Service line coverage insurance Idea

Home » Trending » Service line coverage insurance IdeaYour Service line coverage insurance images are available in this site. Service line coverage insurance are a topic that is being searched for and liked by netizens now. You can Download the Service line coverage insurance files here. Find and Download all royalty-free images.

If you’re searching for service line coverage insurance pictures information linked to the service line coverage insurance keyword, you have come to the right blog. Our website frequently gives you suggestions for seeking the maximum quality video and picture content, please kindly search and locate more enlightening video articles and images that fit your interests.

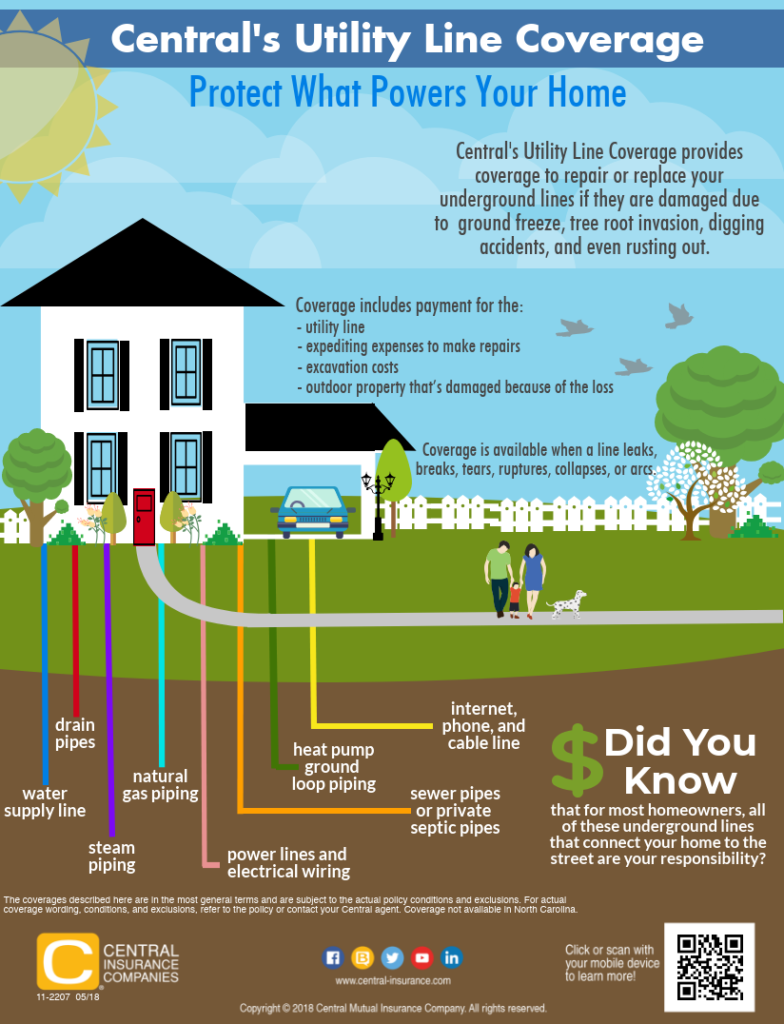

Service Line Coverage Insurance. External forces, such as root invasion; Service line coverage is one of the best value coverage endorsements to your homeowners’ insurance, costing as little as $30 annually for $10,000 in coverage. Rather than searching endless insurance companies online, you should contact an independent insurance agency such as the overmyer insurance agency who works with many insurance companies and knows which companies offer service line coverage and will recommend the appropriate coverage for you. Published on july 27, 2018 insurance tips service line coverage is a newer coverage that will pay for the repair or replacement of exterior underground water and sewer piping, electrical service lines and data lines that fail or are accidentally broken and that are owned by the homeowner.

Service Line Coverage Block’s Agencies — Block�s Agencies From blocksagencies.ca

Service Line Coverage Block’s Agencies — Block�s Agencies From blocksagencies.ca

Service line coverage is one of the best value coverage endorsements, costing as little as $30 annually for $10,000 in coverage. Service line coverage is available in all 50 states. External forces, such as root invasion; Competitive rates, and outstanding coverages through our many insurance company partners. A water line break can run anywhere from $2k to $15k, and the average service line repair costs around $5,000. Service line coverage from the stoop to the curb.

