Stop loss insurance market information

Home » Trend » Stop loss insurance market informationYour Stop loss insurance market images are available in this site. Stop loss insurance market are a topic that is being searched for and liked by netizens now. You can Download the Stop loss insurance market files here. Get all royalty-free photos.

If you’re searching for stop loss insurance market pictures information linked to the stop loss insurance market topic, you have pay a visit to the right site. Our site always provides you with hints for refferencing the maximum quality video and picture content, please kindly hunt and find more enlightening video content and graphics that fit your interests.

Stop Loss Insurance Market. The stop loss market continues to harden with high loss ratios and an 86% increase in catastrophic claims over the past four years. As a result, the medical stop loss market grew from $12 billion at the end of 2014 to $24 billion at the close of 2019. Onesource stoploss insurance marketing (c) 2014. The transition expanded our access to the stop loss market which now includes more than 20 different insurance companies offering a wide range of risk solutions.

StopLoss Orders How Not To Have Your A Handed To You From pinterest.com

StopLoss Orders How Not To Have Your A Handed To You From pinterest.com

Only the amount the employer is responsible for ($25,000) counts toward the aggregate retention$1 million level. It is used to purchase stocks as insurance against loss or protect gains from a short sell. Onesource stoploss insurance marketing (c) 2014. With asd, there are two layers of deductible. The product has some unique reserving challenges for the health/reinsurance actuary because: As a result, the medical stop loss market grew from $12 billion at the end of 2014 to $24 billion at the close of 2019.

The transition expanded our access to the stop loss market which now includes more than 20 different insurance companies offering a wide range of risk solutions.

The transition expanded our access to the stop loss market which now includes more than 20 different insurance companies offering a wide range of risk solutions. All expenses for that one employee for the remainder of the year will be reimbursed by the stop loss insurer. Within the state of new york, only reliastar life insurance company of new york is admitted, and its products issued. However, the stop loss insurance policy protects against claims expenses that exceed a predetermined amount. Stockton blvd, suite 104, elk grove, ca 95758. First, there is an increase in inquiries pertaining to aggregating specific deductibles (asd).

Source: armstrongeconomics.com

Source: armstrongeconomics.com

What effect does the availability of stop loss insurance with various attachment points and other particular provisions have on small employers’ decisions to offer insurance to As a result, the medical stop loss market grew from $12 billion at the end of 2014 to $24 billion at the close of 2019. Stop loss insurer is responsible for the amount above the specific retention level ($1.475 million). All expenses for that one employee for the remainder of the year will be reimbursed by the stop loss insurer. The transition expanded our access to the stop loss market which now includes more than 20 different insurance companies offering a wide range of risk solutions.

Source: marshmma.com

Source: marshmma.com

The product has some unique reserving challenges for the health/reinsurance actuary because: Onesource stoploss insurance marketing (c) 2014. Excess risk (stop loss) insurance products are issued and underwritten by reliastar life insurance company (minneapolis, mn) and reliastar life insurance company of new york (woodbury, ny). Stockton blvd, suite 104, elk grove, ca 95758. Only the amount the employer is responsible for ($25,000) counts toward the aggregate retention$1 million level.

Source: slideshare.net

Source: slideshare.net

As a result, the medical stop loss market grew from $12 billion at the end of 2014 to $24 billion at the close of 2019. As a result, the medical stop loss market grew from $12 billion at the end of 2014 to $24 billion at the close of 2019. The product has some unique reserving challenges for the health/reinsurance actuary because: Within the state of new york, only reliastar life insurance company of new york is admitted, and its products issued. Much of the new growth in this alternative insurance market comes from smaller businesses, or those that employ fewer than 500 people.

Source: pipsedge.com

Source: pipsedge.com

First, there is an increase in inquiries pertaining to aggregating specific deductibles (asd). Medical stop loss captives are growing in popularity among all industry sectors. What effect does the availability of stop loss insurance with various attachment points and other particular provisions have on small employers’ decisions to offer insurance to Significant change in the medical stop loss market. Excess risk (stop loss) insurance products are issued and underwritten by reliastar life insurance company (minneapolis, mn) and reliastar life insurance company of new york (woodbury, ny).

Source: pinterest.com

Source: pinterest.com

The product has some unique reserving challenges for the health/reinsurance actuary because: However, the stop loss insurance policy protects against claims expenses that exceed a predetermined amount. The underlying policy data was What are some recent developments in this stop loss insurance market? First, there is an increase in inquiries pertaining to aggregating specific deductibles (asd).

Source: youtube.com

Source: youtube.com

Significant change in the medical stop loss market. Much of the new growth in this alternative insurance market comes from smaller businesses, or those that employ fewer than 500 people. The report is an update of a similar study performed last year. We pride ourselves on our unique approach and our clients tell us we are truly one of a kind. as consulting underwriters. It is used to purchase stocks as insurance against loss or protect gains from a short sell.

Source: cohealthinitiative.org

It is used to purchase stocks as insurance against loss or protect gains from a short sell. The underlying policy data was It is used to purchase stocks as insurance against loss or protect gains from a short sell. We pride ourselves on our unique approach and our clients tell us we are truly one of a kind. as consulting underwriters. First, there is an increase in inquiries pertaining to aggregating specific deductibles (asd).

Source: gninsurance.com

Source: gninsurance.com

Stockton blvd, suite 104, elk grove, ca 95758. Only the amount the employer is responsible for ($25,000) counts toward the aggregate retention$1 million level. All expenses for that one employee for the remainder of the year will be reimbursed by the stop loss insurer. What are some recent developments in this stop loss insurance market? This predetermined amount marks the point at which the medical claims would be considered excessive and potentially catastrophic.

