Self funded insurance vs fully insured Idea

Home » Trending » Self funded insurance vs fully insured IdeaYour Self funded insurance vs fully insured images are available. Self funded insurance vs fully insured are a topic that is being searched for and liked by netizens today. You can Download the Self funded insurance vs fully insured files here. Download all free photos.

If you’re searching for self funded insurance vs fully insured images information connected with to the self funded insurance vs fully insured interest, you have come to the right blog. Our website always provides you with hints for seeking the highest quality video and image content, please kindly search and find more informative video articles and images that fit your interests.

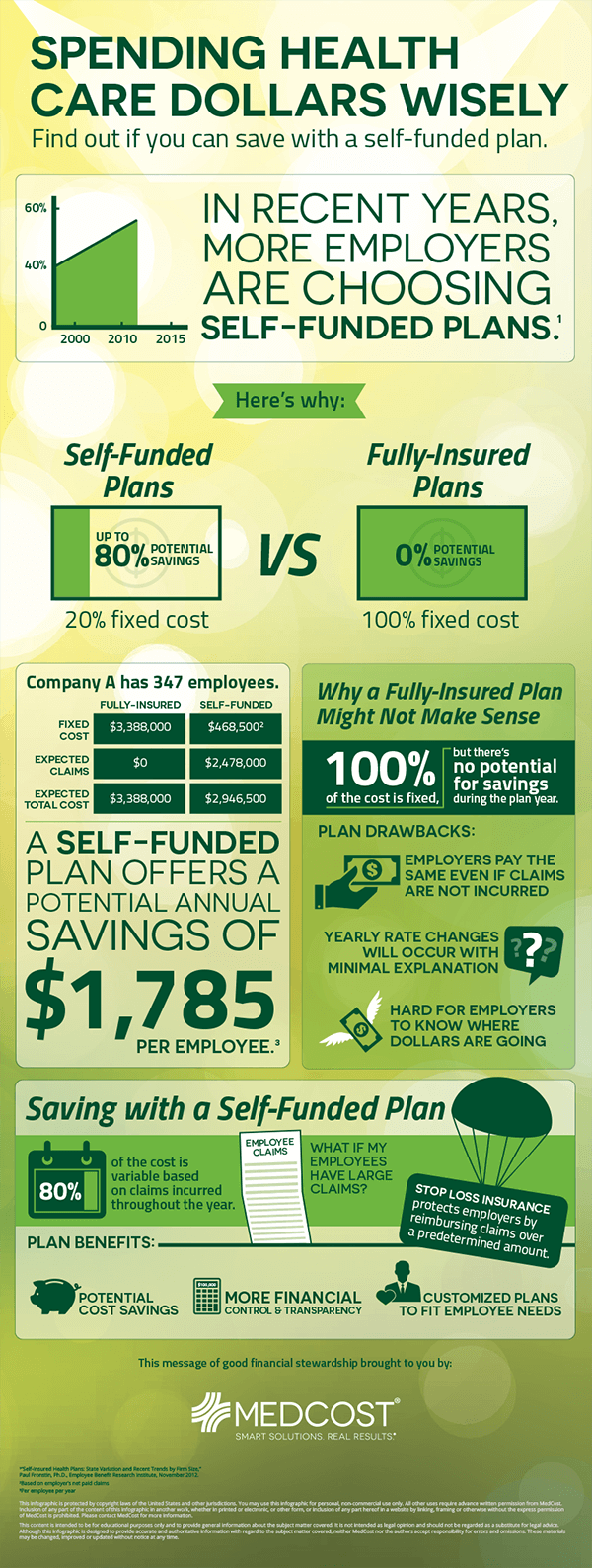

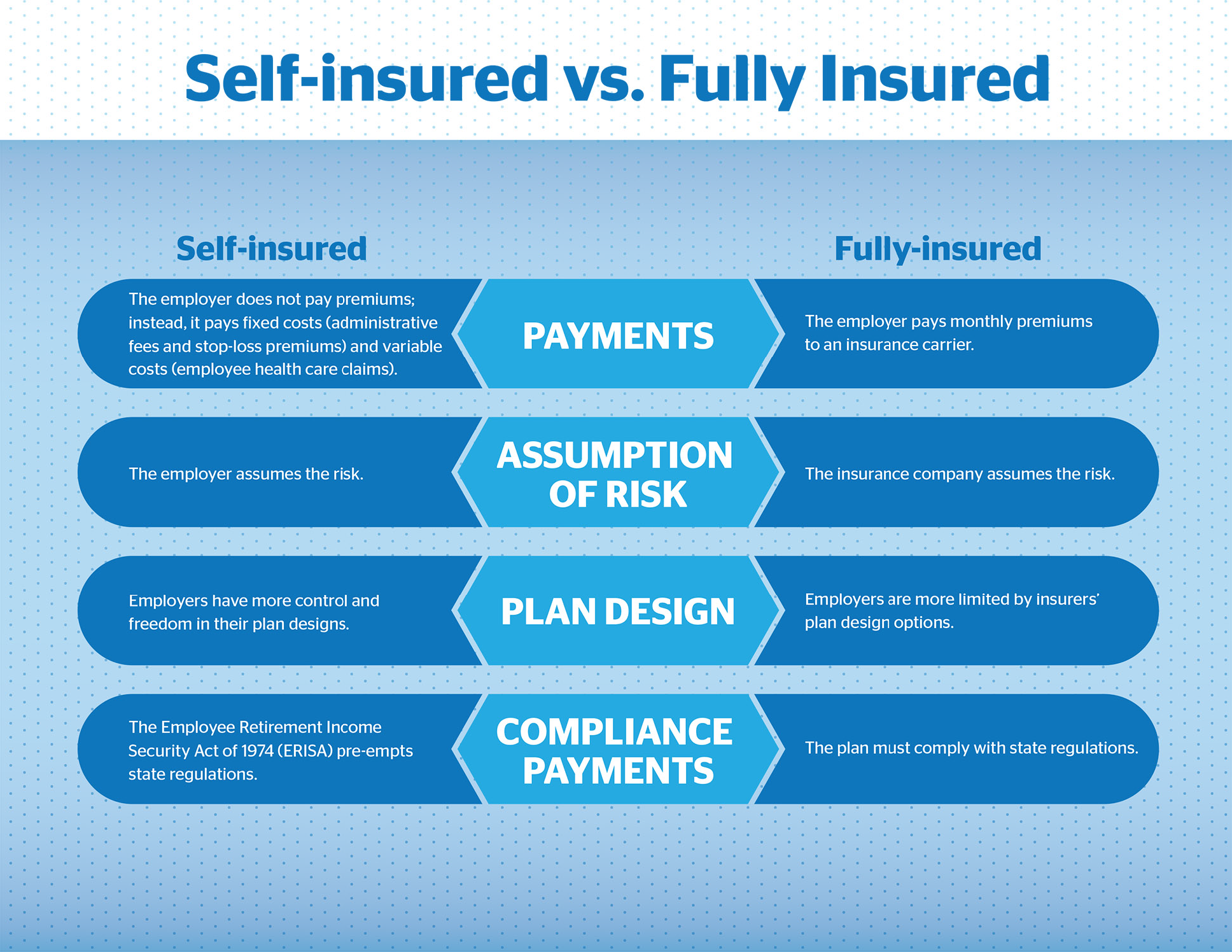

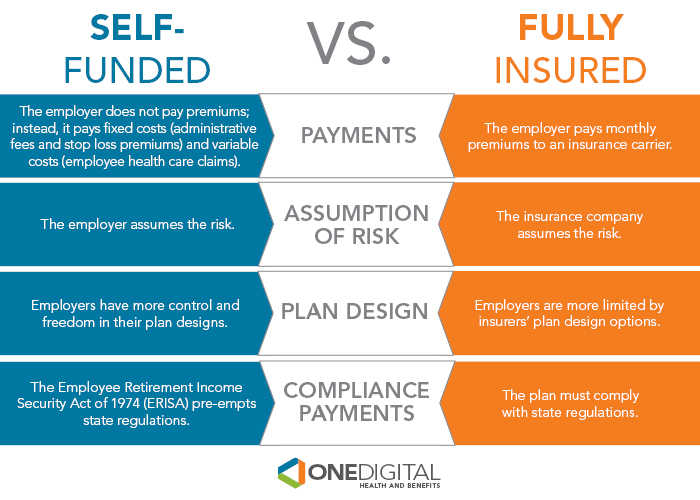

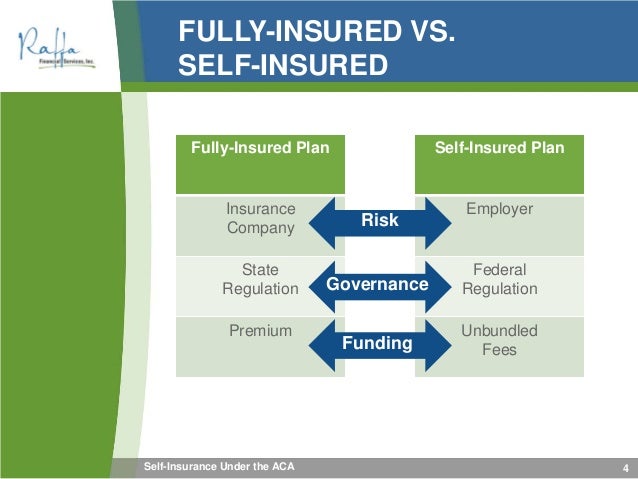

Self Funded Insurance Vs Fully Insured. This number has steadily increased. With a fully insured plan, the risk falls on the insurance company. Monthly costs reflect only expected claims of employees; The fully insured model may mean that employers pay higher premiums to cover the risks and generate profits for insurance companies.

SelfFunding Employee Benefits Group Planners Inc From groupplannersinc.com

SelfFunding Employee Benefits Group Planners Inc From groupplannersinc.com

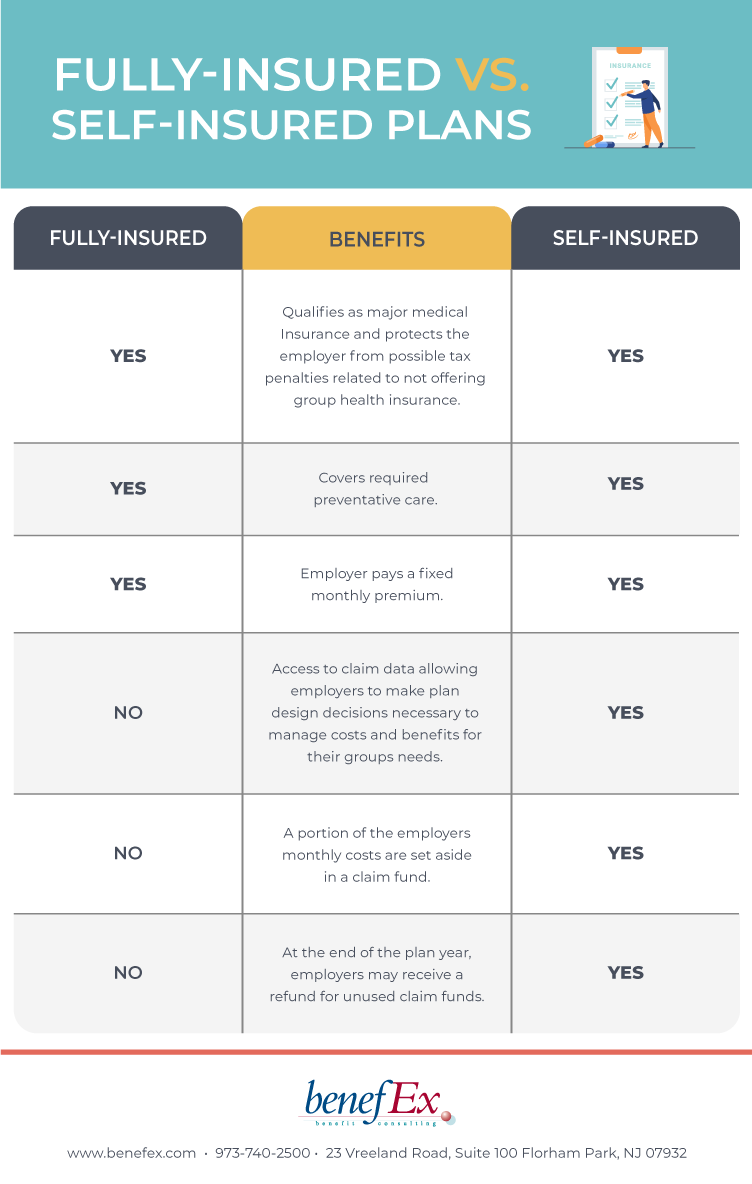

A fully insured plan removes most risk from the employer and employees, but the guaranteed cost of the plan is higher. The employer pays the claims of its employees (with an important caveat—see the next paragraph). The employer pays the premium directly to the insurance company, and the premium is set on an annual basis. An employer also has the option to negotiate with health insurance providers to get the best rates possible for their employees. With fully insured health insurance plans, employers pay an insurance provider in advance to cover projected claims, in addition to the insurer’s overhead and administrative costs. Not subject to all taxes and fees;

Is medicare self funded or fully insured.

