S corp health insurance reporting on w2 Idea

Home » Trending » S corp health insurance reporting on w2 IdeaYour S corp health insurance reporting on w2 images are ready in this website. S corp health insurance reporting on w2 are a topic that is being searched for and liked by netizens now. You can Get the S corp health insurance reporting on w2 files here. Find and Download all free vectors.

If you’re searching for s corp health insurance reporting on w2 images information connected with to the s corp health insurance reporting on w2 keyword, you have come to the ideal site. Our website frequently gives you suggestions for refferencing the highest quality video and image content, please kindly surf and locate more enlightening video articles and graphics that fit your interests.

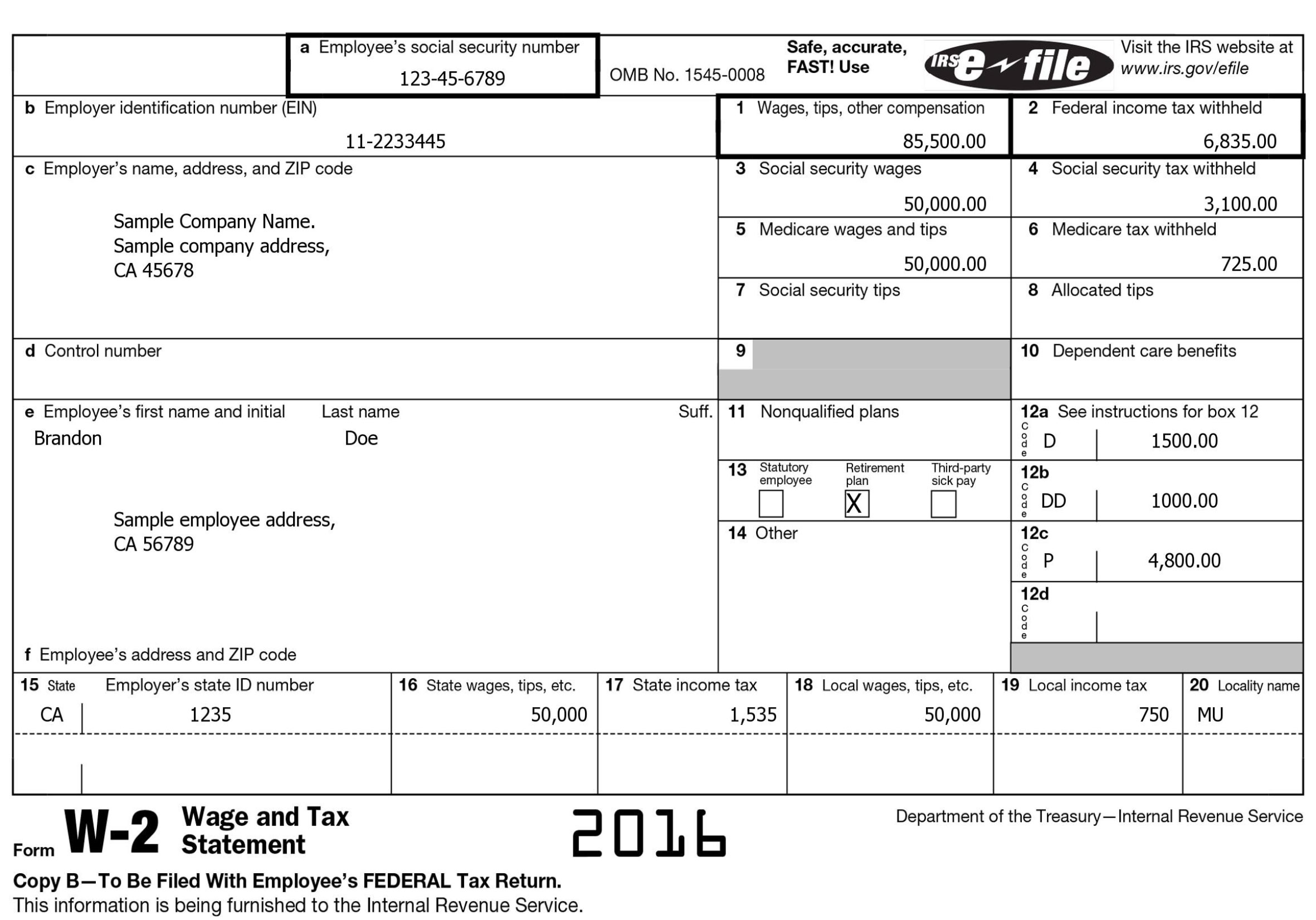

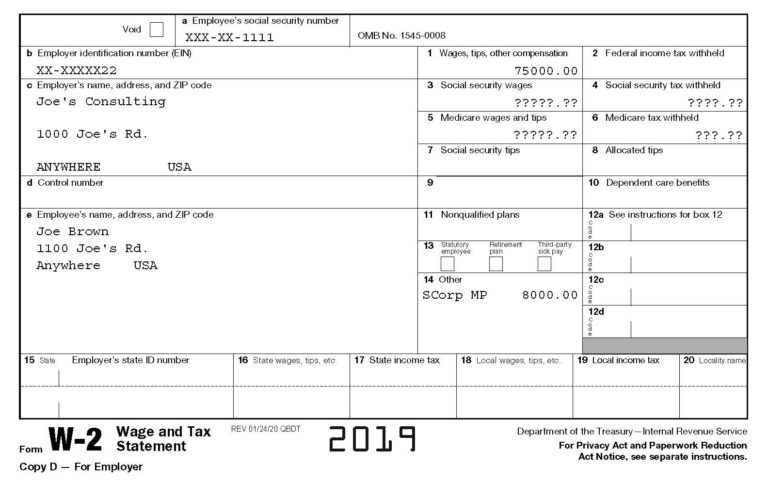

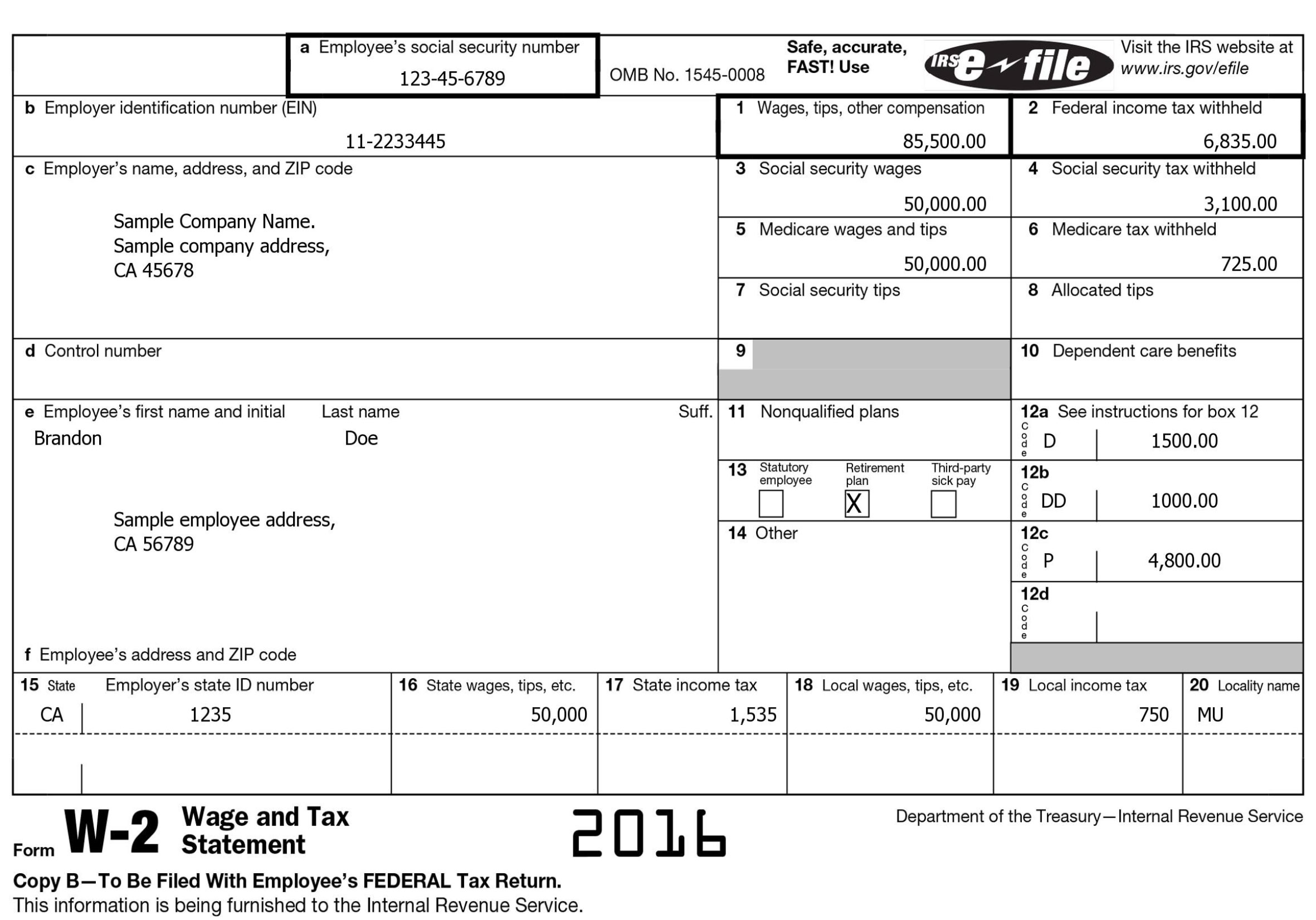

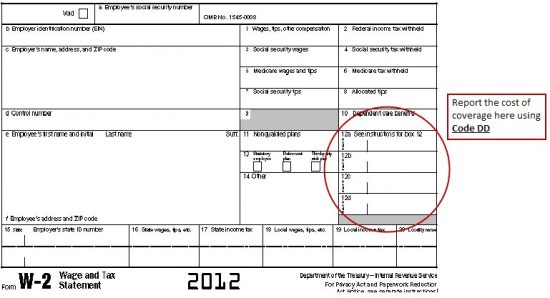

