Scotia accident insurance plan Idea

Home » Trend » Scotia accident insurance plan IdeaYour Scotia accident insurance plan images are available. Scotia accident insurance plan are a topic that is being searched for and liked by netizens today. You can Find and Download the Scotia accident insurance plan files here. Download all free photos.

If you’re searching for scotia accident insurance plan images information connected with to the scotia accident insurance plan topic, you have pay a visit to the right site. Our site always gives you suggestions for viewing the highest quality video and image content, please kindly surf and find more informative video articles and images that fit your interests.

Scotia Accident Insurance Plan. At scotia wealth management, we believe insurance is a critical component to managing your wealth. 365 days after the date of the accident, the insurer will pay: Scotia® accident insurance plan • group policy number slg000008 scotia life insurance company 100 yonge street, suite 400, toronto, ontario m5h 1h1 tel: The nova scotia school insurance program (sip) is a reciprocal insurance exchange, licenced by the superintendent of insurance for the province of nova scotia.

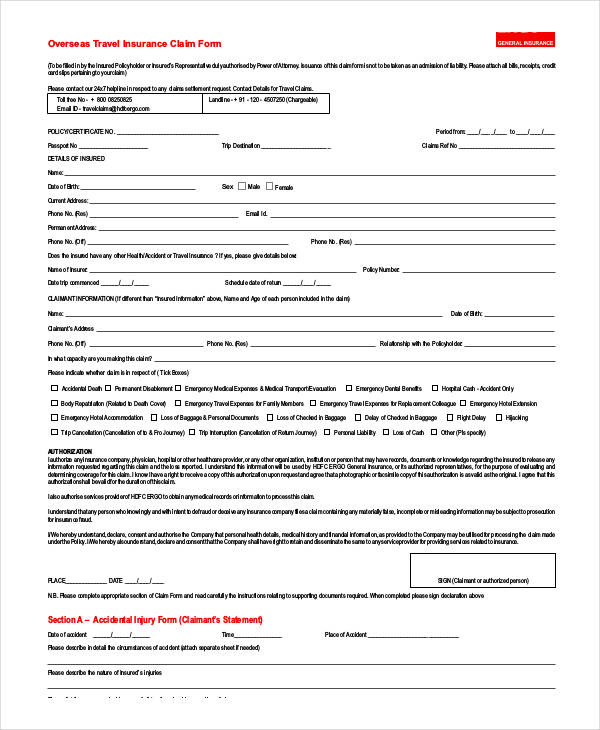

Car Accident Notice of Claim and Proof of Loss Form (Form From novainjurylaw.com

Car Accident Notice of Claim and Proof of Loss Form (Form From novainjurylaw.com

50 required coverage up to $50,000 for all persons injured in an accident 10 required coverage up to $10,000 for property damage in an accident note: Receive up to $2 million cdn per certificate for scotiabank customers in emergency medical insurance. Your existing scotia plan loan life and disability insurance covers: Scotia® accident insurance plan • group policy number slg000008 scotia life insurance company 100 yonge street, suite 400, toronto, ontario m5h 1h1 tel: Scotiabank customers may receive complimentary coverage up to $10,000 with additional coverage available at. The official name of sip is the nova scotia school insurance exchange.

Should an accident occur, scotiabank auto insurance can ensure you have the funds you need to replace or repair your vehicle, replace your personal possessions,.

Though each province has its own rules, there are generally two types of coverage you must have. It can help protect you against the cost of unexpected emergencies that may occur before or during your trip. Should an accident occur, scotiabank auto insurance can ensure you have the funds you need to replace or repair your vehicle, replace your personal possessions,. For loss of percentage of insured’s coverage life 100% both hands 100% both feet 100% 46 retired teachers’ group insurance plan directory johnson inc. 50 required coverage up to $50,000 for all persons injured in an accident 25 required coverage up to $25,000 for property damage in an accident insurer verification of insurance in scotia [ 2] insurer must notify department of motor vehicles or. The nova scotia school insurance program (sip) is a reciprocal insurance exchange, licenced by the superintendent of insurance for the province of nova scotia.

Source: lmt.hrce.ca

Source: lmt.hrce.ca

So if you have been injured in a motor vehicle accident, this is the coverage that you will be able to access when you begin an action or sue the person responsible for the accident. That in order to administer my coverage, scotialife can release my personal information to thirdparty administrators (some of which may be located outside of canada); Medical treatment rehabilitation income replacement Your existing scotia plan loan life and disability insurance covers: Insurance programs for carp members offer complete coverage solutions, no matter what your insurance needs.

