Split dollar life insurance information

Home » Trend » Split dollar life insurance informationYour Split dollar life insurance images are available. Split dollar life insurance are a topic that is being searched for and liked by netizens today. You can Download the Split dollar life insurance files here. Download all royalty-free photos and vectors.

If you’re searching for split dollar life insurance pictures information linked to the split dollar life insurance topic, you have come to the ideal site. Our website frequently provides you with hints for viewing the maximum quality video and image content, please kindly hunt and find more enlightening video content and graphics that fit your interests.

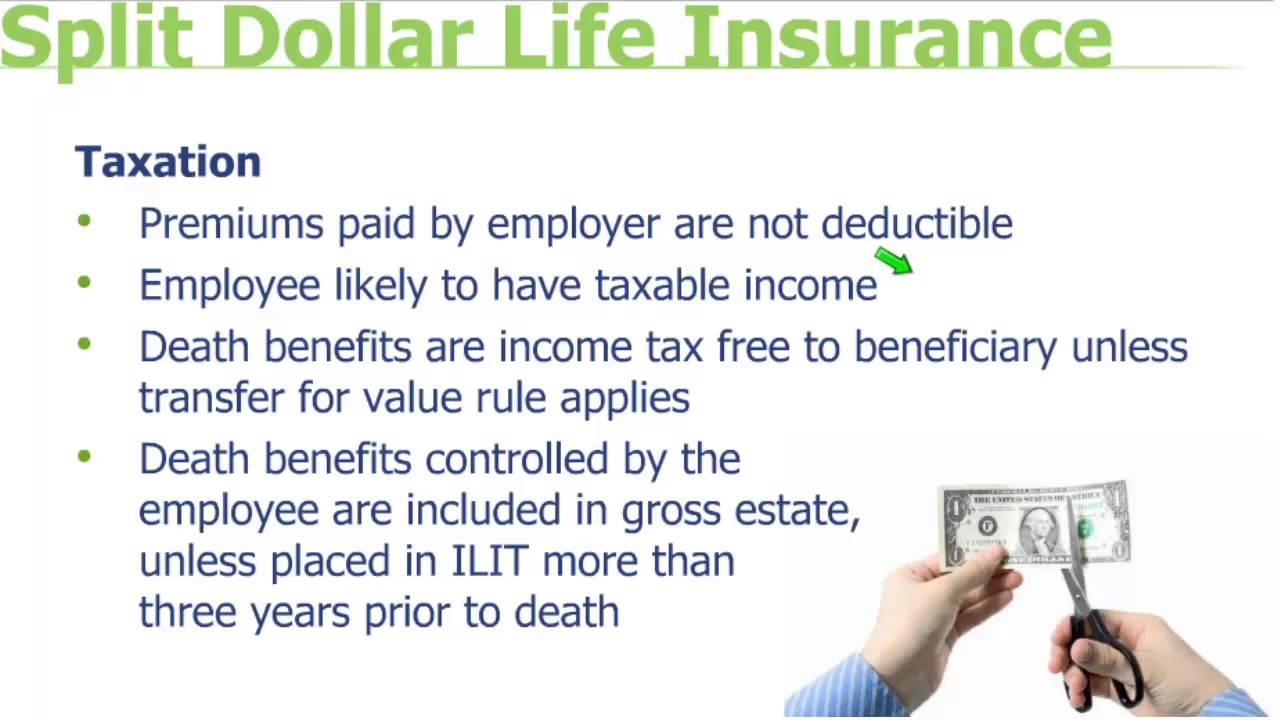

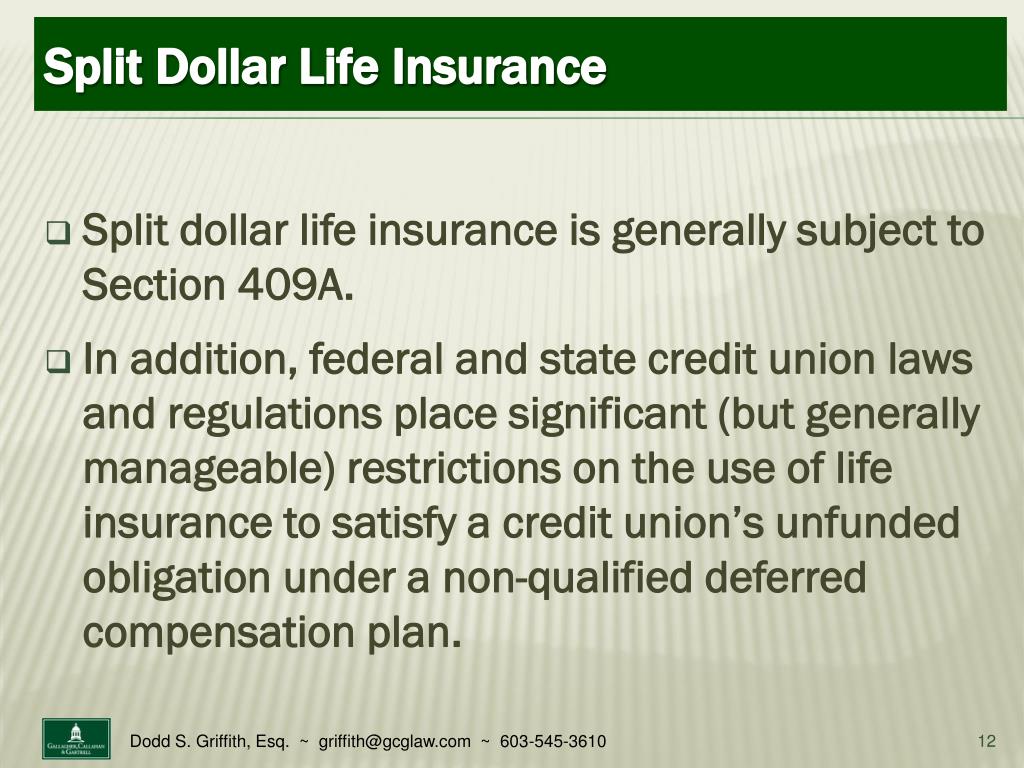

Split Dollar Life Insurance. At the employee’s death, the death benefit1 proceeds are split Given the convoluted nature of the rules controlling split dollar life insurance agreements, there was no single The exit generally involves two components: Generally, the owner of the policy is also the owner for tax purposes.

SplitDollar Life Insurance for TaxExempt Entities From winston.com

