Settlers life insurance application information

Home » Trending » Settlers life insurance application informationYour Settlers life insurance application images are ready in this website. Settlers life insurance application are a topic that is being searched for and liked by netizens now. You can Find and Download the Settlers life insurance application files here. Find and Download all free vectors.

If you’re searching for settlers life insurance application pictures information related to the settlers life insurance application interest, you have come to the right site. Our website frequently provides you with suggestions for seeing the maximum quality video and image content, please kindly search and locate more informative video articles and graphics that fit your interests.

Settlers Life Insurance Application. Life settlements allow you to gain full access to your investment, allowing you to plan for your family’s future, pay off any accumulated debt, and provide you with a financially fruitful. The life settlement process begins with collecting some basic information about the owner, the insured, and the policy. If you aren�t sure which department you need to contact, please email us at phs.settlers@exlservice.com or see below for more information. You’ll receive an offer and you can accept or decline at this point.

A Comprehensive Review of Settlers Life Insurance Company From effortlessinsurance.com

A Comprehensive Review of Settlers Life Insurance Company From effortlessinsurance.com

Neither settlers insurance or ngl insurance are known for providing sizeable personal life insurance policies. License application for a life settlement provider or broker. If you die from natural causes, the beneficiaries will get the premium paid plus 10%. Send instantly towards the receiver. However, settlement ratios for all life insurers for the first six months of the current fiscal were lower than their ratios for the full fy21. Because settlers insurance is no longer offering insurance policies to new clients, you have to go through ngl insurance if you want to access products from the same group.

The appointment must be made within 15 days of the execution of a life settlement contract.

Get settlers life insurance claim signed right from your smartphone using these six tips: Verification of 15 hours of training or education related to life settlements and life settlement transactions. Because settlers insurance is no longer offering insurance policies to new clients, you have to go through ngl insurance if you want to access products from the same group. Full benefits will be paid if you die from an accident. Please be advised that some state regulations use the term “viatical settlement” as opposed to “life settlement” to describe all transactions, regardless of the health of the insured, involving the sale of an existing life insurance policy to a third party. The appointment must be made within 15 days of the execution of a life settlement contract.

Source: settlementbenefits.com

Source: settlementbenefits.com

The plan does not require a medical exam and has level premiums for the life of the policy. Neither settlers insurance or ngl insurance are known for providing sizeable personal life insurance policies. From there, an experienced life settlement broker will review the application, find the cash value of life insurance policy, and respond with the highest cash surrender value of the life insurance policy. The life settlement company will review your application and if all is well you’ll be sent to underwriting. Botwinick explains, “because whole life insurance policies build up a cash surrender value, this amount is considered a countable resource for a medicaid application”.

Source: appadvice.com

Source: appadvice.com

Download the data file or print out your copy. License application for a life settlement provider or broker. The life settlement company will review your application and if all is well you’ll be sent to underwriting. Full benefits will be paid if you die from an accident. A life settlement provider must appoint any life settlement producer that negotiates a life settlement transaction between an owner of a life insurance policy and a life settlement provider.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

You can cancel existing policies by contacting the company. Life settlements allow you to gain full access to your investment, allowing you to plan for your family’s future, pay off any accumulated debt, and provide you with a financially fruitful. If you die from natural causes, the beneficiaries will get the premium paid plus 10%. The typical life insurance settlement process looks like this: Unfortunately, having life insurance can negatively affect one’s application since the policy is considered an asset that is about the standard $2,000 requirement.

