Sr22 insurance wisconsin Idea

Home » Trend » Sr22 insurance wisconsin IdeaYour Sr22 insurance wisconsin images are ready. Sr22 insurance wisconsin are a topic that is being searched for and liked by netizens now. You can Get the Sr22 insurance wisconsin files here. Find and Download all royalty-free photos and vectors.

If you’re looking for sr22 insurance wisconsin pictures information related to the sr22 insurance wisconsin keyword, you have pay a visit to the ideal site. Our site always provides you with suggestions for viewing the highest quality video and picture content, please kindly search and find more informative video content and images that match your interests.

Sr22 Insurance Wisconsin. If a driver registers a vehicle (19). This agreement will prove that the driver has signed a binding contract that will obligate them to pay for their insurance for the future. If a driver is pulled over by a police officer or involved in an auto accident and cannot provide proof of insurance, their driving privileges will be suspended. All states have different minimum liability coverages.

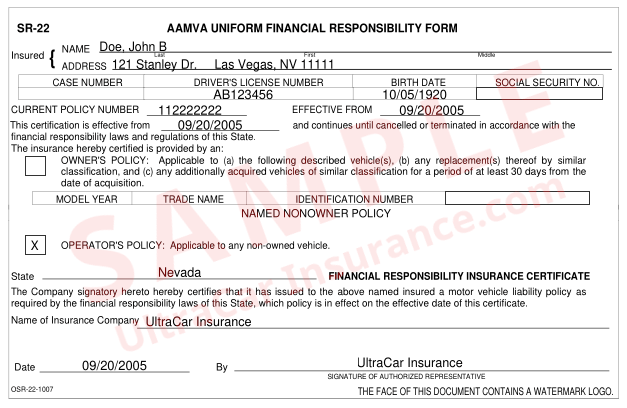

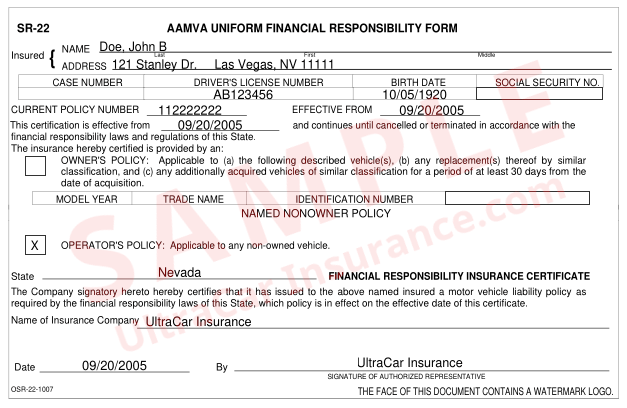

ExampleSR22 Certificate Ultracar Insurance From ultracarinsurance.com

ExampleSR22 Certificate Ultracar Insurance From ultracarinsurance.com

In order to reinstate your wisconsin license after a violation like dui, you will need to obtain sr22, or financial responsibility, endorsed on an auto insurance policy. The expense of a non owner sr22 insurance strategy depends on a few components including age, sexual orientation, postal division, conjugal status, driving record and fico score. You can buy wisconsin sr22 insurance whether you own a vehicle or not. Most insurance companies that file sr22 certificates will electronically file or mail the information to dmv. Common reasons for needing an sr22 are after a dui conviction or for driving without car insurance. An sr22 insurance policy is a financial agreement between the driver and the insurance company.

Here are the wisconsin sr22 requirements to get sr22 insurance wi :

If a driver registers a vehicle (19). An sr22 insurance policy is a financial agreement between the driver and the insurance company. If a driver is pulled over by a police officer or involved in an auto accident and cannot provide proof of insurance, their driving privileges will be suspended. $25,000 for injury to one person, $50,000 for injury to two or more people, and $10,000 for property damage. On our list of insurers, the cheapest option is usaa with an average annual rate of $429. Sr22 insurance wisconsin is a certificate of financial responsibility that is added as a rider to your auto insurance policy and filed with the wisconsin dmv.

