Single member llc insurance information

Home » Trend » Single member llc insurance informationYour Single member llc insurance images are available in this site. Single member llc insurance are a topic that is being searched for and liked by netizens today. You can Get the Single member llc insurance files here. Find and Download all free photos.

If you’re searching for single member llc insurance pictures information connected with to the single member llc insurance interest, you have visit the ideal blog. Our website always provides you with suggestions for seeing the maximum quality video and picture content, please kindly search and locate more informative video articles and images that fit your interests.

Single Member Llc Insurance. Insure your business online in 5 mins! Each of these options impacts your company’s options for health insurance. It is as if the holding company and its operating subsidiaries were a single company. Ad get general liability insurance for llc.

SingleMember LLCs & Workers� Compensation Insurance From pieinsurance.com

SingleMember LLCs & Workers� Compensation Insurance From pieinsurance.com

Companies that do work in the agricultural industry must get worker’s compensation if they have at least. A single member llc (smllc) is simply a limited liability company that has only one member. I have a single member llc. I pay a medical clinic $50 per employee and $50 for the llc member. That means if the only member is an individual, all of the income and expenses of a business. Can llc owners deduct health insurance?

Daigle & travers recommends that all single member llcs that would like to carry workers compensation for.

Again, to be treated by the irs as a corporation, the smllc has to file the form 8832 and elect to be classified as a corporation. According to florida law, companies are required to have workers compensation insurance depending on the industry that they do work in and how many employees they have. $50,000 for reputational harm claims (i.e., slander or libel) source: Single member llcs in the construction industry need worker’s compensation insurance. Instead, the lone member of the llc manages and owns everything, regardless of the fact that the assets involved are legally listed as belonging to the llc. Each of these options impacts your company’s options for health insurance.

Source: journal.firsttuesday.us

Source: journal.firsttuesday.us

Check your state�s requirements to see if your profession requires you to have. Daigle & travers recommends that all single member llcs that would like to carry workers compensation for. A single member llc (smllc) can be either a corporation or a single member “disregarded entity”. Check your state�s requirements to see if your profession requires you to have. Ad get general liability insurance for llc.

Source: llcoperatingagreements.org

Source: llcoperatingagreements.org

This is a big change from how connecticut used to treat workers compensation policies. According to florida law, companies are required to have workers compensation insurance depending on the industry that they do work in and how many employees they have. Therefore, the captive had only one insured for purposes of determining risk distribution, and the arrangement did not qualify as insurance for tax purposes. Insure your business online in 5 mins! Check your state�s requirements to see if your profession requires you to have.

Source: blog.freelancersunion.org

Source: blog.freelancersunion.org

$30,000 for property damage or accident claims; Ad get general liability insurance for llc. That means if the only member is an individual, all of the income and expenses of a business. $30,000 for property damage or accident claims; Again, to be treated by the irs as a corporation, the smllc has to file the form 8832 and elect to be classified as a corporation.

Source: paramythia.info

Source: paramythia.info

Effective july 25 th 2019, members of a single member llc that currently carry workers compensation insurance will now be automatically included on their policies. There are no innocent parties to protect when an smllc is involved. If you are a shareholder in an llc taxed as an s corporation, you can deduct health insurance premiums as long as you own at least 2 percent of the company’s shares and receive a salary from the company. Can llc owners deduct health insurance? Therefore, the captive had only one insured for purposes of determining risk distribution, and the arrangement did not qualify as insurance for tax purposes.

Source: qbalance.com

Source: qbalance.com

However, you might choose to obtain coverage once you see what workers’ compensation insurance can do to. The single member limited liability companies are disregarded entities for tax purposes. A business entity not recognized by the irs and is automatically treated as a sole proprietorship and reported on sch. $50,000 for reputational harm claims (i.e., slander or libel) source: Therefore, the captive had only one insured for purposes of determining risk distribution, and the arrangement did not qualify as insurance for tax purposes.

