Scotiabank critical illness insurance information

Home » Trend » Scotiabank critical illness insurance informationYour Scotiabank critical illness insurance images are ready in this website. Scotiabank critical illness insurance are a topic that is being searched for and liked by netizens today. You can Get the Scotiabank critical illness insurance files here. Download all royalty-free photos.

If you’re searching for scotiabank critical illness insurance pictures information related to the scotiabank critical illness insurance interest, you have visit the ideal blog. Our site always provides you with suggestions for viewing the maximum quality video and picture content, please kindly hunt and find more enlightening video articles and graphics that fit your interests.

Scotiabank Critical Illness Insurance. Creditor group insurance life, critical illness and disability insurance (group policy g/h 60220) for your scotiabank line of credit name and address of insurer: Single life and critical illness coverage costs just 53 cents for every $100 of your outstanding account balance on the previous month�s scotiabank mastercard statement. Your monthly insurance premium amount is added to your scotiabank credit card account automatically and is reported on your statement. Joint life and critical illness coverage (two people) on the same scotiabank mastercard account costs 95 cents for every $100 of your outstanding account balance on the previous month�s scotiabank.

Aero Business Executive MasterCard Credit Card From tt.scotiabank.com

Aero Business Executive MasterCard Credit Card From tt.scotiabank.com

Scotia criticare is a comprehensive insurance plan that provides you with financial support on diagnosis of a critical illness. Mortgage life, critical illness, and disability insurance. This insurance product is designed to offer coverage if a defined event such as death or a covered critical illness occurs. If you are diagnosed with a covered illness, critical illness coverage can pay off the outstanding balance on your insured scotiabank mortgage account up to $500,000 so you can focus on taking care of yourself. Your monthly insurance premium amount is added to your scotiabank credit card account automatically and is reported on your statement. Once you have submitted your claim with your completed forms and supporting documents, you will be contacted by one of our representatives once it has been paid.

If you are a scotiabank line of credit customer, you can enrol for life.

Must suffer from one of the covered illnesses under this plan which are defined in the certificate of insurance: For critical illness, terminal illness or if you pass away, your benefit is equal to the outstanding balance of your scotiabank mortgage account up to the maximum coverage amount. Get financial protection should you be diagnosed with any of the following critical illnesses: Credit protection for credit cards Joint life and critical illness coverage (two people) on the same scotiabank mastercard account costs 95 cents for every $100 of your outstanding account balance on the previous month�s scotiabank. Life and critical illness insurance for the cardholder and secondary cardholder (joint coverage) on the same scotiabank mastercard account) costs $0.95 for every $100 of outstanding balance.

Source: rates.ca

Source: rates.ca

Must suffer from one of the covered illnesses under this plan which are defined in the certificate of insurance: Joint life and critical illness coverage (two people) on the same scotiabank mastercard account costs 95 cents for every $100 of your outstanding account balance on the previous month�s scotiabank. Your monthly insurance premium amount is added to your scotiabank credit card account automatically and is reported on your statement. Exclusive low rates are offered to scotiabank customers. Once you have submitted your claim with your completed forms and supporting documents, you will be contacted by one of our representatives once it has been paid.

Source: insurdinary.ca

Source: insurdinary.ca

Once you have submitted your claim with your completed forms and supporting documents, you will be contacted by one of our representatives once it has been paid. For critical illness, terminal illness or if you pass away, your benefit is equal to the outstanding balance of your scotiabank mortgage account up to the maximum coverage amount. Credit protection for credit cards coverage of outstanding balance up to $85,000 Scotialife ® critical illness insurance give yourself the gift of more financial stability during a difficult time learn more scotialife ® health & dental insurance Joint life and critical illness coverage (two people) on the same scotiabank mastercard account costs 95 cents for every $100 of your outstanding account balance on the.

