Split limits insurance information

Home » Trend » Split limits insurance informationYour Split limits insurance images are ready in this website. Split limits insurance are a topic that is being searched for and liked by netizens today. You can Download the Split limits insurance files here. Find and Download all free photos.

If you’re looking for split limits insurance pictures information linked to the split limits insurance keyword, you have visit the ideal site. Our site frequently gives you suggestions for seeing the highest quality video and image content, please kindly search and find more enlightening video articles and graphics that match your interests.

Split Limits Insurance. For example, the state of texas currently has a minimum of 20/40/15. This differs from split limit insurance, which assigns individual limits on the amount of damages covered for each person injured in an accident and the property damage caused by. The maximum amount that will be paid to any one injured person. Split limit liability policies are easy to identify.

Split Limit Insurance Policy What do the Numbers Mean From youtube.com

Split Limit Insurance Policy What do the Numbers Mean From youtube.com

Per person bodily injury limit, per incident bodily injury limit, and property damage limit. The standard actuarial answer to this dilemma has been to split the analysis of expected costs for liability insurance into two parts. Which is the better option overall? The first limit is a per person limit: This type of liability limit is expressed in three numbers, such as 250/500/100. By limit, class, state and territory, for example.

A split limit liability is the type of liability insurance that most of us are familiar with.

Bodily injury to the other driver. Commonly offered at these limits (in thousands): This type of liability limit is expressed in three numbers, such as 250/500/100. All three can have individual. Which is the better option overall? For example, the state of texas currently has a minimum of 20/40/15.

Source: devineinsurance.com

Source: devineinsurance.com

This differs from split limit insurance, which assigns individual limits on the amount of damages covered for each person injured in an accident and the property damage caused by. Split limit coverage splits the coverage amount into three limits, such as 50/100/25. In a split limit automobile policy, you will purchase a limit of liability insurance that will have three numbers. They also slice bi coverage into a limit per person and per incident. It specifies limits for three specific types of claim:

Source: hertvik.com

Source: hertvik.com

30/60/10 (minnesota state minimum limit) 50/100/50. Combined single limit, bodily injury, property damage and split limit liability insurance are all types of automobile liability insurance available to consumers. A split limit liability is the type of liability insurance that most of us are familiar with. Your declarations page of your auto insurance policy may include an annotation that looks. With split limits, three separate dollar amounts apply to each accident.

Source: noyeshallallen.com

Source: noyeshallallen.com

This differs from split limit insurance, which assigns individual limits on the amount of damages covered for each person injured in an accident and the property damage caused by. Split limits — many auto insurance policies use the split limits approach, which combines the per person and the per occurrence approach. The split limit provides an added aggregate limit that is a multiple, typically 2 or 3 times the per claim limit you select. This insurance policy divides your earthquake coverage into individual limits, unlike the single limit policy, but sets guidelines around how much each of those limits include. A third limit applied to property damage in each accident:

Source: mikeschmisek.com

Source: mikeschmisek.com

Per person bodily injury limit, per incident bodily injury limit, and property damage limit. Bodily injury to the other driver. A combined single limit policy would state that the insurer. Split limits vs combined single limits. Another option widely available is a split limit option.

Source: youtube.com

Source: youtube.com

The maximum amount that will be paid to any one injured person. With split limit coverage there are multiple limits that apply per accident. One for bodily injury for a single person, another for bodily injury caused to a group of people and the last is for payouts to damages whether for a personal property or another individual’s property. The maximum amount that will be paid to any one injured person. Using this example, the first number means that $250,000 would be paid for bodily injury to each person, $500,000 is the amount of.

Source: devineinsurance.com

Source: devineinsurance.com

There are three areas you need to be aware of when it comes to split limit coverage and they are bodily injury per person, bodily injury per accident and property damage coverage. Which is the better option overall? The limits are broken down differently than combined single limit. Commonly offered at these limits (in thousands): If it is split limit coverage it will be broken down as for instance 100/300/50.

Source: carinsurancecomparison.com

Source: carinsurancecomparison.com

Bodily injury per person, bodily injury per accident, and property damage per accident. Under a split limit policy, up to three different liability limits could apply to this accident: Your declarations page of your auto insurance policy may include an annotation that looks. The maximum amount that will be paid to any one injured person. Commonly offered at these limits (in thousands):

Source: newyorkcityvoices.org

Source: newyorkcityvoices.org

The maximum amount that will be paid to any one injured person. They also slice bi coverage into a limit per person and per incident. First, the larger volume of data on claims of relatively smaller sizes is used to calculate basic limit loss costs in full class, state and territory detail. A second limit applied per accident: Most people are familiar with and purchase split limit liability insurance and you can determine what you have by looking at your declarations page that comes with your automobile insurance policy and see how that is represented.

