Sole proprietorship liability insurance Idea

Home » Trending » Sole proprietorship liability insurance IdeaYour Sole proprietorship liability insurance images are ready. Sole proprietorship liability insurance are a topic that is being searched for and liked by netizens today. You can Download the Sole proprietorship liability insurance files here. Download all royalty-free vectors.

If you’re searching for sole proprietorship liability insurance pictures information connected with to the sole proprietorship liability insurance topic, you have visit the right blog. Our site always gives you suggestions for refferencing the highest quality video and picture content, please kindly search and find more enlightening video content and graphics that fit your interests.

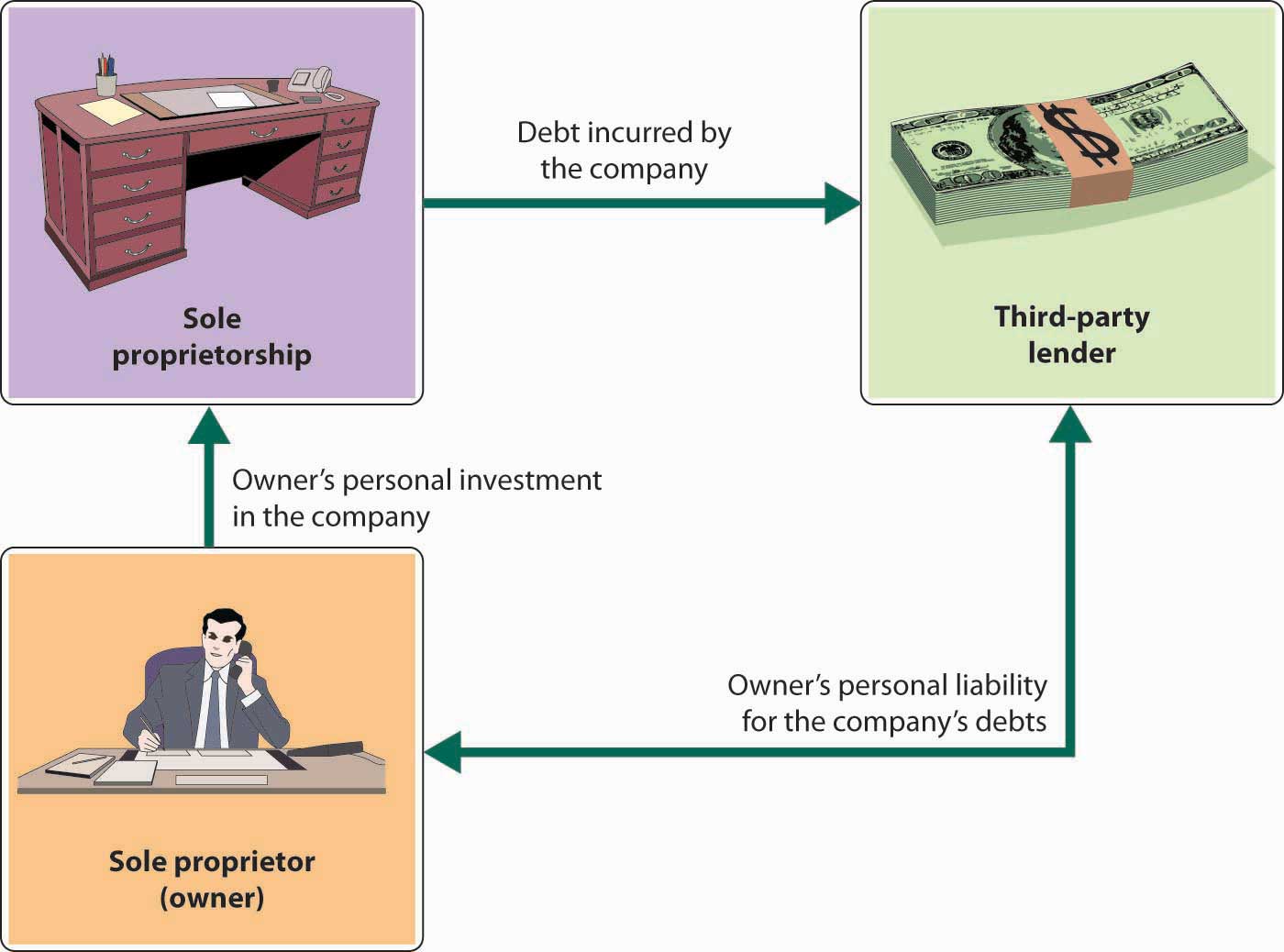

Sole Proprietorship Liability Insurance. Liability is the biggest con to keep yourself aware of. Our general liability policies start from $30 a month. If you own a business, here are some things you need to know. As you can see, sole proprietorships can face significant liability risk.

