Sole proprietorship insurance information

Home » Trend » Sole proprietorship insurance informationYour Sole proprietorship insurance images are ready in this website. Sole proprietorship insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Sole proprietorship insurance files here. Find and Download all free vectors.

If you’re searching for sole proprietorship insurance pictures information linked to the sole proprietorship insurance keyword, you have pay a visit to the right site. Our site frequently provides you with suggestions for viewing the maximum quality video and picture content, please kindly search and find more enlightening video content and images that fit your interests.

Sole Proprietorship Insurance. We represent dozens of insurance companies with trustworthy brands you know. Sole proprietorships are easy to establish and dismantle, due to a lack of. Accordingly, they are not subject to the classic obligations of accident insurance, bvg, etc. The type of business you form will determine the insurance policy options that are right for you, as some small business owners may not require much coverage, while others want to protect their business entity as much as.

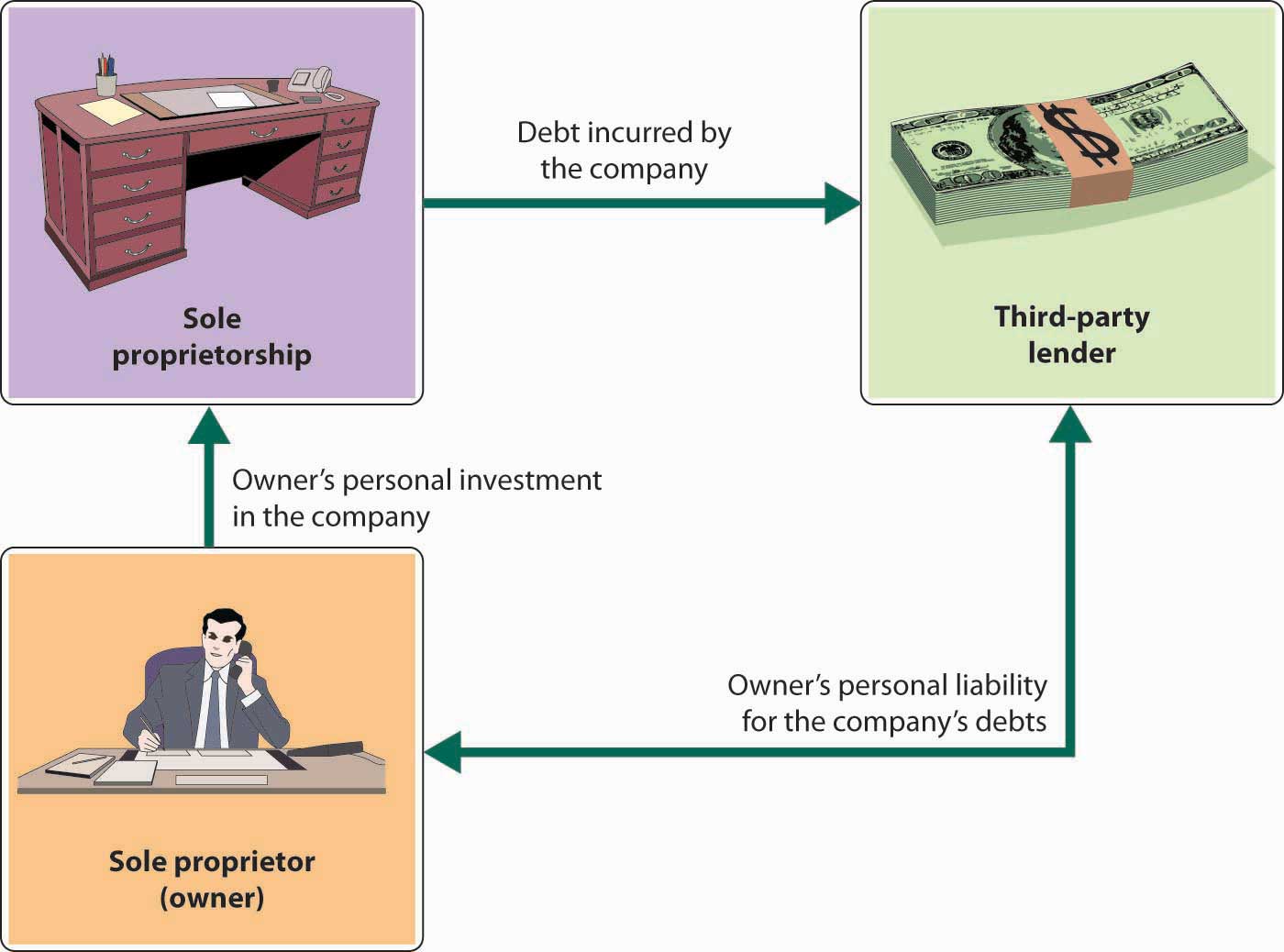

Sole Proprietorship Definition, Pros, and Cons From thefinancialmanagement.com

Sole Proprietorship Definition, Pros, and Cons From thefinancialmanagement.com

Commercial auto insurance is required for any vehicles (including cars) that are primarily used for business purposes. As a sole proprietor, there are several other types of coverage you should consider. Business liability insurance for sole proprietors. The key to affordable sole proprietorship insurance. It takes care of the costs involved with a legal claim. A sole proprietorship will typically cease to exist if the owner dies or sells the business.

Business insurance can help sole proprietors recoup losses in case of an incident or business interruption.

The key to affordable sole proprietorship insurance. This coverage can help protect you when you make a mistake, or if a customer hurts themselves while visiting you at your office. After registering or licensing your business with your state and local governments (so they can tax you appropriately), you’re free to hang out your shingle. Sole proprietorships are easy to establish and dismantle, due to a lack of. Accordingly, they are not subject to the classic obligations of accident insurance, bvg, etc. As a sole proprietor, there are several other types of coverage you should consider.

