Scotia tenant insurance Idea

Home » Trending » Scotia tenant insurance IdeaYour Scotia tenant insurance images are available. Scotia tenant insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the Scotia tenant insurance files here. Get all free images.

If you’re looking for scotia tenant insurance images information connected with to the scotia tenant insurance keyword, you have pay a visit to the right site. Our site always provides you with suggestions for seeing the highest quality video and picture content, please kindly surf and find more informative video articles and images that fit your interests.

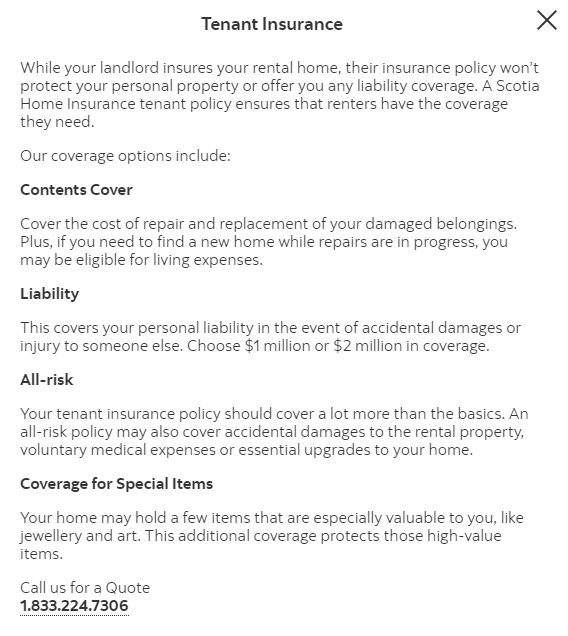

Scotia Tenant Insurance. What does tenant insurance cover? The liability coverage included in a homeowners, condo or tenant insurance plan protects you financially if you unintentionally cause bodily injury or property damage to others—at your home or anywhere in the world. Tenant insurance (also known as renter�s insurance) is like home insurance, but it’s for people who rent rather than own their homes. How much does tenant insurance cost in nova scotia?

Claim Reports Keyes Insurance Brokerage, Nova Scotia From keyesinsurance.com

Claim Reports Keyes Insurance Brokerage, Nova Scotia From keyesinsurance.com

Your landlord will likely have coverage for the building itself, but your belongings aren�t protected by this, which is where tenant insurance comes in. This type of coverage protects you from being held financially responsible for causing injury to a third party or for causing damage to their personal property. Your tenant insurance covers claims made against you for injuries or damages that could happen on the premises. Your toaster oven catches fire, damaging. Is tenant insurance mandatory in nova scotia? If you’re held at fault for an accident and are sued for an amount that is higher than your liability limit, you’ll have to pay the difference.

If a guest is injured at your place, your tenant policy will kick in to help cover any medical or rehabilitation costs.

No matter where you live in halifax if you’re renting a house, apartment, condo, or basement, you’ll want to have tenant/renters insurance to make sure you are covered for all the things that matter most. Tenant insurance in nova scotia (also called renters’ insurance) is meant for people who rent the place where they live, whether home, condo or apartment. This type of insurance is not mandatory. However, keep in mind that this is a big bank. It is advisable to take out tenant insurance as it protects your belongings, living expenses, including moving costs, and liability claims if you cause accidental damage. Where to get help regarding your rights as a tenant in nova scotia

Source: keyesinsurance.com

Source: keyesinsurance.com

Tenant insurance policies also cover a number of other expenses, such as relocation costs and extra living expenses during repairs. The short answer is no; Tenant insurance in nova scotia protection that provides peace of mind feel confident when you choose allstate for tenant insurance in nova scotia because allstate is a known and trusted name canadians have turned to for insurance coverage for the past 65 years. Tenant insurance in nova scotia (also called renters’ insurance) is meant for people who rent the place where they live, whether home, condo or apartment. Where to get help regarding your rights as a tenant in nova scotia

Source: catalfamoagency.com

Source: catalfamoagency.com

Rbc tenant insurance offers many of the main features we track (some at an extra cost), with a lot of extra features that you won�t see everywhere. Your landlord will likely have coverage for the building itself, but your belongings aren�t protected by this, which is where tenant insurance comes in. If you’re held at fault for an accident and are sued for an amount that is higher than your liability limit, you’ll have to pay the difference. If a guest is injured at your place, your tenant policy will kick in to help cover any medical or rehabilitation costs. How much does tenant insurance cost in nova scotia?