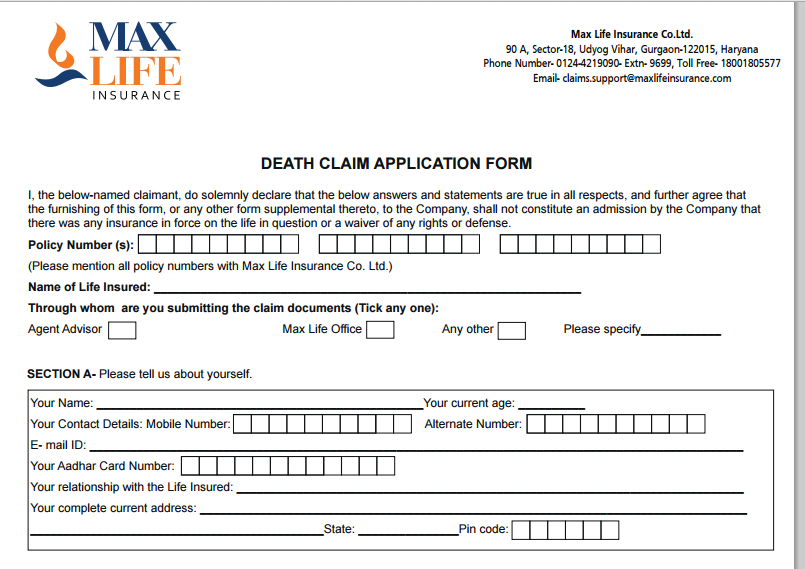

Source: trucompare.in

Source: trucompare.in

The appointment must be made within 15 days of the execution of a life settlement contract. License application for a life settlement provider or broker. Unfortunately, having life insurance can negatively affect one’s application since the policy is considered an asset that is about the standard $2,000 requirement. From there, an experienced life settlement broker will review the application, find the cash value of life insurance policy, and respond with the highest cash surrender value of the life insurance policy. Settlers life’s burial insurance plans are available to individuals between the ages of 15 days and 85 years.

Source: canadianlifesettlements.com

Source: canadianlifesettlements.com

Please be advised that some state regulations use the term “viatical settlement” as opposed to “life settlement” to describe all transactions, regardless of the health of the insured, involving the sale of an existing life insurance policy to a third party. Make a payment use the settlers life payment system for fast, easy payment processing. The life settlement process begins with collecting some basic information about the owner, the insured, and the policy. You’ll receive an offer and you can accept or decline at this point. Unfortunately, having life insurance can negatively affect one’s application since the policy is considered an asset that is about the standard $2,000 requirement.

Source: trucompare.in

Source: trucompare.in

The appointment must be made within 15 days of the execution of a life settlement contract. The life settlement company will review your application and if all is well you’ll be sent to underwriting. Payouts start at $1,000 and go up to $50,000. Please be advised that some state regulations use the term “viatical settlement” as opposed to “life settlement” to describe all transactions, regardless of the health of the insured, involving the sale of an existing life insurance policy to a third party. From there, an experienced life settlement broker will review the application, find the cash value of life insurance policy, and respond with the highest cash surrender value of the life insurance policy.

Source: fromhead-totoe.blogspot.com

Source: fromhead-totoe.blogspot.com

Verification of 15 hours of training or education related to life settlements and life settlement transactions. The appointment must be made within 15 days of the execution of a life settlement contract. Verification of 15 hours of training or education related to life settlements and life settlement transactions. A life settlement provider must appoint any life settlement producer that negotiates a life settlement transaction between an owner of a life insurance policy and a life settlement provider. You’ll receive an offer and you can accept or decline at this point.

Source: trucompare.in

Source: trucompare.in

The plan does not require a medical exam and has level premiums for the life of the policy. Life settlements allow you to gain full access to your investment, allowing you to plan for your family’s future, pay off any accumulated debt, and provide you with a financially fruitful. The life settlement company will review your application and if all is well you’ll be sent to underwriting. From there, an experienced life settlement broker will review the application, find the cash value of life insurance policy, and respond with the highest cash surrender value of the life insurance policy. License application for a life settlement provider or broker.

Source: trucompare.in

Source: trucompare.in

Settlers life is not issuing new policies, therefore a free look period will not apply to existing policies. You’ll receive an offer and you can accept or decline at this point. A life settlement provider must appoint any life settlement producer that negotiates a life settlement transaction between an owner of a life insurance policy and a life settlement provider. Life settlement broker license application: However, there is an exception to this rule.

