Sba loans for insurance agencies Idea

Home » Trend » Sba loans for insurance agencies IdeaYour Sba loans for insurance agencies images are available in this site. Sba loans for insurance agencies are a topic that is being searched for and liked by netizens now. You can Find and Download the Sba loans for insurance agencies files here. Get all royalty-free photos and vectors.

If you’re looking for sba loans for insurance agencies images information linked to the sba loans for insurance agencies keyword, you have pay a visit to the ideal blog. Our site frequently gives you hints for seeing the maximum quality video and picture content, please kindly surf and find more enlightening video articles and images that match your interests.

Sba Loans For Insurance Agencies. In fact, the small business administration counted 4,686 sba 7 (a) loans to insurance agencies and brokerages for a total of $944 million for the 10 years ended 2015. 10 rows that’s why we understand that these have put huge stress on small independent insurance agency. Sba loans up to $150,000; Federal laws may be reflected in state laws, but it is advisable to review laws at both the federal and state level.

Everything to Consider When Choosing a Business Insurance From sbaloansatlanta.com

Everything to Consider When Choosing a Business Insurance From sbaloansatlanta.com

Sba only makes direct loans in the case of businesses and homeowners recovering from a declared disaster. Our insurance agency loan specialists understand the unique financing needs of the independent insurance agent. The required life insurance policy you purchase must be proportionate to the amount and term of the sba loan you secure. Starting the week of april 6, 2021, the sba is raising the loan limit for the eidl program from 6 months of economic injury with a maximum loan amount of $150,000 to 24 months of economic injury with a maximum loan amount of $500,000. Talk with an expert shop &. This information is published by the u.s.

Insurance for employees who use your personal or company vehicle for business purposes.

Insurance for employees who use your personal or company vehicle for business purposes. Any disputes on the accuracy should be directed to the u.s. Apply for a loan through your local lender. The sba guaranty is 75% leaving the bank an actual credit risk of 25%. Lending to the insurance industry is an expanding market that lenders should strongly consider. This lending opportunity is primed to grow even further.

Source: h64xhk1af0.blogspot.com

Source: h64xhk1af0.blogspot.com

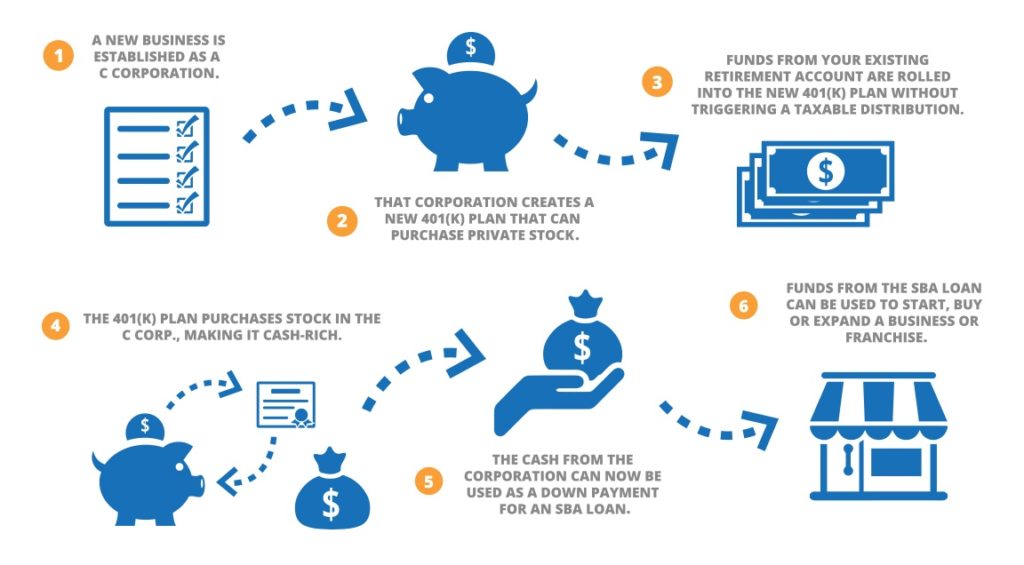

During such dark times, you may opt for the small business administration (sba, which helps small businesses to secure loans either to establish or expand their businesses. Apply for a small business loan; Trust us to guide you to through the process of the sba loan life insurance requirement and we’ll do our part to keep your loan closing on time. Starting the week of april 6, 2021, the sba is raising the loan limit for the eidl program from 6 months of economic injury with a maximum loan amount of $150,000 to 24 months of economic injury with a maximum loan amount of $500,000. Sba partners with lenders to help increase small business access to loans.