Source: insurdinary.ca

Source: insurdinary.ca

This insurance product is designed to offer coverage if a defined event such as death or a covered critical illness occurs. Critical illness protection is a living benefit, which means that the outstanding loan balance on your scotialine account can be paid off in the event that you are diagnosed with a covered critical illness (specifically heart attack, cancer, or stroke). Must suffer from one of the covered illnesses under this plan which are defined in the certificate of insurance: Single life and critical illness coverage costs just 53 cents for every $100 of your outstanding account balance on the previous month�s scotiabank mastercard statement. Get financial protection should you be diagnosed with any of the following critical illnesses:

Source: mayfieldrecorder.com

Provides up to $350,000 in benefits if death is caused by a covered accident. Exclusive low rates are offered to scotiabank customers. Ensure that the principal and interest remaining on your scotiabank loan, mortgage, line of credit or credit cards are paid off in the event of your death or a diagnosis of a critical illness or health crisis. The insurance can pay off your outstanding line of credit balance, relieving your loved ones of added financial pressure at a difficult time. Get financial protection should you be diagnosed with any of the following critical illnesses:

Source: rates.ca

Source: rates.ca

Mortgage life, critical illness, and disability insurance. Scotialife® critical illness insurance provides between $25,000 and $100,000 in protection against heart attack, cancer, or stroke. Mortgage life, critical illness, and disability insurance. Mortgage life and critical illness insurance. Get financial protection should you be diagnosed with any of the following critical illnesses:

Source: tt.scotiabank.com

Source: tt.scotiabank.com

Get financial protection should you be diagnosed with any of the following critical illnesses: Provides up to $350,000 in benefits if death is caused by a covered accident. Credit protection for credit cards Joint life and critical illness coverage (two people) on the same scotiabank mastercard account costs 95 cents for every $100 of your outstanding account balance on the previous month�s scotiabank. Your monthly insurance premium amount is added to your scotiabank credit card account automatically and is reported on your statement.

Source: insurdinary.ca

Source: insurdinary.ca

Mortgage life insurance coverage limits: If you are diagnosed with a covered illness, critical illness coverage can pay off the outstanding balance on your insured scotiabank mortgage account up to $500,000 so you can focus on taking care of yourself. Joint life and critical illness coverage (two people) on the same scotiabank mastercard account costs 95 cents for every $100 of your outstanding account balance on the. Ensure that the principal and interest remaining on your scotiabank loan, mortgage, line of credit or credit cards are paid off in the event of your death or a diagnosis of a critical illness or health crisis. Choose scotialife ® critical illness insurance with confidence affordable group rates enjoy low group rates exclusively for scotiabank customers and their spouses flexible coverage amounts from $25,000 up to $100,000 of affordable protection—available in increments of $25,000 pay for any expense you choose you decide how to spend the money

Source: tc.scotiabank.com

Source: tc.scotiabank.com

For critical illness, terminal illness or if you pass away, your benefit is equal to the outstanding balance of your scotiabank mortgage account up to the maximum coverage amount. Mortgage life and critical illness insurance. Life and critical illness insurance for the cardholder and secondary cardholder (joint coverage) on the same scotiabank mastercard account) costs $0.95 for every $100 of outstanding balance. Credit protection insurance ensure that your loan and credit balances are covered in the event a tragedy. Scotialife ® critical illness insurance give yourself the gift of more financial stability during a difficult time learn more scotialife ® health & dental insurance