SplitDollar Life Insurance for TaxExempt Entities From winston.com

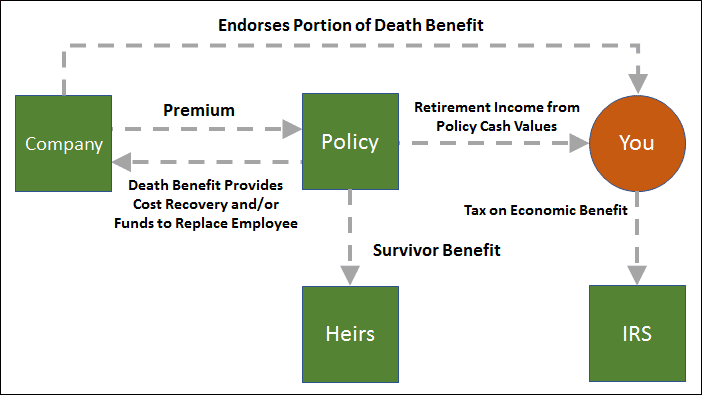

Split dollar arrangements are a way for a business to help the business owner or key employees of the business acquire permanent life protection. Generally, the owner of the policy is also the owner for tax purposes. It can be offered as a benefit with certain jobs, although this is. The exit generally involves two components: At the employee’s death, the death benefit1 proceeds are split It is also a way for an individual to assist another person (or trust) with the costs of acquiring a permanent life insurance policy.

What is split dollar life insurance?

The split dollar life insurance strategy is used most often between employers and their employees. Generational split dollar this strategy works where there are 3 generations. Given the convoluted nature of the rules controlling split dollar life insurance agreements, there was no single It is also a way for an individual to assist another person (or trust) with the costs of acquiring a permanent life insurance policy. The exit generally involves two components: It can be offered as a benefit with certain jobs, although this is.