Source: fiercehealthcare.com

However, the stop loss insurance policy protects against claims expenses that exceed a predetermined amount. What effect does the availability of stop loss insurance with various attachment points and other particular provisions have on small employers’ decisions to offer insurance to Only the amount the employer is responsible for ($25,000) counts toward the aggregate retention$1 million level. Stockton blvd, suite 104, elk grove, ca 95758. Onesource stoploss insurance marketing (c) 2014.

Source: everlongcaptive.com

Source: everlongcaptive.com

It has a stop price that is above the current market price. With a focus on markets ranging from 100 to 3,000 lives and a deductible range of $75,000 to $500,000, hm insurance group admits it likes to target “blue” and commercial tpa groups. The report is an update of a similar study performed last year. This is an automatic order that an investor places with the broker/agent by paying a certain amount of brokerage. Within the state of new york, only reliastar life insurance company of new york is admitted, and its products issued.

Source: corpsyn.com

Source: corpsyn.com

Under this, the stop parameter is based on a trailing change in. Excess risk (stop loss) insurance products are issued and underwritten by reliastar life insurance company (minneapolis, mn) and reliastar life insurance company of new york (woodbury, ny). This is an automatic order that an investor places with the broker/agent by paying a certain amount of brokerage. Within the state of new york, only reliastar life insurance company of new york is admitted, and its products issued. What effect does the availability of stop loss insurance with various attachment points and other particular provisions have on small employers’ decisions to offer insurance to

Source: myfindoc.com

Source: myfindoc.com

All expenses for that one employee for the remainder of the year will be reimbursed by the stop loss insurer. Under this, the stop parameter is based on a trailing change in. Within the state of new york, only reliastar life insurance company of new york is admitted, and its products issued. Excess risk (stop loss) insurance products are issued and underwritten by reliastar life insurance company (minneapolis, mn) and reliastar life insurance company of new york (woodbury, ny). As a result, the medical stop loss market grew from $12 billion at the end of 2014 to $24 billion at the close of 2019.

Source: insuranceblog.us

Source: insuranceblog.us

Stockton blvd, suite 104, elk grove, ca 95758. The product has some unique reserving challenges for the health/reinsurance actuary because: Much of the new growth in this alternative insurance market comes from smaller businesses, or those that employ fewer than 500 people. Within the state of new york, only reliastar life insurance company of new york is admitted, and its products issued. The underlying policy data was

Source: hmig.com

Source: hmig.com

The underlying policy data was With asd, there are two layers of deductible. What effect does the availability of stop loss insurance with various attachment points and other particular provisions have on small employers’ decisions to offer insurance to Under this, the stop parameter is based on a trailing change in. Medical stop loss captives are growing in popularity among all industry sectors.

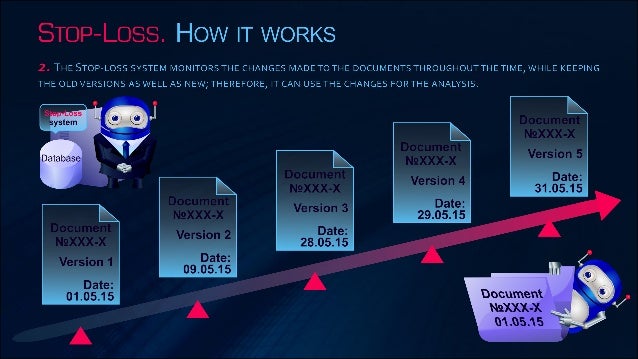

Source: slideshare.net

Source: slideshare.net

The stop loss market continues to harden with high loss ratios and an 86% increase in catastrophic claims over the past four years. With a focus on markets ranging from 100 to 3,000 lives and a deductible range of $75,000 to $500,000, hm insurance group admits it likes to target “blue” and commercial tpa groups. Within the state of new york, only reliastar life insurance company of new york is admitted, and its products issued. All expenses for that one employee for the remainder of the year will be reimbursed by the stop loss insurer. Excess risk (stop loss) insurance products are issued and underwritten by reliastar life insurance company (minneapolis, mn) and reliastar life insurance company of new york (woodbury, ny).

Source: traders-paradise.com

Source: traders-paradise.com

Excess risk (stop loss) insurance products are issued and underwritten by reliastar life insurance company (minneapolis, mn) and reliastar life insurance company of new york (woodbury, ny). It is used to purchase stocks as insurance against loss or protect gains from a short sell. Onesource stoploss insurance marketing (c) 2014. Medical stop loss captives are growing in popularity among all industry sectors. Stockton blvd, suite 104, elk grove, ca 95758.

Source: associationhealthplans.com

Source: associationhealthplans.com

However, the stop loss insurance policy protects against claims expenses that exceed a predetermined amount. Only the amount the employer is responsible for ($25,000) counts toward the aggregate retention$1 million level. All expenses for that one employee for the remainder of the year will be reimbursed by the stop loss insurer. Stop loss insurer is responsible for the amount above the specific retention level ($1.475 million). The report is an update of a similar study performed last year.

Source: everlongcaptive.com

Source: everlongcaptive.com

What effect does the availability of stop loss insurance with various attachment points and other particular provisions have on small employers’ decisions to offer insurance to It has a stop price that is above the current market price. With a focus on markets ranging from 100 to 3,000 lives and a deductible range of $75,000 to $500,000, hm insurance group admits it likes to target “blue” and commercial tpa groups. Maryland attempted to regulate stop loss insurance in the small group market but it failed in court. The underlying policy data was

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title stop loss insurance market by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information