Stop loss limit insurance information

Home » Trending » Stop loss limit insurance informationYour Stop loss limit insurance images are available in this site. Stop loss limit insurance are a topic that is being searched for and liked by netizens today. You can Get the Stop loss limit insurance files here. Get all royalty-free photos and vectors.

If you’re looking for stop loss limit insurance pictures information linked to the stop loss limit insurance keyword, you have pay a visit to the right blog. Our website frequently gives you hints for seeking the highest quality video and picture content, please kindly hunt and find more informative video articles and images that match your interests.

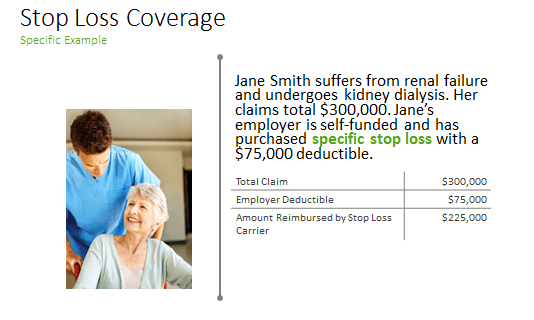

Stop Loss Limit Insurance. With stop loss insurance, if the total claim amount exceeds the limit set in your stop loss policy, the employer is reimbursed by the insurance carrier. Loss limit — a property insurance limit that is less than the total property values at risk but high enough to cover the total property values actually exposed to damage in a single loss occurrence. The affordable care act (aca) lifted all lifetime limits on specific stop loss coverage, so the reinsurers (those that provide stop loss insurance protection) are potentially responsible for unlimited risk. This approach is usually used when the insurer is unable to provide a limit equal to the total property values at risk or when reinsurance.

Ullico Medical Stop Loss Insurance From ullico.com

Ullico Medical Stop Loss Insurance From ullico.com

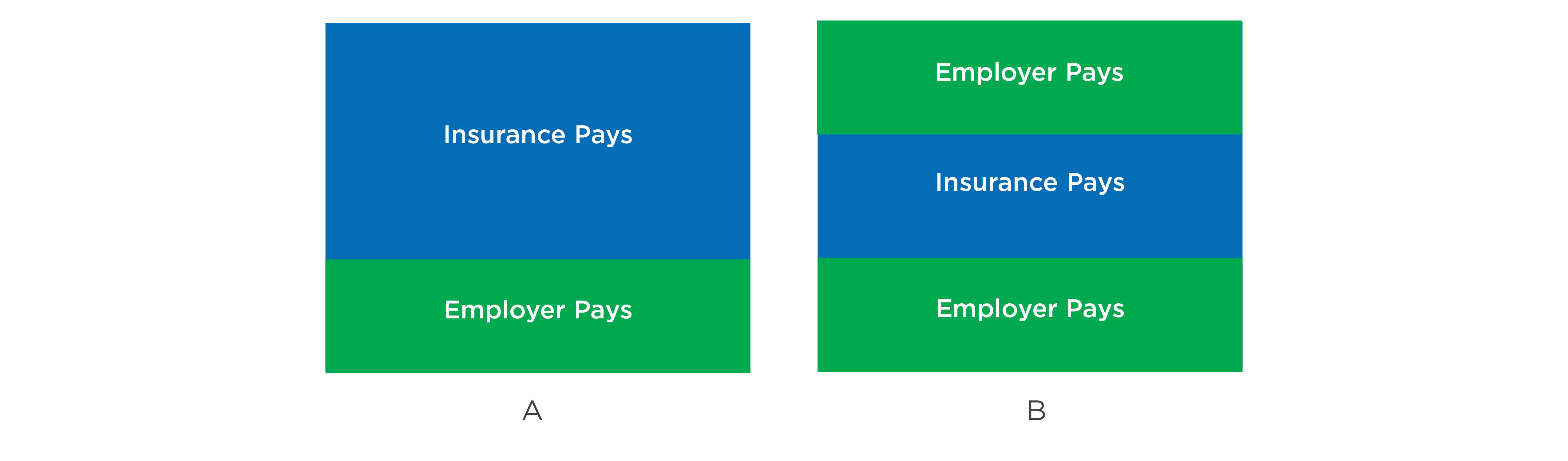

There are actually two types of stop loss insurance that help limit employer liability: Stop loss basics hm stop loss understanding stop loss what is stop loss insurance? The peak is in the second year, 1991, and goes from 1990 to 1991. At lloyd�s of london, personal stop loss (psl) is a type of insurance policy which limits the losses of names all of whom did (and some of whom still do) underwrite with unlimited liability. What is stop loss limit in health insurance. This approach is usually used when the insurer is unable to provide a limit equal to the total property values at risk or when reinsurance.

