Special form insurance information

Home » Trend » Special form insurance informationYour Special form insurance images are ready in this website. Special form insurance are a topic that is being searched for and liked by netizens today. You can Download the Special form insurance files here. Get all royalty-free images.

If you’re searching for special form insurance pictures information related to the special form insurance keyword, you have pay a visit to the right site. Our site always provides you with hints for seeking the highest quality video and picture content, please kindly surf and find more informative video articles and graphics that match your interests.

Special Form Insurance. Special exclusions the following provisions apply only to the specified coverage forms. There are common exclusions to most special form policies. Overall, this is much broader than. Special causes of loss form — one of the three insurance services office, inc.

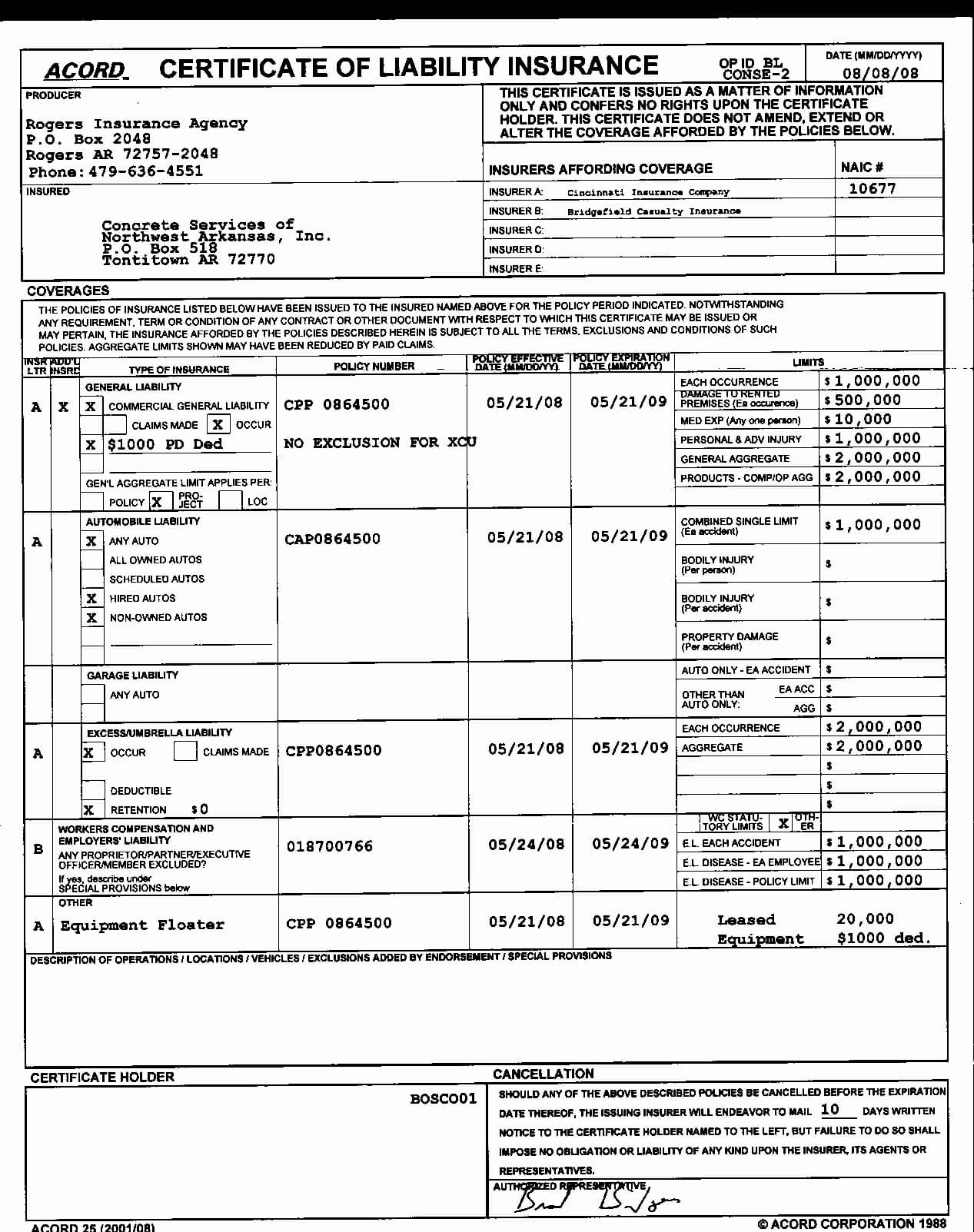

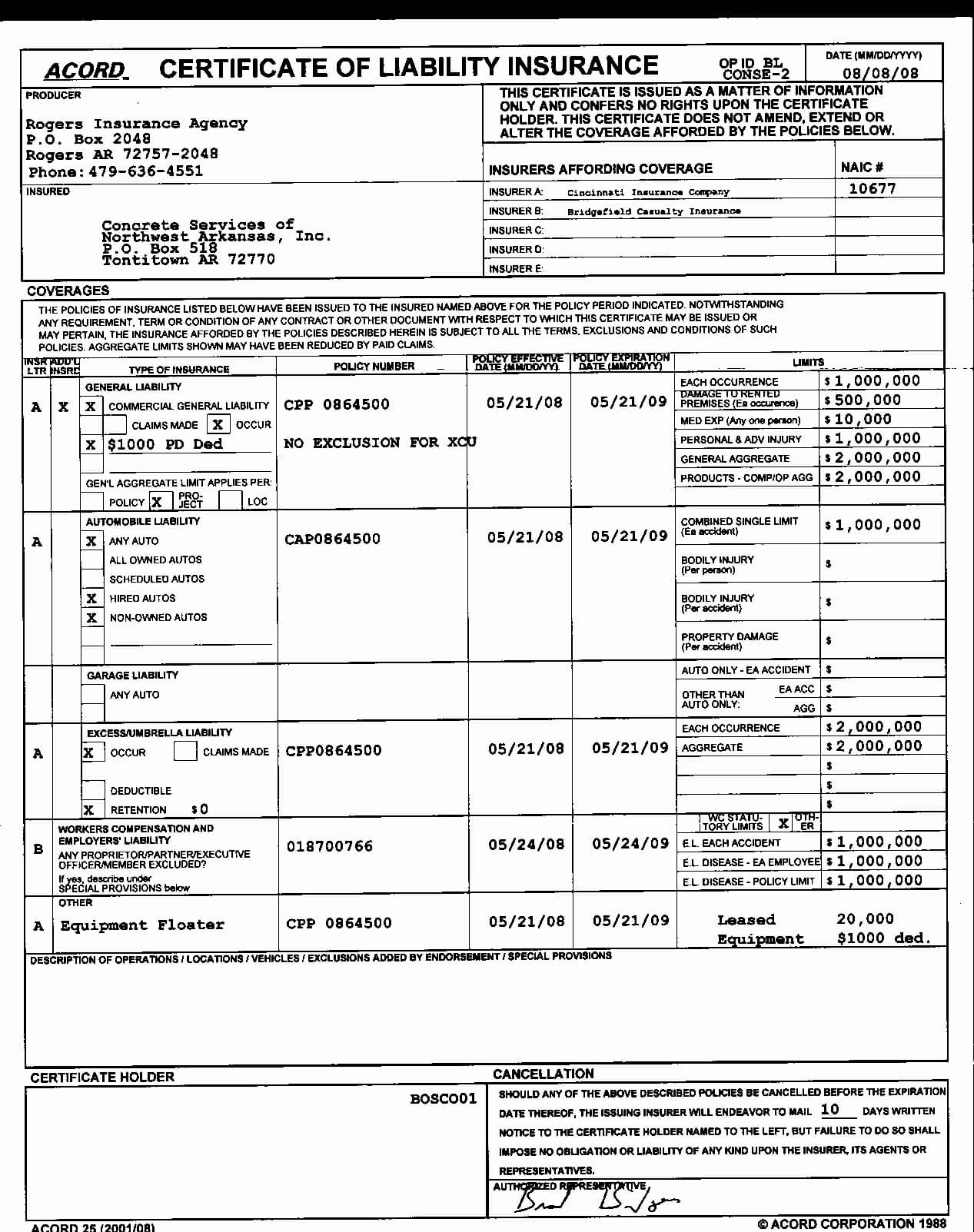

Acord Certificate Of Liability Insurance Insurancelooker From ideas.sybernews.com

Acord Certificate Of Liability Insurance Insurancelooker From ideas.sybernews.com

In this policy, you and your refer to the named When analyzing basic form vs. The most common property insurance form is the special form, formerly referred to as all risk. when a property policy is written on a special form, the insurance company has a duty to specifically exclude coverage. The special causes of loss form is an all risks form; The basic and broad form options are “named peril” coverage forms. Also know, what is special form coverage?

Special causes of loss form — one of the three insurance services office, inc.

