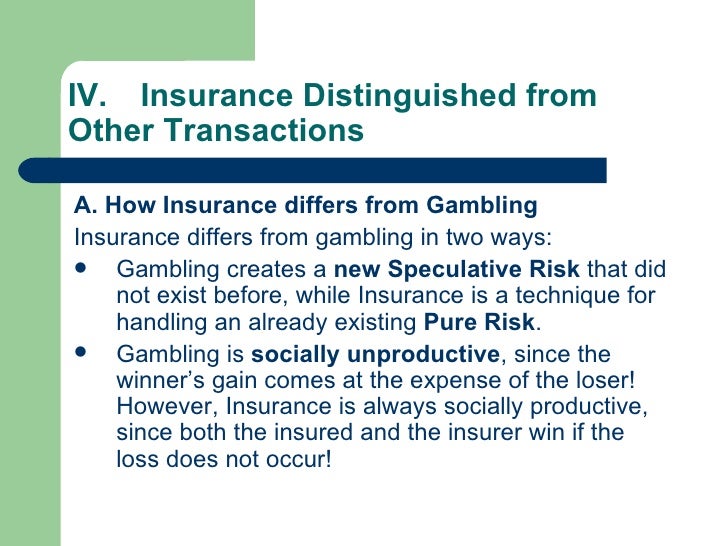

Speculative risk insurance Idea

Home » Trending » Speculative risk insurance IdeaYour Speculative risk insurance images are available in this site. Speculative risk insurance are a topic that is being searched for and liked by netizens now. You can Download the Speculative risk insurance files here. Get all royalty-free vectors.

If you’re searching for speculative risk insurance pictures information connected with to the speculative risk insurance keyword, you have visit the right site. Our website always provides you with hints for viewing the highest quality video and image content, please kindly surf and find more enlightening video content and graphics that fit your interests.

