Second to die term life insurance Idea

Home » Trend » Second to die term life insurance IdeaYour Second to die term life insurance images are available. Second to die term life insurance are a topic that is being searched for and liked by netizens now. You can Get the Second to die term life insurance files here. Download all free images.

If you’re searching for second to die term life insurance images information connected with to the second to die term life insurance interest, you have visit the right blog. Our site always gives you suggestions for seeing the maximum quality video and picture content, please kindly search and find more informative video content and graphics that match your interests.

Second To Die Term Life Insurance. This survivorship life insurance can cover federal estate taxes and other expenses so your heirs don�t have to worry. One of such as joint life insurance insurance, second life expectancy of an accident as an individual. Also known as a second to die policy, survivorship life insurance a joint permanent life insurance policy that pays out upon the death of all insured parties. It is also known as survivorship life insurance.

What is a SecondtoDie Life Insurance Policy? From nextgen-life-insurance.com

What is a SecondtoDie Life Insurance Policy? From nextgen-life-insurance.com

The policy’s death benefit is only paid after both insured individuals die. It’s typically tailored to affluent couples who want to protect their heirs from the costs of estate and inheritance taxes. Below is a brief outline of what can be expected with second to die life insurance: Buying second to die life insurance is the perfect estate planning strategy when neither partner needs financial support after the first dies. Second to die life insurance policies are usually used to protect future generations (usually the children) in the event of the death of both spouses in a marriage. Insurance quote second to die second to die life insurance, or joint life insurance, is very similar to universal, with the exception being that this coverage covers two people rather than just one.

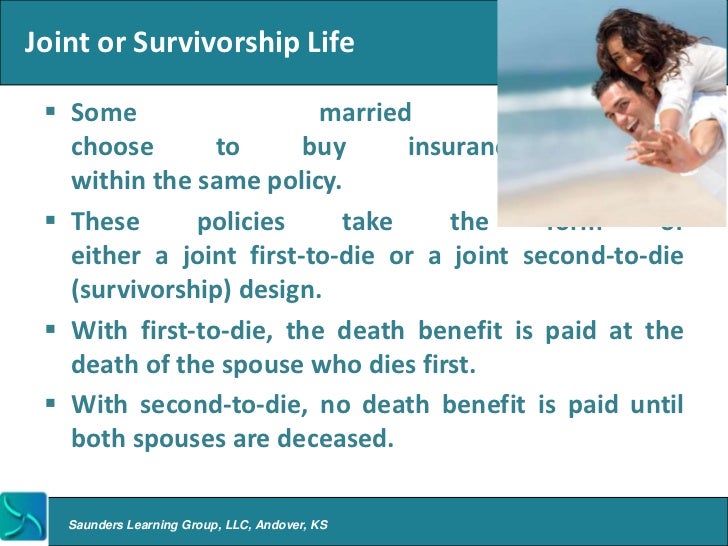

Married couples buying life insurance together have two options:

Second to die life insurance policies are usually used to protect future generations (usually the children) in the event of the death of both spouses in a marriage. It pays out after both partners have died. While these policies only insure one person, there is second to die life insurance which actually insures two people at once. The policy is a joint contract where compensation is paid only after the last surviving person dies. As mentioned previously, second to die life. Affordable life insurance policy, affordable term life insurance quote, affordable term life insurance quotes, second to die life insurance beranda langganan:

Source: youtube.com

Source: youtube.com

It pays out after both partners have died. While this type of coverage is most used for estate protection, parents of children with special needs can provide funds for living and care. Our company is composed of insurance and financial professionals who have been representing many of america�s largest and finest financial institutions. Buying second to die life insurance is the perfect estate planning strategy when neither partner needs financial support after the first dies. Speak to a licensed sales agent!

Source: termlifeadvice.com

Source: termlifeadvice.com

What is a second to die life insurance contract? Affordable life insurance policy, affordable term life insurance quote, affordable term life insurance quotes, second to die life insurance beranda langganan: It pays out after both partners have died. This survivorship life insurance can cover federal estate taxes and other expenses so your heirs don�t have to worry. Buying second to die life insurance is the perfect estate planning strategy when neither partner needs financial support after the first dies.

Source: insuranceandestates.com

Source: insuranceandestates.com

It pays out after both partners have died. In other words, the heirs receive benefits after the second spouse (the surviving one) dies. Typically this type of joint insurance is on a husband and wife, and the policy death benefit is paid only after both die. Below is a brief outline of what can be expected with second to die life insurance: Insurance quote second to die second to die life insurance, or joint life insurance, is very similar to universal, with the exception being that this coverage covers two people rather than just one.

Source: hechtinsuranceadvisors.com

Source: hechtinsuranceadvisors.com

In other words, the heirs receive benefits after the second spouse (the surviving one) dies. What is a joint life insurance policy? Affordable life insurance policy, affordable term life insurance quote, affordable term life insurance quotes, second to die life insurance beranda langganan: While these policies only insure one person, there is second to die life insurance which actually insures two people at once. As mentioned previously, second to die life.

Source: accuquote.com

Source: accuquote.com

Affordable life insurance policy, affordable term life insurance quote, affordable term life insurance quotes, second to die life insurance beranda langganan: Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Married couples buying life insurance together have two options: It’s typically tailored to affluent couples who want to protect their heirs from the costs of estate and inheritance taxes. This type of insurance is typically taken mostly by married couples.

