Self insured plans Idea

Home » Trend » Self insured plans IdeaYour Self insured plans images are available. Self insured plans are a topic that is being searched for and liked by netizens now. You can Download the Self insured plans files here. Find and Download all free photos.

If you’re looking for self insured plans images information connected with to the self insured plans interest, you have visit the right blog. Our site always provides you with hints for refferencing the maximum quality video and picture content, please kindly surf and locate more enlightening video content and images that fit your interests.

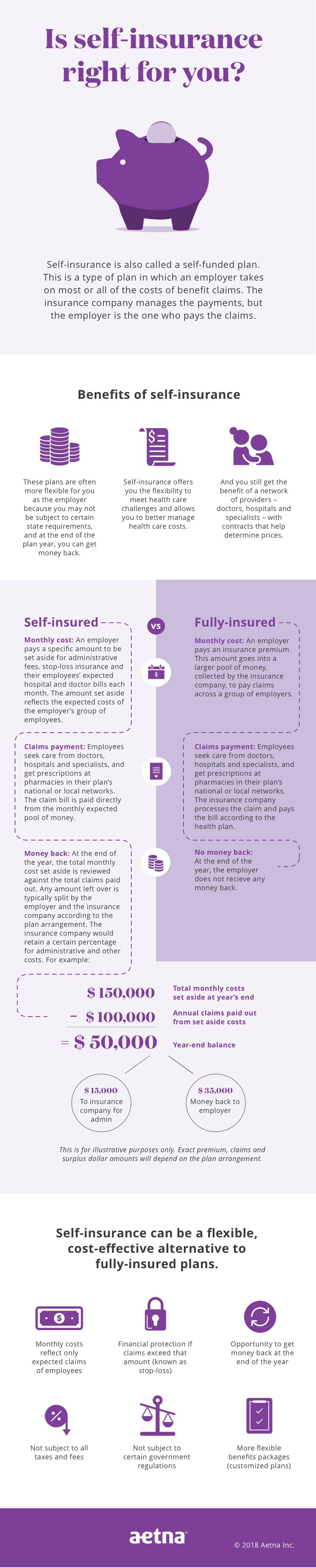

Self Insured Plans. Sip is dedicated to exceeding customer expectations in providing administrative services,. What is a self insured health plan? Advantages of self insured health plans: This is a type of plan in which an employer takes on most or all of the cost of benefit claims.

