Sections of an insurance policy Idea

Home » Trending » Sections of an insurance policy IdeaYour Sections of an insurance policy images are available in this site. Sections of an insurance policy are a topic that is being searched for and liked by netizens now. You can Get the Sections of an insurance policy files here. Find and Download all royalty-free photos.

If you’re searching for sections of an insurance policy pictures information linked to the sections of an insurance policy keyword, you have pay a visit to the ideal blog. Our website always gives you suggestions for refferencing the maximum quality video and image content, please kindly surf and locate more informative video content and graphics that fit your interests.

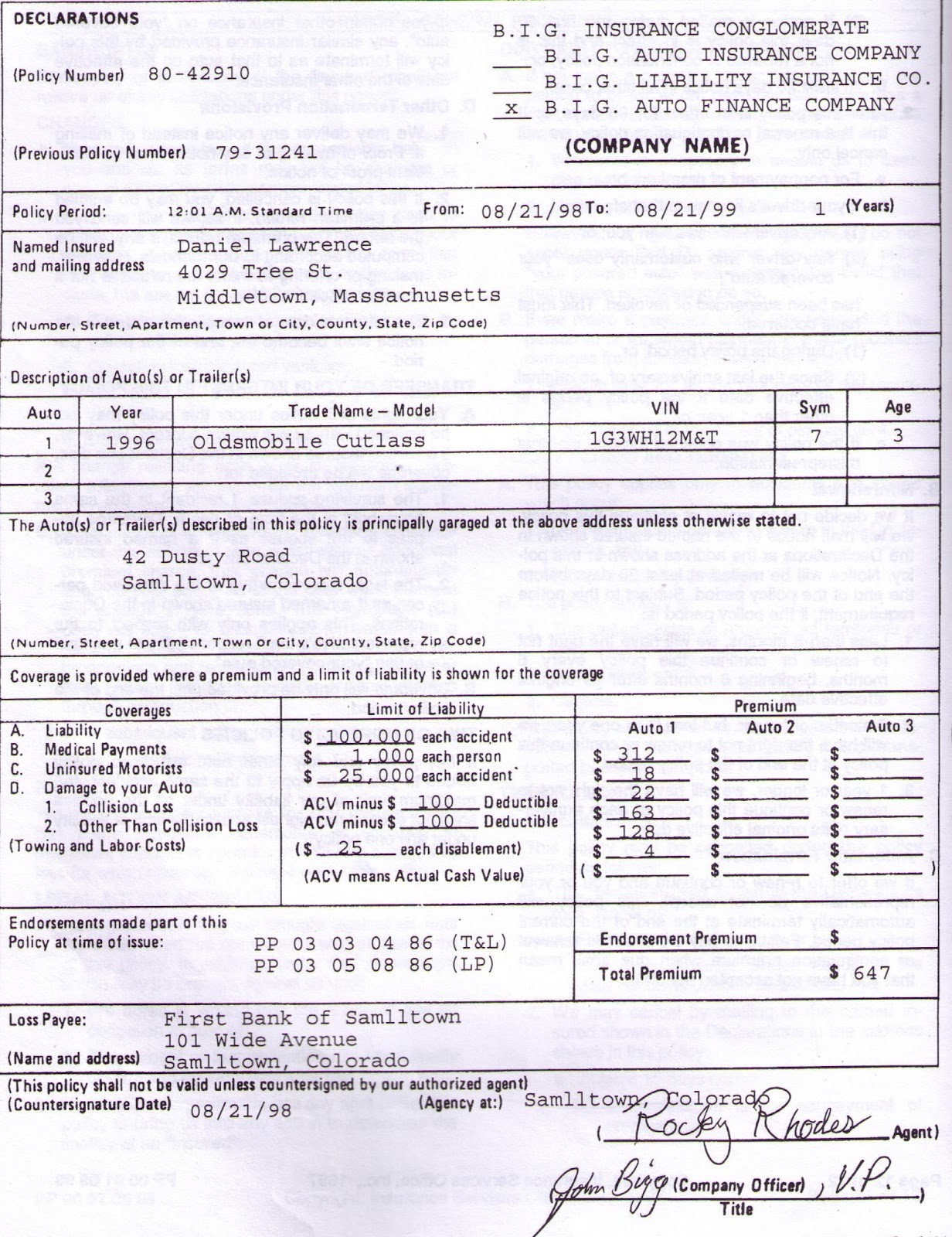

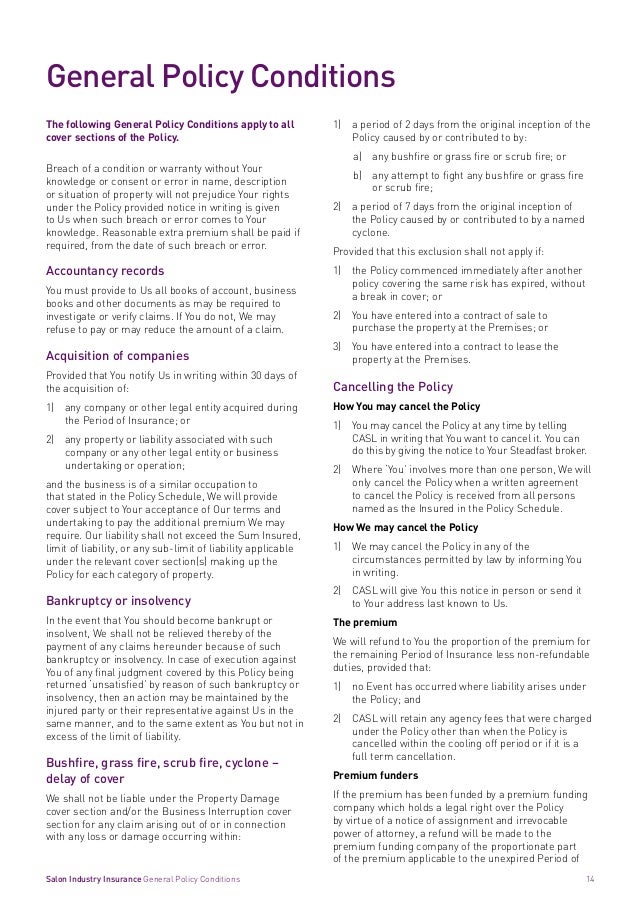

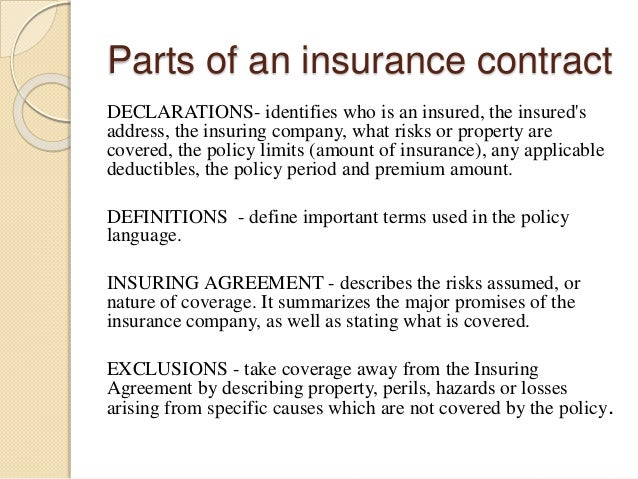

Sections Of An Insurance Policy. A insurance policy is a contact between the policy holder and the insurance company providing the insured, insurance. A section 72 policy allows people to plan for the payment of. Declarations, definitions, lists of covered items, exclusions, conditions, and endorsements. The date of commencement of risk or.