Source: equisgroup.ca

Source: equisgroup.ca

Your monthly loan payments should you become disabled and unable to work as a result of an illness or injury. Should an accident occur, scotiabank auto insurance can ensure you have the funds you need to replace or repair your vehicle, replace your personal possessions,. For loss of percentage of insured’s coverage life 100% both hands 100% both feet 100% 46 retired teachers’ group insurance plan directory johnson inc. 365 days after the date of the accident, the insurer will pay: Insurance programs for carp members offer complete coverage solutions, no matter what your insurance needs.

Source: scotiabank.com

Source: scotiabank.com

The nova scotia school insurance program (sip) is a reciprocal insurance exchange, licenced by the superintendent of insurance for the province of nova scotia. The official name of sip is the nova scotia school insurance exchange. The minimum coverage in nova scotia is $500,000 for any policy that has been issued. Should an accident occur, scotiabank auto insurance can ensure you have the funds you need to replace or repair your vehicle, replace your personal possessions,. Receive up to $2 million cdn per certificate for scotiabank customers in emergency medical insurance.

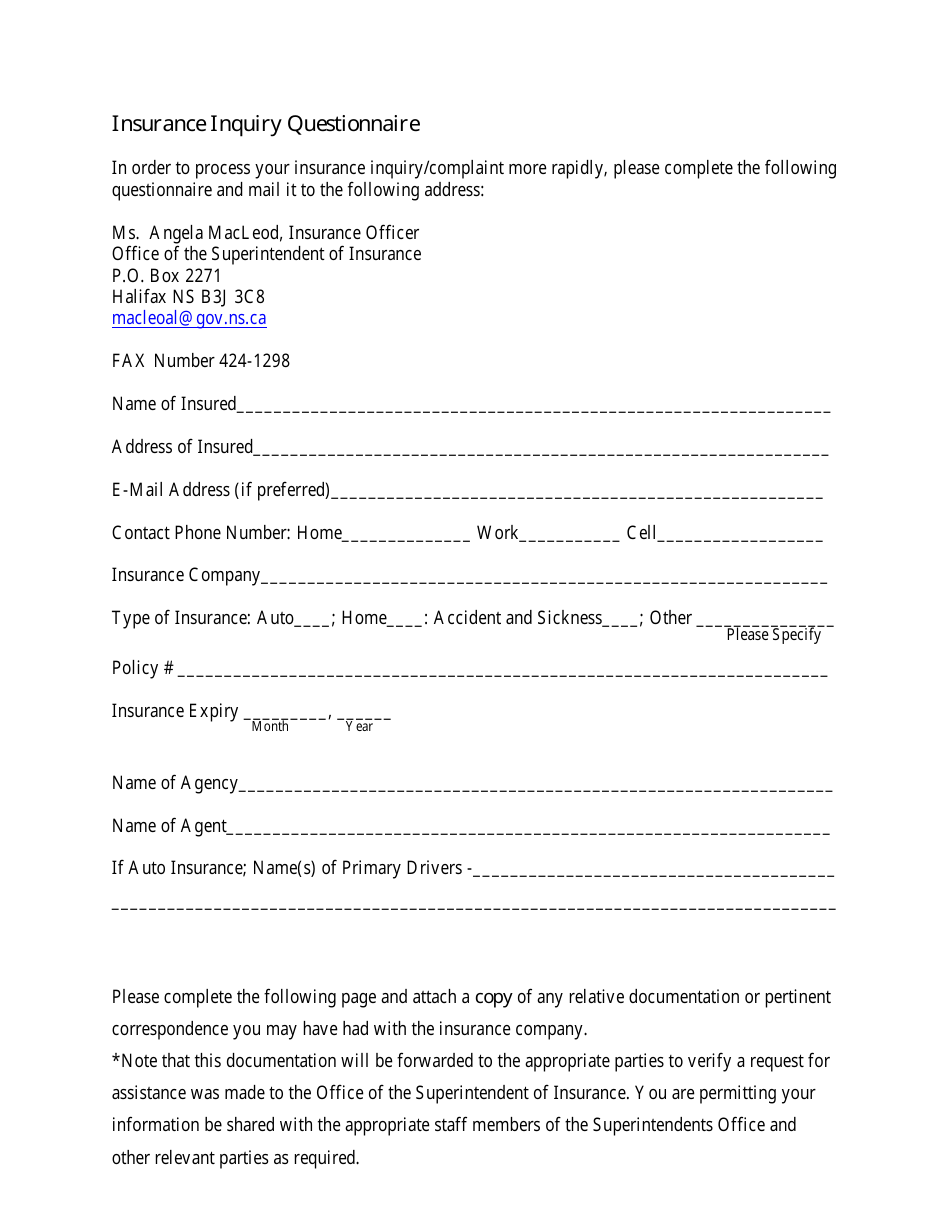

Source: templateroller.com

Source: templateroller.com

21 rows should disaster strike, a scotia home insurance policy can ensure you have the funds you need to rebuild your home, replace your personal possessions, afford comparable temporary housing and even cover liability to other people. 21 rows should disaster strike, a scotia home insurance policy can ensure you have the funds you need to rebuild your home, replace your personal possessions, afford comparable temporary housing and even cover liability to other people. Should an accident occur, scotiabank auto insurance can ensure you have the funds you need to replace or repair your vehicle, replace your personal possessions,. Should disaster strike, scotiabank home insurance can ensure you have the funds you need to rebuild your home, replace your personal possessions, afford comparable temporary housing and even cover liability to other people. In canada certain coverages are mandatory for all drivers, however, there are many optional coverages you can add to suit your individual needs and budget.

Source: novainjurylaw.com

Source: novainjurylaw.com

If you get ill or injured while you’re away, this travel insurance can help pay for the cost of medical care. The scotia accident insurance plan are described in the certificate of insurance, but that coverage is governed by the provisions of the group policy, which can be examined at the head office of scotialife; Scotialife financial accidental death coverage canadians between the ages of 18 and 74 may also be eligible to receive accidental death coverage. The official name of sip is the nova scotia school insurance exchange. In canada certain coverages are mandatory for all drivers, however, there are many optional coverages you can add to suit your individual needs and budget.

Source: fitanosvai.blogspot.com

Source: fitanosvai.blogspot.com