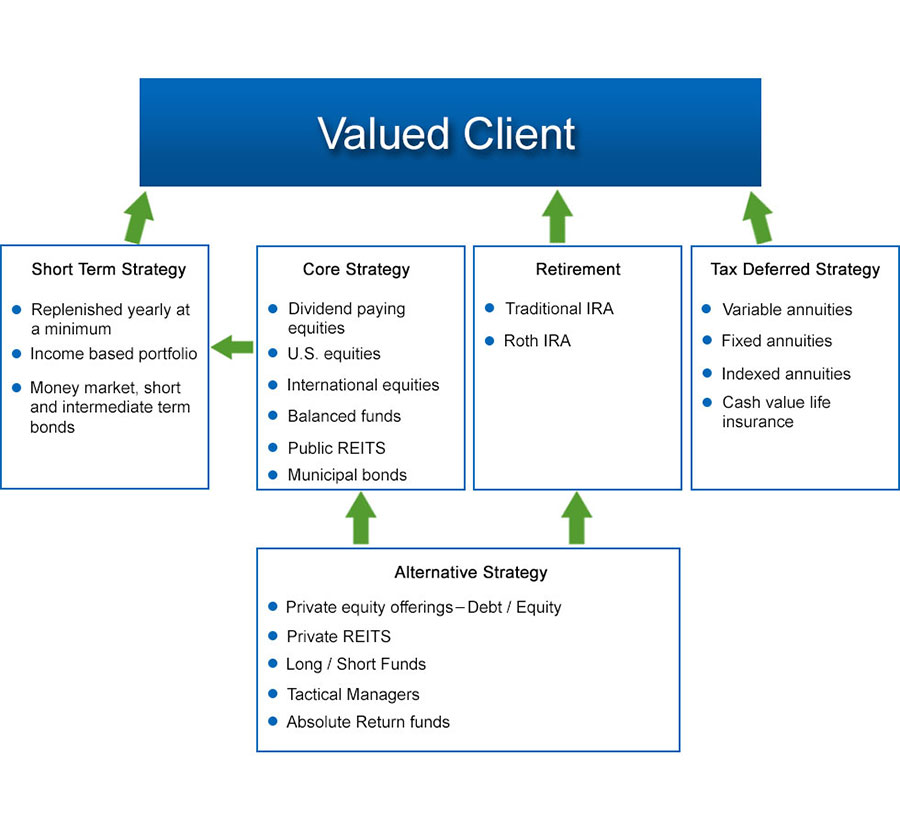

Source: summitwealthpartners.com

Source: summitwealthpartners.com

Each of these options impacts your company’s options for health insurance. A single member llc (smllc) can be either a corporation or a single member “disregarded entity”. Again, to be treated by the irs as a corporation, the smllc has to file the form 8832 and elect to be classified as a corporation. Instead, the lone member of the llc manages and owns everything, regardless of the fact that the assets involved are legally listed as belonging to the llc. Ad get general liability insurance for llc.

