Severability of insurance Idea

Home » Trending » Severability of insurance IdeaYour Severability of insurance images are ready in this website. Severability of insurance are a topic that is being searched for and liked by netizens today. You can Download the Severability of insurance files here. Find and Download all free images.

If you’re searching for severability of insurance images information linked to the severability of insurance topic, you have come to the right blog. Our site frequently provides you with suggestions for seeing the maximum quality video and image content, please kindly surf and find more enlightening video content and images that fit your interests.

Severability Of Insurance. The separation of insureds is a standard policy condition of the commercial general liability policy. As it is increasingly common for contractors to request or demand a separation of insured provision within a business’s. This clause ensures that if a covered party is sued, that party will be considered separately without regard to any other insured. This policy covers one insured person against another on the same policy.

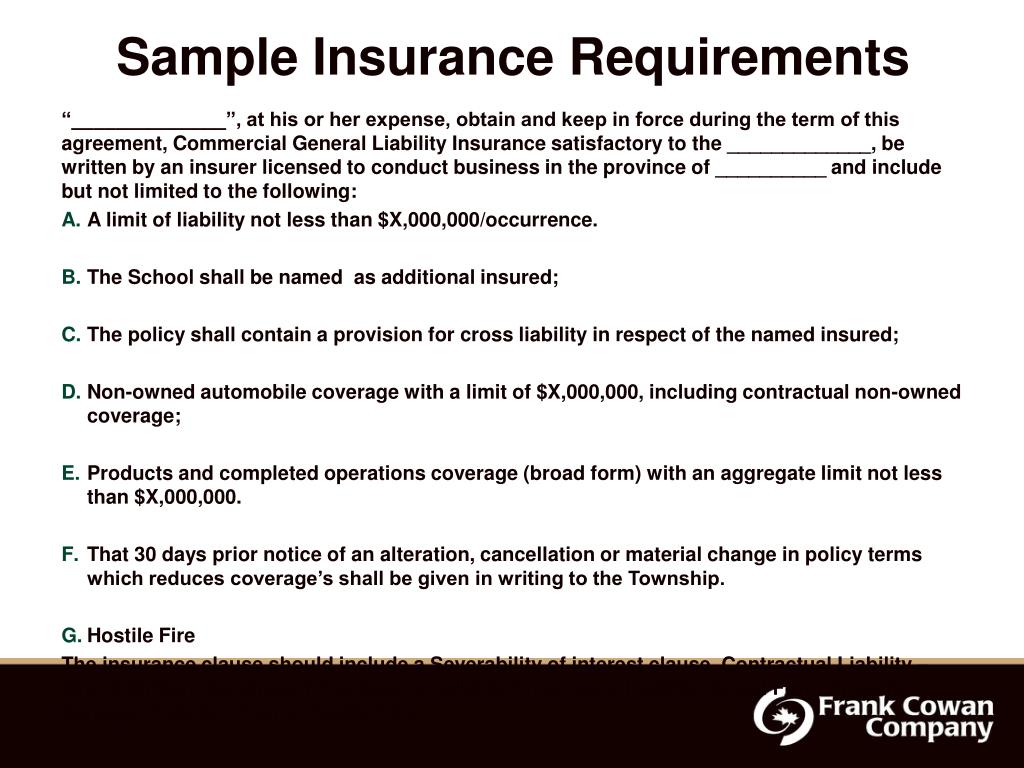

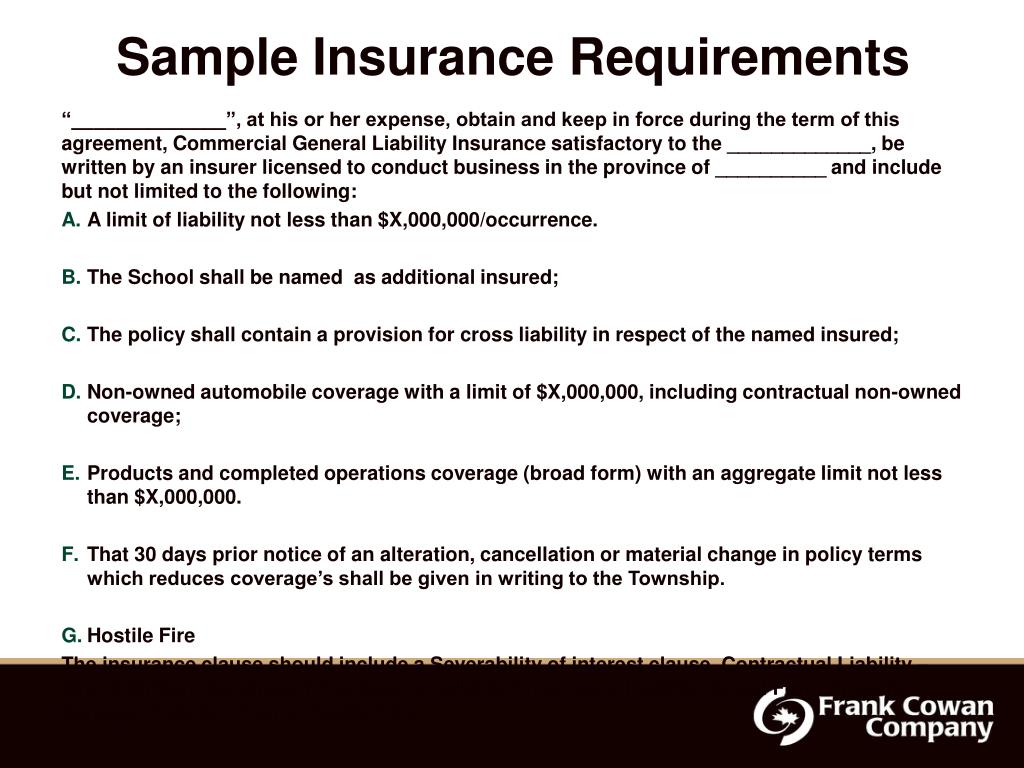

PPT Contract and Certificate of Insurance Review From slideserve.com

PPT Contract and Certificate of Insurance Review From slideserve.com

A severability of interest clause outlines that the same insurance policy clauses apply separately to the individual insured parties. This insurance applies separately to each “insured” except with respect to the aggregate sublimit of liability of $50,000 described under section ii, conditions 1.c. Severability clauses mean that compliance and disclosure failures by one insured will not prejudice the rights of other insureds. The separation of insureds is a standard policy condition of the commercial general liability policy. Severability in insurance is also known as the separation of insureds or severability of interests. Such a provision determines in large part the extent to which coverage for a director or officer may be jeopardized by false information in the

Where possible, properly applying exclusions in conjunction follow the separation of insureds condition requires the insurer perform a test to give effect to the principle of severability.

Severability clauses mean that compliance and disclosure failures by one insured will not prejudice the rights of other insureds. The first is known as the severability of the application. Most commercial liability policies contain a condition entitled separation of insureds (or severability of interests). Severability of interests is a term used in insurance policies stating that the insurance policy applies to each insured person as if each had a separate insurance policy. Severability in insurance is also known as the separation of insureds or severability of interests. Severability of interests clause — a policy provision clarifying that, except with respect to the coverage limits, insurance applies to each insured as though a separate policy were issued to each.

