Sleep apnea life insurance Idea

Home » Trend » Sleep apnea life insurance IdeaYour Sleep apnea life insurance images are available. Sleep apnea life insurance are a topic that is being searched for and liked by netizens now. You can Get the Sleep apnea life insurance files here. Download all free photos and vectors.

If you’re searching for sleep apnea life insurance images information related to the sleep apnea life insurance keyword, you have visit the ideal site. Our site always gives you hints for seeking the maximum quality video and picture content, please kindly surf and locate more enlightening video articles and images that fit your interests.

Sleep Apnea Life Insurance. Even if this man was unexpectedly diagnosed with cancer at age 45, he still would have coverage for only $28.26 per month. And affects more than 22,000,000 americans. Uncontrolled sleep apnea can lead to additional health risks , such as a high blood pressure, which can lead to heart disease. Here’s what to keep in mind to find a plan that will help you and your family sleep well at night.

What To Know About Sleep Apnea And Life Insurance CB From myfasttermquotes.com

What To Know About Sleep Apnea And Life Insurance CB From myfasttermquotes.com

When determining rates for life insurance, many factors are considered, such as age and medical conditions. One vital insurance area that is often overlooked by the sleep apnea patient is life insurance. It won’t automatically prevent you from obtaining life insurance, but it can play a role in the type of coverage you can buy. Here’s what to keep in mind to find a plan that will help you and your family sleep well at night. The best life insurance for sleep apnea sufferers often comes from one of a handful of carriers. If you’re living with sleep apnea, life insurance is still within reach.

If you’re living with sleep apnea, life insurance is still within reach.

If you have any questions about life insurance as an applicant with sleep apnea, please contact one of our agents today. Respiratory patterns chest muscle activity oxygenation The bad news is that most people with sleep apnea may suffer from other health conditions, as well, such as type 2 diabetes, obesity, or even heart problems. Sleep apnea is a common but serious medical condition that can make buying life insurance at cheap rates somewhat difficult. How sleep apnea affects your life insurance rates when you apply for life insurance with sleep apnea, you’ll be required to provide health records, complete a medical exam, and provide any pertinent information about your. Uncontrolled sleep apnea can lead to additional health risks , such as a high blood pressure, which can lead to heart disease.

Source: wholevstermlifeinsurance.com

Source: wholevstermlifeinsurance.com

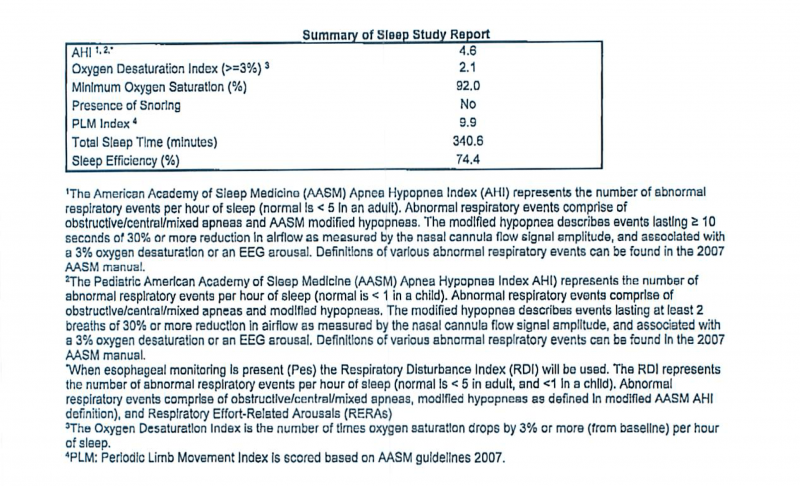

What type of sleep apnea you have. We are a group of independent insurance agents, which means that we don’t work with one single company. Can i qualify for coverage if i have sleep apnea? The price you will pay for life insurance is based on your polysomnogram test results and other medical risks. This includes the severity of your condition, your personal and medical history, the treatments you’ve had (including their results), and any other factors that could affect your risk level as a client.

Source: pinnaclequote.com

Source: pinnaclequote.com

The biggest thing that insurance companies want to see is that you are or have been taking steps to manage the condition. And, because sleep apnea can be managed effectively, there are a select few insurance companies that may offer extremely competitive rates. With some companies, you may even get preferred best rates. The key is demonstrating that your sleep apnea is controlled and you’re taking all the necessary steps to treat it. Even if this man was unexpectedly diagnosed with cancer at age 45, he still would have coverage for only $28.26 per month.

