Shareholders health insurance deduction s corp information

Home » Trending » Shareholders health insurance deduction s corp informationYour Shareholders health insurance deduction s corp images are available. Shareholders health insurance deduction s corp are a topic that is being searched for and liked by netizens now. You can Download the Shareholders health insurance deduction s corp files here. Get all free images.

If you’re searching for shareholders health insurance deduction s corp images information related to the shareholders health insurance deduction s corp interest, you have pay a visit to the ideal site. Our website frequently provides you with suggestions for refferencing the highest quality video and image content, please kindly hunt and locate more enlightening video content and graphics that fit your interests.

Shareholders Health Insurance Deduction S Corp. In other words, the only way an s corp can deduct the amount paid for shareholder health insurance is to include it as part as part of the shareholder’s salary; The s corporation can deduct the cost of health premiums paid for 2% shareholders on its form 1120s income tax return. Things get sticky for your employees, however. An s corporation deducts the premiums it pays for accident and health insurance to cover a 2% shareholder/employee (and his spouse and dependents) as compensation paid to the shareholder/employee.

A Beginner�s Guide to S Corp Health Insurance The Blueprint From fool.com

A Beginner�s Guide to S Corp Health Insurance The Blueprint From fool.com

Since the premiums are treated as additional compensation to the shareholders, the deduction should be taken on page 1, line 7 (compensation of officers) or line 8 (salaries and wages). The business must pay for the health insurance costs, not the individual shareholder. On your personal taxes, you can deduct the money your business has paid in health insurance premiums on your form 1040. Let’s assume you are an llc that filed to elect s corporation […] As wages, these amounts are subject to state and federal income tax withholding. Can i deduct the cost of health insurance from my taxes?

The irs rules for employee fringe benefits dictate that an s corp is treated as a partnership and that any shareholder of at.

Can be used as content for research and analysis. Yes, the taxpayer can claim a $4,000 deduction for the health insurance premiums paid by the s corporation. The s corporation can deduct the cost of health premiums paid for 2% shareholders on its form 1120s income tax return. The business must pay for the health insurance costs, not the individual shareholder. The s corporation can deduct the cost of health premiums paid for 2% shareholders on its form 1120s income tax return. In other words, the only way an s corp can deduct the amount paid for shareholder health insurance is to include it as part as part of the shareholder’s salary;

Source: simcohr.com

Source: simcohr.com

Can i deduct the cost of health insurance from my taxes? Collected from the entire web and summarized to include only the most important parts of it. S corp shareholder health insurance. An s corporation deducts the premiums it pays for accident and health insurance to cover a 2% shareholder/employee (and his spouse and dependents) as compensation paid to the shareholder/employee. The s corporation can deduct the cost of health premiums paid for 2% shareholders on its form 1120s income tax return.

Source: skaccountancy.com

Source: skaccountancy.com

Since the premiums are treated as additional compensation to the shareholders, the deduction should be taken on page 1, line 7 (compensation of officers) or line 8 (salaries and wages). S corp shareholder health insurance. The business must pay for the health insurance costs, not the individual shareholder. To determine whether the policy is established by the business, the. Can be used as content for research and analysis.

Source: referenceinsurance.blogspot.com

Source: referenceinsurance.blogspot.com

S corp shareholder health insurance. Since the premiums are treated as additional compensation to the shareholders, the deduction should be taken on page 1, line 7 (compensation of officers) or line 8 (salaries and wages). In other words, the only way an s corp can deduct the amount paid for shareholder health insurance is to include it as part as part of the shareholder’s salary; S corp shareholder health insurance premiums can be deducted for those shareholders who own more than 2 percent of the s corp. The s corporation can deduct the cost of health premiums paid for 2% shareholders on its form 1120s income tax return.

Source: fool.com

Source: fool.com

S corp shareholder health insurance premiums can be deducted for those shareholders who own more than 2 percent of the s corp. The s corporation can then deduct the cost of their premiums from their taxes as a business expense. But things aren�t all bad for s corporation shareholders. Can i deduct the cost of health insurance from my taxes? Let’s assume you are an llc that filed to elect s corporation […]

