Soft market insurance information

Home » Trending » Soft market insurance informationYour Soft market insurance images are available. Soft market insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Soft market insurance files here. Find and Download all free photos and vectors.

If you’re searching for soft market insurance images information related to the soft market insurance keyword, you have visit the ideal blog. Our website frequently provides you with hints for downloading the maximum quality video and picture content, please kindly surf and find more informative video content and images that match your interests.

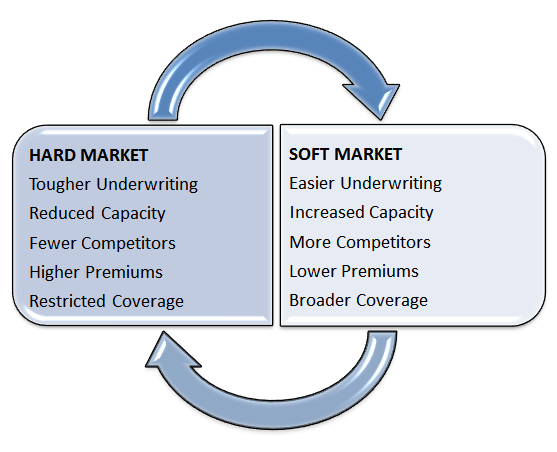

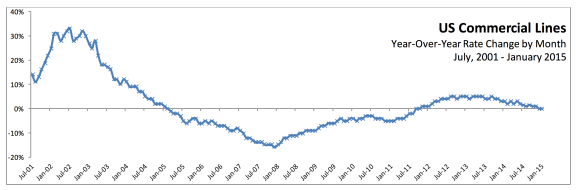

