Stop loss insurance definition Idea

Home » Trending » Stop loss insurance definition IdeaYour Stop loss insurance definition images are available in this site. Stop loss insurance definition are a topic that is being searched for and liked by netizens today. You can Get the Stop loss insurance definition files here. Download all royalty-free photos and vectors.

If you’re looking for stop loss insurance definition images information related to the stop loss insurance definition keyword, you have come to the right blog. Our site frequently gives you hints for seeing the maximum quality video and picture content, please kindly search and find more enlightening video content and graphics that match your interests.

Stop Loss Insurance Definition. See also excess of loss reinsurance, which slr resembles. An insurance policy for insurers.in reinsurance, one insurer cedes a portion of its portfolio of policyholders to another insurer in exchange for paying a fee.there exists the possibility that too many policyholders will make a claim and a single insurer will be unable to pay the benefit without ruining itself. Stop loss insurance definition and meaning: It has nothing directly to do with a company’s employees.

Loss Control Property Insurance Definition PRORFETY From prorfety.blogspot.com

Loss Control Property Insurance Definition PRORFETY From prorfety.blogspot.com

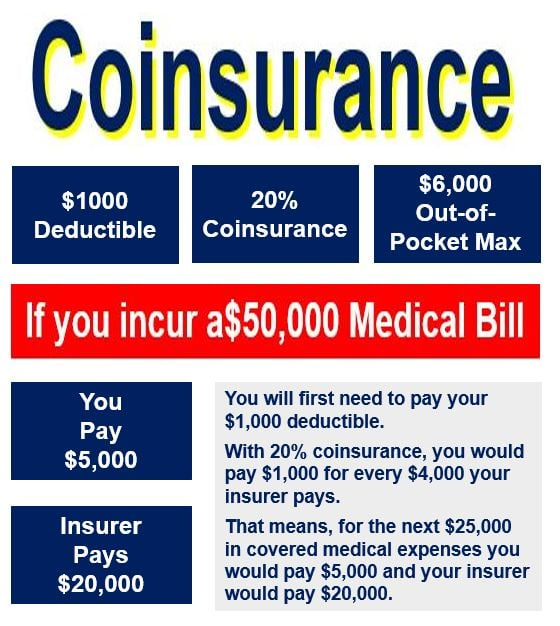

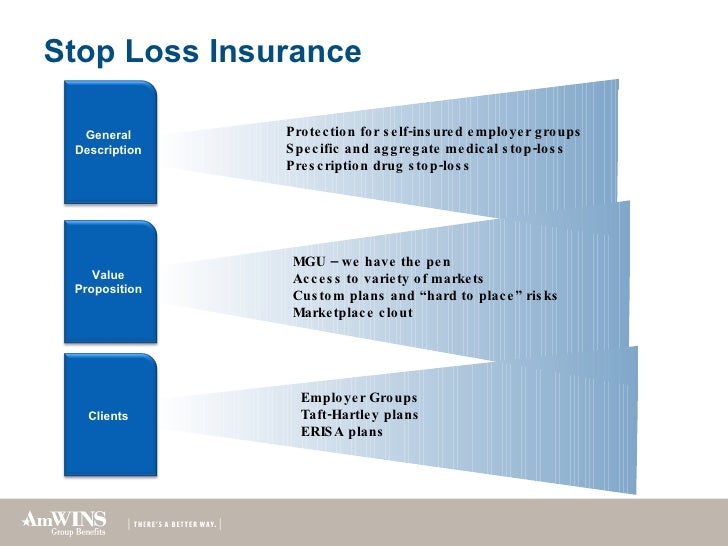

However, it bought stop loss insurance from fnusp for less than $7,000, said pauline carrig, sarcc finance director. Stop loss insurance is not medical insurance, it is a financial and risk management tool for businesses. Stop loss insurance synonyms, stop loss insurance pronunciation, stop loss insurance translation, english dictionary definition of stop. Stop loss insurance definition and meaning: A stop loss reinsurance provides reinsurance coverage when the total amount of claims incurred during a specific period (usually one year), exceeds either a loss ratio, either in excess which is a specified amount up to a limit. Many health insurance policies today contain a provision that requires the insured to pay a certain portion of their medical related expenses.

An insurance policy for insurers.in reinsurance, one insurer cedes a portion of its portfolio of policyholders to another insurer in exchange for paying a fee.there exists the possibility that too many policyholders will make a claim and a single insurer will be unable to pay the benefit without ruining itself.

