Short term vs long term disability insurance information

Home » Trending » Short term vs long term disability insurance informationYour Short term vs long term disability insurance images are ready in this website. Short term vs long term disability insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the Short term vs long term disability insurance files here. Download all royalty-free photos and vectors.

If you’re searching for short term vs long term disability insurance pictures information related to the short term vs long term disability insurance keyword, you have pay a visit to the right blog. Our site frequently provides you with hints for viewing the highest quality video and image content, please kindly surf and locate more informative video articles and graphics that fit your interests.

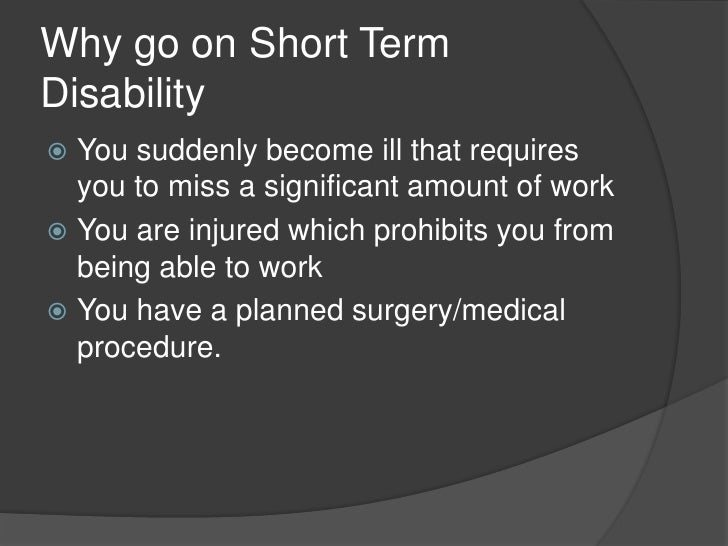

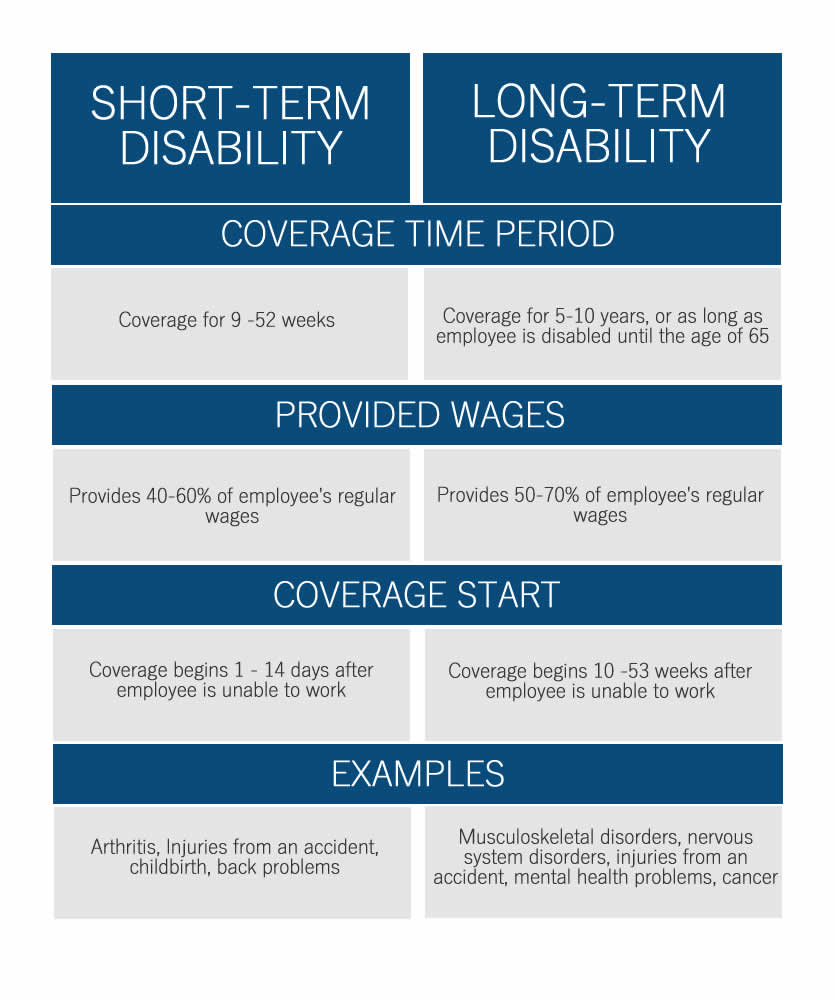

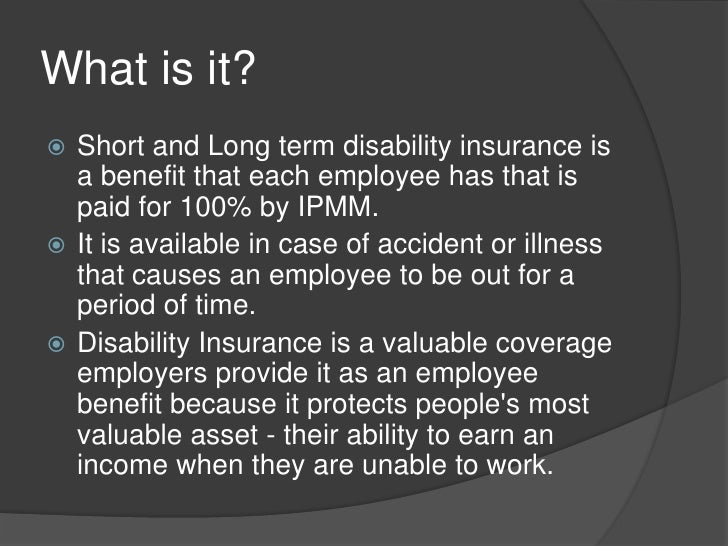

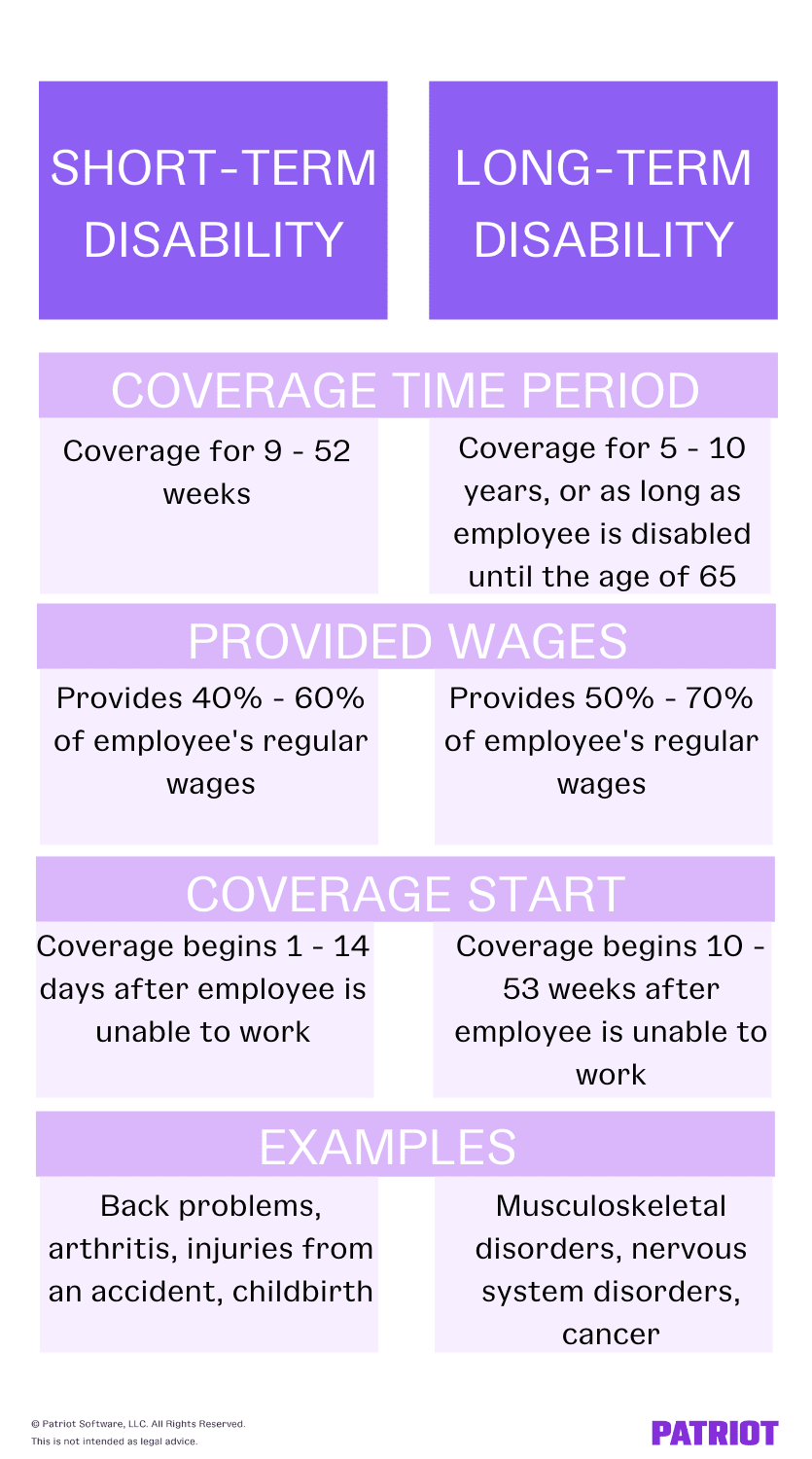

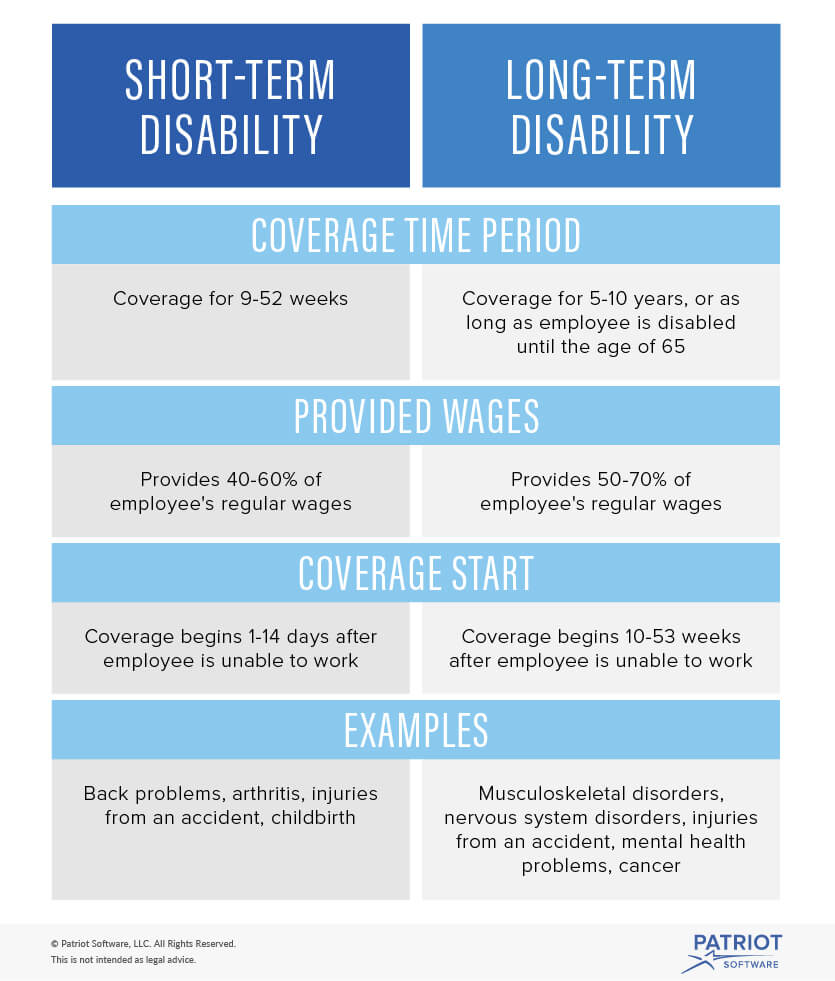

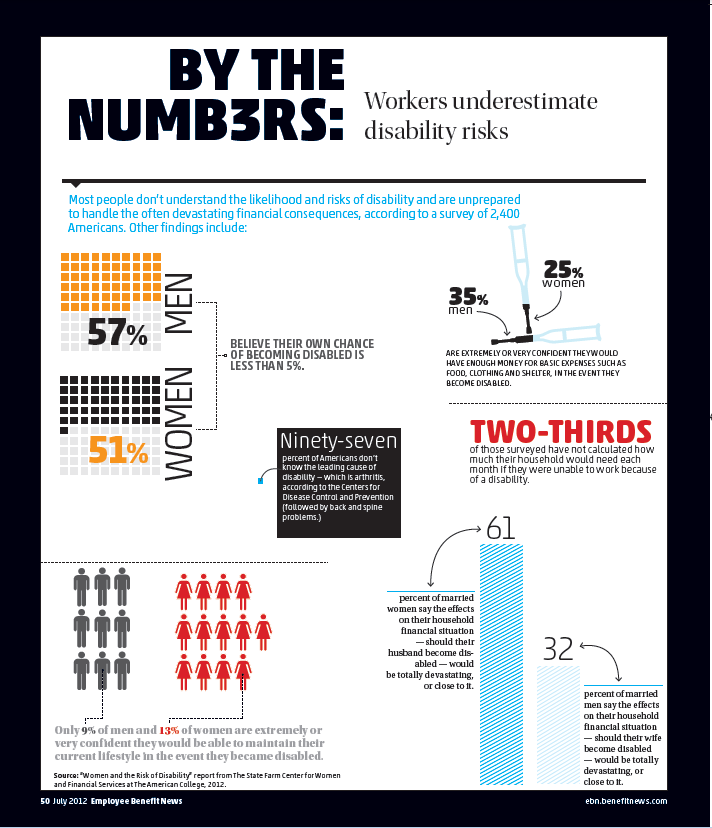

