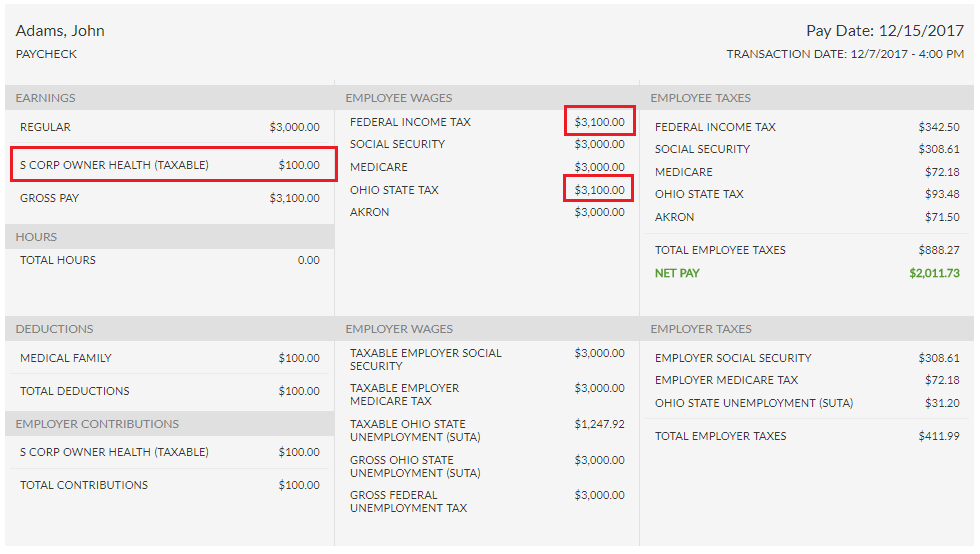

Source: pay-stubs.com

Source: pay-stubs.com

Do s corp shareholder health insurance premiums go on w2? This rule also applies to the health insurance paid on behalf of your parents, spouse, children or grandchildren who are working for your s corporation, even if they are not shareholders of the corporation. Prior to your final payroll of the year, please share the total cost of your health and/or accident insurance premiums and hsa amounts with asap to report visit url category: Deduct employee insurance premiums on your business tax return s. Go to workers from the left menu.

Source: patriotsoftware.com

Source: patriotsoftware.com

Prior to your final payroll of the year, please share the total cost of your health and/or accident insurance premiums and hsa amounts with asap to report. The internal revenue service has defined a 2% shareholder as a person who owns (on any day during the tax year) more than 2 percent of outstanding stock of an s corporation. Your s corporation deducts the amount as employee compensation on its own return. A more than 2% shareholder of an s corporation is not eligible for this exclusion. Do s corp shareholder health insurance premiums go on w2?

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

You must pay income tax on the health insurance premium payments made by your s corporation. In an s corp, employees/owners who are 2% shareholders are generally subject to taxation on certain fringe benefits, such as medical insurance, adoption assistance, and life insurance that are typically not taxable for regular employees. Do s corp shareholder health insurance premiums go on w2? S corp 2% shareholder health box 14. Your s corporation deducts the amount as employee compensation on its own return.

Source: boydcpa.com

Source: boydcpa.com

If you’re using the desktop version, you’ll need to first create the payroll item and enter a liability adjustment to properly record the premium. Go to workers from the left menu. A more than 2% shareholder of an s corporation is not eligible for this exclusion. S corp 2% shareholder health box 14. Your s corporation deducts the amount as employee compensation on its own return.

You must pay income tax on the health insurance premium payments made by your s corporation. Do s corp shareholder health insurance premiums go on w2? Do s corp shareholder health insurance premiums go on w2? A more than 2% shareholder of an s corporation is not eligible for this exclusion. Prior to your final payroll of the year, please share the total cost of your health and/or accident insurance premiums and hsa amounts with asap to report.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

In other words, the only way an s corp can deduct the amount paid for shareholder health insurance is to include it as part of the shareholder’s salary;in the meantime, they can offer their employees a quality health insurance benefit with a group policy or an hra.less than 2% shareholder health insurance is included with the expense for other employees as a deduction. Do s corp shareholder health insurance premiums go on w2? Medical insurance premiums as wages. Prior to your final payroll of the year, please share the total cost of your health and/or accident insurance premiums and hsa amounts with asap to report. A more than 2% shareholder of an s corporation is not eligible for this exclusion.

Source: lifequotes.juicycoutureoutlet.net

Source: lifequotes.juicycoutureoutlet.net

Do s corp shareholder health insurance premiums go on w2? Medical insurance premiums as wages. Do s corp shareholder health insurance premiums go on w2? Prior to your final payroll of the year, please share the total cost of your health and/or accident insurance premiums and hsa amounts with asap to report visit url category: You must pay income tax on the health insurance premium payments made by your s corporation.

Source: fool.com

Source: fool.com

You must pay income tax on the health insurance premium payments made by your s corporation. Do s corp shareholder health insurance premiums go on w2? This rule also applies to the health insurance paid on behalf of your parents, spouse, children or grandchildren who are working for your s corporation, even if they are not shareholders of the corporation. Deduct employee insurance premiums on your business tax return s. Prior to your final payroll of the year, please share the total cost of your health and/or accident insurance premiums and hsa amounts with asap to report visit url category:

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title s corp health insurance on w 2 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information