The stop loss provision explained. Stop loss insurance definition and meaning: The stop loss provision explained. However, it bought stop loss insurance from fnusp for less than $7,000, said pauline carrig, sarcc finance director. Stop loss insurance synonyms, stop loss insurance pronunciation, stop loss insurance translation, english dictionary definition of stop. Many health insurance policies today contain a provision that requires the insured to pay a certain portion of their medical related expenses.

Source: youtube.com

Source: youtube.com

Stop loss insurance is not medical insurance, it is a financial and risk management tool for businesses. However, it bought stop loss insurance from fnusp for less than $7,000, said pauline carrig, sarcc finance director. It has nothing directly to do with a company’s employees. Opting for alternative plans can save cash there are many stop loss carriers to choose from, allowing us to obtain stop loss insurance and good rates with affordable deductibles. Stop loss insurance synonyms, stop loss insurance pronunciation, stop loss insurance translation, english dictionary definition of stop.

Source: harryandrewmiller.com

Source: harryandrewmiller.com

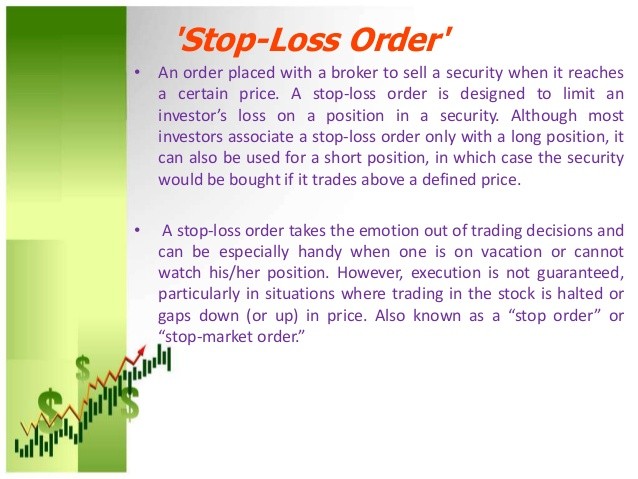

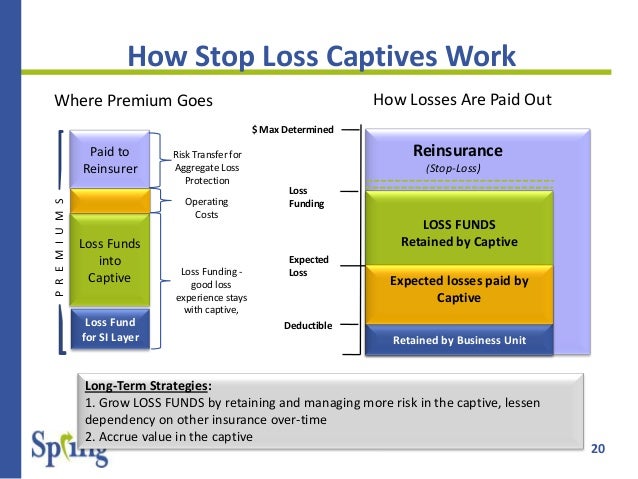

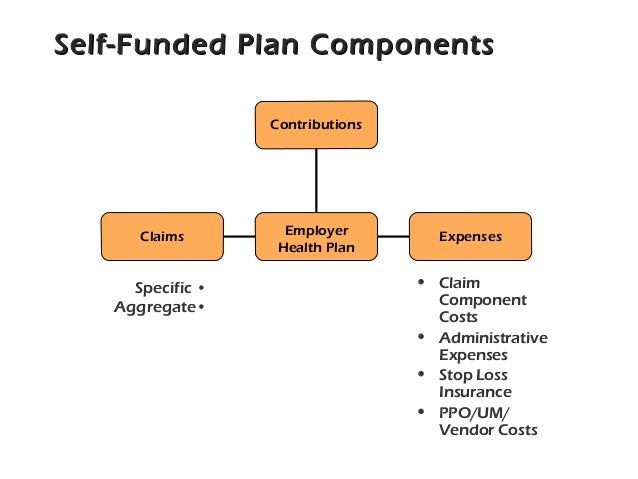

Springgroup.com this is an automatic order that an investor places with the broker/agent by paying a certain amount of brokerage. Links for irmi online subscribers only: Springgroup.com this is an automatic order that an investor places with the broker/agent by paying a certain amount of brokerage. Such businesses effectively act as their own insurance company, paying the covered medical expenses of their employees out of pocket. It has nothing directly to do with a company’s employees.

