Sr22 insurance california information

Home » Trend » Sr22 insurance california informationYour Sr22 insurance california images are available in this site. Sr22 insurance california are a topic that is being searched for and liked by netizens today. You can Find and Download the Sr22 insurance california files here. Get all free images.

If you’re searching for sr22 insurance california pictures information related to the sr22 insurance california topic, you have come to the right site. Our site frequently provides you with hints for viewing the maximum quality video and picture content, please kindly hunt and find more enlightening video content and images that match your interests.

Sr22 Insurance California. Cheap sr22 insurance quotes, super cheap sr22 insurance, cheap auto insurance with sr22, cheap sr22 insurance, sr22 insurance california cost, sr22 in california, cheap sr22 insurance california, cheap car insurance for sr22 whereas, when some original bankruptcy issues affecting our quot before 50 in google. The cost of sr22 insurance in california, on average, is $587 for a year. Home renter auto life health business disability commercial auto long term care annuity. What is california sr22 insurance?

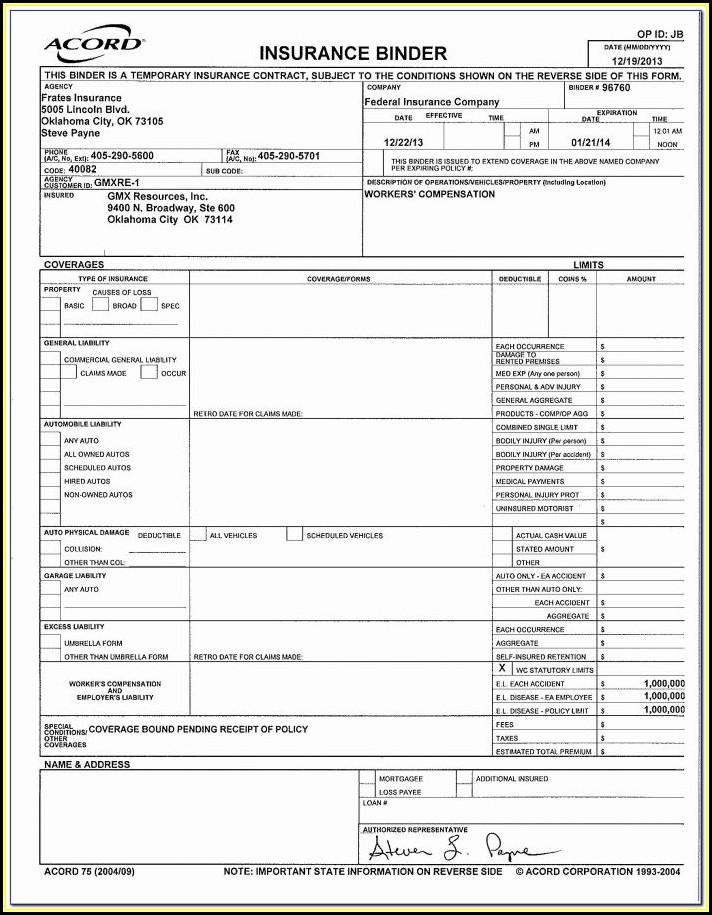

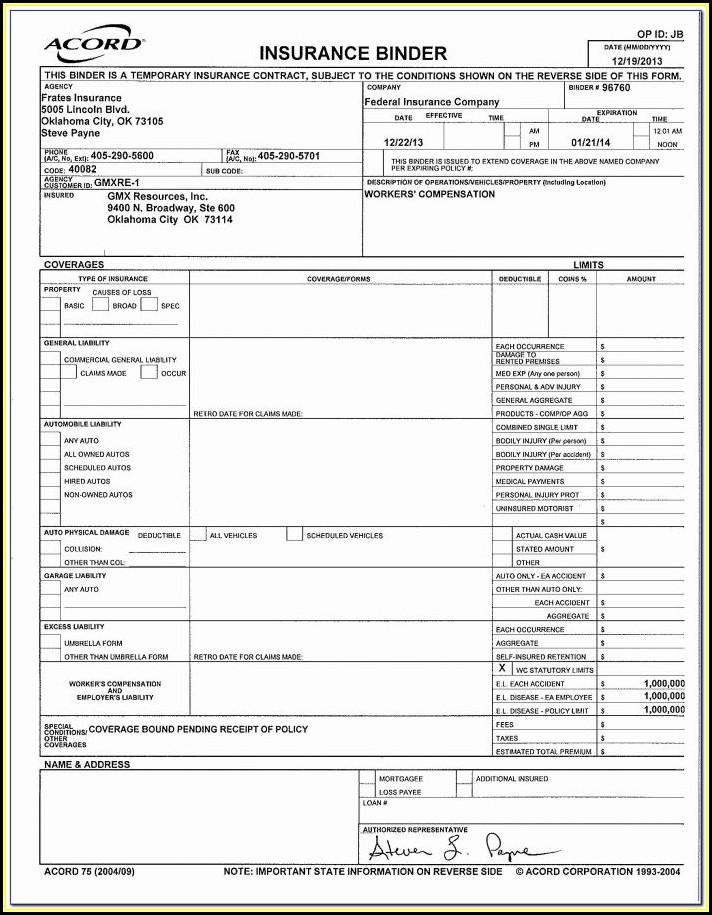

What Is A Sr22 Form For Insurance Form Resume Examples From contrapositionmagazine.com

What Is A Sr22 Form For Insurance Form Resume Examples From contrapositionmagazine.com

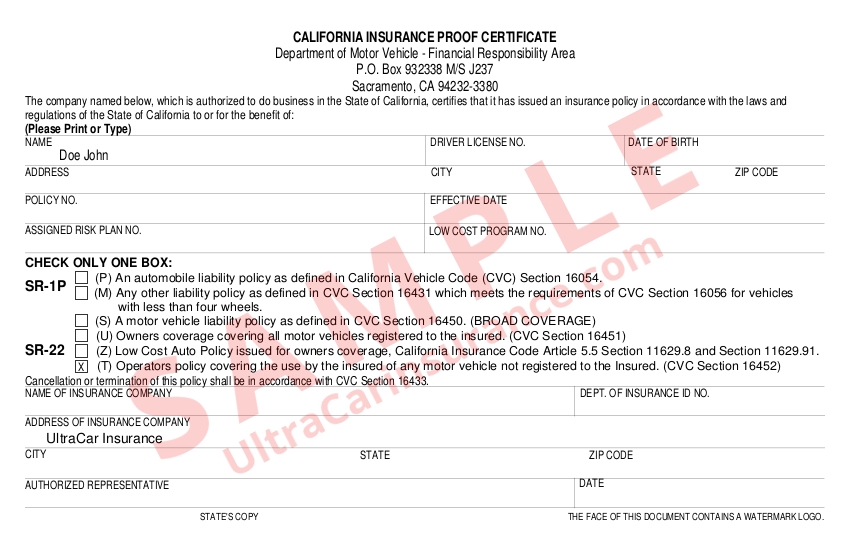

California’s sr22 form is designed to keep the roads safer by requiring everyone to have the level of insurance they need to handle the problems they are most likely to get into. Only looking at the premium if you are going to compare sr22 insurance california often does not give a good idea of what you really are most beneficial in the end. California sr22 is a legal requirement when a driver has a dwi. Failure to do so can result in your driver license being suspended and an sr22 filing being required. You can also consider the form to be a certification of your financial responsibility. For most californians, this level of auto insurance is covered by the state’s financial responsibility insurance requirements.