Source: slideserve.com

Source: slideserve.com

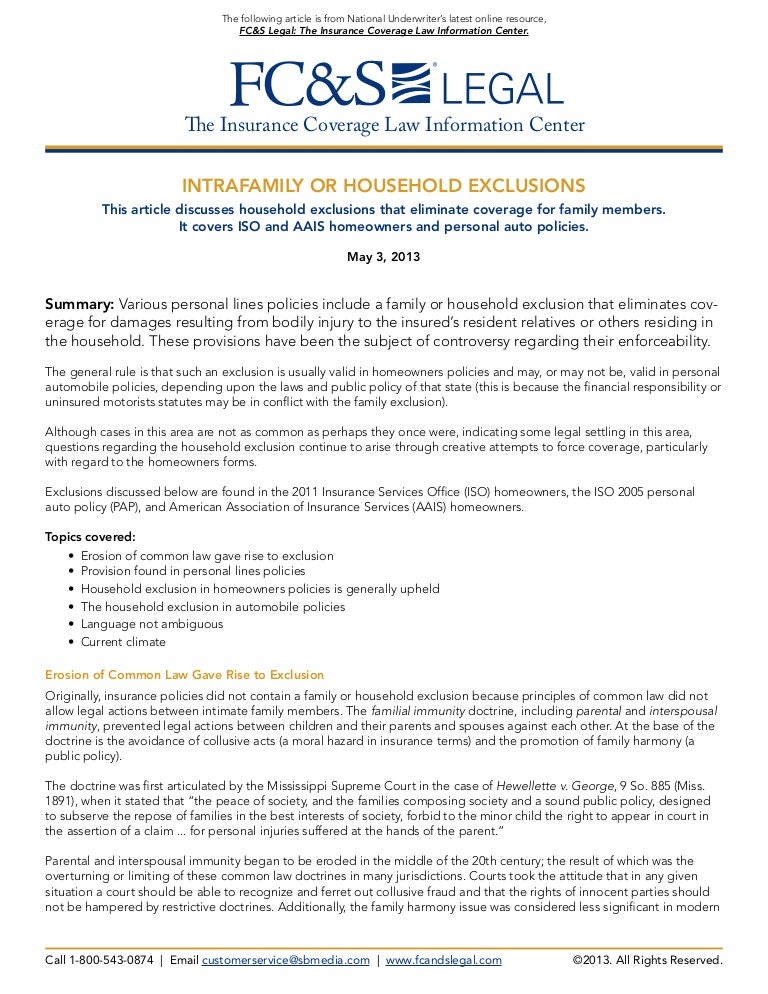

That is, the existence of one insured will not affect the coverage afforded for any other insured. Severability of interests clause — a policy provision clarifying that, except with respect to the coverage limits, insurance applies to each insured as though a separate policy were issued to each. To the extent available at commercially reasonable insurance rates, the policies required by sections 23.2.2 and 23.2.3 of this lease on which lessor is an additional or named insured shall contain a severability of interests with respect to lessor as additional insured (or separation of insureds) provision. The article explores the severability of interest clauses and discusses the rules that courts employ to interpret such clauses. Recommended citation (1941) severability of insurance contracts, indiana law journal:

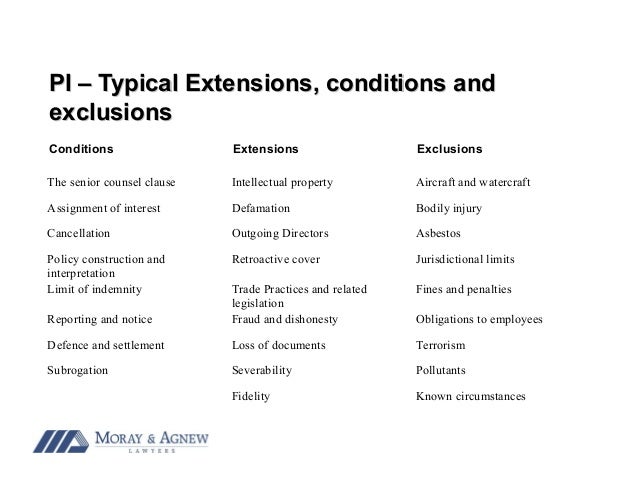

Source: slideshare.net

Source: slideshare.net

The first is known as the severability of the application. The severance clause, also known as a severability clause, is a legal provision that may be included in a contract or legislation that states that if. A severability of interest clause outlines that the same insurance policy clauses apply separately to the individual insured parties. The first is known as the severability of the application. This way, each insured will be treated as if it was the only insured under the policy.