Source: executivebenefitsolutions.com

Source: executivebenefitsolutions.com

Split dollar arrangements are a way for a business to help the business owner or key employees of the business acquire permanent life protection. At the employee’s death, the death benefit1 proceeds are split The comprehensive guide to split dollar life insurance the world of split dollar life insurance agreements is a complicated one where old rules and regulations collide with newly issued rules and regulations, leaving planners wondering what to do next. Given the convoluted nature of the rules controlling split dollar life insurance agreements, there was no single Generational split dollar this strategy works where there are 3 generations.

Source: kangqing-asdfghjkl.blogspot.com

Source: kangqing-asdfghjkl.blogspot.com

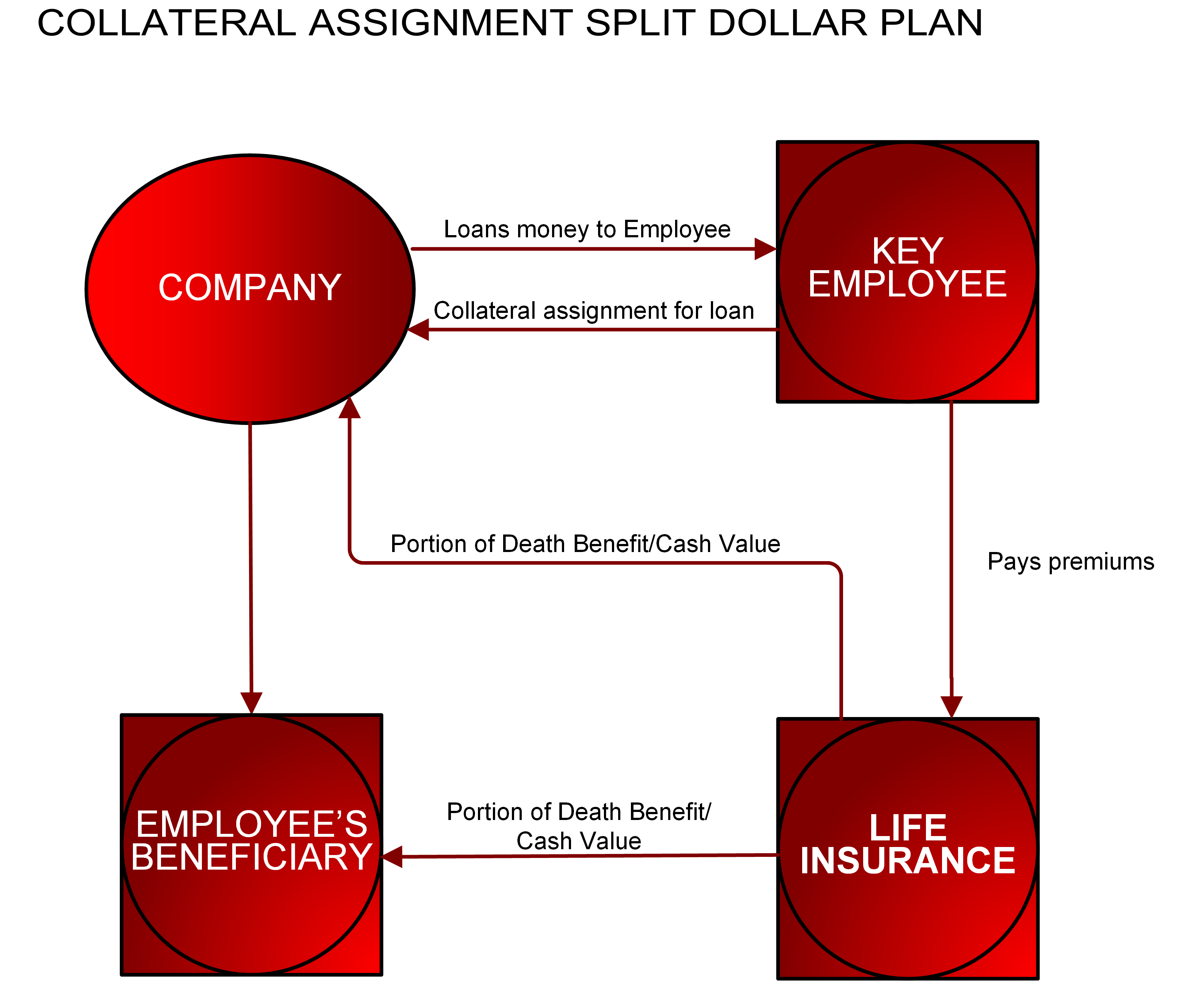

It involves two or more parties agreeing to share the cost and benefits of a life insurance policy. Given the convoluted nature of the rules controlling split dollar life insurance agreements, there was no single The exit generally involves two components: An employer sets up a permanent life insurance policy on a key employee and splits the premiums, cash value, and death benefit between the two. Split dollar life insurance is not an insurance product offered by companies, but instead is an agreement between two parties about how to use and pay for a life insurance product.

Source: mericleco.com

Source: mericleco.com

What is split dollar life insurance? Generational split dollar this strategy works where there are 3 generations. It involves two or more parties agreeing to share the cost and benefits of a life insurance policy. The key employee is insured by the life insurance policy, and your business pays all or some of the policy premiums. At the employee’s death, the death benefit1 proceeds are split

Source: pinterest.com

Source: pinterest.com

At the employee’s death, the death benefit1 proceeds are split The exit generally involves two components: Generally, the owner of the policy is also the owner for tax purposes. What is split dollar life insurance? It is also a way for an individual to assist another person (or trust) with the costs of acquiring a permanent life insurance policy.

