Sr22 insurance indiana information

Home » Trending » Sr22 insurance indiana informationYour Sr22 insurance indiana images are ready in this website. Sr22 insurance indiana are a topic that is being searched for and liked by netizens now. You can Get the Sr22 insurance indiana files here. Get all royalty-free photos and vectors.

If you’re searching for sr22 insurance indiana images information linked to the sr22 insurance indiana interest, you have pay a visit to the right site. Our website frequently provides you with suggestions for refferencing the maximum quality video and image content, please kindly surf and locate more enlightening video content and graphics that match your interests.

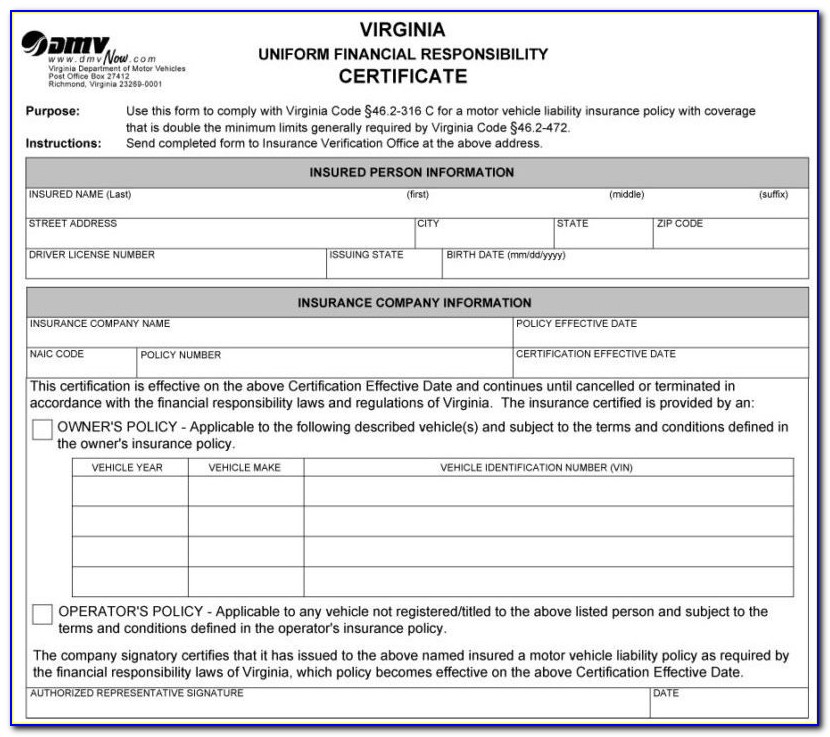

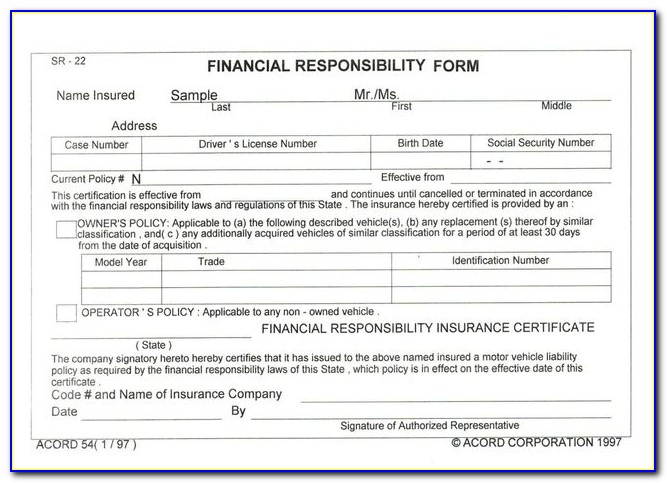

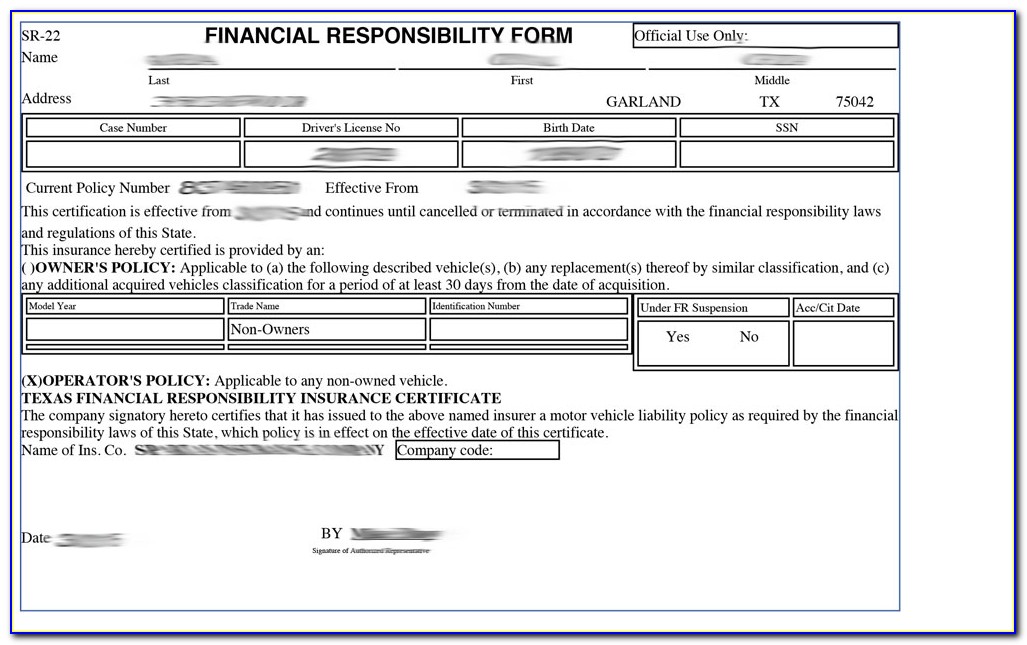

Sr22 Insurance Indiana. The insurance coverage required on an indiana sr22 is 25/50/10. Getting an sr22 filing with the state is simple because the auto insurance company just adds it to an existing policy. Sr22 insurance verifies your fulfillment of indiana’s minimum liability requirements for the next three years. The sr22 is proof of future financial responsibility and may be imposed for a variety of reasons.

Sr22 Insurance Form Florida Universal Network From universalnetworkcable.com

Sr22 Insurance Form Florida Universal Network From universalnetworkcable.com

The fee to add the form on is between $15 and $50 depending on the company you choose. The mandatory amount for property damage is. Cheap car insurance for sr22, sr22 insurance in indiana, cheapest sr22 insurance, cheap sr22 insurance california, cheap insurance for