Source: slideshare.net

Source: slideshare.net

Stop loss insurance definition and meaning: A stop loss reinsurance provides reinsurance coverage when the total amount of claims incurred during a specific period (usually one year), exceeds either a loss ratio, either in excess which is a specified amount up to a limit. Stop loss insurance synonyms, stop loss insurance pronunciation, stop loss insurance translation, english dictionary definition of stop. It has nothing directly to do with a company’s employees. An insurance policy for insurers.in reinsurance, one insurer cedes a portion of its portfolio of policyholders to another insurer in exchange for paying a fee.there exists the possibility that too many policyholders will make a claim and a single insurer will be unable to pay the benefit without ruining itself.

Source: guardiananytime.com

Source: guardiananytime.com

Links for irmi online subscribers only: However, it bought stop loss insurance from fnusp for less than $7,000, said pauline carrig, sarcc finance director. Opting for alternative plans can save cash there are many stop loss carriers to choose from, allowing us to obtain stop loss insurance and good rates with affordable deductibles. A stop loss reinsurance provides reinsurance coverage when the total amount of claims incurred during a specific period (usually one year), exceeds either a loss ratio, either in excess which is a specified amount up to a limit. Stop loss insurance definition and meaning:

Source: clipground.com

Source: clipground.com

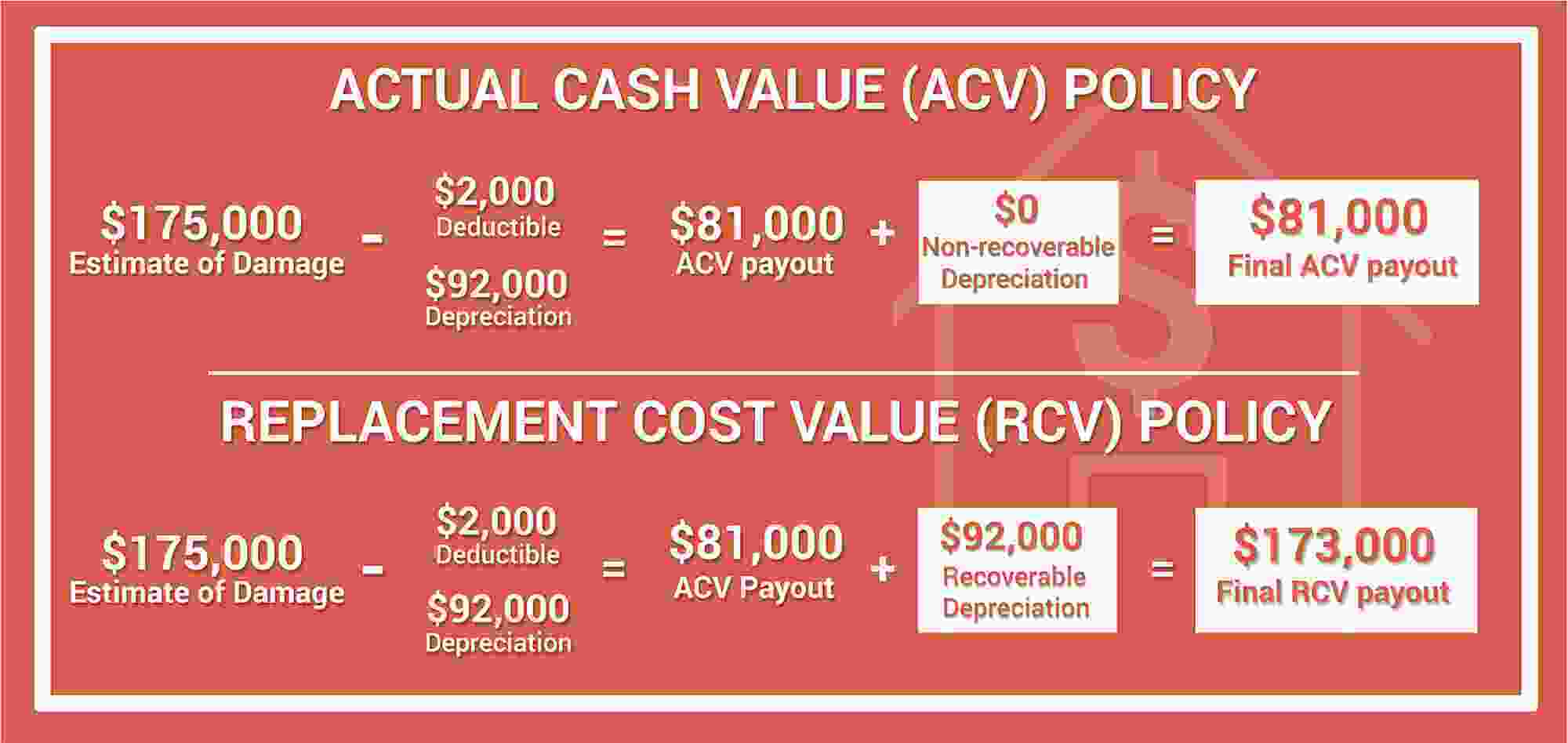

Many health insurance policies today contain a provision that requires the insured to pay a certain portion of their medical related expenses. Stop loss insurance definition and meaning: A stop loss reinsurance provides reinsurance coverage when the total amount of claims incurred during a specific period (usually one year), exceeds either a loss ratio, either in excess which is a specified amount up to a limit. Such businesses effectively act as their own insurance company, paying the covered medical expenses of their employees out of pocket. It has nothing directly to do with a company’s employees.

Source: euphorahealth.com

Source: euphorahealth.com

Many health insurance policies today contain a provision that requires the insured to pay a certain portion of their medical related expenses. See also excess of loss reinsurance, which slr resembles. Opting for alternative plans can save cash there are many stop loss carriers to choose from, allowing us to obtain stop loss insurance and good rates with affordable deductibles. An insurance policy for insurers.in reinsurance, one insurer cedes a portion of its portfolio of policyholders to another insurer in exchange for paying a fee.there exists the possibility that too many policyholders will make a claim and a single insurer will be unable to pay the benefit without ruining itself. Such businesses effectively act as their own insurance company, paying the covered medical expenses of their employees out of pocket.

Source: canonprintermx410.blogspot.com

Source: canonprintermx410.blogspot.com