Creating substantial wealth doesn’t happen by accident, it is the result of sustained hard work. The outstanding balance (up to $150,000) on your scotia plan loans should you pass away. Your government health insurance plan may only cover a fraction of healthcare expenses incurred outside canada, and. For loss of percentage of insured’s coverage life 100% both hands 100% both feet 100% 46 retired teachers’ group insurance plan directory johnson inc. 365 days after the date of the accident, the insurer will pay:

Source: howtosavemoney.ca

Source: howtosavemoney.ca

In canada certain coverages are mandatory for all drivers, however, there are many optional coverages you can add to suit your individual needs and budget. The date you plan to leave the province Creating substantial wealth doesn’t happen by accident, it is the result of sustained hard work. For loss of percentage of insured’s coverage life 100% both hands 100% both feet 100% 46 retired teachers’ group insurance plan directory johnson inc. That in order to administer my coverage, scotialife can release my personal information to thirdparty administrators (some of which may be located outside of canada);

Source: novainjurylaw.com

Source: novainjurylaw.com

Accident benefits coverage this coverage provides you with benefits if you’re injured in a car accident regardless of who caused it. The scotia accident insurance plan are described in the certificate of insurance, but that coverage is governed by the provisions of the group policy, which can be examined at the head office of scotialife; The minimum coverage in nova scotia is $500,000 for any policy that has been issued. Scotialife financial accidental death coverage canadians between the ages of 18 and 74 may also be eligible to receive accidental death coverage. Insurance programs for carp members offer complete coverage solutions, no matter what your insurance needs.

Source: pinterest.com

Source: pinterest.com

The scotia accident insurance plan are described in the certificate of insurance, but that coverage is governed by the provisions of the group policy, which can be examined at the head office of scotialife; Creating substantial wealth doesn’t happen by accident, it is the result of sustained hard work. Receive up to $2 million cdn per certificate for scotiabank customers in emergency medical insurance. At scotia wealth management, we believe insurance is a critical component to managing your wealth. 365 days after the date of the accident, the insurer will pay:

Source: horsenovascotia.ca

Source: horsenovascotia.ca

When a claim is made, you’ll be eligible for compensation including: Creating substantial wealth doesn’t happen by accident, it is the result of sustained hard work. Should disaster strike, scotiabank home insurance can ensure you have the funds you need to rebuild your home, replace your personal possessions, afford comparable temporary housing and even cover liability to other people. Medical treatment rehabilitation income replacement For loss of percentage of insured’s coverage life 100% both hands 100% both feet 100% 46 retired teachers’ group insurance plan directory johnson inc.

