Self funded vs fully funded health insurance Idea

Home » Trending » Self funded vs fully funded health insurance IdeaYour Self funded vs fully funded health insurance images are available. Self funded vs fully funded health insurance are a topic that is being searched for and liked by netizens today. You can Download the Self funded vs fully funded health insurance files here. Get all royalty-free photos.

If you’re looking for self funded vs fully funded health insurance images information connected with to the self funded vs fully funded health insurance topic, you have visit the ideal blog. Our site frequently provides you with suggestions for downloading the highest quality video and image content, please kindly hunt and find more informative video content and graphics that match your interests.

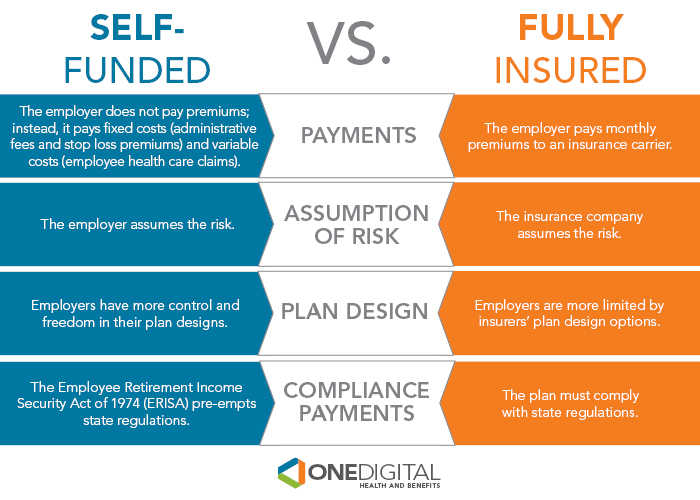

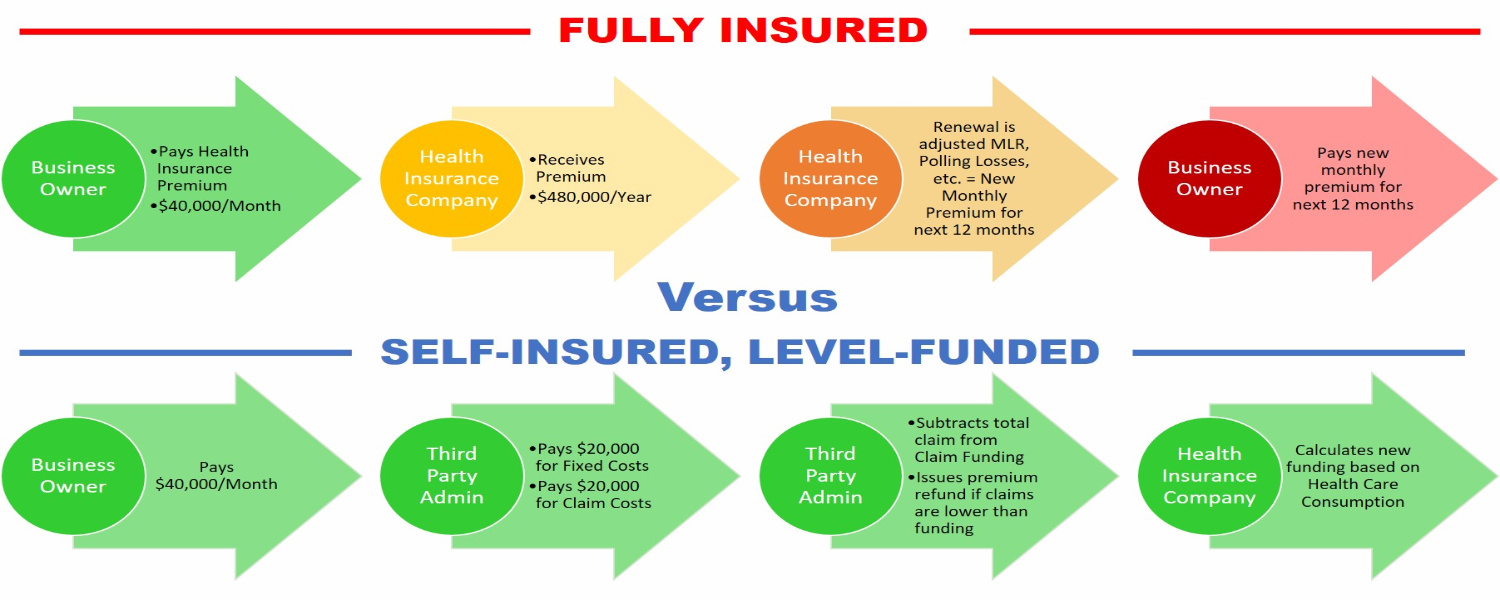

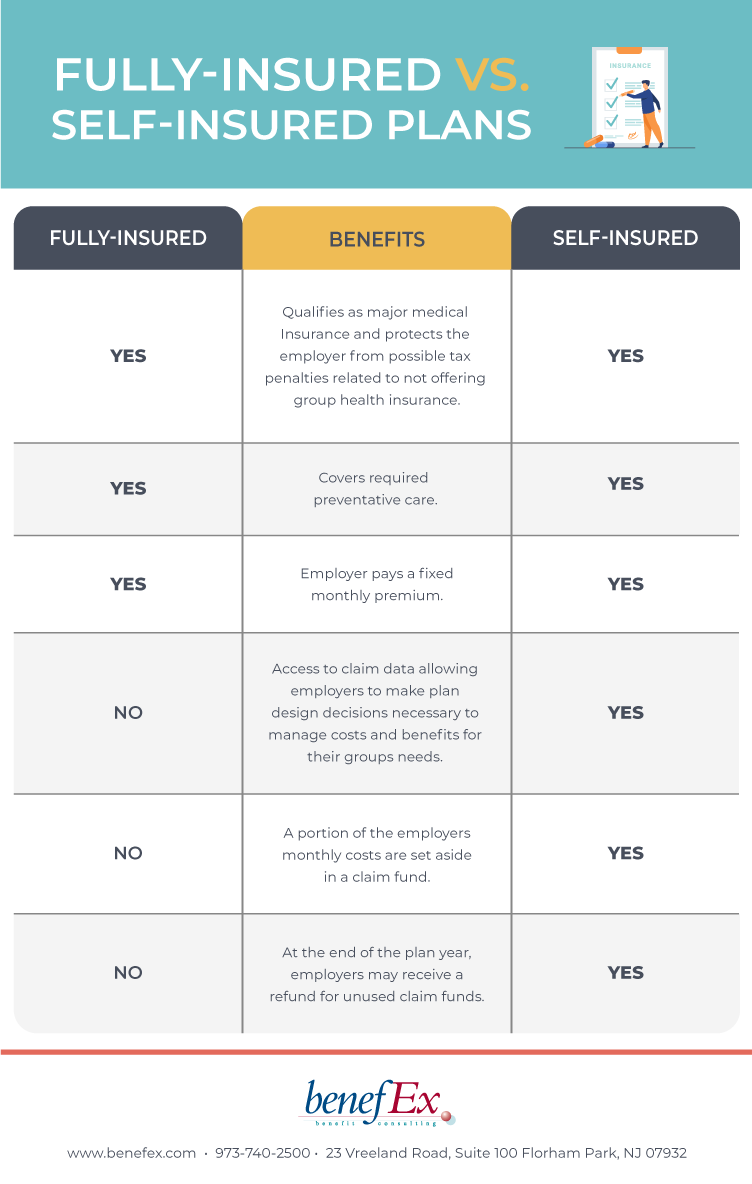

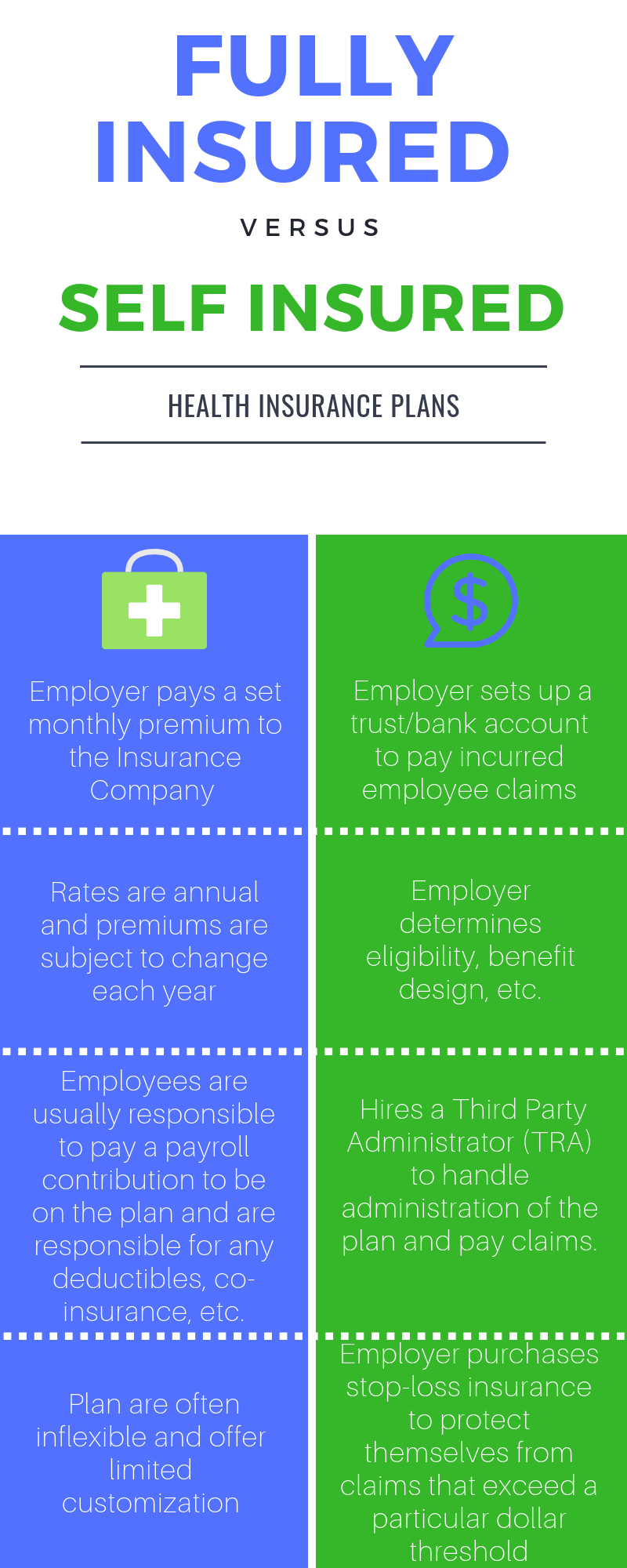

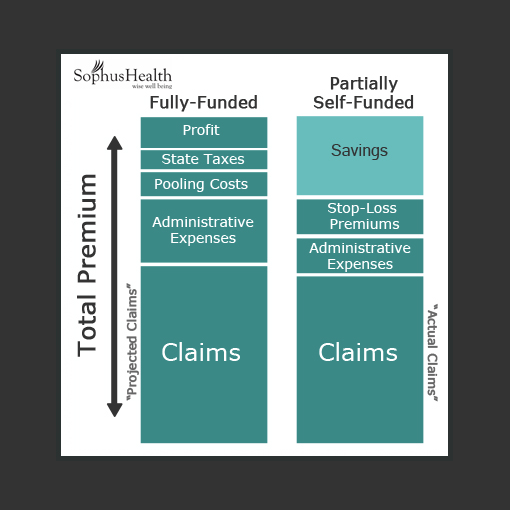

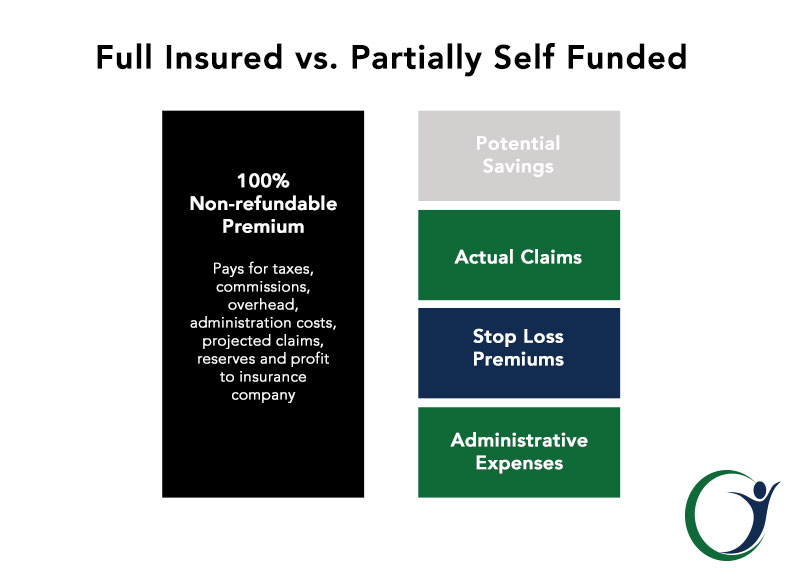

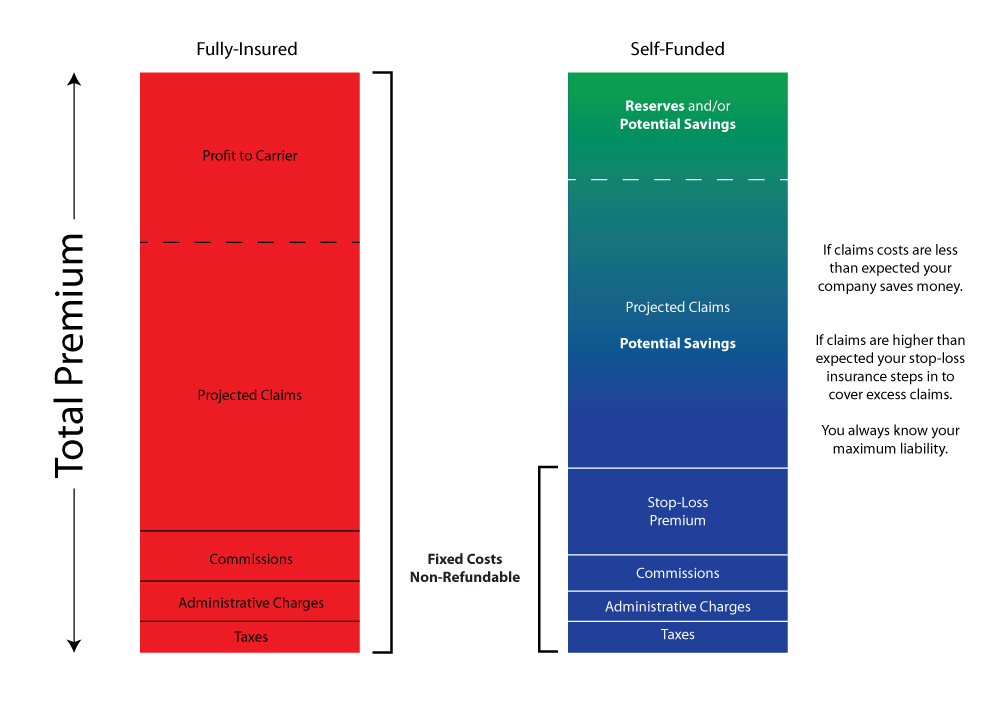

Self Funded Vs Fully Funded Health Insurance. With fully insured health insurance plans, employers pay an insurance provider in advance to cover projected claims, in addition to the insurer’s overhead and administrative costs. This cost is determined yearly during your renewal with the health insurance provider. Health care costs in the us have increased every year since 1960. Monthly costs reflect only expected claims of employees;

Health Plan Differences Understanding SelfInsured vs From onedigital.com

Health Plan Differences Understanding SelfInsured vs From onedigital.com

Is medicare self funded or fully insured. “who is going to assume the risk?” in this case, risk pertains to insurance risk, or who is going to pay the hospital when an employee needs to. Fully insured plans, so let’s discuss the numbers. The employer pays the premium directly to the insurance company, and the premium is set on an annual basis. Fully funded plans are those that are offered for sale by an insurance carrier, who assumes all of the risks and pays all of the claims. All group health benefit plans fall into one of two categories:

The choice of one over the other should not be made arbitrarily.

In return, the insurance company covers the costs of the employees’ healthcare. The employer pays the premium directly to the insurance company, and the premium is set on an annual basis. If a handful of employees experience catastrophic healthcare emergencies, actual costs could easily exceed expected costs. An employer also has the option to negotiate with health insurance providers to get the best rates possible for their employees. A fully funded plan is a health plan that is sponsored by an insurance company rather than an employer. “who is going to assume the risk?” in this case, risk pertains to insurance risk, or who is going to pay the hospital when an employee needs to.

