Self funded health insurance for dummies information

Home » Trend » Self funded health insurance for dummies informationYour Self funded health insurance for dummies images are ready in this website. Self funded health insurance for dummies are a topic that is being searched for and liked by netizens now. You can Download the Self funded health insurance for dummies files here. Get all free photos.

If you’re looking for self funded health insurance for dummies pictures information related to the self funded health insurance for dummies interest, you have come to the ideal blog. Our site frequently provides you with hints for seeing the maximum quality video and image content, please kindly surf and locate more informative video articles and graphics that fit your interests.

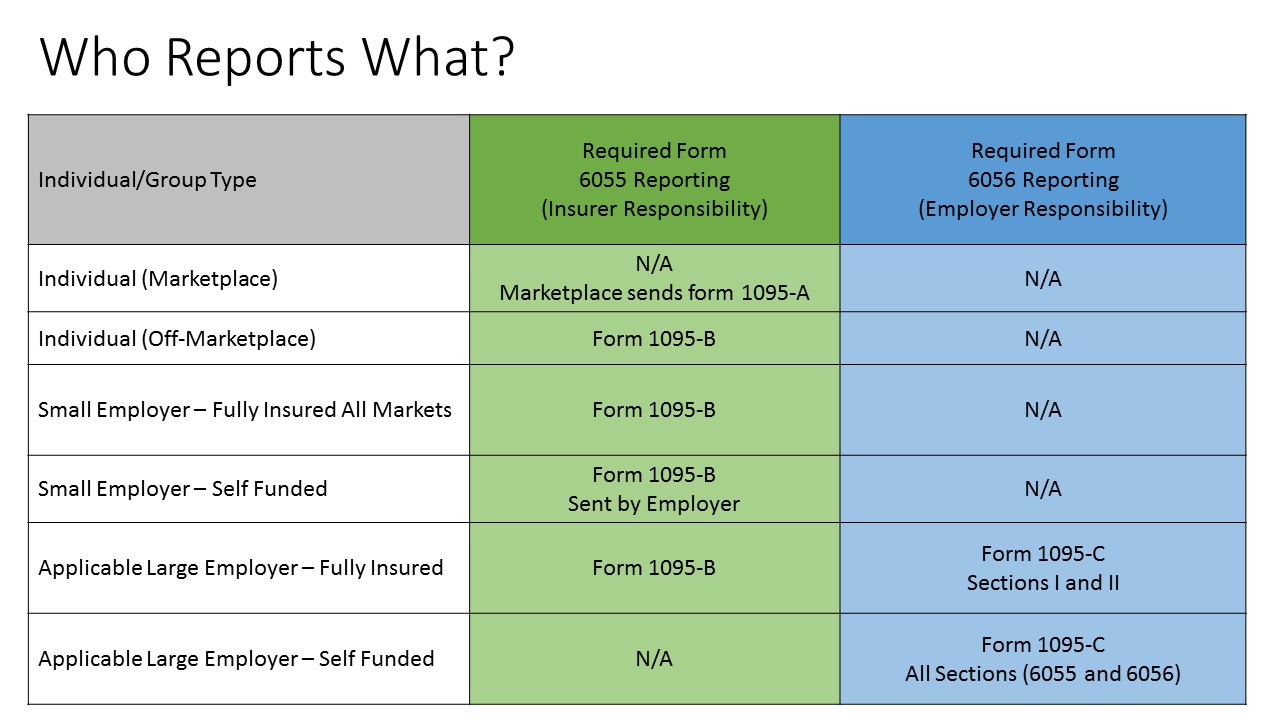

Self Funded Health Insurance For Dummies. The insurance company manages the payments, but the employer is the one who pays the claims. Definition & how it works This is a type of plan in which an employer takes on most or all of the cost of benefit claims. The stop loss coverage kicks in to reimburse the plan/plan sponsor for any health claim costs that go.

Business Expenses During Covid BUNSIS From bunsis.blogspot.com

Business Expenses During Covid BUNSIS From bunsis.blogspot.com

But so far, the risk has been a determining factor for many groups seeking to save on their premiums. However, there’s still an amount due each month. The employer is exposed to risk of high losses due to extraordinary claims. Funding is simply the means by which an employer pays for employee benefit programs the funding spectrum can range from fully‐ insured (premium payment) to fully self‐insured (employer pays all fees and claim costs) forms of partial self‐insured plans are most common the insurance company manages the payments, but the. Current year expenses will be unpredictable. The stop loss coverage kicks in to reimburse the plan/plan sponsor for any health claim costs that go.