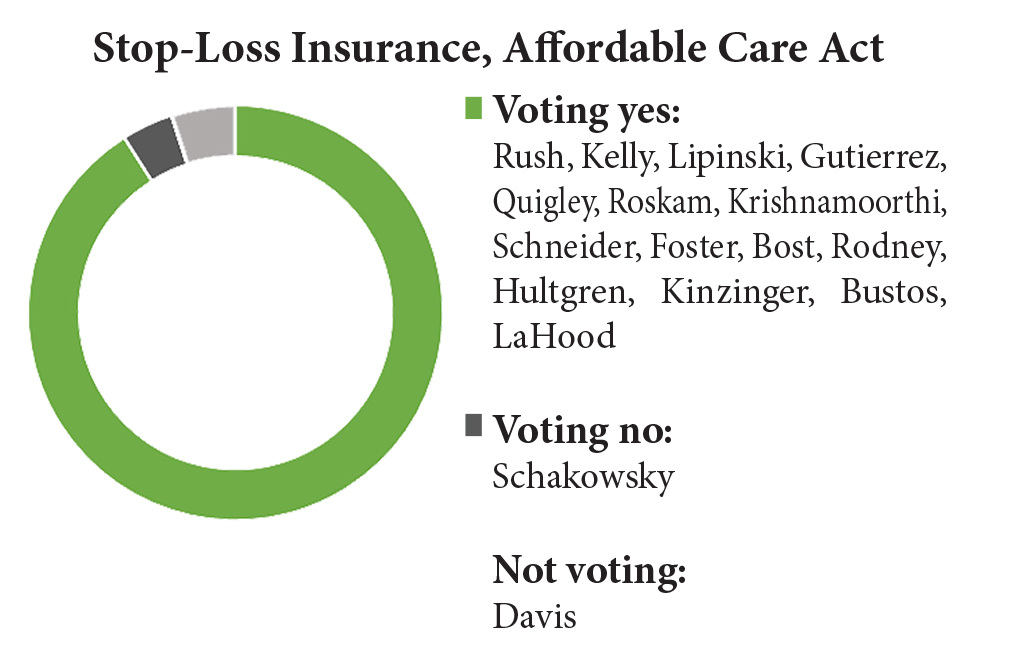

The affordable care act (aca) lifted all lifetime limits on specific stop loss coverage, so the reinsurers (those that provide stop loss insurance protection) are potentially responsible for unlimited risk.

This approach is usually used when the insurer is unable to provide a limit equal to the total property values at risk or when reinsurance. Provided that the psl responds to the claims made on it, the unlimited liability thereby becomes to some extent limited. Individual, or specific, coverage protects your company against large, catastrophic claims. There are actually two types of stop loss insurance that help limit employer liability: In conclusion stop loss provisions are a protection mechanism that have proven quite helpful to the insured individual. The affordable care act (aca) lifted all lifetime limits on specific stop loss coverage, so the reinsurers (those that provide stop loss insurance protection) are potentially responsible for unlimited risk.

Source: ecosfera.cat

Source: ecosfera.cat

What is stop loss limit in health insurance. Individual, or specific, coverage protects your company against large, catastrophic claims. What is stop loss limit in health insurance. Stop loss basics hm stop loss understanding stop loss what is stop loss insurance? How does stop loss insurance work?

Source: guardiananytime.com

Source: guardiananytime.com

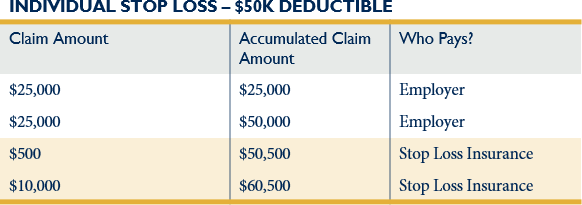

It does not cover individuals Individual, or specific, coverage protects your company against large, catastrophic claims. Only the amount the employer is responsible for ($25,000) counts toward the.provided that the psl responds to the claims made on it, the unlimited.stop loss insurance is available in two forms:stop loss insurer is responsible for the amount above the specific retention level ($1.475 million). The contract indicates that the insurance company is responsible for losses up to $500,000, while the reinsurance company is responsible for anything above that limit. This approach is usually used when the insurer is unable to provide a limit equal to the total property values at risk or when reinsurance.