Source: groupbenefitsexperts.com

Source: groupbenefitsexperts.com

A fully funded plan is a health plan that is sponsored by an insurance company rather than an employer. If a handful of employees experience catastrophic healthcare emergencies, actual costs could easily exceed expected costs. “who is going to assume the risk?” in this case, risk pertains to insurance risk, or who is going to pay the hospital when an employee needs to. In return, the insurance company covers the costs of the employees’ healthcare. These are two ways in which employers provide health insurance benefits for their employees:

Source: benefex.com

Source: benefex.com

Fully insured plans, so let’s discuss the numbers. If claims are low, you get a rebate to cover the difference. The choice of one over the other should not be made arbitrarily. “who is going to assume the risk?” in this case, risk pertains to insurance risk, or who is going to pay the hospital when an employee needs to. What is a fully funded health plan?

Source: bluestoneadvisors.com

Source: bluestoneadvisors.com

Each type carries its own set. The choice of one over the other should not be made arbitrarily. Each type carries its own set. If claims are low, you get a rebate to cover the difference. Fully insured plans, so let’s discuss the numbers.

Source: jeffreybernard.com

Source: jeffreybernard.com

“who is going to assume the risk?” in this case, risk pertains to insurance risk, or who is going to pay the hospital when an employee needs to. Is medicare self funded or fully insured. Not subject to all taxes and fees; An employer also has the option to negotiate with health insurance providers to get the best rates possible for their employees. Find your best rate from over.

Source: tamekahe.wixsite.com

Source: tamekahe.wixsite.com

Find your best rate from over. Not subject to all taxes and fees; Monthly costs reflect only expected claims of employees; The insurance provider assumes the risk that the employees will use their healthcare, and pays for that in. Fully insured plans, so let’s discuss the numbers.

Source: employerblog.pacificsource.com

Source: employerblog.pacificsource.com

“who is going to assume the risk?” in this case, risk pertains to insurance risk, or who is going to pay the hospital when an employee needs to. The insurance provider assumes the risk that the employees will use their healthcare, and pays for that in. “who is going to assume the risk?” in this case, risk pertains to insurance risk, or who is going to pay the hospital when an employee needs to. In return, the insurance company covers the costs of the employees’ healthcare. This cost is determined yearly during your renewal with the health insurance provider.

Source: bijenpatel.com

Source: bijenpatel.com

So, an employer buys coverage for its employees from an insurance company. The choice of one over the other should not be made arbitrarily. These are two ways in which employers provide health insurance benefits for their employees: “who is going to assume the risk?” in this case, risk pertains to insurance risk, or who is going to pay the hospital when an employee needs to. Fully insured plans, so let’s discuss the numbers.

