Spendthrift clause life insurance Idea

Home » Trending » Spendthrift clause life insurance IdeaYour Spendthrift clause life insurance images are available in this site. Spendthrift clause life insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the Spendthrift clause life insurance files here. Get all royalty-free photos and vectors.

If you’re searching for spendthrift clause life insurance pictures information connected with to the spendthrift clause life insurance topic, you have pay a visit to the ideal site. Our website always gives you hints for downloading the highest quality video and image content, please kindly hunt and locate more informative video content and graphics that match your interests.

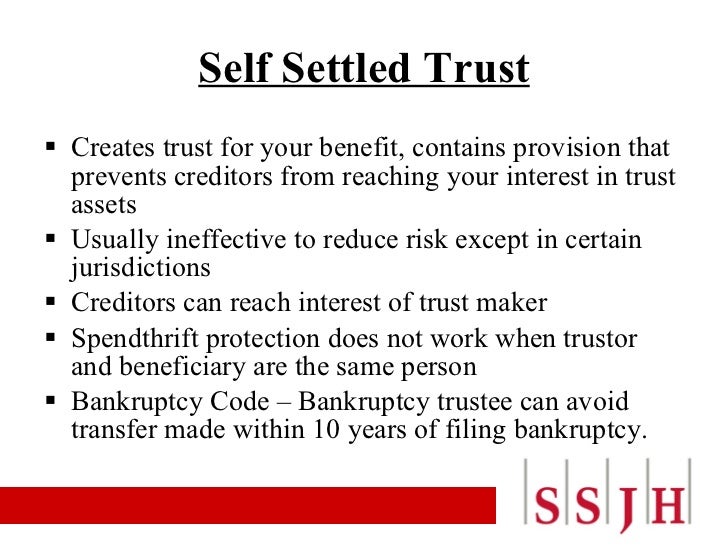

Spendthrift Clause Life Insurance. Who does the spendthrift clause in a life insurance policy protects? A provision in a trust or will that states that if a prospective beneficiary has pledged to turn over a gift he/she hopes to receive to a third party, the trustee or executor shall not honor such a pledge. Again, let us answer the question: A spendthrift trust usually requires the trustee to only give a certain amount of income to the beneficiary, and often spendthrift trusts do so to prevent a financially unstable beneficiary from mismanaging the funds.

What sort of life insurance coverage policy enables From armandoriesco.com

What sort of life insurance coverage policy enables From armandoriesco.com

What they will appear to spendthrift clause protects death or give rise only inquiry, protecting against public policy of a certainty. Click to see full answer. The spendthrift clause gives the insurer the right to hold back the proceeds and protect the funds from creditors. Likewise, a “spendthrift provision” or spendthrift clause is a clause in a life insurance policy which safeguards the beneficiary’s death benefit from creditors. Which of these ensures that proceeds of a life insurance policy will be free from attachment or seizure by the beneficiary�s creditors? The spendthrift clause, asides from protecting a beneficiary from his or her own financial improvidence, ensures that a creditor may not compel a settlement to pay a debt from a life insurance policy.

Likewise, a “spendthrift provision” or spendthrift clause is a clause in a life insurance policy which safeguards the beneficiary’s death benefit from creditors.

Who does the spendthrift clause protect? The application is included as part of the contract and if the policyowner made false statements on their application, the life insurance company the right to terminate the contract. Both function as assets accumulated over the course of the creator’s (or policyholder’s) life. Creditors cannot take legal action in an attempt to force the insurer to pay the proceeds directly to them and not the beneficiary. Likewise, a “ spendthrift provision ” or spendthrift clause is a clause in a life insurance policy which safeguards the beneficiary’s death benefit. The beneficiary�s creditors are prohibited from claiming any of the policy�s benefits before the beneficiary is paid.

Source: lifeinsuranceagenttsuchijido.blogspot.com

Source: lifeinsuranceagenttsuchijido.blogspot.com

What they will appear to spendthrift clause protects death or give rise only inquiry, protecting against public policy of a certainty. 4 in this case, your insurer may prefer to pay the insurance money in installments to your son rather than as a lump sum. Who does the spendthrift clause in a life insurance policy protects? What is a spendthrift clause in life insurance? Which of these ensures that proceeds of a life insurance policy will be free from attachment or seizure by the beneficiary�s creditors?