Business income (and extra expense) coverage form, business income (without extra expense) coverage form, or extra expense coverage form we will not pay for: This means that they specifically list what coverage perils apply to the policy. Just like homeowners policies, there are several different types of dwelling fire coverage. Basic form is the most restrictive, while special offers the greater level of protection. The most common property insurance form is the special form, formerly referred to as all risk. when a property policy is written on a special form, the insurance company has a duty to specifically exclude coverage. In other words, unless the policy states a peril isn�t included, it�s included and your potential loss is covered.

Source: quoteble.com

Source: quoteble.com

In this policy, you and your refer to the named In this policy, “you” and “your” refer to the “named insured” shown in the declarations and the spouse So essentially, a special form insurance policy is read opposite of a basic or broad form insurance policy. Conversely, basic form policies itemize covered perils. The basic and broad form options are “named peril” coverage forms.

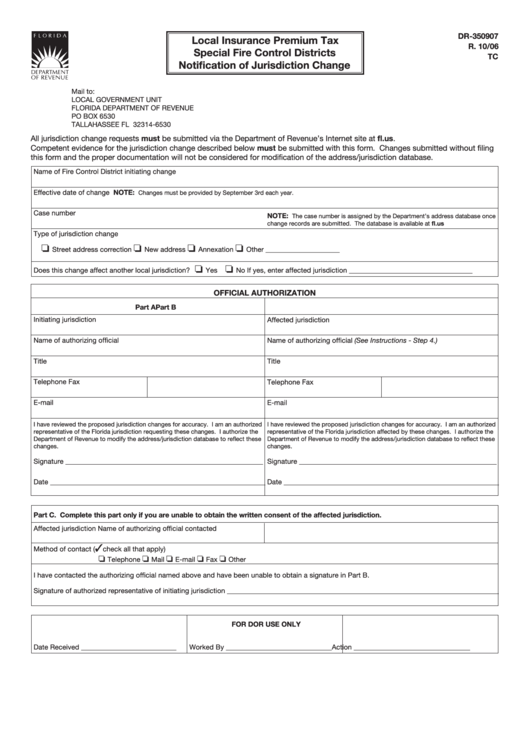

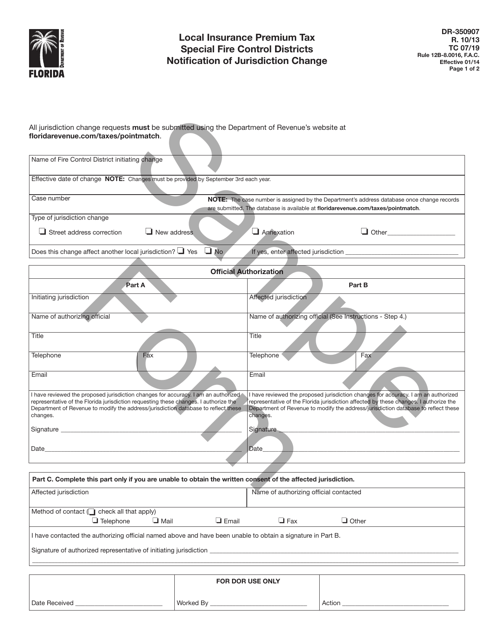

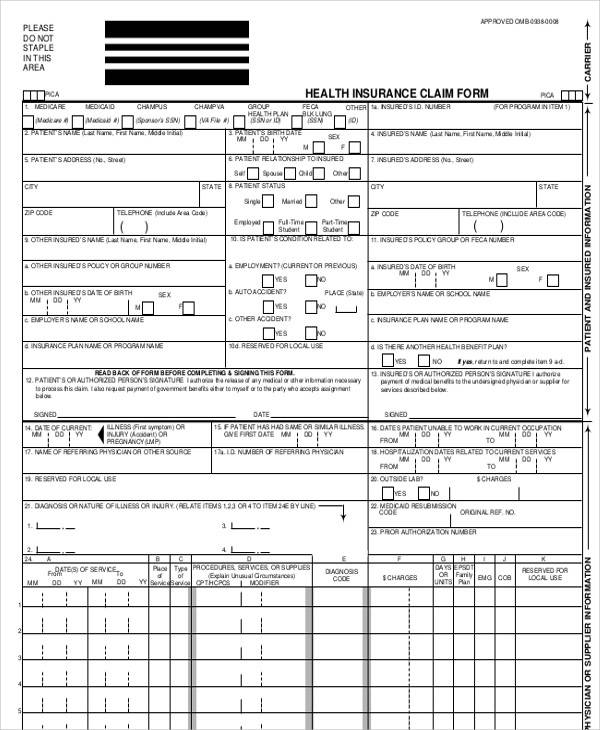

Source: formsbank.com

Source: formsbank.com

Special form coverage protects property against any source of loss that is not specifically excluded. Or 2.limited in section c., limitations that follow. Business income (and extra expense) coverage form, business income (without extra expense) coverage form, or extra expense coverage form we will not pay for: Basic form coverage, broad form coverage and special form insurance coverage. Cp 10 30 10 12 and