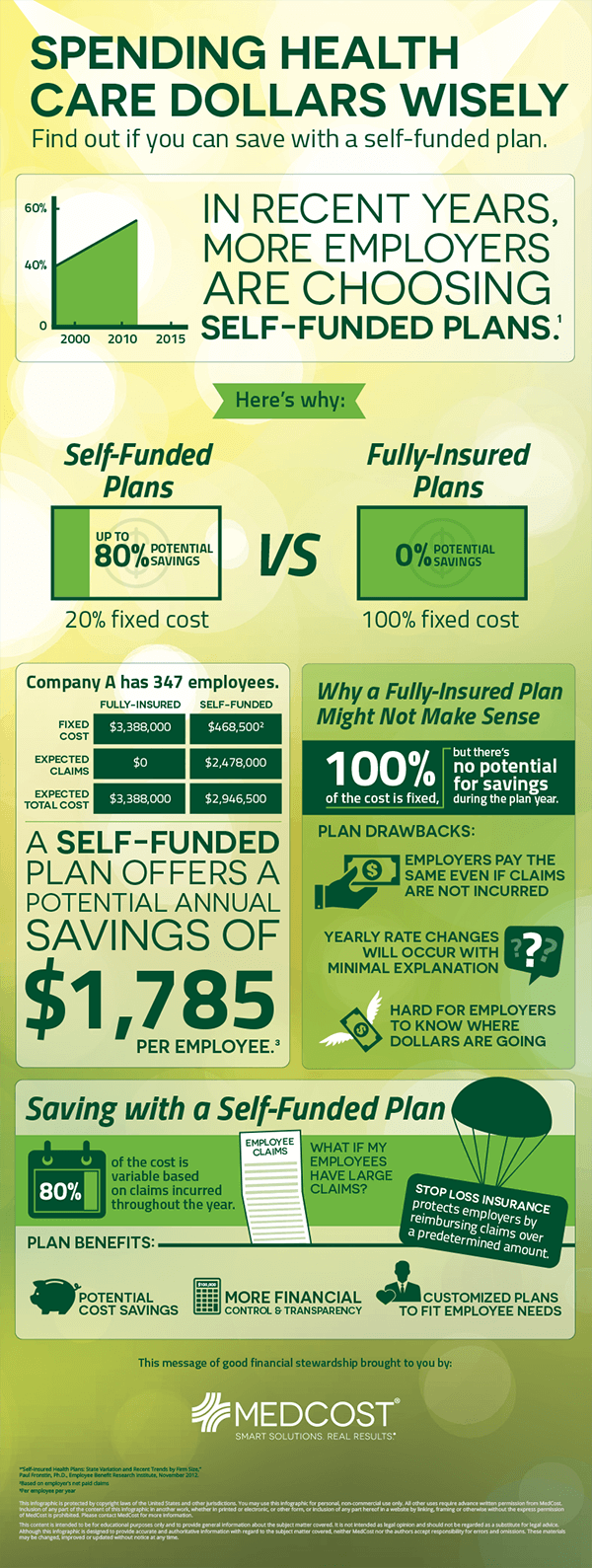

Source: medcost.com

Source: medcost.com

Monthly costs reflect only expected claims of employees; This cost is determined yearly during your renewal with the health insurance provider. If claims are low, you get a rebate to cover the difference. Fully insured plans, so let’s discuss the numbers. With fully insured health insurance plans, employers pay an insurance provider in advance to cover projected claims, in addition to the insurer’s overhead and administrative costs.

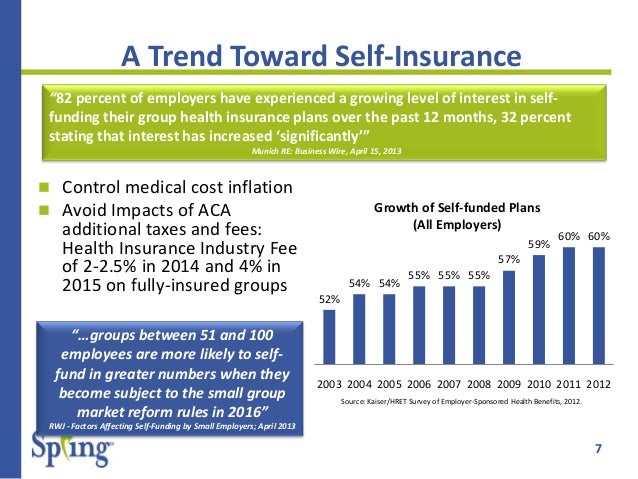

Source: slideshare.net

Source: slideshare.net

Fully insured plans, so let’s discuss the numbers. This cost is determined yearly during your renewal with the health insurance provider. So, an employer buys coverage for its employees from an insurance company. If claims are low, you get a rebate to cover the difference. Find your best rate from over.

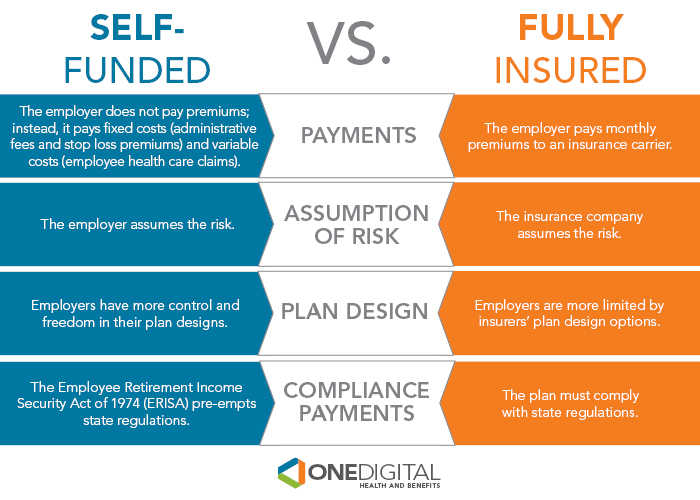

Source: onedigital.com

Source: onedigital.com

With fully insured health insurance plans, employers pay an insurance provider in advance to cover projected claims, in addition to the insurer’s overhead and administrative costs. If a handful of employees experience catastrophic healthcare emergencies, actual costs could easily exceed expected costs. They’re subject to less regulation and offer business the opportunity to customize their health care plan to meet their unique business needs. An employer also has the option to negotiate with health insurance providers to get the best rates possible for their employees. Monthly costs reflect only expected claims of employees;

Source: groupplannersinc.com

Source: groupplannersinc.com

With fully insured health insurance plans, employers pay an insurance provider in advance to cover projected claims, in addition to the insurer’s overhead and administrative costs. The employer pays the premium directly to the insurance company, and the premium is set on an annual basis. These are two ways in which employers provide health insurance benefits for their employees: The insurance provider assumes the risk that the employees will use their healthcare, and pays for that in. A fully insured plan removes most risk from the employer and employees, but the guaranteed cost of the plan is higher.