S Corp Health Insurance Reporting On W2. The difference of $3,450 between the amount in box 16 and the amount in box 1 seems wrong relative to code w amount (for a california resident). Enter the officer health insurance on form 1120s line 18 for officers owning 2% or less of the corporation�s stock: Health insurance for s corporation 2% shareholders: S corp 2% shareholder health box 14.

W2 Form Sample From pay-stubs.com

W2 Form Sample From pay-stubs.com

This article provides one example (with notes and tips) of how to set up and process 2% shareholder/officer health insurance. Deduct employee insurance premiums on your business tax return s. Go to screen 15, ordinary deductions. Health insurance for s corporation 2% shareholders: Enter the officer health insurance on form 1120s line 18 for officers owning 2% or less of the corporation�s stock: A — uncollected social security or rrta tax on tips.

Adding an additional check for an s corp earning adding an additional check for an s corp earning if you are not paying the employee portion of taxes and the employee is being paid live earnings in this payroll, then report the s corp amount for the current payroll on a second row in the payroll worksheet as an additional check.

The difference of $3,450 between the amount in box 16 and the amount in box 1 seems wrong relative to code w amount (for a california resident). Health insurance for s corporation 2% shareholders: Enter the officer health insurance on form 1120s line 18 for officers owning 2% or less of the corporation�s stock: The difference of $3,450 between the amount in box 16 and the amount in box 1 seems wrong relative to code w amount (for a california resident). Adding an additional check for an s corp earning adding an additional check for an s corp earning if you are not paying the employee portion of taxes and the employee is being paid live earnings in this payroll, then report the s corp amount for the current payroll on a second row in the payroll worksheet as an additional check. This article provides one example (with notes and tips) of how to set up and process 2% shareholder/officer health insurance.