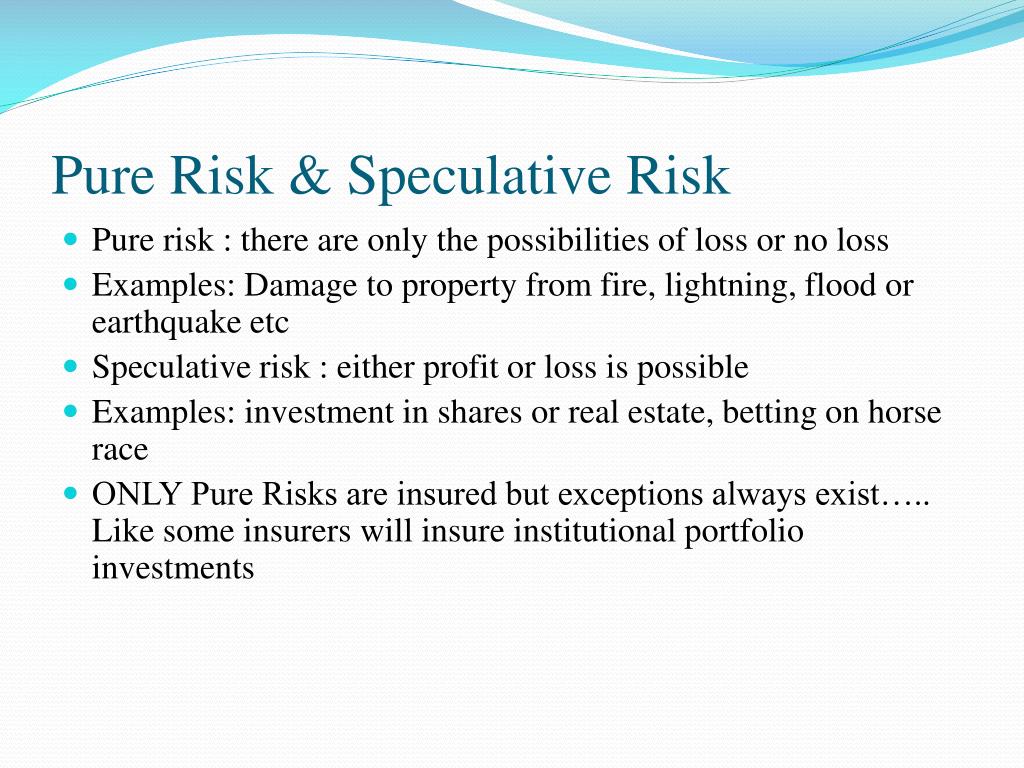

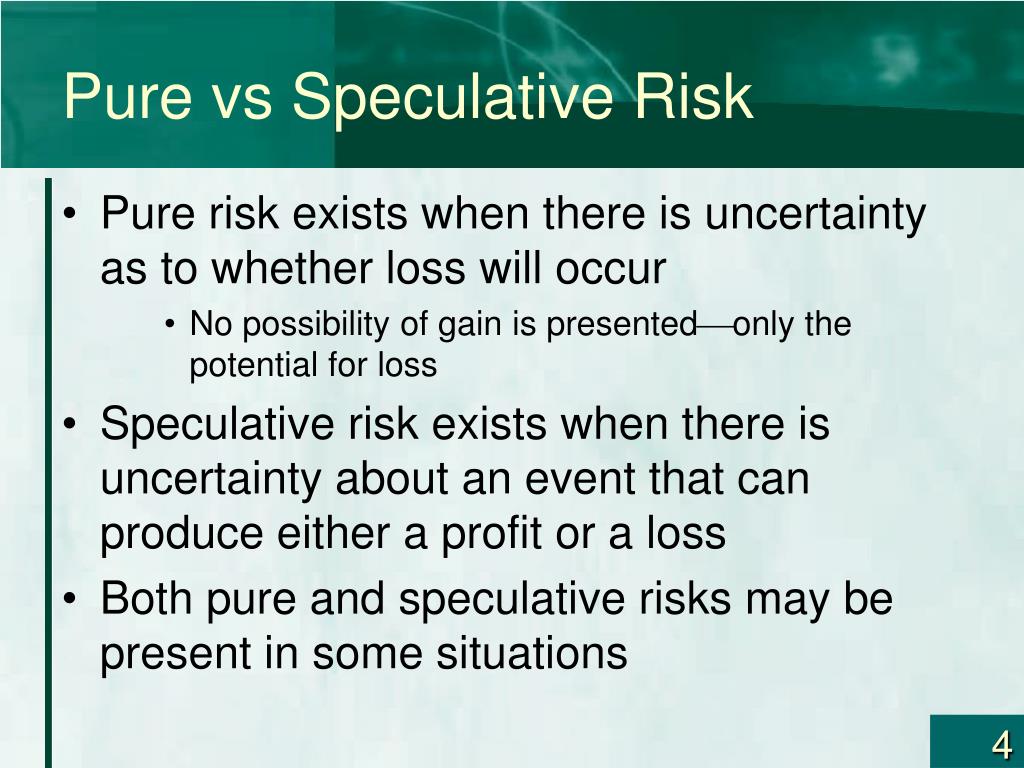

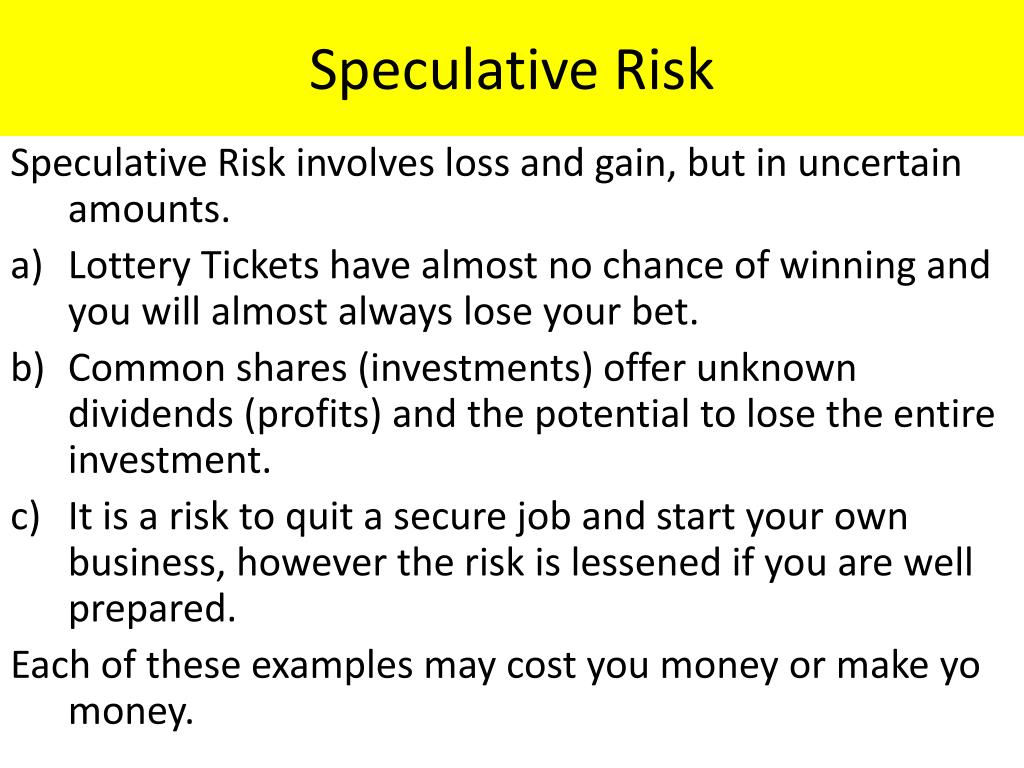

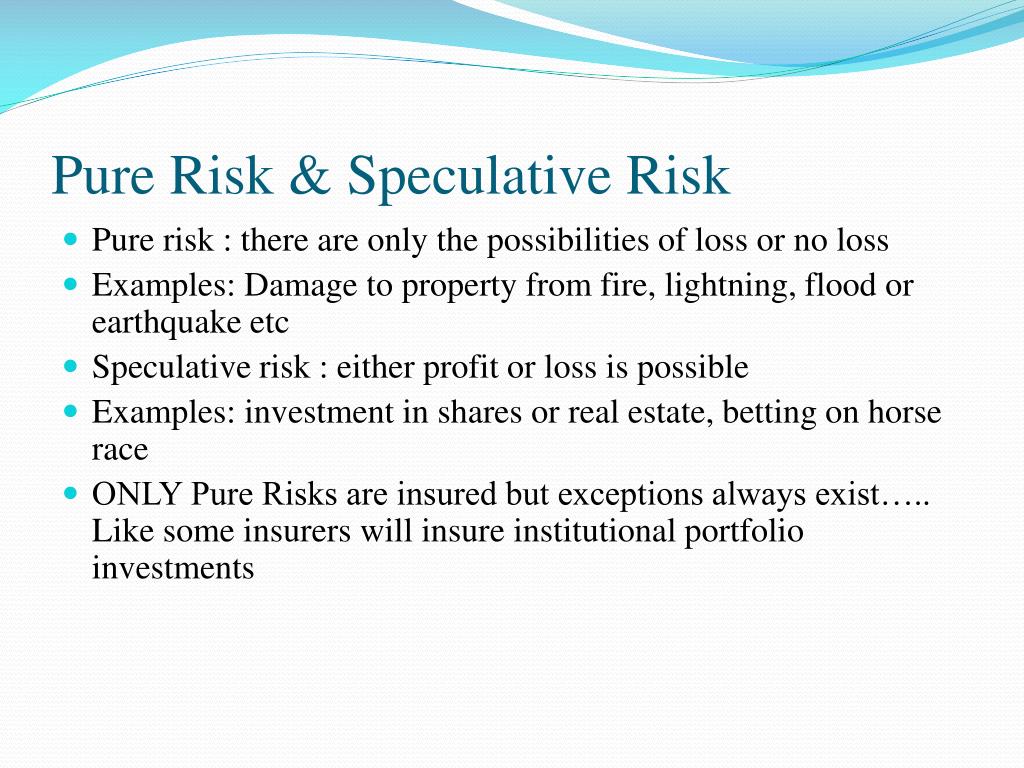

Speculative Risk Insurance. It is possible for the share va. Often referred to as a. Speculative risk is the risk that something will happen causing a loss, or something could happen leading to a gain. Examples of speculative risk || insurancemost financial investments, such as the purchase of stock, involve speculative risk.