Source: quoteray.com

Source: quoteray.com

Not only is it a great way to protect and preserve your legacy and insure that funds are provided to loved ones in case anything happens, but it’s usually less expensive than two individual life insurance policies. Insurance quote second to die second to die life insurance, or joint life insurance, is very similar to universal, with the exception being that this coverage covers two people rather than just one. This coverage was designed to protect heirs to an estate from the tax liability that typically comes with an inheritance of a large estate like a family farm or business. Not only is it a great way to protect and preserve your legacy and insure that funds are provided to loved ones in case anything happens, but it’s usually less expensive than two individual life insurance policies. Affordable life insurance policy, affordable term life insurance quote, affordable term life insurance quotes, second to die life insurance beranda langganan:

Source: exeideas.com

Source: exeideas.com

Speak to a licensed sales agent! The policy’s death benefit is only paid after both insured individuals die. Typically this type of joint insurance is on a husband and wife, and the policy death benefit is paid only after both die. Not only is it a great way to protect and preserve your legacy and insure that funds are provided to loved ones in case anything happens, but it’s usually less expensive than two individual life insurance policies. As a result of this different feature, there is no benefit paid out of a 2nd to die policy until both individuals on the policy have passed away.

Source: pinterest.com

Source: pinterest.com

One of such as joint life insurance insurance, second life expectancy of an accident as an individual. While this type of coverage is most used for estate protection, parents of children with special needs can provide funds for living and care. It’s typically tailored to affluent couples who want to protect their heirs from the costs of estate and inheritance taxes. This life insurance policy works differently than a regular policy and is often purchased for different purposes. Also known as a second to die policy, survivorship life insurance a joint permanent life insurance policy that pays out upon the death of all insured parties.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Second to die life insurance policies are usually used to protect future generations (usually the children) in the event of the death of both spouses in a marriage. Speak to a licensed sales agent! Married couples buying life insurance together have two options: What is a joint life insurance policy? The policy’s death benefit is only paid after both insured individuals die.

Source: termlifeadvice.com

Source: termlifeadvice.com

While this type of coverage is most used for estate protection, parents of children with special needs can provide funds for living and care. Affordable life insurance policy, affordable term life insurance quote, affordable term life insurance quotes, second to die life insurance beranda langganan: What is a second to die life insurance contract? Advantages of survivorship life insurance The policy is a joint contract where compensation is paid only after the last surviving person dies.

Source: youtube.com

Source: youtube.com

Insurance quote second to die second to die life insurance, or joint life insurance, is very similar to universal, with the exception being that this coverage covers two people rather than just one. It pays out after both partners have died. Typically this type of joint insurance is on a husband and wife, and the policy death benefit is paid only after both die. The policy’s death benefit is only paid after both insured individuals die. It is also known as survivorship life insurance.

Source: exeideas.com

Source: exeideas.com

The policy’s death benefit is only paid after both insured individuals die. It pays out after both partners have died. Second to die life insurance policies are usually used to protect future generations (usually the children) in the event of the death of both spouses in a marriage. While this type of coverage is most used for estate protection, parents of children with special needs can provide funds for living and care. Insurance quote second to die second to die life insurance, or joint life insurance, is very similar to universal, with the exception being that this coverage covers two people rather than just one.

Source: statefarmlifeinsuranceunderwritinggui.blogspot.com

Source: statefarmlifeinsuranceunderwritinggui.blogspot.com

As a result of this different feature, there is no benefit paid out of a 2nd to die policy until both individuals on the policy have passed away. As mentioned previously, second to die life. Typically this type of joint insurance is on a husband and wife, and the policy death benefit is paid only after both die. Second to die life insurance is an excellent way to plan for the future of your children or grandchildren. Advantages of survivorship life insurance

Source: quoteray.com

Source: quoteray.com

This survivorship life insurance can cover federal estate taxes and other expenses so your heirs don�t have to worry. While these policies only insure one person, there is second to die life insurance which actually insures two people at once. This differs from regular life insurance in that the surviving partner doesn’t receive any benefits after the spouse dies. Second to die life insurance is an excellent way to plan for the future of your children or grandchildren. Also known as a second to die policy, survivorship life insurance a joint permanent life insurance policy that pays out upon the death of all insured parties.

Source: spectruminsurancegroup.com

Source: spectruminsurancegroup.com

Second to die life insurance policies are usually used to protect future generations (usually the children) in the event of the death of both spouses in a marriage. Married couples buying life insurance together have two options: What is a second to die life insurance contract? Typically this type of joint insurance is on a husband and wife, and the policy death benefit is paid only after both die. As mentioned previously, second to die life.

Source: nextgen-life-insurance.com

Source: nextgen-life-insurance.com

As mentioned previously, second to die life. As a result of this different feature, there is no benefit paid out of a 2nd to die policy until both individuals on the policy have passed away. However, the policies can have more than two people within the contract. Typically this type of joint insurance is on a husband and wife, and the policy death benefit is paid only after both die. This life insurance policy works differently than a regular policy and is often purchased for different purposes.

Source: termlifeadvice.com

Source: termlifeadvice.com

Buying second to die life insurance is the perfect estate planning strategy when neither partner needs financial support after the first dies. This life insurance policy works differently than a regular policy and is often purchased for different purposes. Affordable life insurance policy, affordable term life insurance quote, affordable term life insurance quotes, second to die life insurance beranda langganan: This differs from regular life insurance in that the surviving partner doesn’t receive any benefits after the spouse dies. What is a joint life insurance policy?

Source: br.pinterest.com

Source: br.pinterest.com

Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Most couples will benefit most from buying individual life insurance. As a result of this different feature, there is no benefit paid out of a 2nd to die policy until both individuals on the policy have passed away. Advantages of survivorship life insurance Also known as a second to die policy, survivorship life insurance a joint permanent life insurance policy that pays out upon the death of all insured parties.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title second to die term life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information