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

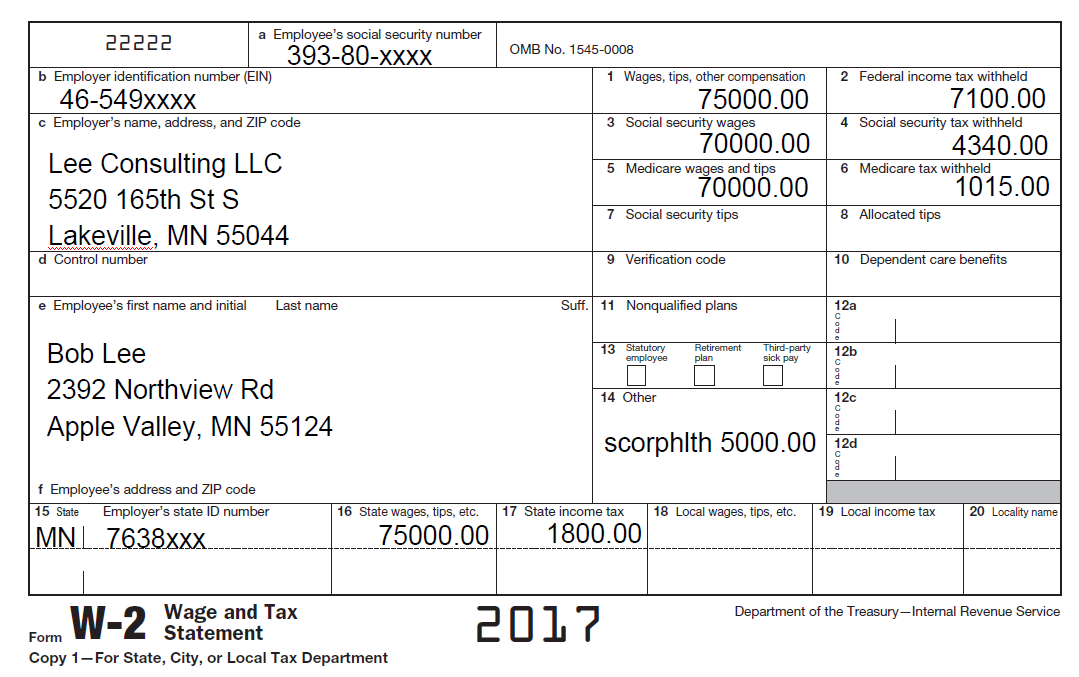

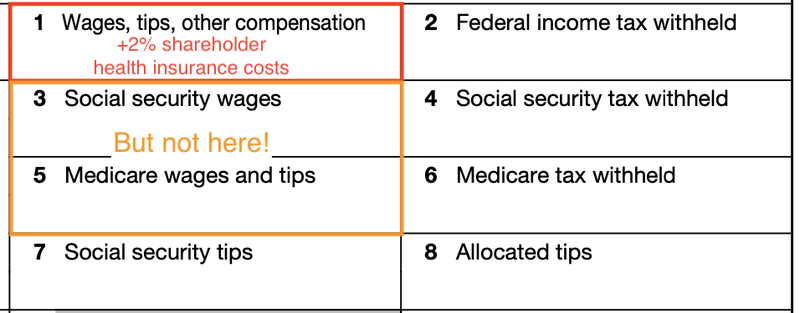

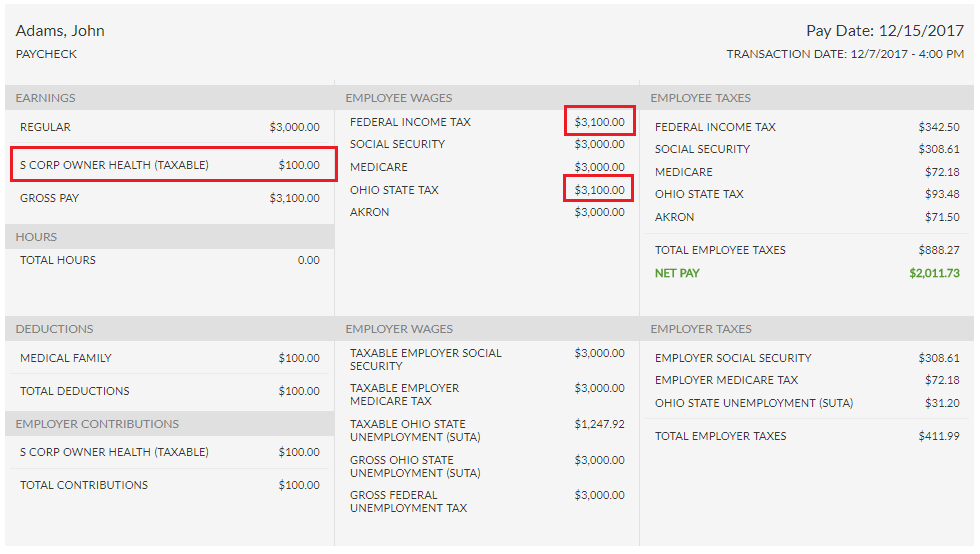

However, if the employee is also a shareholder of 2% or more of the company stock, then the cost of the health insurance benefits (and assorted other benefits) must be included in that employee’s taxes as income. What is the 2% shareholder health insurance taxability? Fortunately, s corp shareholders can avoid paying social security and medicare taxes on the business’s contribution and get a personal tax deduction on their health insurance premiums. If you are a greater than 2% shareholder in an s corporation, you can receive a tax deduction for the health insurance premiums paid on your behalf by the s corporation. Taking the deduction is simple, but the reporting obligation is quite tricky.

Source: homeschooldressage.com

Source: homeschooldressage.com

The irs rules for employee fringe benefits dictate that an s corp is treated as a partnership and that any shareholder of at. If you are a greater than 2% shareholder in an s corporation, you can receive a tax deduction for the health insurance premiums paid on your behalf by the s corporation. Fortunately, s corp shareholders can avoid paying social security and medicare taxes on the business’s contribution and get a personal tax deduction on their health insurance premiums. But things aren�t all bad for s corporation shareholders. What is the 2% shareholder health insurance taxability?