PPT Principles Of Insurance PowerPoint Presentation From slideserve.com

PPT Principles Of Insurance PowerPoint Presentation From slideserve.com

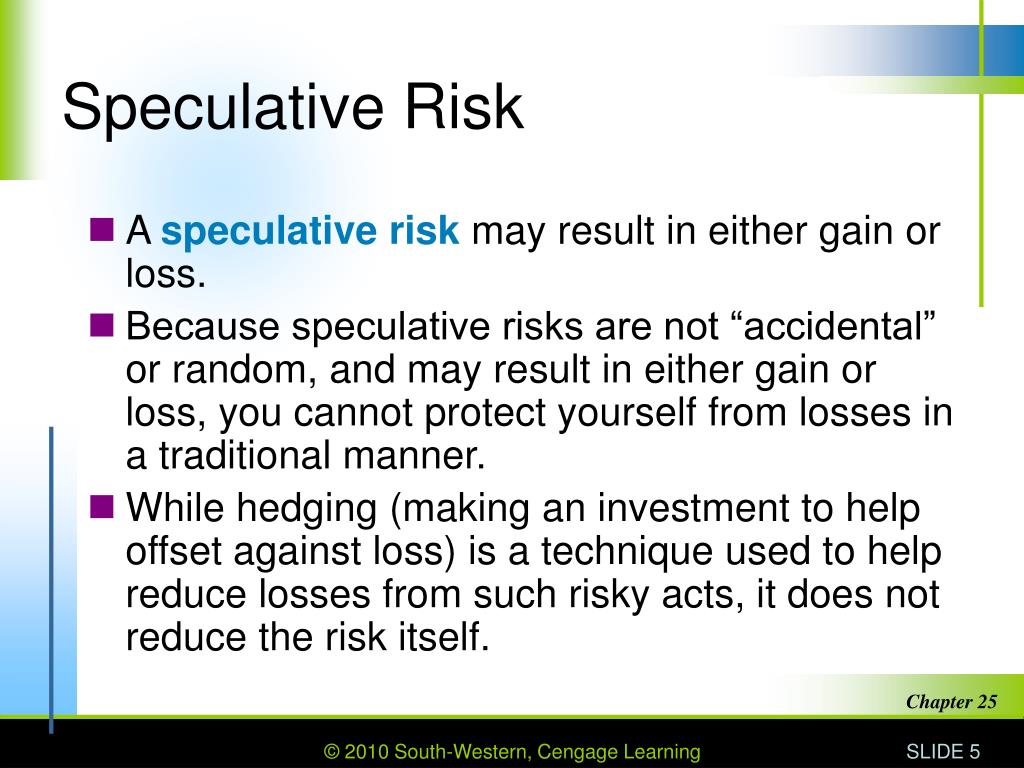

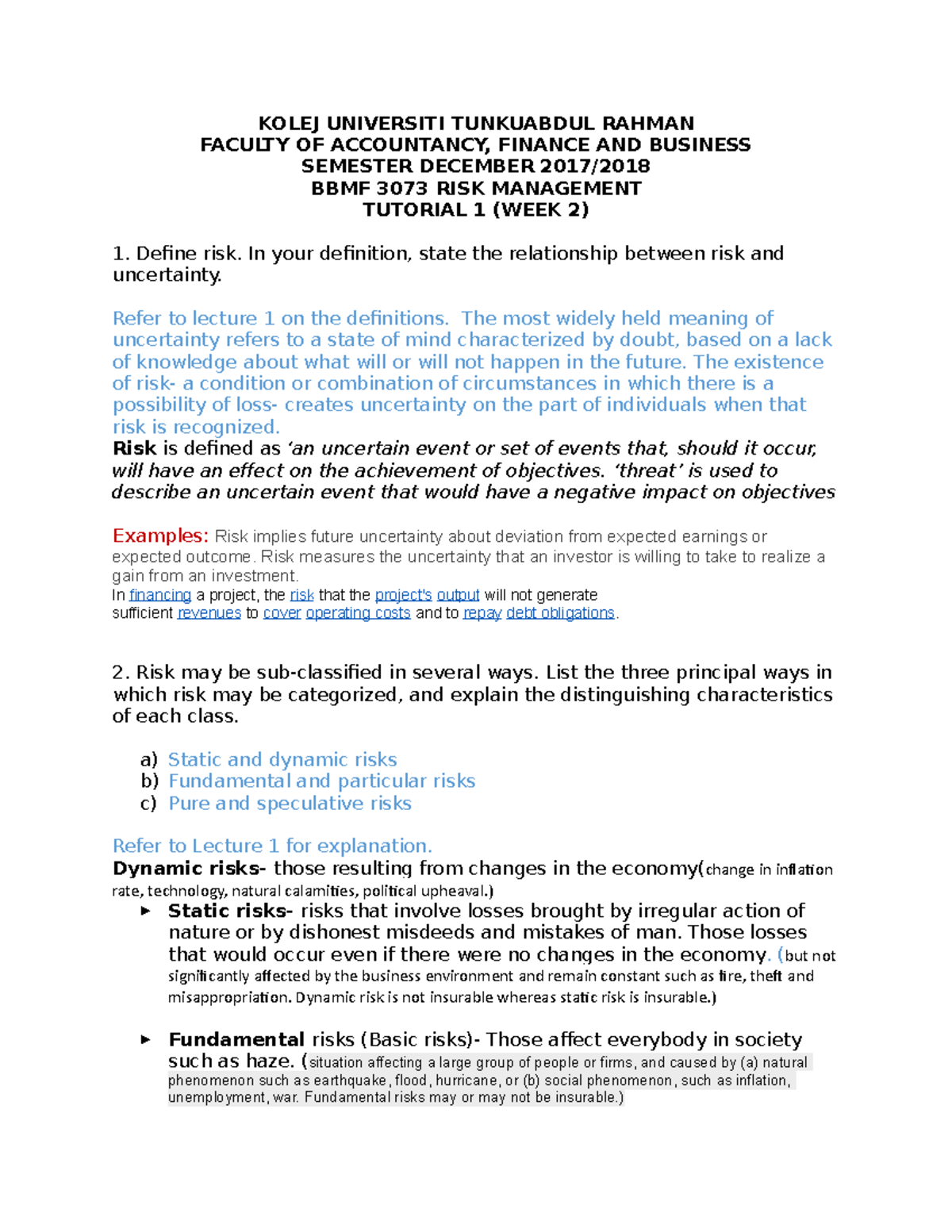

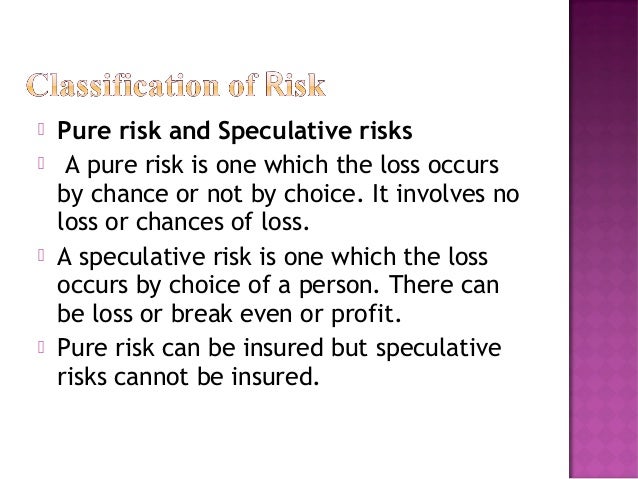

An example of speculative risk includes the purchase of the shares of a company by a person. || speculative riskspeculative risk is a category of risk that, when undertaken, results in an uncertain degree of gai. Only pure risks are insurable because they involve only the chance of loss. Speculative risk is a category of risk that, when undertaken, results in an uncertain degree of gain or loss. Three possible outcomes exist in speculative risk: What is speculative risk in insurance?

Investing in shares may be a good example.

Something good (gain), something bad (loss) or nothing (staying even). At least the intent is to make a profit and no loss (although loss might ensue). Something good (gain), something bad (loss) or nothing (staying even). Insurance is concerned with the economic problems created by pure risks. These types of risk are almost never insured by insurance companies, as they lack the core elements of insurability which include “due to chance,” statistical predictability, and random selection. Both speculative risk and pure risk involve the possibility of loss.