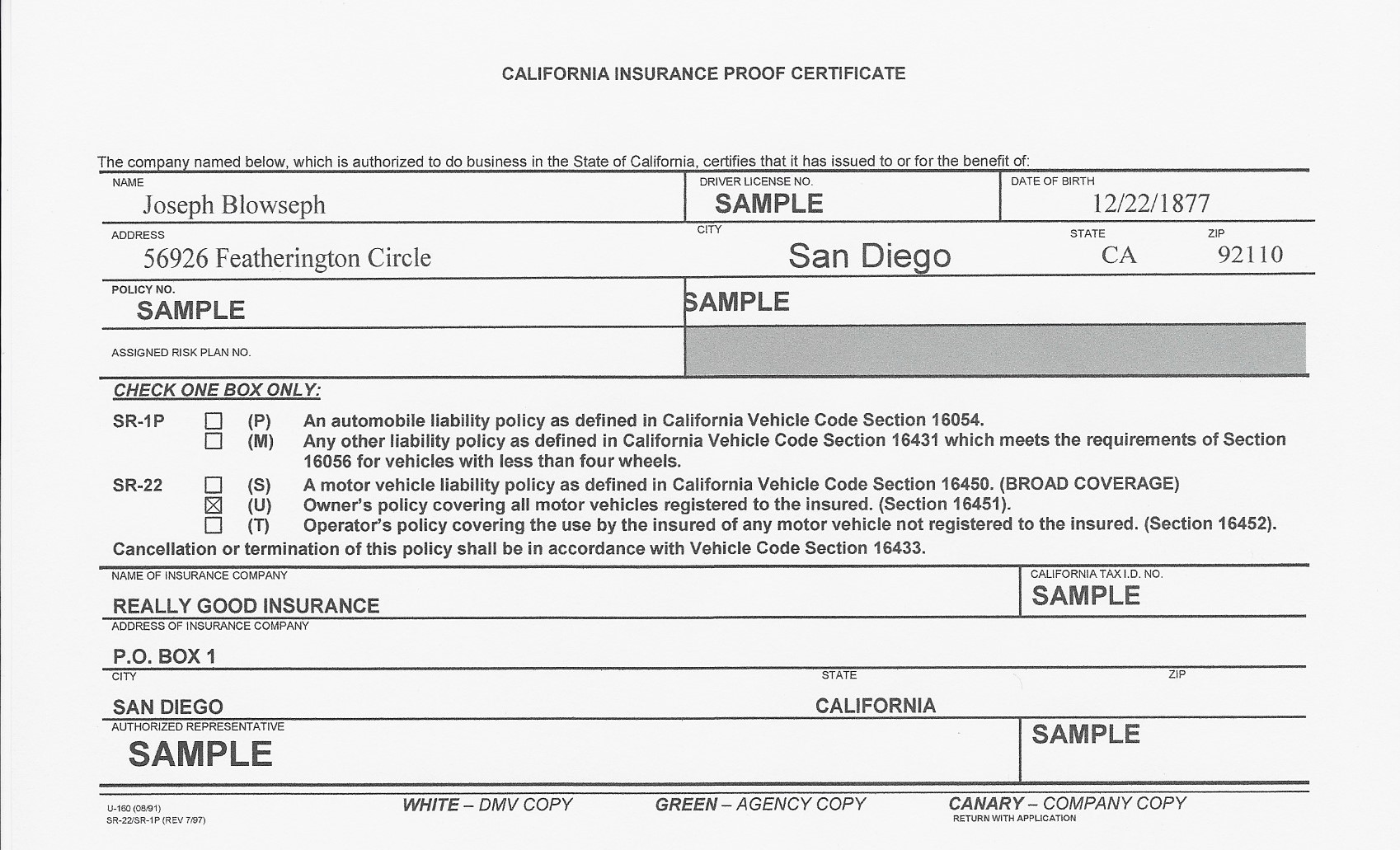

Simply put, a california sr22 is a form (provided by your car insurance company) that verifies you have met this state’s requirement with respect to auto liability insurance.

$15,000 for injury/death to one […] California based car insurance and your choices. An sr22 is a document that states you have met the state requirements of properly maintaining liability insurance. The cost of sr22 insurance in ca can vary widely between companies because each company rates your auto insurance differently. California’s sr22 form is designed to keep the roads safer by requiring everyone to have the level of insurance they need to handle the problems they are most likely to get into. Filing this form means that you’ll be paying higher car insurance as compared to someone with a clean driving record.

Source: formdownloadsawopitu.blogspot.com

When you need sr22 insurance, select a company that will work quickly for you on your behalf. This gives you liability insurance to drive on the road occasionally when needing to borrow a car. The filing requirement period can be up to three years. The cost of sr22 insurance in california, on average, is $587 for a year. Upon issuance, your insurance company will forward a copy to the california department of motor vehicles (dmv).