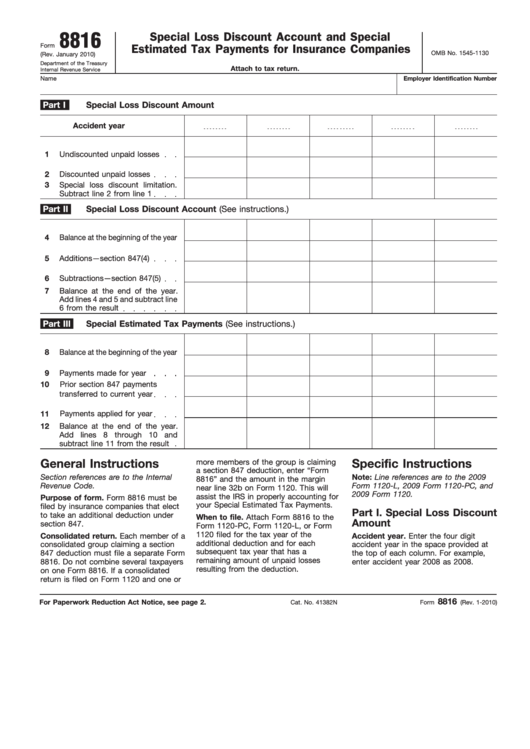

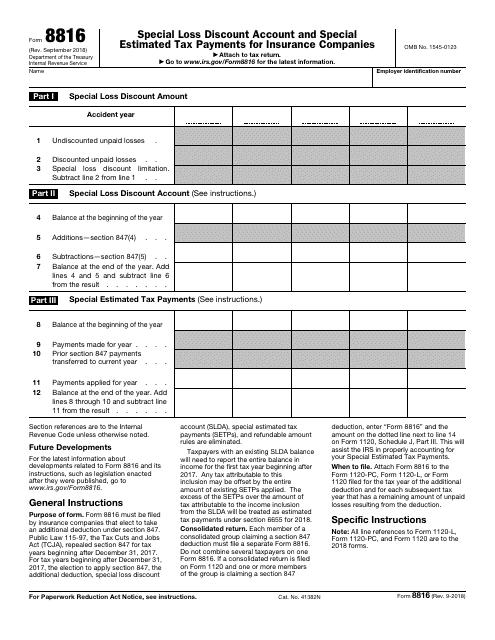

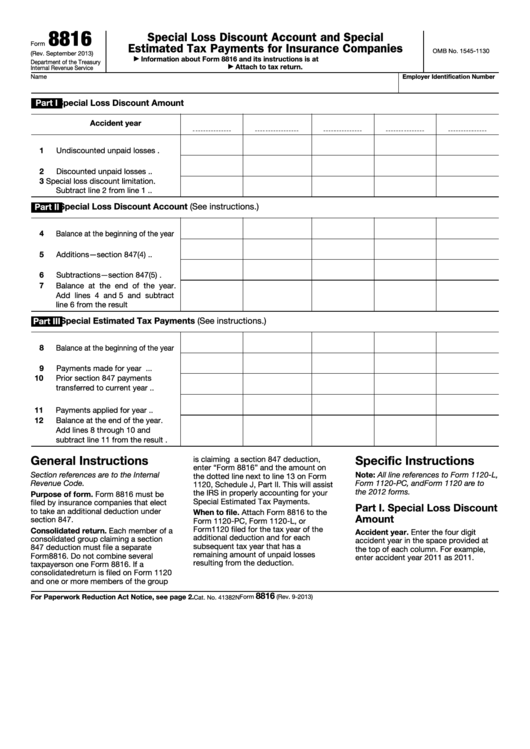

Source: bookstore.gpo.gov

Source: bookstore.gpo.gov

1.excluded in section b., exclusions; Special causes of loss form — one of the three insurance services office, inc. Perils that are not covered on most policies are: The special causes of loss form (cp 10 30) provides what is referred to as all risks coverage: The first two might save you money in the short term.

Source: jvdemeritte.blogspot.com

Source: jvdemeritte.blogspot.com

Basic form coverage, broad form coverage and special form insurance coverage. The basic and broad form options are “named peril” coverage forms. Basic form coverage, broad form coverage and special form insurance coverage. Unlike the named peril coverage forms, special form coverage is also known as “open peril” or “all risk” coverage. Anything that is unlisted is covered, anything listed in the exclusions section is excluded.

