Sr 22 insurance florida Idea

Home » Trending » Sr 22 insurance florida IdeaYour Sr 22 insurance florida images are available in this site. Sr 22 insurance florida are a topic that is being searched for and liked by netizens today. You can Find and Download the Sr 22 insurance florida files here. Get all free vectors.

If you’re looking for sr 22 insurance florida pictures information connected with to the sr 22 insurance florida interest, you have visit the ideal site. Our website always provides you with hints for seeking the highest quality video and picture content, please kindly surf and find more enlightening video content and images that match your interests.

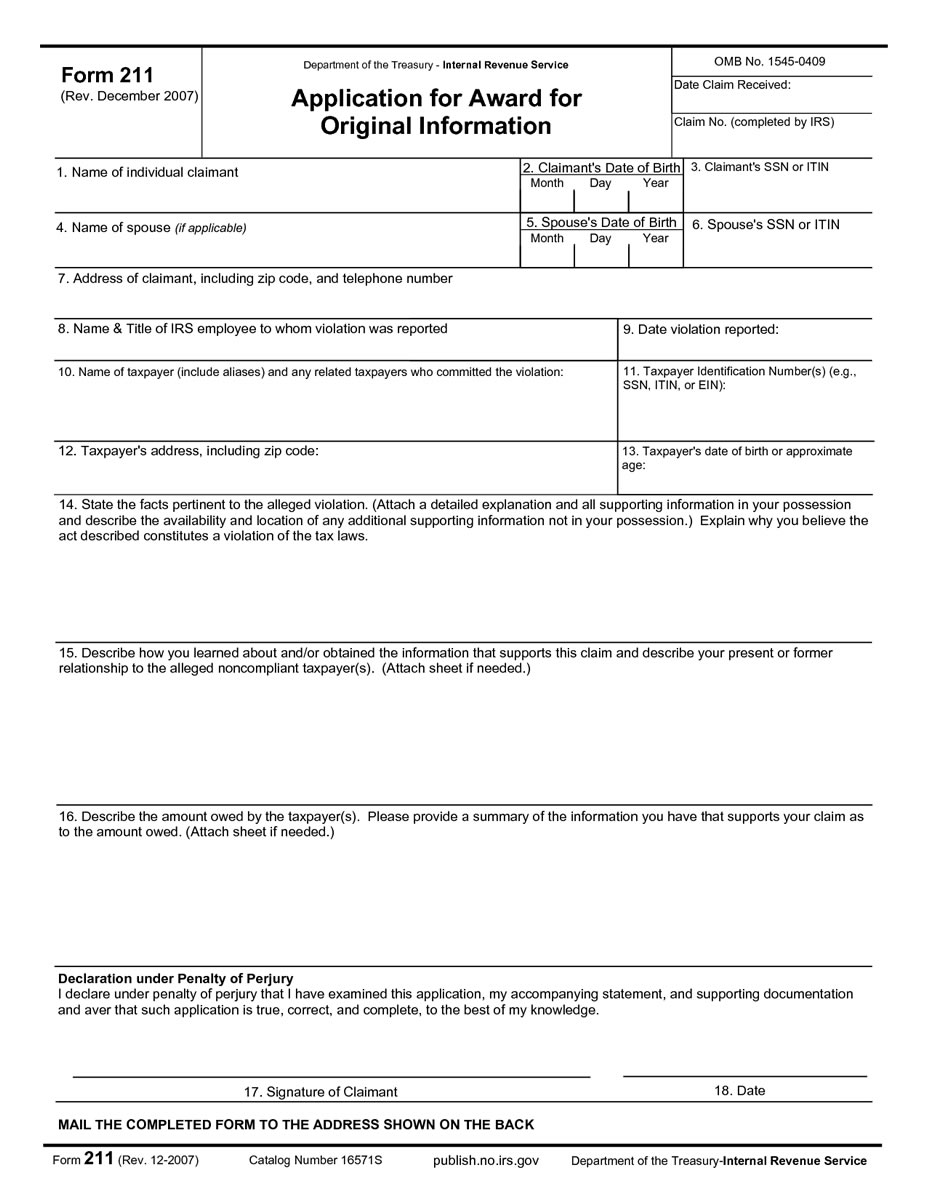

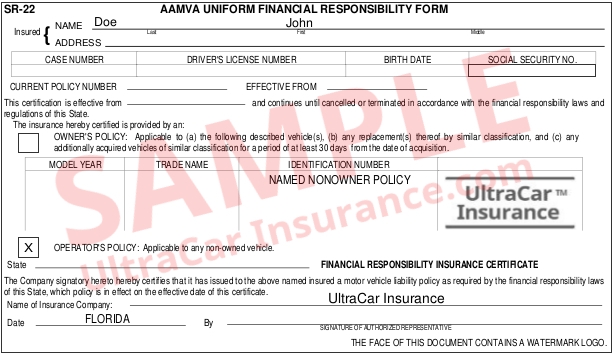

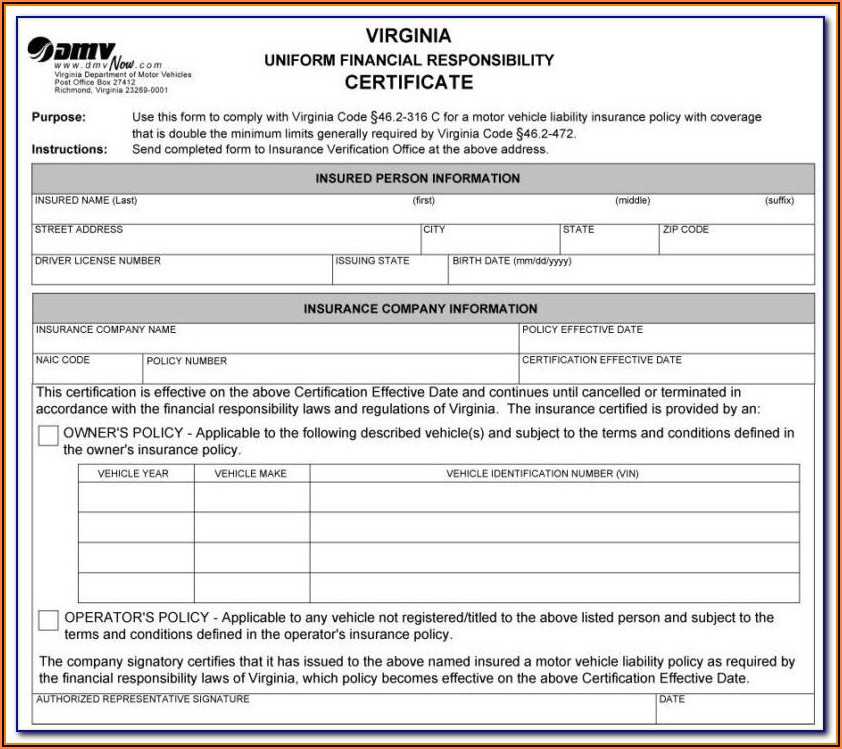

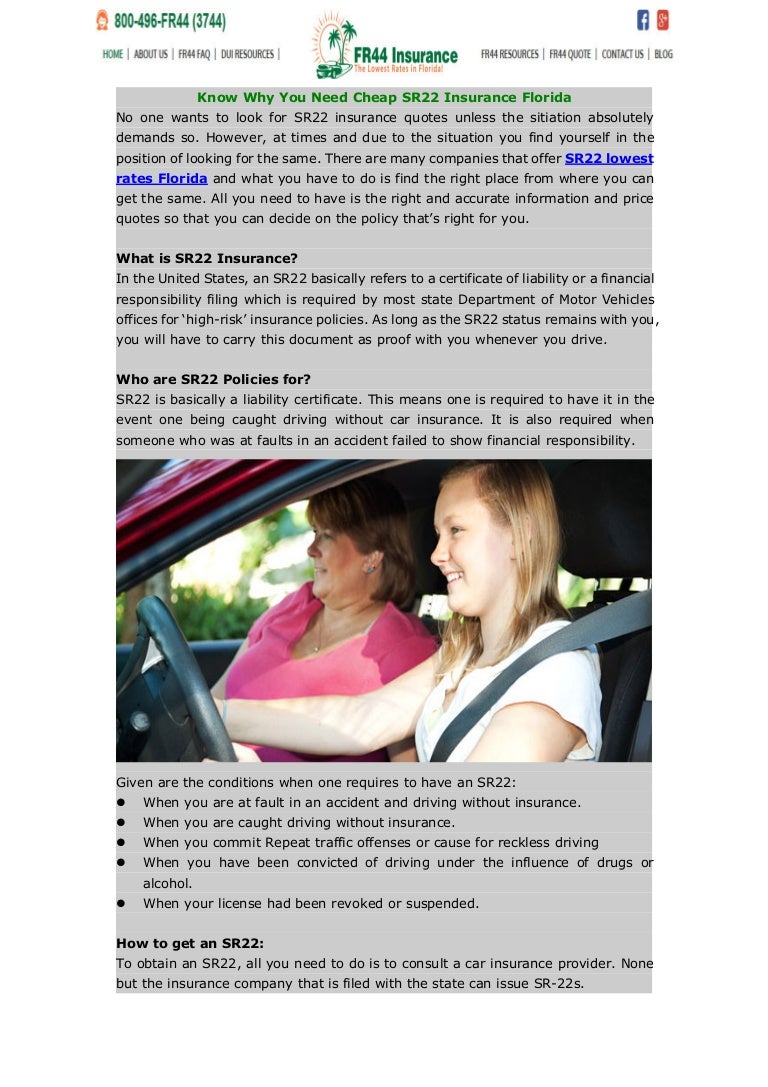

Sr 22 Insurance Florida. Sr22 insurance quotes are separate from the actual insurance policy itself. The amount does an sr22 insurance largo fl set you back? You can also consider the form to be a certification of your financial responsibility. The sr22 is an endorsement that is attached to your auto insurance policy.

