Stranger owned life insurance Idea

Home » Trending » Stranger owned life insurance IdeaYour Stranger owned life insurance images are available. Stranger owned life insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Stranger owned life insurance files here. Download all royalty-free vectors.

If you’re looking for stranger owned life insurance images information linked to the stranger owned life insurance interest, you have come to the right blog. Our website frequently provides you with suggestions for refferencing the maximum quality video and picture content, please kindly hunt and find more informative video content and images that match your interests.

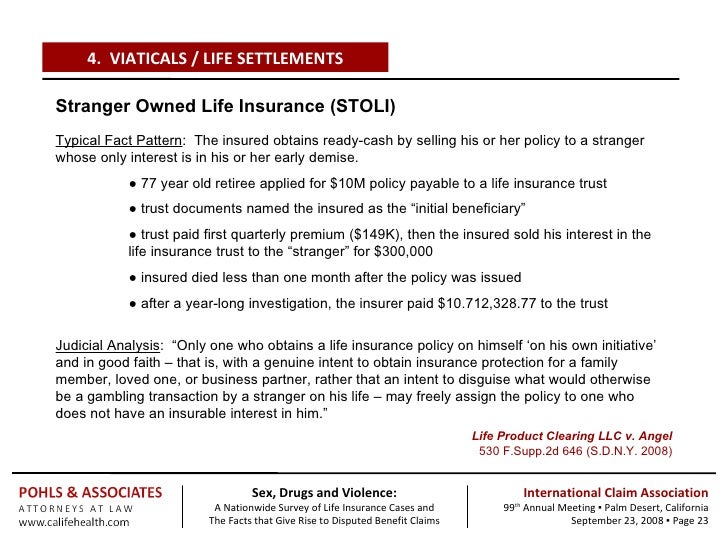

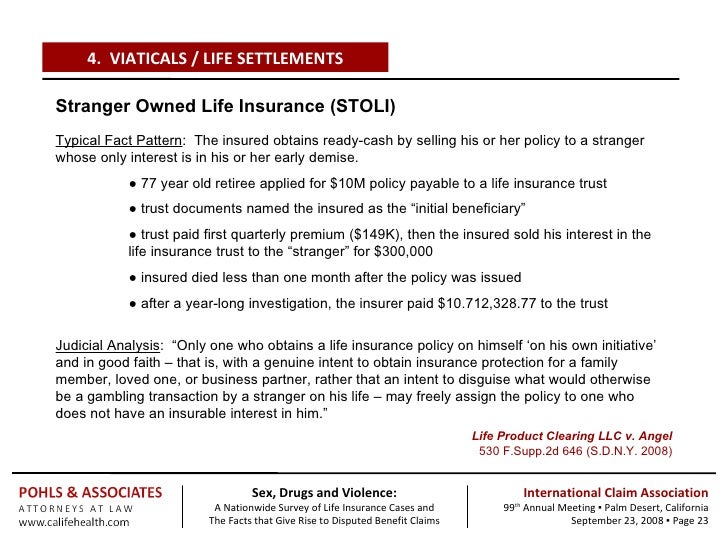

Stranger Owned Life Insurance. Moreover, ramon and mackert misrepresented the purpose for the life insurance, stating it was for “estate conservation” when the actual purpose was to procure “stranger owned life insurance.” based on these misrepresentations, reliastar rescinded the policy and returned the premium paid by the trust. Stranger originated life insurance policies, or stoli policies, have been in the news lately, leading many senior citizens and life insurance policy holders to wonder what it is and why it’s illegal in some states. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Here are some issues to keep in mind when reviewing a stoli transaction:

Life Insurance Caselaw Survey From slideshare.net

Life Insurance Caselaw Survey From slideshare.net

After the mortgage business imploded last year, wall street investment banks began searching for. Stranger owned life insurance is also known as stoli is when investors purchase life insurance usually on an elderly person. That means the insured’s death would adversely affect the policy owner’s finances. This strategy is most common among seniors, who may take out a life insurance policy on themselves with the intent of transferring ownership to an investor in. Moskowitz, 17 a.d.3d 289 (1st dept. (a) the purchase or acquisition of a policy primarily benefiting one or more persons who, at the time of issuance of the policy, lack insurable interest in the person insured under.