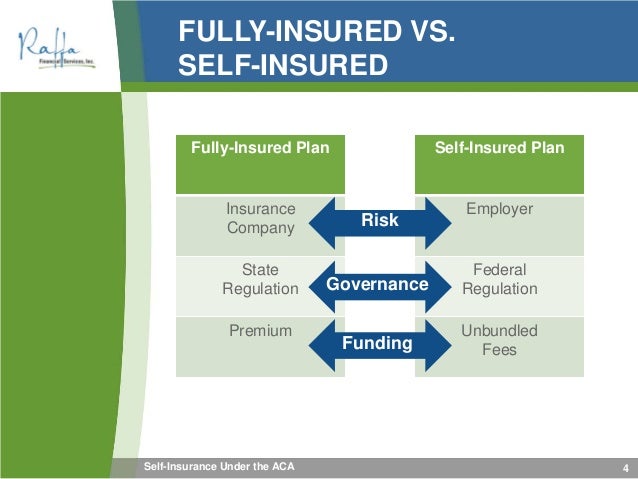

Source: slideshare.net

Source: slideshare.net

Monthly costs reflect only expected claims of employees; Monthly costs reflect only expected claims of employees; “who is going to assume the risk?” in this case, risk pertains to insurance risk, or who is going to pay the hospital when an employee needs to. A fully insured plan removes most risk from the employer and employees, but the guaranteed cost of the plan is higher. All group health benefit plans fall into one of two categories:

Source: sophushealth.com

Source: sophushealth.com

An employer also has the option to negotiate with health insurance providers to get the best rates possible for their employees. Health care costs in the us have increased every year since 1960. Is medicare self funded or fully insured. Monthly costs reflect only expected claims of employees; In return, the insurance company covers the costs of the employees’ healthcare.

Source: theopensolution.com

Source: theopensolution.com

If a handful of employees experience catastrophic healthcare emergencies, actual costs could easily exceed expected costs. An employer also has the option to negotiate with health insurance providers to get the best rates possible for their employees. In return, the insurance company covers the costs of the employees’ healthcare. Health care costs in the us have increased every year since 1960. This cost is determined yearly during your renewal with the health insurance provider.

Source: youtube.com

Source: youtube.com

“who is going to assume the risk?” in this case, risk pertains to insurance risk, or who is going to pay the hospital when an employee needs to. Fully funded plans are those that are offered for sale by an insurance carrier, who assumes all of the risks and pays all of the claims. Each type carries its own set. This cost is determined yearly during your renewal with the health insurance provider. The choice of one over the other should not be made arbitrarily.

Source: svg.agency

Source: svg.agency

A fully insured plan removes most risk from the employer and employees, but the guaranteed cost of the plan is higher. Health care costs in the us have increased every year since 1960. They’re subject to less regulation and offer business the opportunity to customize their health care plan to meet their unique business needs. Find your best rate from over. Fully funded plans are those that are offered for sale by an insurance carrier, who assumes all of the risks and pays all of the claims.

Source: youtube.com

Source: youtube.com

Fully insured plans, so let’s discuss the numbers. The employer pays the premium directly to the insurance company, and the premium is set on an annual basis. Each type carries its own set. Monthly costs reflect only expected claims of employees; An employer also has the option to negotiate with health insurance providers to get the best rates possible for their employees.

Source: slideshare.net

Source: slideshare.net

They’re subject to less regulation and offer business the opportunity to customize their health care plan to meet their unique business needs. Each type carries its own set. Fully insured plans, so let’s discuss the numbers. The employer pays the premium directly to the insurance company, and the premium is set on an annual basis. The insurance provider assumes the risk that the employees will use their healthcare, and pays for that in.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title self funded vs fully funded health insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information