Someone filed a false insurance claim against me Idea

Home » Trend » Someone filed a false insurance claim against me IdeaYour Someone filed a false insurance claim against me images are available. Someone filed a false insurance claim against me are a topic that is being searched for and liked by netizens now. You can Find and Download the Someone filed a false insurance claim against me files here. Get all royalty-free vectors.

If you’re searching for someone filed a false insurance claim against me pictures information related to the someone filed a false insurance claim against me keyword, you have pay a visit to the right blog. Our site always provides you with hints for refferencing the maximum quality video and image content, please kindly search and find more enlightening video articles and images that fit your interests.

Someone Filed A False Insurance Claim Against Me. The owner refused to show us their damage at the time or give any of their details. For example, if you had three years’ no claims bonus, you might lose one year of that, giving you two years’ no. Our insurance company will give us no details of the owner, the car, the damage, time of damage or location of the incident. However, you might not lose the entire bonus:

How To File An Auto Insurance Claim Against Someone From michiganautolaw.com

How To File An Auto Insurance Claim Against Someone From michiganautolaw.com

If so, hopefully they did their job and went after him. Hard insurance fraud (also called premeditated insurance fraud) occurs when the claimant invents a way to make an insurance claim. You can check with your insurance agent if that is correct. Insurance fraud is committed in many forms, but regardless of the type, it is considered a serious crime in all jurisdictions. If fault is difficult to determine, call 311 and file a police report. Another way of filing a claim against a false personal injury claim is to file a separate civil action for damages.

If you are convinced the person who filed the claim did so in violation of section 550 (a), contact your local police department.

On 15 august, i received an email from admiral insurance saying they have been advised of a possible incident on 4 august involving my car, in which a third party is attempting to make a personal injury claim and a claim has been set up under my policy to investigate this. If you fail to report this claim in a timely manner, even though it�s completely bogus, your insurance company could deny you coverage. Although you have to reply to the claim within 14 days, you will probably find it helpful to contact the person making the claim (or their legal Sometimes, insurance companies cannot agree on fault. (1) knowingly present or cause to be presented any false or fraudulent claim for the payment of a loss or injury, including payment of a loss or injury under a contract of insurance. The owner refused to show us their damage at the time or give any of their details.

Source: phoenixprotectiongroup.com

Source: phoenixprotectiongroup.com

This action contemplates filing a new case, separate and distinct from the original suit. Where there is a genuine claim with the correct value but the supporting information may have been dishonestly embellished (the so called “fraudulent device”). On 15 august, i received an email from admiral insurance saying they have been advised of a possible incident on 4 august involving my car, in which a third party is attempting to make a personal injury claim and a claim has been set up under my policy to investigate this. However, you might not lose the entire bonus: The insurance act 2015 has confirmed and therefore replaced the common law, to a degree.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

However, you can learn to recognize the signs of a scam and help prevent your insurance company from paying a fraudulent claim. If you turn this in to your carrier and they deem you to be at fault, then you may get a 25% increase in your premiums for the next 4 years. The insurance act 2015 has confirmed and therefore replaced the common law, to a degree. Even if you believe the claim was false or exaggerated, in this context it is your insurer’s call to make. Call your insurance company�s customer service number and speak to someone in claims to find out if the situation is covered by your.

Source: legaldictionary.net

Source: legaldictionary.net

You won’t get far trying to sue someone who files a phony whiplash claim against you. For example, if you had three years’ no claims bonus, you might lose one year of that, giving you two years’ no. Insurance fraud is committed in many forms, but regardless of the type, it is considered a serious crime in all jurisdictions. Hard insurance fraud (also called premeditated insurance fraud) occurs when the claimant invents a way to make an insurance claim. On 15 august, i received an email from admiral insurance saying they have been advised of a possible incident on 4 august involving my car, in which a third party is attempting to make a personal injury claim and a claim has been set up under my policy to investigate this.

Source: lewisbrisbois.com

Source: lewisbrisbois.com

If fault is difficult to determine, call 311 and file a police report. If so, hopefully they did their job and went after him. This is a false claim against me and i was not in the area during the time of the alleged claim. If fault is difficult to determine, call 311 and file a police report. The owner refused to show us their damage at the time or give any of their details.

Source: zanderjaz.com

Source: zanderjaz.com

If someone filed a claim against your insurance and you are deemed at fault your no claims bonus will be impacted. If you file a fraudulent personal injury claim, you can. One of the more popular insurance fraud scams involves vehicle crashes that result in both legitimate and fake/exaggerated injuries. You go to the chiropractor, who improperly bills the insurer for nonexistent injuries. As for him filing a claim, your insurance will cover you if he does.

