Second to die life insurance Idea

Home » Trend » Second to die life insurance IdeaYour Second to die life insurance images are available in this site. Second to die life insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the Second to die life insurance files here. Download all royalty-free images.

If you’re looking for second to die life insurance pictures information linked to the second to die life insurance keyword, you have pay a visit to the ideal blog. Our site frequently provides you with suggestions for seeing the highest quality video and image content, please kindly search and locate more informative video content and images that match your interests.

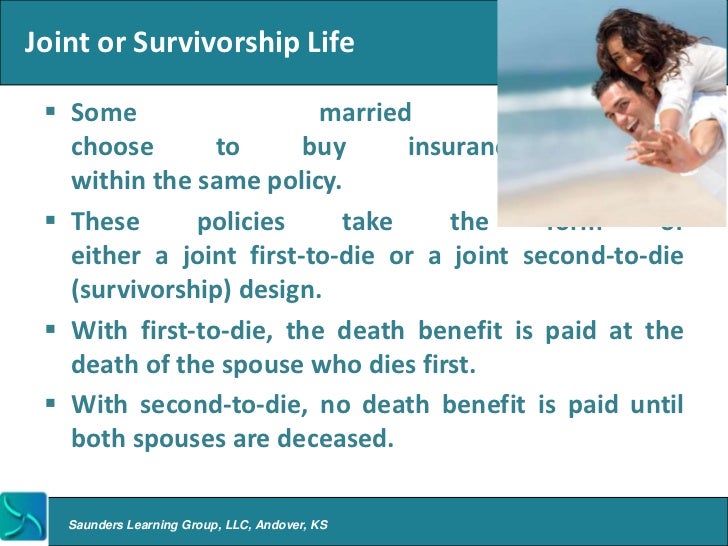

Second To Die Life Insurance. Most of the time, this type of policy covers the lives of a husband and wife. Second to die life insurance is a type of joint life insurance, along with first to die life insurance. Survivorship life insurance is also known as second to die life insurance. While this type of coverage is most used for estate protection, parents of children with special needs can provide funds for living and care.

Second To Die Life Insurance Why I Am A Huge Fan YouTube From youtube.com

Second To Die Life Insurance Why I Am A Huge Fan YouTube From youtube.com

Estate planning, especially when there’s a considerable estate. Survivorship life insurance is a kind of life insurance that covers two people on one policy, but only pays out after both insured’s have died. Survivorship life insurance is also known as second to die life insurance. (unlimited marital deduction comes into play to lower or defer the federal estate tax. Second to die life insurance is a type of joint life insurance, along with first to die life insurance. Also known as a second to die policy, survivorship life insurance a joint permanent life insurance policy that pays out upon the death of all insured parties.

Most of the time, this type of policy covers the lives of a husband and wife.

Both types of joint life policies insure two lives,. Our goal is to provide the best combination of expert advice, top quality products with very competitive prices. If the policy is not structured, funded or owned properly it could cause the policy death benefit to be included in the estate of the deceased insured. Second to die life insurance is an area that we specialize in. Both types of joint life policies insure two lives,. Second to die life insurance is a type of joint life insurance, along with first to die life insurance.

Source: termlifeadvice.com

Source: termlifeadvice.com

It pays out after both partners have died. After the first insured dies, the second insured will continue to pay the life insurance premium until they pass away. Second to die life insurance minggu, 06 februari 2011. Estate planning, especially when there’s a considerable estate. Even if you�ve been declined or think you can�t qualify for coverage, we may be able to help.

Source: exeideas.com

Source: exeideas.com

Typically this type of joint insurance is on a husband and wife, and the policy death benefit is paid only after both die. Second to die life insurance is a type of joint life insurance, along with first to die life insurance. Even if you�ve been declined or think you can�t qualify for coverage, we may be able to help. The ownership of a second to die life policy is very important. A second to die policy connected to a life insurance policy that cannot be revoked can solve that problem.

Source: patch.com

Source: patch.com

The typical second to die life insurance policy will preserve coverage for the entire lives of both policyholders, even significantly after age 100 in many cases. Second to die life insurance is an area that we specialize in. (unlimited marital deduction comes into play to lower or defer the federal estate tax. The policy’s death benefit is only paid after both insured individuals die. While this type of coverage is most used for estate protection, parents of children with special needs can provide funds for living and care.

Source: termlifeadvice.com

Source: termlifeadvice.com

Second to die life insurance is a type of joint life insurance, along with first to die life insurance. A second to die policy connected to a life insurance policy that cannot be revoked can solve that problem. (unlimited marital deduction comes into play to lower or defer the federal estate tax. The purchase of second to die insurance allows you to insure the lives of two people without having to plan for or worry about who will die first. The most common type of survivorship life insurance.

Source: youtube.com

Source: youtube.com

Survivorship life insurance is a kind of life insurance that covers two people on one policy, but only pays out after both insured’s have died. Although normally buyers opt for permanent (including traditional whole life,. By a simple definition, it is a type of permanent life insurance policy that pays a death benefit to the designated beneficiaries only after the death of the second insured party. Survivorship life insurance is a kind of life insurance that covers two people on one policy, but only pays out after both insured’s have died. Survivorship life insurance is also known as second to die life insurance.

