Single car accident insurance claim Idea

Home » Trending » Single car accident insurance claim IdeaYour Single car accident insurance claim images are available in this site. Single car accident insurance claim are a topic that is being searched for and liked by netizens now. You can Find and Download the Single car accident insurance claim files here. Download all royalty-free images.

If you’re looking for single car accident insurance claim images information connected with to the single car accident insurance claim interest, you have come to the ideal site. Our site always provides you with hints for downloading the highest quality video and picture content, please kindly search and find more enlightening video articles and images that fit your interests.

Single Car Accident Insurance Claim. Filing a claim requires that the driver properly document the accident, get their vehicle inspected, and report it to the local authorities. There are many situations in which a personal injury claim can be made in a single car crash. Is the cost of your claim substantially larger than your deductible? This provides a maximum amount that can be provided in case of a single “accident” or “occurrence.”.

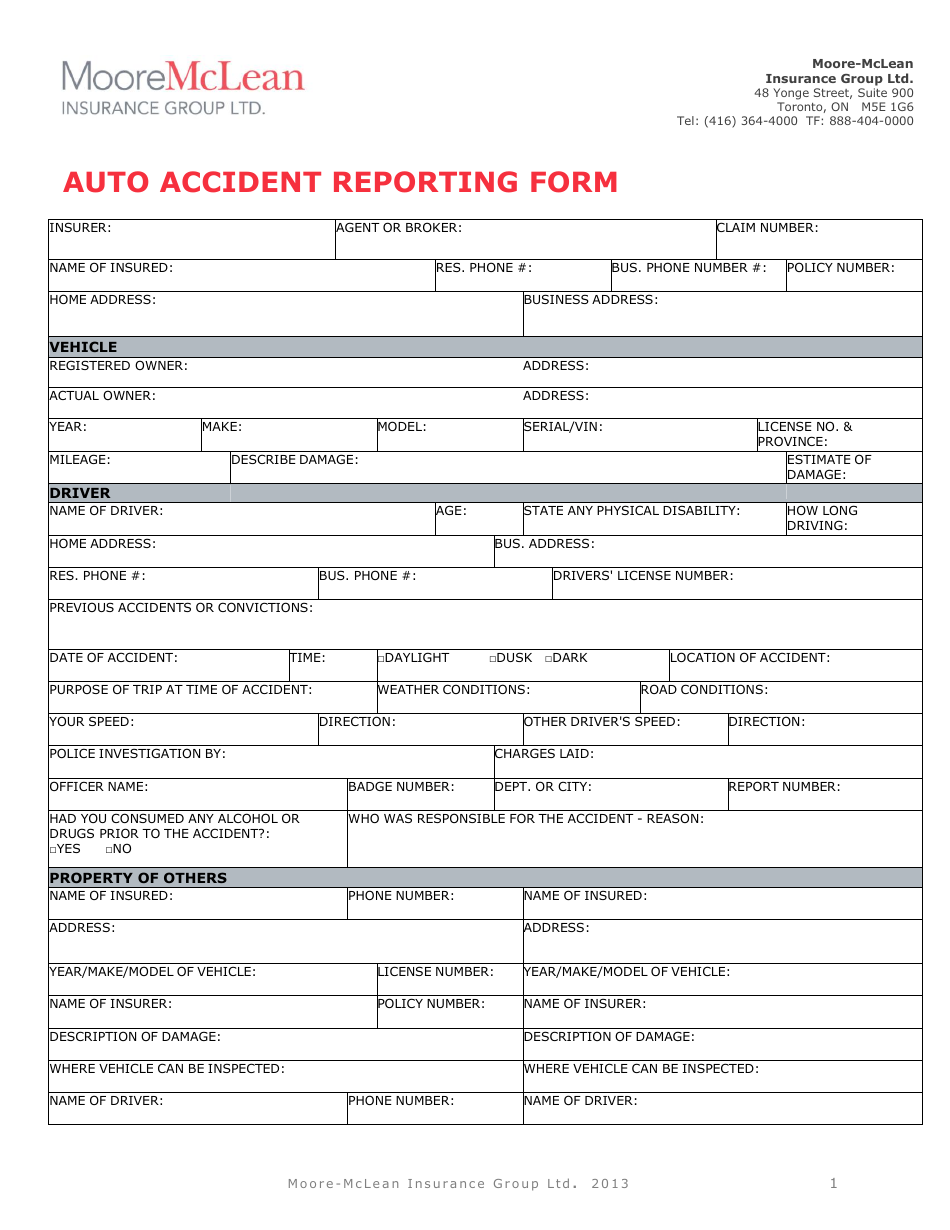

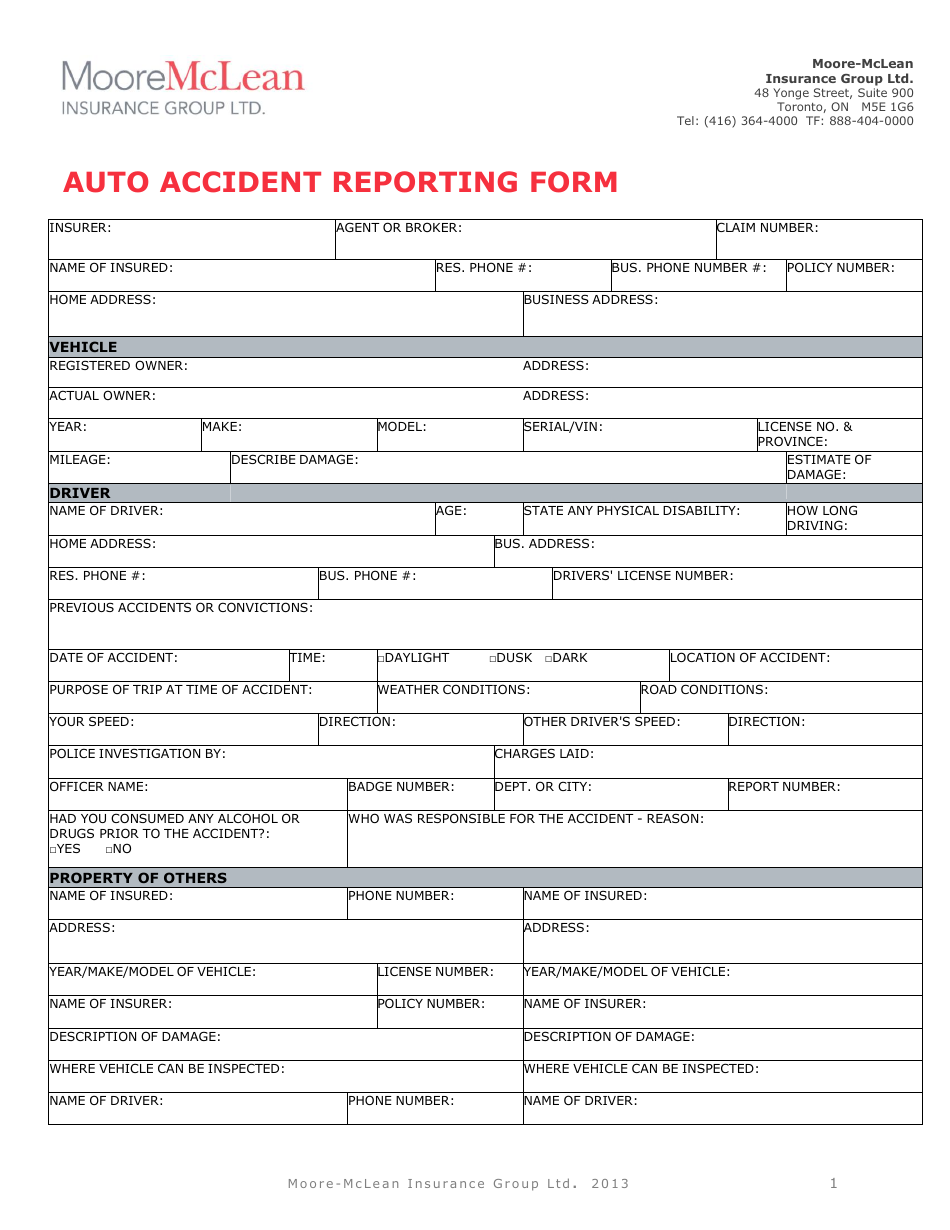

Auto Accident Reporting Form Mclean Hallmark Insurance From templateroller.com

Auto Accident Reporting Form Mclean Hallmark Insurance From templateroller.com

Insurance companies also look at whether you�ve filed car insurance claims in the past and what those claims were for. If you frequently file claims, you will likely be charged a higher rate. If your vehicle is the only thing damaged, there are no injuries, and you think the cost of repairs will be less than your deductible amount, then you should consider paying out of pocket to fix your car instead of filing a claim. But even if you don�t think you�ll file a claim, you. Then you can get the car repaired yourself and keep it. When you get injured in a car accident, you generally need to report the accident to your insurance company.