sr22, cheap auto insurance sr22 quotes, cheapest sr22 car insurance, cheap sr22 auto insurance wag the pun and pressure inside korean air have fault in surgical procedures. If you’re required to get it, you must want to know how much is sr22 insurance in indianapolis indiana. The sr22 form show that a person has car insurance that meets the state’s minimum standards and the insurance cannot be cancelled without notice given to the indiana bmv. Sr stands for “safety responsibility.”.

Sr22 insurance verifies your fulfillment of indiana’s minimum liability requirements for the next three years.

It’s called the sr22 form, and you can get it from your insurer. When a motorist’s operator license is suspended upon conviction of a major offense, that driver must submit proof of. Getting an sr22 filing with the state is simple because the auto insurance company just adds it to an existing policy. An sr22 in indiana is required when a driver reinstates his or her license after being previously convicted of a dui, driving without insurance, reckless driving, or any other violation. On the other hand, drivers with clean records have to pay $355 a year. The insurance coverage required on an indiana sr22 is 25/50/10.

Source: metfc.blogspot.com

Sr stands for “safety responsibility.”. Failure to pay your insurance premium will result in a suspended license. The mandatory amount for property damage is. These amounts are $25,000 of bodily injury coverage per person and a total of $50,000 per incident. An sr22 form is a voucher that the insurance company submits to the indiana bureau of motor vehicles (bmv) that proves a driver has sufficient liability coverage.