Source: pinterest.com

Source: pinterest.com

After the policy is active, the life insurance company cannot change the policy. Uncontrolled sleep apnea can lead to additional health risks , such as a high blood pressure, which can lead to heart disease. The price you will pay for life insurance is based on your polysomnogram test results and other medical risks. How sleep apnea affects your life insurance rates when you apply for life insurance with sleep apnea, you’ll be required to provide health records, complete a medical exam, and provide any pertinent information about your. Sleep apnea and life insurance.

Source: myfasttermquotes.com

Source: myfasttermquotes.com

As a result, if you have the condition and you need life insurance, you should work closely with a competent insurance agent. Even if this man was unexpectedly diagnosed with cancer at age 45, he still would have coverage for only $28.26 per month. When it comes to sleep apnea, you can get approved for life insurance. The quick answer is, yes, life insurance carriers will approve clients that have sleep apnea. The bad news is that most people with sleep apnea may suffer from other health conditions, as well, such as type 2 diabetes, obesity, or even heart problems.

Source: nomedicallifeinsurance.ca

Source: nomedicallifeinsurance.ca

With some companies, you may even get preferred best rates. The best life insurance for suffers of the condition of sleep apnea is usually a fully underwritten level term life insurance policy. As a result, if you have the condition and you need life insurance, you should work closely with a competent insurance agent. Life insurance and sleep apnea. But, the good news is that is highly treatable and can easily be controlled.

Source: myfasttermquotes.com

Source: myfasttermquotes.com

After the policy is active, the life insurance company cannot change the policy. Respiratory patterns chest muscle activity oxygenation After the policy is active, the life insurance company cannot change the policy. If you have sleep apnea and are applying for some form of life insurance, most companies will consider several factors to determine whether to approve your application. Buying life insurance if you have sleep apnea is possible;

Source: myfasttermquotes.com

Source: myfasttermquotes.com

If you’re living with sleep apnea, life insurance is still within reach. The best life insurance for sleep apnea sufferers often comes from one of a handful of carriers. Can i qualify for coverage if i have sleep apnea? It is arguably the central piece of most families’ financial plans, as this coverage protects mortgages, college plans, and overall standard of living. Life insurance companies take sleep apnea very serious.

Source: myfasttermquotes.com

Source: myfasttermquotes.com

Having sleep apnea won’t automatically disqualify you for life insurance, but it can affect your rates — especially if your condition is severe or you don’t follow your treatment plan. After the policy is active, the life insurance company cannot change the policy. Insurance companies view sleep apnea as a risk because it is relatively common in the u.s. Depending on how you are treating your condition and how severe it is, some insurance brokers say that you can get equitable coverage. Life insurance companies take sleep apnea very serious.

![Best Guide To Sleep Apnea Life Insurance [Updated] 2021 Best Guide To Sleep Apnea Life Insurance [Updated] 2021](https://myfasttermquotes.com/wp-content/uploads/2021/03/Sleep-Apnea-Life-Insurance.jpg) Source: myfasttermquotes.com

Source: myfasttermquotes.com

The bad news is that most people with sleep apnea may suffer from other health conditions, as well, such as type 2 diabetes, obesity, or even heart problems. Insurance company underwriting makes the final decision concerning rate class and/or policy approval. As a result, if you have the condition and you need life insurance, you should work closely with a competent insurance agent. Life insurance companies take sleep apnea very serious. How sleep apnea affects your life insurance rates when you apply for life insurance with sleep apnea, you’ll be required to provide health records, complete a medical exam, and provide any pertinent information about your.

Complex sleep apnea is a combination of symptoms from both central sleep apnea and obstructive sleep apnea. And affects more than 22,000,000 americans. Sleep apnea increases your insurance risk because, if left untreated, the disruptions to your sleep and breathing can lead to daytime sleepiness (and therefore injuries or accidents) and other potentially serious. Finding the right policy for you can be difficult if you�ve been diagnosed with sleep apnea. A policy that is written with an agent that is a life insurance specialist.

Source: pinnaclequote.com

Source: pinnaclequote.com

This includes the severity of your condition, your personal and medical history, the treatments you’ve had (including their results), and any other factors that could affect your risk level as a client. Depending on how you are treating your condition and how severe it is, some insurance brokers say that you can get equitable coverage. And, because sleep apnea can be managed effectively, there are a select few insurance companies that may offer extremely competitive rates. The best life insurance for suffers of the condition of sleep apnea is usually a fully underwritten level term life insurance policy. A policy that is written with an agent that is a life insurance specialist.