A stop loss reinsurance provides reinsurance coverage when the total amount of claims incurred during a specific period (usually one year), exceeds either a loss ratio, either in excess which is a specified amount up to a limit. However, it bought stop loss insurance from fnusp for less than $7,000, said pauline carrig, sarcc finance director. Stop loss insurance definition and meaning: Opting for alternative plans can save cash there are many stop loss carriers to choose from, allowing us to obtain stop loss insurance and good rates with affordable deductibles. The stop loss reinsurance is designed to protect the primary insurer, the ceding party, from bad results.

Source: slideshare.net

Source: slideshare.net

Stop loss — a form of reinsurance also known as aggregate excess of loss reinsurance under which a reinsurer is liable for all losses, regardless of size, that occur after a specified loss ratio or total dollar amount of losses has been reached. It has nothing directly to do with a company’s employees. An insurance policy for insurers.in reinsurance, one insurer cedes a portion of its portfolio of policyholders to another insurer in exchange for paying a fee.there exists the possibility that too many policyholders will make a claim and a single insurer will be unable to pay the benefit without ruining itself. See also excess of loss reinsurance, which slr resembles. This is especially true for disaster insurance and other similar policies.

Source: slideshare.net

Source: slideshare.net

This is especially true for disaster insurance and other similar policies. The stop loss provision explained. Stop loss — a form of reinsurance also known as aggregate excess of loss reinsurance under which a reinsurer is liable for all losses, regardless of size, that occur after a specified loss ratio or total dollar amount of losses has been reached. Such businesses effectively act as their own insurance company, paying the covered medical expenses of their employees out of pocket. It has nothing directly to do with a company’s employees.

Source: slideshare.net

Source: slideshare.net

Re·in·sured , re·in·sur·ing , re·in·sures to insure again, especially by transferring all. A stop loss reinsurance provides reinsurance coverage when the total amount of claims incurred during a specific period (usually one year), exceeds either a loss ratio, either in excess which is a specified amount up to a limit. This is especially true for disaster insurance and other similar policies. Links for irmi online subscribers only: Re·in·sured , re·in·sur·ing , re·in·sures to insure again, especially by transferring all.

Source: associationhealthplans.com

Source: associationhealthplans.com

An insurance policy for insurers.in reinsurance, one insurer cedes a portion of its portfolio of policyholders to another insurer in exchange for paying a fee.there exists the possibility that too many policyholders will make a claim and a single insurer will be unable to pay the benefit without ruining itself. See also excess of loss reinsurance, which slr resembles. An insurance policy for insurers.in reinsurance, one insurer cedes a portion of its portfolio of policyholders to another insurer in exchange for paying a fee.there exists the possibility that too many policyholders will make a claim and a single insurer will be unable to pay the benefit without ruining itself. The stop loss provision explained. It has nothing directly to do with a company’s employees.