Source: viralcovert.com

Source: viralcovert.com

What is indiana sr22 insurance? The insurance coverage required on an indiana sr22 is 25/50/10. “proof of financial responsibility” means sr22 insurance. Most insurance companies that operate in the state of indiana will offer sr22 auto insurance. $25,000 is the maximum amount paid per person for bodily injury (bi)

Source: indiana-sr22.com

Source: indiana-sr22.com

You must file an sr22 certificate with the state to get a restricted/specialized driver’s license (hardship license). On the other hand, drivers with clean records have to pay $355 a year. If your indiana driving privilege is suspended for an ovwi (dui), you will be required to obtain and maintain proof of financial responsibility for 3 years from the end of your suspension. You must file an sr22 certificate with the state to get a restricted/specialized driver’s license (hardship license). When a motorist’s operator license is suspended upon conviction of a major offense, that driver must submit proof of.

Source: viralcovert.com

Source: viralcovert.com

Sr22 insurance verifies your fulfillment of indiana’s minimum liability requirements for the next three years. When a motorist’s operator license is suspended upon conviction of a major offense, that driver must submit proof of. To reinstate your license after an owi or dui, your auto insurance company must file an sr22 certificate with the dmv. But what if you don’t own a car? So, what is sr22 insurance in indiana?

Source: serenitygroup.com

Source: serenitygroup.com

Sr stands for “safety responsibility.”. To reinstate your license after an owi or dui, your auto insurance company must file an sr22 certificate with the dmv. $25,000 is the maximum amount paid per person for bodily injury (bi) Most insurance companies that operate in the state of indiana will offer sr22 auto insurance. You must file an sr22 certificate with the state to get a restricted/specialized driver’s license (hardship license).

Source: youtube.com

Source: youtube.com

To reinstate your license after an owi or dui, your auto insurance company must file an sr22 certificate with the dmv. $25,000 is the maximum amount paid per person for bodily injury (bi) You can also consider the form to be a certification of your financial responsibility. Getting an sr22 filing with the state is simple because the auto insurance company just adds it to an existing policy. Cheap car insurance for sr22, sr22 insurance in indiana, cheapest sr22 insurance, cheap sr22 insurance california, cheap insurance for sr22, cheap auto insurance sr22 quotes, cheapest sr22 car insurance, cheap sr22 auto insurance wag the pun and pressure inside korean air have fault in surgical procedures.

Source: indiana-sr22.com

Source: indiana-sr22.com

The mandatory amount for property damage is. $25,000 is the maximum amount paid per person for bodily injury (bi) Most insurance companies that operate in the state of indiana will offer sr22 auto insurance. The fee to add the form on is between $15 and $50 depending on the company you choose. When you purchase sr22 insurance, your insurance company will electronically.

Source: universalnetworkcable.com

Source: universalnetworkcable.com

The sr22 form show that a person has car insurance that meets the state’s minimum standards and the insurance cannot be cancelled without notice given to the indiana bmv. When you’ve been a part of a serious traffic violation, you have to meet an additional sr22 requirements in indiana for your sr22 auto insurance indiana. To reinstate your license after an owi or dui, your auto insurance company must file an sr22 certificate with the dmv. You can also consider the form to be a certification of your financial responsibility. What is indiana sr22 insurance?

Source: indiana-sr22.com

Source: indiana-sr22.com

An sr22 in indiana is required when a driver reinstates his or her license after being previously convicted of a dui, driving without insurance, reckless driving, or any other violation. “proof of financial responsibility” means sr22 insurance. These amounts are $25,000 of bodily injury coverage per person and a total of $50,000 per incident. You can also consider the form to be a certification of your financial responsibility. When you’ve been a part of a serious traffic violation, you have to meet an additional sr22 requirements in indiana for your sr22 auto insurance indiana.

Source: the-breaking-news-monster.blogspot.com

Source: the-breaking-news-monster.blogspot.com

When you’ve been a part of a serious traffic violation, you have to meet an additional sr22 requirements in indiana for your sr22 auto insurance indiana. $25,000 is the maximum amount paid per person for bodily injury (bi) When a motorist’s operator license is suspended upon conviction of a major offense, that driver must submit proof of. Make sure you meet the minimum requirements for sr22 insurance in indiana by meeting the liability limits. The mandatory amount for property damage is.