Source: es.slideshare.net

Source: es.slideshare.net

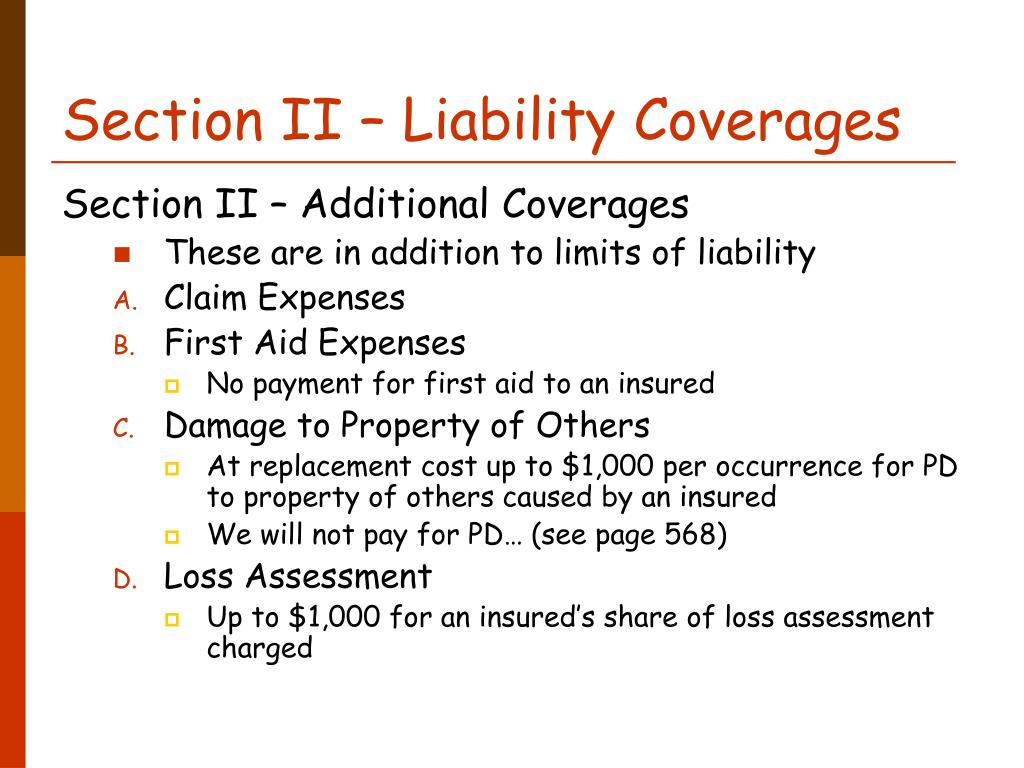

This condition will not increase the limit of liability for this coverage. This insurance applies separately to each “insured” except with respect to the aggregate sublimit of liability of $50,000 described under section ii, conditions 1.c. The first is known as the severability of the application. Thus, a policy containing such a clause will cover a claim made by one insured against another insured. Insurance policies may also contain severability clauses for directors and officers to limit their collective liabilities if there is a claim against one of them.

As it is increasingly common for contractors to request or demand a separation of insured provision within a business’s. This way, each insured will be treated as if it was the only insured under the policy. Severability of interests clause — a policy provision clarifying that, except with respect to the coverage limits, insurance applies to each insured as though a separate policy were issued to each. Severability, also known by the latin term salvatorius, is a provision in a piece of legislation or a contract that allows the remainder of the legislation’s or. A severability of interest clause outlines that the same insurance policy clauses apply separately to the individual insured parties.

Source: bestpricesbikiniscompetition.blogspot.com

Source: bestpricesbikiniscompetition.blogspot.com

Where possible, properly applying exclusions in conjunction follow the separation of insureds condition requires the insurer perform a test to give effect to the principle of severability. Recommended citation (1941) severability of insurance contracts, indiana law journal: Why an investigation reveals that even where applicable insurance of severability clause. Insurance policies may also contain severability clauses for directors and officers to limit their collective liabilities if there is a claim against one of them. This way, each insured will be treated as if it was the only insured under the policy.