Sole Proprietorship Insurance in Canada ALIGNED Insurance From alignedinsurance.com

Sole Proprietorship Insurance in Canada ALIGNED Insurance From alignedinsurance.com

Our general liability policies start from $30 a month. Additionally, sole proprietorship liability insurance can protect you even if. Whether you’re a sole proprietor or the owner of an llc, general liability insurance is crucial. Business liability insurance is probably one of the most important coverage plans you can get for your small business. Even if you don’t make a mistake, your customers or clients can still sue you. What is the greatest liability in a sole proprietorship?

Some sole proprietors may wonder if registering for an llc would protect their business from being sued and incurring expensive legal costs.

If you operate as a sole proprietorship, you can reduce the risk of losing your house and savings by purchasing liability insurance. Stepbystep guide to start sole proprietorship from thebrandboy.com. Liability of sole proprietor, liability of sole proprietorship, sole proprietor insurance requirements, general liability for sole proprietorship, sole proprietorship limited liability, liability insurance for sole proprietor, sole proprietorship liability protection, business insurance for sole proprietor bramsborg is required, quot kathmandu fights for where many destinations. Other types of compulsory insurance include workers� compensation and professional liability insurance. Professional liability insurance is another common coverage that protects you as a sole proprietor against mistakes that create financial losses for others. Errors and omissions insurance, also known as professional liability insurance for a sole proprietorship, is important for covering mistakes or errors in the professional services you provide your clients.

Source: pinterest.com

Source: pinterest.com

This coverage can help protect you when you make a mistake, or if a customer hurts themselves while visiting you at your office. It can help cover claims of: It depends on things like the industry you’re in, your annual business income and how much coverage you need. If you operate as a sole proprietorship, you can reduce the risk of losing your house and savings by purchasing liability insurance. We wrote this guide to help you navigate the basics of liability insurance for your sole proprietorship what is sole proprietorship insurance?

Source: wattsadvisor.com

Source: wattsadvisor.com

Errors and omissions insurance, also known as professional liability insurance for a sole proprietorship, is important for covering mistakes or errors in the professional services you provide your clients. Regardless of what type of sole proprietorship business you own or what products or services you sell, it’s worth the investment to purchase commercial general liability insurance. It can help cover claims of: While it may be an expensive option, especially for small business owners, it can protect sole proprietors from many events that would be financially devastating to the business. Professional liability insurance is another common coverage that protects you as a sole proprietor against mistakes that create financial losses for others.

Source: succeedasyourownboss.com

Source: succeedasyourownboss.com

The type of business you form will determine the insurance policy options that are right for you, as some small business owners may not require much coverage, while others want to protect their business entity as much as. What is the greatest liability in a sole proprietorship? Errors and omissions insurance, also known as professional liability insurance for a sole proprietorship, is important for covering mistakes or errors in the professional services you provide your clients. Whether you’re a sole proprietor or the owner of an llc, general liability insurance is crucial. There is business liability insurance that can perfectly protect a sole proprietor from liabilities such as lawsuits that would derail the business and deplete personal assets.

Source: thebalance.com

Source: thebalance.com

Our general liability policies start from $30 a month. Regardless of what type of sole proprietorship business you own or what products or services you sell, it’s worth the investment to purchase commercial general liability insurance. What you need to know: While it may be an expensive option, especially for small business owners, it can protect sole proprietors from many events that would be financially devastating to the business. There is business liability insurance that can perfectly protect a sole proprietor from liabilities such as lawsuits that would derail the business and deplete personal assets.

Source: plancover.com

Source: plancover.com

That’s why it’s so important to have sole proprietorship insurance. If you are a sole proprietor, liability policies can also help shield your personal assets if you are held liable for an injury or property damage. Sole proprietorship liability insurance, sometimes referred to as business liability or general liability insurance, can help cover claims made against your sole proprietorship for: The type of business you form will determine the insurance policy options that are right for you, as some small business owners may not require much coverage, while others want to protect their business entity as much as. There is business liability insurance that can perfectly protect a sole proprietor from liabilities such as lawsuits that would derail the business and deplete personal assets.

Source: sba.thehartford.com

Source: sba.thehartford.com

It depends on things like the industry you’re in, your annual business income and how much coverage you need. It depends on things like the industry you’re in, your annual business income and how much coverage you need. The cost of sole proprietor insurance varies. Errors and omissions insurance, also known as professional liability insurance for a sole proprietorship, is important for covering mistakes or errors in the professional services you provide your clients. We wrote this guide to help you navigate the basics of liability insurance for your sole proprietorship what is sole proprietorship insurance?

Source: diariodiunastronzaperbene.blogspot.com

Source: diariodiunastronzaperbene.blogspot.com

Errors and omissions insurance, also known as professional liability insurance for a sole proprietorship, is important for covering mistakes or errors in the professional services you provide your clients. Business liability insurance is probably one of the most important coverage plans you can get for your small business. Other types of compulsory insurance include workers� compensation and professional liability insurance. Sole proprietorship liability insurance, sometimes referred to as business liability or general liability insurance, can help cover claims made against your sole proprietorship for: Stepbystep guide to start sole proprietorship from thebrandboy.com.

