Sipc insurance vs fdic Idea

Home » Trending » Sipc insurance vs fdic IdeaYour Sipc insurance vs fdic images are available in this site. Sipc insurance vs fdic are a topic that is being searched for and liked by netizens now. You can Find and Download the Sipc insurance vs fdic files here. Find and Download all royalty-free photos and vectors.

If you’re searching for sipc insurance vs fdic pictures information linked to the sipc insurance vs fdic topic, you have visit the ideal blog. Our website frequently provides you with hints for seeing the maximum quality video and image content, please kindly surf and locate more enlightening video content and images that fit your interests.

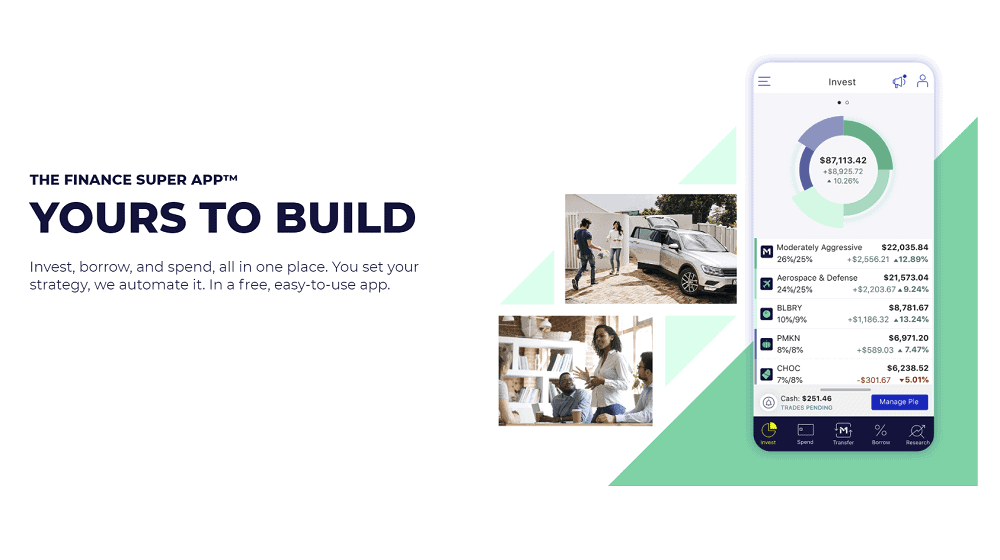

Sipc Insurance Vs Fdic. Both the fdic and sipc are independent agencies created by congress to protect americans’ money. Here are a few key differences between the two entities: It’s insurance against the failure of the financial institution itself. The key difference between fdic insurance and sipc protection at the end of the day, the key difference between fdic vs.

How M1 Finance�s FDIC and SIPC Insurance Covers You From youngandtheinvested.com

How M1 Finance�s FDIC and SIPC Insurance Covers You From youngandtheinvested.com

Sipc is similar but it protects your investments in the event of the failure or fraud of a brokerage firm. Here are some examples of what your coverage may look like, depending on whether you’re single or married and what type of accounts you have. The fdic insurance limit is $250,000 per person, per bank, per ownership category. The limits cover $500,000 in total value per customer, while. When a brokerage is closed due to a bankruptcy or other reason and investor’s securities are missing. Sipc insurance covers assets and cash in a brokerage account up to a certain amount;

