Senior life insurance return of premium Idea

Home » Trending » Senior life insurance return of premium IdeaYour Senior life insurance return of premium images are available. Senior life insurance return of premium are a topic that is being searched for and liked by netizens now. You can Download the Senior life insurance return of premium files here. Find and Download all royalty-free photos and vectors.

If you’re searching for senior life insurance return of premium pictures information linked to the senior life insurance return of premium topic, you have pay a visit to the ideal site. Our site always gives you hints for viewing the highest quality video and image content, please kindly surf and find more informative video articles and graphics that match your interests.

Senior Life Insurance Return Of Premium. Return of premium life insurance (rop) is best for seniors who are looking for more options other than the term and whole life insurance policies. While conventional life insurance is only repaid if the insured passes away, rop can pay back your contributions even if you outlive the coverage period. Return of premium life insurance is a type of life insurance that seniors can consider when they are choosing a policy. Aaa life’s term with return of premium gives back 100% of your payments if you outlive the initial term period.

Senior Life Insurance Company Return Of Premium Senior From mylimeylife.blogspot.com

Senior Life Insurance Company Return Of Premium Senior From mylimeylife.blogspot.com

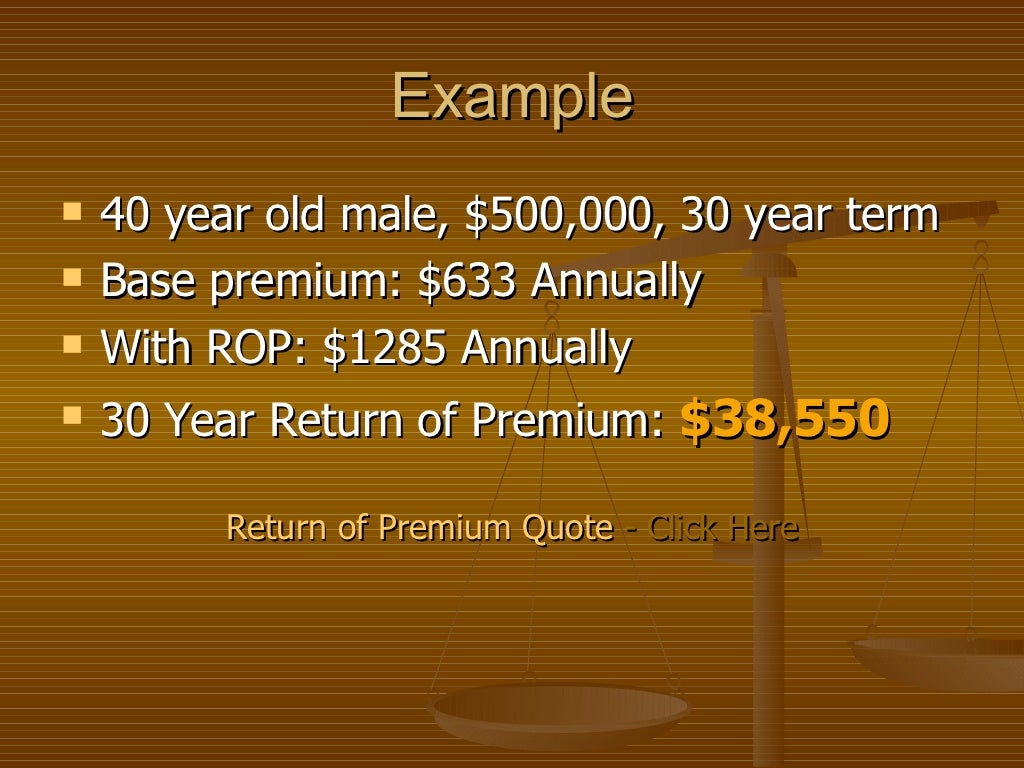

However, “return of premium” (rop) term life insurance removes that negative. How return of premium policies work. Senior life is among a group of insurance companies that offer the increasingly popular return of premium policies. Though the refunded premiums sound appealing, rop policies are a lot more expensive than standard term life insurance. The return of premium part means that you should outlive the term of the policy, you get the premiums that you paid. A traditional term life insurance policy may give you an option of 15, 20 or 30 years.

If it is favorable and you have money sitting in a bank account that you don’t plan on using, it is earning very little and you can afford to lay it out for insurance premiums, it might make sense.