Choosing Self Insured Health Plans for Your Company From jdmbenefits.com

Choosing Self Insured Health Plans for Your Company From jdmbenefits.com

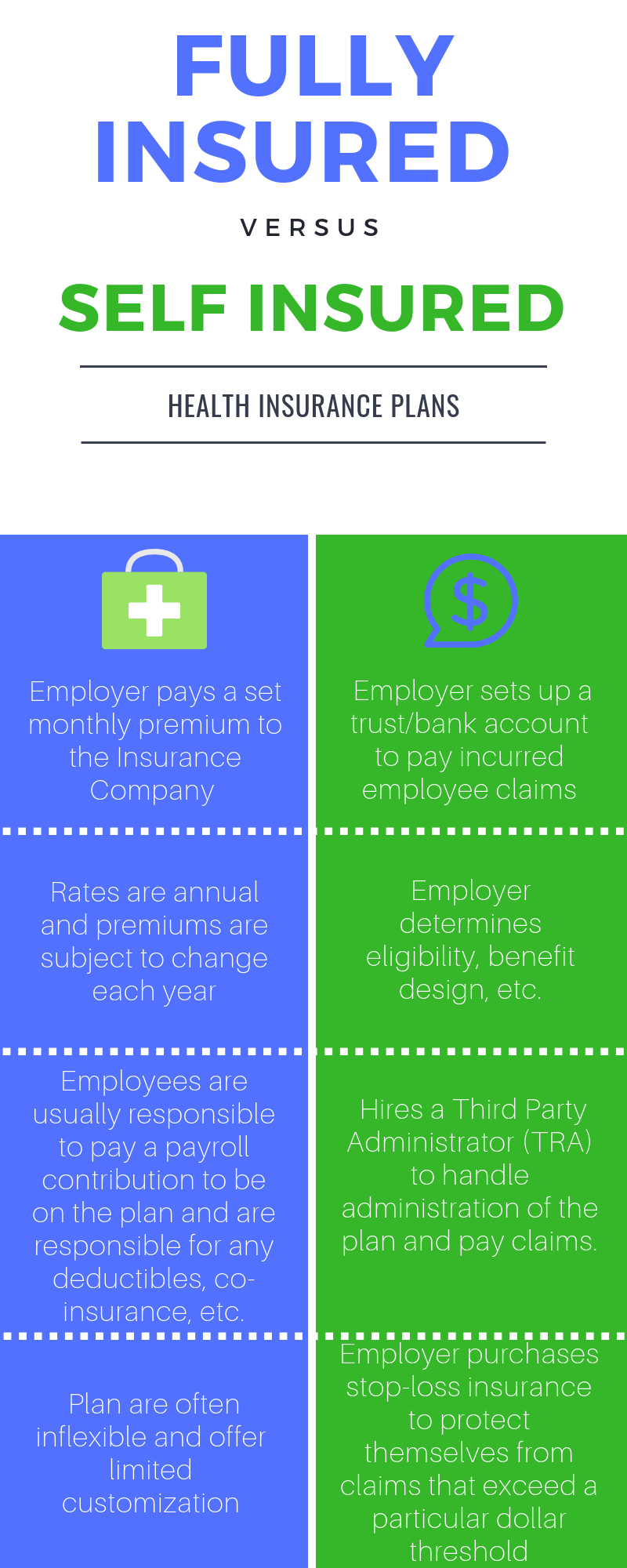

The employer collects premiums for coverage from employees who are enrolled in the plan. The insurance company manages the payments, but the employer is the one who pays the claims. And whether the event impacts one employee, a group of workers or the community in which your business is located, getting life back. Tragedy can strike at any moment and no community, business or family is immune. Sip is dedicated to exceeding customer expectations in providing administrative services,. The patient protection and affordable care act

What is a self insured health plan?

The employer collects premiums for coverage from employees who are enrolled in the plan. The employer collects premiums for coverage from employees who are enrolled in the plan. The patient protection and affordable care act Ways your company can help. What is a self insured health plan? This is a type of plan in which an employer takes on most or all of the cost of benefit claims.

Source: jdmbenefits.com

Source: jdmbenefits.com

And whether the event impacts one employee, a group of workers or the community in which your business is located, getting life back. The employer sets up a fund or trust earmarked to pay for their employees’ health claims. What is a self insured health plan? And whether the event impacts one employee, a group of workers or the community in which your business is located, getting life back. Type of plan usually present in larger companies where the employer itself collects premiums from enrollees and takes on the responsibility of paying employees’ and dependents’ medical claims.

