Sir insurance meaning Idea

Home » Trend » Sir insurance meaning IdeaYour Sir insurance meaning images are ready in this website. Sir insurance meaning are a topic that is being searched for and liked by netizens today. You can Get the Sir insurance meaning files here. Download all free photos and vectors.

If you’re searching for sir insurance meaning images information connected with to the sir insurance meaning interest, you have come to the right site. Our website frequently gives you suggestions for seeing the maximum quality video and picture content, please kindly hunt and find more enlightening video articles and graphics that match your interests.

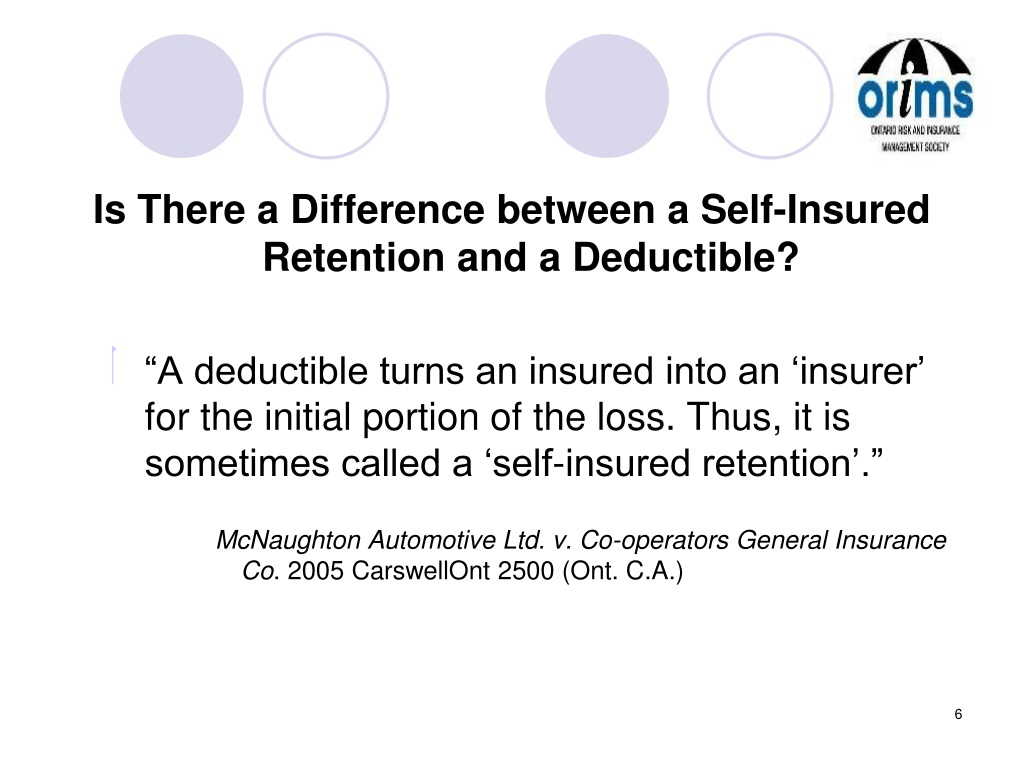

Sir Insurance Meaning. A bordereau is a report provided by an insurance company for a reinsurer that lists either assets that are insured or claims that have been made. In its function it is similar to an insurance deductible although each of the two concepts has its own distinguishing features. We call the party receiving compensation the. Understanding sir chris nash, technical support engineer eric bastow, senior technical support engineer indium corporation many electronics manufacturers perform sir testing to evaluate solder materials and sometimes the results they obtain differ significantly from those stated by the solder material provider.

Insurance for old cars? Page 4 From tsikot.com

Insurance for old cars? Page 4 From tsikot.com

Deductibles and self insured retentions (sir’s) are mechanisms which require the insured to bare a portion of a loss otherwise covered by an insurance policy. Sublimits are extra limitations in an insurance policy�s coverage of certain losses. A loss reserve is an estimation of the amount an insurer would need to pay for future claims on insurance policies it underwrites. Looking for the definition of sir? An asset (the premium to be paid by the policyholder) and a claim obligation (liability for a future claim). Thus, under a policy written with a self insured retention provision, the insured (rather than the insurer) would pay defense and/or indemnity costs associated with a claim until.