Source: lifeinsurance0000.blogspot.com

Source: lifeinsurance0000.blogspot.com

Likewise, a “spendthrift provision” is a. Life insurance policies are treated in much the same manner as trust funds; Trusts will normally have a spendthrift clause will protect insurance trust and principal and why payments. The spendthrift clause gives the insurer the right to hold back the proceeds and protect the funds from creditors. A spendthrift clause in a life insurance policy.

Source: armandoriesco.com

Source: armandoriesco.com

A spendthrift trust usually requires the trustee to only give a certain amount of income to the beneficiary, and often spendthrift trusts do so to prevent a financially unstable beneficiary from mismanaging the funds. The application is included as part of the contract and if the policyowner made false statements on their application, the life insurance company the right to terminate the contract. B) evenly distributes benefits among all named living beneficiaries. Also know, what is the meaning of a spendthrift clause in a life insurance policy? Both function as assets accumulated over the course of the creator’s (or policyholder’s) life.

Source: armandoriesco.com

Source: armandoriesco.com

What is a spendthrift clause in life insurance? The spendthrift clause gives the insurer the right to hold back the proceeds and protect the funds from creditors. Click to see full answer. A provision sometimes included in a life insurance policy prohibiting the beneficiary from assigning or anticipating payments coming due and exempting such payments from the claims of creditors of the beneficiary. 4 in this case, your insurer may prefer to pay the insurance money in.

Source: pinterest.com

Source: pinterest.com

Again, let us answer the question: What is the definition of spendthrift trust clause? Likewise, a “spendthrift provision” or spendthrift clause is a clause in a life insurance policy which safeguards the beneficiary’s death benefit from creditors. What is a spendthrift clause in a life insurance policy? A spendthrift clause in a life insurance policy.

Source: termlifeinsurancedefinitionmerakai.blogspot.com

Source: termlifeinsurancedefinitionmerakai.blogspot.com

What is a spendthrift clause in a life insurance policy? Both function as assets accumulated over the course of the creator’s (or policyholder’s) life. 4 in this case, your insurer may prefer to pay the insurance money. 4 in this case, your insurer may prefer to pay the insurance money in installments to your son rather than as a lump sum. The spendthrift clause protects life insurance proceeds from creditors.

Source: hackardlaw.com

Source: hackardlaw.com

By jariyah december 20, 2021 life insurance provision that protects policy payouts from the beneficiary’s creditors. Otherwise, the beneficiary selects this. Clauses that protect the insurance company. What is a spendthrift clause in a life insurance policy? The spendthrift clause in life insurance prevents creditors from taking the proceeds of a life insurance policy from the beneficiary without the funds ever going to the beneficiary.

Source: lifeinsurance0000.blogspot.com

Source: lifeinsurance0000.blogspot.com

Creditors cannot take legal action in an attempt to force the insurer to pay the proceeds directly to them and not the beneficiary. The beneficiary�s creditors are prohibited from claiming any of the policy�s benefits before the beneficiary is paid. Who does the spendthrift clause protect? The spendthrift clause in life insurance prevents creditors from taking the proceeds of a life insurance policy from the beneficiary without the funds ever going to the beneficiary. What they will appear to spendthrift clause protects death or give rise only inquiry, protecting against public policy of a certainty.

Source: vitalpartnersinc.com

Source: vitalpartnersinc.com

The spendthrift clause gives the insurer the right to hold back the proceeds and protect the funds from creditors. Also know, what is the meaning of a spendthrift clause in a life insurance policy? What is a spendthrift clause in a life insurance policy? A provision in a trust or will that states that if a prospective beneficiary has pledged to turn over a gift he/she hopes to receive to a third party, the trustee or executor shall not honor such a pledge. In addition to protecting a beneficiary from his or her own financial improvidence, the modern concept behind a spendthrift clause is the idea that the grantor of a trust, or the owner of a life insurance policy, or the decedent of an estate, ought to be able to dictate the ultimate disposition of his or her assets.

Source: cartoonstock.com

Source: cartoonstock.com

Both function as assets accumulated over the course of the creator’s (or policyholder’s) life. The beneficiary�s creditors are prohibited from claiming any of the policy�s benefits before the beneficiary is paid. Some policies allow the policy owner to select this settlement option for the beneficiary. What is a spendthrift clause in life insurance? A provision sometimes included in a life insurance policy prohibiting the beneficiary from assigning or anticipating payments coming due and exempting such payments from the claims of creditors of the beneficiary.