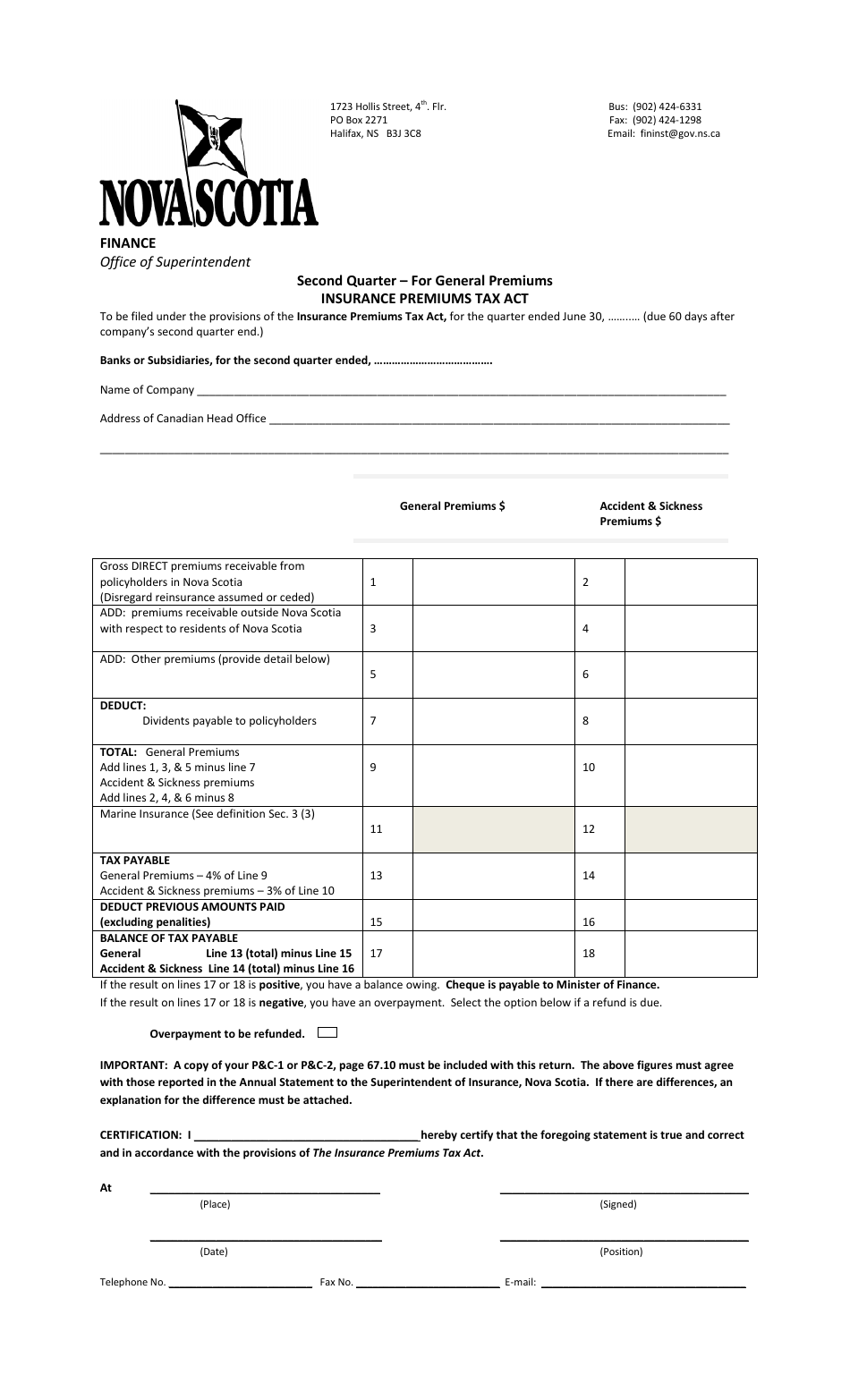

Source: templateroller.com

Source: templateroller.com

Though each province has its own rules, there are generally two types of coverage you must have. It can help protect you against the cost of unexpected emergencies that may occur before or during your trip. The minimum coverage in nova scotia is $500,000 for any policy that has been issued. Scotiabank customers may receive complimentary coverage up to $10,000 with additional coverage available at. Creating substantial wealth doesn’t happen by accident, it is the result of sustained hard work.