Infographic 8 Surprising Things Your Homeowners Insurance From fbfs.com

Infographic 8 Surprising Things Your Homeowners Insurance From fbfs.com

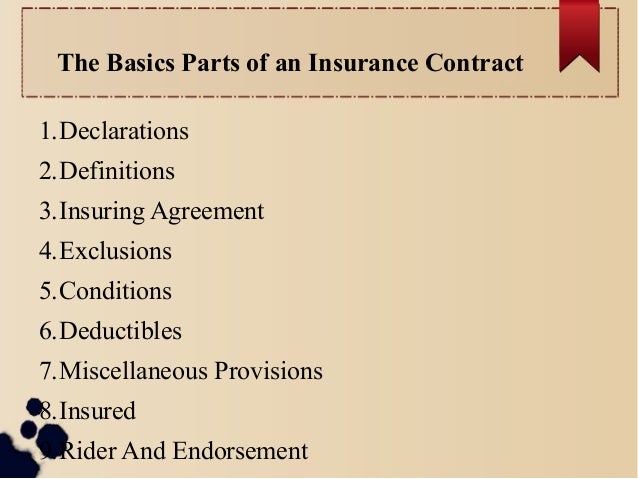

Use these sections as guideposts in reviewing the policies. In new brunswick, the financial and consumer services commission has approved a standard automobile insurance policy. Nor shall it be liable. It will outline the covered perils of your policy, like fire, smoke, theft, vandalism, and more. Location and description of the insured item; An insurance policy is a legal contract between the insurance company (the insurer) and the person(s), business, or entity being insured (the insured).

(1) any deposit made under section 7 or section 98 shall be deemed to be part of the assets of the insurer but shall not be susceptible of any assignment or charge;

The date of issuance of policy or. It may also include specific limitations. Examine each part to identify its key provisions and requirements. No matter the type of insurance, an insurance policy usually consists of six sections: If you only read the policy declarations page and the insuring agreement, you may think you’re paying for coverage that you don’t actually have. Life insurance motor insurance health insurance travel insurance property insurance mobile.

Source: pathwaysbyamica.com

Source: pathwaysbyamica.com

There is a wide range of insurance policies, each aimed at safeguarding certain aspects of your health or assets. The remainder of the policy is divided into sections, or parts, from a to f: Reinsurance.—(1) the insurer under a contract of marine insurance has an insurable interest in his risk, and may reinsure in respect of it. The exclusions section of an insurance policy is also very important. The first section of the personal auto insurance policy defines terms that are used frequently in the contract verbiage.

Source: propertyinsurancecoveragelaw.com

Source: propertyinsurancecoveragelaw.com

A section 72 policy allows people to plan for the payment of. This makes the contract specific to the policyholder. There are four main sections to every insurance policy. It will outline the covered perils of your policy, like fire, smoke, theft, vandalism, and more. The declarations also include the.

Source: fbfs.com

Source: fbfs.com

The remainder of the policy is divided into sections, or parts, from a to f: This means that every insured vehicle in new brunswick has, at the very least, the same minimum coverage. It summarizes the type of property coverage, the covered causes of loss (i.e. In new brunswick, the financial and consumer services commission has approved a standard automobile insurance policy. The date of rider to the.