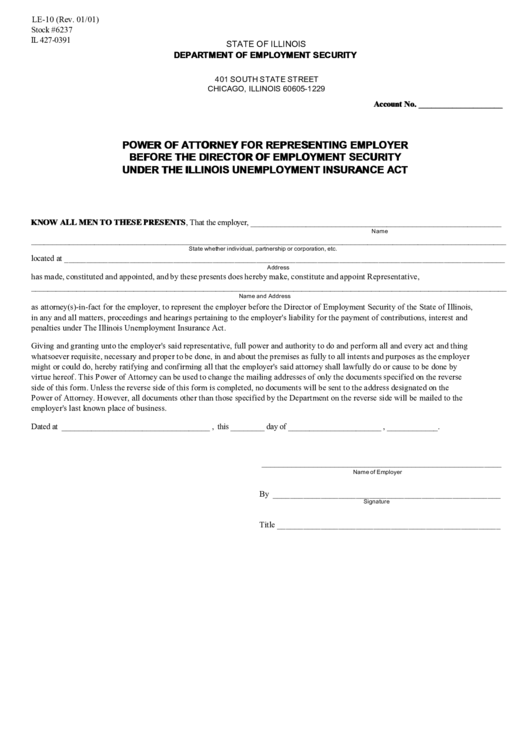

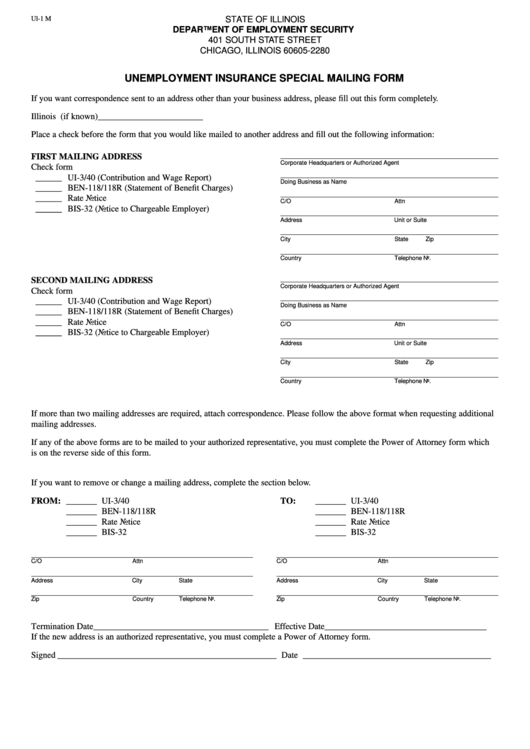

Source: templateroller.com

Source: templateroller.com

Commercial insurance is a must for business owners. Overall, this is much broader than. The special causes of loss form (cp 10 30) provides what is referred to as all risks coverage: Special exclusions the following provisions apply only to the specified coverage forms. So, if the policy doesn’t specifically exclude a peril, it might be covered.

Source: safeguardme.com

Source: safeguardme.com

Keeping this in view, what are the special perils? This means that they specifically list what coverage perils apply to the policy. In general, insurance provides for many sudden, unforeseen, unintended, and unplanned events. The special causes of loss form (cp 10 30) provides what is referred to as all risks coverage: Or 2.limited in section c., limitations that follow.