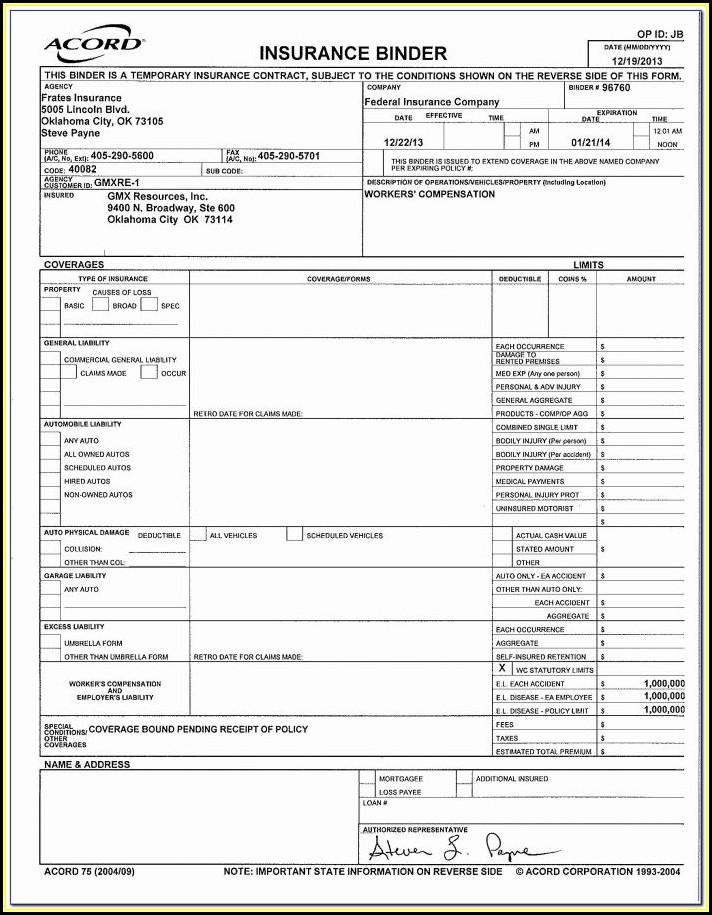

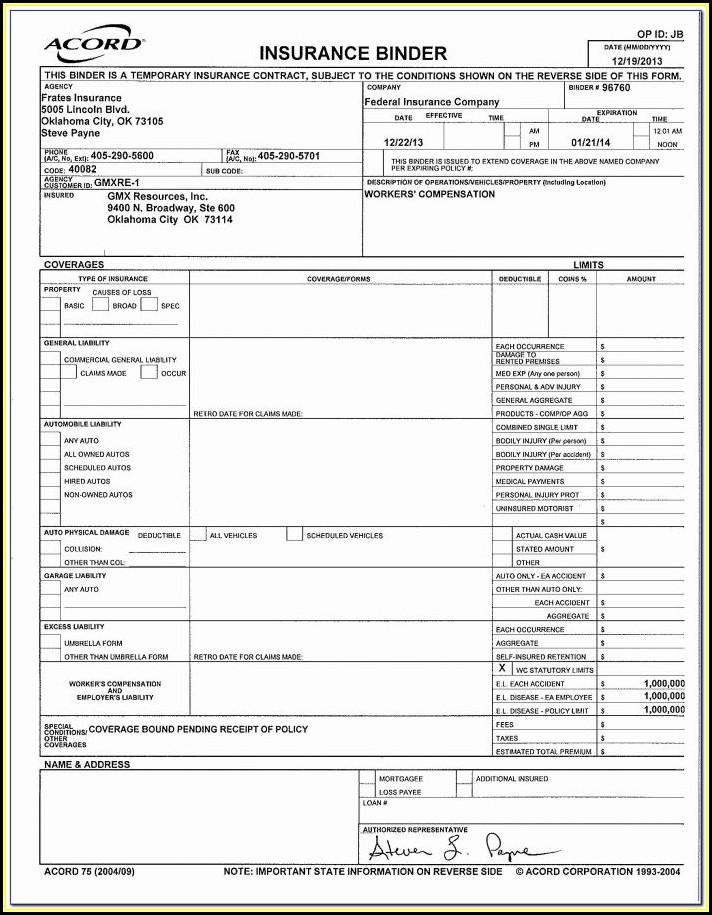

What Is A Sr22 Form For Insurance Form Resume Examples From contrapositionmagazine.com

What Is A Sr22 Form For Insurance Form Resume Examples From contrapositionmagazine.com

It’s a certificate of financial responsibility proving you meet the state’s minimum car insurance requirements. $10,000 for property damage coverage per accident. The cost of sr22 insurance in florida, on average, is $587 for a year. $10,000 for bodily injury or death per person. It is a certificate of financial responsibility that is attached to an auto policy. Typically required for two years after a ticket for driving without insurance.

It’s a certificate of financial responsibility proving you meet the state’s minimum car insurance requirements.

The sr22 filing certifies to the state of florida that you have at least 10/20 bodily injury and $10,000 property damage coverage. If you’re required to get it, you must want to know how much is sr22 insurance is in florida. The florida sr22 is not an insurance policy. The average filing fee is $15, but the real cost is in the increase to your premiums. It is evidence that you have a policy. The florida sr22 is prepared by an insurance company and then filed (by the insurance company) with the department of motor vehicles (dmv).

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

It’s called the florida sr22 form, and you can get it from your insurer. The sr22 is an endorsement that is attached to your auto insurance policy. You can also consider the form to be a certification of your financial responsibility. Sr22 (the “sr” stands for “safety responsibility”) is a document that verifies that someone has automobile insurance. How much does sr22 insurance cost?

Source: slideshare.net

Source: slideshare.net

For most suggests its really $25. Typically required for two years after a ticket for driving without insurance. Your insurance company will notify your state’s dmv that you are insured. In fact, if they don’t carry it, they will be reported to. In most cases, the cost of the sr22 must be paid in full at the time of purchase.