Source: ultracarinsurance.com

Source: ultracarinsurance.com

Proof of insurance is filed by providing a sr22 certificate to dmv. Sr22 insurance wisconsin is a high risk insurance certificate. $40,000 for damage resulting from one accident. The official document from an insurance agency testifies that you have an insurance plan. Our experts can get you the best sr22 insurance quotes with a single phone call.

Source: youtube.com

Source: youtube.com

You can buy wisconsin sr22 insurance whether you own a vehicle or not. All states have different minimum liability coverages. The policy is very similar to a standard auto insurance policy except the vehicle is assumed to be a car that is not owned by the driver. On the other hand, drivers with clean records have to pay $355 a year. On our list of insurers, the cheapest option is usaa with an average annual rate of $429.

Source: quotesgram.com

Source: quotesgram.com

You can buy wisconsin sr22 insurance whether you own a vehicle or not. Here are the wisconsin sr22 requirements to get sr22 insurance wi : The state of wisconsin continues to participate in the sr22 program for drivers involved in certain activities. On our list of insurers, the cheapest option is usaa with an average annual rate of $429. The cost of sr22 insurance is determined by your state’s minimum liability requirements.

Source: ultracarinsurance.com

Source: ultracarinsurance.com

As you can see, wisconsin sr22 insurance can raise the cost of your insurance by $232. You can buy wisconsin sr22 insurance whether you own a vehicle or not. The most common violation requiring an sr22 in wi is dui/dwi. The cost of sr22 insurance in wisconsin, on average, is $587 for a year. Most insurance companies that file sr22 certificates will electronically file or mail the information to dmv.

Source: quotesgram.com

Source: quotesgram.com

To obtain a sr22 certificate, contact an insurance company licensed to do business in wisconsin. Non owner sr22 insurance in wisconsin is required if you need to file a financial responsibility proof with the state but don�t own a car. Most insurance companies mail your certificate directly to wisdot. Here are the wisconsin sr22 requirements to get sr22 insurance wi : Home states wisconsin wisconsin non owner sr22 insurance.

Source: quotesgram.com

Source: quotesgram.com

What is wisconsin sr22 insurance? Most insurance companies that file sr22 certificates will electronically file or mail the information to dmv. The policy is very similar to a standard auto insurance policy except the vehicle is assumed to be a car that is not owned by the driver. Sr22 insurance wisconsin is a high risk insurance certificate. The official document from an insurance agency testifies that you have an insurance plan.

Source: sr22insurancewi.com

Source: sr22insurancewi.com

The most common violation requiring an sr22 in wi is dui/dwi. Most insurance companies that file sr22 certificates will electronically file or mail the information to dmv. Non owner sr22 insurance in wisconsin is required if you need to file a financial responsibility proof with the state but don�t own a car. Most insurance companies mail your certificate directly to wisdot. Proof of insurance is filed by providing a sr22 certificate to dmv.

Source: quotesgram.com

Source: quotesgram.com

The cost differs depending on your violation and the insurance company. Non owner sr22 insurance in wisconsin is required if you need to file a financial responsibility proof with the state but don�t own a car. An sr22 insurance policy is a financial agreement between the driver and the insurance company. In order to reinstate your wisconsin license after a violation like dui, you will need to obtain sr22, or financial responsibility, endorsed on an auto insurance policy. $25,000 for death or injury to one person (it can be a passenger, a pedestrian, another driver on the road, or you) $15,000 in property damage.

Source: preferredlax.com

Source: preferredlax.com

The cost of sr22 insurance in wisconsin, on average, is $587 for a year. Our experts can get you the best sr22 insurance quotes with a single phone call. The most common violation requiring an sr22 in wi is dui/dwi. The official document from an insurance agency testifies that you have an insurance plan. $25,000 for death or injury to one person (it can be a passenger, a pedestrian, another driver on the road, or you) $15,000 in property damage.