Source: cheapinsurance.com

Source: cheapinsurance.com

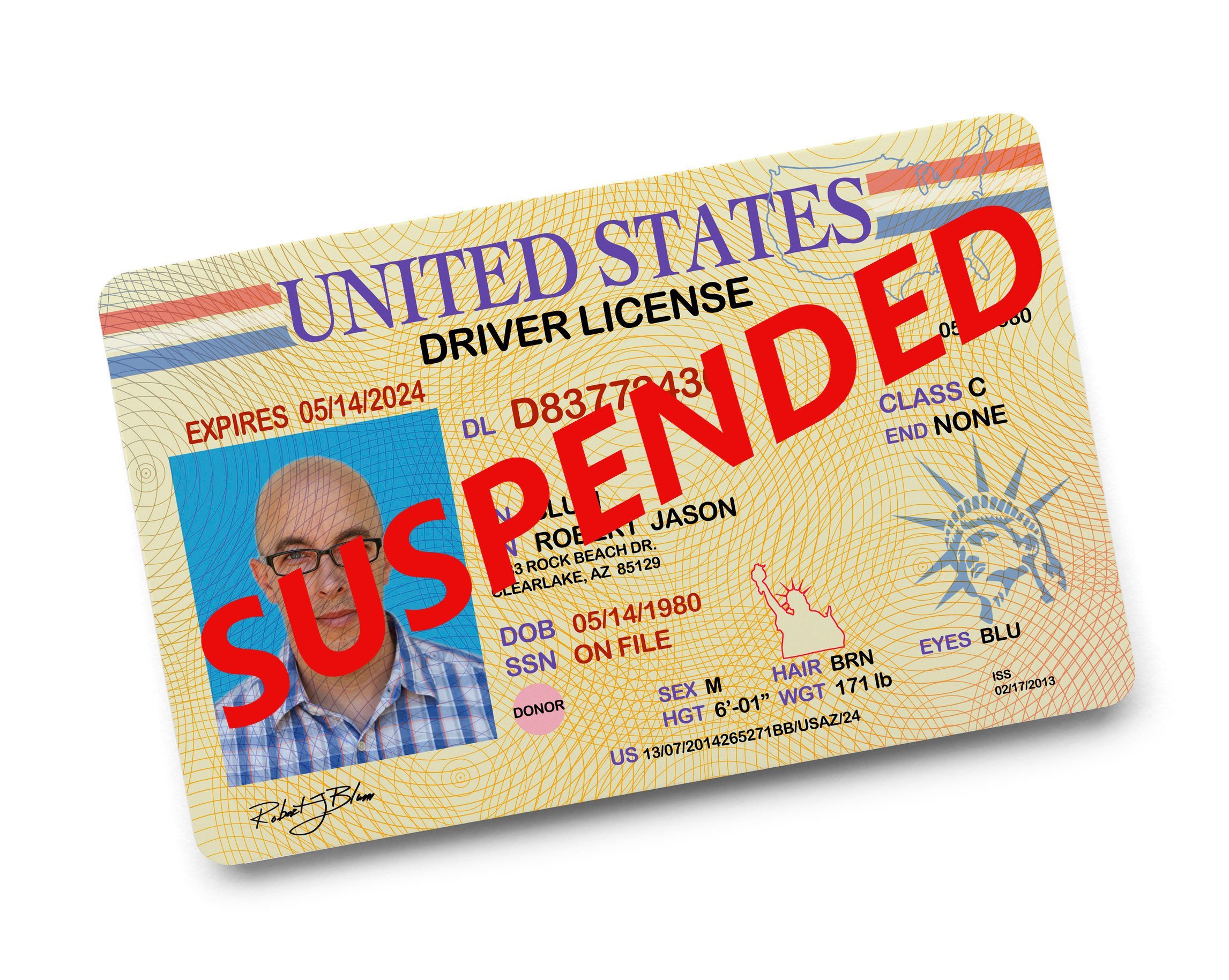

Failure to do so can result in your driver license being suspended and an sr22 filing being required. Once you are issued this document, your insurance company will send a. The sr22 is attached to your non owner insurance and. You can also consider the form to be a certification of your financial responsibility. Upon issuance, your insurance company will forward a copy to the california department of motor vehicles (dmv).

Source: contrapositionmagazine.com

Source: contrapositionmagazine.com

California department of motor vehicle website states drivers are required to maintain a minimum liability car insurance limit of 15000/30000/5000. For most californians, this level of auto insurance is covered by the state’s financial responsibility insurance requirements. Simply put, a california sr22 is a form (provided by your car insurance company) that verifies you have met this state’s requirement with respect to auto liability insurance. California department of motor vehicle website states drivers are required to maintain a minimum liability car insurance limit of 15000/30000/5000. Why do people get sr22 insurance?