Source: howtosavemoney.ca

Source: howtosavemoney.ca

Click here to learn more about this insurance coverage. Bnsia collects your personal information and provides it to either royal & sun alliance insurance company (rsa) or unifund assurance company (unifund) for the purpose of providing you your quote for home or auto insurance. In pei, a maximum of 10%, in new brunswick and nova scotia, a maximum of 20%. It provides coverage against common risks like theft, fire damage, and personal injury that occurs on the property. Rbc tenant insurance product rating:

Source: wclbauld.com

Source: wclbauld.com

Your tenant insurance covers claims made against you for injuries or damages that could happen on the premises. For a competitive tenant insurance quote to suit your individual needs click here. Tenants insurance is a small investment considering the return. In pei, a maximum of 10%, in new brunswick and nova scotia, a maximum of 20%. Is tenant insurance mandatory in nova scotia?

Source: aamunro.com

Source: aamunro.com

How much does tenant insurance cost in nova scotia? That’s why most people choose $1. As a result, in most renting scenarios, you need tenant insurance. You can also get discounts for being claim and mortgage free. It is advisable to take out tenant insurance as it protects your belongings, living expenses, including moving costs, and liability claims if you cause accidental damage.

Source: howtosavemoney.ca

Source: howtosavemoney.ca

What does tenant insurance cover? In pei, a maximum of 10%, in new brunswick and nova scotia, a maximum of 20%. Bnsia collects your personal information and provides it to either royal & sun alliance insurance company (rsa) or unifund assurance company (unifund) for the purpose of providing you your quote for home or auto insurance. Savings are subject to change. However, many property managers won’t lease their units without apartment or renter’s insurance coverage in place.

Source: scautub.com

Source: scautub.com

Some factors that contribute to the premium cost include your location, the limits of insurance selected, and choice of deductible. The short answer is no; You can get an exact price for your own insurance policy easily online by hitting the “get quote” button below. Tenant insurance (also known as renter�s insurance) is like home insurance, but it’s for people who rent rather than own their homes. In new brunswick and nova scotia, the savings are calculated on caa membership tenure and roadside assistance usage.

Source: cluettinsurance.ca

Source: cluettinsurance.ca

In most cases, it can be the same price as eating one meal out per month. Some factors that contribute to the premium cost include your location, the limits of insurance selected, and choice of deductible. Tenant insurance (also known as renter�s insurance) is like home insurance, but it’s for people who rent rather than own their homes. What does tenant insurance cover? This type of insurance is recommended for protecting all your things that your landlord’s building and property insurance do not cover.

Source: cheepinsurance.ca

Source: cheepinsurance.ca

That’s why most people choose $1. Tenants insurance is a small investment considering the return. In pei, a maximum of 10%, in new brunswick and nova scotia, a maximum of 20%. It provides coverage against common risks like theft, fire damage, and personal injury that occurs on the property. However, many property managers won’t lease their units without apartment or renter’s insurance coverage in place.

Source: keyesinsurance.com

Source: keyesinsurance.com

Your personal liability limit (1 or 2 million dollars) your contents coverage limit ($25k, $50k, $75k or $100k) once you. Some factors that contribute to the premium cost include your location, the limits of insurance selected, and choice of deductible. Your toaster oven catches fire, damaging. Wherever your apartment is in nova scotia, you need tenant insurance to protect your valuables (your landlord’s insurance doesn’t usually cover them). This type of coverage protects you from being held financially responsible for causing injury to a third party or for causing damage to their personal property.

