Spousal surcharge health insurance Idea

Home » Trending » Spousal surcharge health insurance IdeaYour Spousal surcharge health insurance images are ready in this website. Spousal surcharge health insurance are a topic that is being searched for and liked by netizens now. You can Download the Spousal surcharge health insurance files here. Find and Download all free photos.

If you’re searching for spousal surcharge health insurance images information connected with to the spousal surcharge health insurance keyword, you have visit the right blog. Our site frequently provides you with hints for seeing the maximum quality video and picture content, please kindly hunt and find more enlightening video content and graphics that fit your interests.

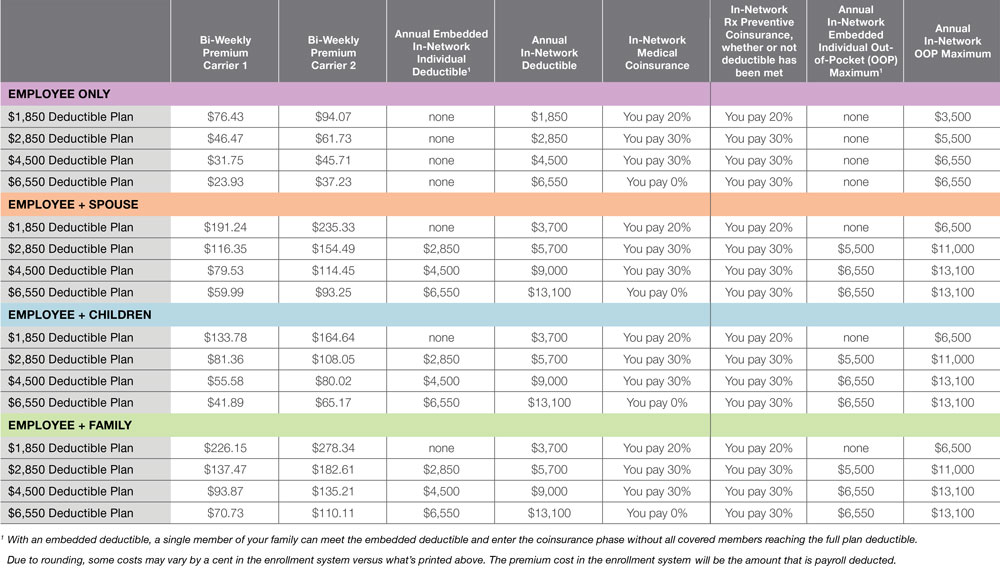

Spousal Surcharge Health Insurance. Ochsner health system in louisiana announced employees will be subject to around a $200 per month. All plans are treated the (20). So if you’re charged $100 extra and are in the 30% bracket, you’ll only effectively be. The spousal surcharge begins as soon as a spouse is employed in a position that will pay greater than $10,000 in that calendar year.

![]() More employers charging extra for spouse when other health From businessinsurance.com

More employers charging extra for spouse when other health From businessinsurance.com

You are responsible for maintaining this eligibility status in workday on the benefits/change dependents event. However, this needs to be done 60 days after your marriage date. In most cases, you can add your spouse to your health insurance plan. Any monetary awards should be provided for under the cafeteria plan and provided on a taxable basis. I think the health insurance spousal surcharge is morally wrong and should be illegal. The spousal surcharge begins as soon as a spouse is employed in a position that will pay greater than $10,000 in that calendar year.

Will the spousal surcharge apply to the dental insurance also?

9 additionally, 10% of employers require spouses to pay more through a larger premium or higher cost share. Will the spousal surcharge apply if my spouse is enrolled in both a. The spousal surcharge is an added charge of $125 per month to the usual employee contribution for health insurance. The surcharge applies if the employee’s spouse has an alternative source of coverage available through his or her own employer, and chooses not to enroll in that coverage. A spousal surcharge is an additional premium or contribution that an employee must pay for coverage for his or her spouse. If your spouse is not eligible for medical coverage through his or her current or former employer, see the waiver process below.

Source: windstreambenefits.com

Source: windstreambenefits.com

The spouse premium surcharge will result in a change in cost for coverage. Ochsner health system in louisiana announced employees will be subject to around a $200 per month. I think the health insurance spousal surcharge is morally wrong and should be illegal. However, this needs to be done 60 days after your marriage date. A spousal surcharge is an additional amount you pay for medical coverage if you choose to enroll your spouse in the sps health plan and he/she.