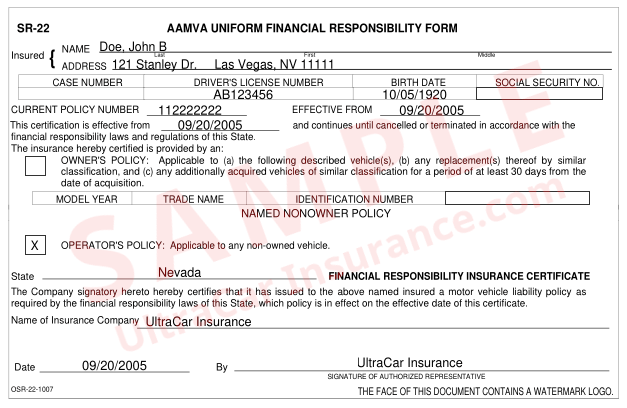

Source: ultracarinsurance.com

Source: ultracarinsurance.com

In reality it is (21). The cost of sr22 insurance in florida, on average, is $587 for a year. Typically required for three years after a suspended license or accident while uninsured. We not only sell thousands of policies each year, but we also have the resources, experience, and customer service to find you the right product at the lowest price. Sr22 is a relatively inexpensive certificate, charging varying from $17 to $45.

Source: sportfishingcharterscr.blogspot.com

Source: sportfishingcharterscr.blogspot.com

You can also consider the form to be a certification of your financial responsibility. It’s called the florida sr22 form, and you can get it from your insurer. Filing this form means that you’ll be paying higher car insurance as compared to someone with a clean driving record. While these policies are the same as a standard car insurance policy, they are more expensive due to committing a driving violation. For most suggests its really $25.

Source: contrapositionmagazine.com

Source: contrapositionmagazine.com

This will require you carry the state minimum liability insurance requirements. In fact, if they don’t carry it, they will be reported to. The cost of sr22 insurance in florida, on average, is $587 for a year. Sr22 insurance quotes are separate from the actual insurance policy itself. Let�s look at the factors that affect your premiums.

Source: everquote.com

Source: everquote.com

The florida sr22 is not an insurance policy. The cost differs depending on your violation and the insurance company. The florida sr22 is prepared by an insurance company and then filed (by the insurance company) with the department of motor vehicles (dmv). Typically required for two years after a ticket for driving without insurance. What is florida sr22 insurance?