Source: autoinsurancequotesoftampa.com

Source: autoinsurancequotesoftampa.com

If you file a fraudulent personal injury claim, you can. There is not much to do even if you think the claim is fraudulent. This action contemplates filing a new case, separate and distinct from the original suit. Insurance fraud is committed in many forms, but regardless of the type, it is considered a serious crime in all jurisdictions. After all, this is why you carry insurance, to protect yourself in the event someone makes a claim.

Source: phoenixprotectiongroup.com

Source: phoenixprotectiongroup.com

If you fail to report this claim in a timely manner, even though it�s completely bogus, your insurance company could deny you coverage. Insurance fraud occurs when a person or entity makes false insurance claims in order to obtain compensation or benefits to which they are not entitled. (1) knowingly present or cause to be presented any false or fraudulent claim for the payment of a loss or injury, including payment of a loss or injury under a contract of insurance. However, if you are sued and do not file an answer or other responsive pleading in court, they may have a default judgment entered against you. A false claim triggers liability to the insurance company.

Source: michiganautolaw.com

Source: michiganautolaw.com

If you file a fraudulent personal injury claim, you can. For example, if you had three years’ no claims bonus, you might lose one year of that, giving you two years’ no. The insurance company must prove your involvement in the accident before they can get a judgment against you. If so, the insurer will pay compensation to people who are injured. In genuine accidents, it�s because someone has taken a reg number down wrong and that 1 digit means you end up getting the claim against you.

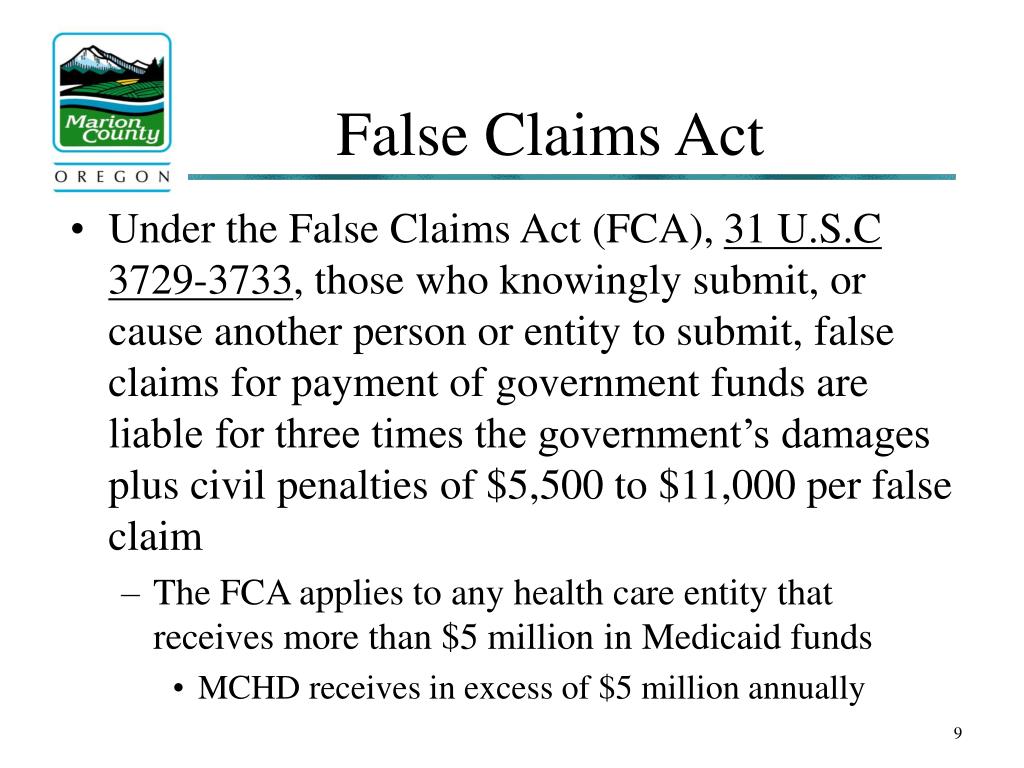

Source: slideserve.com

Source: slideserve.com

This action contemplates filing a new case, separate and distinct from the original suit. This type of insurance fraud usually involves some sort of deliberate action, such as intentionally causing an accident or staging arson or theft of a vehicle. In genuine accidents, it�s because someone has taken a reg number down wrong and that 1 digit means you end up getting the claim against you. One of the more popular insurance fraud scams involves vehicle crashes that result in both legitimate and fake/exaggerated injuries. If you have homeowner�s or renter�s insurance, it typically includes liability insurance.