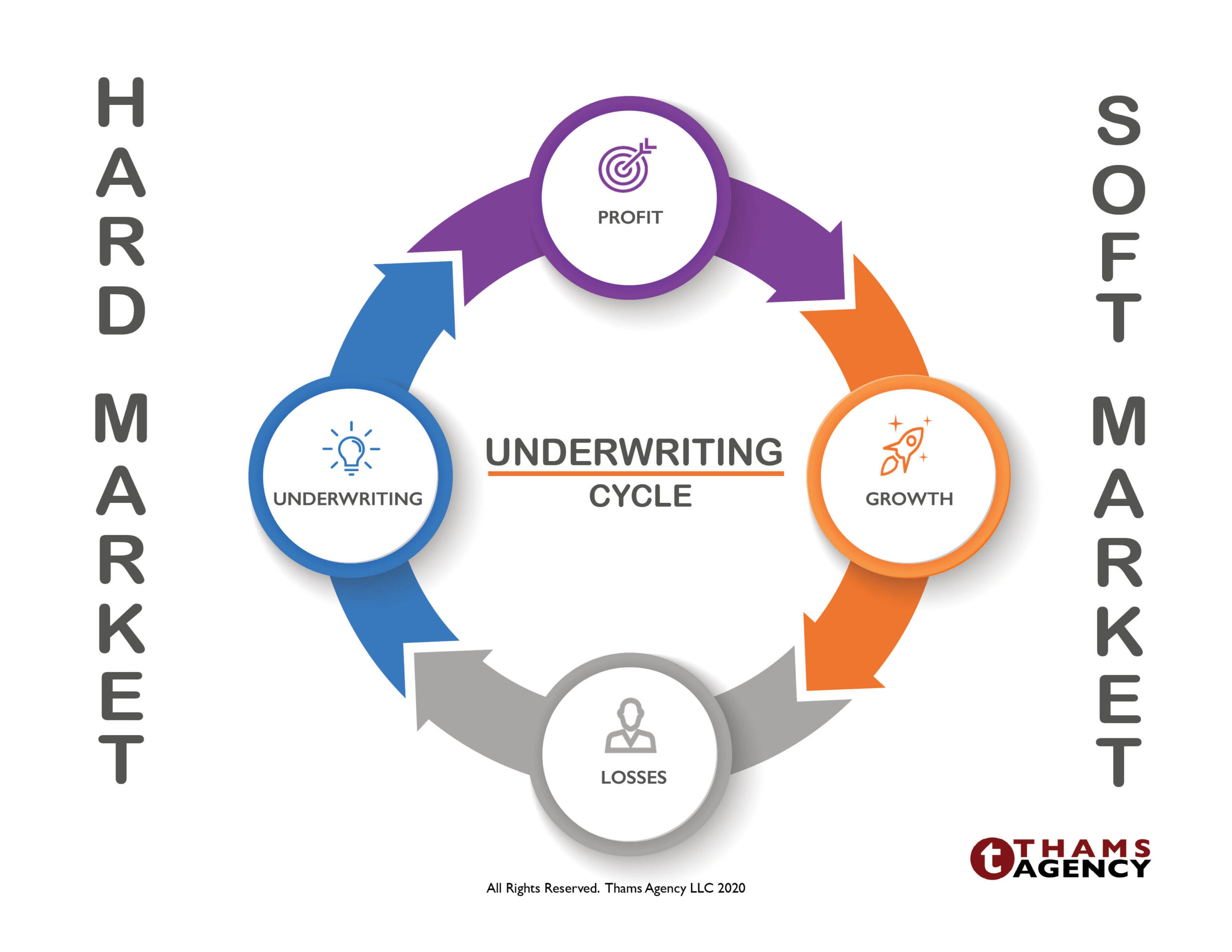

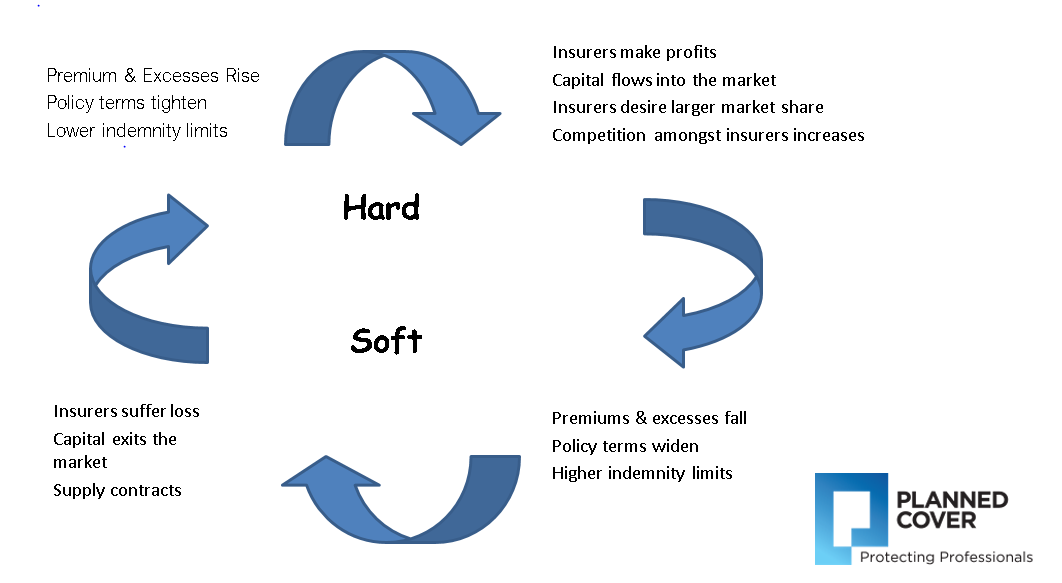

Soft Market Insurance. Increased competition among insurance carriers. Insurance companies rely on premiums and investment income to pay claims — premiums alone aren’t enough, especially as claims continue to become more frequent and more expensive. Lower insurance premiums broader coverage relaxed underwriting criteria, which means underwriting is easier increased capacity, which means insurance carriers write more policies and higher limits increased competition among. A soft insurance market occurs after companies begin to meet their profit goals and are able to loosen their underwriting standards, writing more policies on more clients.

