Stop loss insurance meaning information

Home » Trending » Stop loss insurance meaning informationYour Stop loss insurance meaning images are available in this site. Stop loss insurance meaning are a topic that is being searched for and liked by netizens today. You can Find and Download the Stop loss insurance meaning files here. Find and Download all royalty-free photos and vectors.

If you’re searching for stop loss insurance meaning images information connected with to the stop loss insurance meaning topic, you have visit the ideal blog. Our website always provides you with suggestions for refferencing the highest quality video and image content, please kindly surf and find more informative video articles and images that match your interests.

Stop Loss Insurance Meaning. Of the most current exhibit. Roles and operational aspects insurance arose as a means of protecting against the financial consequences of events that could jeopardize a family or company’s survival, such as house fires, death of a primary breadwinner or an industrial accident. Even with the affordable care act in place, healthcare expenses have risen dramatically in recent years. A stop loss is not a profit guarantee.

Stop Loss Insurance Definition Guardian Anytime From guardiananytime.com

Stop Loss Insurance Definition Guardian Anytime From guardiananytime.com

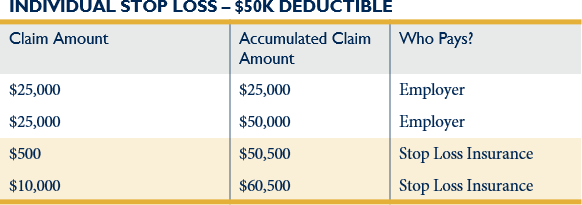

Roles and operational aspects insurance arose as a means of protecting against the financial consequences of events that could jeopardize a family or company’s survival, such as house fires, death of a primary breadwinner or an industrial accident. For example, if you have stop loss coverage that kicks in at $10,000, you would have to pay any out of pocket costs up that amount, and the stop loss coverage would pay for any additional costs related to the same treatment. Of the most current exhibit. A stop loss is not a profit guarantee. Stop loss provisions are a protection mechanism that have proven quite helpful to the insured individual. Unlike conventional employee benefit insurance, stop loss insurance insures only the employer.

It is used to limit loss or gain in a trade.

Of the most current exhibit. In group health insurance, stop loss is a way to limit how much the insured has to pay out of pocket. Stop loss means that the insurance company first has to register a loss when adding up its own costs before the reinsurers intervene: Of the most current exhibit. Roles and operational aspects insurance arose as a means of protecting against the financial consequences of events that could jeopardize a family or company’s survival, such as house fires, death of a primary breadwinner or an industrial accident. It is used to limit loss or gain in a trade.

Source: guardiananytime.com

Source: guardiananytime.com

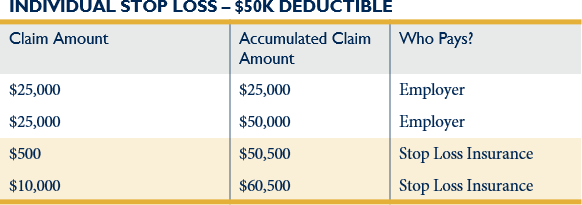

Such businesses effectively act as their own insurance company, paying the covered medical expenses of their employees out of pocket. See also excess of loss reinsurance, which slr resembles. Stop loss insurance, also known as excess insurance, is a product that provides companies protection against unpredictable or catastrophic losses. In group health insurance, stop loss is a way to limit how much the insured has to pay out of pocket. Stop loss means that the insurance company first has to register a loss when adding up its own costs before the reinsurers intervene:

Source: springgroup.com

Source: springgroup.com

Even with the affordable care act in place, healthcare expenses have risen dramatically in recent years. A stop loss is not a profit guarantee. In group health insurance, stop loss is a way to limit how much the insured has to pay out of pocket. It is used to limit loss or gain in a trade. Such businesses effectively act as their own insurance company, paying the covered medical expenses of their employees out of pocket.

Source: guardiananytime.com

Source: guardiananytime.com

An increasing number of businesses are not preferring traditional group health insurance plans due to it�s rising costs and increase in employee contributions and/or deductibles which. It is used to limit loss or gain in a trade. Even with the affordable care act in place, healthcare expenses have risen dramatically in recent years. Unlike conventional employee benefit insurance, stop loss insurance insures only the employer. The employer remains responsible for claim expenses under the deductible amount.

Source: starttrading.com

Source: starttrading.com

Such businesses effectively act as their own insurance company, paying the covered medical expenses of their employees out of pocket. Stop loss provisions are a protection mechanism that have proven quite helpful to the insured individual. See also excess of loss reinsurance, which slr resembles. It is used to limit loss or gain in a trade. Unlike conventional employee benefit insurance, stop loss insurance insures only the employer.

Source: slideshare.net

Source: slideshare.net

It is used to limit loss or gain in a trade. Means the monthly or annual premium, calculated by multiplying the number of coverage units for a particular month by the premium rate indicated in items a.4. Roles and operational aspects insurance arose as a means of protecting against the financial consequences of events that could jeopardize a family or company’s survival, such as house fires, death of a primary breadwinner or an industrial accident. Of the most current exhibit. An increasing number of businesses are not preferring traditional group health insurance plans due to it�s rising costs and increase in employee contributions and/or deductibles which.

Source: harryandrewmiller.com

Source: harryandrewmiller.com

See also excess of loss reinsurance, which slr resembles. Of the most current exhibit. Unlike conventional employee benefit insurance, stop loss insurance insures only the employer. In group health insurance, stop loss is a way to limit how much the insured has to pay out of pocket. In essence, this is a way for an insurance company to protect itself against too many.