Source: youtube.com

Source: youtube.com

If it is split limit coverage it will be broken down as for instance 100/300/50. I’m looking at split limits of 250/500/250, or a csl of 500k for $61 less every 6 months. If it is split limit coverage it will be broken down as for instance 100/300/50. Split limits coverage is a set of limits on payments for auto insurance claims that is split into different categories. The maximum amount that will be paid to any one injured person.

Source: newyorkcityvoices.org

Source: newyorkcityvoices.org

A split limit liability is the type of liability insurance that most of us are familiar with. Another option widely available is a split limit option. A third limit applied to property damage in each accident: This insurance policy divides your earthquake coverage into individual limits, unlike the single limit policy, but sets guidelines around how much each of those limits include. The maximum amount that will be paid to any one injured person.

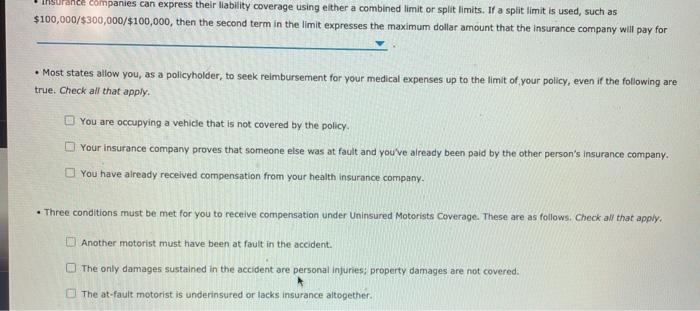

Source: easynotecards.com

Split limits — many auto insurance policies use the split limits approach, which combines the per person and the per occurrence approach. If you’re looking for something that looks and feels like a homeowners policy, the split limit earthquake insurance policy is the solution for you. Bodily injury per person, bodily injury per accident, and property damage per accident. If a split limit is used, such as $100,000/$300,000/$100,000, then the second term in the limit expresses the maximum dollar amount that the insurance company will pay for. Enterprise billing software for property & casualty insurance.

With split limit coverage there are multiple limits that apply per accident. Bodily injury per person, bodily injury per accident, and property damage per accident. Commonly offered at these limits (in thousands): As mentioned, many states, like pennsylvania, for example, have options to purchase a split limit or combined single limit automobile policy. Split limits vs combined single limits.

Source: injuryispersonal.com

Source: injuryispersonal.com

Many individuals don’t realize that liability insurance is the minimum required insurance in most states. Split limits coverage is a set of limits on payments for auto insurance claims that is split into different categories. This differs from split limit insurance, which assigns individual limits on the amount of damages covered for each person injured in an accident and the property damage caused by. This insurance policy divides your earthquake coverage into individual limits, unlike the single limit policy, but sets guidelines around how much each of those limits include. Commonly offered at these limits (in thousands):

Source: cvmasoninsurance.com

Source: cvmasoninsurance.com

Bodily injury to the other driver. With split limits, three separate dollar amounts apply to each accident. Split limit liability policies are easy to identify. Per person bodily injury limit, per incident bodily injury limit, and property damage limit. For instance, in addition to receiving a quote for a $1,000,000 limit you may also be offered a quote for a $1,000,000/$2,000,000 limit.

Source: iruhl.com

Source: iruhl.com

A second limit applied per accident: I’m looking at split limits of 250/500/250, or a csl of 500k for $61 less every 6 months. If your policy limits are 100/300/100, you have a split limits policy. If it is split limit coverage it will be broken down as for instance 100/300/50. A limit applied to each person injured:

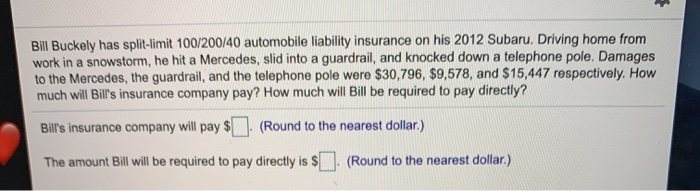

Source: chegg.com

Source: chegg.com

All three can have individual. The split limit provides an added aggregate limit that is a multiple, typically 2 or 3 times the per claim limit you select. Combined single limit, bodily injury, property damage and split limit liability insurance are all types of automobile liability insurance available to consumers. All three can have individual. Split limit liability policies are easy to identify.

Source: gajizmo.com

Source: gajizmo.com

They have separate limits for bodily injury and property damage. It specifies limits for three specific types of claim: For instance, in addition to receiving a quote for a $1,000,000 limit you may also be offered a quote for a $1,000,000/$2,000,000 limit. One for bodily injury for a single person, another for bodily injury caused to a group of people and the last is for payouts to damages whether for a personal property or another individual’s property. All three can have individual.

Source: cheapfullcoverageautoinsurance.com

Source: cheapfullcoverageautoinsurance.com

All three can have individual. A second limit applied per accident: There are three areas you need to be aware of when it comes to split limit coverage and they are bodily injury per person, bodily injury per accident and property damage coverage. Bodily injury per person, bodily injury per accident, and property damage per accident. By limit, class, state and territory, for example.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title split limits insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information