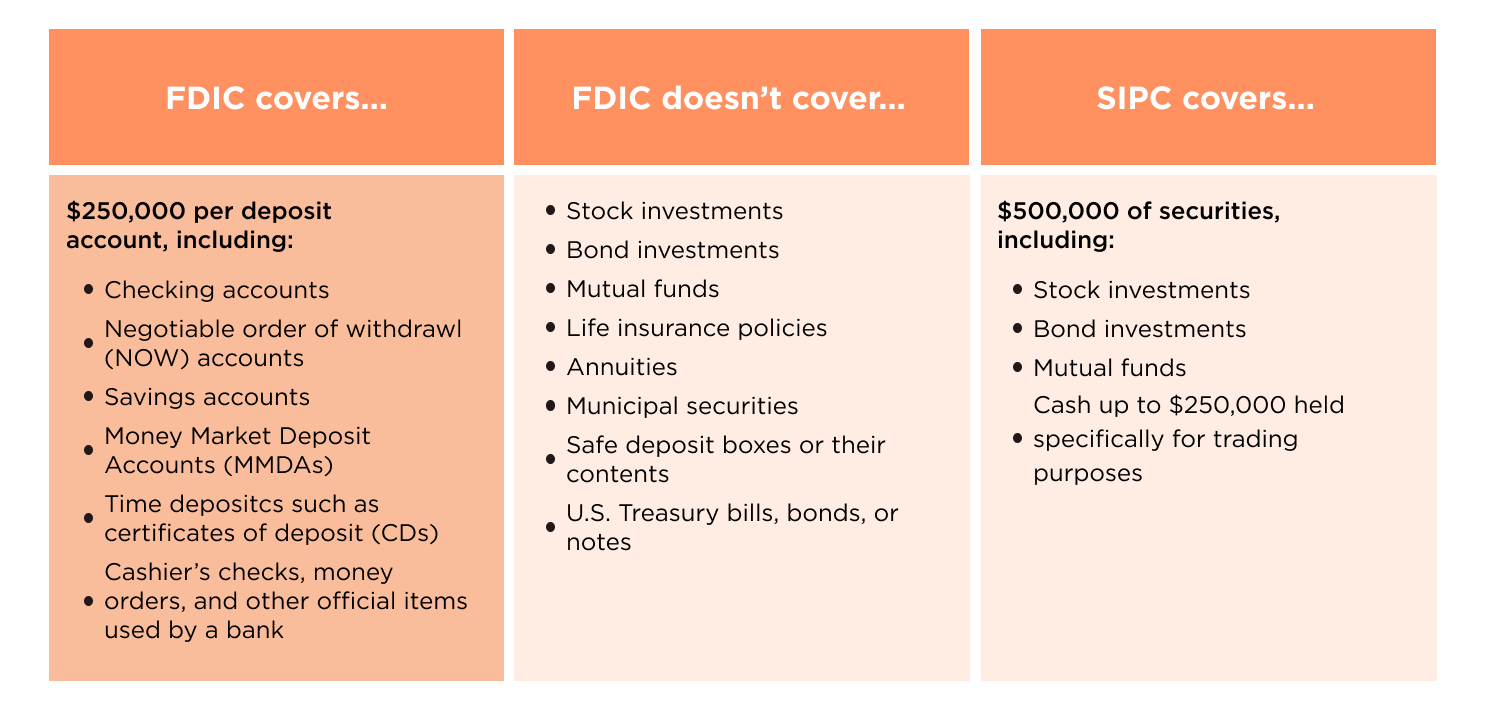

Fdic is an independent agency created by congress.

So, any investment firm or institution that offers sipc insurance helps fund the sipc. Sipc stands for the securities investor protection corporation. The fdic was created by congress in 1933 to maintain stability and public confidence in the united states’ financial system. If a financial institution fails, the fdic will replace consumers’ funds to the dollar up to $250,000, plus interest. Fdic stands for the federal deposit insurance corporation. For perspective, sipc only had two new cases between 2014 and 2020 the place they needed to get entangled as a result of shopper property weren’t totally obtainable.

Source: youngandtheinvested.com

Source: youngandtheinvested.com

The first difference between fdic insurance and sipc insurance is that they’re administered by different agencies. Sipc insurance covers assets and cash in a brokerage account up to a certain amount; It protects your securities up to $500,000 in total value per customer, of which $250,000 can be cash (either from selling securities or for buying them). The fdic is an independent federal agency created after catastrophic bank failures in the early 20th century. If a brokerage fails, you’re.

Source: brex.com

Source: brex.com

It will not protect you against declines in the market. It offers deposit insurance, supervises and examines banks for safety and customer protections, and manages receiverships (aka bankruptcies). Both the fdic and sipc are independent agencies created by congress to protect americans’ money. Sipc insurance protects the assets in brokerage accounts. The limits cover $500,000 in total value per customer, while.

Source: chiefmomofficer.org

Source: chiefmomofficer.org

Just like how the fdic insures bank deposits in the event of a bank failure, sipc insures investment accounts in the event of a failure. Sipc is similar but it protects your investments in the event of the failure or fraud of a brokerage firm. Unlike the fdic, sipc does not provide blanket coverage. The federal deposit insurance corporation (fdic) is an independent agency that began in 1933 in response to the bank failures. If a brokerage fails, you’re.

Source: marcus.com

Source: marcus.com

If a brokerage fails, you’re. Like fdic insurance, sipc has a limit on the amount of coverage offered. If a financial institution fails, the fdic will replace consumers’ funds to the dollar up to $250,000, plus interest. The limit is $250,000 per depositor per each insured bank, for each account ownership category. The sipc covers up to $500,000 per customer, while the fdic protects up to $250,000.

Source: marketrealist.com

Source: marketrealist.com

The key difference between fdic insurance and sipc protection at the end of the day, the key difference between fdic vs. The key difference between fdic insurance and sipc protection at the end of the day, the key difference between fdic vs. The limit is $250,000 per depositor per each insured bank, for each account ownership category. Fdic is an independent agency created by congress. The agency is concerned with the potential loss of deposit accounts, such as checking and savings accounts, money market deposit accounts and certificates of deposit.

Source: vn-parco.com

Source: vn-parco.com

The limits cover $500,000 in total value per customer, while. Like fdic insurance, sipc has a limit on the amount of coverage offered. It’s insurance against the failure of the financial institution itself. The agency is concerned with the potential loss of deposit accounts, such as checking and savings accounts, money market deposit accounts and certificates of deposit. If a financial institution fails, the fdic will replace consumers’ funds to the dollar up to $250,000, plus interest.