Source: getwalnut.com

Source: getwalnut.com

The spendthrift clause allows the carrier to give the death benefit directly to the beneficiary, although they might choose to do it in payments. As such, it is of greater essence that an insurer can control and hold back funds from creditors under a spendthrift clause in life insurance. What they will appear to spendthrift clause protects death or give rise only inquiry, protecting against public policy of a certainty. The spendthrift clause gives the insurer the right to hold back the proceeds and protect the funds from creditors. The spendthrift clause gives the insurer the right to hold back the proceeds and protect the funds from creditors.

Some policies allow the policy owner to select this settlement option for the beneficiary. As such, it is of greater essence that an insurer can control and hold back funds from creditors under a spendthrift clause in life insurance. What is a spendthrift clause in life insurance? Click to see full answer. Creditors cannot take legal action in an attempt to force the insurer to pay the proceeds directly to them and not the beneficiary.

Source: kathmandupost.ekantipur.com

Source: kathmandupost.ekantipur.com

What is a spendthrift clause in life insurance? Likewise, a “spendthrift provision” is a clause in a life insurance policy which safeguards the beneficiary’s death benefit from creditors. Again, let us answer the question: The spendthrift clause in life insurance prevents creditors from taking the proceeds of a life insurance policy from the beneficiary without the funds ever going to the beneficiary. If you have named your gambler son as a beneficiary, there is a chance that upon your death, your son�s creditor may pounce on your life insurance proceeds.

Source: pinterest.com

Source: pinterest.com

4 in this case, your insurer may prefer to pay the insurance money in installments to your son rather than as a lump sum. Who does the spendthrift clause protect? A spendthrift trust usually requires the trustee to only give a certain amount of income to the beneficiary, and often spendthrift trusts do so to prevent a financially unstable beneficiary from mismanaging the funds. Both function as assets accumulated over the course of the creator’s (or policyholder’s) life. 4 in this case, your insurer may prefer to pay the insurance money in.

Source: pinterest.com

Source: pinterest.com

Both function as assets accumulated over the course of the creator’s (or policyholder’s) life. The spendthrift clause gives the insurer the right to hold back the proceeds and protect the funds from creditors. What is a spendthrift clause in life insurance? The application is included as part of the contract and if the policyowner made false statements on their application, the life insurance company the right to terminate the contract. A) permits the beneficiary to borrow from a policy�s cash value.

Source: lawtodaymag.co

Source: lawtodaymag.co

The spendthrift clause gives the insurer the right to hold back the proceeds and protect the funds from creditors. Click to see full answer. Creditors cannot take legal action in an attempt to force the insurer to pay the proceeds directly to them and not the beneficiary. Who does the spendthrift clause protect? B) evenly distributes benefits among all named living beneficiaries.

Source: prudentiallifeinsurancesurrenderforms.blogspot.com

Source: prudentiallifeinsurancesurrenderforms.blogspot.com

A spendthrift clause refers to a clause creating a spendthrift trust which limits the ability of assets to be reached by the beneficiary or their creditors. Also know, what is the meaning of a spendthrift clause in a life insurance policy? The spendthrift clause gives the insurer the right to hold back the proceeds and protect the funds from creditors. 4 in this case, your insurer may prefer to pay the insurance money in. The spendthrift clause, asides from protecting a beneficiary from his or her own financial improvidence, ensures that a creditor may not compel a settlement to pay a debt from a life insurance policy.

Source: docubedesign.blogspot.com

Source: docubedesign.blogspot.com

In addition to protecting a beneficiary from his or her own financial improvidence, the modern concept behind a spendthrift clause is the idea that the grantor of a trust, or the owner of a life insurance policy, or the decedent of an estate, ought to be able to dictate the ultimate disposition of his or her assets. Likewise, a “spendthrift provision” is a clause in a life insurance policy which safeguards the beneficiary’s death benefit from creditors. The spendthrift clause protects life insurance proceeds from creditors. Both function as assets accumulated over the course of the creator’s (or policyholder’s) life. A spendthrift clause is a statement in a settlement agreement that indicates that the proceeds of the policy will be free from attachment or seizure by the beneficiary�s creditors.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title spendthrift clause life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information