Source: youtube.com

Source: youtube.com

Both types of joint life policies insure two lives,. If you ever find bargain insurance coverage? The most common type of survivorship life insurance. It’s typically tailored to affluent couples who want to protect their heirs from the costs of estate and inheritance taxes. When you have a mortgage otherwise you use a significant other, family or even dependents that might endure.

Source: nextgen-life-insurance.com

Source: nextgen-life-insurance.com

Although normally buyers opt for permanent (including traditional whole life,. The ownership of a second to die life policy is very important. After the first insured dies, the second insured will continue to pay the life insurance premium until they pass away. (unlimited marital deduction comes into play to lower or defer the federal estate tax. Survivorship life insurance is a kind of life insurance that covers two people on one policy, but only pays out after both insured’s have died.

Source: hechtinsuranceadvisors.com

Source: hechtinsuranceadvisors.com

The benefits are released to the beneficiaries once the last surviving spouse passes on. Survivorship life insurance is a kind of life insurance that covers two people on one policy, but only pays out after both insured’s have died. Second to die life insurance is an area that we specialize in. Both types of joint life policies insure two lives,. Even if you�ve been declined or think you can�t qualify for coverage, we may be able to help.

Source: youtube.com

Source: youtube.com

Even if you�ve been declined or think you can�t qualify for coverage, we may be able to help. Our goal is to provide the best combination of expert advice, top quality products with very competitive prices. Second to die life insurance allows parents to focus specifically on their children and often is used for estate planning, supporting the surviving children, or even for charitable bequests. That would increase the overall estate and create a. Most of the time, this type of policy covers the lives of a husband and wife.

Source: nextgen-life-insurance.com

Source: nextgen-life-insurance.com

Second to die life insurance minggu, 06 februari 2011. If the policy is not structured, funded or owned properly it could cause the policy death benefit to be included in the estate of the deceased insured. The policy’s death benefit is only paid after both insured individuals die. Even if you�ve been declined or think you can�t qualify for coverage, we may be able to help. The most common type of survivorship life insurance.

Source: insuranceandestates.com

Source: insuranceandestates.com

(unlimited marital deduction comes into play to lower or defer the federal estate tax. Our goal is to provide the best combination of expert advice, top quality products with very competitive prices. Most of the time, this type of policy covers the lives of a husband and wife. The purchase of second to die insurance allows you to insure the lives of two people without having to plan for or worry about who will die first. That would increase the overall estate and create a.

Source: quoteray.com

Source: quoteray.com

Second to die life insurance minggu, 06 februari 2011. By a simple definition, it is a type of permanent life insurance policy that pays a death benefit to the designated beneficiaries only after the death of the second insured party. It pays out after both partners have died. While this type of coverage is most used for estate protection, parents of children with special needs can provide funds for living and care. If you ever find bargain insurance coverage?

Source: termlifeadvice.com

Source: termlifeadvice.com

Second to die life insurance is an area that we specialize in. When you have a mortgage otherwise you use a significant other, family or even dependents that might endure. The purchase of second to die insurance allows you to insure the lives of two people without having to plan for or worry about who will die first. The ownership of a second to die life policy is very important. It’s typically tailored to affluent couples who want to protect their heirs from the costs of estate and inheritance taxes.

Source: accuquote.com

Source: accuquote.com

Although normally buyers opt for permanent (including traditional whole life,. Our goal is to provide the best combination of expert advice, top quality products with very competitive prices. It pays out after both partners have died. (unlimited marital deduction comes into play to lower or defer the federal estate tax. The purchase of second to die insurance allows you to insure the lives of two people without having to plan for or worry about who will die first.

Source: exeideas.com

Source: exeideas.com

Survivorship life insurance is a kind of life insurance that covers two people on one policy, but only pays out after both insured’s have died. The benefits of term life insurance quotes online. Our goal is to provide the best combination of expert advice, top quality products with very competitive prices. Even if you�ve been declined or think you can�t qualify for coverage, we may be able to help. The typical second to die life insurance policy will preserve coverage for the entire lives of both policyholders, even significantly after age 100 in many cases.

Source: statefarmlifeinsuranceunderwritinggui.blogspot.com

Source: statefarmlifeinsuranceunderwritinggui.blogspot.com

Both types of joint life policies insure two lives,. The policy’s death benefit is only paid after both insured individuals die. The ownership of a second to die life policy is very important. The benefits of term life insurance quotes online. Typically this type of joint insurance is on a husband and wife, and the policy death benefit is paid only after both die.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Both types of joint life policies insure two lives,. By a simple definition, it is a type of permanent life insurance policy that pays a death benefit to the designated beneficiaries only after the death of the second insured party. While this type of coverage is most used for estate protection, parents of children with special needs can provide funds for living and care. The most common type of survivorship life insurance. A second to die policy connected to a life insurance policy that cannot be revoked can solve that problem.

Source: spectruminsurancegroup.com

Source: spectruminsurancegroup.com

If you ever find bargain insurance coverage? (unlimited marital deduction comes into play to lower or defer the federal estate tax. Also known as a second to die policy, survivorship life insurance a joint permanent life insurance policy that pays out upon the death of all insured parties. By a simple definition, it is a type of permanent life insurance policy that pays a death benefit to the designated beneficiaries only after the death of the second insured party. Our goal is to provide the best combination of expert advice, top quality products with very competitive prices.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title second to die life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information