Soft Insurance Market How to Stand Out, Survive From youtube.com

Soft Insurance Market How to Stand Out, Survive From youtube.com

They offer cheap rates, attractive policy wordings and reduced excesses all in the search of growth. When the market hardens, as is currently the case, insurance buyers need to be better prepared for renewal negotiations. During a soft market, there�s lots of competition between companies. To maintain and/or gain market share, many insurers relax. During a soft market, competition is fierce and premiums are stable or declining. Consequently, insurers or reinsurers have to tap into their capital.

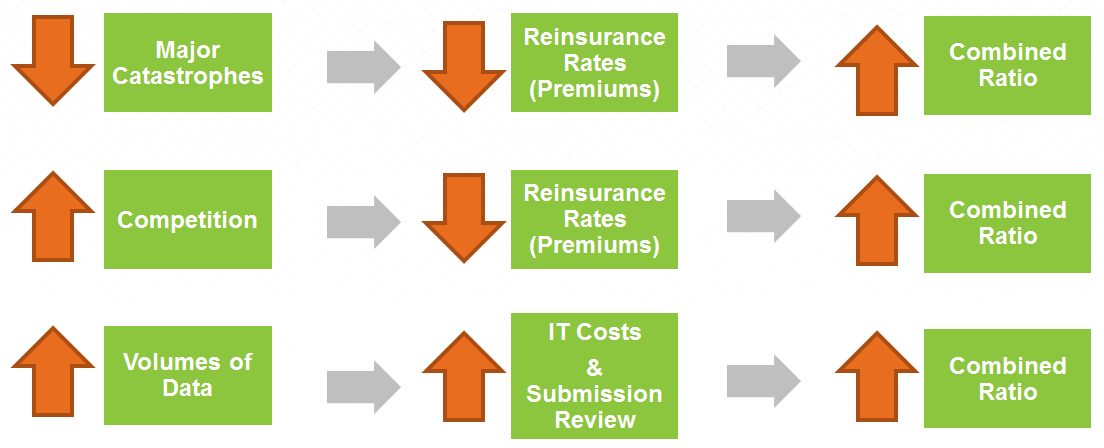

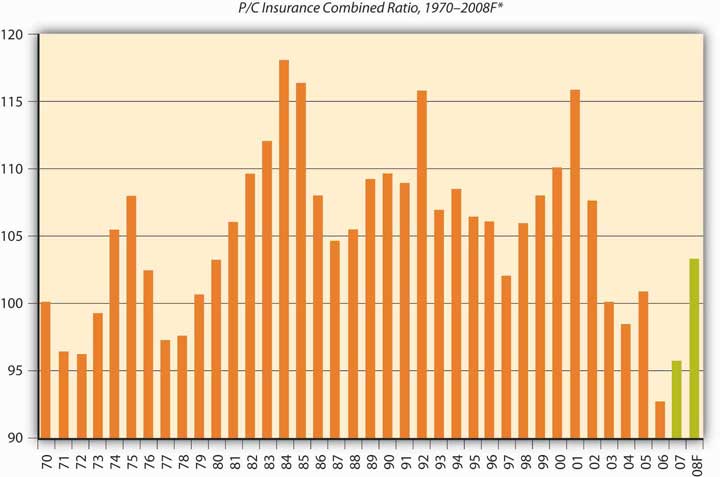

Combined ratios are increasing, and it’s a sink or swim environment that can feel like a futile race to 100%.

The cycles may vary slightly by lines of business (e.g. Increased competition among insurance carriers. To maintain and/or gain market share, many insurers relax. In this episode of the front row view.on insurance, we’ll review the difference between a hard vs. The insurance market is cyclical. Relaxed underwriting criteria, which means underwriting is easier;

Source: kbigroup.com.au

Source: kbigroup.com.au

Soft insurance market a period of time during which insurance companies assess low premiums and therefore achieve relatively low profits. The insurance market is cyclical. So, in a time period with low investment returns and an increase in claim payouts, insurers have to take certain measures to. The ‘soft market’ is when insurance premiums are low (the dip of the cycle). Premiums are stable, if not falling.