Source: minecraftservers.nu

Source: minecraftservers.nu

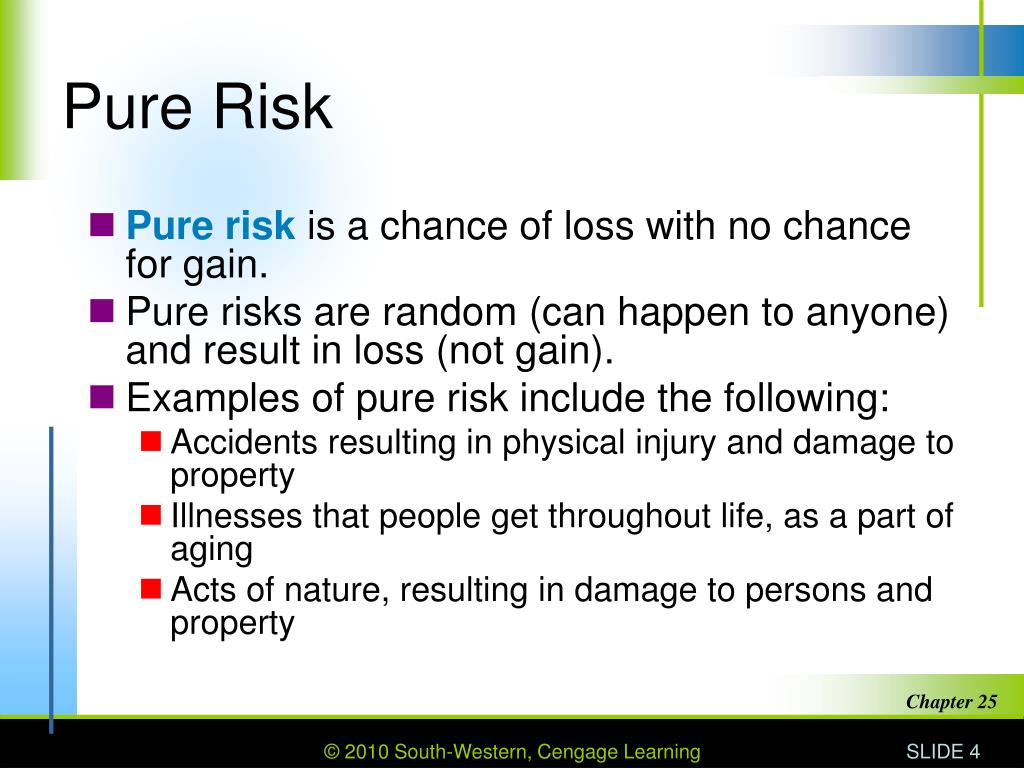

Hence insurance is not for gains but to reduce losses. Pure risks are risks that have no possibility of a positive outcome—something bad will happen or nothing at all will occur. What is an example of pure risk? Something good (gain), something bad (loss) or nothing (staying even). Loss, gain or no change.

Source: slideserve.com

Source: slideserve.com

The uncertainty of an event that could produce either a profit or a loss, such as a business venture Speculative risk is the risk that something will happen causing a loss, or something could happen leading to a gain. A pure risk is generally insurable while speculative risk is usually not. Only pure risks are insurable because they involve only the chance of loss. Investing in shares may be a good example.

Source: slideshare.net

Source: slideshare.net

Speculative risk is the opposite of pure risk, which is a risk that is inevitable and can result in either loss or no loss, but never gain. Investing in shares may be a good example. Examples of speculative risk || insurancemost financial investments, such as the purchase of stock, involve speculative risk. Gambling and investing in the stock. Pure risk can be covered by insurance because of its predictable nature.

Source: slideserve.com

Source: slideserve.com

|| speculative riskspeculative risk is a category of risk that, when undertaken, results in an uncertain degree of gai. Risk can be avoided, reduced, retained or transferred. Pure risk can be covered by insurance because of its predictable nature. Such a risk can be covered and is called as absolute risk or pure risk. All speculative risks are made as conscious choices and are not just a result of uncontrollable circumstances.

Source: slideserve.com

Source: slideserve.com

Loss, gain or no change. Speculative risk — uncertainty about an event under consideration that could produce either a profit or a loss, such as a business venture or a gambling transaction. Both speculative risk and pure risk involve the possibility of loss. An example of speculative risk includes the purchase of the shares of a company by a person. Speculative risks are not insurable.

Source: slideserve.com

Source: slideserve.com

A speculative risk is an investment risk, which if accepted, results in an uncertain outcome. What is a speculative business risk? At least the intent is to make a profit and no loss (although loss might ensue). When a company provides insurance against a pure risk, they are engaging in speculative risk because the entity is trying to ensure that the customer will (7). Speculative risk refers to price uncertainty and the potential for losses in investments.