Source: novascotiabenefits.com

Source: novascotiabenefits.com

It can help protect you against the cost of unexpected emergencies that may occur before or during your trip. For loss of percentage of insured’s coverage life 100% both hands 100% both feet 100% 46 retired teachers’ group insurance plan directory johnson inc. Scotialife financial accidental death coverage canadians between the ages of 18 and 74 may also be eligible to receive accidental death coverage. Your monthly loan payments should you become disabled and unable to work as a result of an illness or injury. Call your scotiabank branch or email scotiainsurance.caribbean@scotiabank.com and make an appointment to talk to us today.

Source: howtosavemoney.ca

Source: howtosavemoney.ca

Insurer verification of insurance in scotia [ 2] Medical treatment rehabilitation income replacement In addition, policyholders must have $50,000/$100,000 for wrongful death coverage. Insurance programs for carp members offer complete coverage solutions, no matter what your insurance needs. Insurer verification of insurance in scotia [ 2]

Source: kimballlaw.ca

Source: kimballlaw.ca

Insurer verification of insurance in scotia [ 2] When a claim is made, you’ll be eligible for compensation including: Should an accident occur, scotiabank auto insurance can ensure you have the funds you need to replace or repair your vehicle, replace your personal possessions,. Your existing scotia plan loan life and disability insurance covers: 21 rows should disaster strike, a scotia home insurance policy can ensure you have the funds you need to rebuild your home, replace your personal possessions, afford comparable temporary housing and even cover liability to other people.

Source: cluettinsurance.ca

Source: cluettinsurance.ca

If you get ill or injured while you’re away, this travel insurance can help pay for the cost of medical care. Should an accident occur, scotiabank auto insurance can ensure you have the funds you need to replace or repair your vehicle, replace your personal possessions,. Insurance cap for soft tissue injuries in nova scotia if you are injured in a car accident in halifax , it is important to know that there is something called the minor injury cap in nova scotia, which can affect the amount of compensation you are able to receive for pain and suffering related to certain types of injuries. Insurance programs for carp members offer complete coverage solutions, no matter what your insurance needs. Creating substantial wealth doesn’t happen by accident, it is the result of sustained hard work.

Source: mikefralick.com

Source: mikefralick.com

50 required coverage up to $50,000 for all persons injured in an accident 25 required coverage up to $25,000 for property damage in an accident insurer verification of insurance in scotia [ 2] insurer must notify department of motor vehicles or. Should disaster strike, scotiabank home insurance can ensure you have the funds you need to rebuild your home, replace your personal possessions, afford comparable temporary housing and even cover liability to other people. 365 days after the date of the accident, the insurer will pay: That in order to administer my coverage, scotialife can release my personal information to thirdparty administrators (some of which may be located outside of canada); In canada certain coverages are mandatory for all drivers, however, there are many optional coverages you can add to suit your individual needs and budget.

Source: judocanada.org

Source: judocanada.org

Insurer verification of insurance in scotia [ 2] The date you plan to leave the province Insurance cap for soft tissue injuries in nova scotia if you are injured in a car accident in halifax , it is important to know that there is something called the minor injury cap in nova scotia, which can affect the amount of compensation you are able to receive for pain and suffering related to certain types of injuries. Scotialife financial accidental death coverage canadians between the ages of 18 and 74 may also be eligible to receive accidental death coverage. Your monthly loan payments should you become disabled and unable to work as a result of an illness or injury.

Source: cluettinsurance.ca

Source: cluettinsurance.ca

Medical treatment rehabilitation income replacement Creating substantial wealth doesn’t happen by accident, it is the result of sustained hard work. Insurance programs for carp members offer complete coverage solutions, no matter what your insurance needs. In addition, policyholders must have $50,000/$100,000 for wrongful death coverage. That in order to administer my coverage, scotialife can release my personal information to thirdparty administrators (some of which may be located outside of canada);

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title scotia accident insurance plan by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information