Service line coverage is available in all 50 states.

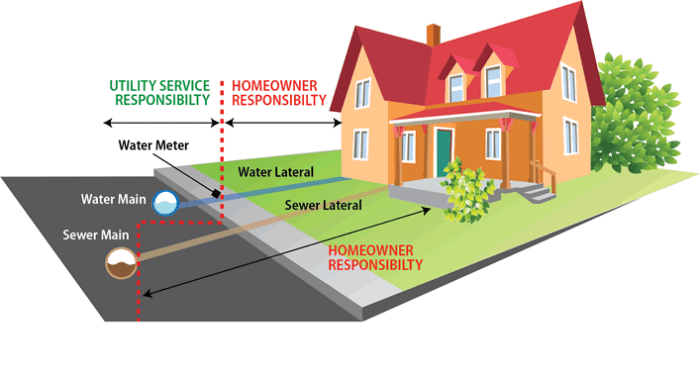

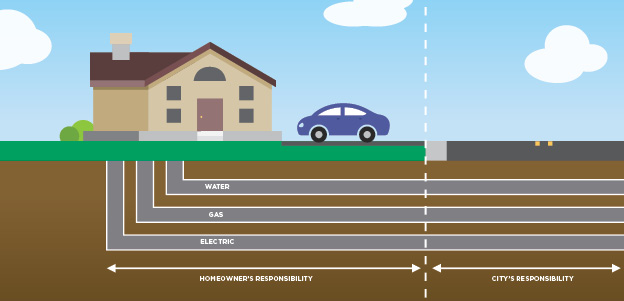

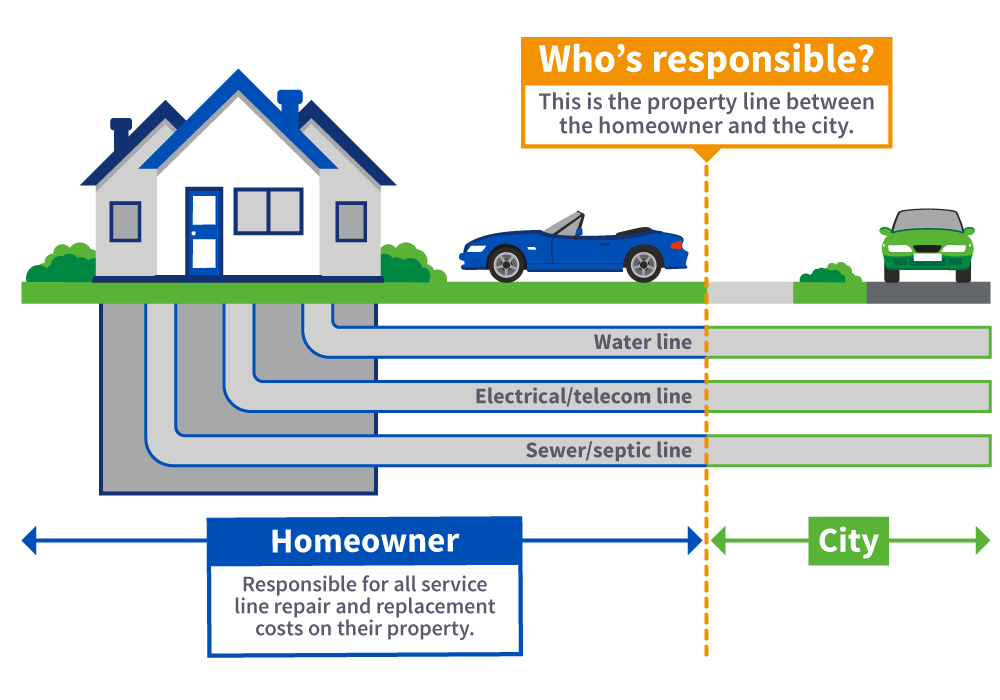

Service line coverage is a homeowner’s insurance endorsement that reimburses you in the event that a utility line is damaged. Service line coverage is one of the best value coverage endorsements, costing as little as $30 annually for $10,000 in coverage. Some utility lines typically covered by service line coverage include: Service line coverage can help cover the costs of fixing service lines that connect your household to vital utility services. The homeowner is responsible for the underground piping that runs from the street to the home and provides water, sewer, and electrical services. At erie insurance, we don’t think it’s right that homeowners need to buy utility service contracts offered by multiple companies in order to avoid costly repairs to underground service lines.