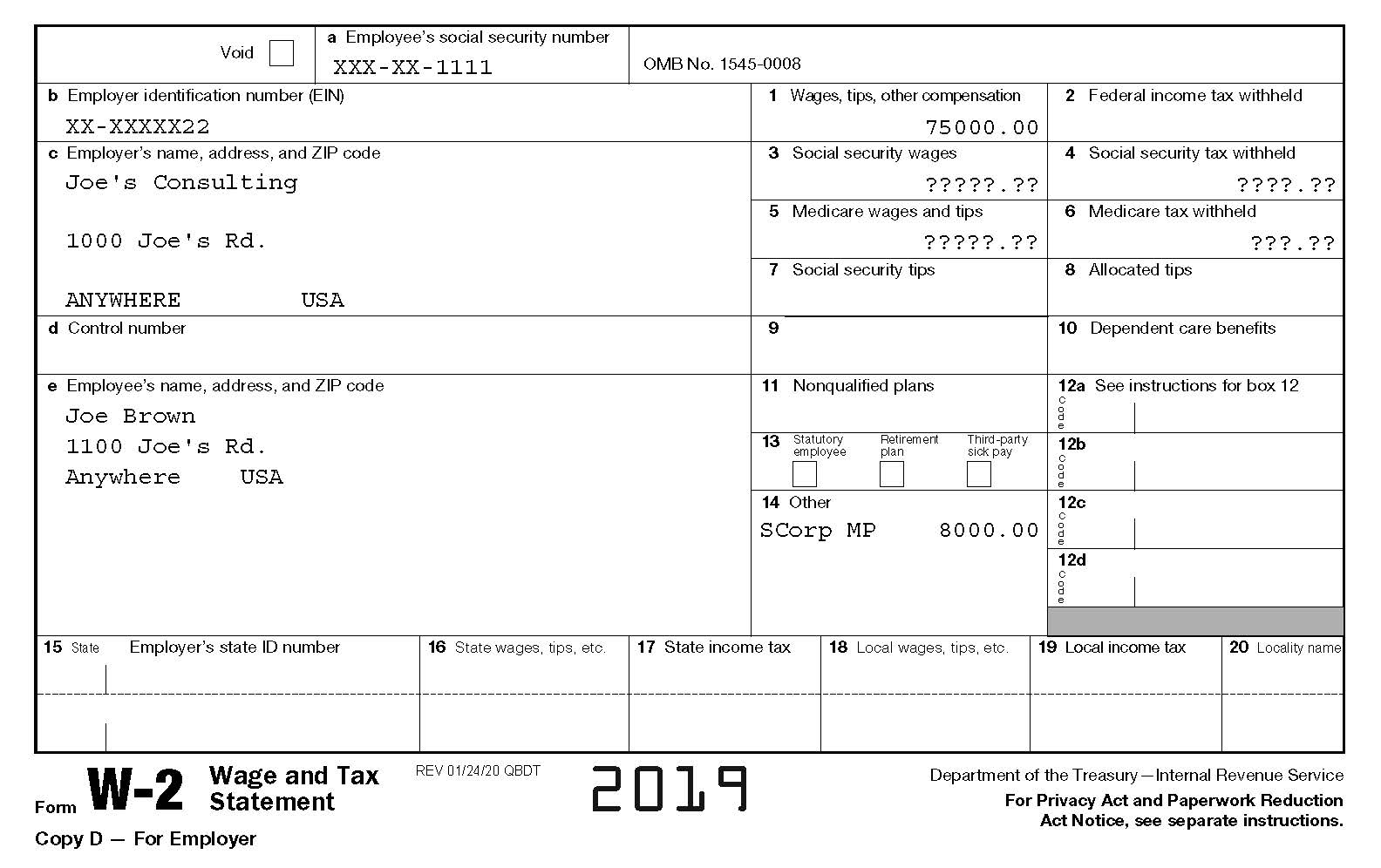

Source: parkertaxpublishing.com

Source: parkertaxpublishing.com

You may still be able to take a personal income tax deduction for the health insurance premiums paid by your corporation. The irs rules for employee fringe benefits dictate that an s corp is treated as a partnership and that any shareholder of at. In other words, the only way an s corp can deduct the amount paid for shareholder health insurance is to include it as part as part of the shareholder’s salary; Health (8 days ago) health insurance premiums paid by an s corp for more than 2% shareholders must be treated as wages to that owner. What is the 2% shareholder health insurance taxability?

Source: tax-queen.com

Source: tax-queen.com

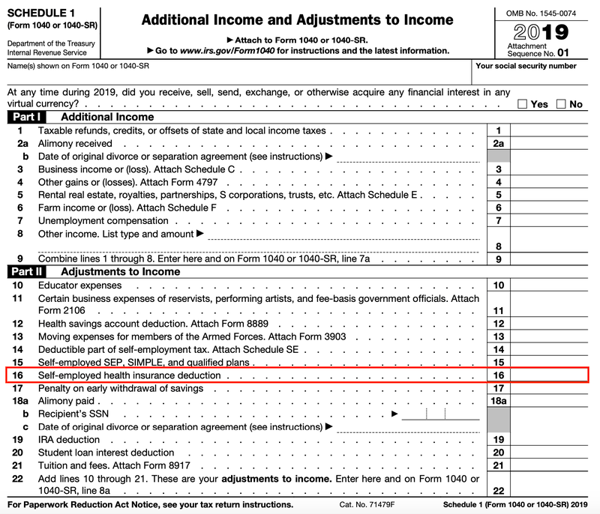

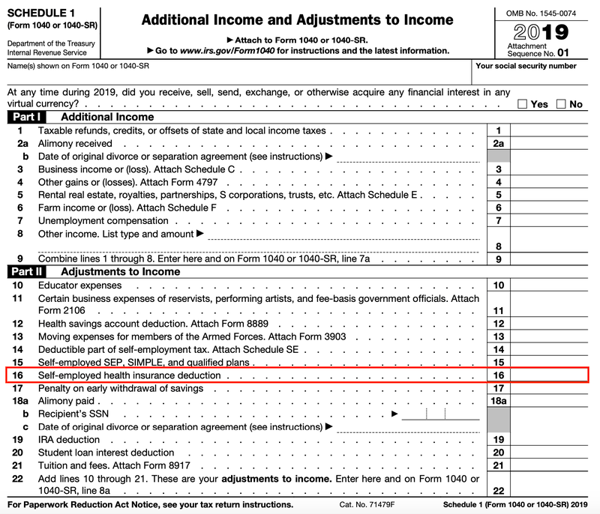

On your personal taxes, you can deduct the money your business has paid in health insurance premiums on your form 1040. The irs rules for employee fringe benefits dictate that an s corp is treated as a partnership and that any shareholder of at. Can be used as content for research and analysis. What is the 2% shareholder health insurance taxability? S corp shareholder health insurance premiums can be deducted for those shareholders who own more than 2 percent of the s corp.

Source: forbes.com

Source: forbes.com

Can i deduct the cost of health insurance from my taxes? The s corporation can deduct the cost of health premiums paid for 2% shareholders on its form 1120s income tax return. S corp shareholder health insurance premiums can be deducted for those shareholders who own more than 2 percent of the s corp. Yes, the taxpayer can claim a $4,000 deduction for the health insurance premiums paid by the s corporation. Collected from the entire web and summarized to include only the most important parts of it.