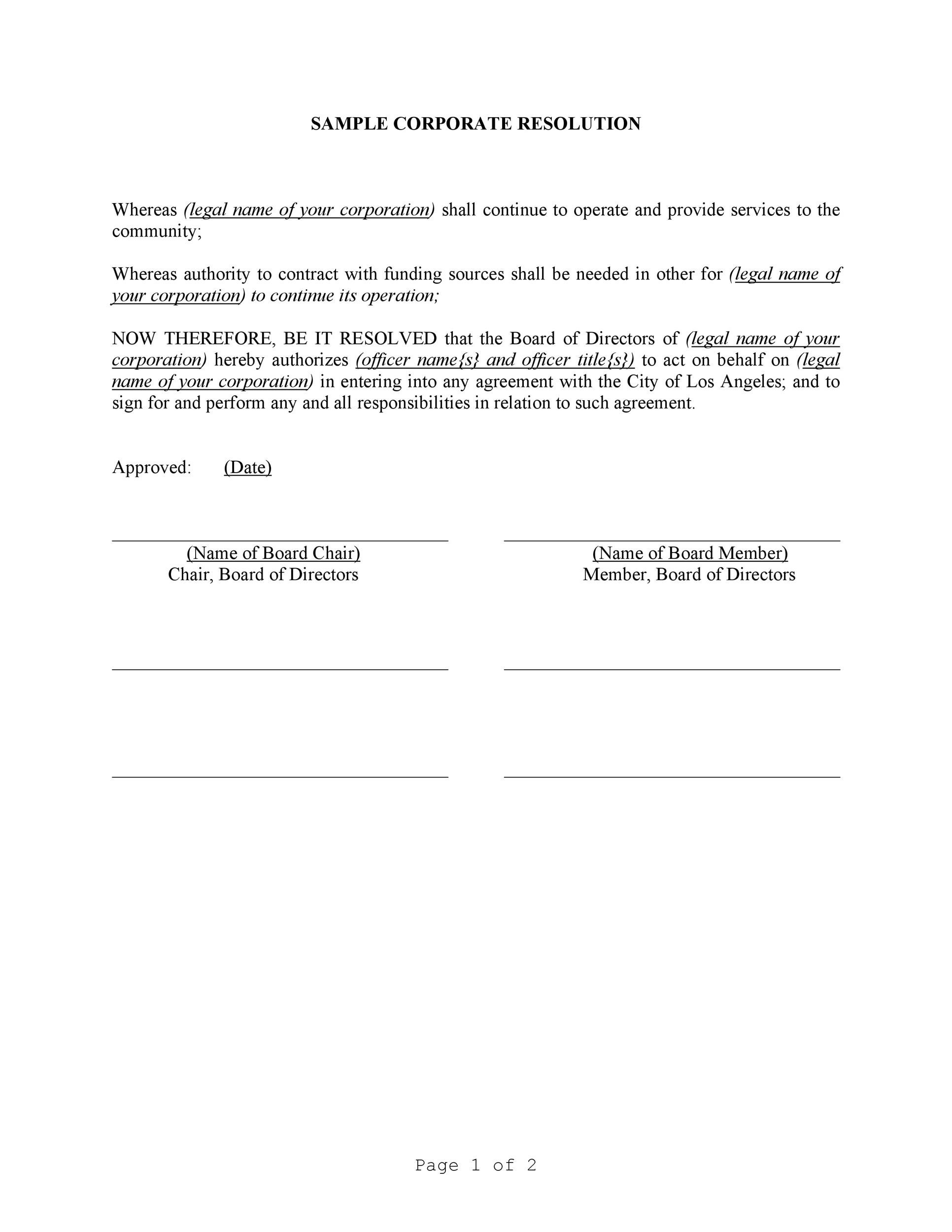

Source: 4allcontracts.com

A single member limited liability company (smllc) is an llc with just one voting member—you, the llc owner. $50,000 for reputational harm claims (i.e., slander or libel) source: If you are a shareholder in an llc taxed as an s corporation, you can deduct health insurance premiums as long as you own at least 2 percent of the company’s shares and receive a salary from the company. A single member llc (smllc) is simply a limited liability company that has only one member. A single member limited liability company (smllc) is an llc with just one voting member—you, the llc owner.

Source: berkshirerealtors.net

Source: berkshirerealtors.net

$30,000 for property damage or accident claims; A single member llc (smllc) can be either a corporation or a single member “disregarded entity”. Companies that do work in the agricultural industry must get worker’s compensation if they have at least. Insure your business online in 5 mins! It is as if the holding company and its operating subsidiaries were a single company.

Source: ultimateestateplanner.com

Source: ultimateestateplanner.com

A business entity not recognized by the irs and is automatically treated as a sole proprietorship and reported on sch. Daigle & travers recommends that all single member llcs that would like to carry workers compensation for. I have a single member llc. $30,000 for property damage or accident claims; If you are a shareholder in an llc taxed as an s corporation, you can deduct health insurance premiums as long as you own at least 2 percent of the company’s shares and receive a salary from the company.

Source: pieinsurance.com

Source: pieinsurance.com

Ad handyman, carpenter, landscaper, electrician, hvac, painter & more. Companies that do work in the agricultural industry must get worker’s compensation if they have at least. $30,000 for property damage or accident claims; Insure your business online in 5 mins! There are no innocent parties to protect when an smllc is involved.

Source: pdffiller.com

Source: pdffiller.com

However, you might choose to obtain coverage once you see what workers’ compensation insurance can do to. Daigle & travers recommends that all single member llcs that would like to carry workers compensation for. Effective july 25 th 2019, members of a single member llc that currently carry workers compensation insurance will now be automatically included on their policies. I have a single member llc. Can llc owners deduct health insurance?

Source: pieinsurance.com

Source: pieinsurance.com

Check your state�s requirements to see if your profession requires you to have. Companies that do work in the agricultural industry must get worker’s compensation if they have at least. Daigle & travers recommends that all single member llcs that would like to carry workers compensation for. I have a single member llc. Whether they have a single owner or many, all llcs come with liability protection.

Source: bawangmerahjugabawangputih.blogspot.com

Source: bawangmerahjugabawangputih.blogspot.com

Daigle & travers recommends that all single member llcs that would like to carry workers compensation for. Ad get general liability insurance for llc. The average price of a standard $1,000,000/$2,000,000 general liability insurance policy for small limited liability companies ranges from $27 to $49 per month based on location, size, payroll, sales and experience. Can llc owners deduct health insurance? If you are a shareholder in an llc taxed as an s corporation, you can deduct health insurance premiums as long as you own at least 2 percent of the company’s shares and receive a salary from the company.