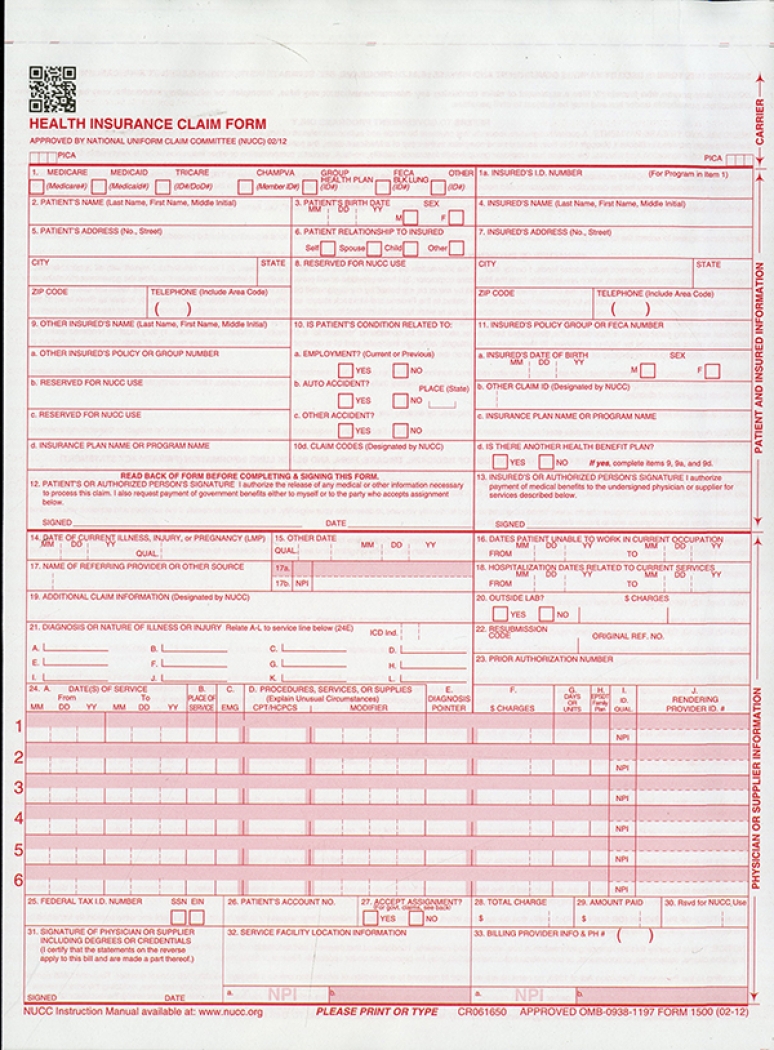

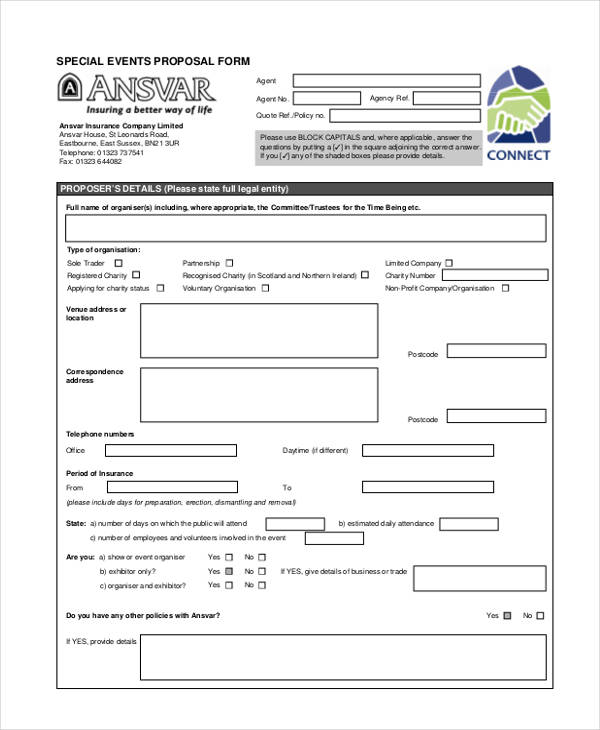

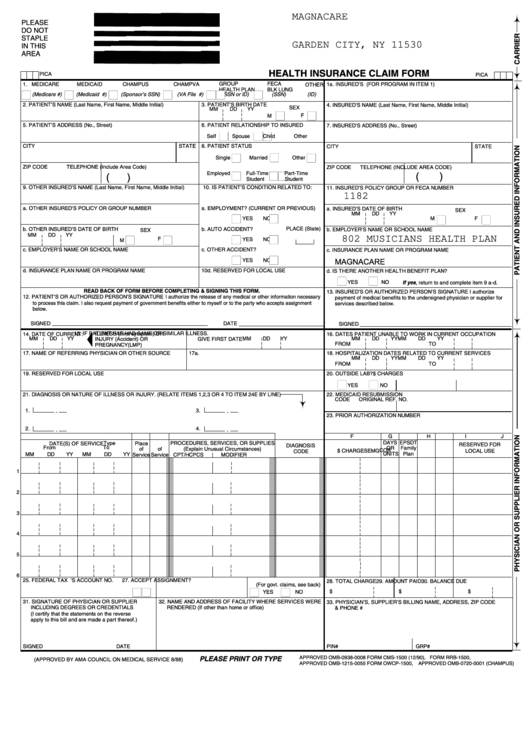

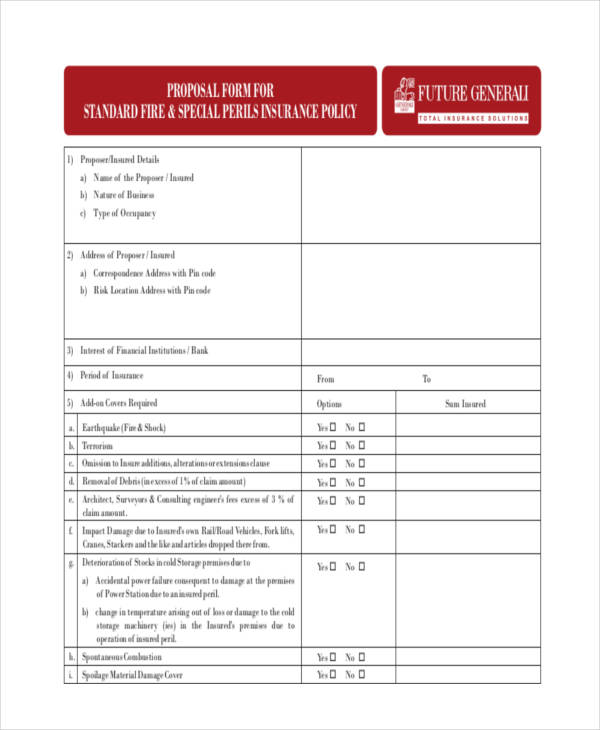

Source: sampleforms.com

Source: sampleforms.com

In other words, unless the policy states a peril isn�t included, it�s included and your potential loss is covered. The most expansive form of insurance coverage is special form. Unlike the named peril coverage forms, special form coverage is also known as “open peril” or “all risk” coverage. Overall, this is much broader than. So, if the policy doesn’t specifically exclude a peril, it might be covered.