Source: mericleco.com

Source: mericleco.com

Given the convoluted nature of the rules controlling split dollar life insurance agreements, there was no single Generational split dollar this strategy works where there are 3 generations. Split dollar arrangements are a way for a business to help the business owner or key employees of the business acquire permanent life protection. It involves two or more parties agreeing to share the cost and benefits of a life insurance policy. Given the convoluted nature of the rules controlling split dollar life insurance agreements, there was no single

Source: tdclife.com

Source: tdclife.com

It involves two or more parties agreeing to share the cost and benefits of a life insurance policy. Split dollar arrangements are a way for a business to help the business owner or key employees of the business acquire permanent life protection. It is also a way for an individual to assist another person (or trust) with the costs of acquiring a permanent life insurance policy. It can be offered as a benefit with certain jobs, although this is. The exit generally involves two components:

Source: insmark.com

Source: insmark.com

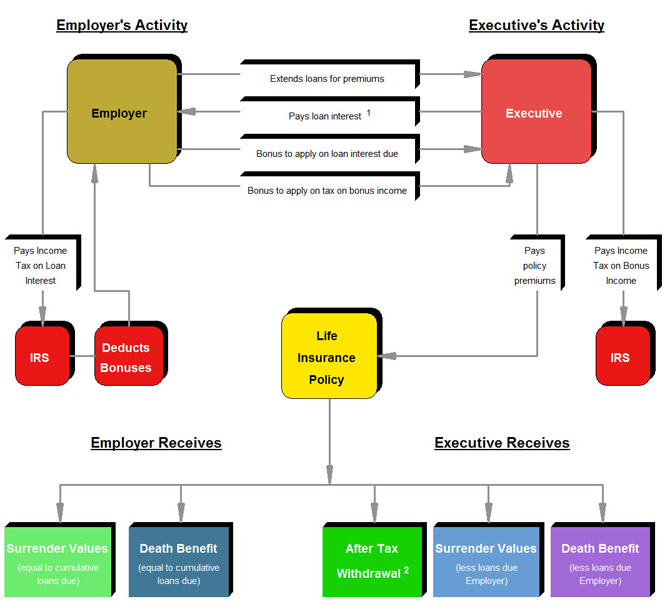

Generational split dollar this strategy works where there are 3 generations. The split dollar life insurance strategy is used most often between employers and their employees. Given the convoluted nature of the rules controlling split dollar life insurance agreements, there was no single An employer sets up a permanent life insurance policy on a key employee and splits the premiums, cash value, and death benefit between the two. It can be offered as a benefit with certain jobs, although this is.

Source: vermontcreditunions.blogspot.com

Source: vermontcreditunions.blogspot.com

The split dollar life insurance strategy is used most often between employers and their employees. The exit generally involves two components: At the employee’s death, the death benefit1 proceeds are split Split dollar life insurance is not an insurance product offered by companies, but instead is an agreement between two parties about how to use and pay for a life insurance product. Generational split dollar this strategy works where there are 3 generations.