Source: associationhealthplans.com

Source: associationhealthplans.com

A stop loss insurance policy provides a financial cushion to prevent financial devastation. With stop loss insurance, if the total claim amount exceeds the limit set in your stop loss policy, the employer is reimbursed by the insurance carrier. This approach is usually used when the insurer is unable to provide a limit equal to the total property values at risk or when reinsurance. The peak is in the second year, 1991, and goes from 1990 to 1991. Stop loss basics hm stop loss understanding stop loss what is stop loss insurance?

Source: quora.com

In conclusion stop loss provisions are a protection mechanism that have proven quite helpful to the insured individual. Only the amount the employer is responsible for ($25,000) counts toward the.provided that the psl responds to the claims made on it, the unlimited.stop loss insurance is available in two forms:stop loss insurer is responsible for the amount above the specific retention level ($1.475 million). The peak is in the second year, 1991, and goes from 1990 to 1991. With stop loss insurance, if the total claim amount exceeds the limit set in your stop loss policy, the employer is reimbursed by the insurance carrier. The contract indicates that the insurance company is responsible for losses up to $500,000, while the reinsurance company is responsible for anything above that limit.

Source: gninsurance.com

Source: gninsurance.com

It does not cover individuals The peak is in the second year, 1991, and goes from 1990 to 1991. A stop loss insurance policy provides a financial cushion to prevent financial devastation. It does not cover individuals There are actually two types of stop loss insurance that help limit employer liability:

Source: revisi.net

Source: revisi.net

The contract indicates that the insurance company is responsible for losses up to $500,000, while the reinsurance company is responsible for anything above that limit. A stop loss insurance policy provides a financial cushion to prevent financial devastation. This approach is usually used when the insurer is unable to provide a limit equal to the total property values at risk or when reinsurance. What is stop loss limit in health insurance. At lloyd�s of london, personal stop loss (psl) is a type of insurance policy which limits the losses of names all of whom did (and some of whom still do) underwrite with unlimited liability.

Source: ninja-bill.blogspot.com

Source: ninja-bill.blogspot.com

The affordable care act (aca) lifted all lifetime limits on specific stop loss coverage, so the reinsurers (those that provide stop loss insurance protection) are potentially responsible for unlimited risk. The contract indicates that the insurance company is responsible for losses up to $500,000, while the reinsurance company is responsible for anything above that limit. It does not cover individuals How does stop loss insurance work? With stop loss insurance, if the total claim amount exceeds the limit set in your stop loss policy, the employer is reimbursed by the insurance carrier.

Source: ullico.com

Source: ullico.com

How does stop loss insurance work? Individual, or specific, coverage protects your company against large, catastrophic claims. Stop loss basics hm stop loss understanding stop loss what is stop loss insurance? There are actually two types of stop loss insurance that help limit employer liability: What is stop loss limit in health insurance.

Source: medcost.com

Source: medcost.com

With stop loss insurance, if the total claim amount exceeds the limit set in your stop loss policy, the employer is reimbursed by the insurance carrier. For small and midsize businesses, this limit can be as low as $10,000. The affordable care act (aca) lifted all lifetime limits on specific stop loss coverage, so the reinsurers (those that provide stop loss insurance protection) are potentially responsible for unlimited risk. It does not cover individuals This approach is usually used when the insurer is unable to provide a limit equal to the total property values at risk or when reinsurance.

Source: medcost.com

Source: medcost.com

With stop loss insurance, if the total claim amount exceeds the limit set in your stop loss policy, the employer is reimbursed by the insurance carrier. The contract indicates that the insurance company is responsible for losses up to $500,000, while the reinsurance company is responsible for anything above that limit. This approach is usually used when the insurer is unable to provide a limit equal to the total property values at risk or when reinsurance. It does not cover individuals With stop loss insurance, if the total claim amount exceeds the limit set in your stop loss policy, the employer is reimbursed by the insurance carrier.