Source: jdmbenefits.com

Source: jdmbenefits.com

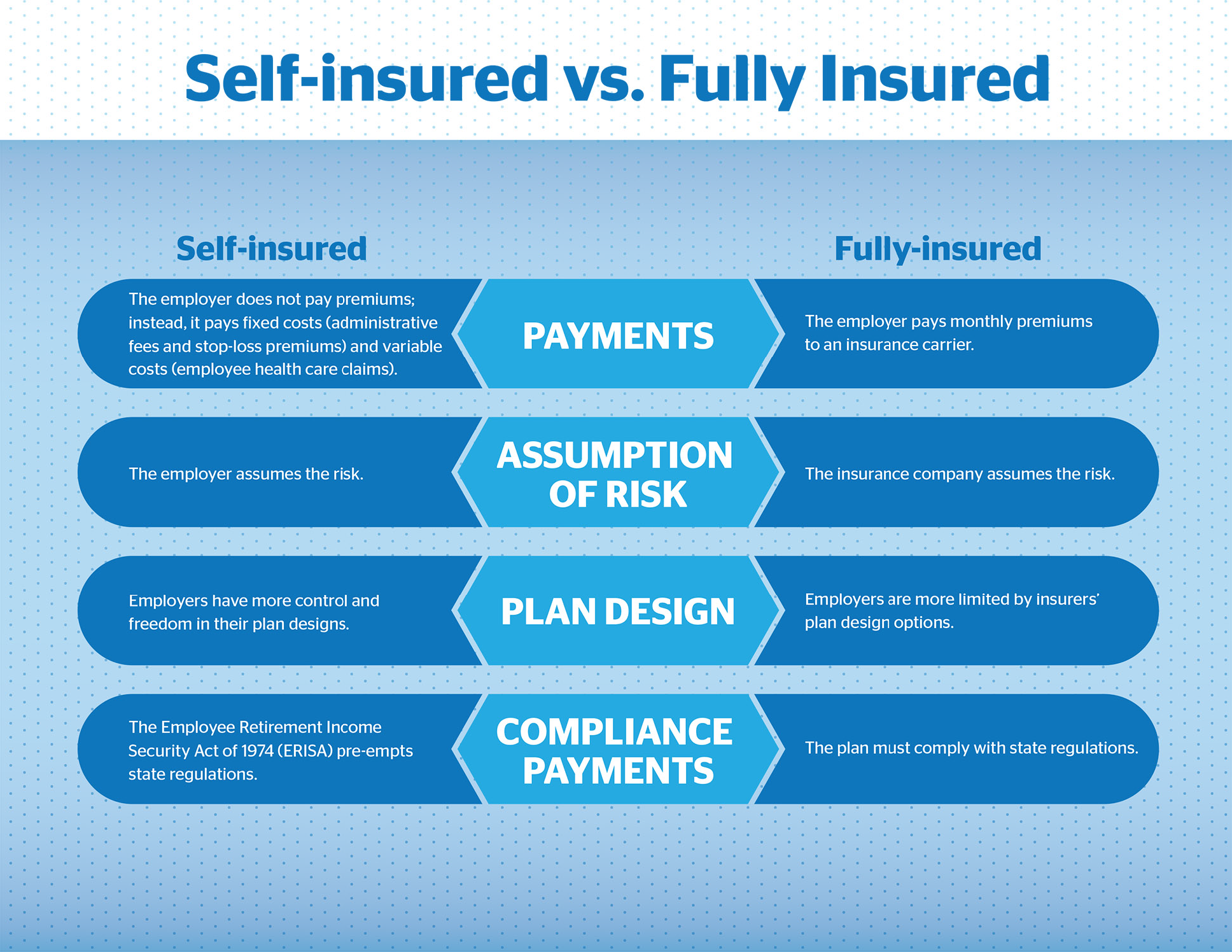

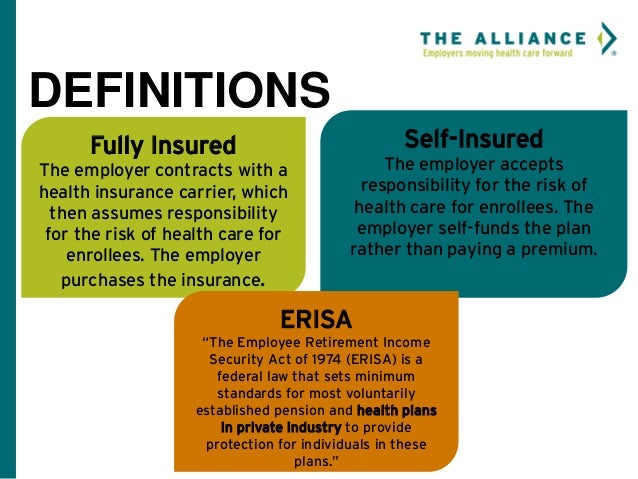

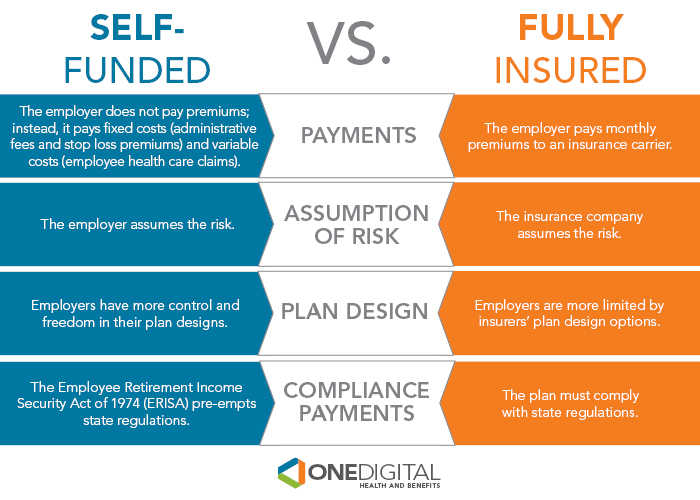

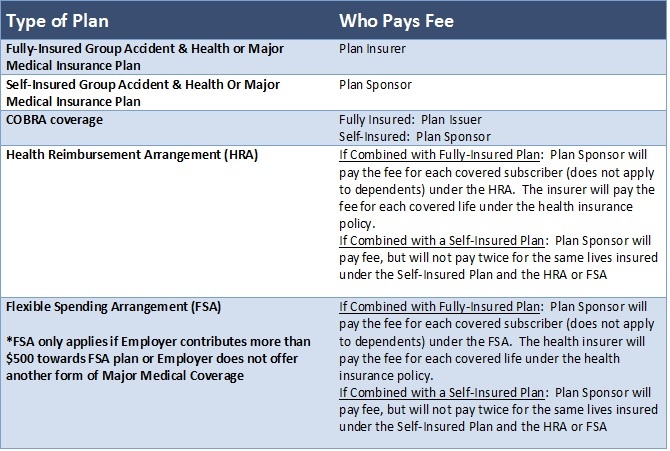

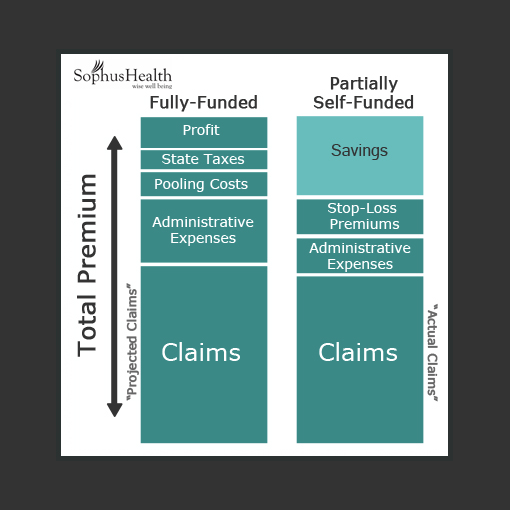

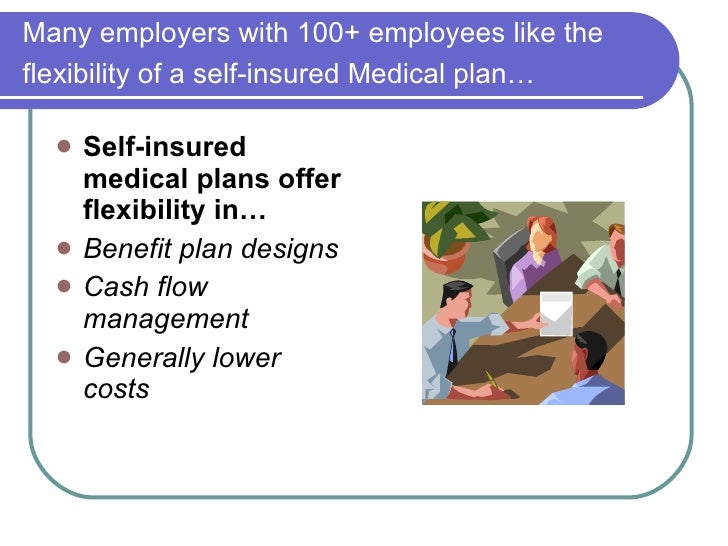

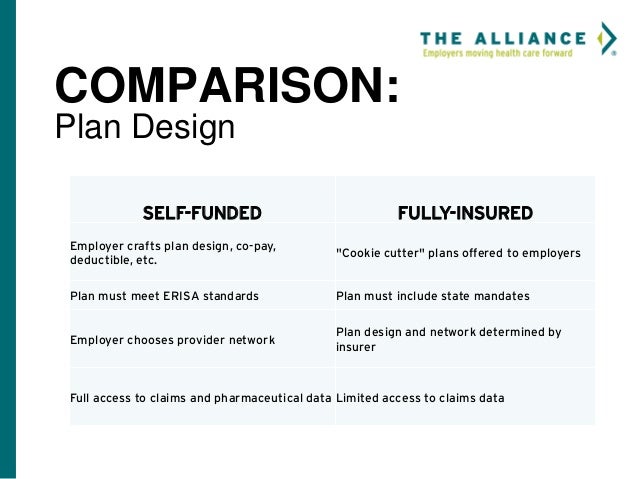

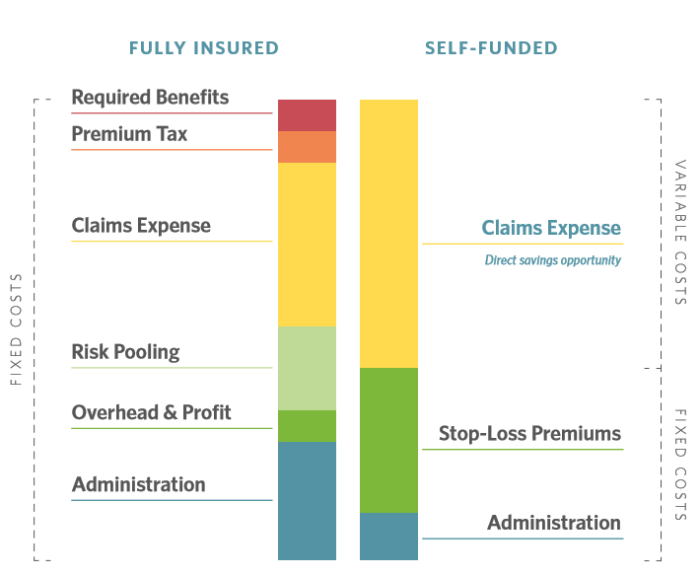

The employer sets premium rates based on claims history and typically benefits from lower administration costs and greater flexibility both in plan design and cash flow within the. These employers can contract for insurance services such as enrollment, claims processing, and provider networks with a third party. The insurance company manages the payments, but the employer is the one who pays the claims. The employer collects premiums for coverage from employees who are enrolled in the plan. The main law that guides these plans is the employee retirement income security act, or erisa.

Source: slideshare.net

Source: slideshare.net

The insurance company manages the payments, but the employer is the one who pays the claims. The patient protection and affordable care act What is a self insured health plan? Self insured plans, llc is a health benefits administrator founded in 1995 in naples, florida and specializes in healthcare plan design, product integration, and claims administration for companies of all sizes, in both single and multiple locations. According to a kaiser family foundation analysis, 61 percent of covered workers are in plans that are either.