Typically, they are initiated by a third party looking to own and control a policy from the beginning.

Here are some issues to keep in mind when reviewing a stoli transaction: Many states regulate or restrict stoli and insurance industry associations and experts have also come out against it. It’s illegal to participate in a stoli agreement, which amounts to gambling on someone’s life expectancy and usually requires concealing information from an insurance provider. That means the insured’s death would adversely affect the policy owner’s finances. Stranger owned life insurance is also known as stoli is when investors purchase life insurance usually on an elderly person. Moreover, ramon and mackert misrepresented the purpose for the life insurance, stating it was for “estate conservation” when the actual purpose was to procure “stranger owned life insurance.” based on these misrepresentations, reliastar rescinded the policy and returned the premium paid by the trust.

Source: lascosasdemacius.blogspot.com

They are discussed more fully in “contested life insurance claims,” infra. Asuransi jiwa milik orang asing (stoli) umumnya digambarkan sebagai pembelian dan penjualan selanjutnya dari polis asuransi jiwa yang baru dikeluarkan kepada investor atau kelompok investor yang tidak memiliki kepentingan yang dapat diasuransikan. Moskowitz, 17 a.d.3d 289 (1st dept. Here are some issues to keep in mind when reviewing a stoli transaction: After the mortgage business imploded last year, wall street investment banks began searching for.

Source: lifeinsurancebeneficiarygekinse.blogspot.com

Source: lifeinsurancebeneficiarygekinse.blogspot.com

Stranger originated life insurance policies, or stoli policies, have been in the news lately, leading many senior citizens and life insurance policy holders to wonder what it is and why it’s illegal in some states. (a) the purchase or acquisition of a policy primarily benefiting one or more persons who, at the time of issuance of the policy, lack insurable interest in the person insured under. After the mortgage business imploded last year, wall street investment banks began searching for. Many states regulate or restrict stoli and insurance industry associations and experts have also come out against it. This strategy is most common among seniors, who may take out a life insurance policy on themselves with the intent of transferring ownership to an investor in.

Source: lascosasdemacius.blogspot.com

Source: lascosasdemacius.blogspot.com

Many states regulate or restrict stoli and insurance industry associations and experts have also come out against it. 2005) (holding that if there is a forged signature to transfer ownership of a life insurance policy to a stranger, “the incontestability clause could not apply, since the provisions for incontestability inure to the benefit of the insured and his beneficiary, or to the benefit of a bona fide assignee, but. Typically, they are initiated by a third party looking to own and control a policy from the beginning. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Traditionally, the consumer (i.e., the insured) initiates the application for insurance and the insured�s loved ones are beneficiaries of the death benefits.

Source: wholesalerg6cablecl78919.blogspot.com

Source: wholesalerg6cablecl78919.blogspot.com

After the mortgage business imploded last year, wall street investment banks began searching for. Asuransi jiwa milik orang asing (stoli) umumnya digambarkan sebagai pembelian dan penjualan selanjutnya dari polis asuransi jiwa yang baru dikeluarkan kepada investor atau kelompok investor yang tidak memiliki kepentingan yang dapat diasuransikan. Asuransi yang dibeli dengan maksud untuk mentransfer kepemilikan ke yang ketiga pesta, biasanya investor. After the mortgage business imploded last year, wall street investment banks began searching for. That means the insured’s death would adversely affect the policy owner’s finances.

Source: ginewra-druella-rosier.blogspot.com

Source: ginewra-druella-rosier.blogspot.com

Traditionally, the consumer (i.e., the insured) initiates the application for insurance and the insured�s loved ones are beneficiaries of the death benefits. (a) the purchase or acquisition of a policy primarily benefiting one or more persons who, at the time of issuance of the policy, lack insurable interest in the person insured under. Stranger originated life insurance is a type of insurance arrangement in which a person you don’t know very well (the “stranger”) can. Stranger originated life insurance policies, or stoli policies, have been in the news lately, leading many senior citizens and life insurance policy holders to wonder what it is and why it’s illegal in some states. Moreover, ramon and mackert misrepresented the purpose for the life insurance, stating it was for “estate conservation” when the actual purpose was to procure “stranger owned life insurance.” based on these misrepresentations, reliastar rescinded the policy and returned the premium paid by the trust.