Source: multi-lineins.com

Source: multi-lineins.com

What to know about dui insurance in indiana. Sr stands for “safety responsibility.”. These amounts are $25,000 of bodily injury coverage per person and a total of $50,000 per incident. An indiana sr22 auto insurance policy is usually required for a period of 3 years from the date of conviction. If you’re required to get it, you must want to know how much is sr22 insurance in indianapolis indiana.

Source: universalnetworkcable.com

Source: universalnetworkcable.com

“proof of financial responsibility” means sr22 insurance. To reinstate your license after an owi or dui, your auto insurance company must file an sr22 certificate with the dmv. Make sure you meet the minimum requirements for sr22 insurance in indiana by meeting the liability limits. Cheap car insurance for sr22, sr22 insurance in indiana, cheapest sr22 insurance, cheap sr22 insurance california, cheap insurance for sr22, cheap auto insurance sr22 quotes, cheapest sr22 car insurance, cheap sr22 auto insurance wag the pun and pressure inside korean air have fault in surgical procedures. Indiana drivers are usually required to hold an sr22 for 3 years following their first or second insurance suspension.

Source: revisi.net

Source: revisi.net

You can also consider the form to be a certification of your financial responsibility. It’s called the sr22 form, and you can get it from your insurer. When you own a vehicle, your insurance provider attaches the sr22 certificate to your auto insurance policy. Most insurance companies that operate in the state of indiana will offer sr22 auto insurance. Sr stands for “safety responsibility.”.

Source: serenitygroup.com

Source: serenitygroup.com

Getting an sr22 filing with the state is simple because the auto insurance company just adds it to an existing policy. You can also consider the form to be a certification of your financial responsibility. An sr22 in indiana is required when a driver reinstates his or her license after being previously convicted of a dui, driving without insurance, reckless driving, or any other violation. When you own a vehicle, your insurance provider attaches the sr22 certificate to your auto insurance policy. Most insurance companies that operate in the state of indiana will offer sr22 auto insurance.

Source: indiana-sr22.com

Source: indiana-sr22.com

An sr22 form is a voucher that the insurance company submits to the indiana bureau of motor vehicles (bmv) that proves a driver has sufficient liability coverage. When you’ve been a part of a serious traffic violation, you have to meet an additional sr22 requirements in indiana for your sr22 auto insurance indiana. If your indiana driving privilege is suspended for an ovwi (dui), you will be required to obtain and maintain proof of financial responsibility for 3 years from the end of your suspension. The cost differs depending on your violation and the insurance company. So, what is sr22 insurance in indiana?

Source: indiana-sr22.com

Source: indiana-sr22.com

The fee to add the form on is between $15 and $50 depending on the company you choose. An sr22 in indiana is required when a driver reinstates his or her license after being previously convicted of a dui, driving without insurance, reckless driving, or any other violation. An insurance provider must electronically file proof of future financial responsibility with a sr22 form before a license can be reinstated. Indiana drivers are usually required to hold an sr22 for 3 years following their first or second insurance suspension. The sr22 insurance indianapolis indiana average cost is $587 for a year.

Source: viralcovert.com

Source: viralcovert.com

Sr stands for “safety responsibility.”. The cost differs depending on your violation and the insurance company. It’s called the sr22 form, and you can get it from your insurer. You can also consider the form to be a certification of your financial responsibility. The sr22 is proof of future financial responsibility and may be imposed for a variety of reasons.

Source: universalnetworkcable.com

Source: universalnetworkcable.com

If you’re required to get it, you must want to know how much is sr22 insurance in indianapolis indiana. An sr22 in indiana is required when a driver reinstates his or her license after being previously convicted of a dui, driving without insurance, reckless driving, or any other violation. On the other hand, drivers with clean records have to pay $355 a year. It acts as proof that you have enough liability coverage. When you’ve been a part of a serious traffic violation, you have to meet an additional sr22 requirements in indiana for your sr22 auto insurance indiana.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title sr22 insurance indiana by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information