Source: oneillinsurance.com

Source: oneillinsurance.com

According to a kaiser family foundation analysis, 61 percent of covered workers are in plans that are either. And whether the event impacts one employee, a group of workers or the community in which your business is located, getting life back. The employer sets premium rates based on claims history and typically benefits from lower administration costs and greater flexibility both in plan design and cash flow within the. Ways your company can help. The main law that guides these plans is the employee retirement income security act, or erisa.

Source: elalmadeunlobo.blogspot.com

Source: elalmadeunlobo.blogspot.com

Sip is dedicated to exceeding customer expectations in providing administrative services,. The main law that guides these plans is the employee retirement income security act, or erisa. Sip is dedicated to exceeding customer expectations in providing administrative services,. Self insured plans coping with tragedy: What is a self insured health plan?

Source: slideshare.net

Source: slideshare.net

Tragedy can strike at any moment and no community, business or family is immune. With this type of plan, the employer instead of the insurance company assumes the financial risk of providing employees with healthcare benefits. And whether the event impacts one employee, a group of workers or the community in which your business is located, getting life back. The patient protection and affordable care act The main law that guides these plans is the employee retirement income security act, or erisa.

Source: svg.agency

Source: svg.agency

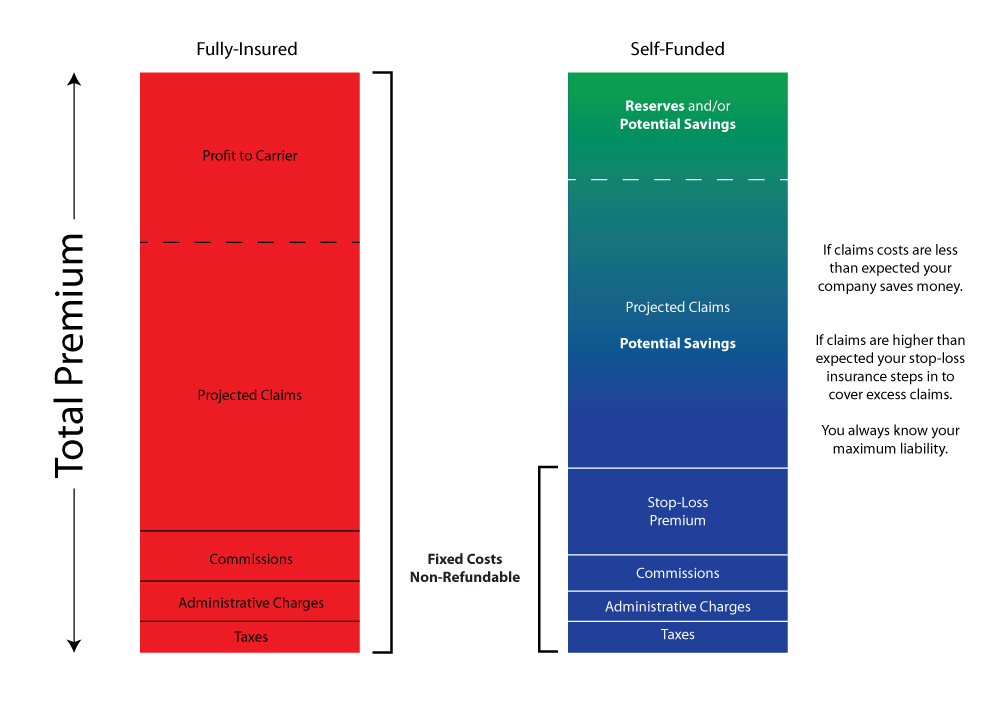

Advantages of self insured health plans: Tragedy can strike at any moment and no community, business or family is immune. The employer sets premium rates based on claims history and typically benefits from lower administration costs and greater flexibility both in plan design and cash flow within the. With this type of plan, the employer instead of the insurance company assumes the financial risk of providing employees with healthcare benefits. Advantages of self insured health plans:

Source: onedigital.com

Source: onedigital.com

The employer sets premium rates based on claims history and typically benefits from lower administration costs and greater flexibility both in plan design and cash flow within the. Tragedy can strike at any moment and no community, business or family is immune. With this type of plan, the employer instead of the insurance company assumes the financial risk of providing employees with healthcare benefits. Type of plan usually present in larger companies where the employer itself collects premiums from enrollees and takes on the responsibility of paying employees’ and dependents’ medical claims. What is a self insured health plan?