Source: investingsimple.com

Source: investingsimple.com

The differences between the two. The securities investor protection corporation (sipc) is a nonprofit membership corporation that was created by federal statute in 1970. For perspective, sipc only had two new cases between 2014 and 2020 the place they needed to get entangled as a result of shopper property weren’t totally obtainable. Fdic and ncua generally cover bank deposits up to $250,000 per account holder, per bank, per ownership category. Here are some examples of what your coverage may look like, depending on whether you’re single or married and what type of accounts you have.

Source: finance.yahoo.com

Source: finance.yahoo.com

The securities investor protection corporation (sipc) is a nonprofit membership corporation that was created by federal statute in 1970. Fdic vs sipc insurance explained. You’ll be able to see a full list of everything covered by sipc insurance here. This coverage is limited to $500,000 in total value per customer, of which $250,000 can be cash (either from selling securities or for buying them). Sipc insurance covers assets and cash in a brokerage account up to a certain amount;

Source: gobankingrates.com

Source: gobankingrates.com

However, fdic insurance does not cover the following: If a financial institution fails, the fdic will replace consumers’ funds to the dollar up to $250,000, plus interest. Both the fdic and sipc also adhere to coverage limits, with coverage amounts differing under the two agencies. Fdic stands for the federal deposit insurance corporation. The key difference between fdic insurance and sipc protection at the end of the day, the key difference between fdic vs.

Source: avocadoughtoast.com

Source: avocadoughtoast.com

It’s insurance against the failure of the financial institution itself. At a high level, you can think of fdic and ncua as providing insurance for banking products, and sipc as providing protection for funds held in a brokerage account in the event that the brokerage fails. The agency is concerned with the potential loss of deposit accounts, such as checking and savings accounts, money market deposit accounts and certificates of deposit. The fdic is an independent federal agency created after catastrophic bank failures in the early 20th century. Both the fdic and sipc are independent agencies created by congress to protect americans’ money.

Source: lovewordssss.blogspot.com

Source: lovewordssss.blogspot.com

The federal deposit insurance corporation (fdic) is an independent agency that began in 1933 in response to the bank failures. Fdic is an independent agency created by congress. Fdic insurance protects your assets in a bank account (checking or savings). However, fdic insurance does not cover the following: The fdic is an independent federal agency created after catastrophic bank failures in the early 20th century.

Source: marcus.com

Source: marcus.com

The agency is concerned with the potential loss of deposit accounts, such as checking and savings accounts, money market deposit accounts and certificates of deposit. The federal deposit insurance corporation (fdic for short) was founded in 1933 as an independent agency of the u.s. The two types of coverage work very differently. Coverage is up to $500,000 per customer for all accounts. Sipc (securities investor protection corporation) insurance covers your assets in a brokerage account.

Source: getsqwire.com

Source: getsqwire.com

Sipc insurance, on the other hand, protects your assets in a brokerage account. Fdic insures your bank savings up to $250,000 (per depositor, per bank) in the event that the bank fails. It sounds like something out of a movie, but banks can fail. What is the difference between fdic and sipc insurance? The fdic insurance limit is $250,000 per person, per bank, per ownership category.

Source: finance.yahoo.com

Source: finance.yahoo.com

The key difference between fdic insurance and sipc protection at the end of the day, the key difference between fdic vs. For perspective, sipc only had two new cases between 2014 and 2020 the place they needed to get entangled as a result of shopper property weren’t totally obtainable. Fdic is an independent agency created by congress. It’s insurance against the failure of the financial institution itself. The federal deposit insurance corporation (fdic) is an independent agency that began in 1933 in response to the bank failures.

Source: brex.com

Source: brex.com

Sipc stands for the securities investor protection corporation. The first difference between fdic insurance and sipc insurance is that they’re administered by different agencies. At the end of the day, the key difference between fdic vs. The fdic was created by congress in 1933 to maintain stability and public confidence in the united states’ financial system. It sounds like something out of a movie, but banks can fail.

Source: ally.com

Source: ally.com

Like fdic insurance, sipc has a limit on the amount of coverage offered. Sipc insurance, on the other hand, protects your assets in a brokerage account. The key difference between fdic insurance and sipc protection. If your bank has fdic insurance, the standard insurance amount is $250,000 per depositor, per insured bank, for each account ownership category; You’ll be able to see a full list of everything covered by sipc insurance here.

Source: riaquueta45.blogspot.com

Source: riaquueta45.blogspot.com

Sipc (securities investor protection corporation) insurance covers your assets in a brokerage account. Here are a few key differences between the two entities: Both the fdic and sipc are independent agencies created by congress to protect americans’ money. That is why the government has an agency that protects customers, up to $250,000. It protects your securities up to $500,000 in total value per customer, of which $250,000 can be cash (either from selling securities or for buying them).

Source: lovewordssss.blogspot.com

Source: lovewordssss.blogspot.com

You’ll be able to see a full list of everything covered by sipc insurance here. In the case with sipc, accounts are insured up to $500,000 per account. Unlike the fdic, sipc does not provide blanket coverage. Fdic is an independent agency created by congress. The first difference between fdic insurance and sipc insurance is that they’re administered by different agencies.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title sipc insurance vs fdic by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information