Source: connell.com

Source: connell.com

Repayment terms between seven and 25 years, relatively low interest rates, and high capital amounts. Lenders will approve and help you manage your loan. Sba partners with lenders to help increase small business access to loans. Federal laws may be reflected in state laws, but it is advisable to review laws at both the federal and state level. Sba only makes direct loans in the case of businesses and homeowners recovering from a declared disaster.

Source: nophysicaltermlife.com

Source: nophysicaltermlife.com

You may want to consider an sba loan —particularly, an sba 7 (a) loan —for things such as general working capital and commercial real estate upgrades. The required life insurance policy you purchase must be proportionate to the amount and term of the sba loan you secure. Sba only makes direct loans in the case of businesses and homeowners recovering from a declared disaster. United midwest�s sba loans provide financing terms that may not otherwise be available to you in the marketplace. Starting the week of april 6, 2021, the sba is raising the loan limit for the eidl program from 6 months of economic injury with a maximum loan amount of $150,000 to 24 months of economic injury with a maximum loan amount of $500,000.

Source: lifeinsuranceforsbaloan.com

Source: lifeinsuranceforsbaloan.com

This lending opportunity is primed to grow even further. Any disputes on the accuracy should be directed to the u.s. Insurance agent loan products when you need a business loan, oak street funding offers a variety of financial solutions and lending capital, customized to meet your needs. Repayment terms between seven and 25 years, relatively low interest rates, and high capital amounts. Depending on the gl limit required, it might be more affordable to purchase a bop or standard package policy with lower limits, and add an umbrella liability insurance policy to raise the.

Source: jimersonfirm.com

Source: jimersonfirm.com

At 1st commercial lending, we specialize in structuring insurance agency loans for new and current insurance agency owners. You complete a collateral assignment for your lender. Build a new insurance agency: Commercial sba loans (over $150,000) referral program; Starting the week of april 6, 2021, the sba is raising the loan limit for the eidl program from 6 months of economic injury with a maximum loan amount of $150,000 to 24 months of economic injury with a maximum loan amount of $500,000.

Source: mycastleintheclouds2.blogspot.com

Source: mycastleintheclouds2.blogspot.com

You may want to consider an sba loan —particularly, an sba 7 (a) loan —for things such as general working capital and commercial real estate upgrades. Businesses that received a loan subject to the previous limits do not need to submit a request for an increase. Every sba loan will require general liability insurance (gl). Posts tagged sba loans insurance agencies sba 7(a) loans for insurance agencies right now, there are more than 1.1 million insurance agents, brokers, and affiliated employees in the united states— all working as part of an industry that wrote more than $1.2 trillion in. Apply for a loan through your local lender.

Source: blogpapi.com

Source: blogpapi.com

At 1st commercial lending, we specialize in structuring insurance agency loans for new and current insurance agency owners. Talk with an expert shop &. Insurance for employees who use your personal or company vehicle for business purposes. Build a new insurance agency: Lending to the insurance industry is an expanding market that lenders should strongly consider.

Source: thebaileygp.com

Source: thebaileygp.com

Starting the week of april 6, 2021, the sba is raising the loan limit for the eidl program from 6 months of economic injury with a maximum loan amount of $150,000 to 24 months of economic injury with a maximum loan amount of $500,000. Depending on the gl limit required, it might be more affordable to purchase a bop or standard package policy with lower limits, and add an umbrella liability insurance policy to raise the. You complete a collateral assignment for your lender. Anything can happen along the way, but by starting early, we can get the right policy at the best price for your situation. Every sba loan will require general liability insurance (gl).