Source: takemycounsel.com

Source: takemycounsel.com

You should immediately contact your auto insurance company and report this claim against you. The insurance company must prove your involvement in the accident before they can get a judgment against you. Where there is a genuine claim but the amount is exaggerated; Our insurance company will give us no details of the owner, the car, the damage, time of damage or location of the incident. On 15 august, i received an email from admiral insurance saying they have been advised of a possible incident on 4 august involving my car, in which a third party is attempting to make a personal injury claim and a claim has been set up under my policy to investigate this.

Source: effreslaw.com

Source: effreslaw.com

If that happens, there is really nothing you can do. If someone filed a claim against your insurance and you are deemed at fault your no claims bonus will be impacted. If you are convinced the person who filed the claim did so in violation of section 550 (a), contact your local police department. A false claim triggers liability to the insurance company. As for him filing a claim, your insurance will cover you if he does.

Source: homeownersinsurancecoverage.com

Source: homeownersinsurancecoverage.com

However, if you are sued and do not file an answer or other responsive pleading in court, they may have a default judgment entered against you. You can check with your insurance agent if that is correct. Where there is a genuine claim but the amount is exaggerated; Making a claim if someone is putting in a claim against you or has told you that they might be doing so, you need to contact our claims team immediately on (01) 290 1999. If you are convinced the person who filed the claim did so in violation of section 550 (a), contact your local police department.

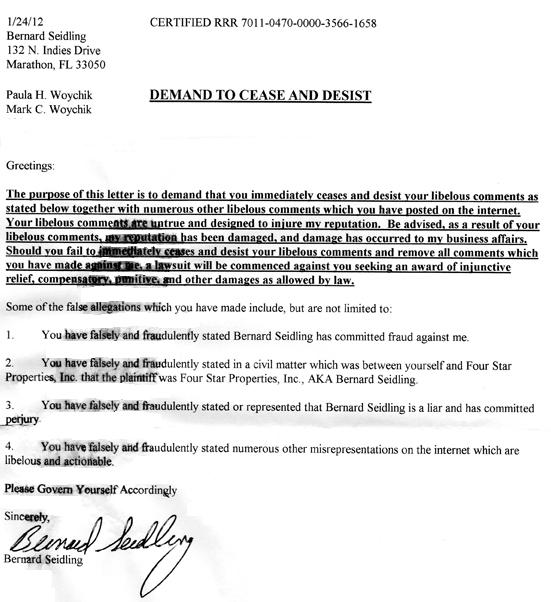

Source: bernardseidling.blogspot.com

Source: bernardseidling.blogspot.com

Depending on the context in which your statements were made, you may be covered by this insurance. If you file a fraudulent personal injury claim, you can. Someone filed a claim against my insurance: Say you�re in a car crash and your back hurts. On 15 august, i received an email from admiral insurance saying they have been advised of a possible incident on 4 august involving my car, in which a third party is attempting to make a personal injury claim and a claim has been set up under my policy to investigate this.

