Stop loss health insurance information

Home » Trending » Stop loss health insurance informationYour Stop loss health insurance images are available. Stop loss health insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Stop loss health insurance files here. Find and Download all free images.

If you’re looking for stop loss health insurance pictures information connected with to the stop loss health insurance interest, you have pay a visit to the right blog. Our website always gives you hints for downloading the maximum quality video and picture content, please kindly hunt and find more informative video content and graphics that fit your interests.

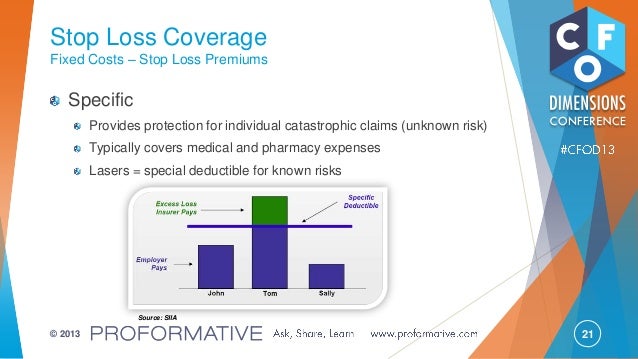

Stop Loss Health Insurance. Through the magic of managed care, we now have reduced this claim from $200,000 to a $140,000, for a 30% discount. In the case that an employee does incur a catastrophic claim. What is stop loss health insurance? What is stop loss insurance?

Medical Stop Loss for Stop Loss Insurance YouTube From youtube.com

Medical Stop Loss for Stop Loss Insurance YouTube From youtube.com

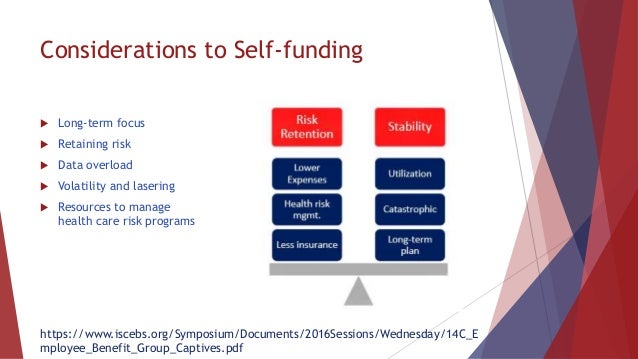

Stop loss insurance can make sure your company is safe in the event that employee healthcare expenses significantly exceed your initial estimates — and that means you won�t face. In the case that an employee does incur a catastrophic claim. Great american insurance group offers medical stop loss insurance through its relationship with radion health, a turnkey stop loss solutions provider to brokers, consultants and tpas. This is a specific clause that is contained within any policy that has a deductible as a core component. Once deductibles and copayments have been met, the stop loss provision is activated. How does stop loss insurance work?

What is stop loss health insurance?

In the case that an employee does incur a catastrophic claim. The organization which takes the insurance policy is called the insured and the employees and other people who are covered through the policy are called participants. Removing the risk with stop loss insurance. An association or employer) liable for the payment of. Any risk of claims exceeding the amount set aside in the healthcare fund can be capped by taking out aggregate stop loss insurance. The nature of health care claims can be inherently unpredictable, and an employer is able to.

Source: ecosfera.cat

Source: ecosfera.cat

The employer is only liable for claims up to the deductible amount. Through the magic of managed care, we now have reduced this claim from $200,000 to a $140,000, for a 30% discount. In the case that an employee does incur a catastrophic claim. It is able to do that by letting the insurance cover for the medical expenses of the employees after the employer spends a specific amount on them. An association or employer) liable for the payment of.

Source: guardiananytime.com

Source: guardiananytime.com

It is able to do that by letting the insurance cover for the medical expenses of the employees after the employer spends a specific amount on them. Once the stop loss provision is enacted, the insured will no longer pay out of pocket for any qualifying medical expenses. This is a specific clause that is contained within any policy that has a deductible as a core component. Once deductibles and copayments have been met, the stop loss provision is activated. Removing the risk with stop loss insurance.

Source: slideshare.net

Source: slideshare.net

Once the stop loss provision is enacted, the insured will no longer pay out of pocket for any qualifying medical expenses. An increasing number of businesses of all sizes are choosing to forego traditional group health. Once the stop loss provision is enacted, the insured will no longer pay out of pocket for any qualifying medical expenses. Once deductibles and copayments have been met, the stop loss provision is activated. How does stop loss insurance work?

Source: cohealthinitiative.org

Excess risk coverage and stop loss aggregate. The organization which takes the insurance policy is called the insured and the employees and other people who are covered through the policy are called participants. The employer is only liable for claims up to the deductible amount. Once the stop loss provision is enacted, the insured will no longer pay out of pocket for any qualifying medical expenses. The nature of health care claims can be inherently unpredictable, and an employer is able to.

Source: theopensolution.com

Source: theopensolution.com

The organization which takes the insurance policy is called the insured and the employees and other people who are covered through the policy are called participants. This is a specific clause that is contained within any policy that has a deductible as a core component. This would obviously result in a $100,000 specific claim. The employer is only liable for claims up to the deductible amount. Once deductibles and copayments have been met, the stop loss provision is activated.

Source: slideshare.net

Source: slideshare.net

What is stop loss health insurance? Excess risk coverage and stop loss aggregate. An increasing number of businesses of all sizes are choosing to forego traditional group health. Through the magic of managed care, we now have reduced this claim from $200,000 to a $140,000, for a 30% discount. How does stop loss insurance work?

