Solvency ii ratio insurance information

Home » Trending » Solvency ii ratio insurance informationYour Solvency ii ratio insurance images are ready. Solvency ii ratio insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Solvency ii ratio insurance files here. Get all free photos and vectors.

If you’re looking for solvency ii ratio insurance images information related to the solvency ii ratio insurance keyword, you have come to the ideal blog. Our website always provides you with hints for downloading the highest quality video and image content, please kindly hunt and locate more informative video articles and images that fit your interests.

Solvency Ii Ratio Insurance. Under pillar 1 there are two distinct capital requirements: Among its aims, solvency ii looks to deepen the integration and harmonisation of the european insurance Three pillars of the solvency ii directive the eu solvency ii directive designates three pillars or tiers for capital requirements. Access robust data and advanced analytical tools.

Three pillars of the solvency ii directive the eu solvency ii directive designates three pillars or tiers for capital requirements. This blog explains solvency ii and its impact on reinsurance without bogging you down. As well as disclosing capital and risk frameworks, they are also required to demonstrate how the regulations’ principles are embedded into their business. Pillar i covers the quantitative requirements; Solvency ii solvency ii solvency ii sets out regulatory requirements for insurance firms and groups, covering financial resources, governance and accountability, risk assessment and management, supervision, reporting and public disclosure. Ad stay ahead of a changing regulatory landscape with our solutions for solvency ii.

The requirement itself is an amount in the company’s functional currency.

Three pillars of the solvency ii directive the eu solvency ii directive designates three pillars or tiers for capital requirements. As well as disclosing capital and risk frameworks, they are also required to demonstrate how the regulations’ principles are embedded into their business. It specifies valuation methodologies for assets and liabilities (“technical provisions”), based on market consistent principles. Among its aims, solvency ii looks to deepen the integration and harmonisation of the european insurance Pillar i covers the quantitative requirements; Since solvency ii came into force at 1 january 2016 the rules for required capital changed.

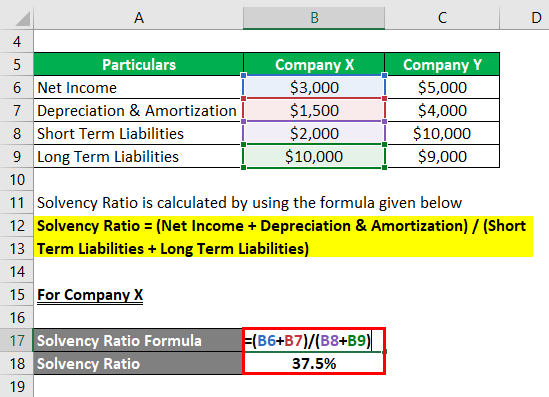

Since solvency ii came into force at 1 january 2016 the rules for required capital changed. Solvency ratio in solvency ii. In this video sukhy explains these ratios in detail along with how they are calculated and applied to the insurance industry. Among its aims, solvency ii looks to deepen the integration and harmonisation of the european insurance As shown in figure 7, in our study, the average unweighted solvency ratio of the companies in scope has been relatively stable over time, increasing slightly from 183% to 196%.

Source: khurak.net

Source: khurak.net

Pillar i covers the quantitative requirements; A company’s solvency ratio should, therefore, be compared with its competitors in the same industry rather than viewed in isolation. The scr includes an interest rate charge. Access robust data and advanced analytical tools. Ad stay ahead of a changing regulatory landscape with our solutions for solvency ii.

Source: global-benefits-vision.com

Source: global-benefits-vision.com

The european insurance and occupational pensions authority (eiopa) kickstarted the review of solvency ii in 2019 and led multiple impact assessment studies over the course of 2020. Solvency ratio in solvency ii. Irda takes a report on quarterly basis and check the ratio. Solvency capital requirements ratio from dec16 to dec19 in belgium Access robust data and advanced analytical tools.

Aims of solvency ii on the publication of the draft solvency ii directive in 2006, the european commission described the new regime as “a world leading standard that requires insurers to focus on managing the risks they run to enable them to operate more efficiently”. Pillar 1 sets out the minimum capital requirements that firms are required to meet. Ad stay ahead of a changing regulatory landscape with our solutions for solvency ii. Ad stay ahead of a changing regulatory landscape with our solutions for solvency ii. A company’s solvency ratio should, therefore, be compared with its competitors in the same industry rather than viewed in isolation.

