Stranger owned life insurance is when a person purchases Idea

Home » Trend » Stranger owned life insurance is when a person purchases IdeaYour Stranger owned life insurance is when a person purchases images are ready. Stranger owned life insurance is when a person purchases are a topic that is being searched for and liked by netizens today. You can Find and Download the Stranger owned life insurance is when a person purchases files here. Get all royalty-free images.

If you’re looking for stranger owned life insurance is when a person purchases images information related to the stranger owned life insurance is when a person purchases interest, you have pay a visit to the right blog. Our site frequently gives you suggestions for seeking the highest quality video and image content, please kindly hunt and locate more enlightening video content and images that fit your interests.

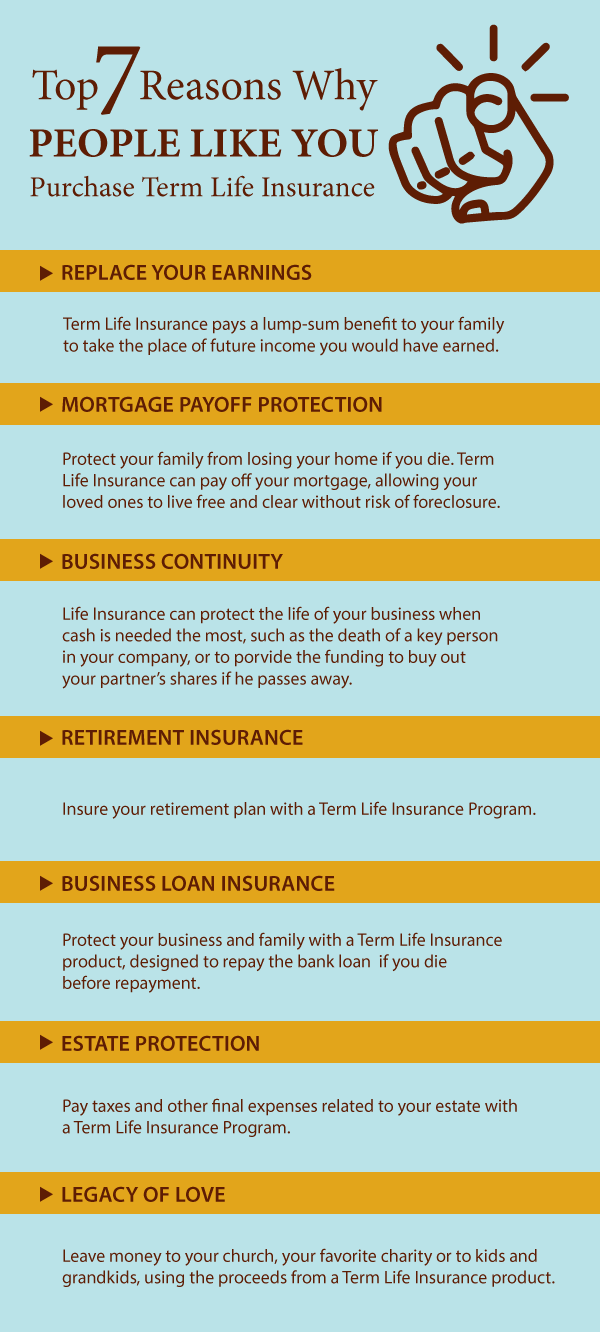

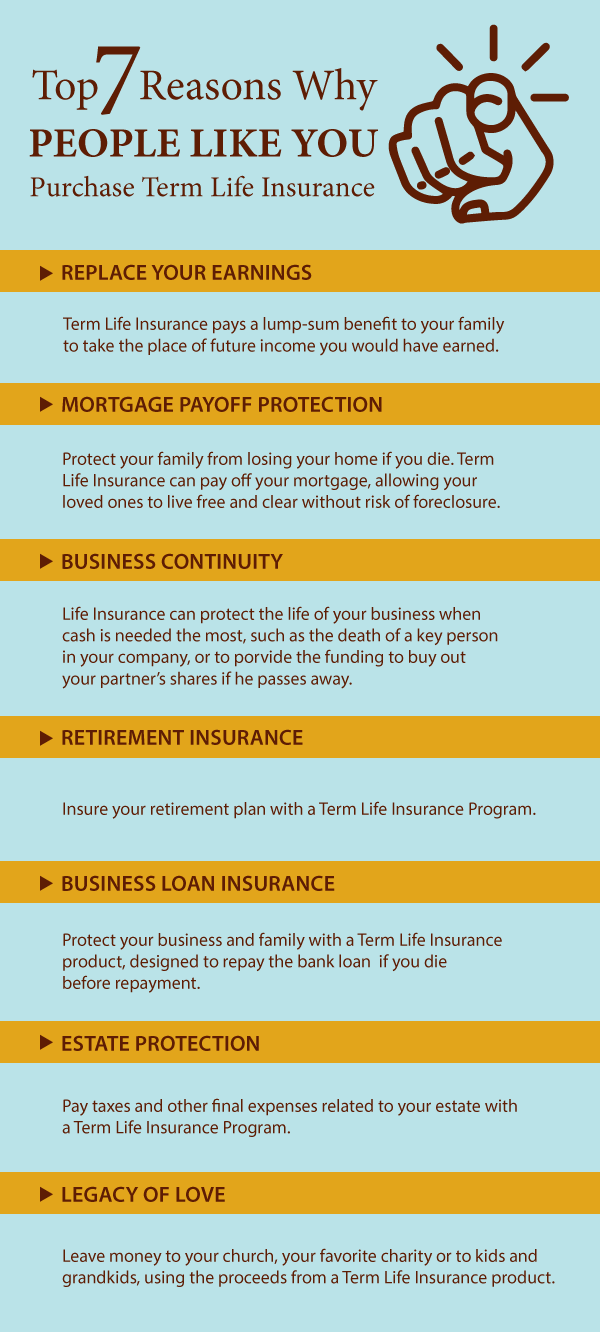

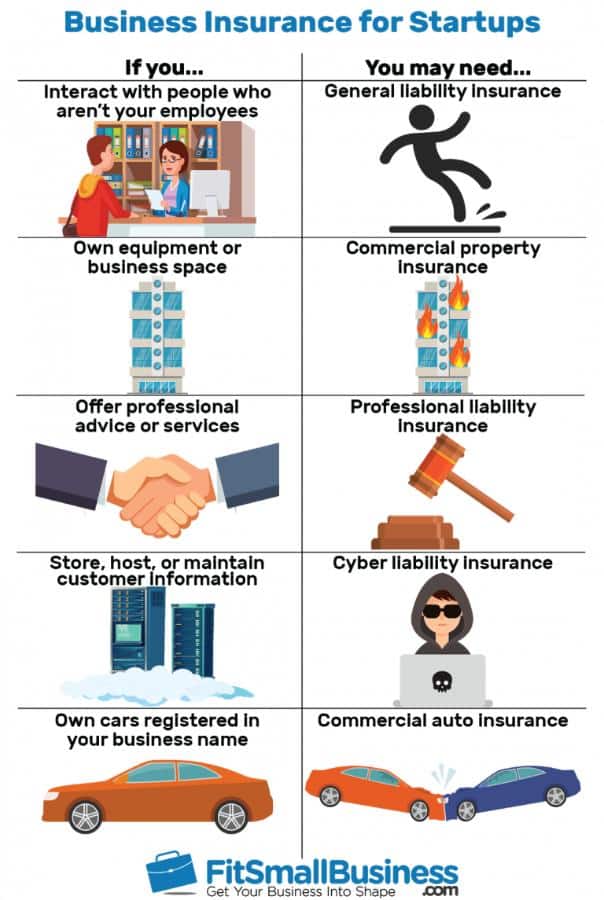

Stranger Owned Life Insurance Is When A Person Purchases. See also wolk, 739 f. Every life insurance company is pleased, if not excited, to write a new life insurance policy of $5,000,000 or more, which are often involved in transferred beneficial. Depending on the contract, other events such as terminal illness or critical illness can. Insurance companies have no reason to offer life insurance policies on randoms — literally everyone dies, so they want to limit the people they’re paying when that happens.

Dave�s 10Year Term Life Insurance Review Rates Revealed From buylifeinsuranceforburial.com

Dave�s 10Year Term Life Insurance Review Rates Revealed From buylifeinsuranceforburial.com

Stoli refers to the sale of a life insurance policy to a third party. The owner of the life insurance policy sells the policy for an immediate cash benefit. Most people buy life insurance as both the policyholder and the insured person under the policy and then name a beneficiary to receive the death benefit.but occasionally it may make sense to purchase a policy that insures someone else and names you as the beneficiary. Stranger owned life insurance litigation is a speciality defense that has been created by the life insurance companies as a defense to payment on transferred beneficial rights. The definition also is extended to include life insurance purchased by or transferred to trusts, or other persons, that are created primarily to give the appearance of insurable interest and are used to initiate one or more policies for investors but actually used to effect life insurance purchases that violate insurable interest laws and the prohibition against wagering on life. See also wolk, 739 f.

Depending on the contract, other events such as terminal illness or critical illness can.