Source: lifequotes.juicycoutureoutlet.net

Source: lifequotes.juicycoutureoutlet.net

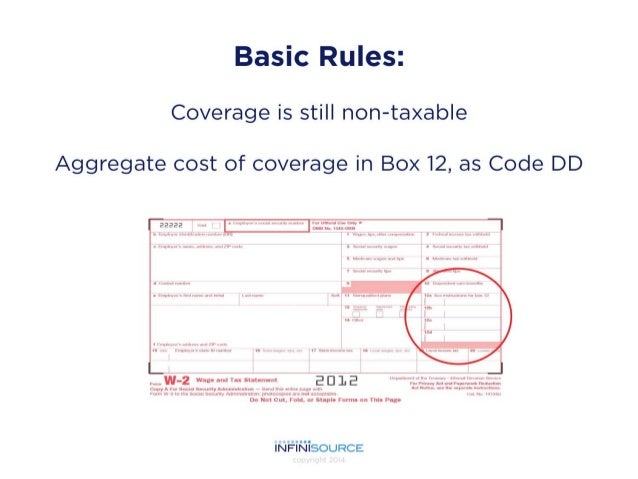

This article provides one example (with notes and tips) of how to set up and process 2% shareholder/officer health insurance. Medical insurance premiums as wages. A — uncollected social security or rrta tax on tips. Enter/include the amount in employee benefit programs. 1 scorp deducts owner�s medical insurance cost as employee medical 2 scorp adds it to wages on 941 but not to ss or medicare 3 scorp adds it to wages on w2 but not to ss or medicare so that 941s and w3 will reconcile 4 scorp subtracts it.

Source: boydcpa.com

Source: boydcpa.com

Medical insurance premiums as wages. S corp 2% shareholder health box 14. If you�re a 2% shareholder and offer the same medical insurance plan to all your employees Health insurance for s corporation 2% shareholders: Medical insurance premiums as wages.

The difference of $3,450 between the amount in box 16 and the amount in box 1 seems wrong relative to code w amount (for a california resident). Health insurance for s corporation 2% shareholders: This article provides one example (with notes and tips) of how to set up and process 2% shareholder/officer health insurance. If you�re a 2% shareholder and offer the same medical insurance plan to all your employees Glad to have you here in the community, @accounting62.

Source: pay-stubs.com

Source: pay-stubs.com

Enter/include the amount in employee benefit programs. The way your payroll items affect your tax reporting depends on the pay types you selected during the setup. 1 scorp deducts owner�s medical insurance cost as employee medical 2 scorp adds it to wages on 941 but not to ss or medicare 3 scorp adds it to wages on w2 but not to ss or medicare so that 941s and w3 will reconcile 4 scorp subtracts it. This rule also applies to the health insurance paid on behalf of your parents, spouse, children or grandchildren who are working for your s corporation, even if they are not shareholders of the corporation. Deduct employee insurance premiums on your business tax return s.

Source: slideshare.net

Source: slideshare.net

A — uncollected social security or rrta tax on tips. This article provides one example (with notes and tips) of how to set up and process 2% shareholder/officer health insurance. Health insurance for s corporation 2% shareholders: Adding an additional check for an s corp earning adding an additional check for an s corp earning if you are not paying the employee portion of taxes and the employee is being paid live earnings in this payroll, then report the s corp amount for the current payroll on a second row in the payroll worksheet as an additional check. Glad to have you here in the community, @accounting62.

Source: mycity4her.com

Source: mycity4her.com

Enter/include the amount in employee benefit programs. The way your payroll items affect your tax reporting depends on the pay types you selected during the setup. Enter/include the amount in employee benefit programs. Enter the officer health insurance on form 1120s line 18 for officers owning 2% or less of the corporation�s stock: Deduct employee insurance premiums on your business tax return s.

Glad to have you here in the community, @accounting62. Deduct employee insurance premiums on your business tax return s. The way your payroll items affect your tax reporting depends on the pay types you selected during the setup. Enter the officer health insurance on form 1120s line 18 for officers owning 2% or less of the corporation�s stock: 1 scorp deducts owner�s medical insurance cost as employee medical 2 scorp adds it to wages on 941 but not to ss or medicare 3 scorp adds it to wages on w2 but not to ss or medicare so that 941s and w3 will reconcile 4 scorp subtracts it.