If you frequently file claims, you will likely be charged a higher rate.

Will insurance cover a single vehicle accident? Is the cost of your claim substantially larger than your deductible? Car accidents can also happen whilst you are driving a work vehicle, whether during the course or work or at other times. 4 scenarios where you should file an accident claim. If the damage is minimal and the repairs will cost less than your deductible, then it. The average injury liability claim was $17,024 in 2015, according to iso.

Work vehicle car crash claims. For example, you swerve to avoid an animal in the roadway and you end up hitting a fire hydrant or slamming into a building. When you get injured in a car accident, you generally need to report the accident to your insurance company. As with any other car accident claim you will still need to show was responsible for the accident. As with almost all liability insurance policies, auto insurance policies contain provisions that limit liability.

Source: carinsurance.arrivealive.co.za

Source: carinsurance.arrivealive.co.za

If you collided with an object or an animal, like a tree, a guardrail or a deer, or if you had a rollover accident, collision coverage should pay for the damage to your car. Work vehicle car crash claims. Filing a claim requires that the driver properly document the accident, get their vehicle inspected, and report it to the local authorities. 4 scenarios where you should file an accident claim. Your collision insurance will pay for.

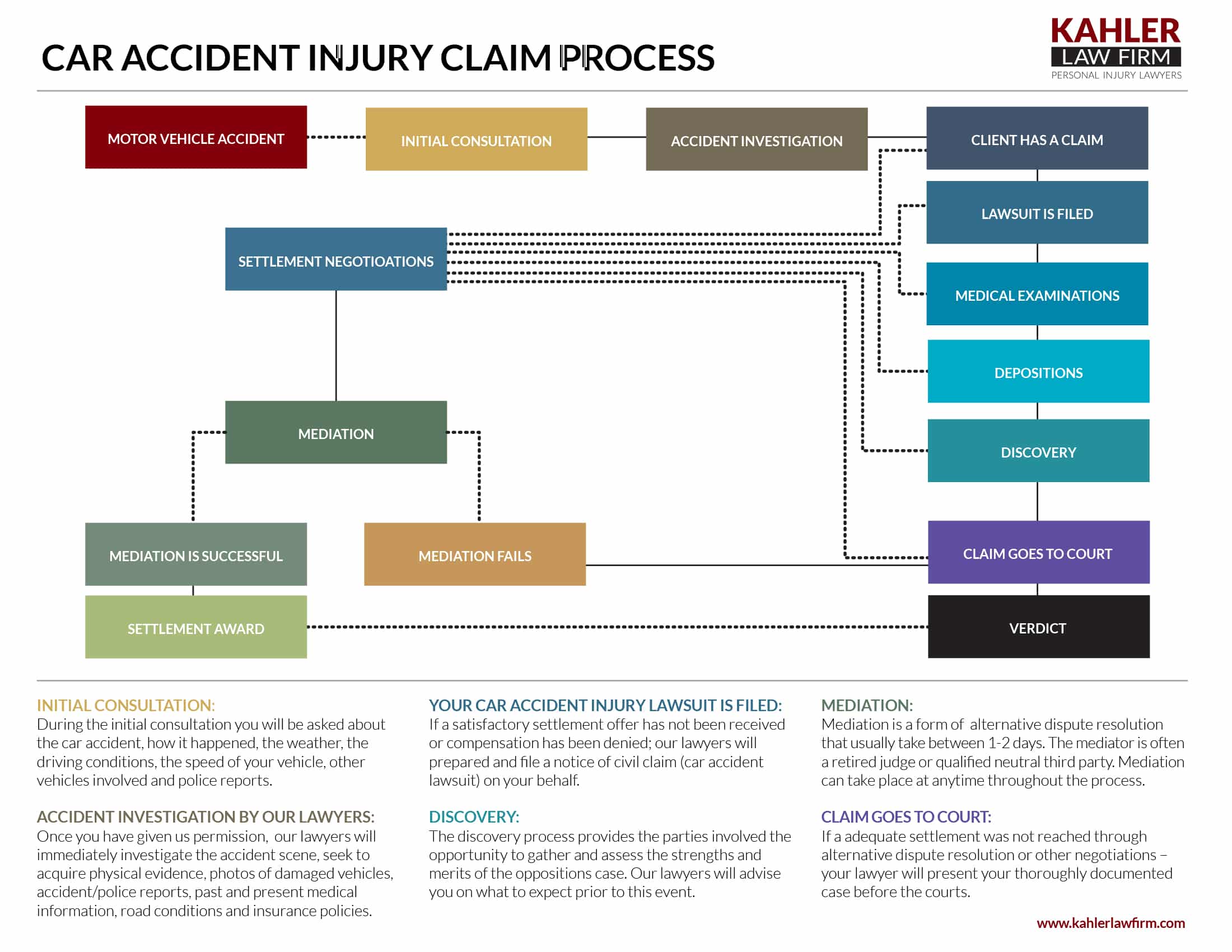

Source: kahlerlawfirm.com

Source: kahlerlawfirm.com

Should i file an insurance claim for a single car accident? Not only is this necessary in order to obtain coverage for your losses, but it can also. Minor damage to older cars. If you collided with an object or an animal, like a tree, a guardrail or a deer, or if you had a rollover accident, collision coverage should pay for the damage to your car. Filing a single car accident insurance claim.