Source: karmichattrick.blogspot.com

Source: karmichattrick.blogspot.com

We will show you your local tailored options without bias. These differences will also define the type of risk setting up a sole proprietorship and the business insurance plans you�ll need in place to protect your assets. The irs points out you are not a sole proprietor if you operate as a corporation. Additionally, sole proprietorship liability insurance can protect you even if. Accordingly, they are not subject to the classic obligations of accident insurance, bvg, etc.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Data breach insurance, which helps protect your sole proprietorship from hacking and other data breaches. The irs defines a sole proprietor as a person who owns an unincorporated business alone and usually without the benefit of any employees. Customer injuries or illnesses that happen at your business location. With sole proprietorship insurance in canada, you can protect yourself from risk and still choose the business structure that makes the most sense for your business. The type of business you form will determine the insurance policy options that are right for you, as some small business owners may not require much coverage, while others want to protect their business entity as much as.

Source: klingerinsurancegroup.com

Source: klingerinsurancegroup.com

Our licensed and accredited agents will guide you to a sole proprietorship insurance policy that fits your needs. Business insurance can help sole proprietors recoup losses in case of an incident or business interruption. It takes care of the costs involved with a legal claim. Most business owners who start a sole proprietorship elect to enroll in insurance coverage that protects their personal assets in the event of a lawsuit. However, due to the dangers of working and private life, it is advisable to at least consider protection for the following risks:

Source: thefinancialmanagement.com

Source: thefinancialmanagement.com

The irs defines a sole proprietor as a person who owns an unincorporated business alone and usually without the benefit of any employees. Customer injuries or illnesses that happen at your business location. An independent contractor works for another company. Enjoy the freedom and flexibility of your business without losing sleep over being bankrupted by a lawsuit. While there are many advantages to running your own business, there are also disadvantages to consider.

