Savings vs insurance Idea

Home » Trend » Savings vs insurance IdeaYour Savings vs insurance images are ready in this website. Savings vs insurance are a topic that is being searched for and liked by netizens now. You can Download the Savings vs insurance files here. Get all royalty-free images.

If you’re looking for savings vs insurance pictures information linked to the savings vs insurance topic, you have pay a visit to the ideal blog. Our site always provides you with suggestions for downloading the maximum quality video and image content, please kindly hunt and locate more enlightening video articles and images that match your interests.

Savings Vs Insurance. A savings account is a type of bank account where you keep money and earn interest while the money remains deposited. As a result, saving money for retirement now is the key to securing your financial future. Roth ira accounts before you make an investment decision. Insurance is purely money for specific purposes and projects.

Are Unit Trust Funds Better Than Savings Accounts? iMoney From imoney.my

Are Unit Trust Funds Better Than Savings Accounts? iMoney From imoney.my

Compare this to someone who buys a much cheaper term life insurance policy, which has no savings feature, and invests the difference in an ira. With your pet insurance plan, you’ll be able to insure your dog or cat and know that their medical bills will most likely be covered by your provider. These plans are not considered to be qualified health plans under the affordable care act. Benefits of life insurance vs. The discounts are available through participating healthcare providers only. So while such insurance saving accounts offer a higher degree of flexibility, fully benefiting from their features takes some work.

Please consult with the respective plan detail page for additional plan terms.

Investing in insurance vs saving in sacco or bank 1. In the bank or sacco, you benefit more if you are looking for short term savings period, like few month. The discounts are available through participating healthcare providers only. These plans are not considered to be qualified health plans under the affordable care act. The biggest difference in dental savings plans and traditional insurance is that the savings plan option doesn’t have an annual spending limit. Investing in insurance vs saving in sacco or bank 1.

Source: youtube.com

Source: youtube.com

Privacy and all it affords. #stockmarket #sharemarket #shares #stocks #sumantvmoneywelcome to sumantv money channel, the place where you are served with online and offline money making. Dental savings plans generally have more flexible enrollment requirements, allowing you to buy a pass that’s good for anywhere from one month up to one year. Investing in insurance vs saving in sacco or bank 1. We recommend a combination of both a pet savings account and pet insurance plan.

Source: lsminsurance.ca

Source: lsminsurance.ca

Life insurance and roth ira accounts can provide you income after you retire. The total cost of enrollment can be significantly less than dental insurance as well, coming in around 20 bucks on a monthly basis, or under 150 bucks per year. Under assurance policy will always result in the payment being made because the investment is combined with the sum insured. Insurance is purely money for specific purposes and projects. To start, the biggest and most influential difference between saving and investing is a risk.

Source: comparenow.co.nz

Source: comparenow.co.nz

And unlike dental insurance, where you often find. In the bank or sacco, you benefit more if you are looking for short term savings period, like few month. Under assurance policy will always result in the payment being made because the investment is combined with the sum insured. They can dip into their savings at any time after. And unlike dental insurance, where you often find.

Source: pinterest.com

Source: pinterest.com

Insurance is purely money for specific purposes and projects. Investing in insurance vs saving in sacco or bank 1. #stockmarket #sharemarket #shares #stocks #sumantvmoneywelcome to sumantv money channel, the place where you are served with online and offline money making. Insurance is purely money for specific purposes and projects. You keep 100% of the fees collected.

Source: pinterest.co.uk

Source: pinterest.co.uk

They can dip into their savings at any time after. It’s good to set aside cash for a rainy day, but you also need to plan for the unexpected, like a sudden death in the family and loss of income. Dental savings plans generally have more flexible enrollment requirements, allowing you to buy a pass that’s good for anywhere from one month up to one year. Benefits of life insurance vs. If you want to schedule three cleanings a year instead of two, you can;