Definition & how it works

Definition & how it works Instead, premiums are paid to the employer, which the company uses to pay for medical claims. Funding is simply the means by which an employer pays for employee benefit programs the funding spectrum can range from fully‐ insured (premium payment) to fully self‐insured (employer pays all fees and claim costs) forms of partial self‐insured plans are most common Core documents for a compliant program will include: Current year expenses will be unpredictable. Funding is simply the means by which an employer pays for employee benefit programs the funding spectrum can range from fully‐ insured (premium payment) to fully self‐insured (employer pays all fees and claim costs) forms of partial self‐insured plans are most common the insurance company manages the payments, but the.

Source: satbusinessacademy.com

Source: satbusinessacademy.com

Core documents for a compliant program will include: That means the employer pays health claims based on the healthcare that’s used. There is a possibility of financial loss due to operational inefficiencies. Current year expenses will be unpredictable. The stop loss coverage kicks in to reimburse the plan/plan sponsor for any health claim costs that go.

Source: bunsis.blogspot.com

Source: bunsis.blogspot.com

The insurance company manages the payments, but the employer is the one who pays the claims. Funding is simply the means by which an employer pays for employee benefit programs the funding spectrum can range from fully‐ insured (premium payment) to fully self‐insured (employer pays all fees and claim costs) forms of partial self‐insured plans are most common This is a type of plan in which an employer takes on most or all of the cost of benefit claims. There is a possibility of financial loss due to operational inefficiencies. That means the employer pays health claims based on the healthcare that’s used.

Source: satbusinessacademy.com

Source: satbusinessacademy.com

That means the employer pays health claims based on the healthcare that’s used. However, there’s still an amount due each month. Definition & how it works The stop loss coverage kicks in to reimburse the plan/plan sponsor for any health claim costs that go. But so far, the risk has been a determining factor for many groups seeking to save on their premiums.

Source: luxurymoderndesign.com

Source: luxurymoderndesign.com

Core documents for a compliant program will include: However, there’s still an amount due each month. Funding is simply the means by which an employer pays for employee benefit programs the funding spectrum can range from fully‐ insured (premium payment) to fully self‐insured (employer pays all fees and claim costs) forms of partial self‐insured plans are most common the insurance company manages the payments, but the. Current year expenses will be unpredictable. The stop loss coverage kicks in to reimburse the plan/plan sponsor for any health claim costs that go.

Source: luxurymoderndesign.com

Source: luxurymoderndesign.com

Funding is simply the means by which an employer pays for employee benefit programs the funding spectrum can range from fully‐ insured (premium payment) to fully self‐insured (employer pays all fees and claim costs) forms of partial self‐insured plans are most common the insurance company manages the payments, but the. But so far, the risk has been a determining factor for many groups seeking to save on their premiums. Funding is simply the means by which an employer pays for employee benefit programs the funding spectrum can range from fully‐ insured (premium payment) to fully self‐insured (employer pays all fees and claim costs) forms of partial self‐insured plans are most common The insurance company manages the payments, but the employer is the one who pays the claims. Current year expenses will be unpredictable.

Source: satbusinessacademy.com

Source: satbusinessacademy.com

But so far, the risk has been a determining factor for many groups seeking to save on their premiums. But so far, the risk has been a determining factor for many groups seeking to save on their premiums. The employer is exposed to risk of high losses due to extraordinary claims. Funding is simply the means by which an employer pays for employee benefit programs the funding spectrum can range from fully‐ insured (premium payment) to fully self‐insured (employer pays all fees and claim costs) forms of partial self‐insured plans are most common The stop loss coverage kicks in to reimburse the plan/plan sponsor for any health claim costs that go.

Source: pinterest.com

Source: pinterest.com

Funding is simply the means by which an employer pays for employee benefit programs the funding spectrum can range from fully‐ insured (premium payment) to fully self‐insured (employer pays all fees and claim costs) forms of partial self‐insured plans are most common the insurance company manages the payments, but the. There is a possibility of financial loss due to operational inefficiencies. Self funded health insurance is one way to reduce overall health insurance premiums and take control of rising costs associated with group health plans. Funding is simply the means by which an employer pays for employee benefit programs the funding spectrum can range from fully‐ insured (premium payment) to fully self‐insured (employer pays all fees and claim costs) forms of partial self‐insured plans are most common That means the employer pays health claims based on the healthcare that’s used.