Short Term Vs Long Term Disability Insurance. In the image above, you can see the. Short term disability is intended to cover you immediately following a serious illness or injury, and long term disability insurance is intended to maintain supplemental income if your condition keeps you out of work past the end of your short term disability benefit period, even to retirement, depending on your plan. Usually three to six months. Replaces 40% to 70% of base income:

Short and long term disability insurance From slideshare.net

Short and long term disability insurance From slideshare.net

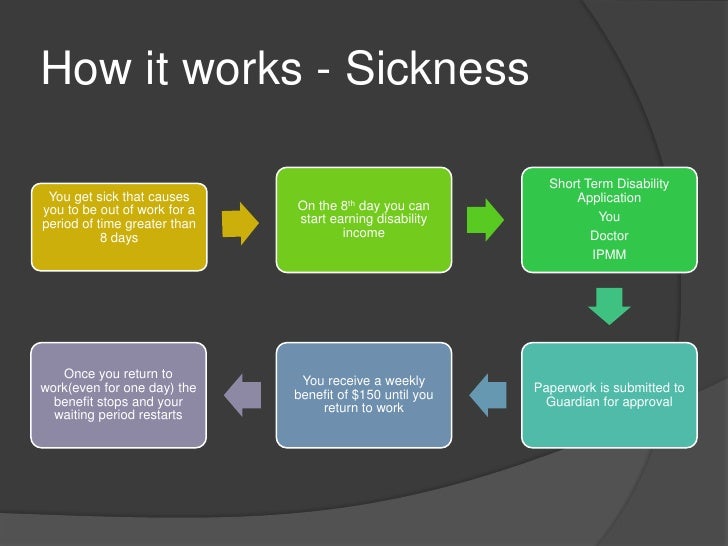

Lasts for 13 to 26 weeks: However, there are other options. It pays for a portion of a victim’s lost wages due to an injury or illness that renders him or her incapable of working. In the image above, you can see the. Short term disability is intended to cover you immediately following a serious illness or injury, and long term disability insurance is intended to maintain supplemental income if your condition keeps you out of work past the end of your short term disability benefit period, even to retirement, depending on your plan. For example, there could be a 14 day period after an injury and a.