Source: diabeteslifesolutions.com

Source: diabeteslifesolutions.com

10 rows that’s why we understand that these have put huge stress on small independent insurance agency. This information is published by the u.s. 10 rows that’s why we understand that these have put huge stress on small independent insurance agency. Repayment terms between seven and 25 years, relatively low interest rates, and high capital amounts. There are many benefits to sba loans, and lots of insurance agencies are finding that this is a particularly good time to apply for them.

Source: cfainsure.com

Source: cfainsure.com

Sba 7(a) loans can finance all aspects of the construction process, including security systems, landscaping, construction permits, and more. Depending on the gl limit required, it might be more affordable to purchase a bop or standard package policy with lower limits, and add an umbrella liability insurance policy to raise the. Apply for a small business loan; If your insurance agency has a significant amount of business debt, using an sba 7(a) loan to refinance it could help improve your cash flow. Trust us to guide you to through the process of the sba loan life insurance requirement and we’ll do our part to keep your loan closing on time.

Source: sbaloansatlanta.com

Source: sbaloansatlanta.com

This information is published by the u.s. The small business association�s 7 (a) program is a popular option for insurance agencies looking to grow or expand their business. Talk with an expert shop &. At 1st commercial lending, we specialize in structuring insurance agency loans for new and current insurance agency owners. Lenders will approve and help you manage your loan.

Source: murrayins.com

Source: murrayins.com

If your insurance agency has a significant amount of business debt, using an sba 7(a) loan to refinance it could help improve your cash flow. Build a new insurance agency: The good news is that general liability can be found in every bop or standard package policy. You are in the process of obtaining an sba loan for $90,000. Since 2004, we�ve helped numerous insurance agents acquire, build, expand and refinance their business and real estate debt.

Source: nophysicaltermlife.com

Source: nophysicaltermlife.com

Since 2004, we�ve helped numerous insurance agents acquire, build, expand and refinance their business and real estate debt. Starting the week of april 6, 2021, the sba is raising the loan limit for the eidl program from 6 months of economic injury with a maximum loan amount of $150,000 to 24 months of economic injury with a maximum loan amount of $500,000. Our insurance agency loan specialists understand the unique financing needs of the independent insurance agent. Sba only makes direct loans in the case of businesses and homeowners recovering from a declared disaster. Depending on the gl limit required, it might be more affordable to purchase a bop or standard package policy with lower limits, and add an umbrella liability insurance policy to raise the.

Source: freedomtaxaccounting.com

Source: freedomtaxaccounting.com

You complete a collateral assignment for your lender. Anything can happen along the way, but by starting early, we can get the right policy at the best price for your situation. The whole procedure starts by securing life insurance for sba loans. Any disputes on the accuracy should be directed to the u.s. There are many benefits to sba loans, and lots of insurance agencies are finding that this is a particularly good time to apply for them.

Source: lifeinsuranceforsbaloan.com

Source: lifeinsuranceforsbaloan.com

Lending to the insurance industry is an expanding market that lenders should strongly consider. They can take more time and paperwork that other types of financing, however. Businesses that received a loan subject to the previous limits do not need to submit a request for an increase. Depending on the gl limit required, it might be more affordable to purchase a bop or standard package policy with lower limits, and add an umbrella liability insurance policy to raise the. Posts tagged sba loans insurance agencies sba 7(a) loans for insurance agencies right now, there are more than 1.1 million insurance agents, brokers, and affiliated employees in the united states— all working as part of an industry that wrote more than $1.2 trillion in.

Source: allusafranchises.com

Source: allusafranchises.com

The small business association�s 7 (a) program is a popular option for insurance agencies looking to grow or expand their business. Repayment terms between seven and 25 years, relatively low interest rates, and high capital amounts. Insurance agent loan products when you need a business loan, oak street funding offers a variety of financial solutions and lending capital, customized to meet your needs. Sba loans are great for insurance agencies…if you’ve got the time. Our insurance agency loan specialists understand the unique financing needs of the independent insurance agent.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title sba loans for insurance agencies by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information