Source: lascosasdemacius.blogspot.com

Source: lascosasdemacius.blogspot.com

Asuransi yang dibeli dengan maksud untuk mentransfer kepemilikan ke yang ketiga pesta, biasanya investor. See also wolk, 739 f. Typically, they are initiated by a third party looking to own and control a policy from the beginning. 2005) (holding that if there is a forged signature to transfer ownership of a life insurance policy to a stranger, “the incontestability clause could not apply, since the provisions for incontestability inure to the benefit of the insured and his beneficiary, or to the benefit of a bona fide assignee, but. Moreover, ramon and mackert misrepresented the purpose for the life insurance, stating it was for “estate conservation” when the actual purpose was to procure “stranger owned life insurance.” based on these misrepresentations, reliastar rescinded the policy and returned the premium paid by the trust.

Source: wholesalerg6cablecl78919.blogspot.com

Source: wholesalerg6cablecl78919.blogspot.com

This strategy is most common among seniors, who may take out a life insurance policy on themselves with the intent of transferring ownership to an investor in. Moreover, ramon and mackert misrepresented the purpose for the life insurance, stating it was for “estate conservation” when the actual purpose was to procure “stranger owned life insurance.” based on these misrepresentations, reliastar rescinded the policy and returned the premium paid by the trust. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. This strategy is most common among seniors, who may take out a life insurance policy on themselves with the intent of transferring ownership to an investor in. (a) the purchase or acquisition of a policy primarily benefiting one or more persons who, at the time of issuance of the policy, lack insurable interest in the person insured under.

Source: mhllp.com

Source: mhllp.com

This strategy is most common among seniors, who may take out a life insurance policy on themselves with the intent of transferring ownership to an investor in. Moreover, ramon and mackert misrepresented the purpose for the life insurance, stating it was for “estate conservation” when the actual purpose was to procure “stranger owned life insurance.” based on these misrepresentations, reliastar rescinded the policy and returned the premium paid by the trust. They are discussed more fully in “contested life insurance claims,” infra. (a) the purchase or acquisition of a policy primarily benefiting one or more persons who, at the time of issuance of the policy, lack insurable interest in the person insured under. Here are some issues to keep in mind when reviewing a stoli transaction:

Source: lascosasdemacius.blogspot.com

Source: lascosasdemacius.blogspot.com

Here are some issues to keep in mind when reviewing a stoli transaction: Many states regulate or restrict stoli and insurance industry associations and experts have also come out against it. 2005) (holding that if there is a forged signature to transfer ownership of a life insurance policy to a stranger, “the incontestability clause could not apply, since the provisions for incontestability inure to the benefit of the insured and his beneficiary, or to the benefit of a bona fide assignee, but. They are discussed more fully in “contested life insurance claims,” infra. After the mortgage business imploded last year, wall street investment banks began searching for.

Source: klips.says.com

Source: klips.says.com

Typically, they are initiated by a third party looking to own and control a policy from the beginning. 2005) (holding that if there is a forged signature to transfer ownership of a life insurance policy to a stranger, “the incontestability clause could not apply, since the provisions for incontestability inure to the benefit of the insured and his beneficiary, or to the benefit of a bona fide assignee, but. Traditionally, the consumer (i.e., the insured) initiates the application for insurance and the insured�s loved ones are beneficiaries of the death benefits. Stranger originated life insurance is a type of insurance arrangement in which a person you don’t know very well (the “stranger”) can. It’s illegal to participate in a stoli agreement, which amounts to gambling on someone’s life expectancy and usually requires concealing information from an insurance provider.