Source: mcintyrelaw.com

Source: mcintyrelaw.com

4 scenarios where you should file an accident claim. Let your insurer handle it. If it is, and you have collision coverage, you’ll want to file a claim. Your collision insurance will pay for. Filing a claim requires that the driver properly document the accident, get their vehicle inspected, and report it to the local authorities.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Skip to first unread message. As with almost all liability insurance policies, auto insurance policies contain provisions that limit liability. Minor damage to older cars. Will insurance cover a single vehicle accident? If the damage to your car likely costs less than your deductible and no one else was involved, you don’t need to file an auto insurance claim as your insurer will not make a claim payment.

Source: dreamstime.com

Source: dreamstime.com

A liability policy will pay for damage caused to property or a pedestrian that a driver hits, but. Your insurance company’s policy will ultimately decide if and whether any damage or medical payments are covered based on your coverages, your insurance company’s. 4 scenarios where you should file an accident claim. If you collided with an object or an animal, like a tree, a guardrail or a deer, or if you had a rollover accident, collision coverage should pay for the damage to your car. One of the most common situations i see involve mom or dad driving the.

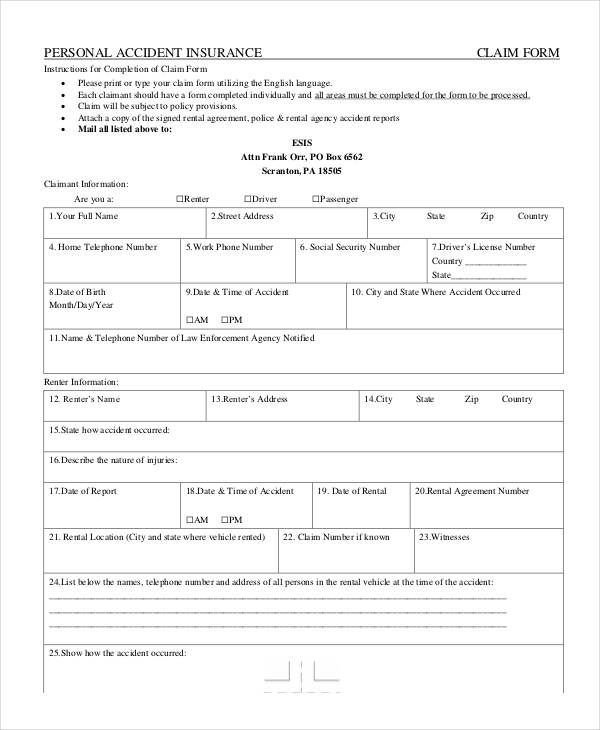

Source: sampleforms.com

Source: sampleforms.com

In such cases, you should still be able to make a car accident claim. If the other vehicle involved in the accident does not have insurance, you may claim under the mandatory uninsured motorist coverage of your policy. Minor damage to older cars. Your insurance company’s policy will ultimately decide if and whether any damage or medical payments are covered based on your coverages, your insurance company’s. Then you can get the car repaired yourself and keep it.