An archaic term rarely used anymore.)

American association of insurance services. An archaic term rarely used anymore.) A loss reserve is an estimation of the amount an insurer would need to pay for future claims on insurance policies it underwrites. An asset (the premium to be paid by the policyholder) and a claim obligation (liability for a future claim). While some view these terms as essentially being interchangeable due to their overall concept being similar, there are some key differences businesses should be aware of. By taking on the role of managing any smaller claims before their insurance policy coverage kicks in, companies can take an active role in managing the risks of their business.

Source: bdjls.org

Source: bdjls.org

(�sire� in this context would mean a respectful form of address for someone of a high social status, particularly a king. Contributing to national sira helps advance the global fight against financial crime and fraud. Asosiasi asuransi jiwa indonesia (indonesian: When underwriting a new policy, an insurance company takes into account two figures: Sublimits are extra limitations in an insurance policy�s coverage of certain losses.

Source: slideserve.com

Source: slideserve.com

An archaic term rarely used anymore.) Both sir and deductibles are used to keep premiums down. This is the amount of money that you are required to pay, per claim, before the insurance company will start paying. Thus, under a policy written with a self insured retention provision, the insured (rather than the insurer) would pay defense and/or indemnity costs associated with a claim until. An archaic term rarely used anymore.)

Source: slideshare.net

Source: slideshare.net

The company also compensates for illness, damage, or death. Life insurance association of indonesia) This is the amount of money that you are required to pay, per claim, before the insurance company will start paying. American association of insurance services. Conversely, large deductibles very often require that the insured provide a letter of credit or some other acceptable form of collateral to cover expected losses that occur within the deductible.

Source: youtube.com

Source: youtube.com

In sirs, because the insurer has no responsibility for paying losses until the sir is exhausted, there is no collateral requirement. This is the amount of money that you are required to pay, per claim, before the insurance company will start paying. Deductibles and self insured retentions (sir’s) are mechanisms which require the insured to bare a portion of a loss otherwise covered by an insurance policy. Conversely, large deductibles very often require that the insured provide a letter of credit or some other acceptable form of collateral to cover expected losses that occur within the deductible. Life insurance association of indonesia)

Source: sirdoggie.com

Source: sirdoggie.com

A bordereau is a report provided by an insurance company for a reinsurer that lists either assets that are insured or claims that have been made. A bordereau is a report provided by an insurance company for a reinsurer that lists either assets that are insured or claims that have been made. In sirs, because the insurer has no responsibility for paying losses until the sir is exhausted, there is no collateral requirement. The company also compensates for illness, damage, or death. In its function it is similar to an insurance deductible although each of the two concepts has its own distinguishing features.

Source: team-bhp.com

Sublimits are extra limitations in an insurance policy�s coverage of certain losses. National sira is regarded by many financial institutions and insurance companies as the default fraud detection and prevention solution. Contributing to national sira helps advance the global fight against financial crime and fraud. Asosiasi asuransi jiwa indonesia (indonesian: That is, they do not provide extra coverage, but set a maximum to cover a specific loss.

Source: firechoices.blogspot.com

Source: firechoices.blogspot.com

We call the party receiving compensation the. Insurance is an arrangement by which a company undertakes to compensate a person, property, company, or entity for a specific loss. Unlike your typical personal insurance experience, whereby a homeowner�s policy may include a per event deductible limit, the sir program is an aggregate deductible. A google search for the etymology or origin of the word �sir�, shows that it is a shortened form of the old english word �sire� and not an acronym. Sir, all acronyms, viewed february 16,.

Source: styrowing.com

Source: styrowing.com

While some view these terms as essentially being interchangeable due to their overall concept being similar, there are some key differences businesses should be aware of. Unlike your typical personal insurance experience, whereby a homeowner�s policy may include a per event deductible limit, the sir program is an aggregate deductible. American association of insurance services. 590 popular meanings of sir abbreviation: Life insurance association of indonesia)

Source: slideshare.net

Source: slideshare.net

National sira is regarded by many financial institutions and insurance companies as the default fraud detection and prevention solution. That is, they do not provide extra coverage, but set a maximum to cover a specific loss. National sira is regarded by many financial institutions and insurance companies as the default fraud detection and prevention solution. Sublimits can be expressed as a dollar amount or as a percentage of the coverage available. These shared challenges are impossible for any single organisation to crack on its own.