Source: herbein.com

Source: herbein.com

Self insured plans, llc is a health benefits administrator founded in 1995 in naples, florida and specializes in healthcare plan design, product integration, and claims administration for companies of all sizes, in both single and multiple locations. What is a self insured health plan? Advantages of self insured health plans: The employer collects premiums for coverage from employees who are enrolled in the plan. The insurance company manages the payments, but the employer is the one who pays the claims.

Source: jeffreybernard.com

Source: jeffreybernard.com

January 30, 2020 january 30, 2020 steverasnick leave a comment. With this type of plan, the employer instead of the insurance company assumes the financial risk of providing employees with healthcare benefits. The employer sets up a fund or trust earmarked to pay for their employees’ health claims. These employers can contract for insurance services such as enrollment, claims processing, and provider networks with a third party. The patient protection and affordable care act

Source: slideshare.net

Source: slideshare.net

With this type of plan, the employer instead of the insurance company assumes the financial risk of providing employees with healthcare benefits. Self insured plans, llc is a health benefits administrator founded in 1995 in naples, florida and specializes in healthcare plan design, product integration, and claims administration for companies of all sizes, in both single and multiple locations. January 30, 2020 january 30, 2020 steverasnick leave a comment. The employer collects premiums for coverage from employees who are enrolled in the plan. The employer sets premium rates based on claims history and typically benefits from lower administration costs and greater flexibility both in plan design and cash flow within the.

Source: insuranceplantsugamagu.blogspot.com

Source: insuranceplantsugamagu.blogspot.com

And whether the event impacts one employee, a group of workers or the community in which your business is located, getting life back. The employer collects premiums for coverage from employees who are enrolled in the plan. The main law that guides these plans is the employee retirement income security act, or erisa. This is a type of plan in which an employer takes on most or all of the cost of benefit claims. The employer sets up a fund or trust earmarked to pay for their employees’ health claims.

Source: slideshare.net

Source: slideshare.net

Tragedy can strike at any moment and no community, business or family is immune. What is a self insured health plan? Tragedy can strike at any moment and no community, business or family is immune. The main law that guides these plans is the employee retirement income security act, or erisa. Self insured plans, llc is a health benefits administrator founded in 1995 in naples, florida and specializes in healthcare plan design, product integration, and claims administration for companies of all sizes, in both single and multiple locations.

Source: slideshare.net

Source: slideshare.net

This is a type of plan in which an employer takes on most or all of the cost of benefit claims. Type of plan usually present in larger companies where the employer itself collects premiums from enrollees and takes on the responsibility of paying employees’ and dependents’ medical claims. The employer collects premiums for coverage from employees who are enrolled in the plan. The insurance company manages the payments, but the employer is the one who pays the claims. The employer sets up a fund or trust earmarked to pay for their employees’ health claims.

Source: youtube.com

Source: youtube.com

Self insured plans, llc is a health benefits administrator founded in 1995 in naples, florida and specializes in healthcare plan design, product integration, and claims administration for companies of all sizes, in both single and multiple locations. Tragedy can strike at any moment and no community, business or family is immune. Self insured plans, llc is a health benefits administrator founded in 1995 in naples, florida and specializes in healthcare plan design, product integration, and claims administration for companies of all sizes, in both single and multiple locations. The patient protection and affordable care act What is a self insured health plan?