Source: shipownersclub.com

Source: shipownersclub.com

As shown in figure 7, in our study, the average unweighted solvency ratio of the companies in scope has been relatively stable over time, increasing slightly from 183% to 196%. In case the ratio goes below 1.5, then irda reviews the situation with insurer and corrective action is taken. In simple terms, solvency indicates the ratio between company assets and liabilities. As shown in figure 2, the average unweighted solvency ratio of the companies in the scope of our study has been relatively stable for the last five years, increasing from 178% to 198%. Pillar i covers the quantitative requirements;

Source: commercialriskonline.com

Source: commercialriskonline.com

The scr includes an interest rate charge. In her previous video on global insurance regulation sukhy briefly touched upon capital requirements for insurers under solvency 2, namely the minimum capital requirement and solvency capital requirement. This blog explains solvency ii and its impact on reinsurance without bogging you down. Ad stay ahead of a changing regulatory landscape with our solutions for solvency ii. Ad stay ahead of a changing regulatory landscape with our solutions for solvency ii.

Source: theinsurer.com

Source: theinsurer.com

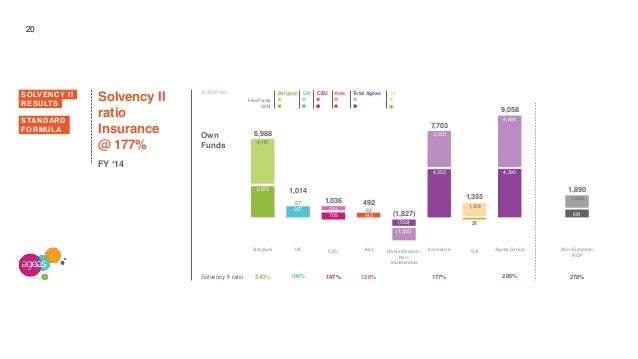

The european insurance and occupational pensions authority (eiopa) kickstarted the review of solvency ii in 2019 and led multiple impact assessment studies over the course of 2020. Solvency ii cover ratios (own funds over scr) in descending order by hy18 ratio • hy18 ye17 240%. As well as disclosing capital and risk frameworks, they are also required to demonstrate how the regulations’ principles are embedded into their business. As shown in figure 7, in our study, the average unweighted solvency ratio of the companies in scope has been relatively stable over time, increasing slightly from 183% to 196%. Irda takes a report on quarterly basis and check the ratio.

Source: shailkeshri.blogspot.com

Source: shailkeshri.blogspot.com

It is therefore important that insurers assess the intensity of Since solvency ii came into force at 1 january 2016 the rules for required capital changed. Under solvency ii, insurance companies will have to comply with minimum capital requirements and be required to calculate two solvency ratios. 1.2 structure the solvency ii framework comprises three “pillars”. Aims of solvency ii on the publication of the draft solvency ii directive in 2006, the european commission described the new regime as “a world leading standard that requires insurers to focus on managing the risks they run to enable them to operate more efficiently”.

Source: noticias.mapfre.com

Source: noticias.mapfre.com

Solvency ii ratios and the volatility challenge credit risk in portfolios and the credit cycle a decline in economic growth can have serious implications for insurance company solvency ratios, as deteriorating credit fundamentals directly impact the solvency capital requirement. The ratio is a percentage. As a result, insurance companies have two regulatory capital requirements to manage and monitor. Under solvency ii, insurers will need enough capital to have 99.5 per cent confidence they could cope with the worst expected losses over a year. Access robust data and advanced analytical tools.

Solvency ii is a directive in european union law that codifies and harmonises the eu insurance regulation. Home conducting business regulatory information solvency ii about solvency ii In her previous video on global insurance regulation sukhy briefly touched upon capital requirements for insurers under solvency 2, namely the minimum capital requirement and solvency capital requirement. 1.2 structure the solvency ii framework comprises three “pillars”. Pillar i covers the quantitative requirements;

Source: zadishqr.blogspot.com

Source: zadishqr.blogspot.com

Member states have the option to impose lower limits. In case the ratio goes below 1.5, then irda reviews the situation with insurer and corrective action is taken. Solvency ii is an eu legislative programme implemented in all 28 member states, including the uk, by 1 january 2016. Irda takes a report on quarterly basis and check the ratio. As well as disclosing capital and risk frameworks, they are also required to demonstrate how the regulations’ principles are embedded into their business.

Source: slideshare.net

Source: slideshare.net

Solvency ratio in solvency ii. The ratio is a percentage. Solvency ratio in solvency ii. Solvency ii is a directive in european union law that codifies and harmonises the eu insurance regulation. Under solvency ii, insurers will need enough capital to have 99.5 per cent confidence they could cope with the worst expected losses over a year.