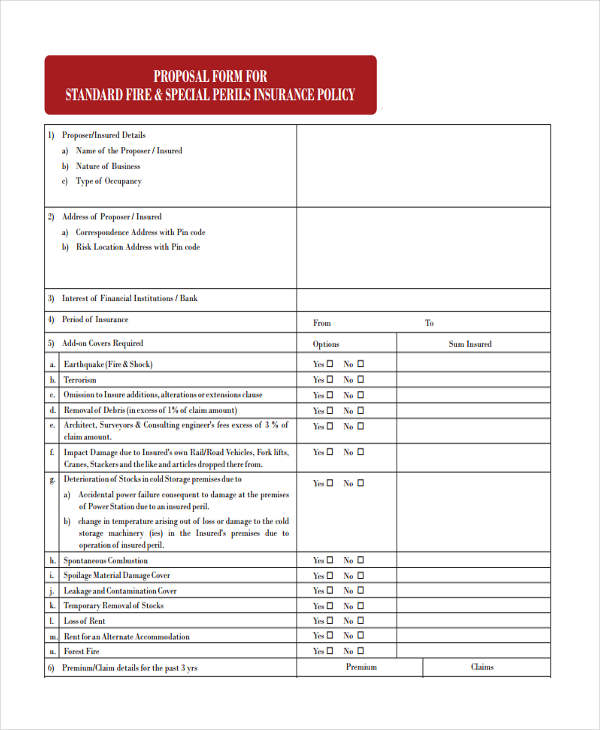

Source: sampleforms.com

Source: sampleforms.com

It essentially means everything is covered except what is listed as an exclusion. The first two might save you money in the short term. Special exclusions the following provisions apply only to the specified coverage forms. Commercial insurance is a must for business owners. In other words, unless the policy states a peril isn�t included, it�s included and your potential loss is covered.