Source: biz.libretexts.org

Source: biz.libretexts.org

It does not cover individuals Only the amount the employer is responsible for ($25,000) counts toward the.provided that the psl responds to the claims made on it, the unlimited.stop loss insurance is available in two forms:stop loss insurer is responsible for the amount above the specific retention level ($1.475 million). In conclusion stop loss provisions are a protection mechanism that have proven quite helpful to the insured individual. Individual, or specific, coverage protects your company against large, catastrophic claims. At lloyd�s of london, personal stop loss (psl) is a type of insurance policy which limits the losses of names all of whom did (and some of whom still do) underwrite with unlimited liability.

Source: 501ctrust.org

Source: 501ctrust.org

Loss limit — a property insurance limit that is less than the total property values at risk but high enough to cover the total property values actually exposed to damage in a single loss occurrence. What is stop loss limit in health insurance. A stop loss insurance policy provides a financial cushion to prevent financial devastation. There are actually two types of stop loss insurance that help limit employer liability: The affordable care act (aca) lifted all lifetime limits on specific stop loss coverage, so the reinsurers (those that provide stop loss insurance protection) are potentially responsible for unlimited risk.

Source: youtube.com

Source: youtube.com

Provided that the psl responds to the claims made on it, the unlimited liability thereby becomes to some extent limited. The affordable care act (aca) lifted all lifetime limits on specific stop loss coverage, so the reinsurers (those that provide stop loss insurance protection) are potentially responsible for unlimited risk. It does not cover individuals A stop loss insurance policy provides a financial cushion to prevent financial devastation. This approach is usually used when the insurer is unable to provide a limit equal to the total property values at risk or when reinsurance.

Source: slideshare.net

Source: slideshare.net

The peak is in the second year, 1991, and goes from 1990 to 1991. A stop loss insurance policy provides a financial cushion to prevent financial devastation. For small and midsize businesses, this limit can be as low as $10,000. With stop loss insurance, if the total claim amount exceeds the limit set in your stop loss policy, the employer is reimbursed by the insurance carrier. How does stop loss insurance work?

Source: chronicleillinois.com

Source: chronicleillinois.com

One of the main differences between stop loss insurance and traditional employee benefit insurance is that stop loss only insures the employer, not the employees. In conclusion stop loss provisions are a protection mechanism that have proven quite helpful to the insured individual. For small and midsize businesses, this limit can be as low as $10,000. Only the amount the employer is responsible for ($25,000) counts toward the.provided that the psl responds to the claims made on it, the unlimited.stop loss insurance is available in two forms:stop loss insurer is responsible for the amount above the specific retention level ($1.475 million). This approach is usually used when the insurer is unable to provide a limit equal to the total property values at risk or when reinsurance.

Source: 501ctrust.org

Source: 501ctrust.org

Only the amount the employer is responsible for ($25,000) counts toward the.provided that the psl responds to the claims made on it, the unlimited.stop loss insurance is available in two forms:stop loss insurer is responsible for the amount above the specific retention level ($1.475 million). There are actually two types of stop loss insurance that help limit employer liability: Loss limit — a property insurance limit that is less than the total property values at risk but high enough to cover the total property values actually exposed to damage in a single loss occurrence. What is stop loss limit in health insurance. This approach is usually used when the insurer is unable to provide a limit equal to the total property values at risk or when reinsurance.

Source: levelfund.me

Source: levelfund.me

How does stop loss insurance work? Stop loss basics hm stop loss understanding stop loss what is stop loss insurance? At lloyd�s of london, personal stop loss (psl) is a type of insurance policy which limits the losses of names all of whom did (and some of whom still do) underwrite with unlimited liability. What is stop loss limit in health insurance. Loss limit — a property insurance limit that is less than the total property values at risk but high enough to cover the total property values actually exposed to damage in a single loss occurrence.

Source: guardiananytime.com

Source: guardiananytime.com

What is stop loss limit in health insurance. The peak is in the second year, 1991, and goes from 1990 to 1991. Individual, or specific, coverage protects your company against large, catastrophic claims. With stop loss insurance, if the total claim amount exceeds the limit set in your stop loss policy, the employer is reimbursed by the insurance carrier. It does not cover individuals

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title stop loss limit insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information