Source: simcoxbrokers.co.uk

Source: simcoxbrokers.co.uk

Today’s soft reinsurance market has put increasing amounts of pressure on traditional reinsurers to develop new strategies and tactics to survive. A soft insurance market occurs after companies begin to meet their profit goals and are able to loosen their underwriting standards, writing more policies on more clients. A hard insurance market is characterized by a high demand for insurance coverage and a reduced supply. Soft insurance market a period of time during which insurance companiesassess low premiumsand therefore achieve relatively low profits. Motor, liability marine etc.), but they do generally correlate and move roughly in the same direction.

Source: youtube.com

Source: youtube.com

Increased competition among insurance carriers. A hard insurance market is characterized by a high demand for insurance coverage and a reduced supply. Soft market conditions occur when insurance losses are low and prices are very competitive. Premiums are stable, if not falling. Relaxed underwriting criteria, which means underwriting is easier;

Source: sec.gov

Source: sec.gov

On the other hand, the characteristics of a hard market include: Increased capacity, which means insurance carriers write more policies and higher limits; A soft market is a market that has more potential sellers than buyers. A soft insurance market occurs after companies begin to meet their profit goals and are able to loosen their underwriting standards, writing more policies on more clients. The term soft market is most frequently applied to the insurance industry, where it can also be.

Source: analyzere.com

Source: analyzere.com

The term soft market is most frequently applied to the insurance industry, where it can also be. In the extreme cases there will be a bidding war for business and brokers have a number of insurers desperate for new business which gives brokers a good choice of who to place risks with. Soft market a market that is characterized by high levels of competition among insurance firms, decreasing prices, and declining underwriting standards as firms fiercely attempt to. Soft market — one side of the market cycle that is characterized by low rates, high limits, flexible contracts, and high availability of coverage. So, in a time period with low investment returns and an increase in claim payouts, insurers have to take certain measures to.

Source: thebalancesmb.com

Source: thebalancesmb.com

Relaxed underwriting criteria, which means underwriting is easier; A soft market is where there will be increase competition or perhaps depressed premiums and then this type of market is usually followed by a hard market. The soft market and increased competition shrinks the margin for error, so make sure you are providing a high level of service or you will get left behind. The characteristics of a soft market in the insurance industry include: What is a hard market in the insurance industry?

Source: ltc-associates.com

Source: ltc-associates.com

Soft market characteristics in soft market conditions, insurance organizations often try to expand their market share. So, in a time period with low investment returns and an increase in claim payouts, insurers have to take certain measures to. The soft market and increased competition shrinks the margin for error, so make sure you are providing a high level of service or you will get left behind. During a soft market, competition is fierce and premiums are stable or declining. A soft market is where there will be increase competition or perhaps depressed premiums and then this type of market is usually followed by a hard market.

Source: insurancejournal.com

Source: insurancejournal.com

A soft market is a market that has more potential sellers than buyers. The insurance market is cyclical. The ‘soft market’ is when insurance premiums are low (the dip of the cycle). A soft market is a market that has more potential sellers than buyers. A soft insurance market occurs after companies begin to meet their profit goals and are able to loosen their underwriting standards, writing more policies on more clients.

Source: saylordotorg.github.io

Source: saylordotorg.github.io

What is a hard market in the insurance industry? Soft market characteristics in soft market conditions, insurance organizations often try to expand their market share. Lower insurance premiums broader coverage relaxed underwriting criteria, which means underwriting is easier increased capacity, which means insurance carriers write more policies and higher limits increased competition among. A hard insurance market is characterized by a high demand for insurance coverage and a reduced supply. Premiums are high and insurers are disincl…

Source: cepagram.com

Source: cepagram.com

The characteristics of a soft market in the insurance industry include: They offer cheap rates, attractive policy wordings and reduced excesses all in the search of growth. During a soft market, competition is fierce and premiums are stable or declining. Insurers impose strict underwriting standards and issue a limited number of policies. Hard market conditions occur when insurance losses are above expectations (see loss development in chapter 7 insurance operations) and reserves are no longer able to cover all losses.