Source: insuranceplanet.blogspot.com

Source: insuranceplanet.blogspot.com

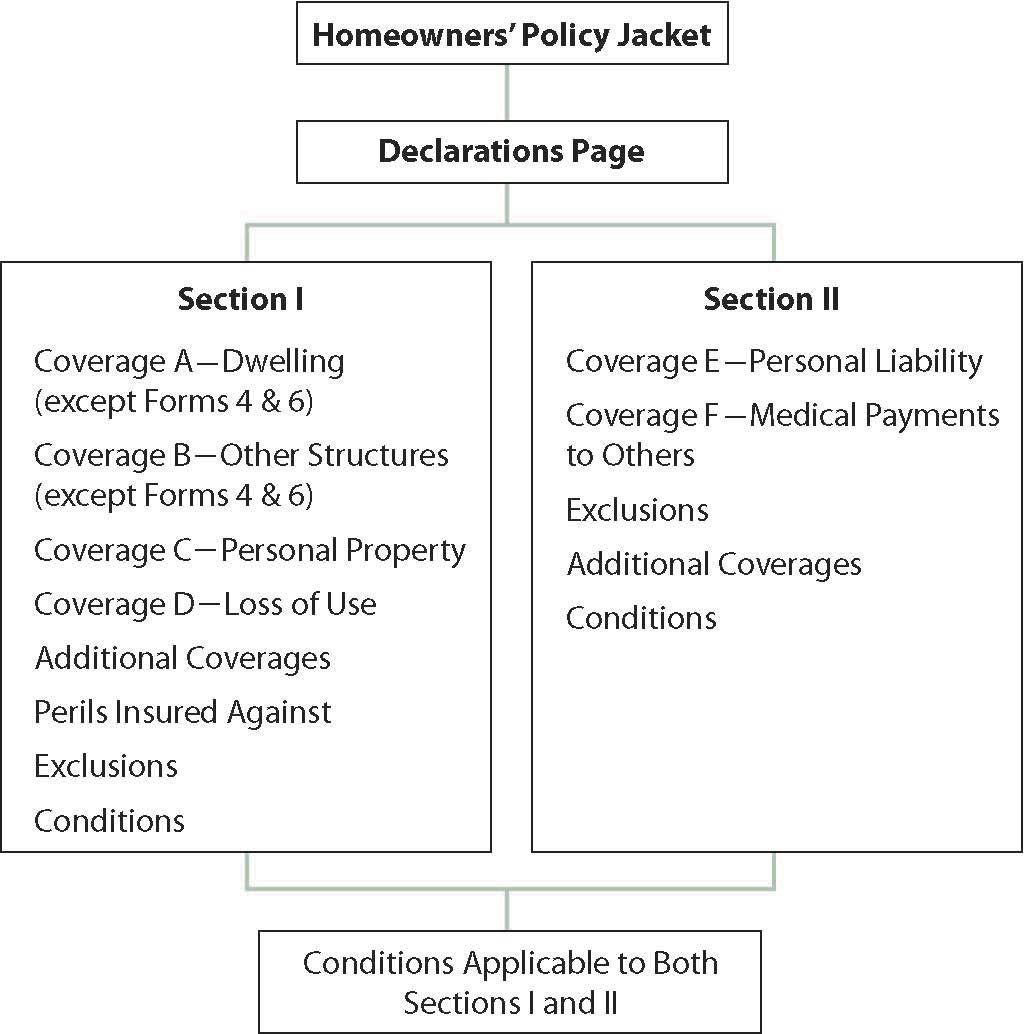

(1) any deposit made under section 7 or section 98 shall be deemed to be part of the assets of the insurer but shall not be susceptible of any assignment or charge; It summarizes the type of property coverage, the covered causes of loss (i.e. It describes property, losses, causes of losses, or perils that are not covered. The initial section of section i of the standard homeowners insurance policy simply clarifies what is and what is not covered by the insurance carrier. There are four main sections to every insurance policy.

Source: youtube.com

Source: youtube.com

Section i coverage a of your policy outlines your dwelling coverage, which includes coverage for the structure, foundation, and roof of your home. This makes the contract specific to the policyholder. It describes property, losses, causes of losses, or perils that are not covered. For example, many homeowners policies. There is a wide range of insurance policies, each aimed at safeguarding certain aspects of your health or assets.

Source: deutermanlaw.com

Source: deutermanlaw.com

The first section is the declarations page: The remainder of the policy is divided into sections, or parts, from a to f: Many policies contain a sixth part: This makes the contract specific to the policyholder. There is a wide range of insurance policies, each aimed at safeguarding certain aspects of your health or assets.

Source: propertyinsurancecoveragelaw.com

Source: propertyinsurancecoveragelaw.com

Broadly, there are 8 types of insurance, namely: It will outline the covered perils of your policy, like fire, smoke, theft, vandalism, and more. Examine each part to identify its key provisions and requirements. A few common sections of a policy include a declaration page, definitions, insuring agreement, exclusions, conditions, exclusions, and riders. Declarations, definitions, lists of covered items, exclusions, conditions, and endorsements.