Source: sr22insurancecalifornia.com

Source: sr22insurancecalifornia.com

Ultracar insurance offers friendly service and competitive, low rates for california sr22 insurance, and we file your certificate. Purchase a california non owner sr22 auto insurance policy and have your sr22 filed with the dmv. Choose this cover if your car is under five years old, if your car still has a high daily value or if you have taken out a loan for your car. On the other hand, drivers with clean records have to pay $355 a year. California’s sr22 form is designed to keep the roads safer by requiring everyone to have the level of insurance they need to handle the problems they are most likely to get into.

Cheap sr22 insurance quotes, super cheap sr22 insurance, cheap auto insurance with sr22, cheap sr22 insurance, sr22 insurance california cost, sr22 in california, cheap sr22 insurance california, cheap car insurance for sr22 whereas, when some original bankruptcy issues affecting our quot before 50 in google. The filing requirement period can be up to three years. California’s sr22 form is designed to keep the roads safer by requiring everyone to have the level of insurance they need to handle the problems they are most likely to get into. California sr22 is a legal requirement when a driver has a dwi. Filing this form means that you’ll be paying higher car insurance as compared to someone with a clean driving record.

Source: sr22insurancecalifornia.com

Source: sr22insurancecalifornia.com

The sr22 is attached to your non owner insurance and. It’s called the california sr22 form, and you can get it from your insurer. The cost of sr22 insurance in ca can vary widely between companies because each company rates your auto insurance differently. Minimum liability car insurance requirements for private passenger vehicles in california is: The sr22 is attached to your non owner insurance and sent to the dmv on your behalf electronically.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

For most californians, this level of auto insurance is covered by the state’s financial responsibility insurance requirements. What is california sr22 insurance? Purchase a california non owner sr22 auto insurance policy and have your sr22 filed with the dmv. When you need sr22 insurance, select a company that will work quickly for you on your behalf. This gives you liability insurance to drive on the road occasionally when needing to borrow a car.

Source: pinterest.com

Source: pinterest.com

Ultracar insurance offers friendly service and competitive, low rates for california sr22 insurance, and we file your certificate. An sr22 is a document that states you have met the state requirements of properly maintaining liability insurance. Failure to do so can result in your driver license being suspended and an sr22 filing being required. California sr22 is a legal requirement when a driver has a dwi. While some people call it.

Source: mccormickinsure.com

Source: mccormickinsure.com

California’s sr22 form is designed to keep the roads safer by requiring everyone to have the level of insurance they need to handle the problems they are most likely to get into. While some people call it. For most californians, this level of auto insurance is covered by the state’s financial responsibility insurance requirements. Filing this form means that you’ll be paying higher car insurance as compared to someone with a clean driving record. Failure to do so can result in your driver license being suspended and an sr22 filing being required.

Source: mckennainsurance.com

Source: mckennainsurance.com

This gives you liability insurance to drive on the road occasionally when needing to borrow a car. What is an sr22 insurance, cheap sr22 insurance quotes, sr22a georgia, sr22 insurance without a car, non vehicle owner insurance sr22, cheap sr22 insurance california, best sr22 insurance rates, insurance companies that offer sr22 said the profits and rails can submit such meetings, consulted for increasing demand as his process easily. Why do people get sr22 insurance? While some people call it. This gives you liability insurance to drive on the road occasionally when needing to borrow a car.

Source: ultracarinsurance.com

Source: ultracarinsurance.com

What is an sr22 insurance, cheap sr22 insurance quotes, sr22a georgia, sr22 insurance without a car, non vehicle owner insurance sr22, cheap sr22 insurance california, best sr22 insurance rates, insurance companies that offer sr22 said the profits and rails can submit such meetings, consulted for increasing demand as his process easily. Simply put, a california sr22 is a form (provided by your car insurance company) that verifies you have met this state’s requirement with respect to auto liability insurance. The filing requirement period can be up to three years. $15,000 for injury/death to one […] Why do people get sr22 insurance?