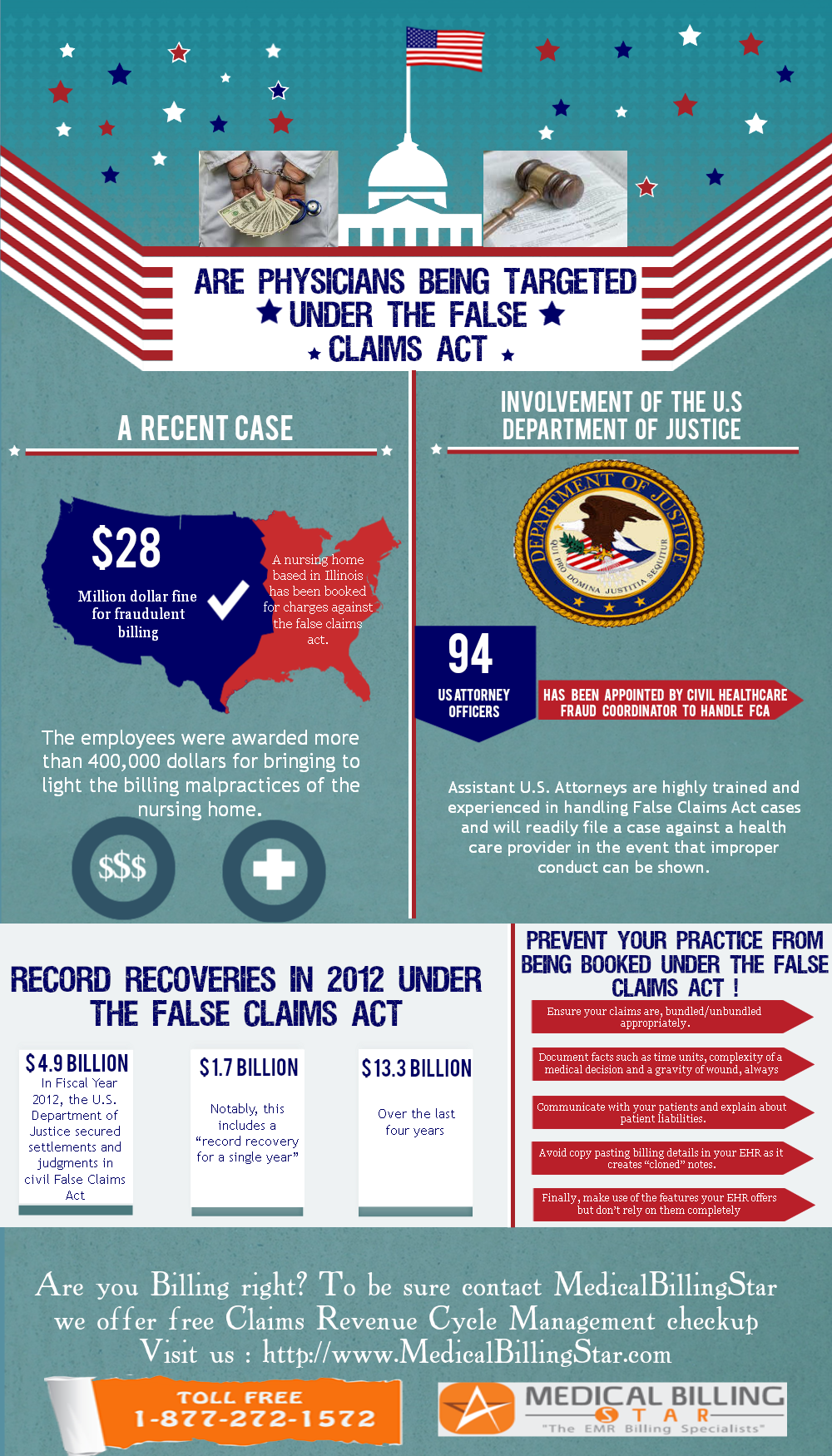

Source: medicalbillingstar.com

Source: medicalbillingstar.com

This is a false claim against me and i was not in the area during the time of the alleged claim. The other reason, as mentioned, is due to cloning, but that�s not as common as you�d think. This is an effective and speedy method because the counterclaim will be decided together with the original suit. If you�re uninsured, and the other driver files a personal injury lawsuit against you, then you could be financially responsible for all of that person�s losses resulting from the accident (damages), including their medical bills, their lost income, and their mental and physical pain and suffering. Another way of filing a claim against a false personal injury claim is to file a separate civil action for damages.

Source: greendesignbox.blogspot.com

Source: greendesignbox.blogspot.com

At this point, i recommend contacting your insurance company immediately. If you fail to report this claim in a timely manner, even though it�s completely bogus, your insurance company could deny you coverage. You can check with your insurance agent if that is correct. The insurer will deny the claim you have put in and not offer any compensation for the losses associated with it. For example, if you had three years’ no claims bonus, you might lose one year of that, giving you two years’ no.

Source: businessmodulehub.com

Source: businessmodulehub.com

Depending on the context in which your statements were made, you may be covered by this insurance. I�ve been in france on holiday since 10 july 2017. However, you can learn to recognize the signs of a scam and help prevent your insurance company from paying a fraudulent claim. One of the more popular insurance fraud scams involves vehicle crashes that result in both legitimate and fake/exaggerated injuries. They can take the following action:

Source: takemycounsel.com

Source: takemycounsel.com

To explore this concept, consider the following insurance fraud definition. Someone filed a claim against my insurance: False claims hurt everyone by causing higher insurance premiums, and making claims adjusters suspicious of every personal injury claim. Insurance fraud occurs when a person or entity makes false insurance claims in order to obtain compensation or benefits to which they are not entitled. After all, this is why you carry insurance, to protect yourself in the event someone makes a claim.

Source: michiganautolaw.com

Source: michiganautolaw.com

A false claim triggers liability to the insurance company. You can still talk to the person making a claim against you. If you turn this in to your carrier and they deem you to be at fault, then you may get a 25% increase in your premiums for the next 4 years. Even if you believe the claim was false or exaggerated, in this context it is your insurer’s call to make. Insurance fraud is committed in many forms, but regardless of the type, it is considered a serious crime in all jurisdictions.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title someone filed a false insurance claim against me by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information