Source: slideserve.com

Source: slideserve.com

So if you’re charged $100 extra and are in the 30% bracket, you’ll only effectively be. A spousal surcharge is an extra charge that an archdiocesan employee pays for electing to insure a spouse who has subsidized health insurance coverage available to them through his/her own employer. This surcharge does not show up on your paycheck as a separate/ line item, but is included in your health insurance premium. I can then use that money to help cover the high deductables. If this is the case, when you enroll your.

Source: ihr.hrs.wsu.edu

Source: ihr.hrs.wsu.edu

If this is the case, when you enroll your. A spousal surcharge is an additional premium or contribution that an employee must pay for coverage for his or her spouse. The spouse surcharge applies when a working spouse has access to a comparable group health insurance on her job and chooses not to enroll in that plan. The spouse should check with their employer regarding Spousal surcharge applies whenever the spouse has access to medical coverage though his/her employer and opts out of that coverage.

Source: rpecwa.org

Source: rpecwa.org

If your spouse is not eligible for medical coverage through his or her current or former employer, see the waiver process below. Also, 33% of large employers impose a fee for spousal health insurance, and the average spousal surcharge is $1,200 a year. If your spouse is not eligible for medical coverage through his or her current or former employer, see the waiver process below. Therefore i haven�t payed it. You are responsible for maintaining this eligibility status in workday on the benefits/change dependents event.

Source: windstreambenefits.com

Source: windstreambenefits.com

What is a spousal surcharge? The surcharge will also apply if you fail to complete or were late turning in the required spouse medical plan surcharge affidavit. 9 additionally, 10% of employers require spouses to pay more through a larger premium or higher cost share. The health insurance premium and any surcharge is paid pretax, darling says. The spouse should check with their employer regarding

Source: slideshare.net

Source: slideshare.net

No, the surcharge will apply to health insurance only. All plans are treated the (20). A spousal surcharge applies only if the spouse has other health insurance options. Ochsner health system in louisiana announced employees will be subject to around a $200 per month. A spousal surcharge is an extra charge that an archdiocesan employee pays for electing to insure a spouse who has subsidized health insurance coverage available to them through his/her own employer.

Source: slideshare.net

Source: slideshare.net

A spousal surcharge applies only if the spouse has other health insurance options. The additional cost, or surcharge, is $100 per month. A spouse or spousal equivalent who has access to health care through their current employer is still eligible to participate under the bucknell university health plan, but the employee will pay a monthly surcharge for this coverage. Ochsner health system in louisiana announced employees will be subject to around a $200 per month. The surcharge will also apply if you fail to complete or were late turning in the required spouse medical plan surcharge affidavit.

Source: rpecwa.org

Source: rpecwa.org

Will the spousal surcharge apply if my spouse is enrolled in both a. In recent months, companies have made waves with covid vaccine mandates and other initiatives to encourage employees to get the shot, such as delta airlines charging an extra $200 per month for employees to remain on the company’s health insurance. This surcharge does not show up on your paycheck as a separate/ line item, but is included in your health insurance premium. Therefore i haven�t payed it. Been lieing on the enrollment form for a few years, is this bad?

Source: benefitnews.com

Source: benefitnews.com

You are responsible for maintaining this eligibility status in workday on the benefits/change dependents event. Additional charge (a surcharge) if your spouse is eligible for medical coverage through his or her employer, but has not enrolled for that coverage. The health insurance premium and any surcharge is paid pretax, darling says. The surcharge will also apply if you fail to complete or were late turning in the required spouse medical plan surcharge affidavit. Yes, the spouse premium surcharge applies if an individual is offered healthcare coverage in any capacity and opts out of the coverage for saws medical plan.

Source: cleartrackhr.com

Source: cleartrackhr.com

Any monetary awards should be provided for under the cafeteria plan and provided on a taxable basis. Should i add my spouse to my health insurance? A spouse or spousal equivalent who has access to health care through their current employer is still eligible to participate under the bucknell university health plan, but the employee will pay a monthly surcharge for this coverage. The spousal surcharge is an added charge of $125 per month to the usual employee contribution for health insurance. In most cases, you can add your spouse to your health insurance plan.