Source: insurdinary.ca

Source: insurdinary.ca

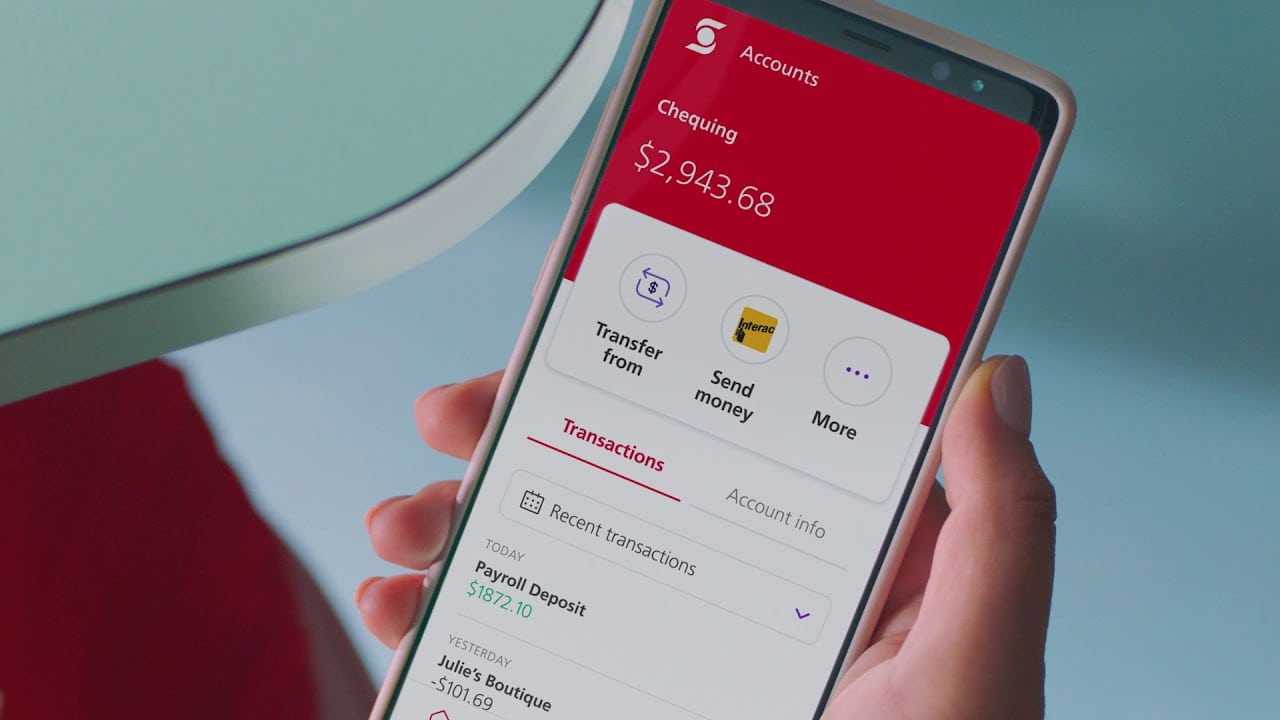

The canada life assurance company creditor insurance department 330 university avenue toronto, ontario m5g 1r8 phone: Your monthly insurance premium amount is added to your scotiabank credit card account automatically and is reported on your statement. Credit protection insurance ensure that your loan and credit balances are covered in the event a tragedy. Once you have submitted your claim with your completed forms and supporting documents, you will be contacted by one of our representatives once it has been paid. Critical illness protection critical illness protection insurance can pay off your entire mortgage account balance, up to a maximum of $500,000, if you are diagnosed with a covered critical illness such as heart attack, stroke, or cancer.

Source: insurdinary.ca

Source: insurdinary.ca

Life and critical illness insurance for the cardholder and secondary cardholder (joint coverage) on the same scotiabank mastercard account) costs $0.95 for every $100 of outstanding balance. Credit protection for credit cards Credit protection insurance ensure that your loan and credit balances are covered in the event a tragedy. Get financial protection should you be diagnosed with any of the following critical illnesses: Life and critical illness insurance for the cardholder and secondary cardholder (joint coverage) on the same scotiabank mastercard account) costs $0.95 for every $100 of outstanding balance.

Source: tt.scotiabank.com

Source: tt.scotiabank.com

Exclusive low rates are offered to scotiabank customers. Scotialife ® critical illness insurance give yourself the gift of more financial stability during a difficult time learn more scotialife ® health & dental insurance If you are a scotiabank line of credit customer, you can enrol for life. Critical illness coverage this coverage can pay the outstanding balance on your scotia mortgage account, up to $500,000 for all insured mortgages combined, if you are diagnosed with a covered critical illness. Credit protection for credit cards coverage of outstanding balance up to $85,000

For critical illness, terminal illness or if you pass away, your benefit is equal to the outstanding balance of your scotiabank mortgage account up to the maximum coverage amount. Mortgage life, critical illness and disability insurance. Choose scotialife ® critical illness insurance with confidence affordable group rates enjoy low group rates exclusively for scotiabank customers and their spouses flexible coverage amounts from $25,000 up to $100,000 of affordable protection—available in increments of $25,000 pay for any expense you choose you decide how to spend the money Credit protection for credit cards coverage of outstanding balance up to $85,000 Scotia criticare is a comprehensive insurance plan that provides you with financial support on diagnosis of a critical illness.