Source: keyesinsurance.com

Source: keyesinsurance.com

Scotia home & auto insurance policies are arranged for by bns insurance agency inc. Rbc tenant insurance product rating: However, many property managers won’t lease their units without apartment or renter’s insurance coverage in place. Your tenant insurance covers claims made against you for injuries or damages that could happen on the premises. The costs of tenant insurance in halifax and nova scotia will depend on a variety of factors such as where you live, the type of building, your apartment, the value of your belongings, coverages you select, and more.

Source: cluettinsurance.ca

Source: cluettinsurance.ca

Rbc tenant insurance offers many of the main features we track (some at an extra cost), with a lot of extra features that you won�t see everywhere. If a guest is injured at your place, your tenant policy will kick in to help cover any medical or rehabilitation costs. What does tenant insurance cover? Wherever your apartment is in nova scotia, you need tenant insurance to protect your valuables (your landlord’s insurance doesn’t usually cover them). It provides coverage against common risks like theft, fire damage, and personal injury that occurs on the property.

Source: encajanegra.blogspot.com

Source: encajanegra.blogspot.com

For a competitive tenant insurance quote to suit your individual needs click here. Rbc tenant insurance product rating: Rbc tenant insurance offers many of the main features we track (some at an extra cost), with a lot of extra features that you won�t see everywhere. Your policy also covers personal or property damage you unintentionally cause away from home, whether you are legally liable or not. The liability coverage included in a homeowners, condo or tenant insurance plan protects you financially if you unintentionally cause bodily injury or property damage to others—at your home or anywhere in the world.

Source: wclbauld.com

Source: wclbauld.com

If a guest is injured at your place, your tenant policy will kick in to help cover any medical or rehabilitation costs. However, many property managers won’t lease their units without apartment or renter’s insurance coverage in place. There are only two key things you need to decide: Tenant insurance in nova scotia protection that provides peace of mind feel confident when you choose allstate for tenant insurance in nova scotia because allstate is a known and trusted name canadians have turned to for insurance coverage for the past 65 years. Tenant insurance (also known as renter�s insurance) is like home insurance, but it’s for people who rent rather than own their homes.

Source: wclbauld.com

Source: wclbauld.com

For a competitive tenant insurance quote to suit your individual needs click here. If a guest is injured at your place, your tenant policy will kick in to help cover any medical or rehabilitation costs. Tenant insurance is not legally mandatory in nova scotia. It is advisable to take out tenant insurance as it protects your belongings, living expenses, including moving costs, and liability claims if you cause accidental damage. For a competitive tenant insurance quote to suit your individual needs click here.

Source: designerjmorgan.blogspot.com

However, keep in mind that this is a big bank. There are only two key things you need to decide: Your policy also covers personal or property damage you unintentionally cause away from home, whether you are legally liable or not. Tenant insurance (also known as renter�s insurance) is like home insurance, but it’s for people who rent rather than own their homes. It is advisable to take out tenant insurance as it protects your belongings, living expenses, including moving costs, and liability claims if you cause accidental damage.

Source: aamunro.com

Source: aamunro.com

Is tenant insurance mandatory in nova scotia? In new brunswick and nova scotia, the savings are calculated on caa membership tenure and roadside assistance usage. Tenant insurance in nova scotia protection that provides peace of mind feel confident when you choose allstate for tenant insurance in nova scotia because allstate is a known and trusted name canadians have turned to for insurance coverage for the past 65 years. How much does tenant insurance cost in nova scotia? For a competitive tenant insurance quote to suit your individual needs click here.

Source: howtosavemoney.ca

Source: howtosavemoney.ca

(bnsia) and serviced by johnson inc. Your toaster oven catches fire, damaging. The liability coverage included in a homeowners, condo or tenant insurance plan protects you financially if you unintentionally cause bodily injury or property damage to others—at your home or anywhere in the world. If a guest is injured at your place, your tenant policy will kick in to help cover any medical or rehabilitation costs. It can even help cover injuries you may accidentally cause while away from home or travelling.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title scotia tenant insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information