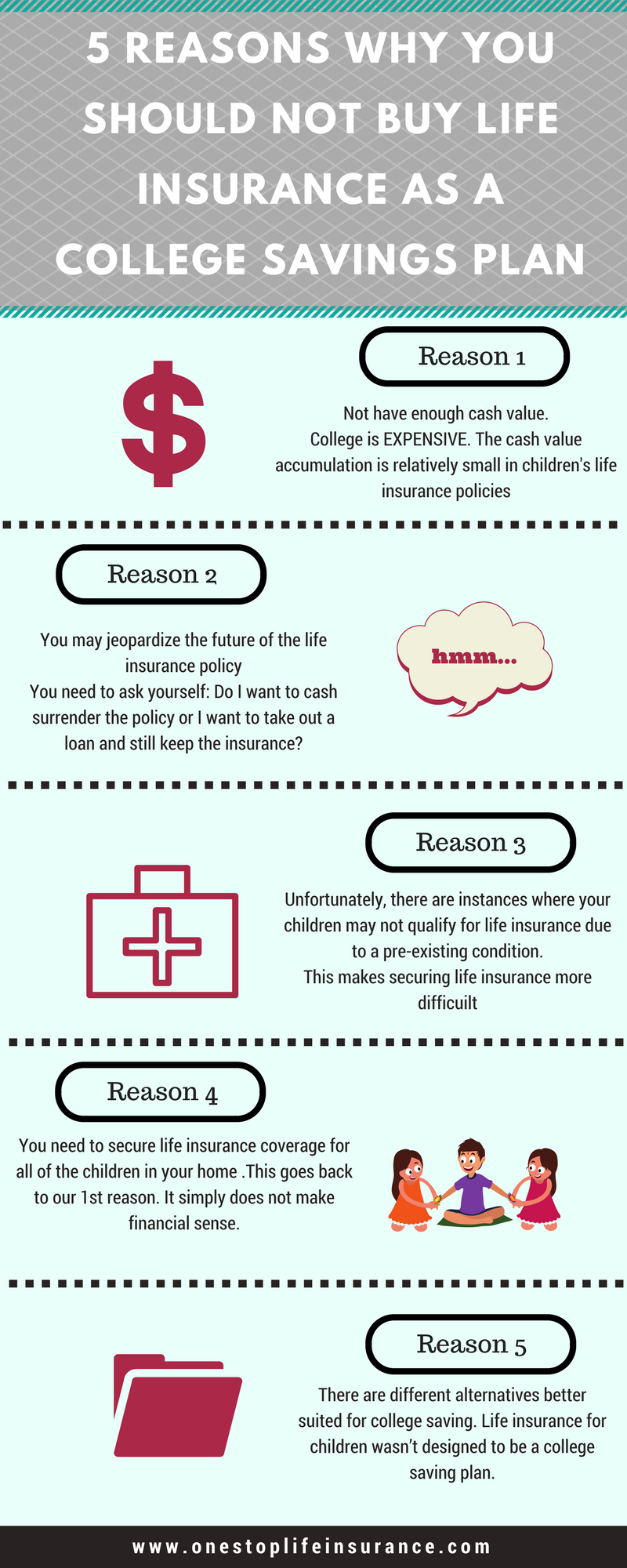

Source: visual.ly

Source: visual.ly

As these are also insurance products, let’s differentiate them by terming them ‘flexible insurance savings accounts’ here, with ‘flexible’ being their major defining characteristic. The total cost of enrollment can be significantly less than dental insurance as well, coming in around 20 bucks on a monthly basis, or under 150 bucks per year. We recommend a combination of both a pet savings account and pet insurance plan. And unlike dental insurance, where you often find. Each option has its own benefits and drawbacks, making it important that you compare life insurance vs.

![Savings vs Investment [Infographic] Investing, Finance Savings vs Investment [Infographic] Investing, Finance](https://i.pinimg.com/originals/7b/16/35/7b1635f6522b0ad61317ba11427ab896.jpg) Source: pinterest.com

Source: pinterest.com

And unlike dental insurance, where you often find. The total cost of enrollment can be significantly less than dental insurance as well, coming in around 20 bucks on a monthly basis, or under 150 bucks per year. So while such insurance saving accounts offer a higher degree of flexibility, fully benefiting from their features takes some work. You design your plan (s) and set the enrollment fee based on the needs of your practice. With your pet insurance plan, you’ll be able to insure your dog or cat and know that their medical bills will most likely be covered by your provider.

Source: coverfox.com

Source: coverfox.com

A return of premium (rop) life insurance policy works exactly like a traditional term life insurance policy except for one significant difference: After i posted an article about collecting data to leverage for insurance purposes, i received comments and emails about privacy issues vs. It’s good to set aside cash for a rainy day, but you also need to plan for the unexpected, like a sudden death in the family and loss of income. Insurance is purely money for specific purposes and projects. Benefits of savings when you pay premiums on an insurance policy, that money belongs to the insurance company.