Source: insurdinary.ca

Source: insurdinary.ca

Ensure that that principal and interest remaining you your scotiabank loan, mortgage, line of credit and/or credit cards are paid in the event of your death or a diagnosis of a critical illness*. Mortgage life and critical illness insurance. Joint life and critical illness coverage (two people) on the same scotiabank mastercard account costs 95 cents for every $100 of your outstanding account balance on the. Acceptance is guaranteed for scotiabank customers. Scotialife® critical illness insurance provides between $25,000 and $100,000 in protection against heart attack, cancer, or stroke.

Source: twitter.com

Source: twitter.com

Acceptance is guaranteed for scotiabank customers. Heart attack, stroke, cancer, major burns, paralysis, blindness, deafness, loss of speech or coma. Ensure that the principal and interest remaining on your scotiabank loan, mortgage, line of credit or credit cards are paid off in the event of your death or a diagnosis of a critical illness or health crisis. Mortgage life, critical illness, and disability insurance. Your monthly insurance premium amount is added to your scotiabank credit card account automatically and is reported on your statement.

Source: clarkinsurance.ca

Source: clarkinsurance.ca

Life and critical illness insurance for the cardholder and secondary cardholder (joint coverage) on the same scotiabank mastercard account) costs $0.95 for every $100 of outstanding balance. Life and critical illness insurance for the cardholder and secondary cardholder (joint coverage) on the same scotiabank mastercard account) costs $0.95 for every $100 of outstanding balance. This insurance product is designed to offer coverage if a defined event such as death or a covered critical illness occurs. Heart attack, stroke, cancer, major burns, paralysis, blindness, deafness, loss of speech or coma. Your monthly insurance premium amount is added to your scotiabank credit card account automatically and is reported on your statement.

Source: stickyblogs.weebly.com

Source: stickyblogs.weebly.com

If you are a scotiabank line of credit customer, you can enrol for life. Mortgage life insurance coverage limits: Your monthly insurance premium amount is added to your scotiabank credit card account automatically and is reported on your statement. The insurance can pay off your outstanding line of credit balance, relieving your loved ones of added financial pressure at a difficult time. Single life and critical illness coverage costs just 53 cents for every $100 of your outstanding account balance on the previous month�s scotiabank mastercard statement.

Source: marketai.com

Mortgage life, critical illness and disability insurance. Ensure that the principal and interest remaining on your scotiabank loan, mortgage, line of credit or credit cards are paid off in the event of your death or a diagnosis of a critical illness or health crisis. If you are diagnosed with a covered illness, critical illness coverage can pay off the outstanding balance on your insured scotiabank mortgage account up to $500,000 so you can focus on taking care of yourself. Critical illness coverage this coverage can pay the outstanding balance on your scotia mortgage account, up to $500,000 for all insured mortgages combined, if you are diagnosed with a covered critical illness. Get financial protection should you be diagnosed with any of the following critical illnesses:

Source: pareansenio.blogspot.com

Scotialife ® critical illness insurance give yourself the gift of more financial stability during a difficult time learn more scotialife ® health & dental insurance Critical illness coverage this coverage can pay the outstanding balance on your scotia mortgage account, up to $500,000 for all insured mortgages combined, if you are diagnosed with a covered critical illness. Acceptance is guaranteed for scotiabank customers. Credit protection for credit cards Creditor group insurance life, critical illness and disability insurance (group policy g/h 60220) for your scotiabank line of credit name and address of insurer:

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title scotiabank critical illness insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information