Source: quotesgram.com

Source: quotesgram.com

Sr22 insurance wisconsin is a certificate of financial responsibility that is added as a rider to your auto insurance policy and filed with the wisconsin dmv. The expense of a non owner sr22 insurance strategy depends on a few components including age, sexual orientation, postal division, conjugal status, driving record and fico score. The state of wisconsin continues to participate in the sr22 program for drivers involved in certain activities. The official document from an insurance agency testifies that you have an insurance plan. Wisconsin typically requires drivers to carry sr22 insurance without lapse, expiration or cancellation for three to five years.

Source: youtube.com

Source: youtube.com

Non owner sr22 insurance requirement in wisconsin is determined by drivers who drive a car but don’t own it. Most insurance companies mail your certificate directly to wisdot. This includes coverage for any damage caused by the driver while driving. On our list of insurers, the cheapest option is usaa with an average annual rate of $429. T is the legal responsibility of drivers in wisconsin to carry at least the minimum liability insurance coverage mandated by the state.

Source: aboutsr22insurance.com

Home states wisconsin wisconsin non owner sr22 insurance. On the other hand, drivers with clean records have to pay $355 a year. $25,000 for injury to one person, $50,000 for injury to two or more people, and $10,000 for property damage. Proof of insurance is filed by providing a sr22 certificate to dmv. In order to reinstate your wisconsin license after a violation like dui, you will need to obtain sr22, or financial responsibility, endorsed on an auto insurance policy.

Source: onlineclassifieds.net

Source: onlineclassifieds.net

You can buy wisconsin sr22 insurance whether you own a vehicle or not. This certificate is tied to either your car insurance policy or to a non owner insurance policy. Non owner sr22 insurance in wisconsin is required if you need to file a financial responsibility proof with the state but don�t own a car. Home states wisconsin wisconsin non owner sr22 insurance. T is the legal responsibility of drivers in wisconsin to carry at least the minimum liability insurance coverage mandated by the state.

Source: quotesgram.com

Source: quotesgram.com

What is wisconsin sr22 insurance? The official document from an insurance agency testifies that you have an insurance plan. Here are the wisconsin sr22 requirements to get sr22 insurance wi : Home states wisconsin wisconsin non owner sr22 insurance. If a driver registers a vehicle (19).

Source: complianceins.com

Source: complianceins.com

This includes coverage for any damage caused by the driver while driving. Sr22 insurance wisconsin is a high risk insurance certificate. We will help you to get connected to the top wisconsin sr22 providers where you can talk to our experts, compare quotes, and save big. $25,000 for injury to one person, $50,000 for injury to two or more people, and $10,000 for property damage. In order to reinstate your wisconsin license after a violation like dui, you will need to obtain sr22, or financial responsibility, endorsed on an auto insurance policy.

Source: breatheeasyins.com

Source: breatheeasyins.com

The expense of a non owner sr22 insurance strategy depends on a few components including age, sexual orientation, postal division, conjugal status, driving record and fico score. The cost differs depending on your violation and the insurance company. Non owner sr22 insurance in wisconsin is required if you need to file a financial responsibility proof with the state but don�t own a car. Wisconsin owi/dui laws & penalties If a driver is pulled over by a police officer or involved in an auto accident and cannot provide proof of insurance, their driving privileges will be suspended.

Source: trottieragency.com

Source: trottieragency.com

Home states wisconsin wisconsin non owner sr22 insurance. Wisconsin typically requires drivers to carry sr22 insurance without lapse, expiration or cancellation for three to five years. The official document from an insurance agency testifies that you have an insurance plan. Sr22 insurance wisconsin is a high risk insurance certificate. Non owner sr22 insurance requirement in wisconsin is determined by drivers who drive a car but don’t own it.

Source: ultracarinsurance.com

Source: ultracarinsurance.com

If a driver registers a vehicle (19). It serves as a guarantee that you will keep the required minimum liability insurance coverage in effect during a period of time required by the state of wisconsin. In order to reinstate your wisconsin license after a violation like dui, you will need to obtain sr22, or financial responsibility, endorsed on an auto insurance policy. On our list of insurers, the cheapest option is usaa with an average annual rate of $429. The policy is very similar to a standard auto insurance policy except the vehicle is assumed to be a car that is not owned by the driver.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title sr22 insurance wisconsin by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information