Source: equityinsgroup.com

Source: equityinsgroup.com

A water line break can run anywhere from $2k to $15k, and the average service line repair costs around $5,000. Repair or replacement of damaged outdoor property caused by the service line failure such as trees, lawns, driveways, or sidewalks. Service line coverage protects you when a service line is damaged on your property. External forces, such as root invasion; This underground service line coverage includes line breakdown resulting from environmental effects, such as freezing;

Source: blocksagencies.ca

Source: blocksagencies.ca

What does service line coverage cost? Some utility lines typically covered by service line coverage include: This coverage form can be added to a homeowners policy for a cost of $30 for. While it can cost the uninsured a small fortune to repair or replace service lines, this won’t be the case for those who purchase coverage. At erie insurance, we don’t think it’s right that homeowners need to buy utility service contracts offered by multiple companies in order to avoid costly repairs to underground service lines.

Source: mcmichaelinsurance.com

Source: mcmichaelinsurance.com

Service line coverage is a type of insurance designed to help you cover the costs associated with damage to your service lines. If that is damaged or otherwise fails, and you don’t have service line coverage, you could be left footing the bill. Service line coverage is available in all 50 states. And direct condition within the line, such as a failure in the material integrity of the service line itself. To learn more about service line coverage, or homeowners insurance in general, contact us today.

Source: mackleyinsurance.com

Source: mackleyinsurance.com

To learn more about service line coverage, or homeowners insurance in general, contact us today. Competitive rates, and outstanding coverages through our many insurance company partners. Service line coverage protects you when a service line is damaged on your property. Service line coverage is an often overlooked need for a homeowner. A water line break can run anywhere from $2k to $15k, and the average service line repair costs around $5,000.

Source: grangeinsurance.com

Source: grangeinsurance.com

Please refer to your policy for specific policy terms and. This coverage form can be added to a homeowners policy for a cost of $30 for. Please refer to your policy for specific policy terms and. Service line coverage is a type of insurance that protects homeowners in the event that pipes or wiring coming into their properties are damaged. If that is damaged or otherwise fails, and you don’t have service line coverage, you could be left footing the bill.

Source: farmersmutualmt.com

Source: farmersmutualmt.com

What is service line coverage? Competitive rates, and outstanding coverages through our many insurance company partners. Repair or replacement of damaged outdoor property caused by the service line failure such as trees, lawns, driveways, or sidewalks. Reposted with permission from the original author, safeco insurance®. External forces, such as root invasion;

Source: zuberinsurance.com

Source: zuberinsurance.com

Standard insurance policies exclude coverage for underground property including pipes and other service lines, such as utility, phone and internet wiring. Repair or replacement of damaged outdoor property caused by the service line failure such as trees, lawns, driveways, or sidewalks. Add service line coverage to your home insurance policy. Service line coverage is a homeowner’s insurance endorsement that reimburses you in the event that a utility line is damaged. Service line coverage is a type of insurance that protects homeowners in the event that pipes or wiring coming into their properties are damaged.

Source: hertvik.com

Source: hertvik.com

Depending on your provider, you may also have to pay a deductible before insurance kicks in — usually $500. This coverage can help cover the costs of repairing the damaged service lines that homeowners are ultimately responsible for. This varies, depending on which company you choose, what coverage level you set and the state in which you live. Typically, service line coverage runs between $20 and $50 in additional insurance premiums per year. Competitive rates, and outstanding coverages through our many insurance company partners.

Source: neckerman.com

Source: neckerman.com

Service line coverage from the stoop to the curb. Coverage is very affordable with additional service line coverage cost starting from $20 annually. Competitive rates, and outstanding coverages through our many insurance company partners. Service line coverage, on the other hand, isn’t. To learn more about service line coverage, or homeowners insurance in general, contact us today.