Source: blog.nisbenefits.com

9 additionally, 10% of employers require spouses to pay more through a larger premium or higher cost share. Also, 33% of large employers impose a fee for spousal health insurance, and the average spousal surcharge is $1,200 a year. The health insurance premium and any surcharge is paid pretax, darling says. You are responsible for maintaining this eligibility status in workday on the benefits/change dependents event. The surcharge generally applies if the employee’s spouse has other coverage available, such as through his or her own employer, and chooses not to enroll in that coverage.

Source: kleentest.com

Source: kleentest.com

Also, 33% of large employers impose a fee for spousal health insurance, and the average spousal surcharge is $1,200 a year. Yes, the spouse premium surcharge applies if an individual is offered healthcare coverage in any capacity and opts out of the coverage for saws medical plan. A spousal surcharge is an additional fee or premium that an employee is required to pay if his or her spouse has an alternative source for healthcare coverage through their own employer, yet elects to be added to the employee’s plan. The spouse surcharge applies when a working spouse has access to a comparable group health insurance on her job and chooses not to enroll in that plan. If your spouse is not eligible for medical coverage through his or her current or former employer, see the waiver process below.

Source: acasignups.net

Source: acasignups.net

A spouse or spousal equivalent who has access to health care through their current employer is still eligible to participate under the bucknell university health plan, but the employee will pay a monthly surcharge for this coverage. The surcharge will also apply if you fail to complete or were late turning in the required spouse medical plan surcharge affidavit. A spousal surcharge is an additional premium or contribution that an employee must pay for coverage for his or her spouse. The surcharge applies if the employee’s spouse has an alternative source of coverage available through his or her own employer, and chooses not to enroll in that coverage. The spouse should check with their employer regarding

Source: windstreambenefits.com

Source: windstreambenefits.com

A spousal surcharge applies only if the spouse has other health insurance options. So if you’re charged $100 extra and are in the 30% bracket, you’ll only effectively be. The surcharge is used to encourage spouses to enroll in health coverage available through their employer. However, this needs to be done 60 days after your marriage date. Will the spousal surcharge apply to the dental insurance also?

![]() Source: businessinsurance.com

Source: businessinsurance.com

All plans are treated the (20). If your spouse is not eligible for medical coverage through his or her current or former employer, see the waiver process below. The spouse should check with their employer regarding A spousal surcharge is an additional premium or contribution that an employee must pay for coverage for his or her spouse. All plans are treated the (20).

Source: slideserve.com

Source: slideserve.com

The additional cost, or surcharge, is $100 per month. The surcharge generally applies if the employee’s spouse has other coverage available, such as through his or her own employer, and chooses not to enroll in that coverage. Also, 33% of large employers impose a fee for spousal health insurance, and the average spousal surcharge is $1,200 a year. In recent months, companies have made waves with covid vaccine mandates and other initiatives to encourage employees to get the shot, such as delta airlines charging an extra $200 per month for employees to remain on the company’s health insurance. A spousal surcharge is an extra charge that an archdiocesan employee pays for electing to insure a spouse who has subsidized health insurance coverage available to them through his/her own employer.

Source: wikihow.com

Source: wikihow.com

Health system, your premium will include a $100 per month spousal or domestic partner surcharge. A spousal surcharge is an additional fee or premium that an employee is required to pay if his or her spouse has an alternative source for healthcare coverage through their own employer, yet elects to be added to the employee’s plan. Health system, your premium will include a $100 per month spousal or domestic partner surcharge. I can then use that money to help cover the high deductables. Also, 33% of large employers impose a fee for spousal health insurance, and the average spousal surcharge is $1,200 a year.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

For 2022, the spousal surcharge is $250.00 per month. Ochsner health system in louisiana announced employees will be subject to around a $200 per month. The health insurance premium and any surcharge is paid pretax, darling says. Alternatively employers may offer a monetary award for spouses not enrolling in the health plan. Spousal surcharge applies whenever the spouse has access to medical coverage though his/her employer and opts out of that coverage.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title spousal surcharge health insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information