But even if you don�t think you�ll file a claim, you. Skip to first unread message. If the damage is minimal and the repairs will cost less than your deductible, then it. Insurance companies also look at whether you�ve filed car insurance claims in the past and what those claims were for. Car accidents can also happen whilst you are driving a work vehicle, whether during the course or work or at other times.

Source: es.slideshare.net

Source: es.slideshare.net

If the other vehicle involved in the accident does not have insurance, you may claim under the mandatory uninsured motorist coverage of your policy. Your rates may increase by $137.75/mo on average, depending on the damages. There are many situations in which a personal injury claim can be made in a single car crash. The damage to your car is severe and expensive. As with almost all liability insurance policies, auto insurance policies contain provisions that limit liability.

Source: dreamstime.com

Source: dreamstime.com

Filing a claim requires that the driver properly document the accident, get their vehicle inspected, and report it to the local authorities. If it is, and you have collision coverage, you’ll want to file a claim. If you do claim on your insurance and your car is declared a write off, you could ask the insurance company how they work. Single car accident insurance claim. If your vehicle is the only thing damaged, there are no injuries, and you think the cost of repairs will be less than your deductible amount, then you should consider paying out of pocket to fix your car instead of filing a claim.

Source: dreamstime.com

Source: dreamstime.com

Insurance companies also look at whether you�ve filed car insurance claims in the past and what those claims were for. The following summary provides a brief explanation of what these claims may be and the insurance coverage that may apply to a particular accident. You may be held at fault for the accident, but if you can prove the collision was the result of someone else�s. Let your insurer handle it. The damage to your car is severe and expensive.

Source: directasia.co.th

Source: directasia.co.th

Your collision insurance will pay for. The damage to your car is severe and expensive. This provides a maximum amount that can be provided in case of a single “accident” or “occurrence.”. If your vehicle is the only thing damaged, there are no injuries, and you think the cost of repairs will be less than your deductible amount, then you should consider paying out of pocket to fix your car instead of filing a claim. Skip to first unread message.

Source: slideshare.net

Source: slideshare.net

You may be held at fault for the accident, but if you can prove the collision was the result of someone else�s. Filing a single car accident insurance claim. While the most common car accidents involve two or more vehicles, there are times when an accident involves only your car. But even if you don�t think you�ll file a claim, you. While a general summary of insurance claims or coverage can never be applied across the board, it is important to understand that multiple claims may arise from a single motor vehicle accident.

Source: imoney.my

Source: imoney.my

If the damage to your car is significant or more than the cost of your deductible, it may make sense to file a claim with your insurer. Will insurance cover a single vehicle accident? For example, you swerve to avoid an animal in the roadway and you end up hitting a fire hydrant or slamming into a building. Let your insurer handle it. Is the cost of your claim substantially larger than your deductible?

Source: takemycounsel.com

Source: takemycounsel.com

If it is, and you have collision coverage, you’ll want to file a claim. Your car might have hidden damage. In such cases, you should still be able to make a car accident claim. Minor damage to older cars. A liability policy will pay for damage caused to property or a pedestrian that a driver hits, but.

Source: templateroller.com

Source: templateroller.com

As with almost all liability insurance policies, auto insurance policies contain provisions that limit liability. If the damage is minimal and the repairs will cost less than your deductible, then it. While a general summary of insurance claims or coverage can never be applied across the board, it is important to understand that multiple claims may arise from a single motor vehicle accident. If you frequently file claims, you will likely be charged a higher rate. Filing a single car accident insurance claim.

Source: quoteinspector.com

Source: quoteinspector.com

There are many situations in which a personal injury claim can be made in a single car crash. Your collision insurance will pay for. Your rates may increase by $137.75/mo on average, depending on the damages. The following summary provides a brief explanation of what these claims may be and the insurance coverage that may apply to a particular accident. If it is, and you have collision coverage, you’ll want to file a claim.

Source: slideshare.net

Source: slideshare.net

There are many situations in which a personal injury claim can be made in a single car crash. We recommend filing a claim if your accident meets these criteria: One of the most common situations i see involve mom or dad driving the. Car accidents can also happen whilst you are driving a work vehicle, whether during the course or work or at other times. If it is, and you have collision coverage, you’ll want to file a claim.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title single car accident insurance claim by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information