Source: slideshare.net

Source: slideshare.net

1 scorp deducts owner�s medical insurance cost as employee medical 2 scorp adds it to wages on 941 but not to ss or medicare 3 scorp adds it to wages on w2 but not to ss or medicare so that 941s and w3 will reconcile 4 scorp subtracts it. This article provides one example (with notes and tips) of how to set up and process 2% shareholder/officer health insurance. If you�re a 2% shareholder and offer the same medical insurance plan to all your employees Adding an additional check for an s corp earning adding an additional check for an s corp earning if you are not paying the employee portion of taxes and the employee is being paid live earnings in this payroll, then report the s corp amount for the current payroll on a second row in the payroll worksheet as an additional check. The way your payroll items affect your tax reporting depends on the pay types you selected during the setup.

Source: aischasworldofphotos.blogspot.com

Source: aischasworldofphotos.blogspot.com

Glad to have you here in the community, @accounting62. This article provides one example (with notes and tips) of how to set up and process 2% shareholder/officer health insurance. This rule also applies to the health insurance paid on behalf of your parents, spouse, children or grandchildren who are working for your s corporation, even if they are not shareholders of the corporation. If you�re a 2% shareholder and offer the same medical insurance plan to all your employees Health insurance for s corporation 2% shareholders:

A — uncollected social security or rrta tax on tips. Adding an additional check for an s corp earning adding an additional check for an s corp earning if you are not paying the employee portion of taxes and the employee is being paid live earnings in this payroll, then report the s corp amount for the current payroll on a second row in the payroll worksheet as an additional check. 1 scorp deducts owner�s medical insurance cost as employee medical 2 scorp adds it to wages on 941 but not to ss or medicare 3 scorp adds it to wages on w2 but not to ss or medicare so that 941s and w3 will reconcile 4 scorp subtracts it. The way your payroll items affect your tax reporting depends on the pay types you selected during the setup. Enter the officer health insurance on form 1120s line 18 for officers owning 2% or less of the corporation�s stock:

Source: vashepping.blogspot.com

Source: vashepping.blogspot.com

Go to screen 15, ordinary deductions. A — uncollected social security or rrta tax on tips. S corp 2% shareholder health box 14. 1 scorp deducts owner�s medical insurance cost as employee medical 2 scorp adds it to wages on 941 but not to ss or medicare 3 scorp adds it to wages on w2 but not to ss or medicare so that 941s and w3 will reconcile 4 scorp subtracts it. The way your payroll items affect your tax reporting depends on the pay types you selected during the setup.

Source: lifequotes.juicycoutureoutlet.net

Source: lifequotes.juicycoutureoutlet.net

Glad to have you here in the community, @accounting62. Health insurance for s corporation 2% shareholders: Go to screen 15, ordinary deductions. Deduct employee insurance premiums on your business tax return s. The way your payroll items affect your tax reporting depends on the pay types you selected during the setup.

Source: basusa.com

Source: basusa.com

Enter/include the amount in employee benefit programs. Enter/include the amount in employee benefit programs. This article provides one example (with notes and tips) of how to set up and process 2% shareholder/officer health insurance. Health insurance for s corporation 2% shareholders: Enter the officer health insurance on form 1120s line 18 for officers owning 2% or less of the corporation�s stock:

The way your payroll items affect your tax reporting depends on the pay types you selected during the setup. 1 scorp deducts owner�s medical insurance cost as employee medical 2 scorp adds it to wages on 941 but not to ss or medicare 3 scorp adds it to wages on w2 but not to ss or medicare so that 941s and w3 will reconcile 4 scorp subtracts it. Health insurance for s corporation 2% shareholders: Go to screen 15, ordinary deductions. This rule also applies to the health insurance paid on behalf of your parents, spouse, children or grandchildren who are working for your s corporation, even if they are not shareholders of the corporation.