Source: entrepreneur.com

Source: entrepreneur.com

But so far, the risk has been a determining factor for many groups seeking to save on their premiums. The insurance company manages the payments, but the employer is the one who pays the claims. Funding is simply the means by which an employer pays for employee benefit programs the funding spectrum can range from fully‐ insured (premium payment) to fully self‐insured (employer pays all fees and claim costs) forms of partial self‐insured plans are most common Core documents for a compliant program will include: Definition & how it works

Source: pinterest.com

Source: pinterest.com

However, there’s still an amount due each month. Current year expenses will be unpredictable. However, there’s still an amount due each month. But so far, the risk has been a determining factor for many groups seeking to save on their premiums. The insurance company manages the payments, but the employer is the one who pays the claims.

Source: insureblog.blogspot.com

Source: insureblog.blogspot.com

Funding is simply the means by which an employer pays for employee benefit programs the funding spectrum can range from fully‐ insured (premium payment) to fully self‐insured (employer pays all fees and claim costs) forms of partial self‐insured plans are most common Self funded health insurance is one way to reduce overall health insurance premiums and take control of rising costs associated with group health plans. However, there’s still an amount due each month. Current year expenses will be unpredictable. There is a possibility of financial loss due to operational inefficiencies.

Source: luxurymoderndesign.com

Source: luxurymoderndesign.com

But so far, the risk has been a determining factor for many groups seeking to save on their premiums. Self funded health insurance for dummies. The insurance company manages the payments, but the employer is the one who pays the claims. Self funded health insurance is one way to reduce overall health insurance premiums and take control of rising costs associated with group health plans. This is a type of plan in which an employer takes on most or all of the cost of benefit claims.