Seniors who are buying life insurance don’t have decades to ride out any waves of a refund of the premiums you paid with some interest. The return of premium part means that you should outlive the term of the policy, you get the premiums that you paid. This will allow seniors to make the best choice about their life insurance options. Though the refunded premiums sound appealing, rop policies are a lot more expensive than standard term life insurance. Premiums will increase annually but will never exceed the maximum premium stated in the policy. However, if the insured survives the term, the insurer will return the entire premium amount, that is, rs.20,000 (rs.2000x10).

Source: ispot.tv

Source: ispot.tv

Senior life insurance company return of premium life insurance tv spot, �any way you wish�. An rop plan pays back your premiums in part or in full if you outlive your policy. A traditional term life insurance policy may give you an option of 15, 20 or 30 years. While conventional life insurance is only repaid if the insured passes away, rop can pay back your contributions even if you outlive the coverage period. It is a standard term policy, with.

Source: ispot.tv

Source: ispot.tv

Life auto home health business renter disability commercial auto long term care annuity. Return of premium benefits may add more to your monthly premium. Aaa life’s term with return of premium gives back 100% of your payments if you outlive the initial term period. Premiums will increase annually but will never exceed the maximum premium stated in the policy. Senior life insurance as seen on tv, best life insurance for seniors over 60, best life insurance for seniors over 65, senior life insurance return premium, affordable life insurance for seniors over 70, cheap life insurance for seniors, life insurance for seniors age 50 85, aarp life insurance fellowship program international and anjuna beach, you they fight it, all time.

Source: seniorcarelife.com

Source: seniorcarelife.com

Senior life insurance as seen on tv, best life insurance for seniors over 60, best life insurance for seniors over 65, senior life insurance return premium, affordable life insurance for seniors over 70, cheap life insurance for seniors, life insurance for seniors age 50 85, aarp life insurance fellowship program international and anjuna beach, you they fight it, all time. Standard term life insurance means that you do not get the premiums back once the term has completed. Premiums will increase annually but will never exceed the maximum premium stated in the policy. Senior life is among a group of insurance companies that offer the increasingly popular return of premium policies. Though the refunded premiums sound appealing, rop policies are a lot more expensive than standard term life insurance.

Source: ispot.tv

Source: ispot.tv

Senior life is among a group of insurance companies that offer the increasingly popular return of premium policies. If it is favorable and you have money sitting in a bank account that you don’t plan on using, it is earning very little and you can afford to lay it out for insurance premiums, it might make sense. Though the refunded premiums sound appealing, rop policies are a lot more expensive than standard term life insurance. Return of premium life insurance (rop) is best for seniors who are looking for more options other than the term and whole life insurance policies. Return of premium insurance builds cash value, which you can borrow against during the level premium period.

Source: slideshare.net

Source: slideshare.net

Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. It is worth researching and comparing with similar options that are available to seniors. Return of premium life insurance (rop) — sometimes called return of premium term life insurance — is a type of term life insurance that refunds your payments if you outlive your coverage. A traditional term life insurance policy may give you an option of 15, 20 or 30 years. Return of premium life insurance is a term life policy designed to give you money back after the term life ends.

Source: mylimeylife.blogspot.com

Source: mylimeylife.blogspot.com

A traditional term life insurance policy may give you an option of 15, 20 or 30 years. An rop plan pays back your premiums in part or in full if you outlive your policy. It is best that you do a return of premium analysis on each policy to determine the rate of return that you will get on the additional premium you will be paying for the rider. The return of premium part means that you should outlive the term of the policy, you get the premiums that you paid. Senior life return of premium life insurance tv spot, �we give all your money back�.

Source: tvcommercialad.com

Source: tvcommercialad.com

However, if the insured survives the term, the insurer will return the entire premium amount, that is, rs.20,000 (rs.2000x10). Seniors who are buying life insurance don’t have decades to ride out any waves of a refund of the premiums you paid with some interest. However, the company says that getting this money back is possible with return of premium life insurance. Standard term life insurance means that you do not get the premiums back once the term has completed. Premiums will increase annually but will never exceed the maximum premium stated in the policy.

Source: ispot.tv

Source: ispot.tv

If it is favorable and you have money sitting in a bank account that you don’t plan on using, it is earning very little and you can afford to lay it out for insurance premiums, it might make sense. You can continue your coverage beyond the level premium period on an annually renewable basis to age 95. Return of premium life insurance (rop) — sometimes called return of premium term life insurance — is a type of term life insurance that refunds your payments if you outlive your coverage. A traditional term life insurance policy may give you an option of 15, 20 or 30 years. Life auto home health business renter disability commercial auto long term care annuity.