In the image above, you can see the.

Usually, this type of insurance is only available through your employer. Short term disability is intended to cover you immediately following a serious illness or injury, and long term disability insurance is intended to maintain income replacement if your condition keeps you out of work past the end of your short term disability benefit period, even to retirement, depending on your plan. Short term disability covers you for just what you think it would, a short term. Your benefit period will be somewhere between 30 and 120 days. Short term disability is intended to cover you immediately following a serious illness or injury, and long term disability insurance is intended to maintain supplemental income if your condition keeps you out of work past the end of your short term disability benefit period, even to retirement, depending on your plan. In the image above, you can see the.

Source: roylawgroup.com

Source: roylawgroup.com

Lasts for 13 to 26 weeks: Replaces 40% to 70% of base income: In the image above, you can see the. Usually, this type of insurance is only available through your employer. Short term disability covers you for just what you think it would, a short term.

Source: slideshare.net

Source: slideshare.net

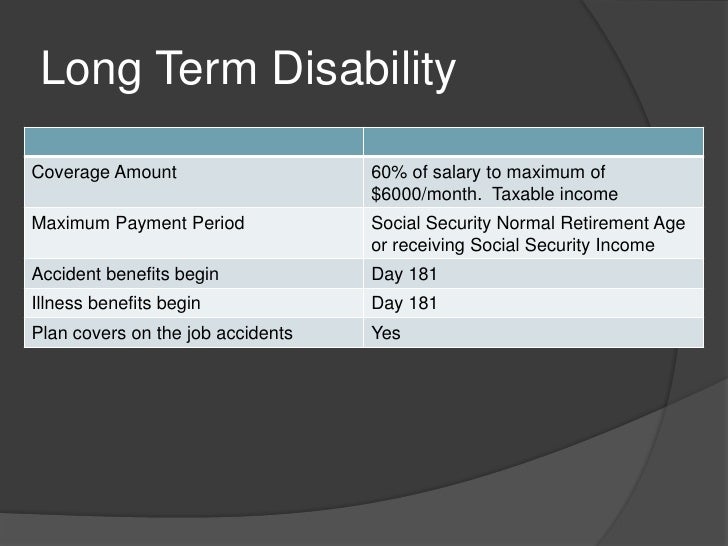

Short term disability covers you for just what you think it would, a short term. Plans vary, typically 5 years to retirement age: It pays for a portion of a victim’s lost wages due to an injury or illness that renders him or her incapable of working. Short term disability is intended to cover you immediately following a serious illness or injury, and long term disability insurance is intended to maintain supplemental income if your condition keeps you out of work past the end of your short term disability benefit period, even to retirement, depending on your plan. Usually, this type of insurance is only available through your employer.

Source: slideshare.net

Source: slideshare.net

Short term disability is intended to cover you immediately following a serious illness or injury, and long term disability insurance is intended to maintain supplemental income if your condition keeps you out of work past the end of your short term disability benefit period, even to retirement, depending on your plan. Disability insurance pays you when you are unable to work due to an illness or injury, regardless of the cause. Plans vary, typically 5 years to retirement age: Usually, this type of insurance is only available through your employer. Replaces 40% to 60% of base income

Source: wrsinsurancesolutions.com

Source: wrsinsurancesolutions.com

Replaces 40% to 60% of base income The length of time that the policy covers is known as a benefit period. Replaces 40% to 70% of base income: Replaces 40% to 60% of base income Short term disability is intended to cover you immediately following a serious illness or injury, and long term disability insurance is intended to maintain income replacement if your condition keeps you out of work past the end of your short term disability benefit period, even to retirement, depending on your plan.

Source: fbsbenefits.com

Source: fbsbenefits.com

This means saving enough to cover the time period a short term. The length of time that the policy covers is known as a benefit period. Disability insurance pays you when you are unable to work due to an illness or injury, regardless of the cause. Your benefit period will be somewhere between 30 and 120 days. This means saving enough to cover the time period a short term.