Source: saylordotorg.github.io

Source: saylordotorg.github.io

How does health insurance for a sole proprietor work? With sole proprietorship insurance in canada, you can protect yourself from risk and still choose the business structure that makes the most sense for your business. How does health insurance for a sole proprietor work? Business insurance can help sole proprietors recoup losses in case of an incident or business interruption. The key to affordable sole proprietorship insurance.

Source: plancover.com

Source: plancover.com

Additionally, sole proprietorship liability insurance can protect you even if. Additionally, depending on the type of work you do or services you provide, your state may require you to have general liability insurance, professional. The irs points out you are not a sole proprietor if you operate as a corporation. After registering or licensing your business with your state and local governments (so they can tax you appropriately), you’re free to hang out your shingle. Sole proprietorship liability insurance, sometimes referred to as business liability or general liability insurance, can help cover claims made against your sole proprietorship for:

Source: diariodiunastronzaperbene.blogspot.com

Source: diariodiunastronzaperbene.blogspot.com

Sole proprietor insurance is the easiest way to protect your home and savings. The type of business you form will determine the insurance policy options that are right for you, as some small business owners may not require much coverage, while others want to protect their business entity as much as. Essential insurance coverages for sole proprietorship. These differences will also define the type of risk setting up a sole proprietorship and the business insurance plans you�ll need in place to protect your assets. Sole proprietorships are less expensive to set up, but also riskier to operate, increasing the need for small business insurance.

Source: healthbenefits.net

Source: healthbenefits.net

Our licensed and accredited agents will guide you to a sole proprietorship insurance policy that fits your needs. However, due to the dangers of working and private life, it is advisable to at least consider protection for the following risks: We represent dozens of insurance companies with trustworthy brands you know. Additionally, depending on the type of work you do or services you provide, your state may require you to have general liability insurance, professional. Enjoy the freedom and flexibility of your business without losing sleep over being bankrupted by a lawsuit.

Source: karmichattrick.blogspot.com

Source: karmichattrick.blogspot.com

The irs points out you are not a sole proprietor if you operate as a corporation. We represent dozens of insurance companies with trustworthy brands you know. Our licensed and accredited agents will guide you to a sole proprietorship insurance policy that fits your needs. Enjoy the freedom and flexibility of your business without losing sleep over being bankrupted by a lawsuit. An independent contractor works for another company.

Source: nextinsurance.com

Source: nextinsurance.com

Additionally, depending on the type of work you do or services you provide, your state may require you to have general liability insurance, professional. What is a sole proprietor? Is sole proprietorship insurance required by law the answer depends on the state youre located in, as some states require sole proprietors to have insurance in order to get a business license. Enjoy the freedom and flexibility of your business without losing sleep over being bankrupted by a lawsuit. With sole proprietorship insurance in canada, you can protect yourself from risk and still choose the business structure that makes the most sense for your business.

Source: yourfreelancerfriend.com

Source: yourfreelancerfriend.com

The sole proprietorship is simple to set up because it doesn’t require you to create a controlling document. Data breach insurance, which helps protect your sole proprietorship from hacking and other data breaches. What is a sole proprietor? Customer injuries or illnesses that happen at your business location. An independent contractor works for another company.

Source: alignedinsurance.com

Source: alignedinsurance.com

What is a sole proprietor? Additionally, sole proprietorship liability insurance can protect you even if. The key to affordable sole proprietorship insurance. These differences will also define the type of risk setting up a sole proprietorship and the business insurance plans you�ll need in place to protect your assets. Accordingly, they are not subject to the classic obligations of accident insurance, bvg, etc.

Source: rwfinancial.com

Source: rwfinancial.com

Business liability insurance for sole proprietors. A sole proprietorship will typically cease to exist if the owner dies or sells the business. Enjoy the freedom and flexibility of your business without losing sleep over being bankrupted by a lawsuit. Our licensed and accredited agents will guide you to a sole proprietorship insurance policy that fits your needs. The type of business you form will determine the insurance policy options that are right for you, as some small business owners may not require much coverage, while others want to protect their business entity as much as.