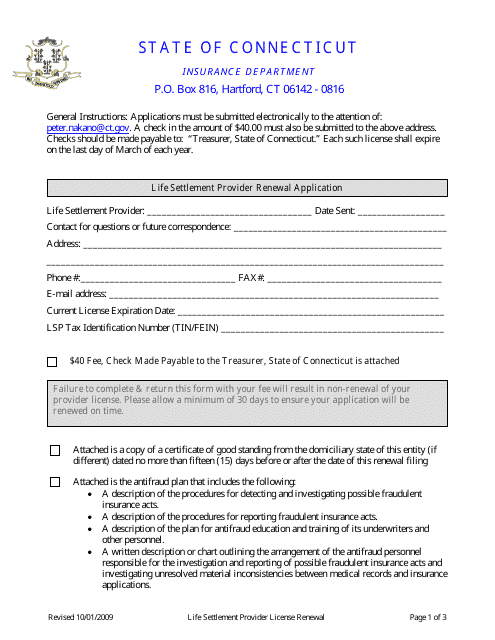

Source: templateroller.com

Source: templateroller.com

Life settlements allow you to gain full access to your investment, allowing you to plan for your family’s future, pay off any accumulated debt, and provide you with a financially fruitful. Apex offers a simple application that includes release forms so additional information can be requested for underwriting. A life settlement provider must appoint any life settlement producer that negotiates a life settlement transaction between an owner of a life insurance policy and a life settlement provider. The life settlement provider must pay the fee for the The first step of the process is to fill out an application.

Source: templateroller.com

Source: templateroller.com

The life settlement provider must pay the fee for the License application for a life settlement provider or broker. Lic claim settlement ratio stood at 94.2% until september this year against 98.3% last fiscal, whereas sbi life�s ratio dipped to 86.5% and icici prudential�s to 91%. Settlers life’s burial insurance plans are available to individuals between the ages of 15 days and 85 years. The life settlement provider must pay the fee for the

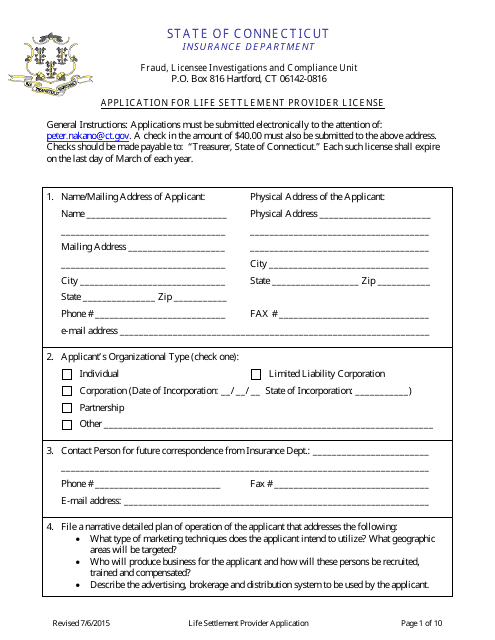

Source: formsbank.com

Source: formsbank.com

A life settlement provider must appoint any life settlement producer that negotiates a life settlement transaction between an owner of a life insurance policy and a life settlement provider. The plan does not require a medical exam and has level premiums for the life of the policy. Download the data file or print out your copy. Neither settlers insurance or ngl insurance are known for providing sizeable personal life insurance policies. A life settlement provider must appoint any life settlement producer that negotiates a life settlement transaction between an owner of a life insurance policy and a life settlement provider.

Source: lisettlements.com

Source: lisettlements.com

Lic claim settlement ratio stood at 94.2% until september this year against 98.3% last fiscal, whereas sbi life�s ratio dipped to 86.5% and icici prudential�s to 91%. The life settlement provider’s and broker’s application requires four (4) categories of information: Verification of 15 hours of training or education related to life settlements and life settlement transactions. Information detailed information is collected for underwriting of both the policy and the insured. Settlers life’s burial insurance plans are available to individuals between the ages of 15 days and 85 years.