Source: balanceddividends.com

Source: balanceddividends.com

Plans vary, typically 5 years to retirement age: In the image above, you can see the. Disability insurance pays you when you are unable to work due to an illness or injury, regardless of the cause. Replaces 40% to 70% of base income: Your benefit period will be somewhere between 30 and 120 days.

Source: view.ceros.com

Source: view.ceros.com

Short term disability covers you for just what you think it would, a short term. Replaces 40% to 70% of base income: Your benefit period will be somewhere between 30 and 120 days. Replaces 40% to 60% of base income Lasts for 13 to 26 weeks:

Source: slideshare.net

Source: slideshare.net

This means saving enough to cover the time period a short term. Plans vary, typically 5 years to retirement age: In the image above, you can see the. Your benefit period will be somewhere between 30 and 120 days. The length of time that the policy covers is known as a benefit period.

Source: slideshare.net

Source: slideshare.net

Usually, this type of insurance is only available through your employer. This means saving enough to cover the time period a short term. Your benefit period will be somewhere between 30 and 120 days. Short term disability is intended to cover you immediately following a serious illness or injury, and long term disability insurance is intended to maintain supplemental income if your condition keeps you out of work past the end of your short term disability benefit period, even to retirement, depending on your plan. Usually three to six months.

Source: sdtplanning.com

Usually, this type of insurance is only available through your employer. Your benefit period will be somewhere between 30 and 120 days. Plans vary, typically 5 years to retirement age: Lasts for 13 to 26 weeks: Replaces 40% to 70% of base income:

Source: patriotsoftware.com

Source: patriotsoftware.com

In the image above, you can see the. However, there are other options. For example, there could be a 14 day period after an injury and a. It pays for a portion of a victim’s lost wages due to an injury or illness that renders him or her incapable of working. Lasts for 13 to 26 weeks:

Source: news.vanderbilt.edu

Source: news.vanderbilt.edu

Your benefit period will be somewhere between 30 and 120 days. Short term disability is intended to cover you immediately following a serious illness or injury, and long term disability insurance is intended to maintain supplemental income if your condition keeps you out of work past the end of your short term disability benefit period, even to retirement, depending on your plan. The length of time that the policy covers is known as a benefit period. Replaces 40% to 60% of base income Plans vary, typically 5 years to retirement age:

Source: patriotsoftware.com

Source: patriotsoftware.com

Usually, this type of insurance is only available through your employer. The length of time that the policy covers is known as a benefit period. Replaces 40% to 60% of base income Usually three to six months. Replaces 40% to 70% of base income:

Source: austinbenefits.com

Source: austinbenefits.com

Your benefit period will be somewhere between 30 and 120 days. This means saving enough to cover the time period a short term. However, there are other options. Plans vary, typically 5 years to retirement age: Replaces 40% to 70% of base income:

Source: guide.mybmcbenefits.com

Source: guide.mybmcbenefits.com

Replaces 40% to 60% of base income The length of time that the policy covers is known as a benefit period. However, there are other options. In the image above, you can see the. Your benefit period will be somewhere between 30 and 120 days.

Source: visual.ly

Source: visual.ly

The length of time that the policy covers is known as a benefit period. Usually three to six months. However, there are other options. Your benefit period will be somewhere between 30 and 120 days. Replaces 40% to 60% of base income

Source: slideshare.net

Source: slideshare.net

Short term disability covers you for just what you think it would, a short term. Usually, this type of insurance is only available through your employer. For example, there could be a 14 day period after an injury and a. Disability insurance pays you when you are unable to work due to an illness or injury, regardless of the cause. Replaces 40% to 60% of base income

Source: bbd.ca

Source: bbd.ca

This means saving enough to cover the time period a short term. Your benefit period will be somewhere between 30 and 120 days. Lasts for 13 to 26 weeks: It pays for a portion of a victim’s lost wages due to an injury or illness that renders him or her incapable of working. The length of time that the policy covers is known as a benefit period.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title short term vs long term disability insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information