It is more common for larger businesses to be fully insured than businesses with thousands of employees due to cost. With a fully insured plan, the risk falls on the insurance company. It is more common for larger businesses to be fully insured than businesses with thousands of employees due to cost. In other words, benefits are paid through a plan which is funded by employer contributions. What is the difference between fully funded and self funded insurance? However, it is important to note that self funding carries more risk than fully insured plans, along with being accompanied by greater regulations.

Source: groupplannersinc.com

Source: groupplannersinc.com

• fully insured premiums expected to jump to accommodate new provisions as a result of ppaca. That means the employer pays health claims based on the healthcare that’s used. It is more common for larger businesses to be fully insured than businesses with thousands of employees due to cost. In other words, benefits are paid through a plan which is funded by employer contributions. The employer pays the claims of its employees, so it.

Source: medcost.com

Source: medcost.com

If employees are relatively healthy and don’t use the health plan very much, the employer’s costs will be lower than if the plan were fully insured. The employer pays the claims of its employees, so it. The employer pays the premium directly to the insurance company, and the premium is set on an annual basis. A fully insured plan removes most risk from the employer and employees, but the guaranteed cost of the plan is higher. Level funding can provide you with the benefits of both fully insured and self insured plans, reducing the downsides of either option separately.

Source: slideserve.com

Source: slideserve.com

One of the biggest differences between fully insured plans and self insured plans is who assumes all the risk. Find your best rate from over. Fully insured plans a fully insured insurance plan is a straightforward insurance product purchased by the employer for the benefit of its employees. With a fully insured plan, the risk falls on the insurance company. However, it is important to note that self funding carries more risk than fully insured plans, along with being accompanied by greater regulations.

Source: oneillinsurance.com

Source: oneillinsurance.com

With a fully insured plan, the risk falls on the insurance company. With fully insured health insurance plans, employers pay an insurance provider in advance to cover projected claims, in addition to the insurer’s overhead and administrative costs. The employer pays the claims of its employees (with an important caveat—see the next paragraph). Monthly costs reflect only expected claims of employees; The employer pays the premium directly to the insurance company, and the premium is set on an annual basis.

Source: onedigital.com

Source: onedigital.com

The employer pays the claims of its employees, so it. Is medicare self funded or fully insured. If employees are relatively healthy and don’t use the health plan very much, the employer’s costs will be lower than if the plan were fully insured. The employer pays the claims of its employees (with an important caveat—see the next paragraph). An employer also has the option to negotiate with health insurance providers to get the best rates possible for their employees.

Source: bbconnecticut.com

Source: bbconnecticut.com

The employer pays the premium directly to the insurance company, and the premium is set on an annual basis. They’re subject to less regulation and offer business the opportunity to customize their health care plan to meet their unique business needs. An employer also has the option to negotiate with health insurance providers to get the best rates possible for their employees. Find your best rate from over. With fully insured health insurance plans, employers pay an insurance provider in advance to cover projected claims, in addition to the insurer’s overhead and administrative costs.

Source: tamekahe.wixsite.com

Source: tamekahe.wixsite.com

That means the employer pays health claims based on the healthcare that’s used. A fully insured plan removes most risk from the employer and employees, but the guaranteed cost of the plan is higher. One of the biggest differences between fully insured plans and self insured plans is who assumes all the risk. The fully insured model may mean that employers pay higher premiums to cover the risks and generate profits for insurance companies. Not subject to all taxes and fees;

Source: ssfllc.com

Source: ssfllc.com

Find your best rate from over. The fully insured model may mean that employers pay higher premiums to cover the risks and generate profits for insurance companies. With a fully insured plan, the risk falls on the insurance company. With fully insured health insurance plans, employers pay an insurance provider in advance to cover projected claims, in addition to the insurer’s overhead and administrative costs. An employer also has the option to negotiate with health insurance providers to get the best rates possible for their employees.