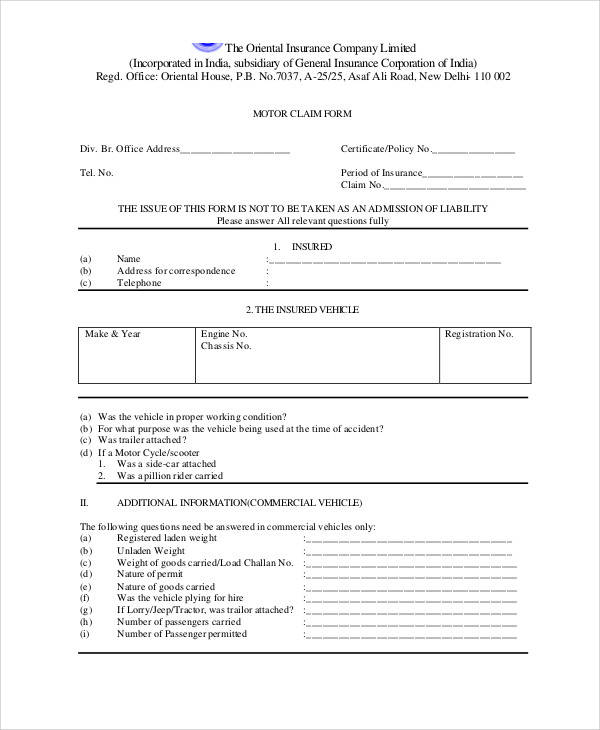

Source: formsbank.com

Source: formsbank.com

The most expansive form of insurance coverage is usually within the special form policies. When comparing insurance policies for your apartment building, make sure you understand the differences between basic form coverage, broad form coverage, and special form coverage. 1.excluded in section b., exclusions; The most common property insurance form is the special form, formerly referred to as all risk. when a property policy is written on a special form, the insurance company has a duty to specifically exclude coverage. In general, insurance provides for many sudden, unforeseen, unintended, and unplanned events.

Source: templateroller.com

Source: templateroller.com

(iso), commercial property insurance causes of loss forms. It provides coverage for loss from any cause except those that are specifically excluded. Overall, this is much broader than. The special form insurance policy is the ideal form for property owners. In policies that use the special form type of coverage, instead of the perils covered being listed, the exclusions are listed.

Causes of loss forms establish and define the causes of loss (or perils) for which coverage is provided. The exclusions are things such as nuclear hazards, earthquakes, war, water (usually defined as floods). Keeping this in view, what are the special perils? Overall, this is much broader than. When comparing insurance policies for your apartment building, make sure you understand the differences between basic form coverage, broad form coverage, and special form coverage.

Source: franciscostandard.blogspot.com

Source: franciscostandard.blogspot.com

When comparing insurance policies for your apartment building, make sure you understand the differences between basic form coverage, broad form coverage, and special form coverage. In this policy, you and your refer to the named The special form insurance policy is the ideal form for property owners. In other words, unless the policy states a peril isn�t included, it�s included and your potential loss is covered. Effective july 1, 2021, all university buildings and contents will be covered for all risk special form property insurance through the state fire protection grant fund, which is managed by the nc department of insurance.

Source: formsbank.com

Source: formsbank.com

Simply put, if the insurance company does not exclude coverage in writing, the damage to your property will be paid for. The special causes of loss form is an all risks form; In this policy, “you” and “your” refer to the “named insured” shown in the declarations and the spouse Basic, broad, and special form are three common coverage forms when insuring property. Special form coverage protects property against any source of loss that is not specifically excluded.

Source: ideas.sybernews.com

Source: ideas.sybernews.com

Or 2.limited in section c., limitations that follow. So, if the policy doesn’t specifically exclude a peril, it might be covered. Causes of loss forms establish and define the causes of loss (or perils) for which coverage is provided. Basic, broad, and special form are three common coverage forms when insuring property. The most common property insurance form is the special form, formerly referred to as all risk. when a property policy is written on a special form, the insurance company has a duty to specifically exclude coverage.

Source: franciscostandard.blogspot.com

Source: franciscostandard.blogspot.com

Conversely, basic form policies itemize covered perils. In other words, unless the policy states a peril isn�t included, it�s included and your potential loss is covered. So, if the policy doesn’t specifically exclude a peril, it might be covered. Basic form is the most restrictive, while special offers the greater level of protection. The exclusions are things such as nuclear hazards, earthquakes, war, water (usually defined as floods).

Source: formsbank.com

Source: formsbank.com

The most expansive form of insurance coverage is usually within the special form policies. So, if the policy doesn’t specifically exclude a peril, it might be covered. Basic form is the most restrictive, while special offers the greater level of protection. Special form insurance coverage, note that broad form policies itemize the perils that aren’t covered. Unlike the named peril coverage forms, special form coverage is also known as “open peril” or “all risk” coverage.

Source: formsbank.com

Source: formsbank.com

Cp 10 30 10 12 and The special limit for each numbered category below is the total limit for each loss for all property in that category. In policies that use the special form type of coverage, instead of the perils covered being listed, the exclusions are listed. Simply put, if the insurance company does not exclude coverage in writing, the damage to your property will be paid for. A dwelling fire policy may be the type of coverage you need to insure your rental or investment property from damages.

Source: sampleforms.com

Source: sampleforms.com

In general, insurance provides for many sudden, unforeseen, unintended, and unplanned events. Final thoughts with so many options, it is important to carefully read your type of policy form with their named perils and exclusions, and if you are unsure, you should contact your agent or insurance carrier. The basic and broad form options are “named peril” coverage forms. In this policy, you and your refer to the named Usually, but not always, the special form is the one you want to buy.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title special form insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information