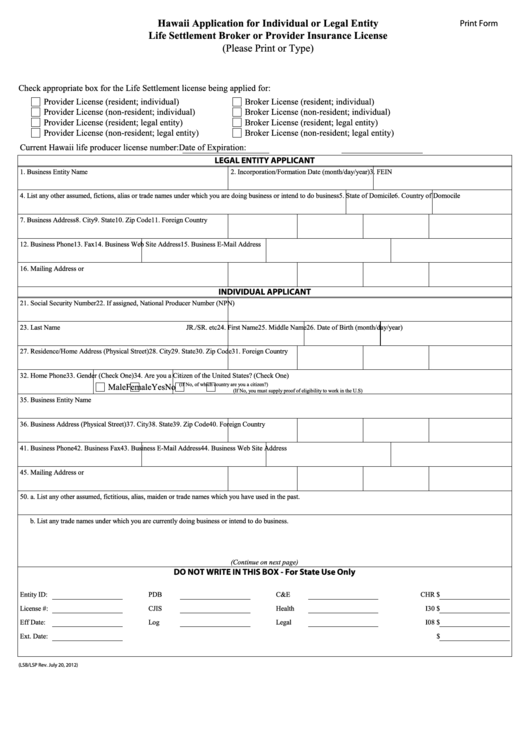

Source: templateroller.com

Source: templateroller.com

Get settlers life insurance claim signed right from your smartphone using these six tips: If your life settlement company isn’t purchasing the policy directly then your policy will enter a bidding process with potential buyers. Settlers life gold plan the gold plan is an immediate benefit whole life policy available for applicants ages 15 days to 85 years. Download the data file or print out your copy. The life settlement provider’s and broker’s application requires four (4) categories of information:

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

The form may be filled out online, by hand, or some combination of the two. Settlers life is not issuing new policies, therefore a free look period will not apply to existing policies. Remove the routine and create papers online! Because settlers insurance is no longer offering insurance policies to new clients, you have to go through ngl insurance if you want to access products from the same group. Botwinick explains, “because whole life insurance policies build up a cash surrender value, this amount is considered a countable resource for a medicaid application”.

Source: effortlessinsurance.com

Source: effortlessinsurance.com

The life settlement process begins with collecting some basic information about the owner, the insured, and the policy. Because settlers insurance is no longer offering insurance policies to new clients, you have to go through ngl insurance if you want to access products from the same group. Botwinick explains, “because whole life insurance policies build up a cash surrender value, this amount is considered a countable resource for a medicaid application”. Simply click done to save the changes. Verification of 15 hours of training or education related to life settlements and life settlement transactions.

Source: harborlifesettlements.com

Source: harborlifesettlements.com

A life settlement provider must appoint any life settlement producer that negotiates a life settlement transaction between an owner of a life insurance policy and a life settlement provider. As a leading professional life insurance settlement brokerage, we’ve had the opportunity to successfully assist thousands of clients sell their life insurance policies for a profitable cash settlement. Once completed the appropriate application can be faxed, emailed or mailed to life insurance settlements, inc. The first step of the process is to fill out an application. All real stories, case studies, and transactional data provided and contained on.

Source: youtube.com

Source: youtube.com

A life settlement provider must appoint any life settlement producer that negotiates a life settlement transaction between an owner of a life insurance policy and a life settlement provider. All real stories, case studies, and transactional data provided and contained on. The plan does not require a medical exam and has level premiums for the life of the policy. Please be advised that some state regulations use the term “viatical settlement” as opposed to “life settlement” to describe all transactions, regardless of the health of the insured, involving the sale of an existing life insurance policy to a third party. The form may be filled out online, by hand, or some combination of the two.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title settlers life insurance application by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information