Source: slideserve.com

Source: slideserve.com

A pure risk is generally insurable while speculative risk is usually not. Risk can be avoided, reduced, retained or transferred. All speculative risks are made as conscious choices and are not just a result of uncontrollable circumstances. Speculative risk is a category of risk that, when undertaken, results in an uncertain degree of gain or loss. Three possible outcomes exist in speculative risk:

Source: slideserve.com

Source: slideserve.com

Something good (gain), something bad (loss) or nothing (staying even). As opposed to this, speculative risks are those risks where there is the possibility of gain or profit. What is a speculative business risk? Only pure risks are insurable because they involve only the chance of loss. Both speculative risk and pure risk involve the possibility of loss.

Source: plasticashtray.blogspot.com

Source: plasticashtray.blogspot.com

A speculative risk is an investment risk, which if accepted, results in an uncertain outcome. Gambling and investing in the stock. What is a speculative business risk? Pure risks are those risks where only a loss can occur if the event As opposed to this, speculative risks are those risks where there is the possibility of gain or profit.

Source: slideserve.com

Source: slideserve.com

Such a risk can be covered and is called as absolute risk or pure risk. These risks are generally not insurable. Speculative risk is the opposite of pure risk, which is a risk that is inevitable and can result in either loss or no loss, but never gain. Only pure risks are insurable because they involve only the chance of loss. Speculative risks are not insurable.

Source: slideshare.net

Source: slideshare.net

Chance of loss or gain; It is possible for the share va. What is a speculative business risk? Pure risks are those risks where only a loss can occur if the event Risk can be avoided, reduced, retained or transferred.

Source: slideserve.com

Source: slideserve.com

An example of speculative risk includes the purchase of the shares of a company by a person. What is speculative risk in insurance? What is a speculative business risk? At least the intent is to make a profit and no loss (although loss might ensue). Speculative risk is a category of risk that, when undertaken, results in an uncertain degree of gain or loss.

Source: slideshare.net

Source: slideshare.net

Pure risk there are two types of risks: Such a risk can be covered and is called as absolute risk or pure risk. When a company provides insurance against a pure risk, they are engaging in speculative risk because the entity is trying to ensure that the customer will (7). What is a speculative business risk? Beyond that, there are two subcategories of risk you need to be familiar with for your insurance exam and they are as follows:

Source: slideserve.com

Source: slideserve.com

Hence insurance is not for gains but to reduce losses. At least the intent is to make a profit and no loss (although loss might ensue). Both speculative risk and pure risk involve the possibility of loss. Beyond that, there are two subcategories of risk you need to be familiar with for your insurance exam and they are as follows: What is an example of pure risk?

Source: slideserve.com

Source: slideserve.com

Often referred to as a. Hence insurance is not for gains but to reduce losses. Speculative risk refers to price uncertainty and the potential for losses in investments. Risk can be avoided, reduced, retained or transferred. Speculative risk is the opposite of pure risk, which is a risk that is inevitable and can result in either loss or no loss, but never gain.

Source: youtube.com

Source: youtube.com

Three possible outcomes exist in speculative risk: Pure risk there are two types of risks: A speculative risk is an investment risk, which if accepted, results in an uncertain outcome. Often referred to as a. When a company provides insurance against a pure risk, they are engaging in speculative risk because the entity is trying to ensure that the customer will (7).

Source: brainly.in

Source: brainly.in

Investing in shares may be a good example. Risk can be avoided, reduced, retained or transferred. Pure risk, also known as absolute risk, is insurable. All speculative risks are made as conscious choices and are not just a result of uncontrollable circumstances. Three possible outcomes exist in speculative risk:

Source: plasticashtray.blogspot.com

Source: plasticashtray.blogspot.com

Something good (gain), something bad (loss) or nothing (staying even). An example of speculative risk includes the purchase of the shares of a company by a person. Risk can be avoided, reduced, retained or transferred. Speculative risk is the risk that something will happen causing a loss, or something could happen leading to a gain. Speculative risk is the opposite of pure risk, which is a risk that is inevitable and can result in either loss or no loss, but never gain.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title speculative risk insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information