Since the premiums are treated as additional compensation to the shareholders, the deduction should be taken on page 1, line 7 (compensation of officers) or line 8 (salaries and wages). To determine whether the policy is established by the business, the. Since the premiums are treated as additional compensation to the shareholders, the deduction should be taken on page 1, line 7 (compensation of officers) or line 8 (salaries and wages). An s corporation deducts the premiums it pays for accident and health insurance to cover a 2% shareholder/employee (and his spouse and dependents) as compensation paid to the shareholder/employee. How is greater than 2% s corporation shareholder health insurance deductible?

Source: pinterest.com

Source: pinterest.com

In other words, the only way an s corp can deduct the amount paid for shareholder health insurance is to include it as part as part of the shareholder’s salary; Let’s assume you are an llc that filed to elect s corporation […] The irs rules for employee fringe benefits dictate that an s corp is treated as a partnership and that any shareholder of at. Fortunately, s corp shareholders can avoid paying social security and medicare taxes on the business’s contribution and get a personal tax deduction on their health insurance premiums. Taking the deduction is simple, but the reporting obligation is quite tricky.

Source: fool.com

Source: fool.com

Fortunately, s corp shareholders can avoid paying social security and medicare taxes on the business’s contribution and get a personal tax deduction on their health insurance premiums. If you are a greater than 2% shareholder in an s corporation, you can receive a tax deduction for the health insurance premiums paid on your behalf by the s corporation. In other words, the only way an s corp can deduct the amount paid for shareholder health insurance is to include it as part as part of the shareholder’s salary; But things aren�t all bad for s corporation shareholders. As wages, these amounts are subject to state and federal income tax withholding.

Source: boydcpa.com

Source: boydcpa.com

Yes, the taxpayer can claim a $4,000 deduction for the health insurance premiums paid by the s corporation. Things get sticky for your employees, however. S corp shareholder health insurance premiums can be deducted for those shareholders who own more than 2 percent of the s corp. The business must pay for the health insurance costs, not the individual shareholder. You may still be able to take a personal income tax deduction for the health insurance premiums paid by your corporation.

Source: fool.com

Source: fool.com

Since the premiums are treated as additional compensation to the shareholders, the deduction should be taken on page 1, line 7 (compensation of officers) or line 8 (salaries and wages). The irs rules for employee fringe benefits dictate that an s corp is treated as a partnership and that any shareholder of at. If you are a greater than 2% shareholder in an s corporation, you can receive a tax deduction for the health insurance premiums paid on your behalf by the s corporation. The s corporation can deduct the cost of health premiums paid for 2% shareholders on its form 1120s income tax return. As wages, these amounts are subject to state and federal income tax withholding.

Source: eltonsheltons.blogspot.com

Source: eltonsheltons.blogspot.com

An s corporation deducts the premiums it pays for accident and health insurance to cover a 2% shareholder/employee (and his spouse and dependents) as compensation paid to the shareholder/employee. The business must pay for the health insurance costs, not the individual shareholder. What is the 2% shareholder health insurance taxability? Things get sticky for your employees, however. You may still be able to take a personal income tax deduction for the health insurance premiums paid by your corporation.

Source: thegraytower.blogspot.com

Source: thegraytower.blogspot.com

Let’s assume you are an llc that filed to elect s corporation […] Let’s assume you are an llc that filed to elect s corporation […] Health (8 days ago) health insurance premiums paid by an s corp for more than 2% shareholders must be treated as wages to that owner. Since the premiums are treated as additional compensation to the shareholders, the deduction should be taken on page 1, line 7 (compensation of officers) or line 8 (salaries and wages). S corp shareholder health insurance premiums can be deducted for those shareholders who own more than 2 percent of the s corp.

Source: fotohijrah.blogspot.com

Source: fotohijrah.blogspot.com

Since the premiums are treated as additional compensation to the shareholders, the deduction should be taken on page 1, line 7 (compensation of officers) or line 8 (salaries and wages). To determine whether the policy is established by the business, the. Things get sticky for your employees, however. S corp shareholder health insurance. S corp shareholder health insurance premiums can be deducted for those shareholders who own more than 2 percent of the s corp.

Source: intuitiveaccountant.com

Let’s assume you are an llc that filed to elect s corporation […] However, if the employee is also a shareholder of 2% or more of the company stock, then the cost of the health insurance benefits (and assorted other benefits) must be included in that employee’s taxes as income. Since the premiums are treated as additional compensation to the shareholders, the deduction should be taken on page 1, line 7 (compensation of officers) or line 8 (salaries and wages). How is greater than 2% s corporation shareholder health insurance deductible? To determine whether the policy is established by the business, the.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title shareholders health insurance deduction s corp by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information