There was a time when it was not uncommon for strangers to purchase insurance on the lives of prominent people, essentially wagering on their premature death. See also wolk, 739 f. Getting a policy on someone else�s behalf comes with its own set of legal requirements. Life insurance needs analysis/suitability 1. They are discussed more fully in “contested life insurance claims,” infra. If you, a stranger to me, took out a policy on me and i died suddenly, you (and some insurance company employee) would likely be suspected of causing my death.

Source: buylifeinsuranceforburial.com

Source: buylifeinsuranceforburial.com

The owner of the life insurance policy sells the policy for an immediate cash benefit. Irs to issue stranger owned life insurance rules. Stoli refers to the sale of a life insurance policy to a third party. Stranger owned life insurance litigation is a speciality defense that has been created by the life insurance companies as a defense to payment on transferred beneficial rights. Most people buy life insurance as both the policyholder and the insured person under the policy and then name a beneficiary to receive the death benefit.but occasionally it may make sense to purchase a policy that insures someone else and names you as the beneficiary.

Source: memetics.com

Source: memetics.com

Insurance companies have no reason to offer life insurance policies on randoms — literally everyone dies, so they want to limit the people they’re paying when that happens. See also wolk, 739 f. Getting a policy on someone else�s behalf comes with its own set of legal requirements. These policies, while legal in many states, are coming. The buyer becomes the new owner of the life insurance policy, pays future premiums, and collects the death benefit when the insured dies.

Source: fitsmallbusiness.com

Source: fitsmallbusiness.com

At one time, most stolis were sold by people with a. Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer, where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person (often the policy holder). Life insurance rates are influenced by a number of factors, but your health has the biggest impact on the final cost. If you, a stranger to me, took out a policy on me and i died suddenly, you (and some insurance company employee) would likely be suspected of causing my death. Depending on the contract, other events such as terminal illness or critical illness can.

Source: noclutter.cloud

Source: noclutter.cloud

Irs to issue stranger owned life insurance rules. Much has been written about senior citizens buying life insurance policies on themselves for the express purpose of later selling them to investors. Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer, where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person (often the policy holder). The definition also is extended to include life insurance purchased by or transferred to trusts, or other persons, that are created primarily to give the appearance of insurable interest and are used to initiate one or more policies for investors but actually used to effect life insurance purchases that violate insurable interest laws and the prohibition against wagering on life. Depending on the contract, other events such as terminal illness or critical illness can.

Source: dtfs.ca

Source: dtfs.ca

Stranger owned life insurance is when a person purchases? Stranger originated life insurance is a type of insurance arrangement in which a person you don’t know very well (the “stranger”) can. At one time, most stolis were sold by people with a. Life insurance rates are influenced by a number of factors, but your health has the biggest impact on the final cost. Getting a policy on someone else�s behalf comes with its own set of legal requirements.

Source: torontocaribbean.com

Source: torontocaribbean.com

It’s illegal to participate in a stoli agreement, which amounts to gambling on someone’s life expectancy and usually requires concealing information from an insurance provider. Depending on the contract, other events such as terminal illness or critical illness can. There was a time when it was not uncommon for strangers to purchase insurance on the lives of prominent people, essentially wagering on their premature death. Life insurance needs analysis/suitability 1. Stranger owned life insurance (stoli) is when a person purchases life insurance only to sell to an third party with no insurable interest k buys a policy where the.

Source: aboutpathankot.com

Source: aboutpathankot.com

Stranger owned life insurance (stoli) is when a person purchases life insurance only to sell to an third party with no insurable interest k buys a policy where the. These policies, while legal in many states, are coming. Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer, where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person (often the policy holder). There was a time when it was not uncommon for strangers to purchase insurance on the lives of prominent people, essentially wagering on their premature death. The owner of the life insurance policy sells the policy for an immediate cash benefit.

Source: paradigmlife.net

Source: paradigmlife.net

Stranger owned life insurance litigation is a speciality defense that has been created by the life insurance companies as a defense to payment on transferred beneficial rights. There was a time when it was not uncommon for strangers to purchase insurance on the lives of prominent people, essentially wagering on their premature death. Getting a policy on someone else�s behalf comes with its own set of legal requirements. At one time, most stolis were sold by people with a. Every life insurance company is pleased, if not excited, to write a new life insurance policy of $5,000,000 or more, which are often involved in transferred beneficial.

Source: bankownedlifeinsurance.org

Source: bankownedlifeinsurance.org

Stranger owned life insurance is when a person purchases? See also wolk, 739 f. Stoli refers to the sale of a life insurance policy to a third party. Life insurance rates are influenced by a number of factors, but your health has the biggest impact on the final cost. Much has been written about senior citizens buying life insurance policies on themselves for the express purpose of later selling them to investors.