Source: medcost.com

Source: medcost.com

It is more common for larger businesses to be fully insured than businesses with thousands of employees due to cost. The employer pays the claims of its employees, so it. Is medicare self funded or fully insured. It is more common for larger businesses to be fully insured than businesses with thousands of employees due to cost. A complaint can only be filed with a state insurance commissioner for fully insured plans.

health plans_fb.jpg “Fullyinsured vs. selfinsured (selffunded) health plans”) Source: peoplekeep.com

A fully insured plan removes most risk from the employer and employees, but the guaranteed cost of the plan is higher. The employer pays the claims of its employees, so it. Monthly costs reflect only expected claims of employees; The employer pays the claims of its employees (with an important caveat—see the next paragraph). They’re subject to less regulation and offer business the opportunity to customize their health care plan to meet their unique business needs.

Source: jeffreybernard.com

Source: jeffreybernard.com

Monthly costs reflect only expected claims of employees; One of the biggest differences between fully insured plans and self insured plans is who assumes all the risk. Fully insured plans a fully insured insurance plan is a straightforward insurance product purchased by the employer for the benefit of its employees. Find your best rate from over. They’re subject to less regulation and offer business the opportunity to customize their health care plan to meet their unique business needs.

Source: slideshare.net

Source: slideshare.net

However, it is important to note that self funding carries more risk than fully insured plans, along with being accompanied by greater regulations. The employer pays the claims of its employees, so it. One of the biggest differences between fully insured plans and self insured plans is who assumes all the risk. In other words, benefits are paid through a plan which is funded by employer contributions. They’re subject to less regulation and offer business the opportunity to customize their health care plan to meet their unique business needs.

Source: employerblog.pacificsource.com

Source: employerblog.pacificsource.com

The employer pays the premium directly to the insurance company, and the premium is set on an annual basis. The employer pays the claims of its employees, so it. This number has steadily increased. What is the difference between fully funded and self funded insurance? It’s also known as a self.

Source: employerblog.pacificsource.com

Source: employerblog.pacificsource.com

• fully insured premiums expected to jump to accommodate new provisions as a result of ppaca. The employer pays the claims of its employees, so it. A fully insured plan removes most risk from the employer and employees, but the guaranteed cost of the plan is higher. The employer pays the claims of its employees (with an important caveat—see the next paragraph). The fully insured model may mean that employers pay higher premiums to cover the risks and generate profits for insurance companies.

Source: ssfllc.com

Source: ssfllc.com

If employees are relatively healthy and don’t use the health plan very much, the employer’s costs will be lower than if the plan were fully insured. The employer pays the claims of its employees, so it. However, it is important to note that self funding carries more risk than fully insured plans, along with being accompanied by greater regulations. They’re subject to less regulation and offer business the opportunity to customize their health care plan to meet their unique business needs. • better strategic position to adjust benefits to control increased provider costs.

Source: benefex.com

Source: benefex.com

That means the employer pays health claims based on the healthcare that’s used. So, an employer buys coverage for its employees from an insurance company. What is the difference between fully funded and self funded insurance? With fully insured health insurance plans, employers pay an insurance provider in advance to cover projected claims, in addition to the insurer’s overhead and administrative costs. They’re subject to less regulation and offer business the opportunity to customize their health care plan to meet their unique business needs.

Source: precisionbenefits.com

Source: precisionbenefits.com

An employer also has the option to negotiate with health insurance providers to get the best rates possible for their employees. It’s also known as a self. • fully insured premiums expected to jump to accommodate new provisions as a result of ppaca. Find your best rate from over. However, it is important to note that self funding carries more risk than fully insured plans, along with being accompanied by greater regulations.

Source: bluestoneadvisors.com

Source: bluestoneadvisors.com

A complaint can only be filed with a state insurance commissioner for fully insured plans. The fully insured model may mean that employers pay higher premiums to cover the risks and generate profits for insurance companies. What is the difference between fully funded and self funded insurance? Fully insured plans a fully insured insurance plan is a straightforward insurance product purchased by the employer for the benefit of its employees. • fully insured premiums expected to jump to accommodate new provisions as a result of ppaca.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title self funded insurance vs fully insured by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information