Source: studylib.net

Source: studylib.net

The characteristics of a soft market in the insurance industry include: During a soft market, competition is fierce and premiums are stable or declining. Insurance companies rely on premiums and investment income to pay claims — premiums alone aren’t enough, especially as claims continue to become more frequent and more expensive. Combined ratios are increasing, and it’s a sink or swim environment that can feel like a futile race to 100%. Insurers impose strict underwriting standards and issue a limited number of policies.

Source: rew-online.com

Source: rew-online.com

They offer cheap rates, attractive policy wordings and reduced excesses all in the search of growth. So, in a time period with low investment returns and an increase in claim payouts, insurers have to take certain measures to. Increased capacity, which means insurance carriers write more policies and higher limits; A soft insurance market occurs after companies begin to meet their profit goals and are able to loosen their underwritingstandards, writing more policies on more clients. The ‘hard market’ is when the insurance premiums are high (highs of the cycle).

Source: neilsonmarketing.com

Source: neilsonmarketing.com

Increased competition among insurance carriers. Today’s soft reinsurance market has put increasing amounts of pressure on traditional reinsurers to develop new strategies and tactics to survive. Soft insurance market a period of time during which insurance companiesassess low premiumsand therefore achieve relatively low profits. So, in a time period with low investment returns and an increase in claim payouts, insurers have to take certain measures to. To maintain and/or gain market share, many insurers relax.

Source: reithandassociates.com

Source: reithandassociates.com

Premiums are high and insurers are disincl… As someone looking to buy insurance, you may have a number of options from which to choose and underwriting rules are less stringent. Soft market — one side of the market cycle that is characterized by low rates, high limits, flexible contracts, and high availability of coverage. Insurers impose strict underwriting standards and issue a limited number of policies. Increased capacity, which means insurance carriers write more policies and higher limits;

Source: plannedcover.com.au

Source: plannedcover.com.au

The cycles may vary slightly by lines of business (e.g. In the extreme cases there will be a bidding war for business and brokers have a number of insurers desperate for new business which gives brokers a good choice of who to place risks with. So, in a time period with low investment returns and an increase in claim payouts, insurers have to take certain measures to. Hard market conditions occur when insurance losses are above expectations (see loss development in chapter 7 insurance operations) and reserves are no longer able to cover all losses. According to the international risk management institute, inc (irmi), a soft market is characterized by low premiums, high limits, broader coverages, and a more competitive landscape with high availability of coverage.

Source: youtube.com

Source: youtube.com

A hard insurance market is characterized by a high demand for insurance coverage and a reduced supply. Today’s soft reinsurance market has put increasing amounts of pressure on traditional reinsurers to develop new strategies and tactics to survive. What is a hard market in the insurance industry? As someone looking to buy insurance, you may have a number of options from which to choose and underwriting rules are less stringent. Premiums are high and insurers are disincl…

Source: minneapolisnewsupdate.blogspot.com

A soft market is where there will be increase competition or perhaps depressed premiums and then this type of market is usually followed by a hard market. They offer cheap rates, attractive policy wordings and reduced excesses all in the search of growth. The characteristics of a soft market in the insurance industry include: During a soft market, there�s lots of competition between companies. It�s fairly easy to get coverage for all kinds of risks.

Source: focusorm.co.uk

Source: focusorm.co.uk

Soft market characteristics in soft market conditions, insurance organizations often try to expand their market share. Soft insurance market a period of time during which insurance companies assess low premiums and therefore achieve relatively low profits. So, in a time period with low investment returns and an increase in claim payouts, insurers have to take certain measures to. A hard insurance market is characterized by a high demand for insurance coverage and a reduced supply. The ‘soft market’ is when insurance premiums are low (the dip of the cycle).

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title soft market insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information