Source: pinnaclequote.com

Source: pinnaclequote.com

Respiratory patterns chest muscle activity oxygenation The price you will pay for life insurance is based on your polysomnogram test results and other medical risks. If you have well controlled sleep apnea and aren’t sure whether you have received a fair life insurance approval, call or email us. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Having sleep apnea won’t automatically disqualify you for life insurance, but it can affect your rates — especially if your condition is severe or you don’t follow your treatment plan.

Source: pinnaclequote.com

Source: pinnaclequote.com

It is arguably the central piece of most families’ financial plans, as this coverage protects mortgages, college plans, and overall standard of living. If you have well controlled sleep apnea and aren’t sure whether you have received a fair life insurance approval, call or email us. The quick answer is, yes, life insurance carriers will approve clients that have sleep apnea. If you have obstructive sleep apnea, life insurance underwriters want to review your polysomnogram. Sleep apnea increases your insurance risk because, if left untreated, the disruptions to your sleep and breathing can lead to daytime sleepiness (and therefore injuries or accidents) and other potentially serious.

Source: pinterest.com

Source: pinterest.com

Buying life insurance if you have sleep apnea is possible; Even if this man was unexpectedly diagnosed with cancer at age 45, he still would have coverage for only $28.26 per month. The biggest thing that insurance companies want to see is that you are or have been taking steps to manage the condition. Life insurance companies use the underwriting process to determine the risk of insuring you. If you have sleep apnea, the life insurance company may ask you questions such as:

![Best Guide To Sleep Apnea Life Insurance [Updated] 2021 Best Guide To Sleep Apnea Life Insurance [Updated] 2021](https://myfasttermquotes.com/wp-content/uploads/2019/10/Sleep-apnea-and-life-insurance-1200x686.png) Source: myfasttermquotes.com

Source: myfasttermquotes.com

How does sleep apnea affect your life insurance rates? Insurance companies view sleep apnea as a risk because it is relatively common in the u.s. Because life insurance companies view sleep apnea as a risk, the type of sleep apnea and its severity may impact your life insurance premiums. Complex sleep apnea is a combination of symptoms from both central sleep apnea and obstructive sleep apnea. If you have sleep apnea, the life insurance company may ask you questions such as:

![Best Guide To Sleep Apnea Life Insurance [Updated] 2021 Best Guide To Sleep Apnea Life Insurance [Updated] 2021](https://myfasttermquotes.com/wp-content/uploads/2019/10/SLEEP-APNEA-QUESTIONNAIRE-1200x1248.jpg) Source: myfasttermquotes.com

Source: myfasttermquotes.com

Possible complications, especially when the condition is not treated properly, include high blood pressure, heart problems, stroke, type 2 diabetes, and liver problems. Even if this man was unexpectedly diagnosed with cancer at age 45, he still would have coverage for only $28.26 per month. We are a group of independent insurance agents, which means that we don’t work with one single company. Possible complications, especially when the condition is not treated properly, include high blood pressure, heart problems, stroke, type 2 diabetes, and liver problems. Depending on how you are treating your condition and how severe it is, some insurance brokers say that you can get equitable coverage.

Source: myfasttermquotes.com

Source: myfasttermquotes.com

If you’re living with sleep apnea, life insurance is still within reach. How sleep apnea affects your life insurance rates when you apply for life insurance with sleep apnea, you’ll be required to provide health records, complete a medical exam, and provide any pertinent information about your. What type of sleep apnea you have. Can i qualify for coverage if i have sleep apnea? Because life insurance companies view sleep apnea as a risk, the type of sleep apnea and its severity may impact your life insurance premiums.

![Best Guide To Sleep Apnea Life Insurance [Updated] 2021 Best Guide To Sleep Apnea Life Insurance [Updated] 2021](https://myfasttermquotes.com/wp-content/uploads/2019/10/Some-of-the-best-insurance-carriers-for-sleep-apnea-life-insurance-2018-768x632.png) Source: myfasttermquotes.com

Source: myfasttermquotes.com

The best life insurance for suffers of the condition of sleep apnea is usually a fully underwritten level term life insurance policy. One vital insurance area that is often overlooked by the sleep apnea patient is life insurance. Yes, many people with sleep apnea are able to qualify for coverage. Life insurance companies take sleep apnea very serious. This includes the severity of your condition, your personal and medical history, the treatments you’ve had (including their results), and any other factors that could affect your risk level as a client.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title sleep apnea life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information