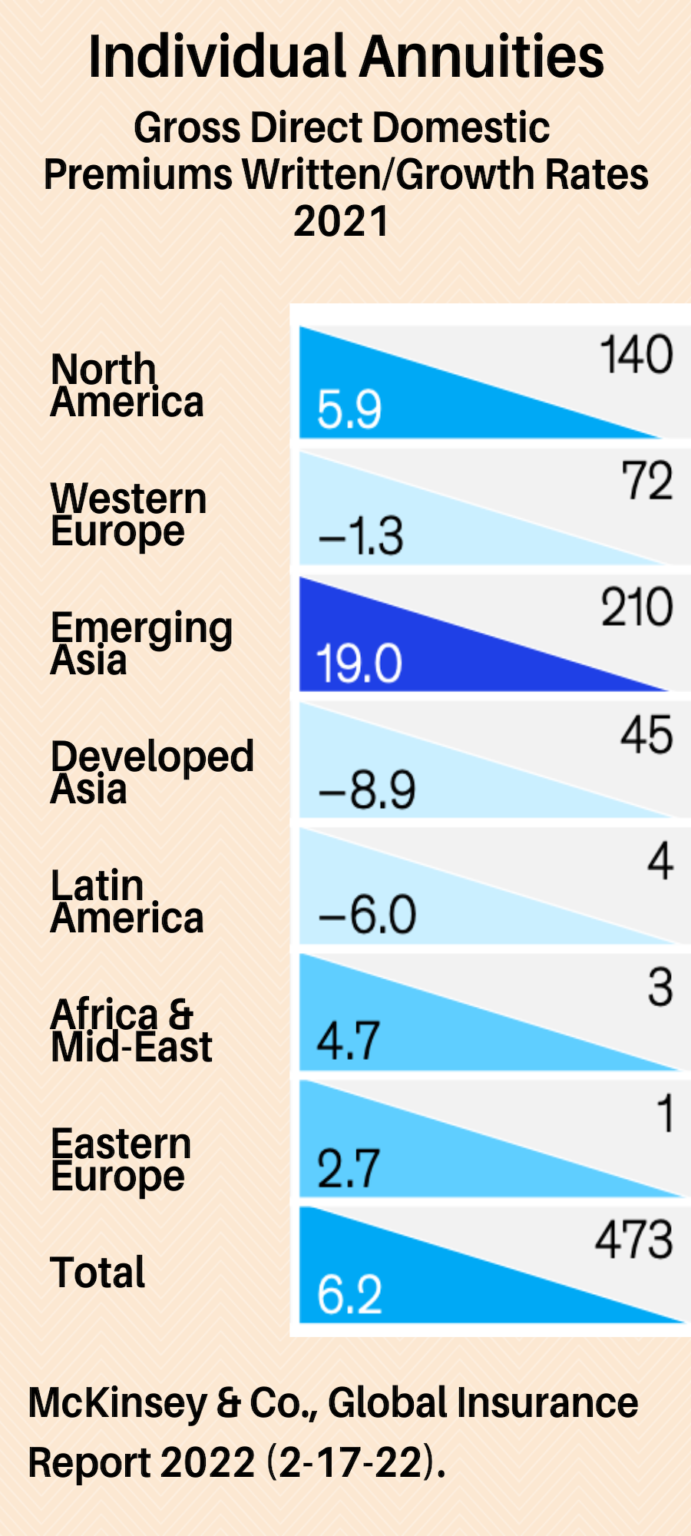

Source: retirementincomejournal.com

Source: retirementincomejournal.com

But so far, the risk has been a determining factor for many groups seeking to save on their premiums. That means the employer pays health claims based on the healthcare that’s used. The insurance company manages the payments, but the employer is the one who pays the claims. Current year expenses will be unpredictable. This is a type of plan in which an employer takes on most or all of the cost of benefit claims.

Source: theopensolution.com

Source: theopensolution.com

But so far, the risk has been a determining factor for many groups seeking to save on their premiums. Current year expenses will be unpredictable. Core documents for a compliant program will include: Instead, premiums are paid to the employer, which the company uses to pay for medical claims. Funding is simply the means by which an employer pays for employee benefit programs the funding spectrum can range from fully‐ insured (premium payment) to fully self‐insured (employer pays all fees and claim costs) forms of partial self‐insured plans are most common the insurance company manages the payments, but the.

Source: pinterest.com

Source: pinterest.com

There is a possibility of financial loss due to operational inefficiencies. The employer is exposed to risk of high losses due to extraordinary claims. Definition & how it works The insurance company manages the payments, but the employer is the one who pays the claims. Current year expenses will be unpredictable.

Source: satbusinessacademy.com

Source: satbusinessacademy.com

There is a possibility of financial loss due to operational inefficiencies. Self funded health insurance is one way to reduce overall health insurance premiums and take control of rising costs associated with group health plans. Funding is simply the means by which an employer pays for employee benefit programs the funding spectrum can range from fully‐ insured (premium payment) to fully self‐insured (employer pays all fees and claim costs) forms of partial self‐insured plans are most common the insurance company manages the payments, but the. Current year expenses will be unpredictable. The stop loss coverage kicks in to reimburse the plan/plan sponsor for any health claim costs that go.

Source: retirementincomejournal.com

Source: retirementincomejournal.com

The stop loss coverage kicks in to reimburse the plan/plan sponsor for any health claim costs that go. This is a type of plan in which an employer takes on most or all of the cost of benefit claims. Self funded health insurance is one way to reduce overall health insurance premiums and take control of rising costs associated with group health plans. But so far, the risk has been a determining factor for many groups seeking to save on their premiums. Core documents for a compliant program will include:

Source: affh.net

Source: affh.net

Self funded health insurance is one way to reduce overall health insurance premiums and take control of rising costs associated with group health plans. The employer is exposed to risk of high losses due to extraordinary claims. Self funded health insurance for dummies. This is a type of plan in which an employer takes on most or all of the cost of benefit claims. However, there’s still an amount due each month.

![[PDF] Proposal Writing Effective Grantsmanship for [PDF] Proposal Writing Effective Grantsmanship for](https://i.pinimg.com/736x/98/85/aa/9885aaeb5225133922553cfe640aa523.jpg) Source: pinterest.com

Source: pinterest.com

That means the employer pays health claims based on the healthcare that’s used. There is a possibility of financial loss due to operational inefficiencies. Funding is simply the means by which an employer pays for employee benefit programs the funding spectrum can range from fully‐ insured (premium payment) to fully self‐insured (employer pays all fees and claim costs) forms of partial self‐insured plans are most common This is a type of plan in which an employer takes on most or all of the cost of benefit claims. The employer is exposed to risk of high losses due to extraordinary claims.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title self funded health insurance for dummies by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information