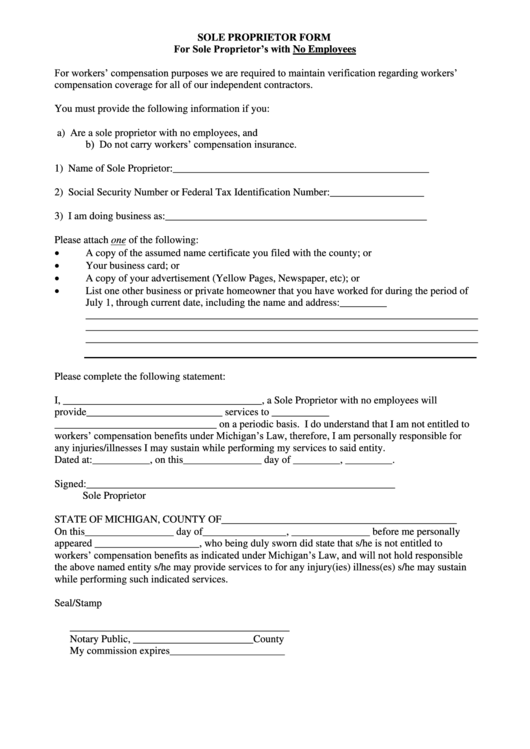

Source: formsbank.com

Source: formsbank.com

Sole proprietorship liability insurance, sometimes referred to as business liability or general liability insurance, can help cover claims made against your sole proprietorship for: Sole proprietorship liability insurance, sometimes referred to as business liability or general liability insurance, can help cover claims made against your sole proprietorship for: It can help you respond to a breach by paying to notify impacted customers or patients. Most business owners who start a sole proprietorship elect to enroll in insurance coverage that protects their personal assets in the event of a lawsuit. Additionally, depending on the type of work you do or services you provide, your state may require you to have general liability insurance, professional.

Source: fotohijrah.blogspot.com

Source: fotohijrah.blogspot.com

Enjoy the freedom and flexibility of your business without losing sleep over being bankrupted by a lawsuit. A sole proprietorship is run by one person who has direct control. Sole proprietorships are less expensive to set up, but also riskier to operate, increasing the need for small business insurance. If you have llc status, you’re able to include additional owners that are people, corporations, other llcs, partnerships, trusts, or estates. While it may be an expensive option, especially for small business owners, it can protect sole proprietors from many events that would be financially devastating to the business.

Source: insurancemaneuvers.com

Source: insurancemaneuvers.com

Most business owners who start a sole proprietorship elect to enroll in insurance coverage that protects their personal assets in the event of a lawsuit. After registering or licensing your business with your state and local governments (so they can tax you appropriately), you’re free to hang out your shingle. With sole proprietorship insurance in canada, you can protect yourself from risk and still choose the business structure that makes the most sense for your business. It takes care of the costs involved with a legal claim. Most business owners who start a sole proprietorship elect to enroll in insurance coverage that protects their personal assets in the event of a lawsuit.

Source: carriehightower.net

Source: carriehightower.net

Sole proprietorships are easy to establish and dismantle, due to a lack of. How does health insurance for a sole proprietor work? A sole proprietorship is owned by one person by definition. The sole proprietorship is simple to set up because it doesn’t require you to create a controlling document. Business liability insurance for sole proprietors.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Business liability insurance for sole proprietors. A sole proprietorship is an unincorporated business with only one owner who pays personal income tax on profits earned. Data breach insurance, which helps protect your sole proprietorship from hacking and other data breaches. With sole proprietorship insurance in canada, you can protect yourself from risk and still choose the business structure that makes the most sense for your business. This coverage can help protect you when you make a mistake, or if a customer hurts themselves while visiting you at your office.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title sole proprietorship insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information