Source: bankonyourself.com

Source: bankonyourself.com

It may also include specific limitations. If your policy includes green flag breakdown These sections are in every policy regardless of the line of insurance you are dealing with. Declarations, definitions, lists of covered items, exclusions, conditions, and endorsements. Jewelry is typically covered under a homeowner�s insurance policy.

Source: slideshare.net

Source: slideshare.net

This means that every insured vehicle in new brunswick has, at the very least, the same minimum coverage. In insurance, the insurance policy is a contract (generally a standard form contract) between the insurer and the policyholder, which determines the claims which the insurer is legally required to pay. Broadly, there are 8 types of insurance, namely: Section i coverage a of your policy outlines your dwelling coverage, which includes coverage for the structure, foundation, and roof of your home. It may also include specific limitations.

Source: bemoneyaware.com

Source: bemoneyaware.com

In exchange for an initial payment, known as the premium, the insurer promises to pay for loss caused by perils covered under the policy language. Broadly, there are 8 types of insurance, namely: Motor legal cover, section 8: The first section of the personal auto insurance policy defines terms that are used frequently in the contract verbiage. It describes property, losses, causes of losses, or perils that are not covered.

Source: slideshare.net

Source: slideshare.net

The amount paid on the acquisition of new insurance, as well as payments made toward the renewal or continuation of an existing policy, is included in the section 80ccc exemption limit. Nor shall it be liable. It summarizes the type of property coverage, the covered causes of loss (i.e. These sections are in every policy regardless of the line of insurance you are dealing with. This section explains how your dwelling coverage works and what is and isn’t covered by your policy.

Source: thepointinsurance.com

Source: thepointinsurance.com

The first page of your insurance policy is the declarations, or dec page. No matter the type of insurance, an insurance policy usually consists of six sections: Location and description of the insured item; Motor legal cover, section 8: These declarations include the name of the insured, the amount of coverage, and the policy terms.

Source: pathwaysbyamica.com

Source: pathwaysbyamica.com

The date of issuance of policy or. The first section of the personal auto insurance policy defines terms that are used frequently in the contract verbiage. The declarations also include the. The initial section of section i of the standard homeowners insurance policy simply clarifies what is and what is not covered by the insurance carrier. For example, many homeowners policies.

Source: slideshare.net

Source: slideshare.net

In order to understand the terms used in the policy, it is important to read this. It describes property, losses, causes of losses, or perils that are not covered. Location and description of the insured item; No matter the type of insurance, an insurance policy usually consists of six sections: Many policies contain a sixth part:

Source: guest.transylvaniancastle.com

Source: guest.transylvaniancastle.com

We are explaining these sections below: This section of the policy, which could be longer than a page in length, summarizes important information about the particular policy at hand. Location and description of the insured item; Declarations, insuring agreements, definitions, exclusions and conditions. In order to understand the terms used in the policy, it is important to read this.

Source: propertyinsurancecoveragelaw.com

Source: propertyinsurancecoveragelaw.com

Section i coverage a of your policy outlines your dwelling coverage, which includes coverage for the structure, foundation, and roof of your home. This section of the policy, which could be longer than a page in length, summarizes important information about the particular policy at hand. Which defines specific terms used in the policy. The initial section of section i of the standard homeowners insurance policy simply clarifies what is and what is not covered by the insurance carrier. It will outline the covered perils of your policy, like fire, smoke, theft, vandalism, and more.

Source: fortpaynelive.blogspot.com

Source: fortpaynelive.blogspot.com

The amount paid on the acquisition of new insurance, as well as payments made toward the renewal or continuation of an existing policy, is included in the section 80ccc exemption limit. A section 72 policy allows people to plan for the payment of. Guaranteed hire car plus and ‘liability for automated cars in great britain’ in section 1: There are 5 major sections in the standard automobile insurance policy. It summarizes the type of property coverage, the covered causes of loss (i.e.

Source: saylordotorg.github.io

Source: saylordotorg.github.io

The exclusions section of an insurance policy is also very important. The date of rider to the. If your policy includes green flag breakdown It may also include specific limitations. This section of the policy, which could be longer than a page in length, summarizes important information about the particular policy at hand.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title sections of an insurance policy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information