Source: slideshare.net

Source: slideshare.net

Stop loss means that the insurance company first has to register a loss when adding up its own costs before the reinsurers intervene: For example, if you have stop loss coverage that kicks in at $10,000, you would have to pay any out of pocket costs up that amount, and the stop loss coverage would pay for any additional costs related to the same treatment. An increasing number of businesses are not preferring traditional group health insurance plans due to it�s rising costs and increase in employee contributions and/or deductibles which. Roles and operational aspects insurance arose as a means of protecting against the financial consequences of events that could jeopardize a family or company’s survival, such as house fires, death of a primary breadwinner or an industrial accident. As employee medical bills can quickly add up, being able to predictably cap expenses is critical.

Source: slideshare.net

Source: slideshare.net

Stop loss insurance, also known as excess insurance, is a product that provides companies protection against unpredictable or catastrophic losses. As employee medical bills can quickly add up, being able to predictably cap expenses is critical. Unlike conventional employee benefit insurance, stop loss insurance insures only the employer. Of the most current exhibit. Means the monthly or annual premium, calculated by multiplying the number of coverage units for a particular month by the premium rate indicated in items a.4.

Source: clipground.com

Source: clipground.com

An increasing number of businesses are not preferring traditional group health insurance plans due to it�s rising costs and increase in employee contributions and/or deductibles which. Means the monthly or annual premium, calculated by multiplying the number of coverage units for a particular month by the premium rate indicated in items a.4. For example, if you have stop loss coverage that kicks in at $10,000, you would have to pay any out of pocket costs up that amount, and the stop loss coverage would pay for any additional costs related to the same treatment. Stop loss means that the insurance company first has to register a loss when adding up its own costs before the reinsurers intervene: See also excess of loss reinsurance, which slr resembles.

Source: euphorahealth.com

Source: euphorahealth.com

Unlike conventional employee benefit insurance, stop loss insurance insures only the employer. A stop loss is not a profit guarantee. Even with the affordable care act in place, healthcare expenses have risen dramatically in recent years. In group health insurance, stop loss is a way to limit how much the insured has to pay out of pocket. Such businesses effectively act as their own insurance company, paying the covered medical expenses of their employees out of pocket.

Source: youtube.com

Source: youtube.com

Of the most current exhibit. Stop loss means that the insurance company first has to register a loss when adding up its own costs before the reinsurers intervene: It is used to limit loss or gain in a trade. This is an automatic order that an investor places with the broker/agent by paying a certain amount of brokerage. As employee medical bills can quickly add up, being able to predictably cap expenses is critical.

Source: sites.google.com

Source: sites.google.com

In group health insurance, stop loss is a way to limit how much the insured has to pay out of pocket. Of the most current exhibit. Stop loss insurance, also known as excess insurance, is a product that provides companies protection against unpredictable or catastrophic losses. It is used to limit loss or gain in a trade. Even with the affordable care act in place, healthcare expenses have risen dramatically in recent years.

Source: guardiananytime.com

Source: guardiananytime.com

This is an automatic order that an investor places with the broker/agent by paying a certain amount of brokerage. An increasing number of businesses are not preferring traditional group health insurance plans due to it�s rising costs and increase in employee contributions and/or deductibles which. It is used to limit loss or gain in a trade. Even with the affordable care act in place, healthcare expenses have risen dramatically in recent years. For example, if you have stop loss coverage that kicks in at $10,000, you would have to pay any out of pocket costs up that amount, and the stop loss coverage would pay for any additional costs related to the same treatment.

Source: associationhealthplans.com

Source: associationhealthplans.com

As employee medical bills can quickly add up, being able to predictably cap expenses is critical. Stop loss provisions are a protection mechanism that have proven quite helpful to the insured individual. Even with the affordable care act in place, healthcare expenses have risen dramatically in recent years. Stop loss means that the insurance company first has to register a loss when adding up its own costs before the reinsurers intervene: A stop loss is not a profit guarantee.

Source: youtube.com

Source: youtube.com

It is used to limit loss or gain in a trade. Even with the affordable care act in place, healthcare expenses have risen dramatically in recent years. A stop loss is not a profit guarantee. In essence, this is a way for an insurance company to protect itself against too many. As employee medical bills can quickly add up, being able to predictably cap expenses is critical.

Source: slideshare.net

Source: slideshare.net

The employer remains responsible for claim expenses under the deductible amount. Stop loss insurance, also known as excess insurance, is a product that provides companies protection against unpredictable or catastrophic losses. Stop loss means that the insurance company first has to register a loss when adding up its own costs before the reinsurers intervene: The employer remains responsible for claim expenses under the deductible amount. Unlike conventional employee benefit insurance, stop loss insurance insures only the employer.

Source: canonprintermx410.blogspot.com

An increasing number of businesses are not preferring traditional group health insurance plans due to it�s rising costs and increase in employee contributions and/or deductibles which. Of the most current exhibit. Unlike conventional employee benefit insurance, stop loss insurance insures only the employer. An increasing number of businesses are not preferring traditional group health insurance plans due to it�s rising costs and increase in employee contributions and/or deductibles which. Stop loss means that the insurance company first has to register a loss when adding up its own costs before the reinsurers intervene:

Source: guardiananytime.com

Source: guardiananytime.com

The employer remains responsible for claim expenses under the deductible amount. Unlike conventional employee benefit insurance, stop loss insurance insures only the employer. In essence, this is a way for an insurance company to protect itself against too many. Roles and operational aspects insurance arose as a means of protecting against the financial consequences of events that could jeopardize a family or company’s survival, such as house fires, death of a primary breadwinner or an industrial accident. Means the monthly or annual premium, calculated by multiplying the number of coverage units for a particular month by the premium rate indicated in items a.4.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title stop loss insurance meaning by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information