Source: selectclouds.blogspot.com

Source: selectclouds.blogspot.com

Can llc owners deduct health insurance? Single member llcs in the construction industry need worker’s compensation insurance. A single member llc (smllc) can be either a corporation or a single member “disregarded entity”. A single member limited liability company (smllc) is an llc with just one voting member—you, the llc owner. Each of these options impacts your company’s options for health insurance.

Source: pdffiller.com

Source: pdffiller.com

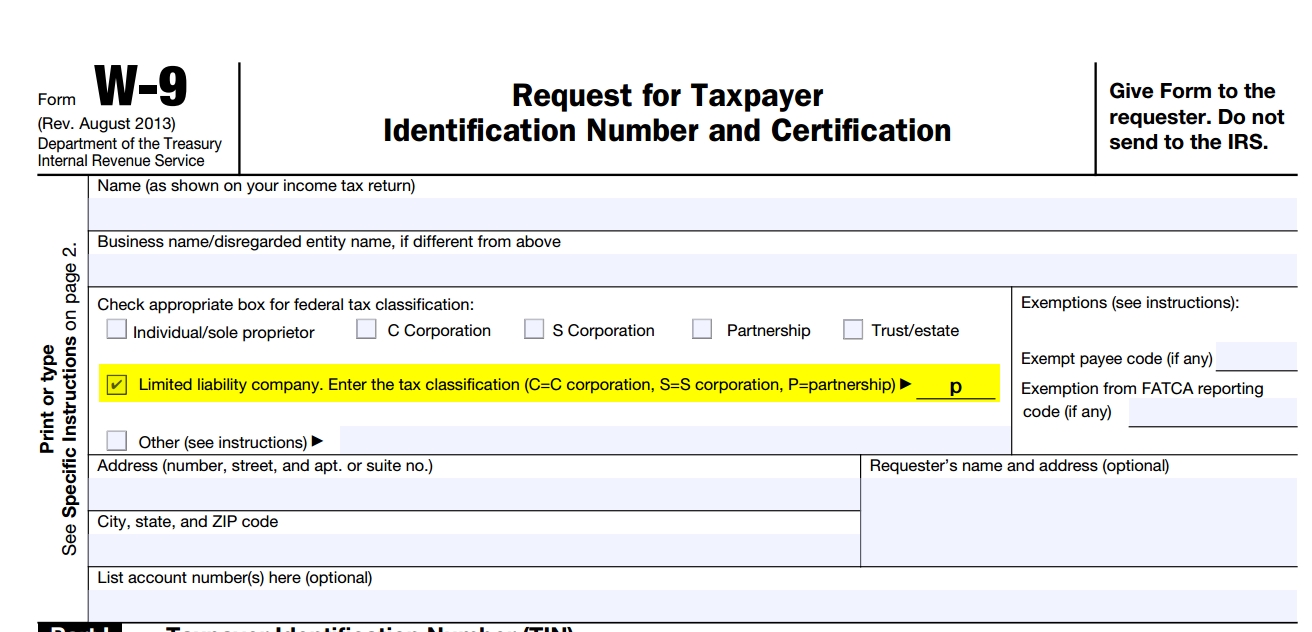

Ad handyman, carpenter, landscaper, electrician, hvac, painter & more. I pay a medical clinic $50 per employee and $50 for the llc member. It should use the name and tin of the single member owner for federal tax purposes. Again, to be treated by the irs as a corporation, the smllc has to file the form 8832 and elect to be classified as a corporation. Can llc owners deduct health insurance?

Source: lawgroupnwa.com

Source: lawgroupnwa.com

There are no innocent parties to protect when an smllc is involved. The single member limited liability companies are disregarded entities for tax purposes. A single member llc (smllc) can be either a corporation or a single member “disregarded entity”. Insure your business online in 5 mins! I have a single member llc.

Source: llcoperatingagreements.org

Source: llcoperatingagreements.org

Each of these options impacts your company’s options for health insurance. Each of these options impacts your company’s options for health insurance. A single member llc (smllc) is simply a limited liability company that has only one member. Again, to be treated by the irs as a corporation, the smllc has to file the form 8832 and elect to be classified as a corporation. Ad get general liability insurance for llc.

Source: tunstallorg.com

Source: tunstallorg.com

$50,000 for reputational harm claims (i.e., slander or libel) source: Whether they have a single owner or many, all llcs come with liability protection. $50,000 for reputational harm claims (i.e., slander or libel) source: A single member llc (smllc) is simply a limited liability company that has only one member. Can llc owners deduct health insurance?

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title single member llc insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information