Source: lascosasdemacius.blogspot.com

Source: lascosasdemacius.blogspot.com

- (holding that if there is a forged signature to transfer ownership of a life insurance policy to a stranger, “the incontestability clause could not apply, since the provisions for incontestability inure to the benefit of the insured and his beneficiary, or to the benefit of a bona fide assignee, but. They are discussed more fully in “contested life insurance claims,” infra. Stranger originated life insurance is a type of insurance arrangement in which a person you don’t know very well (the “stranger”) can. Traditionally, the consumer (i.e., the insured) initiates the application for insurance and the insured�s loved ones are beneficiaries of the death benefits. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

Source: investopedia.com

Source: investopedia.com

Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. It’s illegal to participate in a stoli agreement, which amounts to gambling on someone’s life expectancy and usually requires concealing information from an insurance provider. They are discussed more fully in “contested life insurance claims,” infra. After the mortgage business imploded last year, wall street investment banks began searching for. Here are some issues to keep in mind when reviewing a stoli transaction:

Source: slideshare.net

Source: slideshare.net

Moreover, ramon and mackert misrepresented the purpose for the life insurance, stating it was for “estate conservation” when the actual purpose was to procure “stranger owned life insurance.” based on these misrepresentations, reliastar rescinded the policy and returned the premium paid by the trust. Moskowitz, 17 a.d.3d 289 (1st dept. See also wolk, 739 f. Stranger owned life insurance is also known as stoli is when investors purchase life insurance usually on an elderly person. Many states regulate or restrict stoli and insurance industry associations and experts have also come out against it.

Source: quora.com

It’s illegal to participate in a stoli agreement, which amounts to gambling on someone’s life expectancy and usually requires concealing information from an insurance provider. This strategy is most common among seniors, who may take out a life insurance policy on themselves with the intent of transferring ownership to an investor in. Moreover, ramon and mackert misrepresented the purpose for the life insurance, stating it was for “estate conservation” when the actual purpose was to procure “stranger owned life insurance.” based on these misrepresentations, reliastar rescinded the policy and returned the premium paid by the trust. Typically, they are initiated by a third party looking to own and control a policy from the beginning. Asuransi jiwa milik orang asing (stoli) umumnya digambarkan sebagai pembelian dan penjualan selanjutnya dari polis asuransi jiwa yang baru dikeluarkan kepada investor atau kelompok investor yang tidak memiliki kepentingan yang dapat diasuransikan.

Source: lascosasdemacius.blogspot.com

Source: lascosasdemacius.blogspot.com

Traditionally, the consumer (i.e., the insured) initiates the application for insurance and the insured�s loved ones are beneficiaries of the death benefits. 2005) (holding that if there is a forged signature to transfer ownership of a life insurance policy to a stranger, “the incontestability clause could not apply, since the provisions for incontestability inure to the benefit of the insured and his beneficiary, or to the benefit of a bona fide assignee, but. They are discussed more fully in “contested life insurance claims,” infra. This strategy is most common among seniors, who may take out a life insurance policy on themselves with the intent of transferring ownership to an investor in. It’s illegal to participate in a stoli agreement, which amounts to gambling on someone’s life expectancy and usually requires concealing information from an insurance provider.

Source: longtermdisabilitylawyer.com

Source: longtermdisabilitylawyer.com

It’s illegal to participate in a stoli agreement, which amounts to gambling on someone’s life expectancy and usually requires concealing information from an insurance provider. (a) the purchase or acquisition of a policy primarily benefiting one or more persons who, at the time of issuance of the policy, lack insurable interest in the person insured under. They are discussed more fully in “contested life insurance claims,” infra. See also wolk, 739 f. 2005) (holding that if there is a forged signature to transfer ownership of a life insurance policy to a stranger, “the incontestability clause could not apply, since the provisions for incontestability inure to the benefit of the insured and his beneficiary, or to the benefit of a bona fide assignee, but.

Source: wholesalerg6cablecl78919.blogspot.com

Source: wholesalerg6cablecl78919.blogspot.com

(a) the purchase or acquisition of a policy primarily benefiting one or more persons who, at the time of issuance of the policy, lack insurable interest in the person insured under. Stranger originated life insurance policies, or stoli policies, have been in the news lately, leading many senior citizens and life insurance policy holders to wonder what it is and why it’s illegal in some states. It’s illegal to participate in a stoli agreement, which amounts to gambling on someone’s life expectancy and usually requires concealing information from an insurance provider. They are discussed more fully in “contested life insurance claims,” infra. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title stranger owned life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information