Source: tsikot.com

Source: tsikot.com

While some view these terms as essentially being interchangeable due to their overall concept being similar, there are some key differences businesses should be aware of. Sir, all acronyms, viewed february 16,. That is, they do not provide extra coverage, but set a maximum to cover a specific loss. American association of insurance services. 590 popular meanings of sir abbreviation:

Source: philippplein.us

Source: philippplein.us

That is, they do not provide extra coverage, but set a maximum to cover a specific loss. In its function it is similar to an insurance deductible although each of the two concepts has its own distinguishing features. In sirs, because the insurer has no responsibility for paying losses until the sir is exhausted, there is no collateral requirement. Sublimits can be expressed as a dollar amount or as a percentage of the coverage available. Both sir and deductibles are used to keep premiums down.

Source: spellcheck.net

Source: spellcheck.net

Sublimits are extra limitations in an insurance policy�s coverage of certain losses. This is the amount of money that you are required to pay, per claim, before the insurance company will start paying. In sirs, because the insurer has no responsibility for paying losses until the sir is exhausted, there is no collateral requirement. In its function it is similar to an insurance deductible although each of the two concepts has its own distinguishing features. (�sire� in this context would mean a respectful form of address for someone of a high social status, particularly a king.

Source: philippplein.us

Source: philippplein.us

These shared challenges are impossible for any single organisation to crack on its own. Although these two mechanisms are economically similar, they differ in significant respects and should not be used interchangeably. The company sets up a. Understanding sir chris nash, technical support engineer eric bastow, senior technical support engineer indium corporation many electronics manufacturers perform sir testing to evaluate solder materials and sometimes the results they obtain differ significantly from those stated by the solder material provider. Contributing to national sira helps advance the global fight against financial crime and fraud.

Source: leaseholdknowledge.com

Source: leaseholdknowledge.com

Contributing to national sira helps advance the global fight against financial crime and fraud. An asset (the premium to be paid by the policyholder) and a claim obligation (liability for a future claim). Sir, all acronyms, viewed february 16,. Thus, under a policy written with a self insured retention provision, the insured (rather than the insurer) would pay defense and/or indemnity costs associated with a claim until. These shared challenges are impossible for any single organisation to crack on its own.

Source: thetimes.co.uk

Source: thetimes.co.uk

Contributing to national sira helps advance the global fight against financial crime and fraud. Conversely, large deductibles very often require that the insured provide a letter of credit or some other acceptable form of collateral to cover expected losses that occur within the deductible. The company also compensates for illness, damage, or death. Sublimits can be expressed as a dollar amount or as a percentage of the coverage available. That is, they do not provide extra coverage, but set a maximum to cover a specific loss.

Source: slideserve.com

Source: slideserve.com

Thus, under a policy written with a self insured retention provision, the insured (rather than the insurer) would pay defense and/or indemnity costs associated with a claim until. In sirs, because the insurer has no responsibility for paying losses until the sir is exhausted, there is no collateral requirement. While some view these terms as essentially being interchangeable due to their overall concept being similar, there are some key differences businesses should be aware of. Although these two mechanisms are economically similar, they differ in significant respects and should not be used interchangeably. Both sir and deductibles are used to keep premiums down.

Source: mrunal.org

Source: mrunal.org

Conversely, large deductibles very often require that the insured provide a letter of credit or some other acceptable form of collateral to cover expected losses that occur within the deductible. While some view these terms as essentially being interchangeable due to their overall concept being similar, there are some key differences businesses should be aware of. When underwriting a new policy, an insurance company takes into account two figures: The company also compensates for illness, damage, or death. A google search for the etymology or origin of the word �sir�, shows that it is a shortened form of the old english word �sire� and not an acronym.

Source: philippplein.us

Source: philippplein.us

While some view these terms as essentially being interchangeable due to their overall concept being similar, there are some key differences businesses should be aware of. Understanding sir chris nash, technical support engineer eric bastow, senior technical support engineer indium corporation many electronics manufacturers perform sir testing to evaluate solder materials and sometimes the results they obtain differ significantly from those stated by the solder material provider. American association of insurance services. The company also compensates for illness, damage, or death. Asosiasi asuransi jiwa indonesia (indonesian:

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title sir insurance meaning by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information