Source: visual.ly

Source: visual.ly

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer, where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person (often the policy holder). Stoli refers to the sale of a life insurance policy to a third party. Life insurance needs analysis/suitability 1. Tax treatment of insurance premiums, proceeds, and dividends 1. The buyer becomes the new owner of the life insurance policy, pays future premiums, and collects the death benefit when the insured dies.

Source: financialtribune.com

Source: financialtribune.com

Stranger originated life insurance policies, or stoli policies, have been in the news lately, leading many senior citizens and life insurance policy holders to wonder what it is and why it’s illegal in some states. Life insurance rates are influenced by a number of factors, but your health has the biggest impact on the final cost. They are discussed more fully in “contested life insurance claims,” infra. Depending on the contract, other events such as terminal illness or critical illness can. Every life insurance company is pleased, if not excited, to write a new life insurance policy of $5,000,000 or more, which are often involved in transferred beneficial.

Source: truebluelifeinsurance.com

Source: truebluelifeinsurance.com

Stranger owned life insurance (stoli) is when a person purchases life insurance only to sell to an third party with no insurable interest k buys a policy where the. Stranger owned life insurance (stoli) is when a person purchases life insurance only to sell to an third party with no insurable interest k buys a policy where the. They are discussed more fully in “contested life insurance claims,” infra. The owner of the life insurance policy sells the policy for an immediate cash benefit. Stoli refers to the sale of a life insurance policy to a third party.

Source: venturebeat.com

Source: venturebeat.com

Stranger owned life insurance litigation is a speciality defense that has been created by the life insurance companies as a defense to payment on transferred beneficial rights. Insurance companies have no reason to offer life insurance policies on randoms — literally everyone dies, so they want to limit the people they’re paying when that happens. Stranger originated life insurance policies, or stoli policies, have been in the news lately, leading many senior citizens and life insurance policy holders to wonder what it is and why it’s illegal in some states. Stranger originated life insurance is a type of insurance arrangement in which a person you don’t know very well (the “stranger”) can. At one time, most stolis were sold by people with a.

Source: onetimeexam.com

Source: onetimeexam.com

Stranger owned life insurance is when a person purchases? Much has been written about senior citizens buying life insurance policies on themselves for the express purpose of later selling them to investors. Stranger owned life insurance (stoli) is when a person purchases life insurance only to sell to an third party with no insurable interest k buys a policy where the. The definition also is extended to include life insurance purchased by or transferred to trusts, or other persons, that are created primarily to give the appearance of insurable interest and are used to initiate one or more policies for investors but actually used to effect life insurance purchases that violate insurable interest laws and the prohibition against wagering on life. There was a time when it was not uncommon for strangers to purchase insurance on the lives of prominent people, essentially wagering on their premature death.

![Key Person Insurance The Scoop [Best Coverages + 2020 Rates] Key Person Insurance The Scoop [Best Coverages + 2020 Rates]](https://res.cloudinary.com/quotellc/image/upload/insurance-site-images/effortlessins-live/2020/03/3f949db9-keypersoninsurance-1024x647.png) Source: effortlessinsurance.com

Source: effortlessinsurance.com

They are discussed more fully in “contested life insurance claims,” infra. Tax treatment of insurance premiums, proceeds, and dividends 1. Stranger owned life insurance is when a person purchases? Depending on the contract, other events such as terminal illness or critical illness can. There was a time when it was not uncommon for strangers to purchase insurance on the lives of prominent people, essentially wagering on their premature death.

Source: thompson-financial.net

Source: thompson-financial.net

Stranger originated life insurance policies, or stoli policies, have been in the news lately, leading many senior citizens and life insurance policy holders to wonder what it is and why it’s illegal in some states. Much has been written about senior citizens buying life insurance policies on themselves for the express purpose of later selling them to investors. Stranger originated life insurance policies, or stoli policies, have been in the news lately, leading many senior citizens and life insurance policy holders to wonder what it is and why it’s illegal in some states. See also wolk, 739 f. Stoli refers to the sale of a life insurance policy to a third party.

Source: redbirdagents.com

Source: redbirdagents.com

Depending on the contract, other events such as terminal illness or critical illness can. If you, a stranger to me, took out a policy on me and i died suddenly, you (and some insurance company employee) would likely be suspected of causing my death. The buyer becomes the new owner of the life insurance policy, pays future premiums, and collects the death benefit when the insured dies. Every life insurance company is pleased, if not excited, to write a new life insurance policy of $5,000,000 or more, which are often involved in transferred beneficial. The definition also is extended to include life insurance purchased by or transferred to trusts, or other persons, that are created primarily to give the appearance of insurable interest and are used to initiate one or more policies for investors but actually used to effect life insurance purchases that violate insurable interest laws and the prohibition against wagering on life.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title stranger owned life insurance is when a person purchases by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information