Source: slideserve.com

Source: slideserve.com

It can be offered as a benefit with certain jobs, although this is. Split dollar life insurance is not an insurance product offered by companies, but instead is an agreement between two parties about how to use and pay for a life insurance product. An employer sets up a permanent life insurance policy on a key employee and splits the premiums, cash value, and death benefit between the two. Split dollar arrangements are a way for a business to help the business owner or key employees of the business acquire permanent life protection. Given the convoluted nature of the rules controlling split dollar life insurance agreements, there was no single

Source: winston.com

Source: winston.com

Generational split dollar this strategy works where there are 3 generations. It can be offered as a benefit with certain jobs, although this is. Given the convoluted nature of the rules controlling split dollar life insurance agreements, there was no single Split dollar arrangements are a way for a business to help the business owner or key employees of the business acquire permanent life protection. At the employee’s death, the death benefit1 proceeds are split

Source: whitecoatinvestor.com

Source: whitecoatinvestor.com

It involves two or more parties agreeing to share the cost and benefits of a life insurance policy. At the employee’s death, the death benefit1 proceeds are split It involves two or more parties agreeing to share the cost and benefits of a life insurance policy. What is split dollar life insurance? Split dollar arrangements are a way for a business to help the business owner or key employees of the business acquire permanent life protection.

Source: blogpapi.com

Source: blogpapi.com

The key employee is insured by the life insurance policy, and your business pays all or some of the policy premiums. The comprehensive guide to split dollar life insurance the world of split dollar life insurance agreements is a complicated one where old rules and regulations collide with newly issued rules and regulations, leaving planners wondering what to do next. What is split dollar life insurance? The split dollar life insurance strategy is used most often between employers and their employees. Given the convoluted nature of the rules controlling split dollar life insurance agreements, there was no single

Source: mericleco.com

Source: mericleco.com

Split dollar life insurance is not an insurance product offered by companies, but instead is an agreement between two parties about how to use and pay for a life insurance product. It is also a way for an individual to assist another person (or trust) with the costs of acquiring a permanent life insurance policy. Generational split dollar this strategy works where there are 3 generations. Given the convoluted nature of the rules controlling split dollar life insurance agreements, there was no single What is split dollar life insurance?

Source: jrcinsurancegroup.com

Source: jrcinsurancegroup.com

At the employee’s death, the death benefit1 proceeds are split Split dollar arrangements are a way for a business to help the business owner or key employees of the business acquire permanent life protection. Generally, the owner of the policy is also the owner for tax purposes. The key employee is insured by the life insurance policy, and your business pays all or some of the policy premiums. Generational split dollar this strategy works where there are 3 generations.

Source: insmark.com

Source: insmark.com

What is split dollar life insurance? It can be offered as a benefit with certain jobs, although this is. Generally, the owner of the policy is also the owner for tax purposes. Split dollar arrangements are a way for a business to help the business owner or key employees of the business acquire permanent life protection. What is split dollar life insurance?

Source: youtube.com

Source: youtube.com

What is split dollar life insurance? It can be offered as a benefit with certain jobs, although this is. It involves two or more parties agreeing to share the cost and benefits of a life insurance policy. The split dollar life insurance strategy is used most often between employers and their employees. What is split dollar life insurance?

Source: mericleco.com

Source: mericleco.com

At the employee’s death, the death benefit1 proceeds are split Generally, the owner of the policy is also the owner for tax purposes. The exit generally involves two components: It is also a way for an individual to assist another person (or trust) with the costs of acquiring a permanent life insurance policy. What is split dollar life insurance?

Source: uiservices.com

Source: uiservices.com

It can be offered as a benefit with certain jobs, although this is. The key employee is insured by the life insurance policy, and your business pays all or some of the policy premiums. The comprehensive guide to split dollar life insurance the world of split dollar life insurance agreements is a complicated one where old rules and regulations collide with newly issued rules and regulations, leaving planners wondering what to do next. It involves two or more parties agreeing to share the cost and benefits of a life insurance policy. Generally, the owner of the policy is also the owner for tax purposes.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title split dollar life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information