Source: canonprintermx410.blogspot.com

Stop loss insurance synonyms, stop loss insurance pronunciation, stop loss insurance translation, english dictionary definition of stop. An insurance policy for insurers.in reinsurance, one insurer cedes a portion of its portfolio of policyholders to another insurer in exchange for paying a fee.there exists the possibility that too many policyholders will make a claim and a single insurer will be unable to pay the benefit without ruining itself. Re·in·sured , re·in·sur·ing , re·in·sures to insure again, especially by transferring all. The stop loss provision explained. Stop loss insurance definition and meaning:

Source: slideshare.net

Source: slideshare.net

However, it bought stop loss insurance from fnusp for less than $7,000, said pauline carrig, sarcc finance director. An insurance policy for insurers.in reinsurance, one insurer cedes a portion of its portfolio of policyholders to another insurer in exchange for paying a fee.there exists the possibility that too many policyholders will make a claim and a single insurer will be unable to pay the benefit without ruining itself. The stop loss provision explained. Re·in·sured , re·in·sur·ing , re·in·sures to insure again, especially by transferring all. The contract made between an insurance company and a third party to protect the insurance company from losses.

Source: sites.google.com

Source: sites.google.com

Stop loss insurance definition and meaning: Stop loss insurance definition and meaning: Such businesses effectively act as their own insurance company, paying the covered medical expenses of their employees out of pocket. This is especially true for disaster insurance and other similar policies. However, it bought stop loss insurance from fnusp for less than $7,000, said pauline carrig, sarcc finance director.

Benecaid_flexstyle_Product_Overview.pdf_(page_2_of_2)-20120910-155532.jpg.jpg “Stop Loss Insurance The Definitions Financial Services”)

Source: infinitefinancial.ca

Such businesses effectively act as their own insurance company, paying the covered medical expenses of their employees out of pocket. However, it bought stop loss insurance from fnusp for less than $7,000, said pauline carrig, sarcc finance director. Such businesses effectively act as their own insurance company, paying the covered medical expenses of their employees out of pocket. Springgroup.com this is an automatic order that an investor places with the broker/agent by paying a certain amount of brokerage. Opting for alternative plans can save cash there are many stop loss carriers to choose from, allowing us to obtain stop loss insurance and good rates with affordable deductibles.

Source: guardiananytime.com

Source: guardiananytime.com

The contract made between an insurance company and a third party to protect the insurance company from losses. A stop loss reinsurance provides reinsurance coverage when the total amount of claims incurred during a specific period (usually one year), exceeds either a loss ratio, either in excess which is a specified amount up to a limit. However, it bought stop loss insurance from fnusp for less than $7,000, said pauline carrig, sarcc finance director. The contract provides for the third party to pay for the loss sustained by the insurance company when the company makes a payment on. An insurance policy for insurers.in reinsurance, one insurer cedes a portion of its portfolio of policyholders to another insurer in exchange for paying a fee.there exists the possibility that too many policyholders will make a claim and a single insurer will be unable to pay the benefit without ruining itself.

Source: springgroup.com

Source: springgroup.com

Such businesses effectively act as their own insurance company, paying the covered medical expenses of their employees out of pocket. However, it bought stop loss insurance from fnusp for less than $7,000, said pauline carrig, sarcc finance director. A stop loss reinsurance provides reinsurance coverage when the total amount of claims incurred during a specific period (usually one year), exceeds either a loss ratio, either in excess which is a specified amount up to a limit. Such businesses effectively act as their own insurance company, paying the covered medical expenses of their employees out of pocket. Stop loss insurance definition and meaning:

Source: prorfety.blogspot.com

Source: prorfety.blogspot.com

Stop loss insurance synonyms, stop loss insurance pronunciation, stop loss insurance translation, english dictionary definition of stop. Stop loss insurance definition and meaning: Opting for alternative plans can save cash there are many stop loss carriers to choose from, allowing us to obtain stop loss insurance and good rates with affordable deductibles. The stop loss reinsurance is designed to protect the primary insurer, the ceding party, from bad results. Re·in·sured , re·in·sur·ing , re·in·sures to insure again, especially by transferring all.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title stop loss insurance definition by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information