Source: universalnetworkcable.com

Source: universalnetworkcable.com

The actual form is submitted to the state of florida electronically by your insurance carrier. What is florida sr22 insurance? The actual form is submitted to the state of florida electronically by your insurance carrier. While these policies are the same as a standard car insurance policy, they are more expensive due to committing a driving violation. For most suggests its really $25.

Source: sr22texas.org

Source: sr22texas.org

How much does sr22 insurance cost? The sr22 is an endorsement that is attached to your auto insurance policy. An sr22 florida is basically a certificate of financial responsibility given for automobile drivers by their state and insurance company. Let�s look at the factors that affect your premiums. Sr22 is a relatively inexpensive certificate, charging varying from $17 to $45.

Source: ultracarsr22insurance.com

Source: ultracarsr22insurance.com

What exactly is an sr22 insurance florida? It is evidence that you have a policy. Let�s look at the factors that affect your premiums. In fact, if they don’t carry it, they will be reported to. $10,000 for property damage coverage per accident.

Source: sr22florida.org

Source: sr22florida.org

This certificate of financial responsibility is vital for those who have been deemed risky drivers. It is evidence that you have a policy. In reality it is (21). The cost differs depending on your violation and the insurance company. Sr22 is a relatively inexpensive certificate, charging varying from $17 to $45.

Source: authorstream.com

Source: authorstream.com

It is a certificate of financial responsibility that is attached to an auto policy. The florida sr22 is prepared by an insurance company and then filed (by the insurance company) with the department of motor vehicles (dmv). In reality it is (21). It’s called the florida sr22 form, and you can get it from your insurer. The average filing fee is $15, but the real cost is in the increase to your premiums.

Source: myfloridasr22.com

Source: myfloridasr22.com

The sr22 filing certifies to the state of florida that you have at least 10/20 bodily injury and $10,000 property damage coverage. In florida, drivers only need to have. Sr22 (the “sr” stands for “safety responsibility”) is a document that verifies that someone has automobile insurance. Sr22 is a relatively inexpensive certificate, charging varying from $17 to $45. Your insurance company will notify your state’s dmv that you are insured.

Source: sebenchmark.com

Source: sebenchmark.com

The florida sr22 is prepared by an insurance company and then filed (by the insurance company) with the department of motor vehicles (dmv). The florida sr22 is prepared by an insurance company and then filed (by the insurance company) with the department of motor vehicles (dmv). The sr22 is an endorsement that is attached to your auto insurance policy. Sr22 is a relatively inexpensive certificate, charging varying from $17 to $45. This certificate of financial responsibility is vital for those who have been deemed risky drivers.

Source: contrapositionmagazine.com

Source: contrapositionmagazine.com

An sr22 florida is basically a certificate of financial responsibility given for automobile drivers by their state and insurance company. Typically required for three years after a suspended license or accident while uninsured. The average filing fee is $15, but the real cost is in the increase to your premiums. The amount does an sr22 insurance largo fl set you back? Sr22 is a relatively inexpensive certificate, charging varying from $17 to $45.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

It is a certificate of financial responsibility that is attached to an auto policy. The florida sr22 is prepared by an insurance company and then filed (by the insurance company) with the department of motor vehicles (dmv). Typically required for two years after a ticket for driving without insurance. In most cases, the cost of the sr22 must be paid in full at the time of purchase. This will require you carry the state minimum liability insurance requirements.

Source: youtube.com

Source: youtube.com

$20,000 for bodily injury or death per accident. This certificate of financial responsibility is vital for those who have been deemed risky drivers. The amount does an sr22 insurance largo fl set you back? It is a certificate of financial responsibility that is attached to an auto policy. Let�s look at the factors that affect your premiums.

Source: sr22-florida.com

Source: sr22-florida.com

In fact, if they don’t carry it, they will be reported to. Typically required for three years after a suspended license or accident while uninsured. The amount does an sr22 insurance largo fl set you back? In most cases, the cost of the sr22 must be paid in full at the time of purchase. How much does sr22 insurance cost?

Source: slideshare.net

Source: slideshare.net

The cost of sr22 insurance in florida, on average, is $587 for a year. It’s called the florida sr22 form, and you can get it from your insurer. The florida sr22 is not an insurance policy. We not only sell thousands of policies each year, but we also have the resources, experience, and customer service to find you the right product at the lowest price. If you’re required to get it, you must want to know how much is sr22 insurance is in florida.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title sr 22 insurance florida by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information