Source: moneycentral.com.ng

Source: moneycentral.com.ng

As well as disclosing capital and risk frameworks, they are also required to demonstrate how the regulations’ principles are embedded into their business. Solvency ii is a directive in european union law that codifies and harmonises the eu insurance regulation. Pillar 1 sets out the minimum capital requirements that firms are required to meet. Following an eu parliament vote on the omnibus ii directive on 11 march 2014, solvency ii came into effect on 1 january 2016. The ratio is a percentage.

Source: am.jpmorgan.com

Source: am.jpmorgan.com

Interest rate levels also have a major impact on insurers’ solvency capital requirement (scr), which determines the total amount of capital each insurer and reinsurer must set aside in order to run their business. In simple terms, solvency indicates the ratio between company assets and liabilities. Home conducting business regulatory information solvency ii about solvency ii A company’s solvency ratio should, therefore, be compared with its competitors in the same industry rather than viewed in isolation. The ratio is a percentage.

Source: noticias.mapfre.com

Source: noticias.mapfre.com

Pillar i covers the quantitative requirements; It specifies valuation methodologies for assets and liabilities (“technical provisions”), based on market consistent principles. Solvency ratio in solvency ii. Irda takes a report on quarterly basis and check the ratio. In her previous video on global insurance regulation sukhy briefly touched upon capital requirements for insurers under solvency 2, namely the minimum capital requirement and solvency capital requirement.

Source: forbes.com

Source: forbes.com

In case the ratio goes below 1.5, then irda reviews the situation with insurer and corrective action is taken. Under solvency ii, insurance companies will have to comply with minimum capital requirements and be required to calculate two solvency ratios. Solvency ii ratios and the volatility challenge credit risk in portfolios and the credit cycle a decline in economic growth can have serious implications for insurance company solvency ratios, as deteriorating credit fundamentals directly impact the solvency capital requirement. Primarily this concerns the amount of capital that eu insurance companies must hold to reduce the risk of insolvency. In this section solvency ii effective value test parameters

Source: slideshare.net

Source: slideshare.net

In her previous video on global insurance regulation sukhy briefly touched upon capital requirements for insurers under solvency 2, namely the minimum capital requirement and solvency capital requirement. The european insurance and occupational pensions authority (eiopa) kickstarted the review of solvency ii in 2019 and led multiple impact assessment studies over the course of 2020. Since solvency ii came into force at 1 january 2016 the rules for required capital changed. The solvency ii directive applies to all insurance and reinsurance companies with gross premium income exceeding €5 million or gross technical provisions in excess of €25 million; Insurance firms have the choice of two approaches:

Source: noticias.mapfre.com

Source: noticias.mapfre.com

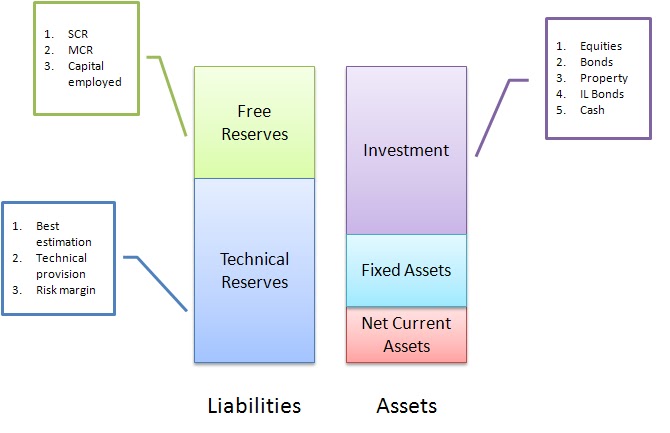

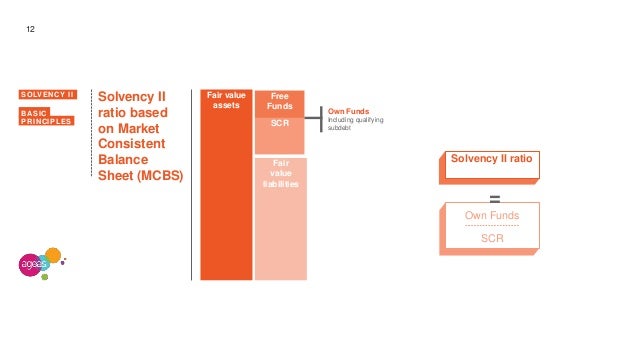

Sensitivity of solvency ii ratios to interest rate movements. Solvency ii solvency ii solvency ii sets out regulatory requirements for insurance firms and groups, covering financial resources, governance and accountability, risk assessment and management, supervision, reporting and public disclosure. It is therefore important that insurers assess the intensity of Primarily this concerns the amount of capital that eu insurance companies must hold to reduce the risk of insolvency. Own funds (of) refers to surplus capital that remains when the liabilities are deducted from the total assets.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title solvency ii ratio insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information