Source: youtube.com

Source: youtube.com

It helps you cultivate a lot of descipline and respect. Savings plans are not insurance and the savings will vary by provider, plan and zip code. And unlike dental insurance, where you often find. Dental savings plans generally have more flexible enrollment requirements, allowing you to buy a pass that’s good for anywhere from one month up to one year. This is a concern for many people and it is completely understood.

Source: largofinancialservices.com

Source: largofinancialservices.com

After i posted an article about collecting data to leverage for insurance purposes, i received comments and emails about privacy issues vs. It’s good to set aside cash for a rainy day, but you also need to plan for the unexpected, like a sudden death in the family and loss of income. Benefits of life insurance vs. Savings accounts at a bank are generally insured by the canada deposit insurance corporation (cdic), while those offered by credit unions are insured by provincial deposit guarantee corporations e.g. You current dentist probably works with a variety of savings plans, so call the office to learn which plans your dentist accepts.

Source: millionin10.com

Source: millionin10.com

So while such insurance saving accounts offer a higher degree of flexibility, fully benefiting from their features takes some work. To start, the biggest and most influential difference between saving and investing is a risk. This is a concern for many people and it is completely understood. In the bank or sacco, you benefit more if you are looking for short term savings period, like few month. Life insurance and roth ira accounts can provide you income after you retire.

Source: kangqing-asdfghjkl.blogspot.com

Source: kangqing-asdfghjkl.blogspot.com

Saving money for unexpected medical emergencies is a great thing that many people follow in our country. The discounts are available through participating healthcare providers only. Privacy and all it affords. Benefits of life insurance vs. This is a concern for many people and it is completely understood.

Source: youtube.com

Source: youtube.com

Savings accounts at a bank are generally insured by the canada deposit insurance corporation (cdic), while those offered by credit unions are insured by provincial deposit guarantee corporations e.g. In the bank or sacco, you benefit more if you are looking for short term savings period, like few month. You current dentist probably works with a variety of savings plans, so call the office to learn which plans your dentist accepts. As a result, saving money for retirement now is the key to securing your financial future. A return of premium (rop) life insurance policy works exactly like a traditional term life insurance policy except for one significant difference:

Source: pinterest.com

Source: pinterest.com

Privacy and all it affords. The closest option you have to get a savings account attached to a life insurance policy is what is known as a return of premium term life insurance policy. #stockmarket #sharemarket #shares #stocks #sumantvmoneywelcome to sumantv money channel, the place where you are served with online and offline money making. This is a concern for many people and it is completely understood. Dental savings plans generally have more flexible enrollment requirements, allowing you to buy a pass that’s good for anywhere from one month up to one year.

Source: thrivecu.org

Source: thrivecu.org

These plans are not considered to be qualified health plans under the affordable care act. Apart from a minimum deposit to start your account (ranging from $500 to $2,000), flexible insurance savings accounts don’t require you to make regular deposits (the way endowments. You current dentist probably works with a variety of savings plans, so call the office to learn which plans your dentist accepts. Savings accounts at a bank are generally insured by the canada deposit insurance corporation (cdic), while those offered by credit unions are insured by provincial deposit guarantee corporations e.g. You save when you put money into a savings account like a money market account or.

Source: beamplify.com

Source: beamplify.com

You save when you put money into a savings account like a money market account or. It’s good to set aside cash for a rainy day, but you also need to plan for the unexpected, like a sudden death in the family and loss of income. If you never suffer a loss, you get nothing for that investment. Each option has its own benefits and drawbacks, making it important that you compare life insurance vs. We recommend a combination of both a pet savings account and pet insurance plan.

Source: imoney.my

Source: imoney.my

A savings account is a type of bank account where you keep money and earn interest while the money remains deposited. If you want to schedule three cleanings a year instead of two, you can; Saving money for unexpected medical emergencies is a great thing that many people follow in our country. As a result, saving money for retirement now is the key to securing your financial future. Compare this to someone who buys a much cheaper term life insurance policy, which has no savings feature, and invests the difference in an ira.

Source: petsbest.com

Source: petsbest.com

Benefits of savings when you pay premiums on an insurance policy, that money belongs to the insurance company. It’s good to set aside cash for a rainy day, but you also need to plan for the unexpected, like a sudden death in the family and loss of income. Life insurance and roth ira accounts can provide you income after you retire. Investing in insurance vs saving in sacco or bank 1. Privacy and all it affords.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title savings vs insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information