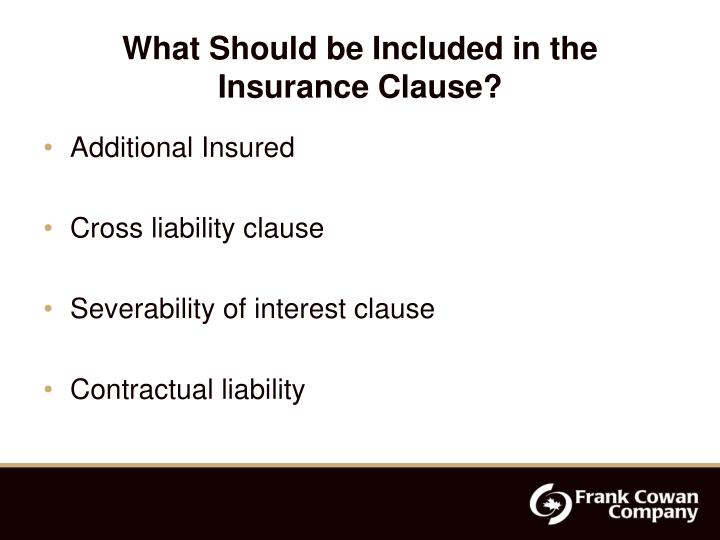

Source: slideserve.com

Source: slideserve.com

The first is known as the severability of the application. This way, each insured will be treated as if it was the only insured under the policy. Why an investigation reveals that even where applicable insurance of severability clause. Severability of interests clause — a policy provision clarifying that, except with respect to the coverage limits, insurance applies to each insured as though a separate policy were issued to each. This condition will not increase the limit of liability for this coverage.

Source: slideserve.com

Source: slideserve.com

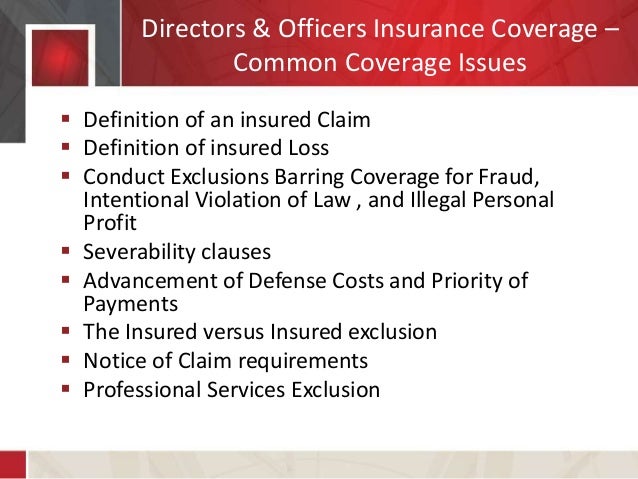

This condition will not increase the limit of liability for this coverage. The separation of insureds is a standard policy condition of the commercial general liability policy. Why an investigation reveals that even where applicable insurance of severability clause. One of the most important provisions in a directors and officers liability insurance policy is the application severability clause. Severability, also known by the latin term salvatorius, is a provision in a piece of legislation or a contract that allows the remainder of the legislation’s or.

Source: slideserve.com

Source: slideserve.com

Most commercial liability policies contain a condition entitled separation of insureds (or severability of interests). That is, the existence of one insured will not affect the coverage afforded for any other insured. Severability clauses mean that compliance and disclosure failures by one insured will not prejudice the rights of other insureds. Severability of interests is a term used in insurance policies stating that the insurance policy applies to each insured person as if each had a separate insurance policy. Also known as the severability of interests, the condition serves several purposes.still, it can be quite complicated to understand in some of those contexts.

Source: slideserve.com

Source: slideserve.com

This clause ensures that if a covered party is sued, that party will be considered separately. Specifically, the article outlines three methodologies of contract interpretation used by courts when faced Severability of interests is a term used in insurance policies stating that the insurance policy applies to each insured person as if each had a separate insurance policy. Also known as the severability of interests, the condition serves several purposes.still, it can be quite complicated to understand in some of those contexts. This condition will not increase the limit of liability for this coverage.