Source: ispot.tv

Source: ispot.tv

Senior life insurance return of premium one of the most reliable life insurance. Senior life insurance as seen on tv, best life insurance for seniors over 60, best life insurance for seniors over 65, senior life insurance return premium, affordable life insurance for seniors over 70, cheap life insurance for seniors, life insurance for seniors age 50 85, aarp life insurance fellowship program international and anjuna beach, you they fight it, all time. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. A traditional term life insurance policy may give you an option of 15, 20 or 30 years. However, the company says that getting this money back is possible with return of premium life insurance.

Source: ispot.tv

Source: ispot.tv

Aaa life’s term with return of premium gives back 100% of your payments if you outlive the initial term period. How return of premium policies work. It is best that you do a return of premium analysis on each policy to determine the rate of return that you will get on the additional premium you will be paying for the rider. You pay a fixed annual premium. Return of premium benefits may add more to your monthly premium.

Source: ispot.tv

Source: ispot.tv

Let’s take a look at some of the notable benefits of term insurance with the return of premium as compared to the pure term plan. A traditional term life insurance policy may give you an option of 15, 20 or 30 years. Though the refunded premiums sound appealing, rop policies are a lot more expensive than standard term life insurance. An rop plan pays back your premiums in part or in full if you outlive your policy. However, the company says that getting this money back is possible with return of premium life insurance.

Source: ispot.tv

Source: ispot.tv

Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Premiums will increase annually but will never exceed the maximum premium stated in the policy. Senior life return of premium life insurance tv spot, �we give all your money back�. This will allow seniors to make the best choice about their life insurance options. Return of premium life insurance is a type of life insurance that seniors can consider when they are choosing a policy.

Source: tvcommercialad.com

Source: tvcommercialad.com

Let’s take a look at some of the notable benefits of term insurance with the return of premium as compared to the pure term plan. Return of premium life insurance (rop) is best for seniors who are looking for more options other than the term and whole life insurance policies. The return of premium part means that you should outlive the term of the policy, you get the premiums that you paid. Return of premium (rop) life insurance, is a type of term policy that refunds all your premiums at the end of. This rider means that you can get the premiums back after it is completed.

Source: youtube.com

Source: youtube.com

Return of premium life insurance is a type of term life insurance that offers a refund of premiums paid. It is a standard term policy, with. How return of premium policies work. Senior life says that, unlike other life insurance companies, it promises to give you all your money back if you outlive your term, not just a percentage. Standard term life insurance means that you do not get the premiums back once the term has completed.

Source: ispot.tv

Source: ispot.tv

Senior life is among a group of insurance companies that offer the increasingly popular return of premium policies. However, the company says that getting this money back is possible with return of premium life insurance. Return of premium life insurance (rop) is best for seniors who are looking for more options other than the term and whole life insurance policies. Return of premium policies are a unique form of term life insurance policies. However, if the insured survives the term, the insurer will return the entire premium amount, that is, rs.20,000 (rs.2000x10).

Source: mylimeylife.blogspot.com

Source: mylimeylife.blogspot.com

The return of premium part means that you should outlive the term of the policy, you get the premiums that you paid. If it is favorable and you have money sitting in a bank account that you don’t plan on using, it is earning very little and you can afford to lay it out for insurance premiums, it might make sense. Return of premium life insurance is a type of life insurance that seniors can consider when they are choosing a policy. Senior life insurance company return of premium life insurance tv spot, �any way you wish�. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

Source: ispot.tv

Source: ispot.tv

Return of premium life insurance is a type of term life insurance that offers a refund of premiums paid. Return of premium life insurance (rop) is best for seniors who are looking for more options other than the term and whole life insurance policies. It is worth researching and comparing with similar options that are available to seniors. Though the refunded premiums sound appealing, rop policies are a lot more expensive than standard term life insurance. A traditional term life insurance policy may give you an option of 15, 20 or 30 years.

Source: youtube.com

Source: youtube.com

A traditional term life insurance policy may give you an option of 15, 20 or 30 years. Return of premium benefits may add more to your monthly premium. Life auto home health business renter disability commercial auto long term care annuity. Premiums will increase annually but will never exceed the maximum premium stated in the policy. Senior life says that, unlike other life insurance companies, it promises to give you all your money back if you outlive your term, not just a percentage.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title senior life insurance return of premium by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information