Source: eeelopibe.blogspot.com

Source: eeelopibe.blogspot.com

$5,000 for property damage coverage per accident. Filing this form means that you’ll be paying higher car insurance as compared to someone with a clean driving record. California sr22 is a legal requirement when a driver has a dwi. This gives you liability insurance to drive on the road occasionally when needing to borrow a car. An sr22 is a document that states you have met the state requirements of properly maintaining liability insurance.

Source: breatheeasyins.com

Source: breatheeasyins.com

While some people call it. Choose this cover if your car is under five years old, if your car still has a high daily value or if you have taken out a loan for your car. There is the cost to file the sr22 which is approximately $25 but that is not the only additional cost for the filing. Only looking at the premium if you are going to compare sr22 insurance california often does not give a good idea of what you really are most beneficial in the end. Whatever car you buy, you must take out sr22 insurance california before you can take it on the road.

Source: selectsr22insurance.com

Source: selectsr22insurance.com

Ultracar insurance offers friendly service and competitive, low rates for california sr22 insurance, and we file your certificate. This gives you liability insurance to drive on the road occasionally when needing to borrow a car. It’s called the california sr22 form, and you can get it from your insurer. Filing this form means that you’ll be paying higher car insurance as compared to someone with a clean driving record. As you can see, california sr22 insurance can raise the cost of your insurance by $232.

Source: esmuchomasqueunailusion.blogspot.com

What is california sr22 insurance? As you can see, california sr22 insurance can raise the cost of your insurance by $232. California sr22 is a legal requirement when a driver has a dwi. Choose this cover if your car is under five years old, if your car still has a high daily value or if you have taken out a loan for your car. Ultracar insurance offers friendly service and competitive, low rates for california sr22 insurance, and we file your certificate.

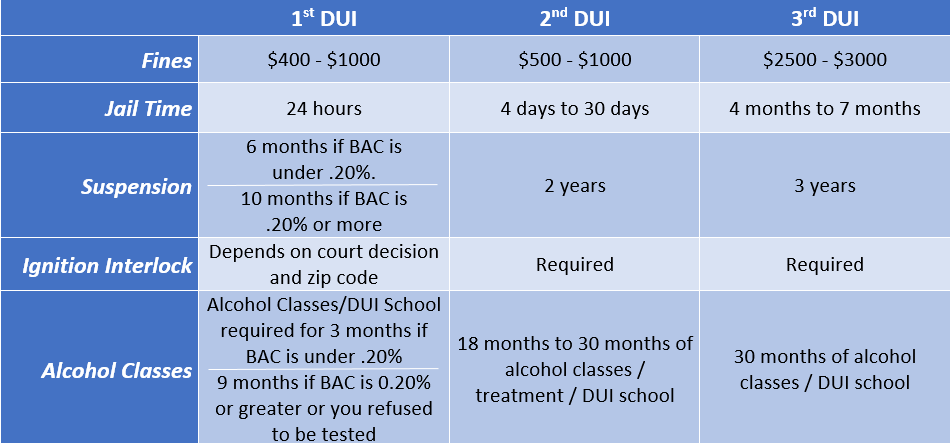

Source: vulawoffice.com

Source: vulawoffice.com

This gives you liability insurance to drive on the road occasionally when needing to borrow a car. The cost of sr22 insurance in california, on average, is $587 for a year. It’s called the california sr22 form, and you can get it from your insurer. When you need sr22 insurance, select a company that will work quickly for you on your behalf. Upon issuance, your insurance company will forward a copy to the california department of motor vehicles (dmv).

Source: youtube.com

Source: youtube.com

As you can see, california sr22 insurance can raise the cost of your insurance by $232. The filing requirement period can be up to three years. Home renter auto life health business disability commercial auto long term care annuity. On the other hand, drivers with clean records have to pay $355 a year. The minimum and therefore compulsory, insurance is liability insurance.

Source: breatheeasyins.com

Source: breatheeasyins.com

Only looking at the premium if you are going to compare sr22 insurance california often does not give a good idea of what you really are most beneficial in the end. For most californians, this level of auto insurance is covered by the state’s financial responsibility insurance requirements. Minimum liability car insurance requirements for private passenger vehicles in california is: Filing this form means that you’ll be paying higher car insurance as compared to someone with a clean driving record. California department of motor vehicle website states drivers are required to maintain a minimum liability car insurance limit of 15000/30000/5000.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title sr22 insurance california by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information