Source: healthgram.com

Source: healthgram.com

Sip is dedicated to exceeding customer expectations in providing administrative services,. Type of plan usually present in larger companies where the employer itself collects premiums from enrollees and takes on the responsibility of paying employees’ and dependents’ medical claims. Sip is dedicated to exceeding customer expectations in providing administrative services,. The employer collects premiums for coverage from employees who are enrolled in the plan. January 30, 2020 january 30, 2020 steverasnick leave a comment.

Source: aetna.com

Source: aetna.com

Ways your company can help. January 30, 2020 january 30, 2020 steverasnick leave a comment. Tragedy can strike at any moment and no community, business or family is immune. Ways your company can help. The patient protection and affordable care act

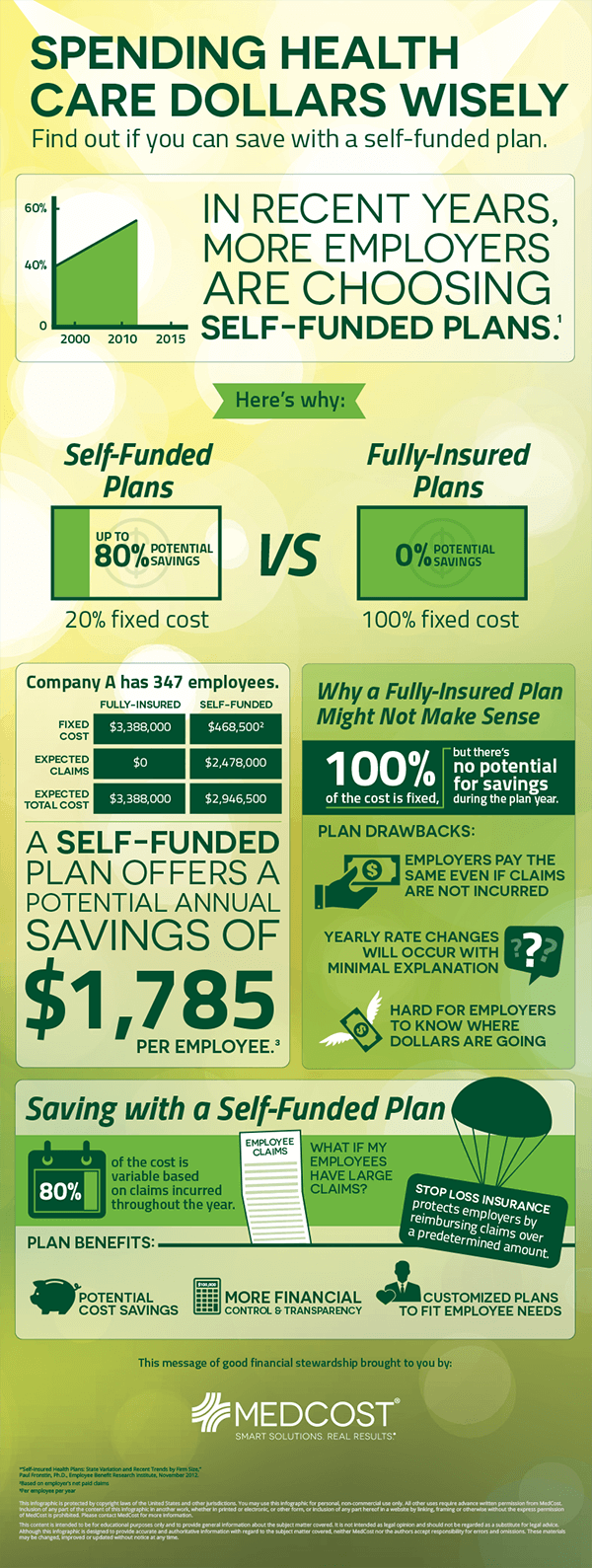

Source: medcost.com

Source: medcost.com

Ways your company can help. The employer collects premiums for coverage from employees who are enrolled in the plan. Self insured plans coping with tragedy: The employer sets up a fund or trust earmarked to pay for their employees’ health claims. Tragedy can strike at any moment and no community, business or family is immune.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title self insured plans by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information