Source: fonkinsurance.com

Source: fonkinsurance.com

Standard insurance policies exclude coverage for underground property including pipes and other service lines, such as utility, phone and internet wiring. Service line coverage can help cover the costs of fixing service lines that connect your household to vital utility services. Please refer to your policy for specific policy terms and. Service line coverage is available in all 50 states. This website is operated by bassett insurance group, 1079 s.

Source: prweb.com

Source: prweb.com

This coverage can help cover the costs of repairing the damaged service lines that homeowners are ultimately responsible for. However, the homeowner may be surprised to learn that damage to these lines is their responsibility. The homeowner is responsible for the underground piping that runs from the street to the home and provides water, sewer, and electrical services. According to the company�s website, american family insurance offers $10,000 in coverage with a $500 deductible, all for only $20. Standard insurance policies exclude coverage for underground property including pipes and other service lines, such as utility, phone and internet wiring.

Source: safeco.bassettinsurancegroup.com

Source: safeco.bassettinsurancegroup.com

After you’ve paid the deductible, you’ll be covered up to the policy limit. After you’ve paid the deductible, you’ll be covered up to the policy limit. Service line coverage is one of the best value coverage endorsements, costing as little as $30 annually for $10,000 in coverage. Service line coverage is a better option than service warranties in large part because it covers all of your utility lines so you don’t have to buy multiple service plans with multiple utilities. Some utility lines typically covered by service line coverage include:

Source: waterone.org

Depending on your provider, you may also have to pay a deductible before insurance kicks in — usually $500. According to the company�s website, american family insurance offers $10,000 in coverage with a $500 deductible, all for only $20. To learn more about service line coverage, or homeowners insurance in general, contact us today. Published on july 27, 2018 insurance tips service line coverage is a newer coverage that will pay for the repair or replacement of exterior underground water and sewer piping, electrical service lines and data lines that fail or are accidentally broken and that are owned by the homeowner. Service line coverage is a homeowners insurance endorsement that reimburses you in the event that a utility line is damaged.

Source: blog.cfmimo.com

Adding service line coverage to your homeowners insurance policy is affordable and protects your pocket if your underground piping or wiring is damaged or causes damage. External forces, such as root invasion; It covers the potentially costly expenses of excavation and repair of underground wiring and piping. However, the homeowner may be surprised to learn that damage to these lines is their responsibility. The small cost of service line insurance can really pay off if you ever need to repair or replace a damaged line.

Source: minneapolisinsuranceteam.com

Service line coverage is a type of insurance designed to help you cover the costs associated with damage to your service lines. Typically, service line coverage runs between $20 and $50 in additional insurance premiums per year. Service line coverage is a type of insurance designed to help you cover the costs associated with damage to your service lines. What does service line insurance cover? Repair or replacement of damaged outdoor property caused by the service line failure such as trees, lawns, driveways, or sidewalks.

Source: petruzelo.com

Source: petruzelo.com

This coverage can help cover the costs of repairing the damaged service lines that homeowners are ultimately responsible for. Service line coverage is available in all 50 states. While it can cost the uninsured a small fortune to repair or replace service lines, this won’t be the case for those who purchase coverage. Service line coverage is a homeowners insurance endorsement that reimburses you in the event that a utility line is damaged. Reposted with permission from the original author, safeco insurance®.

Source: aviva.ca

Source: aviva.ca

Service line coverage is available in all 50 states. Service line coverage is an often overlooked need for a homeowner. What does service line coverage cost? Most service line insurance covers: It covers the potentially costly expenses of excavation and repair of underground wiring and piping.

Source: craighamilton.com

Source: craighamilton.com

Service line coverage is a better option than service warranties in large part because it covers all of your utility lines so you don’t have to buy multiple service plans with multiple utilities. Service line coverage, on the other hand, isn’t. Service line coverage is one of the best value coverage endorsements, costing as little as $30 annually for $10,000 in coverage. Service line coverage is insurance against unexpected expenses related to the damage of service lines on your property, such as power lines, phone and cable lines, water and sewer pipes and more. Competitive rates, and outstanding coverages through our many insurance company partners.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title service line coverage insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information