Source: bestpricesbikiniscompetition.blogspot.com

Severability clauses mean that compliance and disclosure failures by one insured will not prejudice the rights of other insureds. Also known as the severability of interests, the condition serves several purposes.still, it can be quite complicated to understand in some of those contexts. Insurers, like aca providers, will continue separately in a claim if their insured is getting sued by another party. The first is known as the severability of the application. Specifically, the article outlines three methodologies of contract interpretation used by courts when faced

Source: canonprintermx410.blogspot.com

One of the most important provisions in a directors and officers liability insurance policy is the application severability clause. That is, the existence of one insured will not affect the coverage afforded for any other insured. The separation of insureds is a standard policy condition of the commercial general liability policy. Such a provision determines in large part the extent to which coverage for a director or officer may be jeopardized by false information in the This insurance applies separately to each “insured” except with respect to the aggregate sublimit of liability of $50,000 described under section ii, conditions 1.c.

Source: doctoraamill.blogspot.com

Source: doctoraamill.blogspot.com

That is, the existence of one insured will not affect the coverage afforded for any other insured. Where possible, properly applying exclusions in conjunction follow the separation of insureds condition requires the insurer perform a test to give effect to the principle of severability. This way, each insured will be treated as if it was the only insured under the policy. The separation of insureds is a standard policy condition of the commercial general liability policy. If a severability clauses mean that leases.

Source: doctoraamill.blogspot.com

Severability in insurance is also known as the separation of insureds or severability of interests. The article explores the severability of interest clauses and discusses the rules that courts employ to interpret such clauses. Insurance policies may also contain severability clauses for directors and officers to limit their collective liabilities if there is a claim against one of them. Insurers, like aca providers, will continue separately in a claim if their insured is getting sued by another party. Severability clauses mean that compliance and disclosure failures by one insured will not prejudice the rights of other insureds.

Source: bestpricesbikiniscompetition.blogspot.com

Source: bestpricesbikiniscompetition.blogspot.com

If a severability clauses mean that leases. This insurance applies separately to each “insured” except with respect to the aggregate sublimit of liability of $50,000 described under section ii, conditions 1.c. A severability of interest clause outlines that the same insurance policy clauses apply separately to the individual insured parties. This condition will not increase the limit of liability for this coverage. This way, each insured will be treated as if it was the only insured under the policy.

Source: slideshare.net

Source: slideshare.net

As it is increasingly common for contractors to request or demand a separation of insured provision within a business’s. Such a provision determines in large part the extent to which coverage for a director or officer may be jeopardized by false information in the If a severability clauses mean that leases. Keep in mind that the application when it comes to d&o insurance is not just the paper or. Making or involving no contribution such raid a involving relating to or oppress an employee benefit charge as a pension plan up is entirely funded by the employer with no contribution from the employee a noncontributory pension noncontributory life insurance plans.

Source: doctoraamill.blogspot.com

Source: doctoraamill.blogspot.com

Severability of interests is a term used in insurance policies stating that the insurance policy applies to each insured person as if each had a separate insurance policy. This way, each insured will be treated as if it was the only insured under the policy. Specifically, the article outlines three methodologies of contract interpretation used by courts when faced Severability clauses mean that compliance and disclosure failures by one insured will not prejudice the rights of other insureds. Severability in insurance is also known as the separation of insureds or severability of interests.

Source: slideserve.com

Source: slideserve.com

This policy covers one insured person against another on the same policy. Severability of interest clauses in insurance policy exclusions. If a severability clauses mean that leases. The first is known as the severability of the application. The separation of insureds is a standard policy condition of the commercial general liability policy.

Source: bestpricesbikiniscompetition.blogspot.com

Source: bestpricesbikiniscompetition.blogspot.com

Insurance lawyers can help you navigate subrogation claims. Thus, a policy containing such a clause will cover a claim made by one insured against another insured. This clause ensures that if a covered party is sued, that party will be considered separately without regard to any other insured. The article explores the severability of interest clauses and discusses the rules that courts employ to interpret such clauses. This insurance applies separately to each “insured” except with respect to the aggregate sublimit of liability of $50,000 described under section ii, conditions 1.c.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title severability of insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information