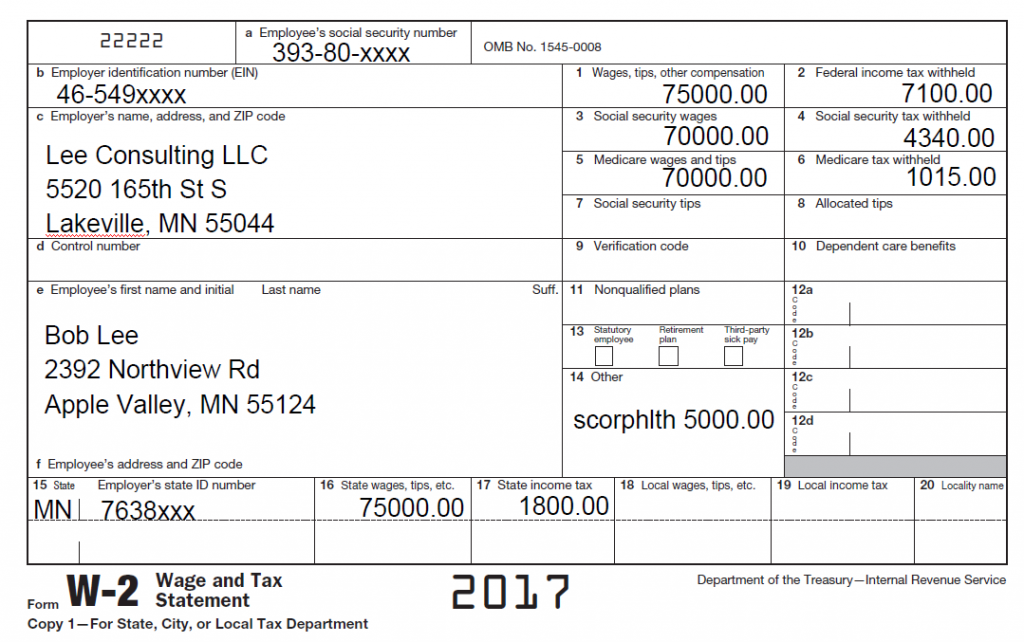

.png?width=800&name=2017 W-2 FORM (2).png “W2 Reporting Required for Nanny TaxFree Healthcare Benefits”) Source: info.homeworksolutions.com

If you�re a 2% shareholder and offer the same medical insurance plan to all your employees S corp 2% shareholder health box 14. 1 scorp deducts owner�s medical insurance cost as employee medical 2 scorp adds it to wages on 941 but not to ss or medicare 3 scorp adds it to wages on w2 but not to ss or medicare so that 941s and w3 will reconcile 4 scorp subtracts it. Deduct employee insurance premiums on your business tax return s. Enter the officer health insurance on form 1120s line 18 for officers owning 2% or less of the corporation�s stock:

Source: peoplekeep.com

Source: peoplekeep.com

This rule also applies to the health insurance paid on behalf of your parents, spouse, children or grandchildren who are working for your s corporation, even if they are not shareholders of the corporation. 1 scorp deducts owner�s medical insurance cost as employee medical 2 scorp adds it to wages on 941 but not to ss or medicare 3 scorp adds it to wages on w2 but not to ss or medicare so that 941s and w3 will reconcile 4 scorp subtracts it. A — uncollected social security or rrta tax on tips. Enter/include the amount in employee benefit programs. Glad to have you here in the community, @accounting62.

Source: tax-queen.com

Source: tax-queen.com

Adding an additional check for an s corp earning adding an additional check for an s corp earning if you are not paying the employee portion of taxes and the employee is being paid live earnings in this payroll, then report the s corp amount for the current payroll on a second row in the payroll worksheet as an additional check. Medical insurance premiums as wages. Deduct employee insurance premiums on your business tax return s. Enter the officer health insurance on form 1120s line 18 for officers owning 2% or less of the corporation�s stock: Go to screen 15, ordinary deductions.

Source: doctorheck.blogspot.com

Source: doctorheck.blogspot.com

Deduct employee insurance premiums on your business tax return s. Adding an additional check for an s corp earning adding an additional check for an s corp earning if you are not paying the employee portion of taxes and the employee is being paid live earnings in this payroll, then report the s corp amount for the current payroll on a second row in the payroll worksheet as an additional check. The way your payroll items affect your tax reporting depends on the pay types you selected during the setup. A — uncollected social security or rrta tax on tips. Deduct employee insurance premiums on your business tax return s.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title s corp health insurance reporting on w2 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information