Source: bfpartners.ca

Source: bfpartners.ca

Through the magic of managed care, we now have reduced this claim from $200,000 to a $140,000, for a 30% discount. Great american insurance group offers medical stop loss insurance through its relationship with radion health, a turnkey stop loss solutions provider to brokers, consultants and tpas. Excess risk coverage and stop loss aggregate. How does stop loss insurance work? This would obviously result in a $100,000 specific claim.

Source: medcost.com

Source: medcost.com

Any risk of claims exceeding the amount set aside in the healthcare fund can be capped by taking out aggregate stop loss insurance. The nature of health care claims can be inherently unpredictable, and an employer is able to. Once deductibles and copayments have been met, the stop loss provision is activated. Once the stop loss provision is enacted, the insured will no longer pay out of pocket for any qualifying medical expenses. This is a specific clause that is contained within any policy that has a deductible as a core component.

Source: youtube.com

Source: youtube.com

Once deductibles and copayments have been met, the stop loss provision is activated. How does stop loss insurance work? In the case that an employee does incur a catastrophic claim. What is stop loss health insurance? What is stop loss insurance?

Source: slideshare.net

Source: slideshare.net

What is stop loss health insurance? Great american insurance group offers medical stop loss insurance through its relationship with radion health, a turnkey stop loss solutions provider to brokers, consultants and tpas. Excess risk coverage and stop loss aggregate. How does stop loss insurance work? The organization which takes the insurance policy is called the insured and the employees and other people who are covered through the policy are called participants.

Source: euphorahealth.com

Source: euphorahealth.com

What is stop loss insurance? The nature of health care claims can be inherently unpredictable, and an employer is able to. This would obviously result in a $100,000 specific claim. It is able to do that by letting the insurance cover for the medical expenses of the employees after the employer spends a specific amount on them. An increasing number of businesses of all sizes are choosing to forego traditional group health.

Source: associationhealthplans.com

Source: associationhealthplans.com

How does stop loss insurance work? The nature of health care claims can be inherently unpredictable, and an employer is able to. In the case that an employee does incur a catastrophic claim. Removing the risk with stop loss insurance. Through the magic of managed care, we now have reduced this claim from $200,000 to a $140,000, for a 30% discount.

Source: coverager.com

Source: coverager.com

The employer is only liable for claims up to the deductible amount. It is able to do that by letting the insurance cover for the medical expenses of the employees after the employer spends a specific amount on them. In the case that an employee does incur a catastrophic claim. Removing the risk with stop loss insurance. What is stop loss health insurance?

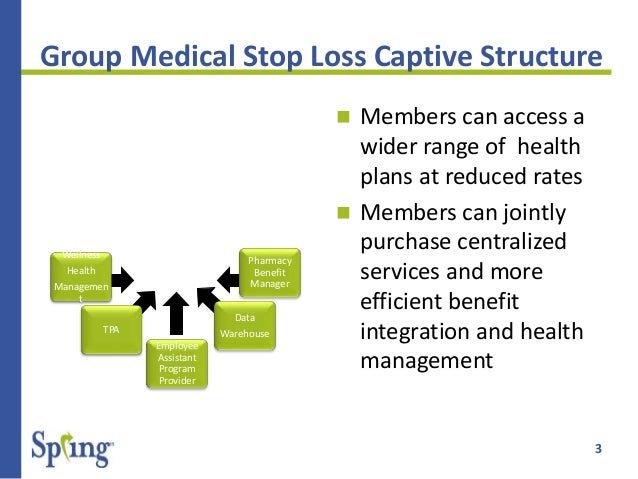

Source: springgroup.com

Source: springgroup.com

Once the stop loss provision is enacted, the insured will no longer pay out of pocket for any qualifying medical expenses. An increasing number of businesses of all sizes are choosing to forego traditional group health. Any risk of claims exceeding the amount set aside in the healthcare fund can be capped by taking out aggregate stop loss insurance. The organization which takes the insurance policy is called the insured and the employees and other people who are covered through the policy are called participants. An association or employer) liable for the payment of.

Source: fotohijrah.blogspot.com

Source: fotohijrah.blogspot.com

Through the magic of managed care, we now have reduced this claim from $200,000 to a $140,000, for a 30% discount. Any risk of claims exceeding the amount set aside in the healthcare fund can be capped by taking out aggregate stop loss insurance. The organization which takes the insurance policy is called the insured and the employees and other people who are covered through the policy are called participants. Stop loss insurance can make sure your company is safe in the event that employee healthcare expenses significantly exceed your initial estimates — and that means you won�t face. How does stop loss insurance work?

Source: varipro.com

Source: varipro.com

It is able to do that by letting the insurance cover for the medical expenses of the employees after the employer spends a specific amount on them. Removing the risk with stop loss insurance. The employer is only liable for claims up to the deductible amount. Once deductibles and copayments have been met, the stop loss provision is activated. How does stop loss insurance work?

Source: slideshare.net

Source: slideshare.net

This would obviously result in a $100,000 specific claim. This would obviously result in a $100,000 specific claim. It is able to do that by letting the insurance cover for the medical expenses of the employees after the employer spends a specific amount on them. An increasing number of businesses of all sizes are choosing to forego traditional group health. This is a specific clause that is contained within any policy that has a deductible as a core component.

Benecaid_flexstyle_Product_Overview.pdf_(page_2_of_2)-20120910-155532.jpg.jpg “Stop Loss Insurance The Definitions Financial Services”)

Source: infinitefinancial.ca

What is stop loss insurance? It is able to do that by letting the insurance cover for the medical expenses of the employees after the employer spends a specific amount on them. Removing the risk with stop loss insurance. Once the stop loss provision is enacted, the insured will no longer pay out of pocket for any qualifying medical expenses. Stop loss insurance can make sure your company is safe in the event that employee healthcare expenses significantly exceed your initial estimates — and that means you won�t face.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title stop loss health insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information