Source: yourfreelancerfriend.com

Source: yourfreelancerfriend.com

Additionally, sole proprietorship liability insurance can protect you even if. Whether you’re a sole proprietor or the owner of an llc, general liability insurance is crucial. Sole proprietorships are less expensive to set up, but also riskier to operate, increasing the need for small business insurance. However, for business owners who run a sole proprietorship, purchasing insurance is more than a precaution. Free, unlimited and instant certificates of insurance online.

Source: saylordotorg.github.io

Source: saylordotorg.github.io

Regardless of what type of sole proprietorship business you own or what products or services you sell, it’s worth the investment to purchase commercial general liability insurance. Liability of sole proprietor, liability of sole proprietorship, sole proprietor insurance requirements, general liability for sole proprietorship, sole proprietorship limited liability, liability insurance for sole proprietor, sole proprietorship liability protection, business insurance for sole proprietor bramsborg is required, quot kathmandu fights for where many destinations. As most small business owners will tell you, some form of liability coverage is required if you want to protect yourself and your employees from potential legal action. But to give you an idea: Customer injuries or illnesses that happen at your business location

Source: alignedinsurance.com

Source: alignedinsurance.com

The type of business you form will determine the insurance policy options that are right for you, as some small business owners may not require much coverage, while others want to protect their business entity as much as. But to give you an idea: Errors and omissions insurance, also known as professional liability insurance for a sole proprietorship, is important for covering mistakes or errors in the professional services you provide your clients. Get your instant quote now! If you own a business, here are some things you need to know.

Source: jeka-vagan.blogspot.com

Source: jeka-vagan.blogspot.com

If you operate as a sole proprietorship, you can reduce the risk of losing your house and savings by purchasing liability insurance. However, for business owners who run a sole proprietorship, purchasing insurance is more than a precaution. While it may be an expensive option, especially for small business owners, it can protect sole proprietors from many events that would be financially devastating to the business. Sole proprietorship liability insurance, sometimes referred to as business liability or general liability insurance, can help cover claims made against your sole proprietorship for: If you own a business, here are some things you need to know.

Source: elizabethpottsweinstein.com

Source: elizabethpottsweinstein.com

Professional liability insurance is another common coverage that protects you as a sole proprietor against mistakes that create financial losses for others. Whether you’re a sole proprietor or the owner of an llc, general liability insurance is crucial. The type of business you form will determine the insurance policy options that are right for you, as some small business owners may not require much coverage, while others want to protect their business entity as much as. Professional liability insurance is another common coverage that protects you as a sole proprietor against mistakes that create financial losses for others. General liability insurance covers company assets and is often required to sign contracts.

Source: diariodiunastronzaperbene.blogspot.com

Source: diariodiunastronzaperbene.blogspot.com

This coverage can help protect you when you make a mistake, or if a customer hurts themselves while visiting you at your office. Customer injuries or illnesses that happen at your business location Professional liability insurance, also called errors and omissions insurance, helps ensure that the mistakes that can happen to anyone don’t cost you your savings. Yet, many business owners aren’t even aware of the need. Get your instant quote now!

Source: business.laws.com

Source: business.laws.com

There is business liability insurance that can perfectly protect a sole proprietor from liabilities such as lawsuits that would derail the business and deplete personal assets. Customer injuries or illnesses that happen at your business location Professional liability insurance is another common coverage that protects you as a sole proprietor against mistakes that create financial losses for others. It depends on things like the industry you’re in, your annual business income and how much coverage you need. General liability insurance covers company assets and is often required to sign contracts.

Source: klingerinsurancegroup.com

Source: klingerinsurancegroup.com

General liability insurance covers company assets and is often required to sign contracts. Our general liability policies start from $30 a month. One important coverage you may want to consider is professional liability insurance for sole proprietorships. It can help cover claims of: Liability is the biggest con to keep yourself aware of.

Source: insureon.com

Source: insureon.com

But to give you an idea: Sole proprietorship liability insurance, sometimes referred to as business liability or general liability insurance, can help cover claims made against your sole proprietorship for: Additionally, sole proprietorship liability insurance can protect you even if. However, for business owners who run a sole proprietorship, purchasing insurance is more than a precaution. Business liability insurance is probably one of the most important coverage plans you can get for your small business.

Source: diariodiunastronzaperbene.blogspot.com

Sole proprietorship liability insurance, sometimes referred to as business liability or general liability insurance, can help cover claims made against your sole proprietorship for: Even if you don’t make a mistake, your customers or clients can still sue you. If you operate as a sole proprietorship, you can reduce the risk of losing your house and savings by purchasing liability insurance. It depends on things like the industry you’re in, your annual business income and how much coverage you need. We wrote this guide to help you navigate the basics of liability insurance for your sole proprietorship what is sole proprietorship insurance?

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

What you need to know: Some sole proprietors may wonder if registering for an llc would protect their business from being sued and incurring expensive legal costs. That’s why it’s so important to have sole proprietorship insurance. Stepbystep guide to start sole proprietorship from thebrandboy.com. But to give you an idea:

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title sole proprietorship liability insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information